UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 1, 2014

|

SEARCHCORE, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

000-51225

|

|

43-2041643

|

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

500 North Northeast Loop 323

Tyler, TX 75708

(Address of principal executive offices) (zip code)

(800) 727-1024

(Registrant’s telephone number, including area code)

_____________________________________________

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Section 7 – Regulation FD

Item 7.01 Regulation FD Disclosure.

On December 1, 2014, we issued a press release containing an open letter from our Chief Executive Officer.

In accordance with General Instruction B.2 of Form 8-K, the information in Item 7.01 of this Current Report on Form 8-K, including the exhibits hereto, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. The information in Item 7.01 of this Current Report on Form 8-K shall not be incorporated by reference into any filing or other document pursuant to the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing or document.

Section 9 – Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

99.1

|

Press Release dated December 1, 2014

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

SearchCore, Inc.

|

|

| |

|

|

|

|

Dated: December 1, 2014

|

|

/s/ James Pakulis

|

|

| |

By: |

James Pakulis

|

|

| |

Its: |

President and Chief Executive Officer

|

|

3

EXHIBIT 99.1

SearchCore Announces Open Letter From Our CEO

Tyler, Texas – December 1, 2014 – SearchCore, Inc. (OTCQB: SRER) a manufactured housing retail center owner and operator that operates its retail centers through its wholly owned subsidiary Wisdom Homes Of America, Inc., announces today an open letter from our CEO, Jim Pakulis. The entirety of the letter is included below.

Open Letter From Our CEO:

In early 2014 we transitioned SearchCore out of the technology sector and into the manufactured home retail industry.

We hired Mr. Brent Nelms, a 32-year manufactured home retail center veteran, to oversee the growth of our retail operation. During our first nine months we secured an inventory flooring credit facility, opened three retail centers located in Tyler, Jacksboro and Rhome, Texas, generated revenue of $402,000, and significantly increased the number of pending home purchase transactions in our pipeline. We also increased the amount of manufactured home inventory at our retail centers in order to accommodate these pending sales.

The retail centers are operated by our wholly owned subsidiary, Wisdom Homes Of America, Inc. We signed our fourth lease in Mount Pleasant, Texas, which will be our largest retail center to date. We also recently acquired fifteen residential lots on which we intend to place manufactured homes and sell to home buyers as a turn-key package. This will expedite the sales process for the manufactured home buyer and increase our revenue.

Additionally, we’ve created a short term bridge financing facility to assist homebuyers with their home and/or land acquisition.

The purpose of this letter is to provide a clear understanding of the direction in which we are taking SearchCore, Inc.

Our Goal

Our goal is straightforward: we intend to become the largest independent manufactured home retailer in the industry by opening 30 retail stores by 2019. We expect that within nine months of opening, each retail store will sell, on average, 4 manufactured homes per month. The average sales price per home is approximately $70,000. Therefore, each store is anticipated to generate $3.36 million in annual revenue.

Approximately 40% of our retail stores will be located in Texas. Other target states include Louisiana, Oklahoma, New Mexico, Oregon and Washington. After Texas, these states have the largest numbers of manufactured home buyers in the US.

We believe our competitive advantages in gaining significant market share in the regional markets we serve include:

| |

1)

|

Our heavily experienced retail manufactured housing management and sales team

|

| |

2)

|

Rapid contract-to-close home/lot packages

|

| |

3)

|

Focus on niche buyers including non-English speaking buyers and sub-prime borrowers

|

| |

4)

|

Lead generation and marketing economies of scale as a multi-market retail center operator

|

Growing Manufactured Home Industry

Since 2010, there has been a steady increase in the number of manufactured homes sold annually in the U.S. In 2013, there was approximately $3.6 billion in manufactured home sales as reported by the Manufactured Housing Institute. The growth rate in sales of manufactured homes is approximately 10% per annum, with 60,000 homes sold in 2013 and sales expected to reach 66,000 in 2014.

From 2008 to 2011, there has been a decline in both manufactured home retailers and manufactured home suppliers. This was caused by illiquid market conditions that existed during the Great Recession of 2008. With fewer retailers now serving a growing number of homebuyers, we believe our business plan will allow us to gain a competitive advantage in the manufactured home market. We also believe the ability to offer land transactions as well as short term bridge financing will provide us an additional competitive advantage since none of our competitors offer these ancillary services.

Improving Home Buyer Market

Overall economic conditions are currently favorable, especially in Texas and surrounding states, for the manufactured home industry. Texas’ pro-business environment, combined with specific industries within the state, such as the energy sector, are creating new jobs and generating an influx of workers to fill those jobs. In fact, new jobs are being created at a pace faster than the traditional home building industry can manage. This influx of new workers is creating a need for new homes that we are well suited to satisfy. Contrary to the increase in job creation, however, is the stagnation in U.S. household income. For the past few years, annual household income as reported by the U.S. Census has been essentially flat. Our conclusion is that more families will be able to afford a $120,000 manufactured home on a one-half acre of land, than a traditional $500,000 “Stick Built” home.

Manufactured Homes As Good As Stick Built

The line between the traditional manufactured home vs. the traditional stick built home is truly blurred. Today, a manufactured home buyer can purchase a well-designed, four bedroom three bath 2,500 square foot home, with vaulted ceiling, rock fireplaces, wrap around porches, and upgraded kitchen appliances on a one half-acre of land for less than $120,000. When you compare the monthly mortgage payment on $120,000 mortgage and include potential tax deductions, then in many areas around the country it’s actually less expensive to own a four bedroom three bath manufactured home on a one half-acre of land than to rent an apartment.

Structurally, a manufactured home is as solid, if not more so, than a stick built. This is because they’re built in an enclosed environment, with little waste, in a systematically engineered process. Some of the manufactured home factories offer State-Of-The-Art equipment and technology which results in the building of environmentally friendly houses. And building standards are set high. Manufacturers are required to adhere to stringent HUD guidelines before a house can be shipped from the factory. Industry tests have proven that a new manufactured home can withstand weather related challenges (e.g. hurricanes, tornadoes, etc.) as well as, if not better than, a traditional stick built home.

Land - Just As Important As the Home

The time to close a manufactured home transaction can be significantly reduced by offering potential buyers a selection of company owned lots for sale from our real estate portfolio or providing them with information on other real estate available in the location of their choice. We recently purchased fifteen lots near our Tyler location and have begun marketing the lots to our clients. We also anticipate placing manufactured homes on our lots and selling them as a real estate transaction as opposed to a chattel (or personal property) transactions.

Outstanding Management Team

We have a great management team comprising our operations and our corporate/public company teams. Brent Nelms, a seasoned veteran in the manufacturing home industry, is President of Wisdom Homes Of America, Inc. Brent has successfully overseen the operations of 33 different manufactured home retail centers generating greater than $100 million in annual revenue. In addition, Brent’s contacts include a deep talent pool of former manufactured home general managers that are anxious to join us as we grow our retail centers.

To date, we have never missed or been late on our annual or quarterly SEC filing requirements. This is because we have an excellent corporate team, which includes our Chief Financial Officer, Munjit Johal, our corporate attorney, Brian Lebrecht from Clyde Snow & Sessions, our auditors from Tarvaran Askelson & Company, our small public company advisor, Sabas Carrillo from Adnant, LLC and me. We have all worked together on SearchCore since the summer of 2010, and that continuity is a significant benefit for our shareholders and investors. With the addition of Brent to our team, we truly believe we can accomplish our 5-year goal.

Thank you for being a shareholder in SearchCore and for your continued support and strong belief in our products and our team. Should you have any questions please feel free to contact our investor relations advisors at Surety Financial Group by phone at 410-833-0078 or by email at info@suretyfingroup.com.

Sincerely,

Jim Pakulis, CEO

SearchCore, Inc.

About SearchCore, Inc.

SearchCore, Inc., founded in 2010, is a manufactured housing retail center owner and operator. The company is headquartered in Tyler, Texas. The Company’s common stock trades on the OTCQB, under the ticker symbol “SRER.”

Safe Harbor Notice

Certain statements contained herein are “forward-looking statements” (as defined in the Private Securities Litigation Reform Act of 1995). SearchCore, Inc. cautions that statements made in this news release constitute forward-looking statements and makes no guarantee of future performance. Forward-looking statements are based on estimates and opinions of management at the time statements are made. These statements may address issues that involve significant risks, uncertainties, estimates and assumptions made by management. Actual results could differ materially from current projections or implied results. SearchCore, Inc. undertakes no obligation to revise these statements following the date of this news release.

Company Contact

SearchCore, Inc.

(800) 727-1024

info@searchcore.com

Investor Relations Contact

Surety Financial Group, LLC

410-833-0078

info@suretyfingroup.com

3

Wisdom Homes of America (CE) (USOTC:WOFA)

Historical Stock Chart

From Mar 2024 to Apr 2024

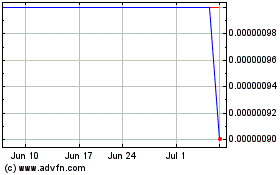

Wisdom Homes of America (CE) (USOTC:WOFA)

Historical Stock Chart

From Apr 2023 to Apr 2024