As filed with the Securities and Exchange Commission on November 24, 2014

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM S-3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Solar3D, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

01-0592299

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

26 West Mission Avenue, Santa Barbara, CA 93101 (805) 690-9000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

James B. Nelson Chief Executive Officer

Solar3D, Inc. 26 West Mission Avenue, Santa Barbara, CA 93101 (805) 690-9000

(Name, address including zip code, and telephone number, including area code, of agent for service)

With copies to:

Gregory Sichenzia, Esq.

Marcelle S. Balcombe, Esq.

Timothy O’Brien, Esq.

Sichenzia Ross Friedman Ference LLP

61 Broadway, 32nd Floor

New York, New York 10006 Telephone: (212) 930-9700

Facsimile: (212) 930-9725

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer ¨

|

|

Accelerated filer ¨

|

|

Non-accelerated filer ¨

|

|

Smaller reporting company x

|

| |

|

|

|

(Do not check if smaller reporting company) |

|

Title of Each Class of Securities to be Registered

|

|

Amount to be

Registered(1)

|

|

|

Proposed Maximum

Offering Price

Per Unit

|

|

|

Proposed Maximum

Aggregate Offering

Price(2)

|

|

|

Amount of

Registration Fee(3)

|

|

|

Common Stock, $.001 par value per share

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Preferred Stock, $.001 par value per share

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Warrants

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Units(4)

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Total

|

|

|

— |

|

|

|

— |

|

|

$ |

50,000,000 |

|

|

$ |

6,440 |

|

|

(1)

|

There are being registered under this registration statement such indeterminate number of shares of common stock and preferred stock; such indeterminate number of warrants to purchase common stock, preferred stock, and/or units; and such indeterminate number of units as may be sold by the registrant from time to time, which together shall have an aggregate initial offering price not to exceed $50,000,000. Any securities registered hereunder may be sold separately or as units with other securities registered hereunder. The securities registered hereunder also include such indeterminate number of shares of common stock and preferred stock, and warrants as may be issued upon conversion of or exchange for preferred stock, upon exercise of warrants; or pursuant to the anti-dilution provisions of any such securities. In addition, pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), the shares being registered hereunder include such indeterminate number of shares of common stock and preferred stock as may be issuable with respect to the shares being registered hereunder as a result of stock splits, stock dividends, or similar transactions..

|

|

(2)

|

Not required to be included in accordance with General Instruction II.D. of Form S-3 under the Securities Act.

|

|

(3)

|

Calculated pursuant to Rule 457(o) under the Securities Act based on the proposed maximum aggregate offering price of all securities listed.

|

|

(4)

|

Each unit will represent an interest in two or more other securities, which may or may not be separable from one another.

|

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

|

PROSPECTUS

|

SUBJECT TO COMPLETION,

|

DATED November 24, 2014

|

SOLAR3D, INC.

|

$50,000,000

Common Stock

Preferred Stock

Warrants

Units

|

|

|

We may offer and sell, from time to time in one or more offerings, any combination of common stock, preferred stock, warrants or units having an aggregate initial offering price not exceeding $50,000,000. The preferred stock, warrants, and units may be convertible or exercisable or exchangeable for common stock or preferred stock or other securities of ours. When we decide to sell a particular class or series of securities, we will provide specific terms of the offered securities in a prospectus supplement.

We will provide specific terms of the offerings of our securities in supplements to this prospectus. The prospectus supplement may also add, update or change information in this prospectus. You should read this prospectus and any prospectus supplement, as well as the documents incorporated by reference or deemed to be incorporated by reference into this prospectus, carefully before you invest.

This prospectus may not be used to offer or sell our securities unless accompanied by a prospectus supplement relating to the offered securities.

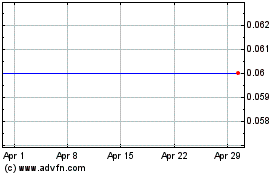

Our common stock is presently traded on the OTC QB under the symbol “SLTD.” On November 21, 2014, the last reported sale price of our common stock was $0.202.

These securities may be sold directly by us, through dealers or agents designated from time to time, to or through underwriters, dealers or through a combination of these methods on a continuous or delayed basis. See “Plan of Distribution” in this prospectus. We may also describe the plan of distribution for any particular offering of our securities in a prospectus supplement. If any agents, underwriters or dealers are involved in the sale of any securities in respect of which this prospectus is being delivered, we will disclose their names and the nature of our arrangements with them in a prospectus supplement. The net proceeds we expect to receive from any such sale will also be included in a prospectus supplement.

Investing in our securities involves various risks. See “Risk Factors” contained herein for more information on these risks. Additional risks will be described in the related prospectus supplements under the heading “Risk Factors”. You should review that section of the related prospectus supplements for a discussion of matters that investors in our securities should consider.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or passed upon the adequacy or accuracy of this prospectus or any accompanying prospectus supplement. Any representation to the contrary is a criminal offense.

The date of this Prospectus is , 2014.

| |

|

Page

|

|

|

|

|

1 |

|

|

|

|

|

1 |

|

|

|

|

|

5 |

|

|

|

|

|

14 |

|

|

|

|

|

14 |

|

|

|

|

|

15 |

|

|

|

|

|

15 |

|

|

|

|

|

17 |

|

|

|

|

|

19 |

|

|

|

|

|

19 |

|

|

|

|

|

21 |

|

|

|

|

|

21 |

|

|

|

|

|

21 |

|

|

|

|

|

22 |

|

|

This prospectus is part of a shelf registration statement that we filed with the Securities and Exchange Commission (the “SEC”) using a “shelf” registration process. Under this shelf registration process, we may sell any combination of the securities described in this prospectus in one or more offerings from time to time having an aggregate initial offering price of $50,000,000. This prospectus provides you with a general description of the securities we may offer. Each time we offer securities, we will provide you with a prospectus supplement that describes the specific amounts, prices and terms of the securities we offer. The prospectus supplement also may add, update or change information contained in this prospectus. You should read carefully both this prospectus and any prospectus supplement together with additional information described below under the caption “Where You Can Find More Information.”

This prospectus does not contain all the information provided in the registration statement we filed with the SEC. You should read both this prospectus, including the section titled “Risk Factors,” and the accompanying prospectus supplement, together with the additional information described under the heading “Where You Can Find More Information.”

You should rely only on the information contained or incorporated by reference in this prospectus or a prospectus supplement. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus is not an offer to sell securities, and it is not soliciting an offer to buy securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus or any prospectus supplement, as well as information we have previously filed with the SEC and incorporated by reference, is accurate as of the date on the front of those documents only. Our business, financial condition, results of operations and prospects may have changed since those dates.

Solar3D, Inc., a Delaware corporation (the “Company,” “Solar3D,” “we, “us”, or “our”), is engaged in the business of providing solar power solutions and developing of a proprietary high efficiency solar cell. The Company’s wholly owned subsidiary, Solar United Networks, Inc. (“SUNworks”) focuses on the design, installation, and management of solar power systems for commercial, agricultural, and residential customers. We believe SUNworks is one of the fastest growing solar systems providers in California. SUNworks has delivered hundreds of 2.5 kilowatt to 1-megawatt commercial systems and has the capability of providing systems as large as 25 megawatts. Solar3D’s technology division is developing a patent-pending three-dimensional solar cell technology to maximize the conversion of sunlight into electricity (the “Solar3D Cell”). The Solar3D Cell collects sunlight from a wide angle and lets the light bounce around in three-dimensional microstructures on the solar cell surface. The Company’s mission is to further the widespread adoption of solar power by deploying affordable, state-of-the-art systems and developing breakthrough new solar technologies.

We were originally formed in January 2002 as MachineTalker, Inc. in order to pursue the development of new wireless process control technology. In August 2005, we filed a Registration Statement on Form SB-2 which was declared effective by the Securities and Exchange Commission on December 22, 2005. In September 2010, we shifted our engineering and research focus to developing a new means for generating solar-produced electrical power for use in the manufacture of highly efficient solar cells. In July 2010, we changed our company name to Solar3D, Inc. in order to better reflect our new business plan and filed for patent protection covering our new concepts for 3D solar cell designs. On January 31, 2014, we acquired 100% of the stock of Solar United Networks, Inc., a California corporation, which we believe is one of the fastest growing providers of solar systems in California and in the United States.

Recent Developments

MD Energy, LLC

Effective November 3, 2014, we entered into an asset purchase agreement (the "APA") with MD Energy, LLC, a Nevada limited liability company (`MDE") and the members of MDE who hold 100% of the outstanding membership interests. MDE is engaged in energy, infrastructure, electrical and building construction. The parties anticipate that the acquisition will close in February 2015, subject to the satisfaction of all closing conditions. Pursuant to the terms of the APA, the Company will acquire tangible and intangible assets of MDE, including cash and cash equivalents.

Background of Solar Cell Technology

Solar cell efficiency is the measure of how much incident sunlight is converted into electricity. Most solar cells today are made from silicon, an inexpensive and abundant raw material. Due to the physics of silicon, the theoretical maximum efficiency of high-grade crystalline silicon solar cells is approximately 29%. In commercial practice, the efficiency ranges from 12% to 19%. We anticipate that our 3D solar cell technology will increase the efficiency of solar cells using low cost processes, in order to decrease the overall cost per watt of solar electricity.

Traditional solar cells are two-dimensional, utilizing a single pass sunlight conversion mechanism. There are two primary ways that these devices lose light and electrons, or electron-hole pairs to be precise, which result in a conversion efficiency much less than the theoretical maximum.

|

·

|

Surface Reflection – Due to fundamental physics, approximately 30% of incident sunlight is reflected off the surface of silicon cells.

|

|

·

|

Electron Reabsorption – When a photon strikes the solar cell, an electron is “knocked loose” creating an electron-hole pair that moves through the cell material creating an electrical current. However, in conventional two-dimensional solar cell designs, these electron-hole pairs must travel a long distance before reaching a metal contact wire. As a result, they are reabsorbed by the material and do not contribute to the production of electrical current.

|

Our 3D Solar Cell Technology

We are designing our three-dimensional solar cell from the ground up as an integrated optoelectrical device that optimally reduces all primary energy losses in a solar cell to achieve the highest efficiency. By leveraging the scalability of conventional solar and semiconductor processes, we believe our 3D solar cell will be able to deliver an unprecedented level of cost and conversion efficiency.

Unlike conventional solar cells where sunlight passes through one time, our 3D solar cell design is planned to use myriad 3D micro-cells that trap sunlight inside photovoltaic structures where photons bounce around until they are all converted into electricity. Our three-dimensional technology is expected to combine thin- and thick-film technologies to achieve the high efficiencies of crystalline at the lower cost per watt of thin film.

We believe the key features and benefits of our 3D solar cell design are:

|

·

|

Light Collection – Instead of allowing sunlight to bounce off the surface, the new design uses light collecting to trench down into the three dimensional structure.

|

|

·

|

3D Photovoltaic Structure – Conventional solar cells have one photon absorbing surface. Solar3D’s unique design is anticipated to increase the surface area many fold in order to allow the photos to bounce off many surfaces until virtually all the photons that can be absorbed, within the limitations of the material, are absorbed.

|

|

·

|

Thin Absorbing Regions – Our 3D photovoltaic structure is anticipated to be fabricated with very thin absorbing regions and designed to enhance charge carrier separation. Therefore, electron-hole pairs will travel short distances before reaching a contact wire where they will be quickly extracted to produce current. We believe this approach will lead to an overall height and silicon material reduction when compared to conventional crystalline silicon cells.

|

|

·

|

Below Surface Contacts – Unlike conventional solar cells where electrical contact wires run on the top of the cell, blocking sunlight, our design is expected to use a network of contact wires that run below the light collectors. We believe this approach will allow our 3D solar cells to trap and utilize nearly 100% of the incident light.

|

|

·

|

A New Solar Cell Design – Almost all conventional solar cells are two-dimensional designs based on wafer or thin film manufacturing processes. As a result, their performance is naturally constrained by their physical structure. By redefining the problem in 3D, we expect that the new design will be able to break down the 2D constraints and develop a more efficient solution.

|

Our initial commercialization objective is to create a low cost, high efficiency silicon solar cell based on our 3D technology. By keeping our focus on silicon, we believe we can leverage the tremendous silicon infrastructure and manufacturing processes of the growing solar industry, as well as the mature and highly optimized semiconductor industry. However, we anticipate that our 3D technology will be able to be used to create multi-junction cells with exotic materials such as gallium arsenide to achieve efficiencies that may be greater than 50% for use in concentrated solar and high performance applications.

We have developed three generations of prototypes—with the final prototype combining all of the elements of our research and experimentation. We are currently seeking a manufacturing partner that will help us take our solar cell from our laboratory prototypes to the solar cell market place by producing a value-engineered manufacturing prototype, conducting a pilot manufacturing run, and then offering the solar cell for sale.

Our Approach to Providing Solar Systems

Our subsidiary, SUNworks, is engaged in the business of the design, installation, and management of solar systems for commercial, agricultural, and residential customers in California. SUNworks designs, finances, and installs systems ranging in size from 2KW (kilowatt) for residential loads to multi MW (megawatt) systems for larger commercial projects.

Through SUNworks, we provide the following systems:

Roof-Mounted Systems. SUNworks roof mounted solar systems range from small 2KW systems to large multi-megawatt systems. The solar panels are lightweight and can be installed on any roof style. Roof mounted systems come with up to a 25 year production warranty.

Ground-Mounted Systems. A ground-mounted solar system is an alternative for owners who have roof issues or open property. Ground-mounted systems are designed to make the most of the available space and sunlight while remaining easy to maintain. These systems are designed to withstand all wind up-lift zoning requirements and come with a 25 year production warranty.

Post-Mounted Systems. Pole-mounted solar systems allow for homes, farms, or businesses to generate electricity in highly-visible and efficient locations without shading or directional issues. Pole-mount systems are placed on a fixed platform and positioned to capture optimal sunlight. Unlike roof-mounted systems, a pole-mount solar system does not involve any building attachment and is a highly-beneficial low cost option to owners with minimal roof or land space.

Carport Systems. A carport or trellis solar system is a viable solution for the residential or commercial business owner that is looking to take advantage of solar power without sacrificing valuable parking, or large portions of expensive real estate. New carport or trellis structures can be custom built or existing carports can be modified to provide shaded or covered parking. Custom-designed solar carport or trellis systems require virtually no maintenance and allow the panels to be positioned for optimal energy production.

Tilted Single Axis Trackers. Tilted single axis trackers offer optimal efficiency and solar tracking capabilities by tracking the sun throughout the day. The motors in the single axis trackers move with the earth's orbit allowing 20% more power to be captured than a fixed solar array.

Duel Axis Trackers. A SUNworks dual-axis tracker can produce 30% more electricity than stationary solar arrays. This is achieved since the array follows the daily movement of the sun from east to west, as well as its change in altitude through the seasons. Although the initial cost of a dual axis tracking system can be higher than a stationary system, the dual axis tracker produces more electricity making it possible to use fewer panels to provide the same amount of electricity. Dual axis trackers can also be a viable solution for property owners that would prefer not to cover large portions of their land with ground mounted solar arrays.

Solar Performance Assessments. A Solar Energy Performance Assessment (“EPA“) is SUNworks’s version of an energy audit. This is the first step to assess how much energy a home or business consumes and to evaluate what measures can be taken to make the home or business more energy efficient, by performing a room by room examination of a structure as well as a thorough examination of past utility bills. By taking this step, customers can make additional changes to reduce energy usage and reduce the necessary size of the solar system. SUNworks’s EPA uses building science to help SUN evaluate and create a comprehensive plan that will increase energy efficiency and comfort, lower utility bills, reduce carbon footprint, improve the indoor air quality, and extend the structure's durability.

Maintenance and Performance Packages: SUN offers maintenance care packages that include system cleanings and maintenance inspections. SUNworks also offers performance packages which include complete system monitoring, performance guarantees, warranties, and cleanings.

Business and Revenue Models

Our SUNworks Division designs, installs, and manages solar systems for commercial, agricultural, and residential customers in California. The solar system projects are sold to customers taking into account the cost of direct material and overhead, and bid with a profit. The bid process is typically competitive, but SUNworks believes it is highly effective at developing bids that are clear and understandable for the customer and detailed enough to make a strong case for using SUNworks services instead of our competitors. With the rapid expansion of the solar market in California and in the United States in general, Solar3D has a significant opportunity to grow organically with the overall industry growth, and also as a result of gaining market share through superior competitive strategy.

We will also seek to pursue a growth strategy by making strategic acquisitions to increase shareholder value. Part of this strategy was our entry into the asset purchase agreement with MDE. We will seek to identify additional companies in the same segment of the solar marketplace. However, except for the asset purchase agreement with MDE, we have no current agreements or understanding in place for any acquisitions and there can be no assurance that we will be able to consummate any such acquisitions.

We completed the third generation prototype of our new solar cell technology in the summer of 2014. We are now seeking a manufacturing partner to help us commercialize the technology. Our objective is to enter into a license or joint venture agreement with a manufacturer and give them broad authority to take our technology to market, and pay us a royalty defined in the licensing agreement.

The market for the design, installation, and management of solar systems in California is highly competitive and fragmented. This provides both a risk and an opportunity. With so many small and medium size companies working in the marketplace, competition for the jobs of the type that we seek to perform is intense. In order to continue to be successful in the solar systems business, we will have to continue to be effective at designing projects, sourcing materials, making strong presentations, and maintaining a strong reputation.

There are a number of competitors that are much stronger financially, are better known, and have more access to capital and material than us. Some larger companies also have proprietary customer acquisition methodology that we do not utilize. There is no guarantee that we will continue to be competitive against strong competition.

The fragmented market with many small to medium-sized companies is consistent with other markets in which well managed companies have been able to combine a number of similar companies with like-minded management in to a larger and stronger competitor. This is our strategy. We are currently seeking to identify our highest quality competitors and approach them with the potential of proposing that we acquire them. Our ability to execute that strategy is dependent on finding, and financing, the type of company that will complement our existing business and help strengthen organic growth. There is currently little competition in the business of consolidating companies in the solar systems business, but we anticipate that that will change within a short period of time. There is not guarantee that we will find additional companies to acquire.

The market for solar cell technology is highly competitive. There are many companies throughout the world that manufacture solar cell arrays using existing technology and several other companies pursuing new methods to produce more energy efficiency using photovoltaic structures. Additionally, researchers at universities worldwide are currently working on new means to increase photovoltaic efficiency. Many of these competitors have longer operating histories, greater name recognition, larger installed customer bases, and substantially greater financial and marketing resources than we do. Our ability to compete successfully in this field will depend upon our completion of development of our proprietary technique for production of more efficient solar cells and the adoption of our technology by major manufacturers in the field. We cannot assure that we will be able to compete successfully in the solar cell technology industry, or that future competition will not have a material adverse effect on our business, operating results, and financial condition.

We are subject to various federal, state and local laws affecting wireless communication and security businesses. The Federal Trade Commission and equivalent state agencies regulate advertising and representations made by businesses in the sale of their products, which apply to us. Our business is also subject to government laws and regulations governing health, safety, working conditions, employee relations, wrongful termination, wages, taxes and other matters applicable to businesses in general. Our failure to comply with applicable government rules or regulations could have a material adverse effect on our financial condition and business operations.

We have 77 full time employees. We also rely upon the services of consultants to assist us with designing photovoltaic receptors to produce electricity from that incident light energy. We believe our employee relations are satisfactory.

Our operations are not expected to be affected by seasonal fluctuations, although our cash flow may be affected by fluctuations in the timing of investment capital to support our research and product development. We experiences some seasonality in our design and installation business, with winter being relatively slow and summer and fall being busy.

You should carefully consider the risks described below before making an investment decision. The risks described below are not the only ones we face. Additional risks we are not presently aware of or that we currently believe are immaterial may also impair our business operations. Our business could be harmed by any of these risks. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment. In assessing these risks, you should also refer to the other information contained or incorporated by reference into this prospectus supplement and the accompanying prospectus, including our financial statements and related notes.

Risks Related to Our Financial Position and Capital Requirements

We have a limited operating history, which could make it difficult to accurately evaluate our business and prospect.

Although we were formed in January 2002, we have not begun to test market or sell our 3D solar cell technology. We acquired SUNworks in January 2014 which experienced rapid and profitable growth in its first three years of operations. We cannot assure you at this time that we will operate profitably or that we will have adequate working capital to meet our obligations as they become due. Management believes that our success will depend in large part on our ability to continue to successfully sell solar systems in California against determined competition, consummate synergistic acquisitions, and on the industry’s acceptance of our 3D solar cell technology as an alternative to traditional energy sources. We intend to invest heavily in completing development of our 3D solar cell technology. As a result, we may incur operating losses.

We have incurred significant losses since inception and anticipate that we will incur continued losses for the foreseeable future.

As of December 31, 2013 and September 30, 2014, we had an accumulated deficit of $15,947,107 and $32,218,977 respectively. We continue to incur significant research and development and other expenses related to our ongoing and acquired operations. We have incurred operating losses since our inception, may continue to incur significant operating losses for the foreseeable future, and we expect that these losses may increase as we: (i) continue to identify and advance a number of products, (ii) continue our development of our product candidates, and commercialize our products, and (iii) expand our corporate infrastructure, including the costs associated with being a public company. As such, we are subject to all of the risks incidental to the development of new solar energy products and related companion diagnostics, and we may encounter unforeseen expenses, difficulties, complications, delays and other unknown factors that may adversely affect our business. Our prior losses, combined with expected future losses, have had and will continue to have an adverse effect on our stockholders’ equity and working capital.

Our independent registered public accounting firm has expressed substantial doubt about our ability to continue as a going concern, which may hinder our ability to obtain future financing.

Our consolidated financial statements as of December 31, 2013 were prepared under the assumption that we will continue as a going concern for the next twelve months. Our independent registered public accounting firm has issued a report that included an explanatory paragraph referring to our recurring losses from operations and expressing substantial doubt in our ability to continue as a going concern without additional capital becoming available. Our ability to continue as a going concern is dependent upon our ability to obtain additional equity or debt financing, attain further operating efficiencies, reduce expenditures, and, ultimately, to generate revenue. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

We may require substantial additional funding which may not be available to us on acceptable terms, or at all. If we fail to raise the necessary additional capital, we may be unable to complete the development and commercialization of our product candidates, or continue our development programs.

Our operations have consumed substantial amounts of cash since inception. We expect to significantly increase our spending to advance our product candidates and commercialize our products, including building our own commercial organizations to address certain markets. We will require additional capital for the further development and commercialization of our product candidates, as well as to fund our other operating expenses and capital expenditures.

We cannot be certain that additional funding will be available on acceptable terms, or at all. If we are unable to raise additional capital in sufficient amounts or on terms acceptable to us we may have to significantly delay, scale back or discontinue the development or commercialization of one or more of our product candidates. We may also seek collaborators for one or more of our current or future product candidates at an earlier stage than otherwise would be desirable or on terms that are less favorable than might otherwise be available. Any of these events could significantly harm our business, financial condition and prospects.

Our future capital requirements will depend on many factors, including:

| |

•

|

|

the progress of the development of our product candidates;

|

| |

•

|

|

the number of product candidates we pursue;

|

| |

•

|

|

the time and costs involved in obtaining regulatory approvals;

|

| |

•

|

|

the costs involved in filing and prosecuting patent applications and enforcing or defending patent claims;

|

| |

•

|

|

our plans to establish sales, marketing and/or manufacturing capabilities;

|

| |

•

|

|

the effect of competing technological and market developments;

|

| |

•

|

|

the terms and timing of any collaborative, licensing and other arrangements that we may establish;

|

| |

•

|

|

general market conditions for offerings from solar energy companies;

|

| |

•

|

|

our ability to establish, enforce and maintain selected strategic alliances and activities required for product commercialization; and

|

| |

•

|

|

our revenues, if any, from successful development and commercialization of our product candidates.

|

In order to carry out our business plan and implement our strategy, we anticipate that we will need to obtain additional financing from time to time and may choose to raise additional funds through strategic collaborations, licensing arrangements, public or private equity or debt financing, bank lines of credit, asset sales, government grants, or other arrangements. We cannot be sure that any additional funding, if needed, will be available on terms favorable to us or at all. Furthermore, any additional equity or equity-related financing may be dilutive to our stockholders, and debt or equity financing, if available, may subject us to restrictive covenants and significant interest costs. If we obtain funding through a strategic collaboration or licensing arrangement, we may be required to relinquish our rights to certain of our product candidates or marketing territories.

In addition, certain investors, including institutional investors, may be unwilling to invest in our securities since we are traded on the Over-the-Counter Bulletin Board, or OTCBB, and not on a national securities exchange. Our inability to raise capital when needed would harm our business, financial condition and results of operations, and could cause our stock price to decline or require that we wind down our operations altogether.

Risks Related to Our Business and Industry

Existing electric utility industry regulations, and changes to regulations, may present technical, regulatory and economic barriers to the purchase and use of solar energy systems that may significantly reduce demand for our solar energy systems.

Federal, state and local government regulations and policies concerning the electric utility industry, and internal policies and regulations promulgated by electric utilities, heavily influence the market for electricity

generation products and services. These regulations and policies often relate to electricity pricing and the interconnection of customer-owned electricity generation. In the United States, governments and utilities continuously modify these regulations and policies. These regulations and policies could deter customers from purchasing renewable energy, including solar energy systems. This could result in a significant reduction in the potential demand for our solar energy systems. For example, utilities commonly charge fees to larger, industrial customers for disconnecting from the electric grid or for having the capacity to use power from the electric grid for back-up purposes. These fees could increase our customers’ cost to use our systems and make them less desirable, thereby harming our business, prospects, financial condition and results of operations. In addition, depending on the region, electricity generated by solar energy systems competes most effectively with expensive peak-hour electricity from the electric grid, rather than the less expensive average price of electricity. Modifications to the utilities’ peak hour pricing policies or rate design, such as to a flat rate, would require us to lower the price of our solar energy systems to compete with the price of electricity from the electric grid.

In addition, any changes to government or internal utility regulations and policies that favor electric utilities could reduce our competitiveness and cause a significant reduction in demand for our products and services. For example, certain jurisdictions have proposed assessing fees on customers purchasing energy from solar energy systems or imposing a new charge that would disproportionately impact solar energy system customers who utilize net metering, either of which would increase the cost of energy to those customers and could reduce demand for our solar energy systems. Any similar government or utility policies adopted in the future could reduce demand for our products and services and adversely impact our growth.

Our business strategy depends on the widespread adoption of solar power technology.

The market for solar power products is emerging and rapidly evolving, and its future success is uncertain. If solar power technology proves unsuitable for widespread commercial deployment or if demand for solar power products fails to develop sufficiently, we would be unable to generate enough revenues to achieve and sustain profitability and positive cash flow. The factors influencing the widespread adoption of solar power technology include but are not limited to:

|

·

|

cost-effectiveness of solar power technologies as compared with conventional and non-solar alternative energy technologies;

|

|

·

|

performance and reliability of solar power products as compared with conventional and non-solar alternative energy products;

|

|

·

|

fluctuations in economic and market conditions which impact the viability of conventional and non-solar alternative energy sources, such as increases or decreases in the prices of oil and other fossil fuels;

|

|

·

|

continued deregulation of the electric power industry and broader energy industry; and

|

|

·

|

availability of governmental subsidies and incentives.

|

Our business strategy depends on the widespread adoption of solar power technology.

The market for solar power products is emerging and rapidly evolving, and its future success is uncertain. If solar power technology proves unsuitable for widespread commercial deployment or if demand for solar power products fails to develop sufficiently, we would be unable to generate enough revenues to achieve and sustain profitability and positive cash flow. The factors influencing the widespread adoption of solar power technology include but are not limited to:

|

·

|

cost-effectiveness of solar power technologies as compared with conventional and non-solar alternative energy technologies;

|

|

·

|

performance and reliability of solar power products as compared with conventional and non-solar alternative energy products;

|

|

·

|

fluctuations in economic and market conditions which impact the viability of conventional and non-solar alternative energy sources, such as increases or decreases in the prices of oil and other fossil fuels;

|

|

·

|

continued deregulation of the electric power industry and broader energy industry; and

|

|

·

|

availability of governmental subsidies and incentives.

|

Our business currently depends on the availability of rebates, tax credits and other financial incentives. The expiration, elimination or reduction of these rebates, credits and incentives would adversely impact our business.

U.S. federal, state and local government bodies provide incentives to end users, distributors, system integrators and manufacturers of solar energy systems to promote solar electricity in the form of rebates, tax credits and other financial incentives such as system performance payments and payments for renewable energy credits associated with renewable energy generation. We rely on these governmental rebates, tax credits and other financial incentives to lower the cost of installing solar systems and to incent customers to purchase solar systems. These incentives enable us to lower the price we charge customers for energy and for our solar energy systems. However, these incentives may expire on a particular date, end when the allocated funding is exhausted, or be reduced or terminated as solar energy adoption rates increase. These reductions or terminations often occur without warning.

The federal government currently offers a 30% investment tax credit under Section 48(a)(3) of the Internal Revenue Code, or the Federal ITC, for the installation of certain solar power facilities until December 31, 2016. This credit is due to adjust to 10% in 2017. Solar energy systems that began construction prior to the end of 2011 were eligible to receive a 30% federal cash grant paid by the U.S. Treasury Department under Section 1603 of the American Recovery and Reinvestment Act of 2009, or the U.S. Treasury grant, in lieu of the Federal ITC. Pursuant to the Budget Control Act of 2011, U.S. Treasury grants are subject to sequestration beginning in 2013. Specifically, U.S. Treasury grants made on or after March 1, 2013 through September 30, 2013 will be reduced by 8.7%, and U.S. Treasury grants made on or after October 1, 2013 through September 30, 2014 will be reduced by 7.2%, regardless of when the U.S. Treasury received the application. As a result, for all applications pending or submitted prior to December 31, 2013, we expect to suffer grant shortfalls of approximately $1.3 million associated with our financing funds. Applicable authorities may adjust or decrease incentives from time to time or include provisions for minimum domestic content requirements or other requirements to qualify for these incentives.

Reductions in, or eliminations or expirations of, governmental incentives could adversely impact our results of operations and ability to compete in our industry by increasing our cost of capital, causing us to increase the prices of our energy and solar energy systems, and reducing the size of our addressable market. In addition, this would adversely impact our ability to attract investment partners and to form new financing funds and our ability to offer attractive financing to prospective customers.

Our business depends in part on the regulatory treatment of third-party owned solar energy systems.

Our leases and power purchase agreements are third-party ownership arrangements. Sales of electricity by third parties face regulatory challenges in some states and jurisdictions. Other challenges pertain to whether third-party owned systems qualify for the same levels of rebates or other non-tax incentives available for customer-owned solar energy systems, whether third-party owned systems are eligible at all for these incentives, and whether third-party owned systems are eligible for net metering and the associated significant cost savings. Reductions in, or eliminations of, this treatment of these third-party arrangements could reduce demand for our systems, adversely impact our access to capital and could cause us to increase the price we charge our customers for energy.

Our ability to provide solar energy systems to customers on an economically viable basis depends on our ability to help customers find financing for such systems .

Our solar energy systems have been eligible for Federal ITCs or U.S. Treasury grants, as well as depreciation benefits. We have relied on, and will continue to rely on, financing structures that monetize a substantial portion of those benefits and provide financing for our solar energy systems. With the lapse of the U.S. Treasury grant program, we anticipate that our reliance on these tax-advantaged financing structures will increase substantially. If, for any reason, we were unable to continue to monetize those benefits through these arrangements, we may be unable to provide and maintain solar energy systems for new customers on an economically viable basis.

The availability of this tax-advantaged financing depends upon many factors, including:

| |

•

|

|

the state of financial and credit markets;

|

| |

•

|

|

changes in the legal or tax risks associated with these financings; and

|

| |

•

|

|

non-renewal of these incentives or decreases in the associated benefits.

|

Under current law, the Federal ITC will be reduced from approximately 30% of the cost of the solar energy systems to approximately 10% for solar energy systems placed in service after December 31, 2016. In addition, U.S. Treasury grants are no longer available for new solar energy systems. Changes in existing law and interpretations by the Internal Revenue Service and the courts could reduce the willingness of funding sources to provide funds to customers of these solar energy systems. We cannot assure you that this type of financing will be available to our customers. If, for any reason, we are unable to find financing solar energy systems, we may no longer be able to provide solar energy systems to new customers on an economically viable basis. This would have a material adverse effect on our business, financial condition and results of operations.

We may incur cost overruns in the development, manufacture, and distribution of our various products.

We may incur substantial cost overruns in the development, enhancement, and marketing of our 3D solar cell technology. Management is not obligated to contribute capital to us. Unanticipated costs may force us to obtain additional capital or financing from other sources, or may cause us to lose your entire investment in us if we are unable to obtain the additional funds necessary to implement our business plan. We cannot assure that we will be able to obtain sufficient capital to implement our business plan successfully. If a greater investment is required in the business because of cost overruns, the probability of earning a profit or a return of stockholders’ investment in us is diminished.

If we cannot compete successfully against other solar and energy companies, we may not be successful in developing and commercializing our technology and our business will suffer.

The solar and energy industries are characterized by intense competition and rapid technological advances, both in the United States and internationally. We will compete with a number of existing and future technologies and product candidates developed, manufactured and marketed by others. Many of these competitors have validated technologies with products already in various stages of development. In addition, many of these competitors, either alone or together with their collaborative partners, operate larger research and development programs and have substantially greater financial resources than we do, as well as significantly greater experience in:

| |

•

|

|

developing product candidates and technologies generally;

|

| |

•

|

|

manufacturing product candidates; and

|

| |

•

|

|

launching, marketing and selling product candidates.

|

Many of our competitors have substantially greater financial, technical and other resources, such as larger research and development staff and experienced marketing and manufacturing organizations. Additional mergers and acquisitions in the solar and energy industries may result in even more resources being concentrated in our competitors. As a result, may be more effective in selling and marketing their products as well. Smaller or early-stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large, established companies.

Because we will be competing against significantly larger companies with established track records, we will have to demonstrate that, based on experience, and other factors, our products, are competitive with other products.

Adverse economic conditions may have material adverse consequences on our business, results of operations and financial condition.

Unpredictable and unstable changes in economic conditions, including recession, inflation, increased government intervention, or other changes, may adversely affect our general business strategy. We rely upon our ability to generate additional sources of liquidity and we may need to raise additional funds through public or private debt or equity financings in order to fund existing operations or to take advantage of opportunities, including acquisitions of complementary businesses or technologies. Any adverse event would have a material adverse impact on our business, results of operations and financial condition.

If we are unable to retain and recruit qualified scientists and advisors, or if our key executives, key employees or consultants discontinues his or her employment or consulting relationship with us, it may delay our development efforts or otherwise harm our business.

We may not be able to attract or retain qualified management and scientific personnel in the future due to the intense competition for qualified personnel among solar, energy and other businesses. Our industry has experienced a high rate of turnover of management personnel in recent years. If we are not able to attract, retain and motivate necessary personnel to accomplish our business objectives, we may experience constraints that will significantly impede the successful development of any product candidates, our ability to raise additional capital and our ability to implement our overall business strategy.

We are highly dependent on members of our management and scientific staff, especially James B. Nelson, our Chief Executive Officer and President. Our success also depends on our ability to continue to attract, retain and motivate highly skilled junior, mid-level, and senior managers as well as junior, mid-level, and senior scientific personnel. The loss of any of our executive officers, key employees or consultants and our inability to find suitable replacements could impede the achievement of our research and development objectives, potentially harm our business, financial condition and prospects. Furthermore, recruiting and retaining qualified scientific personnel to perform research and development work in the future is critical to our success. We may be unable to attract and retain personnel on acceptable terms given the competition among solar and energy companies, universities and non-profit research institutions for experienced scientists. Certain of our current officers, directors, scientific advisors and/or consultants or certain of the officers, directors, scientific advisors and/or consultants hereafter appointed may from time to time serve as officers, directors, scientific advisors and/or consultants of other solar and energy companies. We do not maintain “key man” insurance policies on any of our officers or employees. All of our employees are employed “at will” and, therefore, each employee may leave our employment at any time.

We plan to grant stock options, restricted stock grants, or other forms of equity awards in the future as a method of attracting and retaining employees, motivating performance and aligning the interests of employees with those of our stockholders. If we are unable to implement and maintain equity compensation arrangements that provide sufficient incentives, we may be unable to retain our existing employees and attract additional qualified candidates. If we are unable to retain our existing employees, including qualified scientific personnel, and attract additional qualified candidates, our business and results of operations could be adversely affected.

We may not successfully implement our business model.

Our business model is predicated on our ability, or the ability of our Licensees to produce 3D solar cell technology in qualified facilities, our ability to provide solar systems at a profit, and our growth through strategic acquisition r. We intend to continue to operate as we have previously with sourcing and marketing methods that we have used in the past. However, we cannot assure that our methods will continue to attract new customers nor that we can maintain a profit in the very competitive solar systems marketplace. We are actively seeking to acquire additional companies that are similar to ours, and that make a profit. We cannot guarantee that such companies are available or that we can sustain their performance after we acquire them. We intend to outsource manufacturing or to license the proprietary technology to customers for production in their own facilities. We cannot assure that customers will license our technology to produce it in their own facilities, that various industries will adopt our 3D solar cell technology in the volume that we project, or that prospective customers will agree to pay the prices that we propose to charge. In the event our customers resist paying the prices projected in our business plan to purchase our 3D solar cell technology or to license the technology to produce it themselves, our business, financial condition, and results of operations will be materially and adversely affected.

We will need to increase the size of our company and may not effectively manage our growth.

Our success will depend upon growing our business and our employee base. Over the next 12 months, we plan to add additional employees to assist us with operations, sales, administration and research and development. Our future growth, if any, may cause a significant strain on our management, and our operational, financial and other resources. Our ability to manage our growth effectively will require us to implement and improve our operational, financial and management systems and to expand, train, manage and motivate our employees. These demands may require the hiring of additional management personnel and the development of additional expertise by management. Any increase in resources devoted to research and product development without a corresponding increase in our operational, financial and management systems could have a material adverse effect on our business, financial condition, and results of operations.

If we acquire companies or technologies in the future, they could prove difficult to integrate, disrupt our business, dilute stockholder value, and adversely affect our operating results and the value of our common stock.

As part of our business strategy, we may acquire, enter into joint ventures with, or make investments in complementary or synergistic companies, services, and technologies in the future. Acquisitions and investments involve numerous risks, including:

| |

•

|

|

difficulties in identifying and acquiring products, technologies, or businesses that will help our business;

|

| |

•

|

|

difficulties in integrating operations, technologies, services, and personnel;

|

| |

•

|

|

diversion of financial and managerial resources from existing operations;

|

| |

•

|

|

the risk of entering new development activities and markets in which we have little to no experience;

|

| |

•

|

|

risks related to the assumption of known and unknown liabilities; and

|

| |

•

|

|

risks related to our ability to raise sufficient capital to fund additional operating activities.

|

As a result, if we fail to properly evaluate acquisitions or investments, we may not achieve the anticipated benefits of any such acquisitions, we may incur costs in excess of what we anticipate, and management resources and attention may be diverted from other necessary or valuable activities.

Risks Related to Ownership of Our Common Stock

The market price of our common stock may fluctuate significantly, and investors in our common stock may lose all or a part of their investment.

The market prices for securities of solar and energy companies have historically been highly volatile, and the market has from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies. The market price of our common stock may fluctuate significantly in response to numerous factors, some of which are beyond our control, such as:

| |

•

|

|

our failure to commercialize our product candidates;

|

| |

•

|

|

unanticipated serious safety concerns related to the use of any of our product candidates;

|

| |

•

|

|

adverse regulatory decisions;

|

| |

•

|

|

changes in laws or regulations applicable to our product candidates;

|

| |

•

|

|

legal disputes or other developments relating to proprietary rights, including patents, litigation matters and our ability to obtain patent protection for our product candidates, and the results of any proceedings or lawsuits, including patent or stockholder litigation;

|

| |

•

|

|

our dependence on third parties, including;

|

| |

•

|

|

announcements of the introduction of new products by our competitors;

|

| |

•

|

|

market conditions in the solar and energy sectors;

|

| |

•

|

|

announcements concerning product development results or intellectual property rights of others;

|

| |

•

|

|

future issuances of common stock or other securities;

|

| |

•

|

|

the addition or departure of key personnel;

|

| |

•

|

|

failure to meet or exceed any financial guidance or expectations regarding development milestones that we may provide to the public;

|

| |

•

|

|

actual or anticipated variations in quarterly operating results;

|

| |

•

|

|

our failure to meet or exceed the estimates and projections of the investment community;

|

| |

•

|

|

overall performance of the equity markets and other factors that may be unrelated to our operating performance or the operating performance of our competitors, including changes in market valuations of similar companies;

|

| |

•

|

|

announcements of significant acquisitions, strategic partnerships, joint ventures or capital commitments by us or our competitors;

|

| |

•

|

|

issuances of debt or equity securities;

|

| |

•

|

|

sales of our common stock by us or our stockholders in the future;

|

| |

•

|

|

trading volume of our common stock;

|

| |

•

|

|

ineffectiveness of our internal controls;

|

| |

•

|

|

publication of research reports about us or our industry or positive or negative recommendations or withdrawal of research coverage by securities analysts;

|

| |

•

|

|

general political and economic conditions;

|

| |

•

|

|

effects of natural or man-made catastrophic events; and;

|

| |

•

|

|

other events or factors, many of which are beyond our control.

|

Further, the equity markets in general have recently experienced extreme price and volume fluctuations. Continued market fluctuations could result in extreme volatility in the price of our common stock, which could cause a decline in the value of our common stock. Price volatility of our common stock might worsen if the trading volume of our common stock is low. The realization of any of the above risks or any of a broad range of other risks, including those described in these “Risk Factors,” could have a dramatic and material adverse impact on the market price of our common stock.

We do not expect to pay cash dividends on our common stock, and investors will be able to receive cash in respect of their shares of our common stock only upon the sale of such shares.

We have no intention in the foreseeable future to pay any cash dividends on our common stock. Therefore, an investor in our common stock may obtain an economic benefit from the common stock only after an increase in its trading price and only then by selling the common stock.

Because our common stock is a “penny stock,” it may be more difficult for investors to sell shares of our common stock, and the market price of our common stock may be adversely affected.

According to the definition adopted by the SEC, our common stock is a “penny stock” because, among other things, its price is below $5.00 per share, it is not listed on a national securities exchange and we do not meet certain net tangible asset or average revenue requirements. Broker-dealers that sell penny stock must provide purchasers of such stock with a standardized risk-disclosure document prepared by the SEC. This document provides information about penny stock and the nature and level of risks involved in investing in penny stock. A broker must also give a purchaser, orally or in writing, bid and offer quotations and information regarding broker and salesperson compensation, make a written determination that the penny stock is a suitable investment for the purchaser and obtain the purchaser’s written agreement to the purchase. Broker-dealers must also provide customers that hold penny stock in their accounts with such broker-dealer a monthly statement containing price and market information relating to the penny stock. If a penny stock is sold to an investor in violation of the penny stock rules, the investor may be able to cancel its purchase and get its money back.

If applicable, the penny stock rules may make it difficult for investors to sell their shares of our common stock. Because of the rules and restrictions applicable to a penny stock, there is less trading in penny stock, and the market price of our common stock may be adversely affected. Also, many brokers choose not to participate in penny stock transactions. Accordingly, investors may not always be able to publicly resell their shares of our common stock at times and prices that they feel are appropriate.

A sale of a substantial number of shares of the common stock may cause the price of our common stock to decline.

If our stockholders sell, or the market perceives that our stockholders intend to sell for various reasons, substantial amounts of our common stock in the public market, including shares issued in connection with the exercise of outstanding options or warrants, the market price of our common stock could fall. Sales of a substantial number of shares of our common stock may make it more difficult for us to sell equity or equity-related securities in the future at a time and price that we deem reasonable or appropriate. We may become involved in securities class action litigation that could divert management’s attention and harm our business.

The stock markets have from time to time experienced significant price and volume fluctuations that have affected the market prices for the common stock of solar and energy companies. These broad market fluctuations may cause the market price of our common stock to decline. In the past, securities class action litigation has often been brought against a company following a decline in the market price of our securities. This risk is especially relevant for us because solar and energy companies have experienced significant stock price volatility in recent years. We may become involved in this type of litigation in the future. Litigation often is expensive and diverts management’s attention and resources, which could adversely affect our business.

Existing stockholders’ interest in us may be diluted by additional issuances of equity securities and raising funds through lending and licensing arrangements may restrict our operations or require us to relinquish proprietary rights.

We may issue additional equity securities to fund future expansion and pursuant to employee benefit plans. We may also issue additional equity for other purposes. These securities may have the same rights as our common stock or, alternatively, may have dividend, liquidation or other preferences to our common stock. The issuance of additional equity securities will dilute the holdings of existing stockholders and may reduce the share price of our common stock.

If we raise additional funds through collaboration, licensing or other similar arrangements, it may be necessary to relinquish potentially valuable rights to our product candidates, potential products or proprietary technologies, or grant licenses on terms that are not favorable to us. If adequate funds are not available, our ability to achieve profitability or to respond to competitive pressures would be significantly limited and we may be required to delay, significantly curtail or eliminate the development of our product candidates.

Directors, executive officers, principal stockholders and affiliated entities own a significant percentage of our capital stock, and they may make decisions that you do not consider to be in your best interests or those of our other stockholders.

As of November 10, 2014, our directors, executive officers and principal stockholders beneficially owned, in the aggregate, over 9.9% of our outstanding voting securities. As a result, if some or all of them acted together, they would have the ability to exert substantial influence over the election of our board of directors and the outcome of issues requiring approval by our stockholders. This concentration of ownership may also have the effect of delaying or preventing a change in control of our company that may be favored by other stockholders. This could prevent transactions in which stockholders might otherwise recover a premium for their shares over current market prices.

Our certificate of incorporation, as amended, and bylaws provide for indemnification of officers and directors at our expense and limits their liability, which may result in a major cost to us and hurt the interests of our stockholders because corporate resources may be expended for the benefit of our officers and/or directors.

Our certificate of incorporation, as amended, bylaws and applicable Delaware law provide for the indemnification of our directors, officers, employees, and agents, under certain circumstances, against attorney’s fees and other expenses incurred by them in any litigation to which they become a party arising from their association with or activities on our behalf. We will also bear the expenses of such litigation for any of our directors, officers, employees, or agents, upon such person’s promise to repay us, therefore if it is ultimately determined that any such person shall not have been entitled to indemnification. This indemnification policy could result in substantial expenditures by us, which we will be unable to recover.

Our corporate documents and Delaware law contain provisions that could discourage, delay or prevent a change in control of our company, prevent attempts to replace or remove current management and reduce the market price of our common stock.

Provisions in our certificate of incorporation, as amended, and bylaws may discourage, delay or prevent a merger or acquisition involving us that our stockholders may consider favorable. For example, our certificate of incorporation, as amended, authorizes our board of directors to issue up to 5,000,000 shares of “blank check” preferred stock. As a result, without further stockholder approval, the board of directors has the authority to attach special rights, including voting and dividend rights, to this preferred stock. With these rights, preferred stockholders could make it more difficult for a third party to acquire us.

We are also subject to the anti-takeover provisions of the Delaware General Corporation Law. Under these provisions, if anyone becomes an “interested stockholder,” we may not enter into a “business combination” with that person for three years without special approval, which could discourage a third party from making a takeover offer and could delay or prevent a change in control of us. An “interested stockholder” means, generally, someone owning 15% or more of our outstanding voting stock or an affiliate of ours that owned 15% or more of our outstanding voting stock during the past three years, subject to certain exceptions as described in the Delaware General Corporation Law.

Compliance with changing regulations concerning corporate governance and public disclosure may result in additional expenses.

There have been changing laws, regulations and standards relating to corporate governance and public disclosure, including the Dodd-Frank Wall Street Reform and Consumer Protection Act, or the Dodd-Frank Act, the Sarbanes-Oxley Act of 2002, or Sarbanes-Oxley, new regulations promulgated by the SEC and rules promulgated by the national securities exchanges. The Dodd-Frank Act, enacted in July 2010, expands federal regulation of corporate governance matters and imposes requirements on public companies to, among other things, provide stockholders with a periodic advisory vote on executive compensation and also adds compensation committee reforms and enhanced pay-for-performance disclosures. While some provisions of the Dodd-Frank Act are effective upon enactment, others will be implemented upon the SEC’s adoption of related rules and regulations. The scope and timing of the adoption of such rules and regulations is uncertain and, accordingly, the cost of compliance with the Dodd-Frank Act is also uncertain.

These new or changed laws, regulations and standards are, or will be, subject to varying interpretations in many cases due to their lack of specificity, and, as a result, their application in practice may evolve over time as new guidance is provided by regulatory and governing bodies, which could result in continuing uncertainty regarding compliance matters and higher costs necessitated by ongoing revisions to disclosure and governance practices. As a result, our efforts to comply with evolving laws, regulations and standards are likely to continue to result in increased general and administrative expenses and a diversion of management time and attention from revenue-generating activities to compliance activities. Members of our board of directors and our principal executive officer and principal financial officer could face an increased risk of personal liability in connection with the performance of their duties. As a result, we may have difficulty attracting and retaining qualified directors and executive officers, which could harm our business. If the actions we take in our efforts to comply with new or changed laws, regulations and standards differ from the actions intended by regulatory or governing bodies, we could be subject to liability under applicable laws or our reputation may be harmed.

If we fail to comply with the rules under the Sarbanes-Oxley Act of 2002 related to accounting controls and procedures, or, if we discover material weaknesses and deficiencies in our internal control and accounting procedures, our stock price could decline significantly and raising capital could be more difficult.

Sarbanes-Oxley specifically requires, among other things, that we maintain effective internal controls for financial reporting and disclosure of controls and procedures. In particular, we must perform system and process evaluation and testing of our internal controls over financial reporting to allow management to report on the effectiveness of our internal controls over financial reporting, as required by Section 404 of Sarbanes-Oxley. Our testing, or the subsequent testing by our independent registered public accounting firm, if and when required, may reveal deficiencies in our internal controls over financial reporting that are deemed to be material weaknesses. Our compliance with Section 404 will require that we incur substantial accounting expense and expend significant management efforts. We currently do not have an internal audit group, and we will need to hire additional accounting and financial staff with appropriate public company experience and technical accounting knowledge. Moreover, if we are not able to comply with the requirements of Section 404 in a timely manner, or if we or our independent registered public accounting firm identifies deficiencies in our internal controls over financial reporting that are deemed to be material weaknesses, the market price of our stock could decline, and we could be subject to sanctions or investigations by the SEC or other regulatory authorities, which would require additional financial and management resources.

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and any accompanying prospectus supplement, including the documents that we incorporate by reference, contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Exchange Act. Such forward-looking statements include those that express plans, anticipation, intent, contingency, goals, targets or future development and/or otherwise are not statements of historical fact. These forward-looking statements are based on our current expectations and projections about future events and they are subject to risks and uncertainties known and unknown that could cause actual results and developments to differ materially from those expressed or implied in such statements.