The bulls have managed to return to Wall Street with full force,

as evidenced by the steep rebound that matched the

equally steep sell-off since the lows seen on October 15th.

Corporate earnings season is still well underway, and for the time

being, according to data compiled by FactSet, it appears that the

majority of companies are reporting better-than-expected sales

numbers. The economic data release front was light this week,

although investors did digest upbeat existing home sales data as

well as an uptick in the consumer price index from the month before

[see also How to Build an Income Portfolio with ETFs].

To help investors keep up with markets, we present our ETF

Scorecard, which takes a step back and looks at how various asset

classes across the globe are performing. For most of the return

comparisons below, we reference trailing 1-week and trailing

1-month returns; this offers a good insight into the prevailing

sentiment in the markets by capturing the performances across

short-term and longer-term time intervals [for more ETF news and

analysis subscribe to our free newsletter].

Risk Appetite Review

Buyers returned to the market with a “risk on” appetite as

evidenced by High Beta stock taking the lead by a fairly wide

margin:

google.load('visualization', '1', {packages: ['corechart']});

function drawVisualization() { // Create and populate the data

table. var data = google.visualization.arrayToDataTable([

['Ticker', '5-Day Return', {role: 'style'}], ['S&P 500 (SPY)',

4.65, 'blue'], ['Equal Weight (RSP)', 4.67, 'orange'], ['High Beta

(SPHB)', 6.14, 'red'], ['Low Volatility (SPLV)', 3.59, 'green'],

]); var formatter = new google.visualization.NumberFormat( {suffix:

"%"}); formatter.format(data,1); // Create and draw the

visualization. new

google.visualization.BarChart(document.getElementById('visualization104613')).

draw(data, {title:"Comparing Risk Preferences", width:700,

height:400, vAxis: {title: ""}, hAxis: {title: ""}} ); }

google.setOnLoadCallback(drawVisualization); Major Index Review

The Nasdaq 100 led the rebound among the major indexes while

Emerging Markets were the biggest laggard in green:

// // Domestic Sector Review

The Healthcare sector posted the strongest rebound in light of

overblown fears surrounding the Ebola outbreak while Utilities had

the weakest returns:

// //

Sector Valuations

Sector valuations improved across the board with Technology

being the biggest laggard:

google.load('visualization', '1', {packages: ['corechart']});

function drawVisualization() { // Create and populate the data

table. var data = google.visualization.arrayToDataTable([ ['Index',

'Last Weeks P/E', 'This Weeks P/E'], ['Discretionary (XLY)', 17.57,

18.33], ['Financials (XLF)', 14.48, 15.19], ['Energy (XLE)', 13.32,

14.19], ['Utilities (XLU)', 16.29, 16.8], ['Staples (XLP)', 18.42,

18.88], ['Technology (XLK)', 15.45, 15.51], ['Health Care (XLV)',

16.62, 17.35], ['Materials (XLB)', 16.91, 17.83], ['Industrials

(XLI)', 15.83, 16.41], ]); // Create and draw the visualization.

new

google.visualization.ColumnChart(document.getElementById('visualization104619')).

draw(data, {title:"Valuation Review: Comparing Sector P/E's",

width:700, height:400, hAxis: {title: ""}} ); }

google.setOnLoadCallback(drawVisualization); Foreign Equity Review

On the international front, German equities were the best

performers while Brazil was by far the worst country to be invested

in over the past week:

google.load('visualization', '1', {packages: ['corechart']});

function drawVisualization() { // Create and populate the data

table. var data = google.visualization.arrayToDataTable([ ['Index',

'1-Week Return', '1-Month Return'], ['Brazil (EWZ)', -7.95,

-12.29], ['Russia (RSX)', -0.71, -10.27], ['India (EPI)', 3.67,

2.9], ['China (FXI)', 1.85, -1.28], ['Japan (EWJ)', 3.03, -5.08],

['Australia (EWA)', 2.84, 1.52], ['Germany (EWG)', 4.04, -5.25],

['United Kingdom (EWU)', 3.27, -5.1], ]); var formatter = new

google.visualization.NumberFormat( {suffix: "%"});

formatter.format(data,1); formatter.format(data,2); var options = {

title:"", width:700, height:400, title: "Geographic Review:

Comparing Single Countries", colors: ["green", "orange"] }; //

Create and draw the visualization. new

google.visualization.ColumnChart(document.getElementById('visualization104622')).

draw(data, options); } google.setOnLoadCallback(drawVisualization);

Regional Valuations

Regional P/Es increased across the board with the exception

of Latin America, which saw a slight contraction in its pricing

multiple:

google.load('visualization', '1', {packages: ['corechart']});

function drawVisualization() { // Create and populate the data

table. var data = google.visualization.arrayToDataTable([ ['Index',

'Last Weeks P/E', 'This Weeks P/E'], ['United States (SPY)', 15.69,

16.24], ['ex-U.S. (CWI)', 13.03, 13.39], ['Asia Pacific (GMF)',

12.36, 12.55], ['Dev. Europe (FEZ)', 13.06, 13.58], ['Em. Europe

(GUR)', 6.79, 6.94], ['Latin America (GML)', 13.91, 13.37],

['Middle East & Africa (GAF)', 14.62, 15.15], ]); // Create and

draw the visualization. new

google.visualization.ColumnChart(document.getElementById('visualization104625')).

draw(data, {title:"Valuation Review: Comparing Regional P/E's",

width:700, height:400, hAxis: {title: ""}} ); }

google.setOnLoadCallback(drawVisualization); Alternatives Review

Commodities

Copper prices were the only ones to rise this week on the

commodity front, while energy remains the

worst performing group over the trailing month by far:

// //

Currencies

On the currency front, the U.S. dollar was the biggest

winner while the Japanese yen turned in the worst performance over

the past week:

// //

*All data as of market close 10/23/2014.

Follow me on Twitter @Sbojinov.

[For more ETF analysis, make sure to sign up for our free ETF

newsletter]

Disclosure: No positions at time of writing.

Click here to read the original article on ETFdb.com.

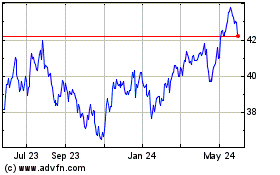

iShares MSCI Emerging Ma... (AMEX:EEM)

Historical Stock Chart

From Mar 2024 to Apr 2024

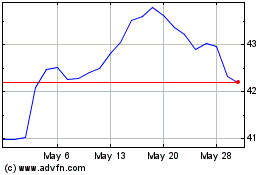

iShares MSCI Emerging Ma... (AMEX:EEM)

Historical Stock Chart

From Apr 2023 to Apr 2024