UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): October 20, 2014

| | | | |

PetMed Express, Inc.

(Exact name of registrant as specified in its charter)

|

| | | | |

Florida

| | 000-28827

| | 65-0680967

|

(State or other jurisdiction

of incorporation)

| | (Commission

File Number)

| | (I.R.S. Employer

Identification No.)

|

|

1441 S.W. 29th Avenue, Pompano Beach, FL 33069

|

(Address of principal executive offices) (Zip Code)

|

| |

(954) 979-5995

|

|

(Registrant’s telephone number, including area code)

|

|

|

Not Applicable

|

(Former name or former address, if changed since last report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

¨

| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

¨

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 8.01 Other Events.

On October 20, 2014, PetMed Express, Inc. discussed its financial results for the quarter ended September 30, 2014. A copy of this conference call transcript is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

| | |

| (d)

| Exhibits.

|

|

|

|

|

| 99.1 – Conference call transcript by PetMed Express, Inc. on October 20, 2014.

|

EXHIBIT INDEX

| | | |

Exhibit No.

|

| Description

|

|

|

|

|

|

99.1

|

| Conference call transcript by PetMed Express, Inc. on October 20, 2014.

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: October 21, 2014

| | |

| PETMED EXPRESS, INC.

|

|

|

|

| By:

| /s/ Bruce S. Rosenbloom

|

| Name:

| Bruce S. Rosenbloom

|

| Title:

| Chief Financial Officer

|

|

|

|

2

EXHIBIT 99.1

PETMED EXPRESS, INC.

QUARTER ENDED SEPTEMBER 30, 2014

CONFERENCE CALL TRANSCRIPT

OCTOBER 20, 2014 AT 8:30 A.M. ET

Coordinator:

Welcome to the PetMed Express, Inc., d/b/a 1-800-PetMeds, conference call to review the financial results for the second fiscal quarter ended on September 30, 2014. At the request of the Company, this conference call is being recorded. Founded in 1996, 1-800-PetMeds is America’s largest pet pharmacy, delivering prescription and non-prescription pet medications and other health products for dogs and cats direct to the consumer. 1-800-PetMeds markets its products through national television, on-line, direct mail, and print advertising campaigns, which direct consumers to order by phone or on the Internet and aim to increase the recognition of the “PetMeds” family of brand names. 1-800-PetMeds provides an attractive alternative for obtaining pet medications in terms of convenience, price, ease of ordering, and rapid home delivery. At this time I would like to turn the call over to the Company’s Chief Financial Officer, Mr. Bruce Rosenbloom. Sir, you may begin.

Bruce Rosenbloom:

Thank you. I would like to welcome everybody here today. Before I turn the call over to Mendo Akdag, our President and Chief Executive Officer, I would like to remind everyone that the first portion of this conference call will be listen-only until the question and answer session, which will be later in the call. Also certain information that will be included in this press conference may include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, or the Securities and Exchange Commission, that may involve a number of risks and uncertainties. These statements are based on our beliefs, as well as assumptions we have used based upon information currently available to us. Because these statements reflect our current views concerning future events these statements involve risks, uncertainties and assumptions. Actual future results may vary significantly based on a number of factors that may cause the actual results or events to be materially different from future results, performance, or achievements expressed or implied by these statements. We have identified various risk factors associated with our operations in our most recent Annual Report and other filings with the Securities and Exchange Commission.

Now let me introduce today’s speaker, Mendo Akdag, the President and Chief Executive Officer of 1-800-PetMeds, Mendo.

Mendo Akdag:

Thank you, Bruce. Welcome everyone. Thank you for joining us. Today we will review the highlights of our financial results; we’ll compare our second fiscal quarter and six months ended on September 30, 2014, to last year’s quarter and six months ended on September 30, 2013.

For the second fiscal quarter ended on September 30, 2014, sales were $57.6 million, compared to $60.5 million for the same period the prior year, a decrease of 4.8%. For the six months ended on September 30, 2014, sales were $130.1 million compared to $134.7 million for the same six months the prior year, a decrease of 3.4%. The decreases in sales were due to decreases in new order and reorder sales. The weakness in demand for flea and tick topicals negatively impacted sales. The average order value was approximately $75 for the quarter, compared to $73 for the same quarter the prior year.

Excluding a one-time charge for an IT-related discontinued project, for the second fiscal quarter, net income was $3.8 million, or $0.19 diluted per share, compared to $4.2 million, or $0.21 diluted per share, for the same quarter the prior year, and for the six months, net income was $8.8 million, or $0.44 diluted per share, compared to $8.9 million, or $0.44 diluted per share a year ago. The one-time IT-related discontinued project charge was $1.7 million before taxes and the net after-tax impact of this charge was $1.1 million, or $0.05 diluted per share. The discontinued project was for a new software platform. We concluded that it was not in the best interest of the company to proceed with it. We decided to stay with, and upgrade, our current platform.

Exhibit 99.1 Page 1 of 6

Reorder sales decreased by 4.6% to $46.6 million for the quarter, compared to reorder sales of $48.9 million for the same quarter the prior year. For the six months, the reorder sales decreased by 2.5% to $105.1 million, compared to $107.9 million for the same period last year. New order sales decreased by 5.6% to $11.0 million for the quarter, compared to $11.6 million for the same period the prior year. For the six months, the new order sales decreased by 6.8% to $25.0 million, compared to $26.8 million for the same period last year.

We acquired approximately 152,000 new customers in our second fiscal quarter, compared to 169,000 for the same period the prior year, and we acquired approximately 336,000 new customers in the six months, compared to 376,000 for the same period a year ago. Approximately 80% of our sales were generated on our website for the quarter, compared to 79% for the same period the prior year. The seasonality in our business is due the proportion of flea, tick, and heartworm medications in our product mix. Spring and summer are considered peak seasons, with fall and winter being the off season.

For the second fiscal quarter, our gross profit as a percent of sales was 32.1%, compared to 31.8% for the same period the prior year, and for the six months, our gross profit as a percent of sales was 32.5%, compared to 32.1% for the same period a year ago. The percentage increases can be attributed to a shift in sales to higher margin items.

Our general and administrative expenses were lower by approximately $120,000 for both the quarter and the six months. For the quarter we spent $6.9 million in advertising, compared to $7.0 million for the same quarter the prior year. For the six months we spent $16.8 million in advertising, compared to $17.4 million during the same period a year ago. The advertising costs of acquiring a customer was approximately $45 for the quarter, compared to $41 for the same quarter the prior year. For the six months it was $50, compared to $46 for the six months the prior year. The increases were due to advertising cost increases.

We had $50.2 million in cash and short-term investments and $20.5 million in inventory with no debt as of September 30, 2014. Net cash from operations for the six months was $23.6 million, compared to $24.4 million for the same six months last year.

This ends the financial review. Operator, we are ready to take questions.

Coordinator:

Thank you. For our participants over the phone, if you’d like to ask a question you may press star and then 1 on your touchtone phone and please record your name clearly and company names when prompted. To cancel you may press star and then 2. Again that’s star 1 to ask a question. Our first question came from the line of Mr. Kevin Ellich of Piper Jaffray. Your line is now open, sir. You may proceed.

Kevin Ellich:

Good morning. Thanks, Mendo, I’ve got a few questions for you. I guess starting off with your comments about demand for your flea and tick topicals being a little weak. Do you think - is that due to the new products that have come to the market, like NexGard and Bravecto, the oral medications? Do you think that’s having an impact?

Mendo Akdag:

That’s having some impact on topicals, but the data we have is that overall market is down.

Kevin Ellich:

Overall market’s down. Do you have any idea why the overall market’s down?

Mendo Akdag:

The season started late. That’s probably why. The weather is impacting it.

Kevin Ellich:

Okay, but I mean now vets are recommending people, even in the Northern part of the country where I live, give flea and tick medication to their pets year round. So that really shouldn’t have a major impact should it?

Mendo Akdag:

Well everybody is not listening to the vets, so...

Exhibit 99.1 Page 2 of 6

Kevin Ellich:

Okay, okay that’s a fair point. And then I guess, you know, you called out in the press release focusing on improving the marketing efforts to drive sales in ’15. Is there anything specific that you can call out or is it just more advertising?

Mendo Akdag:

We are putting more emphasis on database marketing. We are running some tests - we are doing some database analysis. Really the full implementation will be next spring.

Kevin Ellich:

Next spring okay. Should we expect advertising costs to increase then next year?

Mendo Akdag:

All I can tell you is currently our advertising costs has been up per impression - mid-to-high single digits.

Kevin Ellich:

Mid-to-high single. Okay that’s good. And then last question for me, your customer acquisition costs went up, I think, 10% you said to $45 or so. And you said that was due to advertising cost increases. Is that across the board between both on-line and TV? And I guess how are you thinking about the mix between the two on a go forward basis?

Mendo Akdag:

It’s across the board. Actually online increase was higher than the TV cost increase.

Kevin Ellich:

Okay. Do you think that’s sustainable?

Mendo Akdag:

We hope so. We’ll see.

Kevin Ellich:

Okay thank you.

Mendo Akdag:

Thank you.

Coordinator:

Our next question came from the line of Erin Wilson from Bank of America Merrill Lynch. Your line is now open. You may proceed. Once again, Erin Wilson, your line is open. Please check your...

Erin Wilson:

Sorry about that. Can you speak to the details on the IT-related project? What did you see - why did you see - sort of the need to change your platform initially and what made you stop the project? And should we anticipate additional costs associated with the new project going forward?

Mendo Akdag:

We concluded that it was not in the best interest of the company to proceed with it. We thought it wasn’t going to be - we recently concluded that it was not going to work for us, so that’s why we’re sticking to our current platform, which works. We are on an older version of the platform, so we are in the process of upgrading that to the new version.

Erin Wilson:

Okay. And then it seems one of your competitors has been sold; another, Drs. Foster and Smith, is apparently up for sale. Can you give us an update of your capital deployment strategy in light of those sort of shifts, or commotion, in the market? When does it make sense to look at potential acquisitions or valuations? Are they unrealistically high still out there?

Mendo Akdag:

In the normal course of business we always look at opportunities.

Erin Wilson:

Okay thanks.

Mendo Akdag:

You’re welcome.

Coordinator:

The next question came from the line of Michael Kupinski of Noble. Your line is open, sir.

Michael Kupinski:

Thank you. Mendo, I was wondering why do you think that advertising yields are not higher?

Mendo Akdag:

There are two things, the overall market is down and advertising costs are up.

Exhibit 99.1 Page 3 of 6

Michael Kupinski:

So do you believe that there’s an issue with creative or do you think - and in terms of the overall market isn’t the pet population, I guess, increasing? I guess the households with pets are actually increasing. Why do you think the market is down then?

Mendo Akdag:

Well on the flea and tick category the weather is playing a role. That’s the data we have on it from independent sources, so the weather is playing a role as far as...

Michael Kupinski:

And in terms of creative do you think you have the right creative or…?

Mendo Akdag:

Again, we don’t think it’s creative related. The demand was weak for the flea and tick topicals and our cost per impression on advertising was up.

Michael Kupinski:

And in terms of...

Mendo Akdag:

Cost per impression.

Michael Kupinski:

Okay. And in terms of the generics for flea and tick, you had indicated that the margins are higher for the generics. Do you think that you’re price competitive? Do you think that you should be bringing down the price to being the market share or what do you - what are - what could be the strategy there to kind of turn that ship around?

Mendo Akdag:

We do price testing, price sensitivity testing, and we price ourselves accordingly. We’ll consider reducing the prices if needed based on data.

Michael Kupinski:

And in terms of the higher, you know, customer average order size going up was that related to any accessories being sold or what was - just people buying more flea and tick products, or what drove that number?

Mendo Akdag:

Sales shifting to higher priced items.

Michael Kupinski:

Away from flea and tick or - because typically flea and tick would be a lower priced item I would think, unless they were buying a full year of - were they buying more for the year or were they buying - you know, I’m just trying to get a flavor on what drove the number.

Mendo Akdag:

More prescription and we had higher priced brands and there’s a slight increase in the doses that they were buying also.

Michael Kupinski:

A slight decrease in the doses?

Mendo Akdag:

Increase, not decrease.

Michael Kupinski:

Oh increase, okay. And in terms of accessories what - did that percentage of revenue increase in the quarter?

Mendo Akdag:

There was no increase actually. We have not focused on it.

Michael Kupinski:

Okay. All right those were all of my questions. Thank you.

Mendo Akdag:

You’re welcome.

Coordinator:

Thank you. The next question came from the line of Anthony Lebiedzinski, of Sidoti and Company. Your line is now open.

Anthony Lebiedzinski:

Thank you. Good morning. Just to follow-up on some previous questions so, you know, as far as the prescription business and just wanted to get a better sense of how that business did in the quarter, plus also over the counter medications other than flea and tick. Could you just give us a sense as how sales of those products performed?

Mendo Akdag:

Prescription business was up. It was healthy. And overall OTC was down.

Exhibit 99.1 Page 4 of 6

Anthony Lebiedzinski:

Okay got it. Okay and, you know, when looking at your sales results, reorders versus new orders, I mean, you know, clearly this was a quarter that was down here. But as far as - you know, your new order sales have struggled for the past few quarters. You know, last time there was an increase was, it looks like, first quarter fiscal ’14. So I know you guys have talked about changing some things and focusing on marketing efforts, but can you give us just a, you know, better sense as to, you know, how we should think about the trends for the new order sales going forward?

Mendo Akdag:

We’ll attempt to increase it obviously. That’s what we’re working on. We’ll see what happens.

Anthony Lebiedzinski:

Okay but, you know, what exactly are - as far as trying to get those to improve, is it just mixing up the medium mix a little bit, or I mean or, you know, changing the - tweaking the creatives? I mean can you just give us a little bit better, you know, sense as to how you’re proceeding with that?

Mendo Akdag:

Right. We are putting more emphasis on database marketing. They actually could really improve reorders, so we can afford to pay more for a new order customer.

Anthony Lebiedzinski:

Okay thank you.

Coordinator:

Once again to ask a question please press star and then 1. You will be prompted to record your name. To withdraw your request you may press star, 2. Our next question came from the line of Mitch Bartlett of Craig-Hallum. Your line is now open. You may proceed.

Mitch Bartlett:

Good morning. Mendo, I wonder if you would address - I know the overall market for flea and tick is weak, but do you think you’re losing market share? Your orders were down in aggregate 7%, 7.3% using your AOVs that you’ve talked about. There is obviously a - been a shift away from brand towards your own private label. And then you’re talking about prescription being way up versus, not way up, but prescription is up versus flea and tick that was - or OTC that was down obviously pretty hard. So all aggravating those - that 7% order decline pretty aggressively. I don’t - maybe you have the industry statistics, but it seems like that the industry for flea and tick wouldn’t be down 10% - 15% year-over-year. So are you losing market share?

Mendo Akdag:

The data we have on flea and tick topicals is that it’s down actually 11%, according to IRI, and there’s a shift to oral medications and combo products, which are prescription meds.

Mitch Bartlett:

Could you address private label in the quarter, how it did versus your branded?

Mendo Akdag:

Actually the private label was down.

Mitch Bartlett:

Oh okay. So the margins came, the margin increase came, from holding price on the branded side as well?

Mendo Akdag:

Prescription meds have higher margins.

Mitch Bartlett:

And was that shift towards prescription pretty dramatic year-over-year?

Mendo Akdag:

Well we disclose that once a year, so I’m not going to get into specifics. I have told you directionally, so...

Mitch Bartlett:

So you don’t think you’re losing market share is the conclusion?

Mendo Akdag:

We think we are holding it unless we have wrong data. So based on the data we got we don’t think so.

Mitch Bartlett:

Thank you.

Coordinator:

Thank you. The next question came from the line of Kevin Ellich of Piper Jaffray. Your line is now open.

Exhibit 99.1 Page 5 of 6

Kevin Ellich:

Hey, I just had a couple of follow-ups and actually some have been addressed in terms of the competitive landscape. Just wondering if you have been successful in acquiring any supply of these new medications, the orals that you talked about, that have come to market?

Mendo Akdag:

There - currently there are no issues for us to get any product, so that’s the current state.

Kevin Ellich:

Okay. Great thank you.

Mendo Akdag:

You’re welcome.

Coordinator:

Thank you. At this time there are no further questions. I would now like to hand the call back to Mr. Akdag for any closing remarks.

Mendo Akdag:

Thank you. For the fiscal year 2015 we are focusing on improving our marketing efforts to increase sales. This wraps up today’s conference call. Thank you for joining us. Operator, this ends the conference call.

Coordinator:

Thank you for participating. You may now disconnect.

Exhibit 99.1 Page 6 of 6

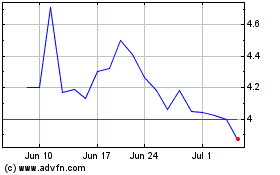

PetMed Express (NASDAQ:PETS)

Historical Stock Chart

From Mar 2024 to Apr 2024

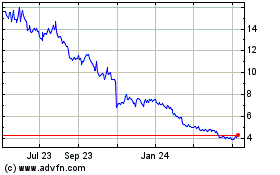

PetMed Express (NASDAQ:PETS)

Historical Stock Chart

From Apr 2023 to Apr 2024