Current Report Filing (8-k)

October 17 2014 - 12:58PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): October 17, 2014

THE BRINK’S COMPANY

(Exact name of registrant as specified in its charter)

|

Virginia

|

001-09148

|

54-1317776

|

|

(State or other jurisdiction

of incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

1801 Bayberry Court

P. O. Box 18100

Richmond, VA 23226-8100

(Address and zip code of

principal executive offices)

Registrant’s telephone number, including area code: (804) 289-9600

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.):

|

[ ]

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

|

[ ]

|

|

Soliciting materials pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

|

[ ]

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

|

[ ]

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item 7.01

|

Regulation FD Disclosure

|

On October 17, 2014, The Brink’s Company issued a press release announcing its plan to restructure its Netherlands operations. The release is furnished as Exhibit 99.1 hereto.

|

Item 9.01

|

Financial Statements and Exhibits

|

|

| |

|

|

|

(d)

|

Exhibits

|

|

| |

|

|

| |

99.1

|

Press Release, dated October 17, 2014, issued by The Brink’s Company

|

| |

|

|

| |

|

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

THE BRINK’S COMPANY

(Registrant)

|

| |

|

| |

|

|

Date: October 17, 2014

|

By:

|

/s/ Joseph W. Dziedzic

|

| |

|

Joseph W. Dziedzic

|

| |

|

Vice President and Chief Financial Officer

|

EXHIBIT INDEX

|

EXHIBIT

|

DESCRIPTION

|

| |

|

|

99.1

|

Press Release, dated October 17, 2014, issued by The Brink’s Company

|

EXHIBIT 99.1

|

The Brink’s Company

|

| |

1801 Bayberry Court

|

| |

P.O. Box 18100

|

| |

Richmond, VA 23226-8100 USA

|

|

PRESS RELEASE

|

Tel. 804.289.9600

|

|

Fax 804.289.9770

|

| |

|

|

Contact:

|

FOR IMMEDIATE RELEASE

|

|

Investor Relations and Corporate Communications

|

|

|

804.289.9709

|

|

Brink’s To Restructure Netherlands Operations

RICHMOND, Va., October 17, 2014 – The Brink’s Company (NYSE: BCO) announced its plan to restructure its Netherlands operations in response to a loss of business with Rabobank, its largest customer in that country. Brink’s expects to incur a charge of $16 million to $22 million against third-quarter GAAP earnings. The expected charge is related to asset impairments, severance and other costs associated with the expected cessation of service to Rabobank on July 1, 2015. The restructuring plan includes the potential closure of three branches and a workforce reduction of approximately 600 employees.

In 2013, the Netherlands operations generated approximately $120 million of revenue at an operating margin rate that was slightly above the company average. Upon completion of restructuring activities, the remaining business is expected to generate annual revenue of approximately $40 million, primarily from retail customers.

In 2011, the country’s three largest banks -- Rabobank, ING Bank and ABN AMRO -- with the support of the central bank of the Netherlands, founded a collaborative entity known as Geldservice Nederland B.V. (GSN). GSN has provided money processing services for the three banks since 2011. Brink’s currently provides all ATM managed services to Rabobank. In July 2015, GSN will provide these services to Rabobank.

Brink’s challenged the validity of the GSN entity, based on antitrust regulations. The challenge was unsuccessful.

The potential loss of business in the Netherlands was considered prior to the company’s July 24 disclosure of its goal to achieve a non-GAAP segment margin rate of 8% by the end of 2016, and the goal remains unchanged. Brink’s will provide additional details on the

restructuring plan on its third-quarter earnings conference call, which is scheduled for October 30.

About The Brink’s Company

The Brink’s Company (NYSE:BCO) is the world’s premier provider of secure transportation and cash management services. For more information, please visit The Brink’s Company website at www.Brinks.com or call 804-289-9709.

Forward-Looking Statements

This release contains both historical and forward-looking information. Words such as "anticipates," "assumes," "estimates," "expects," "projects," "predicts," "intends," "plans," "believes," "potential," "may," "should" and similar expressions may identify forward-looking information. Forward-looking information in this release includes, but is not limited to, 2016 non-GAAP segment margin outlook. Forward-looking information in this document is subject to known and unknown risks, uncertainties and contingencies, which are difficult to predict or quantify, and which could cause actual results, performance or achievements to differ materially from those that are anticipated.

These risks, uncertainties and contingencies, many of which are beyond our control, include, but are not limited to:

|

·

|

continuing market volatility and commodity price fluctuations and their impact on the demand for our services;

|

|

·

|

our ability to continue profit growth in Latin America;

|

|

·

|

our ability to maintain or improve volumes at favorable pricing levels and increase cost and productivity efficiencies, particularly in the United States and Mexico;

|

|

·

|

investments in information technology and value-added services and their impact on revenue and profit growth;

|

|

·

|

our ability to develop and implement solutions for our customers and gain market acceptance of those solutions;

|

|

·

|

our ability to maintain an effective IT infrastructure and safeguard confidential information;

|

|

·

|

risks customarily associated with operating in foreign countries including changing labor and economic conditions, currency devaluations, safety and security issues, political instability, restrictions on repatriation of earnings and capital, nationalization, expropriation and other forms of restrictive government actions;

|

|

·

|

the strength of the U.S. dollar relative to foreign currencies and foreign currency exchange rates;

|

|

·

|

the stability of the Venezuelan economy, changes in Venezuelan policy regarding foreign-owned businesses;

|

|

·

|

changes in currency restrictions and in foreign exchange rates, including fluctuations in value of the Venezuelan bolivar;

|

|

·

|

regulatory and labor issues in many of our global operations, including negotiations with organized labor and the possibility of work stoppages;

|

|

·

|

our ability to identify and execute further cost and operational improvements and efficiencies in our core businesses;

|

|

·

|

our ability to integrate successfully recently acquired companies and improve their operating profit margins;

|

|

·

|

costs related to dispositions and market exits;

|

|

·

|

our ability to identify evaluate and pursue acquisitions and other strategic opportunities including those in the home security industry and emerging markets;

|

|

·

|

the willingness of our customers to absorb fuel surcharges and other future price increases;

|

|

·

|

our ability to obtain necessary information technology and other services at favorable pricing levels from third party service providers;

|

|

·

|

variations in costs or expenses and performance delays of any public or private sector supplier, service provider or customer;

|

|

·

|

our ability to obtain appropriate insurance coverage, positions taken by insurers with respect to claims made and the financial condition of insurers, safety and security performance, our loss experience, and changes in insurance costs;

|

|

·

|

security threats worldwide and losses of customer valuables;

|

|

·

|

costs associated with the purchase and implementation of cash processing and security equipment;

|

|

·

|

employee and environmental liabilities in connection with our former coal operations, black lung claims incidence;

|

|

·

|

the impact of the Patient Protection and Affordable Care Act on black lung liability and the Company's ongoing operations;

|

|

·

|

changes to estimated liabilities and assets in actuarial assumptions due to payments made, investment returns, interest rates and annual actuarial revaluations, the funding requirements, accounting treatment, investment performance and costs and expenses of our pension plans, the VEBA and other employee benefits, mandatory or voluntary pension plan contributions;

|

|

·

|

the nature of our hedging relationships;

|

|

·

|

changes in estimates and assumptions underlying our critical accounting policies;

|

|

·

|

our ability to realize deferred tax assets;

|

|

·

|

the outcome of pending and future claims, litigation, and administrative proceedings;

|

|

·

|

public perception of the Company’s business and reputation;

|

|

·

|

access to the capital and credit markets;

|

|

·

|

seasonality, pricing and other competitive industry factors; and

|

|

·

|

the promulgation and adoption of new accounting standards and interpretations, new government regulations and interpretation of existing regulations.

|

This list of risks, uncertainties and contingencies is not intended to be exhaustive. Additional factors that could cause our results to differ materially from those described in the forward-looking statements can be found under "Risk Factors" in Item 1A of our Annual Report on Form 10-K for the period ended December 31, 2013, and in our other public filings with the Securities and Exchange Commission. The forward-looking information included in this document is representative only as of the date of this document and The Brink's Company undertakes no obligation to update any information contained in this document.

# # #

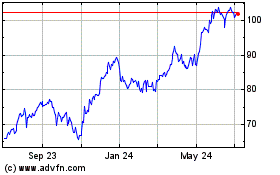

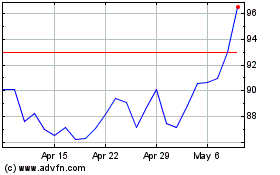

Brinks (NYSE:BCO)

Historical Stock Chart

From Aug 2024 to Sep 2024

Brinks (NYSE:BCO)

Historical Stock Chart

From Sep 2023 to Sep 2024