UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 23, 2014

THE HAIN CELESTIAL GROUP, INC.

(Exact name of registrant as specified in its charter)

|

| | | | |

| | | | |

Delaware | | 0-22818 | | 22-3240619 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

1111 Marcus Avenue, Lake Success, NY 11042

(Address of principal executive offices)

Registrant’s telephone number, including area code: (516) 587-5000

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

¨

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

¨

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

¨

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

| |

Item 5.02. | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On September 23, 2014, The Hain Celestial Group, Inc. (the “Company”) entered into an amendment (the “Amendment”) to the Company’s employment agreement with Irwin D. Simon, as amended (the “Employment Agreement”), the material terms of which are as follows:

| |

• | Extends the term of the Employment Agreement until June 30, 2019; |

| |

• | Establishes Mr. Simon’s base salary of $1,850,000 for the fiscal year ending June 30, 2015; |

| |

• | Amends the maximum annual incentive award so that Mr. Simon will be eligible to receive up to four times his base salary; |

| |

• | Amends the target and maximum long-term incentive compensation (“LTI”) award to seven and ten times his base salary, respectively; |

| |

• | Amends the additional benefits (as defined in the Employment Agreement) to include three times (two times in the case of termination due to death) the LTI paid to Mr. Simon over the immediately preceding fiscal year; and |

| |

• | Provides that Mr. Simon will receive the additional benefits upon termination not for good reason (as defined in the Employment Agreement). As consideration for such additional benefits, for three years following the termination not for good reason, Mr. Simon will not compete with the Company and will serve as Non-Executive Chairman of the Board or, if he is neither appointed nor elected Non-Executive Chairman of the Board, will provide consulting services of a similar nature. |

The foregoing description of the Employment Agreement and the Amendment does not purport to be complete and is qualified in its entirety by reference to the actual Employment Agreement, as amended (as previously publicly filed and described by the Company) and the full text of the Amendment (included as Exhibit 10.1 to this Current Report on Form 8-K (the “Form 8-K”)) each incorporated herein by reference.

|

| |

Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits. The following exhibits are filed herewith:

|

| | |

Exhibit No. | | Description |

| |

10.1 | | Amendment to Employment Agreement between the Company and Irwin D. Simon, dated September 23, 2014 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: September 29, 2014

|

| | |

| | |

THE HAIN CELESTIAL GROUP, INC. |

(Registrant) |

| |

By: | | /s/ Denise M. Faltischek |

Name: | | Denise M. Faltischek |

Title: | | Executive Vice President and |

| | General Counsel, Chief Compliance Officer |

Exhibit 10.1

AMENDMENT TO EMPLOYMENT AGREEMENT

THIS AMENDMENT (“Amendment”) is made effective on the date hereof to the employment agreement, dated as of July 1, 2003 and as amended on October 30, 2006, December 31, 2008, July 1, 2009, June 30, 2012 and November 2, 2012 (as so amended, the “Employment Agreement”), between The Hain Celestial Group, Inc., a Delaware corporation (the “Company”), and Irwin D. Simon (the “Executive”).

WHEREAS, Executive has been employed by the Company pursuant to the terms of the Employment Agreement;

WHEREAS, the parties desire to amend the Employment Agreement in accordance with the provisions of Section 7(j) of the Agreement; and

WHEREAS, the Compensation Committee of the Company’s Board of Directors, at a meeting duly called and held, has authorized and approved the execution and delivery of this Amendment by the Company;

NOW, THEREFORE, in consideration of the foregoing, of the mutual promises contained herein and of other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto hereby agree to amend the Agreement and supersede the provisions of the Agreement as follows:

1.The first sentence of Section 1 of the Employment Agreement is hereby amended to change the phrase “June 30, 2017” to “June 30, 2019”.

2.Section 2 of the Employment Agreement is hereby amended to delete the last sentence in its entirety and to insert the following: “Executive’s place of employment shall be at the Company’s principal executive office in Lake Success, New York.”

3.The first sentence of Section 3(a) of the Employment Agreement is hereby deleted its entirety and replaced with the following: “The Company shall pay Executive a base salary of $1,850,000 for the fiscal year ending June 30, 2015.”

4.Section 3(b) of the Employment Agreement is hereby amended to change the phrase “up to 225% of his Base Salary” to “up to four times his Base Salary”.

5.Section 3(e) of the Employment Agreement is hereby deleted in its entirety and replaced with the following:

“(e) Long-Term Incentive Compensation. For each fiscal year during the Employment Period, Executive shall be eligible to receive long-term incentive compensation (“LTI”) in cash, performance-based restricted stock, performance-based restricted stock units, restricted stock, restricted stock units, stock options or any combination thereof, as determined by the Compensation Committee in its sole discretion. With respect to the total LTI awarded in any such fiscal year during the Employment Period, Executive’s LTI target award shall equal seven times his Base Salary upon the achievement of target performance objectives, with a maximum award equal to ten times his Base Salary, and based on vesting conditions, in each case, as determined by the Compensation Committee in its sole discretion.”

6.Section 4(c) of the Employment Agreement is hereby is hereby deleted in its entirety and replaced with the following:

“(c) Business Expenses. During the Employment Period, the Company shall pay or reimburse Executive for all reasonable expenses incurred or paid by Executive in the performance of Executive's duties hereunder, upon presentation of expense statements or vouchers and such other information as the Company may require and in accordance with the generally applicable policies and procedures of the Company. In addition, the Company shall provide the Executive with a non-accountable supplemental benefit expense up to $250,000 per year, to be used against any expenses incurred by Executive that are not reimbursable pursuant to this paragraph or otherwise. Notwithstanding anything herein to the contrary, the reimbursement of expenses pursuant to this Section 4(c) shall be subject to the following conditions: (1) the expenses eligible for reimbursement in one taxable year shall not affect the expenses eligible for reimbursement in any other taxable year; (2) the

reimbursement of eligible expenses shall be made promptly, subject to the Company’s applicable policies, but in no event later than the end of the year after the year in which such expense was incurred; and (3) the right to reimbursement shall not be subject to liquidation or exchange for another benefit.”

7.Section 5(b) is hereby deleted in its entirety and replaced with the following:

“(b) Benefits Payable Upon Early Termination; Change of Control; Non-Renewal. (1) Following the end of the Employment Period pursuant to Section 5(a), (2) following a Change of Control of the Company after which the Executive remains employed by the Company or its successor under the terms of this Agreement, or (3) in the event this Agreement is not renewed upon or prior to its expiration on equal or more favorable terms (a "Non-Renewal"), Executive (or, in the event of his death, his surviving spouse, if any, or his estate) shall be paid the type or types of compensation, without duplication, determined to be payable in accordance with the following table at the times established pursuant to Section 5(c)::

|

| | | |

Event | Earned Salary | Vested Benefits | Additional Benefits |

Termination due to death | Payable | Payable | Payable |

Termination due to Disability | Payable | Payable | Payable |

Termination for Cause | Payable | Payable | Not payable |

Termination for Good Reason | Payable | Payable | Payable |

Termination Without Cause | Payable | Payable | Payable |

Termination Not for Good Reason | Payable | Payable | Payable |

Change of Control of the Company (without Termina- tion) | Not payable | Not payable | Not payable |

Non-Renewal | Payable | Payable | Payable |

provided, however that (i) in the case of Termination Not for Good Reason (before the occurrence of a Change of Control of the Company), Executive will receive the Additional Benefits only if he agrees to serve as Non-Executive Chairman of the Board during the Restricted Period (such service being subject to Executive being appointed or elected Non-Executive Chairman of the Board during the Restricted Period and, if Executive is not so appointed or elected, Executive will provide consulting services of a similar nature and extent, to the extent the Company shall reasonably request) and (ii) for the avoidance of doubt, this Agreement will continue in accordance with its terms following a Change of Control of the Company and the termination provisions of (b)(1) and (b)(3) and benefits due thereunder will apply in all respects.”

8.Subsection (iii) of the defined term “Additional Benefits” in Section 5(d) of the Agreement is hereby deleted in its entirety and replaced with the following:

“(iii) An amount equal to (A) three times (two times in the case of termination due to death) Base Salary in effect on the date of termination, plus (B) three times (two times in the case of termination due to death) the average annual bonus paid to the Executive over two immediately preceding fiscal years, including any annual bonus paid pursuant to Section 3(b), plus (C), three times (two times in the case of termination due to death) the LTI paid to the Executive over the immediately preceding fiscal year, plus (D) except in the case of Non-Renewal, the Executive's accrued annual bonus through the date of termination, determined in accordance with clause (B) above; and”

9.The last sentence of Subsection (i) of the defined term “Additional Benefits” in Section 5(d) of the Agreement is hereby amended by adding the following clarification at the end thereof:

“(or, if later, as soon as permitted by Section 409A of the Code)”

10. Subsection (ii) of Section 6(a) of the Agreement is hereby deleted in its entirety and replaced with the following:

“(ii) In accordance with the foregoing and this Agreement, the Executive hereby agrees that, during the term of the Executive’s employment with the Company and, except in the case of Termination for Cause, for a period of three year(s) after the termination of Executive’s employment with the Company (it being understood and agreed that the provisions of this Section 6 shall not apply in the event Executive’s employment terminates for any reason without payment of the Additional Benefits) (the “Restricted Period”), the Executive will not, directly or indirectly, individually or on behalf of any person or entity other than the Company or any of its subsidiaries:”

Except as provided herein, all other terms and conditions of the Agreement shall remain in full force and effect. Executive hereby agrees and acknowledges that the terms of this Amendment shall not create or provide any grounds for payment of any benefits under Section 5(b) of the Employment Agreement or otherwise trigger any rights of Executive under the Employment Agreement.

IN WITNESS WHEREOF, the undersigned has caused this Amendment to be executed as of September 23, 2014.

EXECUTIVE

Date: September 23, 2014

/s/ Irwin D. Simon

Irwin D. Simon

THE HAIN CELESTIAL GROUP, INC.

Date: September 23, 2014

By: /s/ Denise M. Faltischek

Name: Denise M. Faltischek

Title: Executive Vice President and

General Counsel, Chief Compliance Officer

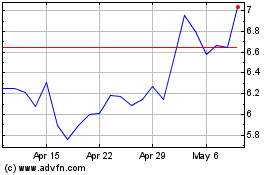

Hain Celestial (NASDAQ:HAIN)

Historical Stock Chart

From Mar 2024 to Apr 2024

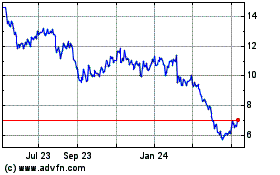

Hain Celestial (NASDAQ:HAIN)

Historical Stock Chart

From Apr 2023 to Apr 2024