UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

|

Vortex Brands Co.

|

|

(Exact name of registrant as specified in its charter)

|

|

Colorado

|

|

3949

|

|

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Primary Standard Industrial

Classification Code Number)

|

|

(IRS Employer

Identification No.)

|

|

28202 Cabot Rd #300 Laguna Niguel, California

|

|

(Address of principal executive offices) (zip code)

|

|

(949) 461-1469

|

|

(Registrant’s telephone number, including area code)

|

|

|

|

(949) 271-5730

|

|

(Registrant’s fax number, including area code)

|

Securities to be registered pursuant to Section 12(g) of the Act:

Common Stock, Par Value $.0001

(Title of class)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer," "accelerated filer,” and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

|

Non-accelerated filer

|

o

|

Smaller reporting company

|

x

|

| (Do not check if a smaller reporting company) |

|

|

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date: As of August 27, 2014, the Registrant had 99,050,000 shares of common stock, par value of $0.001 per share, issued and outstanding.

Item 1 Business.

Our Company

Vortex Brands, Co., (“Vortex and the Company”) an Indiana Corporation, was incorporated on May 28, 2014. Zulu Energy Corp. (“Zulu”) was incorporated under the laws of the State of Colorado on May 6, 2000. On May 29, 2014, Zulu issued shares representing 80% of its issued and outstanding stock to the shareholders of Vortex in exchange for 100% of Vortex. This transaction is being accounted for as a reverse merger and recapitalization. At the date of merger, Zulu had no net assets or liabilities. Contemporaneous with the merger, Zulu changed its name to Vortex Brands, Co. The Company selected May 31 as its fiscal year end.

Business of Registrant

Vortex Brands Co., was incorporated under the laws of the State of Colorado on May 6, 2000. In May 2014, the Company executed a licensing agreement to market and sell the product Vortex Tennis. Our license agreement is exclusive throughout the world. Under the license agreement, the Company may sell tennis racquets and other tennis related products under the trademarked name of Vortex Tennis. The Company may not sell any other products that are in competition with Vortex Tennis without the written consent of Vortex Tennis. Under this exclusive license, the Company shall purchase from Vortex Tennis the licensed products and resell the products to consumers within the United States. The Company may sell other products under the name of Vortex Tennis subject to the written consent of Vortex Tennis. If the Company, brands a 3rd party product under the Vortex Tennis name the Company would pay Vortex Tennis a royalty under the license agreement.

License Agreement

Term

The license agreement is for a term of twenty (20) years. The Company has the right to renew the license agreement for successive ten (10) year period by paying $1,000,000 for each new term.

Payments/Royalty

The Company shall pay a royalty equal to Seven and One Half Percent (7.5%) of the Gross Revenue from the licensed products. Gross revenue is defined as total revenue minus discounts and allowances. In addition to the royalty, the license requires that the Company pay a $7,500 monthly fee beginning twelve (12) months from the execution of the license agreement. Thereby the fee shall begin on July 1, 2015. The monthly fee shall increase each year per the following table:

Year 1: $0 per month

Year 2: $7,500 per month

Year 3: $8,500 per month

Year 4: $9,500 per month

Year 5: $10,500 per month

Year 6: $11,500 per month

Year 7: $12,500 per month

Year 8: $13,500 per month

Year 9+: $15,000 per month

Product Ordering

The Company is able to purchase the products directly from the manufactures.

Buy-Out

The Company also has the option, at its election, to the purchase the intellectual property associated to the license agreement. The buy-out amount is equal to revenue for the 12 months immediately prior to the buy-out.

Expansion

Proposed Milestones to Implement Business Operations

The following milestones are based on estimates made by our management team. The working capital requirements and the projected milestones are approximations and are subject to adjustments. The Company projects it will need $500,000 over the next 12 months to expand outside of California. The Company expects to raise the $500,000 needed through debt financing. We are currently negotiating the final terms of a debt financing in the amount of $500,000 and we will provide a copy of the agreement once it is filing as an Exhibit under Form 8-K.

We plan to complete our milestones as follows:

0 - 4 Months

The Company will increase its marketing budget to recruit additional tennis pros to assist in marketing and selling of the Company’s products within California:

|

Description

|

|

Expense

|

|

|

Sales personal recruitment

|

|

$ |

50,000 |

|

|

Marketing

|

|

|

25,000 |

|

|

Tennis Pro Recruitment

|

|

|

25,000 |

|

|

Total

|

|

$ |

100,000 |

|

4 - 6 Months

The Company will need to acquire additional product and increase it marketing budge to begin to expand its operations into states outside of California products:

|

Description

|

|

Expense

|

|

|

Marketing Expenses

|

|

$ |

100,000 |

|

|

Total

|

|

$ |

100,000 |

|

7 - 11 Months

The Company will increase its marketing budget to recruit additional tennis pros to assist in marketing and selling of the Company’s products.

|

Description

|

|

Expense

|

|

|

Tennis Pro recruitment

|

|

$ |

50,000 |

|

|

Marketing

|

|

|

100,000 |

|

|

Total

|

|

$ |

150,000 |

|

12-14 Months

The Company will need to acquire additional product and increase it marketing budget:

|

Description

|

|

Expense

|

|

|

Tennis Pro recruitment

|

|

$ |

50,000 |

|

|

Marketing

|

|

|

100,000 |

|

|

Total

|

|

$ |

150,000 |

|

15-18 Months

The Company will increase its marketing budget to recruit additional tennis pros to assist in marketing and selling of the Company’s products.

|

Description

|

|

Expense

|

|

|

Tennis Pro recruitment

|

|

$ |

50,000 |

|

|

Marketing

|

|

|

100,000 |

|

|

Total

|

|

$ |

150,000 |

|

19-24 Months

Further, we intend to launch a marketing campaign via television ads and tournament sponsorship to promote the company’s product.

|

Description

|

|

Expense

|

|

|

Television

|

|

$ |

250,000 |

|

|

Tennis Pro Recruitment

|

|

|

50,000 |

|

|

Sponsorship

|

|

|

50,000 |

|

|

Total

|

|

$ |

350,000 |

|

Note: The amounts allocated to each line item in the above milestones are subject to change without notice. Our planned milestones are based on the estimated amount of time to complete each milestone.

Long-Term Plan (5 Years)

Over the ensuing five years our growth and expansion will focus on a disciplined growth strategy of expanding the Company into other states by recruiting sales staff and teaching pros.

We estimate that we will need to raise between an additional $1.0 - $1.5 million to fully expand the Company throughout the United States.

Sales and Marketing

Our marketing strategy is aimed at attracting new customers through both traditional and creative avenues. We intend to focus on building a reputation among active tennis place while directing our marketing efforts toward the recruitment of teaching pros and then possibly move into selling on QVC or HSN.

Emerging Growth Company Status

We are an “emerging growth company,” as defined in the JOBS Act. For as long as we are an “emerging growth company,” we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies,” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding advisory “say-on-pay” votes on executive compensation and shareholder advisory votes on golden parachute compensation.

Under the JOBS Act, we will remain an “emerging growth company” until the earliest of:

| |

•

|

the last day of the fiscal year during which we have total annual gross revenues of $1 billion or more;

|

| |

•

|

the last day of the fiscal year following the fifth anniversary of the completion of this offering;

|

| |

•

|

the date on which we have, during the previous three-year period, issued more than $1 billion in non- convertible debt; and

|

| |

•

|

the date on which we are deemed to be a “large accelerated filer” under the Securities Exchange Act of 1934, or the Exchange Act.

|

We will qualify as a large accelerated filer as of the first day of the first fiscal year after we have (i) more than $700 million in outstanding common equity held by our non-affiliates and (ii) been public for at least 12 months. The value of our outstanding common equity will be measured each year on the last day of our second fiscal quarter.

The Section 107 of the JOBS Act provides that we may elect to utilize the extended transition period for complying with new or revised accounting standards and such election is irrevocable if made. As such, we have made the election to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1) of the JOBS Act. Please refer to a discussion on page 13 under “Risk Factors” of the effect on our financial statements of such election.

Form 10 Filing

This is an Exchange Act registration statement and not a registered offering of securities.

Item 1A. Risk Factors.

Set forth, under the caption “Risk Factors,” where appropriate, the risk factors described in Item 503(c) of

Regulation S-K (§229.503(c) of this chapter) applicable to the registrant. Provide any discussion of risk

factors in plain English in accordance with Rule 421(d) of the Securities Act of 1933 (§230.421(d) of this chapter). Smaller reporting companies are not required to provide the information required by this item

An investment in our Common Stock is highly speculative and involves a high degree of risk. Before making an investment decision, you should carefully consider the risks described below together with all of the other information included in this prospectus. The statements contained in or incorporated into this prospectus that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, the value of our Common Stock could decline, and an investor in our securities may lose all or part of their investment. Currently, shares of our Common Stock are not publicly traded.

The Company has limited capitalization and lack of working capital and as a result is dependent on raising funds to grow and expand its business.

Our management has concluded that there is substantial doubt about our ability to continue as a going concern. The Company has extremely limited capitalization and is dependent on raising funds to grow and expand its businesses. The Company will endeavor to finance its need for additional working capital through debt or equity financing. Additional debt financing would be sought only in the event that equity financing failed to provide the Company necessary working capital. Debt financing may require the Company to mortgage, pledge or hypothecate its assets, and would reduce cash flow otherwise available to pay operating expenses and acquire additional assets. Debt financing would likely take the form of short-term financing provided by officers and directors of the Company, to be repaid from future equity financing. Additional equity financing is anticipated to take the form of one or more private placements to qualified investors under exemptions from the registration requirements of the 1933 Act or a subsequent public offering. However, there are no current agreements or understandings with regard to the form, time or amount of such financing and there is no assurance that any of this financing can be obtained or that the Company can continue as a going concern.

The Company has limited revenue and limited operating history which make it difficult to evaluate the Company which could restrict your ability to sell your shares.

The Company was organized on January 12, 2000. Consequently, the Company has only a limited operating history and limited revenues. Activities to date have been limited to acquiring products to sell, organizational efforts and obtaining initial financing. The Company must be considered in the developmental stage. Prospective investors should be aware of the difficulties encountered by such enterprises, as the Company faces all the risks inherent in any new business, including the absence of any prior operating history, need for working capital and intense competition. The likelihood of success of the Company must be considered in light of such problems, expenses and delays frequently encountered in connection with the operation of a new business and the competitive environment in which the Company will be operating.

The Company is dependent on key personnel and loss of the services of any of these individuals could adversely affect the conduct of the company's business.

Initially, success of the Company is entirely dependent upon the management efforts and expertise of Mr. Tom Olmstead. A loss of the services of Mr. Olmstead could adversely affect the conduct of the Company's business. In such event, the Company would be required to obtain other personnel to manage and operate the Company, and there can be no assurance that the Company would be able to employ a suitable replacement for either of such individuals, or that a replacement could be hired on terms which are favorable to the Company. The Company currently maintains no key man insurance on the lives of any of its officers or directors. The Company currently has not entered into any employment agreements with our officers or key personal. The Company expects to enter into employment agreements in 2014.

Because we do not expect to pay dividends for the foreseeable future, investors seeking cash dividends should not purchase our common stock.

We have never declared or paid any cash dividends on our common stock. We currently intend to retain future earnings, if any, to finance our business. As a result, we do not anticipate paying any cash dividends in the foreseeable future. Our payment of any future dividends will be at the sole discretion of our Board of Directors after considering whether we have generated sufficient revenues, our financial condition, operating results, cash needs, growth plans and other factors. Accordingly, investors that are seeking cash dividends should not purchase our common stock.

We cannot guarantee that an active trading market will develop for our Common Stock that may restrict your ability to sell your shares.

There is no public market for our Common Stock and there can be no assurance that a regular trading market for our Common Stock will ever develop or that, if developed, it will be sustained. Therefore, purchasers of our Common Stock should have a long-term investment intent and should recognize that it may be difficult to sell the shares, notwithstanding the fact that they are not restricted securities. There has not been a market for our Common Stock. We cannot predict the extent to which a trading market will develop or how liquid a market might become.

Our shares may be subject to the “penny stock” rules that might subject you to restrictions on marketability and you may not be able to sell your shares

Broker-dealer practices in connection with transactions in "Penny Stocks" are regulated by certain penny stock rules adopted by the Securities and Exchange Commission. Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ system). The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the risk associated with the penny stock market. The broker-dealer must also provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker- dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer's account. In addition, the penny stock rules generally require that prior to a transaction in a penny stock, the broker- dealer must make a written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for a stock that becomes subject to the penny stock rules. If the Company's securities become subject to the penny stock rules, investors in this offering may find it more difficult to sell their securities.

Due to the control by management of 99% of the total voting power our non-management shareholders will have no power to choose management or impact operations.

Management currently maintains a voting power of 99%. Consequently, management has the ability to influence control of our operations and, acting together, will have the ability to influence or control substantially all matters submitted to stockholders for approval, including:

|

●

|

Election of the Board of Directors;

|

|

●

|

Amendment to the our certificate of incorporation or bylaws; and

|

These stockholders will thus have substantial influence over our management and affairs and other stockholders possess no practical ability to remove management or effect the operations of our business. Accordingly, this concentration of ownership by itself may have the effect of impeding a merger, consolidation, takeover or other business consolidation, or discouraging a potential acquirer from making a tender offer for the Common Stock.

This registration statement contains forward-looking statements and information relating to us, our industry and to other businesses. Our actual results may differ materially from those contemplated in our forward looking statements which may negatively impact our company.

These forward-looking statements are based on the beliefs of our management, as well as assumptions made by and information currently available to our management. When used in this registration statement, the words "estimate," "project," "believe," "anticipate," "intend," "expect" and similar expressions are intended to identify forward-looking statements. These statements reflect our current views with respect to future events and are subject to risks and uncertainties that may cause our actual results to differ materially from those contemplated in our forward-looking statements. We caution you not to place undue reliance on these forward-looking statements, which speak only as of the date of this registration statement. We do not undertake any obligation to publicly release any revisions to these forward-looking statements to reflect events or circumstances after the date of this registration statement or to reflect the occurrence of unanticipated events.

We may need additional financing which we may not be able to obtain on acceptable terms. If we are unable to raise additional capital, as needed, the future growth of our business and operations would be severely limited.

A limiting factor on our growth, and is our limited capitalization which could impact our ability execute on our divisions business plans. If we raise additional capital through the issuance of debt, this will result in increased interest expense. If we raise additional funds through the issuance of equity or convertible debt securities, the percentage ownership of the Company held by existing shareholders will be reduced and our shareholders may experience significant dilution. In addition, new securities may contain rights, preferences or privileges that are senior to those of our Common Stock. If additional funds are raised by the issuance of debt or other equity instruments, we may become subject to certain operational limitations (for example, negative operating covenants). There can be no assurance that acceptable financing necessary to further implement our plan of operation can be obtained on suitable terms, if at all. Our ability to develop our business, fund expansion, develop or enhance products or respond to competitive pressures, could suffer if we are unable to raise the additional funds on acceptable terms, which would have the effect of limiting our ability to increase our revenues or possibly attain profitable operations in the future.

Due to limited liquidity in our shares, if a public market does develop, the market price of our Common Stock may fluctuate significantly which could cause a decline in value of your shares.

There is no public market for our Common Stock and there can be no assurance that a regular trading market for our Common Stock will ever develop or that, if developed, it will be sustained. If a public market does develop, the market price of our Common Stock may fluctuate significantly in response to factors, some of which are beyond our control. The market price of our common stock could be subject to significant fluctuations and the market price could be subject to any of the following factors:

| ● |

our failure to achieve and maintain profitability;

|

| ● |

changes in earnings estimates and recommendations by financial analysts;

|

| ● |

actual or anticipated variations in our quarterly and annual results of operations;

|

| ● |

changes in market valuations of similar companies;

|

| ● |

announcements by us or our competitors of significant contracts, new services, acquisitions, commercial relationships, joint ventures or capital commitments;

|

| ● |

loss of significant clients or customers;

|

| ● |

loss of significant strategic relationships; and

|

| ● |

general market, political and economic conditions.

|

Recently, the stock market in general has experienced extreme price and volume fluctuations. Continued market fluctuations could result in extreme volatility in the price of shares of our Common Stock, which could cause a decline in the value of our shares. Price volatility may be worse if the trading volume of our Common Stock is low.

Our by-laws provide for indemnification of our officers and directors at our expense and limit their liability which may result in a major cost to us and hurt the interests of our shareholders because corporate resources may be expended for the benefit of officers and/or directors.

Our bylaws require that we indemnify and hold harmless our officers and directors, to the fullest extent permitted by law, from certain claims, liabilities and expenses under certain circumstances and subject to certain limitations and the provisions of Colorado law. Under Colorado law a corporation may indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of the corporation) by reason of the fact that he is or was a director, officer, employee or agent of the corporation, against expenses, attorneys fees, judgments, fines and amounts paid in settlement, actually and reasonably incurred by him in connection with an action, suit or proceeding if the person acted in good faith and in a manner reasonably believed to be in or not opposed to the best interests of the corporation.

The Company's auditors have issued a going concern opinion that the Company's may not be able to continue without raising additional capital therefore needs to raise additional capital to continue its operations and to implement its plan of operations.

Our auditors and management has concluded that there is substantial doubt about our ability to continue as a going concern. The Company has extremely limited capitalization and is dependent on raising funds to grow and expand its businesses. The Company needs to raise additional capital to continue its operations and to implement its plan of operations. Additional equity financing is anticipated to take the form of one or more private placements to qualified investors under exemptions from the registration requirements of the 1933 Act or a subsequent public offering. However, there are no current agreements or understandings with regard to the form, time or amount of such financing and there is no assurance that any of this financing can be obtained or that the Company can continue as a going concern.

Our internal controls may be inadequate, which could cause our financial reporting to be unreliable and lead to misinformation being disseminated to the public.

Our management is responsible for establishing and maintaining adequate internal control over financial reporting. As defined in Exchange Act Rule 13a-15(f), internal control over financial reporting is a process designed by, or under the supervision of, the principal executive and principal financial officer and effected by the board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles and includes those policies and procedures that: (i) pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the Company; (ii) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management and/or directors of the Company; and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company's assets that could have a material effect on the financial statements. Our internal controls may be inadequate or ineffective, which could cause our financial reporting to be unreliable and lead to misinformation being disseminated to the public. Investors relying upon this misinformation may make an uninformed investment decision.

Management identified the following control deficiencies that represent material weaknesses as of May 31, 2014:

|

(1)

|

Lack of an independent audit committee. Although we have an audit committee it is not comprised solely of independent directors. We may establish an audit committee comprised solely of independent directors when we have sufficient capital resources and working capital to attract qualified independent directors and to maintain such a committee.

|

|

(2)

|

Inadequate staffing and supervision within our bookkeeping operations. The relatively small number of people who are responsible for bookkeeping functions prevents us from segregating duties within our internal control system. The inadequate segregation of duties is a weakness because it could lead to the ultimate identification and resolution of accounting and disclosure matters or could lead to a failure to perform timely and effective reviews which may result in a failure to detect errors in spreadsheets, calculations, or assumptions used to compile the financial statements and related disclosures as filed with the Securities and Exchange Commission.

|

|

(3)

|

Insufficient number of independent directors. At the present time, our Board of Directors does not consist of a majority of independent directors, a factor that is counter to corporate governance practices as set forth by the rules of various stock exchanges.

|

Our management determined that these deficiencies constituted material weaknesses. Due to a lack of financial and personnel resources, we are not able to, and do not intend to, immediately take any action to remediate these material weaknesses. We will not be able to do so until we acquire sufficient financing and staff to do so.

The sporting goods industry is highly competitive and our failure to remain competitive could adversely affect our result of operations and financial condition.

The sporting goods industry industry is highly competitive and includes many regional, national and international companies, some of which have achieved substantial market share. We compete primarily on the basis of product features, brand recognition, quality and price. The failure to remain competitive could adversely affect our results of operations and financial condition. Some of our competitors offer types of products that we do not sell, and some of our competitors are larger and have substantially greater financial and other resources than us.

Economic conditions, weather and other factors beyond our control could cause a decline in demand for our products.

We are dependent on the economies in which we sell our products, and in particular on levels of consumer spending. Economic conditions affect not only the ultimate consumer, but also retailers, our primary direct customers. As a result, our results may be adversely affected by downward trends in the economies in which we sell our products. Adverse weather also can cause a significant decline in our sales. In addition, the occurrence of events that adversely affect economies or international tourism, such as terrorism or regional instability, continue to adversely affect leisure travel and related discretionary consumer spending, which can have a particularly negative impact on our business.

We are dependent in part on the performance of third-party suppliers, which may cause delays in filling orders, thereby affecting our financial condition.

As a result of our business rationalization and cost reduction efforts, we outsource a substantial portion of our manufacturing to third parties in Asia, such as in China and Thailand. As a result of this outsourcing, we are dependent in part on the performance of third-party suppliers in order to deliver quality products in a timely manner. We are also increasingly subject to risks relating to the local economic and political conditions in the countries to which we outsource our manufacturing operations. Although these factors have not had an adverse impact on our operations to date, we cannot assure you that they will not affect quality control, orders and shipments, or the image of our trademark in the case of licensees. In addition, our third-party manufacturer’s produce certain of our key products, exposes us to the risk that major incidents at such sites, such as fire or earthquake damage, could substantially reduce or halt production. In the event we are required to shift the manufacturing of some of our products from one geographical location, or from one contract manufacturer, to another, our ability to fulfill orders and our cost of sales may be adversely affected, which would negatively impact our results of operations.

We may be affected by raw material and energy price increases which may decrease our margins and impact our ability to achieve profitability.

Our production is dependent on the timely availability of certain raw materials whose prices are driven by the oil and steel price development on the world market. Such raw materials are used in manufacturing, among other items, plastic components for bindings, ski boots and diving fins, carbon-fibers for racquets and metal parts for binding components and ski edges. Changing raw material prices historically have had a material impact on our earnings and cash flows, and are likely to continue to have a significant impact on earnings and cash flows in future periods. Historically, we generally have not been able to pass on to our customers increases in costs resulting from raw material and energy prices, and have sought other means, particularly through the restructuring of our production processes, to maintain operating margins.

Our performance may be impacted by general economic conditions and an economic downturn.

Recessionary pressures from an overall decline in U.S. economic activity could adversely impact our results of operations. Economic uncertainty may reduce consumer spending and could result in increased pressure from competitors or customers to reduce the prices of our products and/or limit our ability to increase or maintain prices, which could lower revenues and profitability. Instability in the financial markets may impact our ability or increase the cost to enter into new credit agreements in the future. Additionally, it may weaken the ability of customers, suppliers, distributors, banks, insurance companies and other business partners to perform in the normal course of business, which could expose us to losses or disrupt supply of inputs used to conduct our business. If one or more key business partners fail to perform as expected or contracted, our operating results could be negatively impacted.

We may incur significant future expenses due to the implementation of our business strategy.

We strive to achieve our long-term vision of being a leading marketer and manufacturer of shelf stable products. Such action is subject to the substantial risks, expenses and difficulties frequently encountered in the implementation of a business strategy. If we are unsuccessful in developing, acquiring and/or licensing new brands, and increasing distribution and sales volume of our existing products, our operating results could be negatively impacted. Even if we are successful, this business strategy may require us to incur substantial additional expenses, including advertising and promotional costs, and integration costs of any future acquisitions. We also may be unsuccessful at integrating any future acquisitions.

Unavailability of our necessary supplies, at reasonable prices, could adversely affect our operations.

Our manufacturing costs are subject to fluctuations in the prices. The raw products for Vortex Brands Co. products are widely available year-round. Nonetheless, we are dependent on our suppliers to provide us with products and ingredients in adequate supply and on a timely basis. The failure of certain suppliers to meet our performance specifications, quality standards or delivery schedules could have a material adverse effect on our operating results. To the extent that product ingredients become scarce, substantially increase in price, or become unavailable or unavailable on commercially attractive terms, our operating results could be materially and adversely affected. From time to time, we may lock in prices for raw materials, such as oils, as we deem appropriate, and such strategies may result in us paying prices for raw materials that are above market at the time of purchase.

Changes in consumer preferences and discretionary spending may have a material adverse effect on our revenue, results of operations and financial condition.

The sporting goods industry in general, is subject to changing consumer trends, demands and preferences. Trends within the sporting goods industry and our failure to anticipate, identify or react to changes in these trends could, among other things, lead to reduced demand and price reductions, and could have a material adverse effect on our business, results of operations and financial condition. These changes might include consumer demand for new products or formulations that include health-promoting ingredients. Our success depends, in part, on our ability to anticipate the tastes and dietary habits of consumers and to offer products that appeal to their needs and preferences on a timely and affordable basis.

The sporting goods industry is highly competitive and our failure to remain competitive could adversely affect our result of operations and financial condition.

The sporting goods industry is highly competitive and includes many regional, national and international companies, some of which have achieved substantial market share. We compete primarily on the basis of product features, brand recognition, quality and price. The failure to remain competitive could adversely affect our results of operations and financial condition. Some of our competitors offer types of sports products that we do not sell, and some of our competitors are larger and have substantially greater financial and other resources than us.

Changes in the tastes of the sporting public could affect the demand for our products which could negatively impact our business.

In recent years we have observed declining demand overall in the global tennis markets. The general decline in demand in the tennis market has been observed since the period of peak demand in the early 1990’s. We believe this decline is due to competing leisure activities, including computer games and the Internet. We and the sporting goods industry in general are dependent on the tastes of the sporting public and its priorities in spending on leisure activities. A further decrease in interest in tennis would cause a decline in the size of the markets from which we derive most of our sales and could thus cause a decline in our revenues and operating results.

Economic conditions, weather and other factors beyond our control could cause a decline in demand for our products.

We are dependent on the economies in which we sell our products, and in particular on levels of consumer spending. Economic conditions affect not only the ultimate consumer, but also retailers, our primary direct customers. As a result, our results may be adversely affected by downward trends in the economies in which we sell our products. Adverse weather also can cause a significant decline in our sales. In addition, the occurrence of events that adversely affect economies or international tourism, such as terrorism or regional instability, continue to adversely affect leisure travel and related discretionary consumer spending, which can have a particularly negative impact on our business.

Summary

We believe it is important to communicate our expectations to investors. There may be events in the future, however, that we are unable to predict accurately or over which we have no control. The risk factors listed on the previous pages as well as any cautionary language in this registration statement, provide examples of risks, uncertainties and events that may cause our actual results to differ materially from the expectations we describe in our forward looking statements. The occurrence of the events our business described in the previous risk factors and elsewhere in this registration statement could negatively impact our business, cash flows, results of operation, prospects, financial condition and stock price.

Dividend Policy

Since inception we have not paid any dividends on our common stock. We currently do not anticipate paying any cash dividends in the foreseeable future on our common stock, although we intend to retain our earnings, if any, to finance the exploration and growth of our business, our Board of Directors will have the discretion to declare and pay dividends in the future.

Item 2. Financial Information.

You should read the following discussion and analysis of our financial condition and results of operations in conjunction with our consolidated financial statements, the notes to those consolidated financial statements, and the other financial information appearing elsewhere in this registration statement. The following discussion, analysis and other parts of this registration statement, in addition to historical information, contain forward-looking statements that reflect our plans, estimates, intentions, expectations, and beliefs. Such statements are only predictions, and our actual results could differ materially from those discussed in, or implied by, these forward-looking statements. The historical results set forth in this discussion and analysis are not necessarily indicative of trends with respect to any actual or projected future financial performance. See “Special note regarding forward looking statements.” Factors that could cause or contribute to such differences include those set forth in “Item 1A - Risk factors” contained elsewhere in this registration statement.

Management’s Discussion and Analysis and Results of Operations

This following information specifies certain forward-looking statements of management of the Company. Forward-looking statements are statements that estimate the happening of future events and are not based on historical fact. Forward-looking statements may be identified by the use of forward-looking terminology, such as may, shall, could, expect, estimate, anticipate, predict, probable, possible, should, continue, or similar terms, variations of those terms or the negative of those terms. The forward-looking statements specified in the following information have been compiled by our management on the basis of assumptions made by management and considered by management to be reasonable. Our future operating results, however, are impossible to predict and no representation, guaranty, or warranty is to be inferred from those forward-looking statements.

The assumptions used for purposes of the forward-looking statements specified in the following information represent estimates of future events and are subject to uncertainty as to possible changes in economic, legislative, industry, and other circumstances. As a result, the identification and interpretation of data and other information and their use in developing and selecting assumptions from and among reasonable alternatives require the exercise of judgment. To the extent that the assumed events do not occur, the outcome may vary substantially from anticipated or projected results, and, accordingly, no opinion is expressed on the achievability of those forward-looking statements. We cannot guaranty that any of the assumptions relating to the forward-looking statements specified in the following information are accurate, and we assume no obligation to update any such forward-looking statements.

Critical Accounting Policies and Estimates.

Our Management’s Discussion and Analysis of Financial Condition and Results of Operations section discusses our financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of these financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. On an on-going basis, management evaluates its estimates and judgments, including those related to revenue recognition, accrued expenses, financing operations, and contingencies and litigation. Management bases its estimates and judgments on historical experience and on various other factors that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying value of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions. The most significant accounting estimates inherent in the preparation of our financial statements include estimates as to the appropriate carrying value of certain assets and liabilities which are not readily apparent from other sources.

Result of Operations

The Company generates revenue from the sale of its product.

Operating Expenses

The Company had the following operating expenses:

|

|

|

Year Ended

May 31, 2014

|

|

|

|

|

|

|

General and Administrative

|

|

$ |

121,000 |

|

|

|

|

$ |

(121,000 |

) |

For the period ending May 31, 2014, the Company had $121,000 in operating expenses. These expenses related to setting up the company after the reverse merger.

The Company expects the operating expenses will be $2,000 per month for audits and legal expenses related to being a reporting company. The Company’s overall monthly expenses are expected to be $15,000.

Net Loss

For the Period ending May 31, 2014, the Company had net loss of $121,000. This was derived as follows:

| |

|

Year Ended

May 31, 2014

|

|

| |

|

|

|

|

|

|

$ |

- |

|

|

|

|

|

121,000 |

|

|

|

|

$ |

(121,000 |

) |

Dividends

The Company has not paid dividends on its Common Stock.

Sale of Unregistered Securities.

On May 29, 2014, Vortex Brands issued 200,000 shares in exchange for $200 cash.

On May 29, 2014, Vortex Brands executed a license agreement with Innovative Sport Brands, Inc. Vortex owns the intellectual property rights related to products licensed by the Company.

On May 30, 2014, the Company executed a reverse merger between the Company and Vortex Brands Co whereby Vortex Brands was the surviving entity and the Company changed its name from Zulu Energy to Vortex Brands. The Company issued 200,000 shares of its Series B Preferred Stock in exchange for the 200,000 shares of Vortex Brands.

Liquidity and Capital Resources

As of May 31, 2014 the Company had $200 in cash for a total of $200 in assets. In management’s opinion, the Company’s cash position is insufficient to maintain its operations at the current level for the next 12 months. Any expansion may cause the Company to require additional capital until such expansion began generating revenue. It is anticipated that the raise of additional funds will principally be through the sales of our securities. As of the date of this report, additional funding has not been secured and no assurance may be given that we will be able to raise additional funds.

If the Company is not able to able to raise or secure the necessary funds required to maintain our operations and fully execute our business then the Company would be required to cease operations.

As of May 31, 2014, our total liabilities were $84,100.

Sixty days after the Company files this Form 10, the Company shall be come a fully reporting company to the SEC. As a result, the Company expects the legal and accounting costs of being a public company will impact our liquidity. The expected costs of these are approximately $15,000 to $20,000. This amount is expected to possibly increase to $25,000 once the Company begins acquiring thoroughbreds. Our officers, directors and principal shareholders have verbally agreed to provide $20,000 in financing that can be used to cover these expenses. However, there is no guarantee that we will receive the funds from our officers and directors since there is no legal commitment or obligation. Other than the anticipated increases in legal and accounting costs due to the reporting requirements of being a reporting company, we are not aware of any other known trends, events or uncertainties, which may affect our future liquidity. This is the only amount and for that our officer, director and principal shareholders have committed to which will be sufficient to fund the company's current operations and its expenses related to being a public company for the next 12 months.

Timing needs for Funding

The Company expects to require the following capital needs based on the stages of its products:

Proposed Milestones to Implement Business Operations

The following milestones are based on estimates made by our management team. The working capital requirements and the projected milestones are approximations and are subject to adjustments. The Company projects it will need $500,000 over the next 12 months to expand outside of California. The Company expects to raise the $500,000 needed through debt financing. We are currently negotiating the final terms of a debt financing in the amount of $500,000 and we will provide a copy of the agreement once it is filing as an Exhibit under Form 8-K.

We plan to complete our milestones as follows:

0 - 4 Months

The Company will increase its marketing budget to recruit additional tennis pros to assist in marketing and selling of the Company’s products within California:

|

Description

|

|

Expense

|

|

|

Sales personal recruitment

|

|

$ |

50,000 |

|

|

Marketing

|

|

|

25,000 |

|

|

Tennis Pro Recruitment

|

|

|

25,000 |

|

|

Total

|

|

$ |

100,000 |

|

4-6 Months

The Company will need to acquire additional product and increase it marketing budge to begin to expand its operations into states outside of California products:

|

Description

|

|

Expense

|

|

|

Marketing Expenses

|

|

$ |

100,000 |

|

|

Total

|

|

$ |

100,000 |

|

7 - 11 Months

The Company will increase its marketing budget to recruit additional tennis pros to assist in marketing and selling of the Company’s products.

|

Description

|

|

Expense

|

|

|

Tennis Pro recruitment

|

|

$ |

50,000 |

|

|

Marketing

|

|

|

100,000 |

|

|

Total

|

|

$ |

150,000 |

|

12-14 Months

The Company will need to acquire additional product and increase it marketing budget:

|

Description

|

|

Expense

|

|

|

Tennis Pro recruitment

|

|

$ |

50,000 |

|

|

Marketing

|

|

|

100,000 |

|

|

Total

|

|

$ |

150,000 |

|

15-18 Months

The Company will increase its marketing budget to recruit additional tennis pros to assist in marketing and selling of the Company’s products.

|

Description

|

|

Expense

|

|

|

Tennis Pro recruitment

|

|

$ |

50,000 |

|

|

Marketing

|

|

|

100,000 |

|

|

Total

|

|

$ |

150,000 |

|

19-24 Months

Further, we intend to launch a marketing campaign via television ads and tournament sponsorship to promote the company’s product.

|

Description

|

|

Expense

|

|

|

Television

|

|

$ |

250,000 |

|

|

Tennis Pro Recruitment

|

|

|

50,000 |

|

|

Sponsorship

|

|

|

50,000 |

|

|

Total

|

|

$ |

350,000 |

|

Long-Term Plan (5 Years)

Over the ensuing five years our growth and expansion will focus on a disciplined growth strategy of expanding the Company into other states by recruiting sales staff and teaching pros.

We estimate that we will need to raise between $1.0 - $1.5 million to fully expand the Company throughout the United States.

Item 3. Properties.

Our executive, administrative and operating offices are located at 28202 Cabot Rd #300 Laguna Niguel CA. We design our product in Los Angles, California and are manufactured in China. The office space is being provided by our officers.

Item 4. Security Ownership of Certain Beneficial Owners and Management.

Furnish the information required by Item 403 of Regulation S-K (§229.403 of this chapter).

The following table sets forth, as of the date of this filing, certain information concerning the beneficial ownership of our common stock by (i) each stockholder known by us to own beneficially five percent or more of our outstanding common stock; (ii) each director; (iii) each named executive officer; and (iv) all of our executive officers and directors as a group, and their percentage ownership and voting power.

Unless otherwise indicated below, to our knowledge, all persons named in the table have sole voting and investment power with respect to their shares of our common stock, except to the extent authority is shared by spouses under community property laws. Except as otherwise indicated in the table below, addresses of named beneficial owners are in care of the Company, 15061 Springdale, Suite 113, Huntington Beach, California 92649.

|

Name and Address

|

|

Series A

Preferred

Stock(a)

|

|

|

Percentage

of Class

|

|

|

Series B

Preferred

Stock

|

|

|

Percentage

of Class

|

|

|

Common

Stock

|

|

|

Percentage

of Class

|

|

|

Total

Voting

Power

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tom Olmstead, CEO/Director

|

|

|

1,077,016 |

|

|

|

100 |

% |

|

|

150,000 |

|

|

|

75 |

% |

|

|

- |

|

|

|

- |

|

|

|

99 |

% |

|

Total

|

|

|

1,077,016 |

|

|

|

100 |

% |

|

|

150,000 |

|

|

|

75 |

% |

|

|

- |

|

|

|

- |

|

|

|

99 |

% |

|

(a)

|

The Series A Preferred has voting rights equal to 2,500 common votes. Unless required by law, the Common Stock and Preferred Stock vote together as a single class. As such, the Series A Preferred has total voting power of 2,692,540,000 votes and thereby controls the Company.

|

Item 5. Directors and Executive Officers.

Furnish the information required by Item 401 of Regulation S-K (§229.401 of this chapter).

Our directors and executive officers and additional information concerning them are as follows:

Committees of the Board

We do not have a separate audit committee at this time. Our entire board of directors acts as our audit committee. We intend to form an audit committee, a corporate governance and nominating committee and a compensation committee once our board membership increases. Our plan is to start searching and interviewing possible independent board members in the next six months.

Significant Employees

There are no persons other than our executive officers who are expected by us to make a significant contribution to our business.

Family Relationships

There are no family relationships of any kind among our directors, executive officers, or persons nominated or chosen by us to become directors or executive officers.

Involvement in Certain Legal Proceedings

We are not currently involved in any legal proceedings and we are not aware of any pending or potential legal actions.

Audit and Compensation Committees, Financial Expert

We do not have a standing audit or compensation committee or any committee performing a similar function, although we may form such committees in the future. Our entire Board of Directors handles the functions that would otherwise be handled by an audit or compensation committee.

Since we do not currently have an audit committee, we have no audit committee financial expert.

Since we do not currently pay any compensation to our officers or directors, we do not have a compensation committee. If we decide to provide compensation for our officers and directors in the future, our Board of Directors may appoint a committee to exercise its judgment on the determination of salary and other compensation.

Code of Ethics

We have adopted a Code of Ethics which is designed to ensure that our directors and officers meet the highest standards of ethical conduct. The Code of Ethics requires that our directors and officers comply with all laws and other legal requirements, conduct business in an honest and ethical manner and otherwise act with integrity and in our best interest. A copy of the Company's code of ethics has been attached to this registration statement as Exhibit 14.

Involvement in Certain Legal

Our directors, executive officers and control persons have not been involved in any of the following events during the past ten years:

Any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time, or

Any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); or

Being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his or her involvement in any type of business, securities or banking activities; or

Being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any Federal or State authority, barring, suspending or otherwise limiting for more than 60 days his or her involvement in any type of business, securities or banking activities; or

Being found by a court of competent jurisdiction (in a civil action), the Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated.

Subject to, or a party to, any Federal or State judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended, or vacated, relating to the alleged violation of any Federal or State securities or commodities law or regulation, or any law or regulation respecting financial institutions or insurance companies, any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or

Subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, self regulatory organization (as defined by Section 3(a)(26) of the Exchange Act), any registered entity, or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member.

Executive Compensation.

The Companies’ officers and director have received the annual salary listed below for the services rendered on behalf of the Company:

|

Name and

|

|

|

|

|

|

|

|

|

|

Stock

|

|

|

All other

|

|

|

|

|

|

Principal Position

|

|

Year

|

|

Salary

|

|

|

Bonus

|

|

|

Awards

|

|

|

Compensation

|

|

|

TOTAL

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tom Olmstead, President, CEO, Director

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 7. Certain Relationships and Related Transactions, and Director Independence

Related Party Transactions

On May 29, 2014, Vortex Brands issued 200,000 shares in exchange for $200 cash.

On May 29, 2014, Vortex Brands executed a license agreement with Vortex. Vortex owns the intellectual property rights related to products licensed by the Company.

On May 30, 2014, the Company executed a reverse merger between the Company and Vortex Brands Co whereby Vortex Brands was the surviving entity and the Company changed its name from Zulu Energy to Vortex Brands. The Company issued 200,000 shares of its Series B Preferred Stock in exchange for the 200,000 shares of Vortex Brands.

Policies and Procedures with Respect to Related Party Transactions

As of the date hereof, our Board of Directors has not adopted formal written policies or procedures regarding the review, approval or ratification of related party transactions. It is the Company’s intention to adopt such policies and procedures in the immediate future. Such policies will include, among other things, descriptions of the types of transactions covered, the standards to be applied in reviewing such transactions, the process for review of such transactions, and the individuals on the Board of Directors or otherwise who are responsible for implementing the policies and procedures. It is our intention that our audit committee, which will be comprised entirely of independent directors, will be responsible for such matters on an ongoing basis, consistent with its written charter. Notice of the Company’s adoption of these policies and procedures will be given to all appropriate Company personnel.

Director Independence

Our Board of Directors has determined that none of our directors are independent.

Policies and Procedures with Respect to Related Party Transactions

As of the date hereof, our Board of Directors has not adopted formal written policies or procedures regarding the review, approval or ratification of related party transactions. It is the Company’s intention to adopt such policies and procedures in the immediate future. Such policies will include, among other things, descriptions of the types of transactions covered, the standards to be applied in reviewing such transactions, the process for review of such transactions, and the individuals on the Board of Directors or otherwise who are responsible for implementing the policies and procedures. It is our intention that our audit committee, which will be comprised entirely of independent directors, will be responsible for such matters on an ongoing basis, consistent with its written charter. Notice of the Company’s adoption of these policies and procedures will be given to all appropriate Company personnel.

Conflicts of Interest and Corporate Opportunities

The officers and directors have acknowledged that under Nevada Revised Statutes law that they must present to the Company any business opportunity presented to them as an individual that met the Nevada’s standard for a corporate opportunity: (1) the corporation is financially able to exploit the opportunity; (2) the opportunity is within the corporation's line of business; (3) the corporation has an interest or expectancy in the opportunity; and (4) by taking the opportunity for his own, the corporate fiduciary will thereby be placed in a position inimical to their duties to the corporation. This is enforceable and binding upon the officers and directors as it is part of the Code of Ethics that every officer and director is required to execute. However, the Company has not adopted formal written policies or procedures regarding the process for how these corporate opportunities are to be presented to the Board. It is the Company’s intention to adopt such policies and procedures in the immediate future.

Item 8. Legal Proceedings

We are not currently a party to any material litigation and we are not aware of any pending or threatened litigation against us that could have a material adverse effect on our business, operating results or financial condition. However, we may from time to time be involved in legal proceedings in the ordinary course of our business.

Item 9. Market Price and Dividends on the Registrant’s Common Equity and Related Stockholder Matters

(a) Market Information.

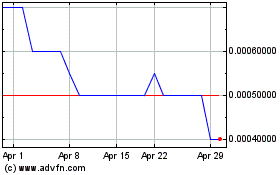

Our Common Stock is currently trading on the OTC markets under the ticker symbol VTXB.

(b) Holders.

As of May 31, 2014 there were 16 shareholders of record of our Common Stock for an aggregate of 99,050,000 shares of the Common Stock issued and outstanding.

As of May 31, 2014 there was 1 holder of our Series A Preferred Stock for an aggregate of 1,077,016 Preferred Stock issued and outstanding.

As of May 31, 2014 there were approximately 10 holders of our Series B Preferred Stock for an aggregate of 200,000 Preferred Stock issued and outstanding.

(c) Equity Compensation Plan.

As of the date of this filing, the company did not have any equity compensation plans.

(d) Dividends.

The Company has not paid any dividends.

Item 10. Recent Sales of Unregistered Securities

The following sets forth information relating to all previous sales of our common stock, which sales were not registered pursuant to the Securities Act.

On May 29, 2014, Vortex Brands issued 200,000 shares in exchange for $200.

On May 29, 2014, the Company executed a reverse merger between the Company and Vortex Brands Co whereby Vortex Brands was the surviving entity and the Company changed its name from Zulu Energy to Vortex Brands. The Company issued 200,000 shares of its Series B Preferred Stock in exchange for the 200,000 shares of Vortex Brands.

The above shares, referenced in each of the above transactions, were issued in reliance of the exemption from registration requirements of the 33 Act provided by Section 4(2) promulgated thereunder, as the issuance of the stock did not involve a public offering of securities based on the following:

|

·

|

the investors represented to us that they were acquiring the securities for their own account for investment and not for the account of any other person and not with a view to or for distribution, assignment or resale in connection with any distribution within the meaning of the 33 Act;

|

|

·

|

we provided each investor with written disclosure prior to sale that the securities have not been registered under the 33 Act and, therefore, cannot be resold unless they are registered under the 33Act or unless an exemption from registration is available;

|

|

·

|

the investors agreed not to sell or otherwise transfer the purchased securities unless they are registered under the 33 Act and any applicable state laws, or an exemption or exemptions from such registration are available;

|

|

·

|

each investor had knowledge and experience in financial and other business matters such that he, she or it was capable of evaluating the merits and risks of an investment in us;

|

|

·

|

each investor was given information and access to all of our documents, records, books, officers and directors, our executive offices pertaining to the investment and was provided the opportunity to ask questions and receive answers regarding the terms and conditions of the offering and to obtain any additional information that we possesses or were able to acquire without unreasonable effort and expense;

|

|

·

|

each investor had no need for liquidity in their investment in us and could afford the complete loss of their investment in us;

|

|

·

|

we did not employ any advertisement, article, notice or other communication published in any newspaper, magazine or similar media or broadcast over television or radio;

|

|

·

|

we did not conduct, hold or participate in any seminar or meeting whose attendees had been invited by any general solicitation or general advertising;

|

|

·

|

we placed a legend on each certificate or other document that evidences the securities stating that the securities have not been registered under the 33 Act and setting forth or referring to the restrictions on transferability and sale of the securities;

|

|

·

|

we placed stop transfer instructions in our stock transfer records;

|

|

·

|

no underwriter was involved in the offering; and

|

|

·

|

we made independent determinations that such persons were sophisticated or accredited investors and that they were capable of analyzing the merits and risks of their investment in us, that they understood the speculative nature of their investment in us and that they could lose their entire investment in us.

|

Item 11. Description of Registrant’s Securities to be Registered

(a) Common Stock.

The Certificate of Incorporation, as amended, authorizes the Company to issue up to 100,000,000 shares of Common Stock ($0.0001 par value). As of the date hereof, there are 99,050,000 shares of our Common Stock issued and outstanding, which are held by 16 shareholders of record. All outstanding shares of Common Stock are of the same class and have equal rights and attributes. Holders of our Common Stock are entitled to one vote per share on matters to be voted on by shareholders and also are entitled to receive such dividends, if any, as may be declared from time to time by our Board of Directors in its discretion out of funds legally available therefore.

(b) Debt Securities.

None being registered.

(c) Warrants and Rights.

None being registered.

(d) Other Securities Not Being Registered.

Series A Preferred

The Series A Preferred Stock consist of 2,000,000 authorized and 1,077,016 are issued and outstanding as of the date of this filing. The Series A Preferred has the following terms and rights:

Dividend: No dividend rights

Ranks: Ranks superior to the Company’s Common Stock and all other Capital Stock as to distributions of assets upon liquidation, dissolution or winding up of the Corporation, whether voluntary or involuntary, including the payment of dividends.

Conversion Provisions. Each Series A Preferred Share cannot be converted into Common Shares.

Voting Rights. Except as otherwise required by law, each Series A Preferred Share shall have voting rights and shall carry a voting weight equal to two thousand five hundred (2,500) Common Shares. Except as otherwise required by law or by these Articles, the holders of shares of Common Stock and Preferred Stock shall vote together.

Series B Preferred

The Series B Preferred Stock consist of 200,000 authorized and 200,000 are issued and outstanding as of the date of this filing. The Series B Preferred has the following terms and rights:

Dividend: No dividend rights

Ranks: Ranks superior to the Company’s Common Stock and all other Capital stock except Series B Preferred Stock as to distributions of assets upon liquidation, dissolution or winding up of the Corporation, whether voluntary or involuntary, including the payment of dividends.

Conversion Provisions. Each Series B Preferred Share can be converted into 1,000 Common Shares.

Voting Rights. Except as otherwise required by law, each Series B Preferred Share shall have voting rights and shall carry a voting weight equal to one (1) Common Shares. Except as otherwise required by law or by these Articles, the holders of shares of Common Stock and Preferred Stock shall vote together.

Item 12. Indemnification of Directors and Officers

Our directors and officers are indemnified as provided by the Article 109 of the Colorado Business Corporation Act and our Bylaws. We have agreed to indemnify each of our directors and certain officers against certain liabilities, including liabilities under the Securities Act of 1933. Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to our directors, officers and controlling persons pursuant to the provisions described above, or otherwise, we have been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than our payment of expenses incurred or paid by our director, officer or controlling person in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, we will, unless in the opinion of our counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

We have been advised that in the opinion of the Securities and Exchange Commission indemnification for liabilities arising under the Securities Act is against public policy as expressed in the Securities Act, and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities is asserted by one of our directors, officers, or controlling persons in connection with the securities being registered, we will, unless in the opinion of our legal counsel the matter has been settled by controlling precedent, submit the question of whether such indemnification is against public policy to a court of appropriate jurisdiction. We will then be governed by the court’s decision.

Item 13. Financial Statements and Supplementary Data

The Company's financial statements for the years ended May 31, 2014, have been audited to the extent indicated in their report by MaloneBailey, LLP an independent registered public accounting firm. The financial statements have been prepared in accordance with generally accepted accounting principles and are included in Item 15 of this Form 10. Please see the Financial Statements Index on page F-1.

Item 14. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

We have not had any disagreements with our auditors on any matters of accounting principles, practices, or financial statement disclosure.

Item 15. Financial Statements and Exhibits

|

(a)

|

Our audited financial statements for the fiscal year 2014, including the report of our independent registered public accounting firm, are attached hereto beginning at page F-1 immediately following the signature page of this registration statement.

|

|

Exhibit

|

|

Description

|

| |

|

|

|

3.1

|

|

Restated and Amended Articles of Incorporation

|

|

3.2

|

|

By-Laws

|

|

3.3

|

|

Series A Preferred Stock Designation

|

|

3.4

|

|

Series B Preferred Stock Designation

|

|

10.1

|

|

License Agreement

|

|

14.1

|

|

Code of Ethics

|

SIGNATURES

Pursuant to the requirements of Section 12 of the Securities Exchange Act of 1934, the registrant has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Vortex Brands Co.

|

|

|

|

|

|

|

|

Date: August 29, 2014

|

By:

|

/s/ Tom Olmstead

|

|

|

|

Name:

|

Tom Olmstead

|

|

|

|

Its:

|

Principal Executive Officer,