UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 12, 2014

DOCUMENT SECURITY SYSTEMS, INC.

(Exact name of registrant as specified

in its charter)

| New York |

|

001-32146 |

|

16-1229730 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

First Federal Plaza, Suite 1525

28 East Main Street

Rochester, NY |

|

14614 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (585) 325-3610

Not Applicable

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition

On August 12, 2014,

Document Security Systems, Inc. (“Company”) issued a press release disclosing the Company’s unaudited financial

results for the second quarter ended June 30, 2014. A copy of the Company’s press release is attached as Exhibit 99.1 to

this Current Report on Form 8-K.

The information in

this Item 2.02 (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange

Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated

by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference

in such a filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| Exhibit No. |

|

Description |

| |

|

|

| 99.1 |

|

Document Security Systems, Inc. Press Release dated August 12, 2014. |

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

|

DOCUMENT SECURITY SYSTEMS, INC. |

| |

|

|

| Dated: August 12, 2014 |

|

By: |

|

/s/ Jeffrey Ronaldi |

| |

|

|

|

Jeffrey Ronaldi |

| |

|

|

|

Chief Executive Officer |

Exhibit 99.1

Document Security Systems Reports Second

Quarter of 2014 Financial Results

ROCHESTER, NY — August 12, 2014 — Document Security

Systems, Inc. (NYSE MKT: DSS) (DSS), a leader in anti-counterfeiting and authentication solutions, reported results for the

second quarter ending June 30, 2014.

Q2 2014 Operational Highlights

| · | Delivered

first fully-integrated AuthentiGuard customer for DSS’ secure digital application

and labeling. |

| · | Filed

a patent infringement lawsuit against Lenovo (United States), Inc. in the District Court

for the Eastern District of Texas, with the case currently in the pleadings stage. |

| · | Acquired

approximately 90 active patents covering certain methods and processes in the semiconductor

industry, bringing the company's patent portfolio to more than 120 active patents issued

in the U.S. and abroad, and 25 patent applications pending. |

| · | At

quarter end, the company had seven active disputes at various stages of the monetization

process. |

Q2 2014 Financial Highlights

Revenue for the second quarter of 2014 increased 14% to $4.9

million from $4.3 million in the same year-ago quarter. Printed product revenue, which includes sales of packaging, printing and

plastics, increased 15% to $4.4 million from $3.8 million in the same year-ago period. Technology sales, services and licensing

revenues increased 4% to $476,000 from $458,000 in the year-ago period.

Costs of goods and expenses totaled $7.1 million, an increase

of 16% from $6.1 million in the same year-ago period. The increase primarily reflected depreciation and amortization costs of

$1.3 million for Q2 2014 compared to $229,000 in the same year-ago period. This increase was partially offset by a 69% decrease

in stock-based compensation expense during Q2 2014.

Cost of goods sold, excluding depreciation and amortization,

increased 26% to $3.2 million compared to $2.5 million in the same year-ago period, driven by a higher percentage of packaging

sales as a percentage of total printed products sales in the second quarter of 2014.

Adjusted EBITDA loss, a non-GAAP metric defined as earnings

before interest, taxes, depreciation, amortization, and stock-based compensation, as well as other non-recurring items, totaled

$633,000 compared to an adjusted EBITDA loss of $171,000 in the same year-ago period (see further discussion about the use of

adjusted EBITDA, below). The increase in adjusted EBITDA loss reflected higher professional fees incurred for the company’s

IP monetization business in Q2 2014 compared to the year-ago quarter, where the majority of the professional fees were incurred

from the company’s merger with Lexington Technology Group (LTG) in July 2013.

Net Loss totaled $2.3 million or $(0.06) per basic and

diluted share, as compared to a net loss of $1.9 million or $(0.09) per basic and diluted share in the second quarter of 2013.

Management Commentary

“We saw a particularly strong sequential increase in

revenue in the second quarter, driven by demand for our printed products, including the timing of certain packaging orders that

slipped from Q1 to Q2,” said Jeff Ronaldi, the company’s CEO. “Looking at our results on a comparative first

half basis, revenue was a record overall for the first six months of the year, up 6% from the same period a year ago.

“Q2 was also highlighted by our first fully-integrated

AuthentiGuard sale to a customer for printing and hosting, along with the customized mobile application. This win reaffirms the

strong value proposition of our AuthentiSuite platform, especially when integrated with our secure printing and packaging capabilities.

“Along those lines, our sales team has been effectively

building and expanding our AuthentiGuard pipeline of prospective customers. We are currently in varying stages with several national

brands about implementing our AuthentiGuard technology.

“AuthentiGuard is an ideal representation of our business

model, which involves developing and acquiring IP that enables us to bring innovative product and service offerings to market,

while actively licensing our IP portfolio.

“A major goal for us this year and going forward is to

grow and diversify our intellectual property portfolio. Since 2012, we have systematically expanded our patent portfolio from

15 issued patents to more than 120 active patents today, along with seven active cases on file. Looking ahead, we expect to have

10 cases on file by yearend and at least 15 by the end of 2015. Our expectations for the future remain high as we build upon the

momentum we’ve established and pursue the widening pipeline of opportunities ahead.”

Intellectual Property Enforcement

DSS provided an update on the status of its six intellectual

property cases:

| · | Document

Security Systems, Inc. v. Coupons.com Incorporated (6:11-cv-06528-CJS-MWP) |

In October 2011, DSS initiated litigation against

Coupons.com alleging, among other things, that Coupons.com misused DSS’s proprietary block-out technology in violation of

the terms of a nondisclosure agreement between the parties. On July 10, 2014 the US District Court for the Western District of

New York heard oral arguments in connection with Coupons.com’s motion for Summary Judgment. No decision has been rendered

yet on the motion.

| · | Bascom

Research, LLC v. Facebook, Inc., LinkedIn Corporation et al (CAND-3-12-cv-06293; CAND-3-12-cv-06294) |

In October 2012, Bascom Research, a subsidiary of

Lexington Technology Group, Inc. (LTG), which was acquired by DSS in July 2013, initiated litigation with Facebook, Inc., LinkedIn

Corporation and three other defendants in the US District Court for the Eastern District of Virginia. The complaint alleged infringement

by the defendants of four patents that are instrumental to social and business networking technology and related to the manner

in which users and application developers on the Facebook and LinkedIn platforms make connections between “objects”

such as photos, people, events and pages.

In January 2013, all five cases were transferred

to the US District Court for the Northern District of California. In April and May of 2013, LTG announced that Bascom Research

had reached settlements with two of the named defendants. Currently, Facebook and LinkedIn remain as defendants in the litigation.

On January 15, 2014, these two cases were stayed

by the US District Court for the Northern District of California pending the outcome of Alice Corp v. CLS Bank in the United States

Supreme Court, which was decided on June 24, 2014. Following this decision, a case management conference was scheduled for August

22, 2014, at which time the parties will propose timetables for the remainder of the case.

On May 22, 2014, Facebook, Inc. filed a Petition

for Covered Business Method (CBM) Patent Review with the USPTO’s Patent Trial and Appeal Board. Bascom Research has until

September 3, 2014 to file a preliminary response to the CBM petition.

| · | VirtualAgility,

Inc. v. Salesforce.com, Inc. et al* (TXED-2-13-cv-00011) |

On March 5, 2013, Lexington Technology Group (now

DSS Technology Management) made a strategic investment in VirtualAgility, Inc.

On January 5, 2013, prior to DSS’s investment,

VirtualAgility initiated litigation against Salesforce.com and a number of Salesforce’s customers in the US District Court

for the Eastern District of Texas. VirtualAgility’s complaint against Salesforce.com alleges infringement of one of five

VirtualAgility patents that enable user-friendly programming platforms that facilitate the creation of sophisticated business

applications without programming.

On February 12, 2014, the United States Court of

Appeals for the US Circuit overturned a decision rendered by the US District Court for the Eastern District of Texas, and granted

a temporary stay of the case in light of Salesforce.com’s Petition for Covered Business Method (CBM) Patent Review pending

before the USPTO’s Patent Trial and Appeal Board (PTAB).

On July 10, 2014, a three-judge panel of the US

Circuit issued a divided opinion granting a stay pending the CBM proceedings. Oral argument in the CBM proceeding was held on

July 14, 2014.

| · | DSS

Technology Management, Inc. (DSSTM) v. Taiwan Semiconductor Manufacturing Company, Ltd.

(TSMC) et al (TXED-2-14-cv-00199) |

On March 10, 2014, DSSTM initiated litigation with

TSMC, Samsung Electronics Co. Inc., and NEC Corporation of America in the US District Court for the Eastern District of Texas.

DSSTM’s complaint against these companies alleges infringement of DSS patents relating to a semiconductor manufacturing

process called “double-patterning.”

On June 24, 2014, TSMC filed a petition for Inter

Partes Review (IPR) with the USPTO Patent Trial and Appeal Board, and DSSTM has until October 17, 2014 to file a preliminary response.

| · | DSS

Technology Management, Inc. (DSSTM) v. Apple, Inc. (TXED-6-13-cv-00919) |

On November 29, 2013, DSSTM initiated litigation

against Apple, Inc. in the US District Court for the Eastern District of Texas. DSSTM’s complaint alleges infringement by

Apple of DSS patents that relate to systems and methods of using low power wireless peripheral devices.

On March 3, 2014, Apple filed a motion to transfer

venue of the case from the Eastern District of Texas to the Northern District of California, which is pending a ruling by the

District Court for the Eastern District of Texas.

| · | DSS

Technology Management, Inc. (DSSTM) v. Lenovo (United States), Inc. (TXED-6-14-cv-00525) |

On May 30, 2014, DSSTM initiated litigation against

Lenovo (United States), Inc. in the US District Court for the Eastern District of Texas. DSSTM’s complaint alleges infringement

by Lenovo of DSS patents that relate to systems and methods of using low power wireless peripheral devices. The case is currently

in the pleadings stage.

These active disputes are also listed on the company’s

website here. Further information regarding patent litigation involving DSS investments is available to the public via

the PACER Service here.

Conference Call

DSS management will hold a conference call later today (August

12, 2014) to discuss these results. The company’s CEO, Jeff Ronaldi, and CFO, Phil Jones, will host the presentation, followed

by a question and answer period.

Date: August 12, 2014

Time: 4:30 p.m. Eastern time (1:30 p.m. Pacific time)

U.S. dial-in: (877) 407-9210

International dial-in: (201) 689-8049

The conference call will be broadcast simultaneously and available

for replay via the investor section of the company’s website at www.dsssecure.com.

Please call the conference telephone number 10 minutes prior

to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference

call, please contact Liolios Group at (949) 574-3860.

A replay of the call will be available after 7:30 p.m. Eastern

time on the same day through August 26, 2014.

U.S. replay dial-in: (877) 660-6853

International replay dial-in: (201) 612-7415

Replay ID: 13588604

About Document Security Systems

Document Security Systems, Inc.’s

(NYSE MKT: DSS) products and solutions are used by governments, corporations and financial institutions to defeat fraud and to

protect brands and digital information from the expanding world-wide counterfeiting problem. DSS technologies help ensure the

authenticity of both digital and physical financial instruments, identification documents, sensitive publications, brand packaging

and websites.

DSS continually invests in research and development to meet

the ever-changing security needs of its clients and offers licensing of its patented technologies through its subsidiary, DSS

Technology Management, Inc.

For more information on the AuthentiGuard Suite, please visit

www.AuthentiGuard.com. For more information on DSS and its subsidiaries, please visit www.DSSsecure.com. To follow

DSS on Facebook, click here.

For More Information

Investor Relations

Document Security Systems

(585) 325-3610

Email: ir@documentsecurity.com

Forward-Looking Statements

Forward-looking statements that may be contained in this press

release, including, without limitation, statements related to the Company’s plans, strategies, objectives, expectations,

potential value, intentions and adequacy of resources, are made pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act and contain words such as “believes,” “anticipates,” “expects,” “plans,”

“intends” and similar words and phrases. These forward-looking statements are subject to risks and uncertainties that

could cause actual results to differ materially from the results projected in any forward-looking statement. In addition to the

factors specifically noted in the forward-looking statements, other important factors, risks and uncertainties that could result

in those differences include, but are not limited to, those disclosed in the “Risk Factors” section of the Company’s

Annual Report on Form 10-K for the year ended December 31, 2013, filed with the Securities and Exchange Commission. Forward-looking

statements that may be contained in this press release are being made as of the date of its release, and the Company assumes no

obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those projected

in the forward-looking statements.

DOCUMENT SECURITY SYSTEMS, INC. AND

SUBSIDIARIES

Consolidated Statements of Operations

(Unaudited)

| | |

Three Months

Ended June 30,

2014 | | |

Three Months

Ended June 30,

2013 | | |

%

change | | |

Six Months

Ended June 30,

2014 | | |

Six Months

Ended June 30,

2013 | | |

% change | |

| Revenue | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Printed products | |

$ | 4,407,000 | | |

$ | 3,822,000 | | |

| 15 | % | |

$ | 7,571,000 | | |

$ | 7,101,000 | | |

| 7 | % |

| Technology sales, services and licensing | |

| 476,000 | | |

| 458,000 | | |

| 4 | % | |

| 940,000 | | |

$ | 949,000 | | |

| -1 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total revenue | |

$ | 4,883,000 | | |

$ | 4,280,000 | | |

| 14 | % | |

$ | 8,511,000 | | |

$ | 8,050,000 | | |

| 6 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Costs and expenses | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cost of goods sold, exclusive of depreciation and amortization | |

$ | 3,197,000 | | |

$ | 2,546,000 | | |

| 26 | % | |

$ | 5,395,000 | | |

$ | 4,749,000 | | |

| 14 | % |

| Sales, general and administrative compensation | |

| 1,154,000 | | |

| 1,221,000 | | |

| -5 | % | |

| 2,446,000 | | |

| 2,356,000 | | |

| 4 | % |

| Depreciation and amortization | |

| 1,288,000 | | |

| 229,000 | | |

| 462 | % | |

| 2,602,000 | | |

| 454,000 | | |

| 473 | % |

| Professional fees | |

| 502,000 | | |

| 602,000 | | |

| -17 | % | |

| 1,042,000 | | |

| 1,016,000 | | |

| 3 | % |

| Stock based compensation | |

| 294,000 | | |

| 949,000 | | |

| -69 | % | |

| 841,000 | | |

| 1,289,000 | | |

| -35 | % |

| Sales and marketing | |

| 128,000 | | |

| 126,000 | | |

| 2 | % | |

| 301,000 | | |

| 208,000 | | |

| 45 | % |

| Rent and utilities | |

| 181,000 | | |

| 154,000 | | |

| 18 | % | |

| 366,000 | | |

| 311,000 | | |

| 18 | % |

| Other operating expenses | |

| 243,000 | | |

| 224,000 | | |

| 8 | % | |

| 449,000 | | |

| 446,000 | | |

| 1 | % |

| Research and development | |

| 112,000 | | |

| 62,000 | | |

| 81 | % | |

| 226,000 | | |

| 121,000 | | |

| 87 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total costs and expenses | |

$ | 7,099,000 | | |

$ | 6,113,000 | | |

| 16 | % | |

$ | 13,668,000 | | |

$ | 10,950,000 | | |

| 25 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operating loss | |

| (2,216,000 | ) | |

| (1,833,000 | ) | |

| 21 | % | |

| (5,157,000 | ) | |

| (2,900,000 | ) | |

| 78 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Other income (expenses) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| (89,000 | ) | |

| (50,000 | ) | |

| 78 | % | |

| (164,000 | ) | |

| (94,000 | ) | |

| 74 | % |

| Amortization of note discount and loss on debt extinguishment | |

| (35,000 | ) | |

| (43,000 | ) | |

| -19 | % | |

| (52,000 | ) | |

| (54,000 | ) | |

| -4 | % |

| Foreign currency translation loss | |

| | | |

| - | | |

| | | |

| (16,000 | ) | |

| - | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Other expense, net | |

| (124,000 | ) | |

| (93,000 | ) | |

| 33 | % | |

| (232,000 | ) | |

| (148,000 | ) | |

| 57 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loss before income taxes | |

| (2,340,000 | ) | |

| (1,926,000 | ) | |

| 21 | % | |

| (5,389,000 | ) | |

| (3,048,000 | ) | |

| 77 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Deferred tax expense, net | |

| 5,000 | | |

| 5,000 | | |

| 0 | % | |

| 9,000 | | |

| 9,000 | | |

| 0 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (2,344,000 | ) | |

$ | (1,925,000 | ) | |

| 22 | % | |

$ | (5,399,000 | ) | |

$ | (3,057,000 | ) | |

| 77 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Earnings per share: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

$ | (0.06 | ) | |

$ | (0.09 | ) | |

| -33 | % | |

$ | (0.13 | ) | |

$ | (0.14 | ) | |

| -7 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shares used in computing earnings per share: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

| 42,040,907 | | |

| 21,710,034 | | |

| 94 | % | |

| 41,982,770 | | |

| 21,711,503 | | |

| 93 | % |

DOCUMENT SECURITY SYSTEMS, INC.

AND SUBSIDIARIES

Condensed Consolidated Balance Sheets

As of

| | |

June 30, 2014 | | |

December 31, 2013 | |

| | |

(Unaudited) | | |

| |

| ASSETS | |

| | | |

| | |

| | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash | |

$ | 1,304,656 | | |

$ | 1,977,031 | |

| Restricted cash | |

| 245,479 | | |

| 500,000 | |

| Accounts receivable, net of allowance of $68,000 ($60,000- 2013) | |

| 1,789,986 | | |

| 2,149,123 | |

| Inventory | |

| 919,659 | | |

| 834,979 | |

| Prepaid expenses and other current assets | |

| 537,206 | | |

| 403,107 | |

| Deferred tax asset, net | |

| 223,323 | | |

| 223,323 | |

| Total current assets | |

| 5,020,309 | | |

| 6,087,563 | |

| | |

| | | |

| | |

| Property, plant and equipment, net | |

| 5,226,230 | | |

| 5,157,852 | |

| Investments and other assets | |

| 12,529,602 | | |

| 11,448,008 | |

| Goodwill | |

| 15,046,197 | | |

| 15,046,197 | |

| Other intangible assets, net | |

| 28,486,834 | | |

| 29,602,591 | |

| | |

| | | |

| | |

| Total assets | |

$ | 66,309,172 | | |

$ | 67,342,211 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 1,454,846 | | |

$ | 1,421,765 | |

| Accrued expenses and other current liabilities | |

| 1,416,737 | | |

| 1,455,629 | |

| Revolving lines of credit | |

| - | | |

| 158,087 | |

| Short-term debt | |

| 850,000 | | |

| 824,857 | |

| Current portion of long-term debt, net | |

| 521,699 | | |

| 613,488 | |

| | |

| | | |

| | |

| Total current liabilities | |

| 4,243,282 | | |

| 4,473,826 | |

| | |

| | | |

| | |

| Long-term debt, net | |

| 5,770,868 | | |

| 3,087,358 | |

| Other long-term liabilities | |

| 361,783 | | |

| 27,566 | |

| Deferred tax liability, net | |

| 1,373,921 | | |

| 1,364,447 | |

| | |

| | | |

| | |

| Commitments and contingencies (Note 8) | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders' equity | |

| | | |

| | |

| Common stock, $.02 par value; 200,000,000 shares authorized, 46,275,297 shares issued

and outstanding (49,411,486 on December 31, 2013) | |

| 925,506 | | |

| 988,230 | |

| Additional paid-in capital | |

| 99,247,351 | | |

| 97,790,426 | |

| Accumulated other comprehensive loss | |

| (52,783 | ) | |

| (27,566 | ) |

| Accumulated deficit | |

| (50,260,756 | ) | |

| (44,862,076 | ) |

| Non-controlling interest in subsidiary | |

| 4,700,000 | | |

| 4,500,000 | |

| Total stockholders' equity | |

| 54,559,318 | | |

| 58,389,014 | |

| | |

| | | |

| | |

| Total liabilities and stockholders' equity | |

$ | 66,309,172 | | |

$ | 67,342,211 | |

DOCUMENT SECURITY SYSTEMS,

INC. AND SUBSIDIARIES

Condensed Consolidated Statements

of Cash Flows

For the Six Months Ended June

30,

(Unaudited)

| | |

2014 | | |

2013 | |

| | |

| | |

| |

| Cash flows from operating activities: | |

| | | |

| | |

| Net loss | |

$ | (5,398,680 | ) | |

$ | (3,057,064 | ) |

| Adjustments to reconcile net loss to net cash used by operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 2,601,684 | | |

| 454,129 | |

| Stock based compensation | |

| 840,879 | | |

| 1,288,689 | |

| Amortization of note discount | |

| 51,915 | | |

| 27,570 | |

| Loss on extinguishment of debt | |

| - | | |

| 26,252 | |

| Change in deferred tax provision | |

| 9,474 | | |

| 9,474 | |

| Foreign currency translation loss | |

| 16,420 | | |

| - | |

| Decrease (increase) in assets: | |

| | | |

| | |

| Accounts receivable | |

| 359,137 | | |

| 5,338 | |

| Inventory | |

| (84,680 | ) | |

| 2,466 | |

| Prepaid expenses and other assets | |

| (174,616 | ) | |

| (69,859 | ) |

| Release of restricted cash | |

| 254,521 | | |

| - | |

| Increase in liabilities: | |

| | | |

| | |

| Accounts payable | |

| 33,081 | | |

| 124,863 | |

| Accrued expenses and other liabilities | |

| 387,188 | | |

| 250,206 | |

| Net cash used by operating activities | |

| (1,103,677 | ) | |

| (937,936 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Purchase of equipment and building improvements | |

| (157,789 | ) | |

| (82,312 | ) |

| Purchase of investments | |

| (750,000 | ) | |

| - | |

| Purchase of intangible assets | |

| (1,196,980 | ) | |

| (52,506 | ) |

| Net cash used by investing activities | |

| (2,104,769 | ) | |

| (134,818 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Net payments on revolving lines of credit | |

| (158,087 | ) | |

| (168,247 | ) |

| Payments of long-term debt | |

| (298,816 | ) | |

| (166,876 | ) |

| Borrowings of long-term debt | |

| 2,691,000 | | |

| - | |

| Issuances of common stock, net of issuance costs | |

| 301,974 | | |

| 80,000 | |

| Net cash provided (used) by financing activities | |

| 2,536,071 | | |

| (255,123 | ) |

| | |

| | | |

| | |

| Net decrease in cash | |

| (672,375 | ) | |

| (1,327,877 | ) |

| Cash beginning of period | |

| 1,977,031 | | |

| 1,887,163 | |

| | |

| | | |

| | |

| Cash end of period | |

$ | 1,304,656 | | |

$ | 559,286 | |

About the Presentation of Adjusted

EBITDA

The Company uses Adjusted EBITDA as a non-GAAP financial performance

measurement. Adjusted EBITDA is calculated by the Company by adding back to net income (loss) interest, income taxes, depreciation

and amortization expense as further adjusted to add back stock-based compensation expense and non-recurring items, such as costs

related to the Company’s merger with Lexington Technology Group. Adjusted EBITDA is provided to investors to supplement

the results of operations reported in accordance with GAAP. Management believes that Adjusted EBITDA provides an additional tool

for investors to use in comparing its financial results with other companies in the industry, many of which also use Adjusted

EBITDA in their communications to investors. By excluding non-cash charges such as amortization, depreciation and stock-based

compensation, as well as non-operating charges for interest and income taxes, investors can evaluate the Company's operations

and its ability to generate cash flows from operations and can compare its results on a more consistent basis to the results of

other companies in the industry. Management also uses Adjusted EBITDA to evaluate potential acquisitions, establish internal budgets

and goals, and evaluate performance of its business units and management. The Company considers Adjusted EBITDA to be an important

indicator of the Company's operational strength and performance of its business and a useful measure of the Company's historical

and prospective operating trends. However, there are significant limitations to the use of Adjusted EBITDA since it excludes interest

income and expense and income taxes and non-recurring items such as costs related to the Company’s merger with Lexington

Technology Group, all of which impact the Company's profitability and operating cash flows, as well as depreciation, amortization

and stock-based compensation. The Company believes that these limitations are compensated by clearly identifying the difference

between the two measures. Consequently, Adjusted EBITDA should not be considered in isolation or as a substitute for net income

and loss presented in accordance with GAAP. Adjusted EBITDA as defined by the Company may not be comparable with similarly named

measures provided by other entities. The following is a reconciliation of net loss to Adjusted EBITDA loss:

| | |

Three Months Ended June 30 | | |

Six Months Ended June 30 | |

| | |

2014 | | |

2013 | | |

% change | | |

2014 | | |

2013 | | |

% change | |

| | |

(unaudited) | | |

(unaudited) | | |

| | |

(unaudited) | | |

(unaudited) | | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Net Loss | |

$ | (2,344,000 | ) | |

$ | (1,925,000 | ) | |

| 22 | % | |

$ | (5,399,000 | ) | |

$ | (3,057,000 | ) | |

| 77 | % |

| Add back: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Depreciation & Amortization | |

| 1,288,000 | | |

| 229,000 | | |

| 462 | % | |

| 2,602,000 | | |

| 454,000 | | |

| 473 | % |

| Stock based compensation | |

| 294,000 | | |

| 948,000 | | |

| -69 | % | |

| 841,000 | | |

| 1,289,000 | | |

| -35 | % |

| Interest expense | |

| 89,000 | | |

| 50,000 | | |

| 78 | % | |

| 164,000 | | |

| 94,000 | | |

| 74 | % |

| Amortization of note discount and loss on debt extinguishment | |

| 35,000 | | |

| 43,000 | | |

| -19 | % | |

| 52,000 | | |

| 54,000 | | |

| -4 | % |

| Income Taxes | |

| 5,000 | | |

| 5,000 | | |

| 0 | % | |

| 9,000 | | |

| 9,000 | | |

| 0 | % |

| Professional fees and other costs incurred in conjunction

with the Merger with Lexington Technology Group | |

| - | | |

| 479,000 | | |

| -100 | % | |

| - | | |

| 587,000 | | |

| -100 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted EBITDA | |

| (633,000 | ) | |

| (171,000 | ) | |

| -270 | % | |

| (1,731,000 | ) | |

| (570,000 | ) | |

| -204 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted EBITDA, by group (unaudited) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Printed Products | |

$ | 469,000 | | |

$ | 461,000 | | |

| 2 | % | |

$ | 752,000 | | |

$ | 778,000 | | |

| -3 | % |

| Technology Management | |

| (386,000 | ) | |

| (146,000 | ) | |

| 164 | % | |

| (854,000 | ) | |

| (334,000 | ) | |

| 156 | % |

| Corporate, less Merger costs | |

| (716,000 | ) | |

| (486,000 | ) | |

| 47 | % | |

| (1,629,000 | ) | |

| (1,014,000 | ) | |

| 61 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| (633,000 | ) | |

| (171,000 | ) | |

| -270 | % | |

| (1,731,000 | ) | |

| (570,000 | ) | |

| -204 | % |

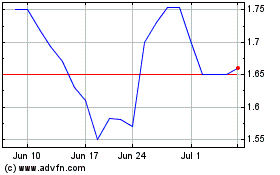

DSS (AMEX:DSS)

Historical Stock Chart

From Mar 2024 to Apr 2024

DSS (AMEX:DSS)

Historical Stock Chart

From Apr 2023 to Apr 2024