UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):August 1, 2014

GENTHERM INCORPORATED

(Exact name of registrant as specified in its charter)

|

|

Michigan |

|

0-21810 |

|

95-4318554 |

|

|

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

21680 Haggerty Road, Ste. 101, Northville, MI |

|

48167 |

|

|

|

(Address of principal executive offices) |

|

(Zip Code) |

|

Registrant’s telephone number, including area code: (248) 504-0500

Former name or former address, if changed since last report: N/A

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

o |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

o |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

o |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

o |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02Results of Operations and Financial Condition.

On August 1, 2014, Gentherm Incorporated (the “Company”) publicly announced its financial results for the second quarter of 2014. A copy of the Company’s news release is attached hereto as Exhibit 99.1 and is incorporated herein by reference. The information in this Item 2.02 and the attached exhibit shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall they be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act except as shall be expressly stated by specific reference in such filing.

Item 9.01Financial Statements and Exhibits.

(d)Exhibits

|

Exhibit 99.1 |

|

Company news release dated August 1, 2014 concerning financial results. |

|

|

|

|

|

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

GENTHERM INCORPORATED |

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Kenneth J. Phillips |

|

|

|

|

|

Kenneth J. Phillips |

|

|

|

|

|

Vice-President and General Counsel |

|

Date: August 1, 2014

Exhibit Index

|

Exhibit 99.1 |

|

Company news release dated August 1, 2014 concerning financial results. |

|

|

|

|

|

|

|

|

Exhibit 99.1

NEWS RELEASE for August 1, 2014 at 6:00 AM ET

|

Contact: |

|

Allen & Caron Inc

Mike Mason (investors)

michaelm@allencaron.com

(212) 691-8087

Rene Caron (investors)

rene@allencaron.com

Len Hall (media)

len@allencaron.com

(949) 474-4300 |

GENTHERM REPORTS RESULTS FOR ITS 2014 SECOND QUARTER

AND FIRST SIX MONTHS

Revenues Up Year-Over-Year 28 Percent and 30 Percent, Respectively

NORTHVILLE, MI (August 1, 2014) . . . Gentherm (NASDAQ-GS:THRM), the global market leader and developer of innovative thermal management technologies, today announced its financial results for the second quarter and first six months ended June 30, 2014.

President and CEO Daniel R. Coker said, “The excellent results in this year’s second quarter followed a very strong first quarter and capped off an exceptional first six months of 2014. We achieved record levels of revenue and profit in both periods and every one of our operations met or exceeded its goals. Revenues for this year’s second quarter were again driven by a significant year-over-year increase in sales of our Climate Control (CCS™) systems. Operational efficiencies continued to increase in the first half of this year, and our gross margins improved significantly year over year and were again at the high end of our expected range.

“We completed the acquisition of Global Thermoelectric Inc. effective April 1, which provides the Company with an important strategic beachhead from which we can develop and market innovative industrial applications based on advanced thermoelectric technologies,” Coker added. “In addition, our new electronics manufacturing facility in China continued to increase production volumes throughout the second quarter, and the second quarter savings from insourcing were larger than the additional overhead costs of the facility, which we expect will generate additional margin improvements as production volumes continue to increase.”

Second Quarter Financial Highlights

For the 2014 second quarter, revenues were up 28 percent to $206.2 million from $160.5 million in the prior year period. The year-over-year revenue increase was driven by continued strong shipments of the Company’s CCS systems and $8.2 million in revenue from Global Thermoelectric Inc.

CCS revenue in the 2014 second quarter, compared to the 2013 second quarter, increased by $23.2 million, or 37 percent, to $85.2 million. Similar to the first quarter, this increase was partially the result of new program launches since second quarter 2013 and strong production volumes and sales of vehicles equipped with CCS systems, particularly vehicles in the luxury segment. Additionally, certain vehicles that have been redesigned since the Second Quarter 2013 are experiencing very strong production and sales levels, including the General Motors full size SUV platform (“K2XX”) and the Jeep Grand Cherokee.

Seat heater revenue in this year’s second quarter increased by $11.1 million, or 16 percent year over year, to $81.7 million, reflecting market penetration on certain vehicle programs and strong production volumes on General Motors’ K2XX platform. The Company also had significant growth in sales of its heated steering wheel product, which increased $2.6 million, or 40 percent year over year, to $8.9 million.

Coker noted that European-based sales were significantly higher in the 2014 second quarter than in the second quarter of last year as local economies and car sales continue to improve.

Foreign currency translation of the Company’s Euro-denominated product revenue for this year’s second quarter, which was approximately €39.2 million compared with €35.5 million for the second quarter of last year, increased the Company’s US Dollar-reported revenue by approximately $2.6 million, or 1.3 percent. The average US Dollar/Euro exchange rate for the 2014 second quarter was 1.3715 compared with 1.3056 for the second quarter of last year.

Net income attributable to common shareholders for the 2014 second quarter was $16.4 million, or $0.46 per basic and diluted share. Net income attributable to common shareholders for the second quarter of 2013 was $5.0 million, or $0.15 per basic and diluted share, which included $422,000 in fees, legal and other expenses associated with the acquisition of additional W.E.T. shares during the quarter. During the second quarter 2014, the Company did not incur any such expenses.

Further non-cash purchase accounting impacts associated with the Company’s recent acquisitions are detailed in the Acquisition Transaction Expenses, Purchase Accounting Impacts and Other Effects table accompanying the release.

Gross margin as a percentage of revenue for this year’s second quarter increased to 29.5 percent, up from 25.0 percent for the 2013 second quarter. This increase was due to a favorable change in product mix, greater coverage of fixed manufacturing costs at the higher volume levels, favorable contribution from the Company’s new electronics manufacturing facility in China and foreign currency impact on production expenses in the Mexican Peso and Ukraine Hryvna. The favorable product mix is primarily due to the greater sales growth in CCS products on which Gentherm has historically had better margin performance.

Adjusted EBITDA for the 2014 second quarter was $32.3 million, up $15.8 million or 95 percent, compared with Adjusted EBITDA of $16.5 million for the 2013 second quarter. Adjusted EBITDA (which is a non-GAAP measure) is provided to help shareholders understand Gentherm’s results of operations due to the significant amount of acquisition-related amortization recorded against the Company’s earnings. This non-GAAP financial measure should be viewed in addition to, and not as an alternative for, Gentherm’s reported results prepared in accordance with GAAP.

The Company’s balance sheet as of June 30, 2014, had total cash and cash equivalents of $43.2 million, total assets of $534.8 million, shareholders’ equity of $272.6 million and total debt of $85.3 million.

Year-to-Date Summary

For the first six months of 2014, revenues increased 29.7 percent to $400.1 million from $308.6 million in the first six months of 2013. CCS revenue increased year over year in the first six months of 2014 by $49.2 million, or 42 percent, to $167.2 million. Seat heater revenue increased year over year by $26.6 million, or 20 percent, to $162.1 million. The Company also had significant growth in its heated steering wheel heater product with a year-over-year increase of $5.8 million, or 48 percent, to $17.7 million

Foreign currency translation of the Company’s Euro-denominated revenue for the first six months of 2014, which was €78.3 million compared with €70.4 million during the first six months of 2013, increased the US Dollar-reported revenue by approximately $4.5 million, or 1.1 percent. The average US Dollar/Euro exchange rate for the first six months of this year was 1.3709 compared with 1.3133 for the first six months of the prior year.

Net income attributable to common shareholders for the first six months of 2014 was $33.0 million, or $0.94 per basic share and $0.92 per diluted share, which included $1.1 million in fees and expenses associated with the acquisition of Global Thermoelectric Inc. that was completed on April 1, 2014. Net income attributable to common shareholders for the first six months of 2013 was $12.7 million, or $0.38 per basic share and $0.37 per diluted share. During the First Half 2013, the Company incurred $1.6 million in fees, legal and other expenses associated with the acquisition of W.E.T. shares.

Further non-cash purchase accounting impacts associated with the recent acquisitions are detailed in the Acquisition Transaction Expenses, Purchase Accounting Impacts and Other Effects table accompanying the release.

Gross margin as a percentage of revenue for first six months of 2014 was 29.4 percent compared with 25.7 percent for the first six months of 2013.

Adjusted EBITDA for the first half of 2014 was $64.8 million compared with Adjusted EBITDA of $34.7 million for the comparable period of the prior year.

Research and Development, Selling, General and Administrative (SG&A) Expenses

Net research and development expenses for this year’s second quarter and first six months were up year over year $2.1 million and $3.4 million to $14.6 million and $27.6 million, respectively. This increase reflects additional resources, including personnel, focused on application engineering for new production programs of existing products, development of new products and a program to develop the next generation of seat comfort products. The increase also included $270,000 in net research and development expenses due to the inclusion of Global Thermoelectric Inc. New product development includes automotive heated and cooled storage devices, automotive interior thermal management devices, medical thermal management devices, battery thermal management devices and other potential products.

SG&A expenses for the second quarter and first six months of 2014 increased $3.1 million and $4.9 million, respectively, to a respective $22.0 million and $40.1 million, when compared to the prior year periods. The year-over-year increase includes $2.1 million of selling, general and administrative expenses of Global Thermoelectric Inc. Also included in this year’s second quarter and first six months are higher general legal, audit and travel costs, as well as wages and benefits costs resulting from new employee hiring and merit increases. The additional employees are primarily related to establishing a new electronics production facility in Shenzhen, China, and increasing sales and marketing efforts aimed at supporting the Company’s current product strategy.

Guidance

Barring unforeseen economic turbulence, including worsening geopolitical tensions or unfavorable fluctuations of the Euro exchange rate, the 2014 revenue growth outlook remains strong. Reflecting strong revenue results for the first half of this year and the incorporation of the product revenues of Global Thermoelectric Inc., the Company is now expecting revenue for 2014 to increase by at least 20 percent over 2013 revenue, which was $662.0 million.

Conference Call

As previously announced, Gentherm is conducting a conference call today to be broadcast live over the Internet at 11:30 AM Eastern Time to review these financial results. The dial-in number for the call is 1-877-407-4018 or (1-201-689-8471). The live webcast and archived replay of the call can be accessed in the Events page of the Investor section of Gentherm’s website at www.gentherm.com.

About Gentherm

Gentherm (NASDAQ-GS:THRM) is a global developer and marketer of innovative thermal management technologies for a broad range of heating and cooling and temperature control applications. Automotive products include actively heated and cooled seat systems and cup holders, heated and ventilated seat systems, thermal storage bins, heated automotive interior systems (including heated seats, steering wheels, armrests and other components), cable systems and other electronic devices. The Company’s advanced technology team is developing more efficient materials for thermoelectric and systems for waste heat recovery and electrical power generation for the automotive market that may have far-reaching applications for consumer products as well as industrial and technology markets. Gentherm has more than 8,300 employees in facilities in the U.S., Germany, Mexico, China, Canada, Japan, England, Korea, Malta, Hungary and the Ukraine. For more information, go to www.gentherm.com.

Except for historical information contained herein, statements in this release are forward-looking statements that are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements include statements regarding future sales, products, opportunities, markets, expenses and profits. Forward-looking statements involve known and unknown risks and uncertainties which may cause the Company’s actual results in future periods to differ materially from forecasted results. Those risks include, but are not limited to, risks that sales may not increase, additional financing requirements may not be available, new competitors may arise and adverse conditions in the industry in which the Company operates may negatively affect its results. Those and other risks are described in the Company’s annual report on Form 10-K for the year ended December 31, 2013 and subsequent reports filed with the Securities and Exchange Commission (SEC), copies of which are available from the SEC or may be obtained from the Company. Except as required by law, the Company assumes no obligation to update the forward-looking statements, which are made as of the date hereof, even if new information becomes available in the future.

TABLES FOLLOW

GENTHERM INCORPORATED

CONSOLIDATED CONDENSED STATEMENTS OF INCOME

(In thousands, except per share data)

(Unaudited)

|

|

|

Three Months Ended

June 30, |

|

|

Six Months Ended

June 30, |

|

|

|

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

|

Product revenues |

|

$ |

206,182 |

|

|

$ |

160,520 |

|

|

|

400,120 |

|

|

|

308,610 |

|

|

Cost of sales |

|

|

145,425 |

|

|

|

120,368 |

|

|

|

282,338 |

|

|

|

229,407 |

|

|

Gross margin |

|

|

60,757 |

|

|

|

40,152 |

|

|

|

117,782 |

|

|

|

79,203 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net research and development expenses |

|

|

14,550 |

|

|

|

12,403 |

|

|

|

27,595 |

|

|

|

24,244 |

|

|

Acquisition transaction expenses |

|

|

— |

|

|

|

422 |

|

|

|

1,075 |

|

|

|

1,585 |

|

|

Selling, general and administrative |

|

|

21,972 |

|

|

|

18,908 |

|

|

|

40,061 |

|

|

|

35,164 |

|

|

Total operating expenses |

|

|

36,522 |

|

|

|

31,733 |

|

|

|

68,731 |

|

|

|

60,993 |

|

|

Operating income |

|

|

24,235 |

|

|

|

8,419 |

|

|

|

49,051 |

|

|

|

18,210 |

|

|

Interest expense |

|

|

(970 |

) |

|

|

(873 |

) |

|

|

(1,901 |

) |

|

|

(1,854 |

) |

|

Revaluation of derivatives |

|

|

(340 |

) |

|

|

638 |

|

|

|

(587 |

) |

|

|

984 |

|

|

Foreign currency (loss) gain |

|

|

(320 |

) |

|

|

(889 |

) |

|

|

(1,843 |

) |

|

|

98 |

|

|

Gain realized from step acquisition of subsidiary |

|

|

— |

|

|

|

— |

|

|

|

785 |

|

|

|

— |

|

|

Income from equity investment |

|

|

— |

|

|

|

17 |

|

|

|

— |

|

|

|

242 |

|

|

Other income |

|

|

320 |

|

|

|

164 |

|

|

|

301 |

|

|

|

500 |

|

|

Earnings before income tax |

|

|

22,925 |

|

|

|

7,476 |

|

|

|

45,806 |

|

|

|

18,180 |

|

|

Income tax expense |

|

|

6,502 |

|

|

|

1,948 |

|

|

|

12,804 |

|

|

|

2,743 |

|

|

Net income |

|

|

16,423 |

|

|

|

5,528 |

|

|

|

33,002 |

|

|

|

15,437 |

|

|

Income attributable to non-controlling interest |

|

|

— |

|

|

|

(19 |

) |

|

|

— |

|

|

|

(1,277 |

) |

|

Net income attributable to Gentherm Incorporated |

|

|

16,423 |

|

|

|

5,509 |

|

|

|

33,002 |

|

|

|

14,160 |

|

|

Convertible preferred stock dividends |

|

|

— |

|

|

|

(540 |

) |

|

|

— |

|

|

|

(1,463 |

) |

|

Net income attributable to common shareholders |

|

$ |

16,423 |

|

|

$ |

4,969 |

|

|

$ |

33,002 |

|

|

$ |

12,697 |

|

|

Basic earnings per share |

|

$ |

0.46 |

|

|

$ |

0.15 |

|

|

$ |

0.94 |

|

|

$ |

0.38 |

|

|

Diluted earnings per share |

|

$ |

0.46 |

|

|

$ |

0.15 |

|

|

$ |

0.92 |

|

|

$ |

0.37 |

|

|

Weighted average number of shares – basic |

|

|

35,361 |

|

|

|

32,658 |

|

|

|

35,213 |

|

|

|

33,698 |

|

|

Weighted average number of shares – diluted |

|

|

36,094 |

|

|

|

33,167 |

|

|

|

35,841 |

|

|

|

34,143 |

|

MORE-MORE-MORE

GENTHERM INCORPORATED

RECONCILIATION OF ADJUSTED EBITDA TO NET INCOME

(Unaudited, in thousands)

|

|

|

Three Months Ended

June 30, |

|

|

Six Months Ended

June 30, |

|

|

|

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

|

Net income |

|

$ |

16,423 |

|

|

$ |

5,528 |

|

|

$ |

33,002 |

|

|

$ |

15,437 |

|

|

Add Back: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax expense |

|

|

6,502 |

|

|

|

1,948 |

|

|

|

12,804 |

|

|

|

2,743 |

|

|

Interest expense |

|

|

970 |

|

|

|

873 |

|

|

|

1,901 |

|

|

|

1,854 |

|

|

Depreciation and amortization |

|

|

8,313 |

|

|

|

7,579 |

|

|

|

15,631 |

|

|

|

15,258 |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition transaction expense |

|

|

— |

|

|

|

422 |

|

|

|

1,075 |

|

|

|

1,585 |

|

|

Unrealized currency (gain) loss |

|

|

(241 |

) |

|

|

836 |

|

|

|

1,024 |

|

|

|

(77 |

) |

|

Unrealized revaluation of derivatives |

|

|

340 |

|

|

|

(638 |

) |

|

|

(685 |

) |

|

|

(2,140 |

) |

|

Adjusted EBITDA |

|

$ |

32,307 |

|

|

$ |

16,548 |

|

|

$ |

64,752 |

|

|

$ |

34,660 |

|

Use of Non-GAAP Financial Measures

In evaluating its business, Gentherm considers and uses Adjusted EBITDA as a supplemental measure of its operating performance. The Company defines Adjusted EBITDA as earnings before interest, taxes, depreciation and amortization, deferred financing cost amortization, transaction expenses, debt retirement expenses, unrealized currency gain or loss and unrealized revaluation of derivatives. Management believes that Adjusted EBITDA is a meaningful measure of liquidity and the Company’s ability to service debt because it provides a measure of cash available for such purposes. Management provides an Adjusted EBITDA measure so that investors will have the same financial information that management uses with the belief that it will assist investors in properly assessing the Company’s performance on a period-over-period basis.

The term Adjusted EBITDA is not defined under GAAP, and is not a measure of operating income, operating performance or liquidity presented in accordance with GAAP. Adjusted EBITDA has limitations as an analytical tool, and when assessing the Company’s operating performance, investors should not consider Adjusted EBITDA in isolation, or as a substitute for net income or other consolidated income statement data prepared in accordance with GAAP. Gentherm compensates for these limitations by relying primarily on its GAAP results and using Adjusted EBITDA only supplementally.

MORE-MORE-MORE

GENTHERM INCORPORATED

ACQUISITION TRANSACTION EXPENSES, PURCHASE ACCOUNTING IMPACTS AND OTHER EFFECTS

(Unaudited and in thousands, except per share data)

|

|

|

Three Months Ended

June 30, |

|

|

Six Months Ended

June 30, |

|

|

Future Full Year Periods (estimated) |

|

|

|

|

|

2014 |

|

|

|

2013 |

|

|

|

2014 |

|

|

|

2013 |

|

|

|

2014 |

|

|

|

2015 |

|

|

|

2016 |

|

|

|

Thereafter |

|

|

Transaction related current expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition transaction expenses |

|

$ |

— |

|

|

$ |

422 |

|

|

$ |

1,075 |

|

|

$ |

1,585 |

|

|

$ |

1,075 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

Non-cash purchase accounting impacts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Customer relationships amortization |

|

$ |

2,196 |

|

|

$ |

1,956 |

|

|

$ |

4,252 |

|

|

$ |

3,940 |

|

|

$ |

8,625 |

|

|

$ |

8,756 |

|

|

$ |

8,756 |

|

|

$ |

39,203 |

|

|

Technology amortization |

|

|

948 |

|

|

|

820 |

|

|

|

1,810 |

|

|

|

1,652 |

|

|

|

3,695 |

|

|

|

3,375 |

|

|

|

3,775 |

|

|

|

5,434 |

|

|

Product development costs amortization |

|

|

570 |

|

|

|

542 |

|

|

|

1,139 |

|

|

|

1,091 |

|

|

|

2,274 |

|

|

|

1,288 |

|

|

|

52 |

|

|

|

— |

|

|

Trade name amortization |

|

|

63 |

|

|

|

— |

|

|

|

63 |

|

|

|

— |

|

|

|

185 |

|

|

|

243 |

|

|

|

243 |

|

|

|

183 |

|

|

Order backlog amortization |

|

|

494 |

|

|

|

— |

|

|

|

494 |

|

|

|

— |

|

|

|

1,453 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Inventory fair value adjustment |

|

|

1,303 |

|

|

|

— |

|

|

|

1,303 |

|

|

|

— |

|

|

|

1,303 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

$ |

5,574 |

|

|

$ |

3,318 |

|

|

$ |

9,061 |

|

|

$ |

6,683 |

|

|

$ |

17,535 |

|

|

$ |

14,062 |

|

|

$ |

12,826 |

|

|

$ |

44,820 |

|

|

Tax effect |

|

|

(1,329 |

) |

|

|

(932 |

) |

|

|

(2,524 |

) |

|

|

(2,163 |

) |

|

|

(4,514 |

) |

|

|

(3,277 |

) |

|

|

(2,991 |

) |

|

|

(10,520 |

) |

|

Net income effect |

|

|

4,245 |

|

|

|

2,808 |

|

|

|

7,612 |

|

|

|

6,105 |

|

|

|

14,096 |

|

|

|

10,785 |

|

|

|

9,835 |

|

|

|

34,300 |

|

|

Non-controlling interest effect |

|

|

— |

|

|

|

(25 |

) |

|

|

— |

|

|

|

(103 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Net income available to shareholders effect |

|

$ |

4,245 |

|

|

$ |

2,783 |

|

|

$ |

7,612 |

|

|

$ |

6,002 |

|

|

$ |

14,096 |

|

|

$ |

10,785 |

|

|

$ |

9,835 |

|

|

$ |

34,300 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share—difference |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.12 |

|

|

$ |

0.09 |

|

|

$ |

0.22 |

|

|

$ |

0.18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted |

|

$ |

0.12 |

|

|

$ |

0.08 |

|

|

$ |

0.21 |

|

|

$ |

0.18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Series C Preferred Stock dividend |

|

$ |

— |

|

|

$ |

540 |

|

|

$ |

— |

|

|

$ |

1,463 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share—difference |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

— |

|

|

$ |

0.02 |

|

|

$ |

— |

|

|

$ |

0.04 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted |

|

$ |

— |

|

|

$ |

0.02 |

|

|

$ |

— |

|

|

$ |

0.04 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MORE-MORE-MORE

GENTHERM INCORPORATED

CONSOLIDATED BALANCE SHEETS

(In thousands, except share data)

|

|

|

June 30,

2014 |

|

|

December 31,

2013 |

|

|

|

|

(unaudited) |

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

Current Assets: |

|

|

|

|

|

|

|

|

|

Cash & cash equivalents |

|

$ |

43,154 |

|

|

$ |

54,885 |

|

|

Accounts receivable, less allowance of $1,601 and $1,807, respectively |

|

|

145,957 |

|

|

|

118,283 |

|

|

Inventory: |

|

|

|

|

|

|

|

|

|

Raw materials |

|

|

43,409 |

|

|

|

33,783 |

|

|

Work in process |

|

|

2,943 |

|

|

|

2,864 |

|

|

Finished goods |

|

|

21,671 |

|

|

|

27,570 |

|

|

Inventory, net |

|

|

68,023 |

|

|

|

64,217 |

|

|

Derivative financial instruments |

|

|

325 |

|

|

|

67 |

|

|

Deferred income tax assets |

|

|

10,700 |

|

|

|

10,616 |

|

|

Prepaid expenses and other assets |

|

|

29,042 |

|

|

|

21,864 |

|

|

Total current assets |

|

|

297,201 |

|

|

|

269,932 |

|

|

Property and equipment, net |

|

|

84,158 |

|

|

|

79,234 |

|

|

Goodwill |

|

|

32,247 |

|

|

|

25,809 |

|

|

Other intangible assets |

|

|

87,239 |

|

|

|

83,431 |

|

|

Deferred financing costs |

|

|

945 |

|

|

|

1,072 |

|

|

Deferred income tax assets |

|

|

20,104 |

|

|

|

7,103 |

|

|

Derivative financial instruments |

|

|

1,343 |

|

|

|

1,969 |

|

|

Other non-current assets |

|

|

11,599 |

|

|

|

13,373 |

|

|

Total assets |

|

$ |

534,836 |

|

|

$ |

481,923 |

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

Current Liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

64,907 |

|

|

$ |

61,662 |

|

|

Accrued liabilities |

|

|

68,394 |

|

|

|

66,783 |

|

|

Current maturities of long-term debt |

|

|

19,519 |

|

|

|

21,439 |

|

|

Derivative financial instruments |

|

|

2,776 |

|

|

|

2,552 |

|

|

Deferred income tax liabilities |

|

|

705 |

|

|

|

710 |

|

|

Total current liabilities |

|

|

156,301 |

|

|

|

153,146 |

|

|

Pension benefit obligation |

|

|

7,189 |

|

|

|

6,868 |

|

|

Other liabilities |

|

|

4,533 |

|

|

|

1,601 |

|

|

Long-term debt, less current maturities |

|

|

65,727 |

|

|

|

60,881 |

|

|

Derivative financial instruments |

|

|

8,288 |

|

|

|

9,358 |

|

|

Deferred income tax liabilities |

|

|

20,218 |

|

|

|

17,975 |

|

|

Total liabilities |

|

|

262,256 |

|

|

|

249,829 |

|

|

Shareholders’ equity: |

|

|

|

|

|

|

|

|

|

Common Stock: |

|

|

|

|

|

|

|

|

|

No par value; 55,000,000 shares authorized, 35,451,435 and 34,929,334 issued and outstanding at June 30, 2014 and December 31, 2013, respectively |

|

|

238,091 |

|

|

|

232,067 |

|

|

Paid-in capital |

|

|

(5,820 |

) |

|

|

(9,582 |

) |

|

Accumulated other comprehensive loss |

|

|

(7,505 |

) |

|

|

(5,203 |

) |

|

Accumulated earnings |

|

|

47,814 |

|

|

|

14,812 |

|

|

Total shareholders’ equity |

|

|

272,580 |

|

|

|

232,094 |

|

|

Total liabilities and shareholders’ equity |

|

$ |

534,836 |

|

|

$ |

481,923 |

|

MORE-MORE-MORE

GENTHERM INCORPORATED

CONSOLIDATED CONDENSED STATEMENTS OF CASH FLOWS

(In thousands)

|

|

|

Three Months Ended June 30, |

|

|

|

|

2014 |

|

|

2013 |

|

|

Operating Activities: |

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

33,002 |

|

|

$ |

15,437 |

|

|

Adjustments to reconcile net income to cash provided by operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

15,931 |

|

|

|

15,730 |

|

|

Deferred tax provision |

|

|

(2,154 |

) |

|

|

(1,210 |

) |

|

Stock compensation |

|

|

2,225 |

|

|

|

998 |

|

|

Defined benefit plan expense |

|

|

28 |

|

|

|

(105 |

) |

|

Provision of doubtful accounts |

|

|

(330 |

) |

|

|

(8 |

) |

|

Gain on revaluation of financial derivatives |

|

|

(217 |

) |

|

|

(1,878 |

) |

|

Gain on equity investment |

|

|

— |

|

|

|

(197 |

) |

|

Loss (gain) on sale of property, plant and equipment |

|

|

28 |

|

|

|

(16 |

) |

|

Excess tax benefit from equity awards |

|

|

(4,155 |

) |

|

|

(204 |

) |

|

Gain realized from step acquisition of subsidiary |

|

|

(785 |

) |

|

|

— |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(17,456 |

) |

|

|

(12,028 |

) |

|

Inventory |

|

|

5,024 |

|

|

|

(2,835 |

) |

|

Prepaid expenses and other assets |

|

|

(6,959 |

) |

|

|

(4,091 |

) |

|

Accounts payable |

|

|

(1,312 |

) |

|

|

14,470 |

|

|

Accrued liabilities |

|

|

1,496 |

|

|

|

2,372 |

|

|

Net cash provided by (used in) operating activities |

|

|

24,366 |

|

|

|

26,435 |

|

|

Investing Activities: |

|

|

|

|

|

|

|

|

|

Purchase of non-controlling interest |

|

|

— |

|

|

|

(46,827 |

) |

|

Acquisition and investment in subsidiary, net of cash acquired |

|

|

(31,739 |

) |

|

|

— |

|

|

Proceeds from the sale of property, plant and equipment |

|

|

44 |

|

|

|

9 |

|

|

Purchase of property and equipment |

|

|

(15,489 |

) |

|

|

(18,032 |

) |

|

Net cash used in investing activities |

|

|

(47,184 |

) |

|

|

(64,850 |

) |

|

Financing Activities: |

|

|

|

|

|

|

|

|

|

Borrowing of debt |

|

|

13,455 |

|

|

|

46,280 |

|

|

Repayments of debt |

|

|

(12,470 |

) |

|

|

(10,286 |

) |

|

Excess tax benefit from equity awards |

|

|

4,155 |

|

|

|

204 |

|

|

Cash paid to Series C Preferred Stock Holders |

|

|

— |

|

|

|

(8,945 |

) |

|

Proceeds from the exercise of common stock options |

|

|

3,406 |

|

|

|

2,411 |

|

|

Net cash provided by (used in) financing activities |

|

|

8,546 |

|

|

|

29,664 |

|

|

Foreign currency effect |

|

|

2,541 |

|

|

|

— |

|

|

Net increase (decrease) in cash and cash equivalents |

|

|

(11,731 |

) |

|

|

(8,751 |

) |

|

Cash and cash equivalents at beginning of period |

|

|

54,885 |

|

|

|

58,152 |

|

|

Cash and cash equivalents at end of period |

|

$ |

43,154 |

|

|

$ |

49,401 |

|

# # # #

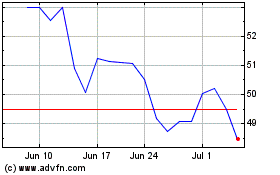

Gentherm (NASDAQ:THRM)

Historical Stock Chart

From Mar 2024 to Apr 2024

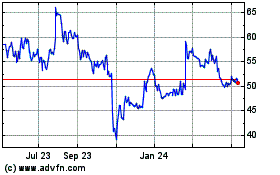

Gentherm (NASDAQ:THRM)

Historical Stock Chart

From Apr 2023 to Apr 2024