Dream Unlimited Corp. (TSX:DRM)(TSX:DRM.PR.A) -

This news release contains forward-looking information that is based upon

assumptions and is subject to risks and uncertainties as indicated in the

cautionary note contained within this press release.

Dream Unlimited Corp. ("Dream") today announced its financial results for the

three and six months ended June 30, 2014. Basic earnings per share (EPS) for the

three and six months ended June 30, 2014 were $0.16 and $0.28, respectively.

During and subsequent to the quarter we:

-- successfully completed the previously announced reorganization of the

ROI Canadian High Income Mortgage Fund; ROI Canadian Mortgage Income

Fund; ROI Canadian Real Estate Fund and ROI Institutional Private

Placement Fund (collectively the "ROI Funds"). As part of the

reorganization, all of the assets within the ROI Funds were indirectly

transferred to the newly formed Dream Hard Asset Alternatives Trust

("Dream Alternatives") (TSX:DRA.UN). Dream Alternatives has

approximately $1.0 billion of gross assets and is the fourth TSX-listed

entity managed by a subsidiary of Dream;

-- extended the maturity to November 30, 2016 and increased the capacity of

our existing secured revolving term credit facility through a syndicate

of chartered banks from $230 million to $290 million, while maintaining

existing pricing terms;

-- completed the sale of a 12 acre land parcel to Walmart for a future

130,000 square foot store in Edmonton, and subsequently broke ground on

the first phase of a multi-parcel retail site consisting of 180,000

square feet. The first phase of the development is expected to be

completed by the spring/summer of 2015.

"The first six months of 2014 have been an exciting time for our company," said

Michael Cooper, CEO. "We continue to grow, diversify and leverage our asset

management business and increase our recurring sources of income, we have

increased our liquidity through expansion of our credit facility to provide us

with improved flexibility in running our day-to-day operations and we

successfully broke ground on our first ever retail development at our site in

Edmonton. As the cities move to intensify, it will be increasingly more valuable

to build more residential, retail and multi-family projects on our own lands."

A summary of our 2014 second quarter results is included in the table below.

Three months ended Six months ended June

June 30, 30,

----------------------------------------------------------------------------

(in thousands of Canadian dollars,

except per share amounts) 2014 2013 2014 2013

----------------------------------------------------------------------------

Revenue $ 99,619 $ 119,715 $ 183,542 $ 241,622

Net margin (1) $ 27,427 $ 30,128 $ 51,195 $ 61,499

Net margin (1) 27.5% 25.2% 27.9% 25.5%

Earnings for the period before

tax $ 25,586 $ 28,848 $ 46,315 $ 59,398

Earnings for the period $ 17,621 $ 44,893 $ 31,247 $ 66,947

Basic earnings per share(2) $ 0.16 $ 0.41 $ 0.28 $ 0.62

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) "Net margin" represents revenue less direct operating costs and asset

management and advisory services expenses; including selling, marketing and

other operating costs.

(2) Note: Basic EPS is computed by dividing Dream's earnings attributable to

owners of the parent by the weighted average number of Dream Subordinate

Voting Shares and Dream Class B shares outstanding during the year.

Other Key Highlights:

-- In the six months ended June 30, 2014, we completed 173 lot sales, 33

acre sales, 93 housing unit occupancies and 310 condominium unit

occupancies (157 condominium unit occupancies at Dream's share).

-- We received approval for our first new community in east Saskatoon

called Brighton - an 870 acre neighbourhood of which Dream owns 510

acres. We have commenced our construction efforts, with initial lot

sales anticipated to be finalized later in 2014. We continue to advance

approvals for an additional 151 acres in Saskatoon.

-- The City of Regina has given direction in their interim plan concerning

the immediate approval of approximately 260 acres of new development in

the Towns and Harbour Landing West. We continue to work with the city

and pursue approvals for the majority of our lands over the next two

years.

-- Commitments of $5.6 million were made for an additional 148 acres of

lands, thereby enhancing our existing inventory position in Saskatoon.

Including these lands, there are an additional 941 acres of land under

commitments of which $31.6 million is left to fund.

-- Development of the Toronto 2015 Pan/Parapan American Games Athletes'

Village ("Pan Am") project that will evolve after the Games into a mixed

use neighbourhood known as the Canary District, is now approximately 83%

complete and is on time and on budget.

Selected financial operating metrics for the three and six months ended June 30,

2014 are summarized below.

Traditionally, our highest sales volume quarter for our land and housing

divisions has been the fourth quarter, while our lowest has been the first

quarter. In the first quarter of 2013, we experienced higher lot sales than

would be typical within our business, due to a significant amount of delayed lot

sales recorded in the previous period. Therefore we note that there is limited

direct comparability in the year over year results within the land development

business segment.

Selected Operating Metrics

Three months ended June Six months ended June

30, 30,

----------------------------------------------------------------------------

(in thousands of Canadian

dollars) 2014 2013 2014 2013

----------------------------------------------------------------------------

LAND DEVELOPMENT

----------------------------

Lot revenue $ 8,086 $ 26,928 $ 19,720 $ 71,540

Acre revenue $ 15,374 $ 13,038 $ 24,290 $ 22,828

Revenue (1) $ 23,460 $ 39,966 $ 44,010 $ 94,368

Gross margin (1) $ 12,327 $ 12,900 $ 20,276 $ 31,227

Gross margin 52.5% 32.3% 46.1% 33.1%

Net margin (1) $ 9,843 $ 10,439 $ 16,200 $ 27,761

Net margin 42.0% 26.1% 36.8% 29.4%

Lots Sold 73 239 173 619

Average selling price - lot

units $ 111,000 $ 113,000 $ 114,000 $ 116,000

Acres Sold 18 18 33 37

Average selling price - acre

units $ 846,000 $ 772,000 $ 741,000 $ 640,000

HOUSING DEVELOPMENT

----------------------------

Housing units occupied 55 77 93 126

Revenue (1) $ 23,936 $ 30,431 $ 39,786 $ 51,255

Gross margin (1) $ 5,183 $ 7,051 $ 8,555 $ 12,065

Gross margin 21.7% 23.2% 21.5% 23.5%

Net margin (1) $ 2,277 $ 4,605 $ 3,508 $ 7,773

Net margin 9.5% 15.1% 8.8% 15.2%

Average selling price -

housing units $ 435,000 $ 395,800 $ 428,000 $ 406,800

(1) Results include land revenues and net margin on internal lot sales to

our housing division, as the homes have been sold to external customers by

the housing division during the period. Revenue (and net margin) results of

$3.9 million ($2.7 million) and $6.0 million ($4.1 million) in the three and

six months ended June 30, 2014 and $5.0 million ($3.4 million) and $8.6

million ($5.9 million) in the same period in the prior year, recognized in

both the land and housing divisions have been eliminated on consolidation.

CONDOMINIUM DEVELOPMENT

----------------------------

Attributable to Dream,

excluding equity accounted

investmentsCondominium

occupancies (units) 86 62 157 140

Revenue $ 36,453 $ 30,326 $ 62,427 $ 58,903

Gross margin $ 10,068 $ 8,788 $ 19,873 $ 13,446

Gross margin 27.6% 29.0% 31.8% 22.8%

Net margin $ 9,495 $ 7,365 $ 18,294 $ 10,554

Net margin 26.0% 24.3% 29.3% 17.9%

Average selling price of

condominiums occupied

Per unit $ 415,000 $ 357,000 $ 368,000 $ 365,000

Per square foot $ 517 $ 498 $ 499 $ 576

Pre-sold condominiums

(units) 337 424 337 424

ASSET MANAGEMENT AND

ADVISORY SERVICES

----------------------------

Fee earning assets under

management - listed funds $10,716,630 $ 9,201,028 $10,716,630 $ 9,201,028

Revenue $ 7,427 $ 11,921 $ 17,303 $ 23,105

Gross margin $ 5,177 $ 7,770 $ 10,890 $ 15,620

Gross margin 69.7% 65.2% 62.9% 67.6%

Net margin $ 5,128 $ 7,413 $ 10,140 $ 14,877

Net margin 69.0% 62.2% 58.6% 64.4%

INVESTMENT AND RECREATIONAL

PROPERTIES

----------------------------

Revenue $ 12,284 $ 12,117 $ 26,066 $ 22,567

Net margin $ 1,933 $ 1,921 $ 5,025 $ 3,229

Net margin 15.7% 15.9% 19.3% 14.3%

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Capital Structure

At June 30, 2014, Dream had 76.3 million Subordinate Voting Shares and 3.1

million Class B Shares outstanding. Including the non-controlling interest, the

market capitalization was $1.75 billion and the enterprise value was $2.1

billion. Our debt-to-enterprise value was approximately 18%.

We believe our capital structure remains conservative, which offers significant

flexibility to grow the business over time by seeking out new opportunities

where we can use our experience, expertise and relationships to achieve

attractive risk adjusted returns.

Other Information

Information appearing in this news release is a select summary of results. The

financial statements and management's discussion and analysis for the Company

are available at www.dream.ca and on www.sedar.com.

Conference Call

Senior management will host a conference call to discuss the results tomorrow,

July 25 at 9:00 a.m. (ET). To access the call, please dial 1-866-229-4144 in

Canada and the United States or 416-216-4169 elsewhere and use passcode 6281

674#.

To access the conference call via webcast, please go to Dream's website at

www.dream.ca and click on the link for News and Events, then click on Calendar

of Events. A taped replay of the conference call and the webcast will be

available for 90 days.

About Dream Unlimited Corp.

Dream is one of Canada's leading real estate companies with approximately $14.6

billion of assets under management in North America and Europe. The scope of the

business includes residential land development, housing and condominium

development, asset management for three TSX-listed real estate investment trusts

and one TSX-listed diversified, hard asset alternatives trust, investments in

and management of Canadian renewable energy infrastructure and commercial

property ownership. Dream has an established track record for being innovative

and for its ability to source, structure and execute on compelling investment

opportunities.

Forward-Looking Information

This press release may contain forward-looking information within the meaning of

applicable securities legislation. Forward-looking information is based on a

number of assumptions and is subject to a number of risks and uncertainties,

many of which are beyond Dream's control, which could cause actual results to

differ materially from those that are disclosed in or implied by such

forward-looking information. These risks and uncertainties include, but are not

limited to general and local economic and business conditions, employment

levels, regulatory risks, mortgage rates and regulations, environmental risks,

consumer confidence, seasonality, adverse weather conditions, reliance on key

clients and personnel and competition. All forward looking information in this

press release speaks as of July 24, 2014. Dream does not undertake to update any

such forward looking information whether as a result of new information, future

events or otherwise. Additional information about these assumptions and risks

and uncertainties is disclosed in filings with securities regulators filed on

SEDAR (www.sedar.com).

FOR FURTHER INFORMATION PLEASE CONTACT:

DREAM Unlimited Corp.

Michael J. Cooper

Chief Executive Officer

(416) 365-5145

mcooper@dream.ca

DREAM Unlimited Corp.

Pauline Alimchandani

Chief Financial Officer

(416) 365-5992

palimchandani@dream.ca

www.dream.ca

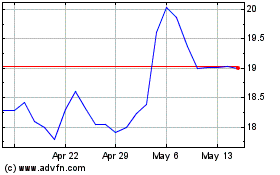

DREAM Unlimited (TSX:DRM)

Historical Stock Chart

From Mar 2024 to Apr 2024

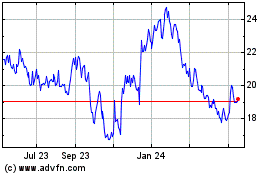

DREAM Unlimited (TSX:DRM)

Historical Stock Chart

From Apr 2023 to Apr 2024