UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

| Date of report (Date of earliest event reported) |

July 7, 2014 |

CYTOCORE, INC.

(Exact Name of Registrant as Specified in

Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

| 333-143570 |

36-4296006 |

| (Commission File Number) |

(IRS Employer Identification No.) |

| 4203 SW 34th St. |

|

| Orlando, FL |

32811 |

| (Address of Principal Executive Offices) |

(Zip Code) |

(407)

996-9631

(Registrant’s telephone number, including

area code)

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 7.01 Regulation FD

Disclosure.

On July 7, 2014, Cytocore,

Inc. (the “Company”) issued a letter to its shareholders to provide certain information regarding recent Company developments

and plans for the upcoming year. A copy of the letter to shareholders is attached to this

Current Report on Form 8-K as Exhibit 99.1 and is incorporated herein by reference. The Company does not undertake to update this

presentation.

The information contained

in this Item 7.01 of this Current Report on Form 8-K and in the accompanying exhibit incorporated by reference herein shall not

be incorporated by reference into any filing of the Company, whether made before or after the date hereof, regardless of any general

incorporation language in such filing, unless expressly incorporated by specific reference to such filing. This information, including

the exhibit hereto, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of

1934, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933.

The information set

forth in this Current Report on Form 8-K and the attached Exhibit 99.1, includes "forward-looking statements" within

the meaning of Section 27A of the Securities Act of 1933 as amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, regarding future operating performance, events, trends and plans. All statements other than statements of historical fact

contained herein, including, without limitation, statements regarding our future financial position, business strategy, budgets,

projected revenues and costs, and plans and objectives of management for future operations, are forward-looking statements. Forward-looking

statements generally can be identified by the use of forward-looking terminology such as “may,” “will,”

“expects,” “intends,” “plans,” “projects,” “estimates,” “anticipates,”

or “believes” or the negative thereof or any variation thereon or similar terminology or expressions. We have based

these forward-looking statements on our current expectations and projections about future events. These forward-looking statements

are not guarantees and are subject to known and unknown risks, uncertainties and assumptions about us that may cause our actual

results, levels of activity, performance or achievements to be materially different from any future results, levels of activity,

performance or achievements expressed or implied by such forward-looking statements. Important factors that could cause our actual

results to differ from our expectations, include but are not limited to, MEDITE’s ability following the acquisition to maintain

and grow its revenues, our ability to integrate MEDITE’s operations with our historic operations, the effect that the acquisition

will have on MEDITE’s existing customers and employees, our ability to protect our intellectual property rights, as well

as those risk factors that apply to our operations as disclosed in Item 1A of Cytocore’s Annual Report on Form 10-K for the

year ended December 31, 2013 and other filings with the Securities and Exchange Commission. Readers are cautioned not to place

undue reliance on our forward-looking statements, as they speak only as of the date made. Such statements are not guarantees of

future performance or events and we undertake no obligation to disclose any revision to these forward-looking statements to reflect

events or circumstances occurring after the date hereof.

Item 9.01 Financial Statements

and Exhibits.

Exhibit 99.1. Shareholder Letter dated July 7, 2014

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

CYTOCORE, INC. |

|

|

|

| |

|

|

| Date: July 7, 2014 |

By: |

/s/ Robert McCullough |

| |

|

Robert McCullough |

| |

|

Chief Financial Officer |

July 7, 2014

To Our Shareholders and Friends,

Last month, Cytocore, Inc. (OTCBB: CYOE)

filed financial statements of Medite Enterprise, Inc. for 2012, 2013 and first quarter 2014 prepared in accordance with US GAAP

with the Securities & Exchange Commission. The filing represented a significant milestone for our company. Shortly, we expect

to change the name of our company to Medite Holdings, Inc. and change our ticker symbol to better align with our new name. The

first half of 2014 has been filled with corporate and operational progress and we wanted to take a moment to bring you up to date

on where we are as a company as well as outline our goals for the second half of the year.

Since completing the combination of Medite

and Cytocore on April 3rd, we have made significant progress integrating the MEDITE and Cytocore businesses and we are well on

our way to becoming a rapidly growing and disruptive force in the multi-billion dollar global histology and cytology systems marketplace

for cancer detection. We have relocated the MEDITE/Cytocore global headquarters to Orlando, FL, and implemented a number of cost

synergies. For instance, we moved the Cytocore research laboratory and reduced facility costs by 75%. At the same time, we raised

in excess of $1.7 million in new capital providing us with some of the resources to fuel our growth and execute our business plan.

MEDITE was founded in 1978 and acquired

by us in 2006. Since we began operating the company the strategic focus was on developing innovative and very competitive new products

and complete product lines. We have a well-earned reputation for being an innovative and trend setting developer and manufacturer

of innovative, high-quality equipment and supplies for the cancer diagnostic segments of histology, pathology and cytology laboratories.

We have also generated consistent profitability every year, including in 2013 when we generated revenue of $9.6 million and an

operating profit of $0.3 million. As we planned, our growth and profitability from MEDITE stand alone operations this year have

accelerated. Our first quarter revenue increased 51%, to a record $2.7 million and we generated an operating profit of $0.4 million.

This growth reflects increased sales in the U.S. and in the European Cytology business.

What we are excited about as we look forward

was that our 51% growth in the first quarter did not reflect the positive impact from several initiatives. We expect that some

of these initiatives will begin to contribute to our growth in the second half of the year.

Some of the factors behind our strong start

to 2014 include:

| · | We commercially launched CytoTape, our proprietary

high transparency coverslipping film to be used in all Tape-Coverslipper machines. We believe that the tape will be coveted by

high volume labs because it allows them process up to 1,200 microscopic slides per hour compared to up to 400 slides per hour

for standard glass coverslippers. In April 2014, we signed an agreement with a leading anatomical pathology company to market,

sell and distribute our coverslipping film as an OEM product in the U.S. and Canada, and the demand to date from this OEM has

exceeded our initial forecast. |

| · | In the second half of 2013, we also entered into a

strategic alliance agreement with UNIC Technologies, a Chinese manufacturer of pathology digital scanners and tele-pathology services.

Reflecting our reputation for manufacturing quality and reliable products and ‘made in Germany’ label, we are now

the ‘Preferred’ vendor to develop and implement the new histology standard for a digital pathology solution in China.

On a recent trip to China and other Southeast Asia countries, UNIC introduced us to 30 distributors, 20 sales representatives

as well as local and central government officials. We have not previously sold any equipment to the Chinese market. With approximately

20,000 labs currently and the addition of about 500 new labs annually, we believe that China represents a significant growth opportunity.

Given the shortage of pathologists and cytologists in China, our systems are well positioned to meet the country’s expanding

needs. We are pleased to report we have received our first order from this initiative. |

| · | In the U.S., following several sales training seminars

and meetings with sales teams of our new distribution partner, a leading anatomic pathology distributor, our Cytology business

is performing well. We expect to see demand for our products increase in the immediate future. |

| · | By strengthening the international sales team including

the hiring of an additional sales manager with great international experience we believe that we are well positioned to capitalize

on the increased requests for quotes we are receiving, as well as provide increased management resources to our existing international

distributors. |

As our growth increases, so, too, do our

organizational needs. To meet the rising demand for our equipment and supplies, we are in the process of hiring additional personnel,

primarily in our European manufacturing facilities, to increase our capacity. We are also increasing our sales and marketing efforts

in select countries, such as the U.S., China and some European countries, where we anticipate the majority of our growth will come

from in the coming years. To complement these efforts and leverage the goodwill we have established over the years, we plan to

change the name of the combined company to MEDITE Holdings, Inc. and intend to update our website in the third quarter. We will

be sure to share these developments with you so you can follow our progress.

As our momentum continues, so too is our

expectation for continued business development in the 2014 second half. Some of these anticipated milestones include:

| · | Receive CFDA registration of our products in China. |

| · | Develop new products for the growing Chinese market, including working with our JV partner to develop

and implement a digital pathology network with “cloud” storage technology. |

| · | Establish a cost effective R&D team and manufacturing capability in Eastern Europe. |

| · | Initiate marketing efforts for three new products that are in the final stages of development. |

In summary, 2013 laid the groundwork for

2014 to be a very successful year for MEDITE, our partners, shareholders and employees. We achieved our initial goal of completing

the acquisition and are well on our way to integrating our two organizations. We have already eliminated expenses designed to strengthen

our Company and we are committed to aggressively pursuing our growth opportunities and look forward to sharing our success with

you as the year unfolds.

Thank you for your continued support!

Respectfully,

| Michaela Ott |

Robert McCullough |

Michael Ott |

| Chief Executive Officer |

Chief Financial Officer |

President and Chief Operating Officer |

This letter to shareholders contains

forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended, regarding future operating performance, events, trends and plans. All statements other than statements

of historical fact contained herein, including, without limitation, statements regarding our future financial position, business

strategy, budgets, projected revenues and costs, and plans and objectives of management for future operations, are forward-looking

statements. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,”

“will,” “expects,” “intends,” “plans,” “projects,” “estimates,”

“anticipates,” or “believes” or the negative thereof or any variation thereon or similar terminology or

expressions. We have based these forward-looking statements on our current expectations and projections about future events. These

forward-looking statements are not guarantees and are subject to known and unknown risks, uncertainties and assumptions about us

that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results,

levels of activity, performance or achievements expressed or implied by such forward-looking statements. Important factors that

could cause our actual results to differ from our expectations, include but are not limited to, MEDITE’s ability following

the acquisition to maintain and grow its revenues, our ability to integrate MEDITE’s operations with our historic operations,

the effect that the acquisition will have on MEDITE’s existing customers and employees, our ability to protect our intellectual

property rights, as well as those risk factors that apply to our operations as disclosed in Item 1A of Cytocore’s Annual

Report on Form 10-K for the year ended December 31, 2013 and other filings with the Securities and Exchange Commission. Readers

are cautioned not to place undue reliance on our forward-looking statements, as they speak only as of the date made. Such statements

are not guarantees of future performance or events and we undertake no obligation to disclose any revision to these forward-looking

statements to reflect events or circumstances occurring after the date hereof.

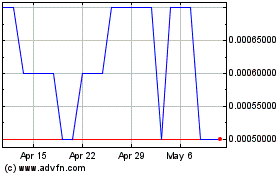

Himalaya Technologies (PK) (USOTC:HMLA)

Historical Stock Chart

From Mar 2024 to Apr 2024

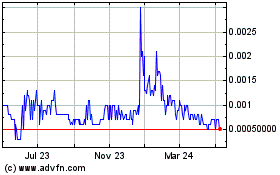

Himalaya Technologies (PK) (USOTC:HMLA)

Historical Stock Chart

From Apr 2023 to Apr 2024