Peak Closes Quickable Acquisition

June 16 2014 - 8:30AM

Marketwired

Peak Closes Quickable Acquisition

MONTREAL, QUEBEC--(Marketwired - Jun 16, 2014) - Peak

Positioning Technologies Inc. (TSX-VENTURE:PKK)(PINKSHEETS:PKKFF)

("Peak" or the "Company") today announced that it has officially

acquired the assets associated with the Quickable Marketplace (the

"Assets") from Quick Technologies LLC ("Quick"). The transaction,

which was first announced on March 26, 2014, was closed as

scheduled on June 13, 2014.

"We have been consistent with our message to shareholders that

our objective is to create long-term sustained value with

exceptional growth potential", said Johnson Joseph, President and

CEO of Peak. "We've clearly laid out our strategy for how we plan

on doing that, and the announcement made today is a key component

of the execution of that strategy. Having the Quickable assets now

in hand really sets the stage for everything we set out to

accomplish in 2014, both in North America and in China", concluded

Mr. Joseph.

"What really sold us on this acquisition is the vision that Peak

has, not just for Quickable, but for the Company's overall strategy

and where it plans to be tomorrow, 6 months from now, a year from

now and beyond. We couldn't be more pleased to be joining the ranks

of Peak's shareholders at this point in time", commented Doug

Brenhouse, President of Quick.

As part of the total consideration package to be paid to Quick

for the Assets, as previously disclosed in the news release dated

May 15, 2014, Quick received from Peak 20 million Peak Common

Shares at a deemed price of $0.05 per share. The Peak Common Shares

received by Quick are subject to a trading restriction until

October 14, 2014.

Debt Settlement with

Newfield Partners LLC

Peak also announced that it has completed a "shares for debt"

transaction with Newfield Partners LLC ("Newfield"). On June 11,

2014, Peak issued 470,000 common shares to Newfield at a deemed

price of $0.05 per share to repay $23,500 worth of short-term notes

payable to Newfield, which matured on May 30, 2014.

Pursuant to Policy 5.9 of the TSXV and Multilateral Instrument

61-101 Respecting protection of minority security holders in

special transactions ("MI 61-101"), the debt settlement transaction

constitutes a "related party transaction" as Newfield is controlled

by Mr. David Kugler (the "Related Party"), who is a member of

Peak's Board of Director. In reviewing the applicable valuation

requirements under MI 61-101, Peak has determined that the

exemption set out in subsection 5.5 (c) of MI 61-101 is applicable

since the transaction is a distribution of securities of Peak to

the Related Party for cash consideration. In addition, subsection

5.7(b) provides that a transaction meeting such criteria is also

exempt from the minority shareholder approval requirement. Peak has

not filed a material change report 21 days prior to the closing of

the debt settlement transaction as no agreement to that effect was

in place at that time.

About Peak Positioning Technologies Inc.:

Peak Positioning Technologies Inc. ("Peak"),

(TSX-VENTURE:PKK)(PINKSHEETS:PKKFF), is a management company whose

wholly-owned subsidiary, Peak Positioning Corporation provides Web

development services and develops mobile software platforms

destined to mobile network operators worldwide. Peak aims to

deliver value to its shareholders by assembling a portfolio of

high-growth projects and companies in mobile, mobile e-Commerce,

and Web development in North America and China. For more

information: http://www.peakpositioning.com

Forward-Looking Statements / Information

This news release may include certain forward-looking

information, including statements relating to business and

operating strategies, plans and prospects for revenue growth, using

words including "anticipate", "believe", "could", "expect",

"intend", "may", "plan", "potential", "project", "seek", "should",

"will", "would" and similar expressions, which are intended to

identify a number of these forward-looking statements.

Forward-looking information reflects current views with respect to

current events and is not a guarantee of future performance and is

subject to risks, uncertainties and assumptions. The Company

undertakes no obligation to publicly update or review any

forward-looking information contained in this news release, except

as may be required by applicable laws, rules and regulations.

Readers are urged to consider these factors carefully in evaluating

any forward-looking information.

The TSX Venture Exchange has in no way passed upon the merits of

this transaction and has neither approved nor disapproved the

contents of this press release. Neither the TSX Venture Exchange,

Inc. nor its Regulation Service Provider (as that term is defined

under the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of the contents of this

press release.

Jeanny SoSenior Account ManagerCHF Investor RelationsPhone:

416-868-1079 ext.: 225Email: jeanny@chfir.comJohnson

JosephPresident and CEOPeak Positioning Technologies Inc.Phone:

514-340-7775 ext.: 501Email: investors@peakpositioning.com

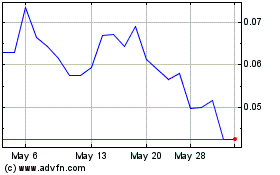

Tenet Fintech (PK) (USOTC:PKKFF)

Historical Stock Chart

From Mar 2024 to Apr 2024

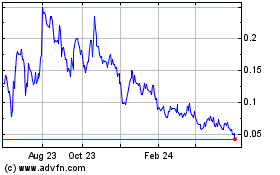

Tenet Fintech (PK) (USOTC:PKKFF)

Historical Stock Chart

From Apr 2023 to Apr 2024