Current Report Filing (8-k)

June 05 2014 - 4:07PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15 (d) of the

Securities Exchange Act of 1934

June 4, 2014

Date of report (Date of earliest event reported)

Universal Insurance Holdings, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-33251 |

|

65-0231984 |

| (State or other jurisdiction

of incorporation or organization) |

|

(Commission file number) |

|

(IRS Employer

Identification No.) |

1110 W. Commercial Blvd., Fort Lauderdale, Florida 33309

(Address of Principal Executive Offices)

Registrant’s telephone number, including area code: (954) 958-1200

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425). |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12). |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)). |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)). |

On June 4, 2014, Universal Insurance Holdings, Inc. (“Company”) announced

that, pursuant to its previously announced repurchase program, it repurchased in the open market 161,281 shares of the Company’s common stock at an average price of $12.36 per share using cash on hand.

The June 4, 2014 press release is attached to this report as Exhibit 99.1 and is incorporated herein by reference.

| ITEM 9.01 |

Financial Statements and Exhibits. |

| 99.1 |

Press release dated June 4, 2014 |

-2-

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, hereunto duly authorized.

|

|

|

|

|

|

|

| Date: June 5, 2014 |

|

|

|

|

|

UNIVERSAL INSURANCE HOLDINGS,

INC. |

|

|

|

|

|

|

|

|

|

|

/s/ Frank W. Wilcox |

|

|

|

|

|

|

Frank W. Wilcox |

|

|

|

|

|

|

Chief Financial Officer |

Exhibit 99.1

FOR IMMEDIATE RELEASE

Universal Insurance Holdings, Inc. Announces Completion of Additional $2

Million Share Repurchase

Total of Approximately 408,000 Shares Repurchased in the Open Market to Date in 2014

Fort Lauderdale, FL, June 4, 2014 - Universal Insurance Holdings, Inc. (NYSE: UVE) announced today that it repurchased 161,281 shares of common

stock at an average price of $12.36 per share through the open market, pursuant to the Board authorized share repurchase program announced on May 28, 2014. The Company financed the share repurchase using cash on hand.

About Universal Insurance Holdings, Inc.

Universal

Insurance Holdings, Inc., with its wholly-owned subsidiaries, is a vertically integrated insurance holding company performing all aspects of insurance underwriting, distribution and claims. Universal Property & Casualty Insurance Company

(UPCIC), a wholly-owned subsidiary of the Company, is one of the leading writers of homeowners insurance in Florida and is now fully licensed and has commenced its operations in North Carolina, South Carolina, Hawaii, Georgia, Massachusetts and

Maryland. American Platinum Property and Casualty Insurance Company, also a wholly-owned subsidiary, currently writes homeowners multi-peril insurance on Florida homes valued in excess of $1 million, which are limits and coverages currently not

targeted through its affiliate UPCIC. For additional information on the Company, please visit our investor relations website at www.universalinsuranceholdings.com.

Forward-Looking Statements and Risk Factors

This press

release may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The words “believe,” “expect,” “anticipate,” and similar expressions identify

forward-looking statements, which speak only as of the date the statement was made. Such statements may include commentary on plans, products and lines of business, marketing arrangements, reinsurance programs and other business developments and

assumptions relating to the foregoing. Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified. Future results could differ materially from those described and the Company

undertakes no obligation to correct or update any forward-looking statements. For further information regarding risk factors that could affect the Company’s operations and future results, refer to the Company’s reports filed with the

Securities and Exchange Commission, including the Form 10-K for the year ended December 31, 2013 and the Form 10-Q for the quarter ended March 31, 2014.

Investor Contact:

Andy Brimmer / Mahmoud Siddig

Joele Frank, Wilkinson Brimmer

Katcher

212-355-4449

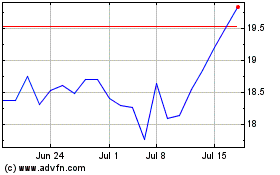

Universal Insurance (NYSE:UVE)

Historical Stock Chart

From Mar 2024 to Apr 2024

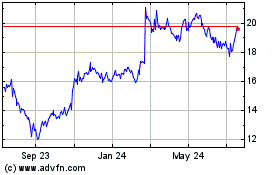

Universal Insurance (NYSE:UVE)

Historical Stock Chart

From Apr 2023 to Apr 2024