UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report: (Date of earliest event reported): May 28, 2014

Chico’s FAS, Inc.

(Exact Name of Registrant as Specified in its Charter)

Florida

(State or Other Jurisdiction of Incorporation)

|

|

|

| 001-16435 |

|

59-2389435 |

| (Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 11215 Metro Parkway, Fort Myers, Florida |

|

33966 |

| (Address of Principal Executive Offices) |

|

(Zip code) |

(239) 277-6200

(Registrant’s Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition

On May 28, 2014, Chico’s FAS, Inc. (the “Company”) issued a press release announcing its first quarter earnings for the

period ended May 3, 2014. A copy of the release issued on May 28, 2014 is attached to this Report as Exhibit 99.1 and is incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits

|

|

|

|

|

| Exhibit 99.1 |

|

Press Release of Chico’s FAS, Inc. dated May 28, 2014 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

CHICO’S FAS, INC. |

|

|

|

|

| Date: May 28, 2014 |

|

|

|

|

|

By: |

|

|

|

|

|

|

/s/ Pamela K Knous |

|

|

|

|

|

|

Pamela K Knous, Executive Vice President — Chief Financial Officer |

INDEX TO EXHIBITS

|

|

|

| Exhibit

Number |

|

Description |

|

|

| Exhibit 99.1 |

|

Press Release of Chico’s FAS, Inc. dated May 28, 2014 |

Exhibit 99.1

Chico’s FAS, Inc. • 11215 Metro Parkway • Fort Myers, Florida 33966 •

(239) 277-6200

Chico's FAS, Inc. Reports First Quarter Results and

Updates Second Quarter-to-Date Sales

Fort Myers, FL – May 28, 2014 – Chico’s FAS, Inc. (NYSE: CHS) today announced its financial results for the

fiscal 2014 first quarter.

For the thirteen weeks ended May 3, 2014 (the first quarter), the Company reported net income of $39.9

million compared to adjusted net income of $51.7 million for the thirteen weeks ended May 4, 2013, and first quarter 2014 earnings per diluted share of $0.26 compared to adjusted earnings per diluted share of $0.32 in last year’s first

quarter. The adjusted first quarter fiscal 2013 results exclude the impact of non-recurring acquisition and integration costs, as presented in the accompanying GAAP to non-GAAP reconciliation. Including the first quarter 2013 impact of non-recurring

acquisition and integration costs of $0.6 million after tax, or $0.01 per diluted share, the Company reported first quarter fiscal 2013 net income of $51.1 million, or $0.31 per diluted share.

Net Sales

For the first quarter, net

sales were a record $681.6 million, an increase of 1.6% compared to $670.7 million in last year’s first quarter, primarily reflecting 99 net new stores for a square footage increase of 6.9%, offset by a decrease in comparable sales. Comparable

sales for the first quarter decreased 2.6% following flat comparable sales in last year’s first quarter, reflecting lower average dollar sale as a result of the impact of a highly promotional environment in response to lower traffic due in part

to inclement weather.

For the first quarter, the Chico’s/Soma Intimates brands’ comparable sales increased 0.4% following a

2.8% decrease in last year’s first quarter. The Chico’s brand experienced a decrease of less than 1% in comparable sales in the first quarter compared to a mid-single digit decrease in last year’s first quarter, and the Soma Intimates

brand experienced a high-single digit comparable sales increase in the first quarter compared to a mid-single digit increase in last year’s first quarter. The White House | Black Market brand’s comparable sales decreased 8.6% following a

6.4% increase in last year’s first quarter.

Gross Margin

For the first quarter, gross margin was $382.9 million compared to $386.8 million in last year’s first quarter. Gross margin was 56.2% of

net sales, a 150 basis point decrease from last year’s first quarter, primarily reflecting increased promotional activity in response to lower traffic, partially offset by lower incentive compensation as a percent of net sales.

Selling, General and Administrative Expenses

For the first quarter, selling, general and administrative expenses (“SG&A”) were $319.0 million compared to $304.9 million in

last year’s first quarter. SG&A was 46.8% of net sales, a 130 basis point increase from last year’s first quarter, primarily reflecting sales deleverage of store expenses and the impact of approximately $4 million in investment

spending on strategic initiatives, partially offset by lower incentive compensation as a percent of net sales.

Page 1 of 8

Inventories

In-store inventories per square foot increased 4.9% in the first quarter of 2014 when compared to last year’s first quarter, primarily

reflecting higher average unit cost. At the end of the first quarter of 2014, total inventories increased $13.5 million, or 5.6%, over the same period last year, when excluding $11.9 million of inventory related to new store activity.

Second Quarter-to-Date Sales Update

For

the fiscal 2014 second quarter, unaudited total sales and comparable sales through May 26, 2014 increased approximately 5% and 1%, respectively, compared to the same period last year.

ABOUT CHICO’S FAS, INC.

The Company, through its

brands – Chico's, White House | Black Market, Soma Intimates, and Boston Proper, is a leading omni-channel specialty retailer of women’s private branded, sophisticated, casual-to-dressy clothing, intimates, complementary accessories, and

other non-clothing items.

As of May 3, 2014, the Company operated 1,496 stores in the US and Canada. The Company’s merchandise is also

available at www.chicos.com, www.whbm.com, www.soma.com, and www.bostonproper.com. For more detailed information on Chico's FAS, Inc., please go to our corporate website at www.chicosfas.com.

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 Certain statements contained herein, including without limitation, statements

addressing the beliefs, plans, objectives, estimates or expectations of the Company or future results or events constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended.

Such forward-looking statements involve known or unknown risks, including, but not limited to, general economic and business conditions, and conditions in the specialty retail industry. There can be no assurance that the actual future results,

performance, or achievements expressed or implied by such forward-looking statements will occur. Users of forward-looking statements are encouraged to review the Company’s latest annual report on Form 10-K, its filings on Form 10-Q,

management’s discussion and analysis in the Company’s latest annual report to stockholders, the Company’s filings on Form 8-K, and other federal securities law filings for a description of other important factors that may affect the

Company’s business, results of operations and financial condition. The Company does not undertake to publicly update or revise its forward-looking statements even if experience or future changes make it clear that projected results expressed or

implied in such statements will not be realized.

(Financial Tables Follow)

Executive Contact:

Todd Vogensen

Senior Vice President – Finance

Chico’s FAS, Inc.

(239) 346-4199

Page 2 of 8

Chico’s FAS, Inc. and Subsidiaries

Condensed Consolidated Statements of Income

(Unaudited)

(in thousands, except

per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Thirteen Weeks Ended |

|

| |

|

May 3, 2014 |

|

|

May 4, 2013 |

|

| |

|

Amount |

|

|

% of Sales |

|

|

Amount |

|

|

% of Sales |

|

| Net sales: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Chico’s/Soma Intimates |

|

$ |

440,121 |

|

|

|

64.6 |

% |

|

$ |

424,661 |

|

|

|

63.3 |

% |

| White House | Black Market |

|

|

217,173 |

|

|

|

31.9 |

% |

|

|

220,398 |

|

|

|

32.9 |

% |

| Boston Proper |

|

|

24,311 |

|

|

|

3.5 |

% |

|

|

25,663 |

|

|

|

3.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total net sales |

|

|

681,605 |

|

|

|

100.0 |

% |

|

|

670,722 |

|

|

|

100.0 |

% |

| Cost of goods sold |

|

|

298,714 |

|

|

|

43.8 |

% |

|

|

283,878 |

|

|

|

42.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross margin |

|

|

382,891 |

|

|

|

56.2 |

% |

|

|

386,844 |

|

|

|

57.7 |

% |

| Selling, general and administrative expenses |

|

|

319,049 |

|

|

|

46.8 |

% |

|

|

304,899 |

|

|

|

45.5 |

% |

| Acquisition and integration costs |

|

|

— |

|

|

|

0.0 |

% |

|

|

914 |

|

|

|

0.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from operations |

|

|

63,842 |

|

|

|

9.4 |

% |

|

|

81,031 |

|

|

|

12.1 |

% |

| Interest income, net |

|

|

40 |

|

|

|

0.0 |

% |

|

|

191 |

|

|

|

0.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income taxes |

|

|

63,882 |

|

|

|

9.4 |

% |

|

|

81,222 |

|

|

|

12.1 |

% |

| Income tax provision |

|

|

24,000 |

|

|

|

3.5 |

% |

|

|

30,100 |

|

|

|

4.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

39,882 |

|

|

|

5.9 |

% |

|

$ |

51,122 |

|

|

|

7.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Per share data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income per common share-basic |

|

$ |

0.26 |

|

|

|

|

|

|

$ |

0.31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income per common and common equivalent share–diluted |

|

$ |

0.26 |

|

|

|

|

|

|

$ |

0.31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average common shares outstanding–basic |

|

|

148,475 |

|

|

|

|

|

|

|

158,584 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average common and common equivalent shares

outstanding–diluted |

|

|

149,044 |

|

|

|

|

|

|

|

159,536 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dividends declared per share |

|

$ |

0.15 |

|

|

|

|

|

|

$ |

0.11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 3 of 8

Chico’s FAS, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(Unaudited)

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

May 3, 2014 |

|

|

February 1, 2014 |

|

|

May 4, 2013 |

|

| ASSETS |

|

| Current Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

80,529 |

|

|

$ |

36,444 |

|

|

$ |

85,616 |

|

| Marketable securities, at fair value |

|

|

90,984 |

|

|

|

116,002 |

|

|

|

202,769 |

|

| Inventories |

|

|

268,917 |

|

|

|

238,145 |

|

|

|

243,472 |

|

| Prepaid expenses and other current assets |

|

|

51,801 |

|

|

|

50,698 |

|

|

|

55,280 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Current Assets |

|

|

492,231 |

|

|

|

441,289 |

|

|

|

587,137 |

|

|

|

|

|

| Property and Equipment, net |

|

|

636,614 |

|

|

|

631,050 |

|

|

|

614,423 |

|

|

|

|

|

| Other Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

| Goodwill |

|

|

171,427 |

|

|

|

171,427 |

|

|

|

238,693 |

|

| Other intangible assets, net |

|

|

117,107 |

|

|

|

118,196 |

|

|

|

126,665 |

|

| Other assets, net |

|

|

10,210 |

|

|

|

9,229 |

|

|

|

8,206 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Other Assets |

|

|

298,744 |

|

|

|

298,852 |

|

|

|

373,564 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

1,427,589 |

|

|

$ |

1,371,191 |

|

|

$ |

1,575,124 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

| Current Liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

148,858 |

|

|

$ |

131,254 |

|

|

$ |

152,123 |

|

| Other current and deferred liabilities |

|

|

155,579 |

|

|

|

142,073 |

|

|

|

160,004 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Current Liabilities |

|

|

304,437 |

|

|

|

273,327 |

|

|

|

312,127 |

|

|

|

|

|

| Noncurrent Liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

| Deferred liabilities |

|

|

143,789 |

|

|

|

138,874 |

|

|

|

137,929 |

|

| Deferred taxes |

|

|

49,694 |

|

|

|

49,887 |

|

|

|

52,221 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Noncurrent Liabilities |

|

|

193,483 |

|

|

|

188,761 |

|

|

|

190,150 |

|

|

|

|

|

| Stockholders’ Equity: |

|

|

|

|

|

|

|

|

|

|

|

|

| Preferred stock |

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Common stock |

|

|

1,532 |

|

|

|

1,522 |

|

|

|

1,621 |

|

| Additional paid-in capital |

|

|

385,730 |

|

|

|

382,088 |

|

|

|

355,162 |

|

| Retained earnings |

|

|

542,332 |

|

|

|

525,381 |

|

|

|

715,911 |

|

| Accumulated other comprehensive income |

|

|

75 |

|

|

|

112 |

|

|

|

153 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Stockholders’ Equity |

|

|

929,669 |

|

|

|

909,103 |

|

|

|

1,072,847 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

1,427,589 |

|

|

$ |

1,371,191 |

|

|

$ |

1,575,124 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 4 of 8

Chico’s FAS, Inc. and Subsidiaries

Condensed Consolidated Cash Flow Statements

(Unaudited)

(in thousands)

|

|

|

|

|

|

|

|

|

| |

|

Thirteen Weeks Ended |

|

| |

|

May 3, 2014 |

|

|

May 4, 2013 |

|

| Cash Flows From Operating Activities: |

|

|

|

|

|

|

|

|

| Net income |

|

$ |

39,882 |

|

|

$ |

51,122 |

|

| Adjustments to reconcile net income to net cash provided by operating

activities — |

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

|

30,083 |

|

|

|

29,124 |

|

| Deferred tax (benefit) expense |

|

|

(1,164 |

) |

|

|

4,169 |

|

| Stock-based compensation expense |

|

|

6,474 |

|

|

|

7,492 |

|

| Excess tax benefit from stock-based compensation |

|

|

(925 |

) |

|

|

(1,028 |

) |

| Deferred rent and lease credits |

|

|

(4,671 |

) |

|

|

(4,263 |

) |

| Loss on disposal and impairment of property and equipment |

|

|

— |

|

|

|

281 |

|

| Changes in assets and liabilities: |

|

|

|

|

|

|

|

|

| Inventories |

|

|

(30,772 |

) |

|

|

(36,623 |

) |

| Prepaid expenses and other assets |

|

|

(2,084 |

) |

|

|

1,545 |

|

| Accounts payable |

|

|

6,111 |

|

|

|

13,823 |

|

| Accrued and other liabilities |

|

|

24,534 |

|

|

|

(2,193 |

) |

|

|

|

|

|

|

|

|

|

| Net cash provided by operating activities |

|

|

67,468 |

|

|

|

63,449 |

|

|

|

|

|

|

|

|

|

|

| Cash Flows From Investing Activities: |

|

|

|

|

|

|

|

|

| Decrease in marketable securities |

|

|

25,010 |

|

|

|

69,666 |

|

| Purchases of property and equipment, net |

|

|

(34,506 |

) |

|

|

(34,599 |

) |

|

|

|

|

|

|

|

|

|

| Net cash (used in) provided by investing activities |

|

|

(9,496 |

) |

|

|

35,067 |

|

|

|

|

|

|

|

|

|

|

| Cash Flows From Financing Activities: |

|

|

|

|

|

|

|

|

| Proceeds from issuance of common stock |

|

|

2,945 |

|

|

|

3,067 |

|

| Excess tax benefit from stock-based compensation |

|

|

925 |

|

|

|

1,028 |

|

| Dividends paid |

|

|

(11,439 |

) |

|

|

(8,939 |

) |

| Repurchase of common stock |

|

|

(6,309 |

) |

|

|

(64,915 |

) |

|

|

|

|

|

|

|

|

|

| Net cash used in financing activities |

|

|

(13,878 |

) |

|

|

(69,759 |

) |

|

|

|

|

|

|

|

|

|

| Effects of exchange rate changes on cash and cash equivalents |

|

|

(9 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Net increase in cash and cash equivalents |

|

|

44,085 |

|

|

|

28,757 |

|

| Cash and Cash Equivalents, Beginning of period |

|

|

36,444 |

|

|

|

56,859 |

|

|

|

|

|

|

|

|

|

|

| Cash and Cash Equivalents, End of period |

|

$ |

80,529 |

|

|

$ |

85,616 |

|

|

|

|

|

|

|

|

|

|

Page 5 of 8

Supplemental Detail on Earnings Per Share Calculation

In accordance with accounting guidance, unvested share-based payment awards that include non-forfeitable rights to dividends, whether paid or

unpaid, are considered participating securities. As a result, such awards are required to be included in the calculation of earnings per common share pursuant to the “two-class” method. For the Company, participating securities are

composed entirely of unvested restricted stock awards and performance-based restricted stock units (“PSUs”) that have met their relevant performance criteria.

Earnings per share is determined using the two-class method, as it is more dilutive than the treasury stock method. Basic earnings per share

is computed by dividing net income available to common stockholders by the weighted-average number of common shares outstanding during the period. Diluted earnings per share reflects the dilutive effect of potential common shares from

non-participating securities such as stock options and PSUs. For the thirteen weeks ended May 3, 2014 and May 4, 2013, potential common shares from non-participating securities were excluded from the computation of diluted EPS because they

were antidilutive.

The following unaudited table sets forth the computation of basic and diluted earnings per share shown on the face of the accompanying

condensed consolidated statements of income (in thousands, except per share amounts):

|

|

|

|

|

|

|

|

|

| |

|

Thirteen Weeks Ended |

|

| |

|

May 3, 2014 |

|

|

May 4, 2013 |

|

| Numerator |

|

|

|

|

|

|

|

|

| Net income |

|

$ |

39,882 |

|

|

$ |

51,122 |

|

| Net income and dividends declared allocated to

participating securities |

|

|

(1,055 |

) |

|

|

(1,187 |

) |

|

|

|

|

|

|

|

|

|

| Net income available to common shareholders |

|

$ |

38,827 |

|

|

$ |

49,935 |

|

|

|

|

|

|

|

|

|

|

| Denominator |

|

|

|

|

|

|

|

|

| Weighted average common shares outstanding – basic |

|

|

148,475 |

|

|

|

158,584 |

|

| Dilutive effect of non-participating securities |

|

|

569 |

|

|

|

952 |

|

|

|

|

|

|

|

|

|

|

| Weighted average common and common equivalent

shares outstanding – diluted |

|

|

149,044 |

|

|

|

159,536 |

|

|

|

|

|

|

|

|

|

|

| Net income per common share: |

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.26 |

|

|

$ |

0.31 |

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

$ |

0.26 |

|

|

$ |

0.31 |

|

|

|

|

|

|

|

|

|

|

Page 6 of 8

SEC Regulation G - The Company reports its consolidated financial results in accordance with

generally accepted accounting principles (GAAP). However, to supplement these consolidated financial results, management believes that certain non-GAAP results, which exclude certain non-recurring charges including acquisition and integration costs,

may provide a more meaningful measure on which to compare the Company’s results of operations between periods. The Company believes these non-GAAP results provide useful information to both management and investors by excluding certain expenses

that impact the comparability of the results. A reconciliation of net income and earnings per diluted share on a GAAP basis to net income and earnings per diluted share on a non-GAAP basis is presented in the table below:

Chico’s FAS, Inc. and Subsidiaries

GAAP to Non-GAAP Reconciliation of Net Income and Diluted EPS

(in thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

| |

|

Thirteen Weeks Ended |

|

| |

|

May 3, 2014 |

|

|

May 4, 2013 |

|

| Net income: |

|

|

|

|

|

|

|

|

| GAAP basis |

|

$ |

39,882 |

|

|

$ |

51,122 |

|

| Add: Impact of acquisition and integration costs, net of tax |

|

|

— |

|

|

|

575 |

|

|

|

|

|

|

|

|

|

|

| Non-GAAP adjusted basis |

|

$ |

39,882 |

|

|

$ |

51,697 |

|

|

|

|

|

|

|

|

|

|

| Net income per diluted share: |

|

|

|

|

|

|

|

|

| GAAP basis |

|

$ |

0.26 |

|

|

$ |

0.31 |

|

| Add: Impact of acquisition and integration costs, net of tax |

|

|

0.00 |

|

|

|

0.01 |

|

|

|

|

|

|

|

|

|

|

| Non-GAAP adjusted basis |

|

$ |

0.26 |

|

|

$ |

0.32 |

|

|

|

|

|

|

|

|

|

|

Page 7 of 8

Chico's FAS, Inc. and Subsidiaries

Store Count and Square Footage

Thirteen Weeks Ended May 3, 2014

(Unaudited)

|

|

|

|

|

|

|

|

|

| |

|

As of

2/1/14 |

|

New

Stores |

|

Closures |

|

As of

5/3/14 |

| Store count: |

|

|

|

|

|

|

|

|

| Chico’s frontline boutiques |

|

611 |

|

10 |

|

(2) |

|

619 |

| Chico’s outlets |

|

110 |

|

2 |

|

(1) |

|

111 |

| WH|BM frontline boutiques |

|

436 |

|

4 |

|

(3) |

|

437 |

| WH|BM outlets |

|

59 |

|

2 |

|

— |

|

61 |

| WH|BM Canada |

|

3 |

|

— |

|

— |

|

3 |

| Soma frontline boutiques |

|

232 |

|

12 |

|

(1) |

|

243 |

| Soma outlets |

|

17 |

|

— |

|

(1) |

|

16 |

| Boston Proper frontline boutiques |

|

4 |

|

2 |

|

— |

|

6 |

|

|

|

|

|

|

|

|

|

| Total Chico’s FAS, Inc. |

|

1,472 |

|

32 |

|

(8) |

|

1,496 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

As of

2/1/14 |

|

|

New

Stores |

|

|

Closures |

|

|

Other

changes in

SSF |

|

|

As of

5/3/14 |

|

| Net selling square footage (SSF): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Chico’s frontline boutiques |

|

|

1,672,225 |

|

|

|

25,358 |

|

|

|

(5,544 |

) |

|

|

(739 |

) |

|

|

1,691,300 |

|

| Chico’s outlets |

|

|

278,223 |

|

|

|

5,085 |

|

|

|

(3,696 |

) |

|

|

— |

|

|

|

279,612 |

|

| WH|BM frontline boutiques |

|

|

986,708 |

|

|

|

10,390 |

|

|

|

(7,456 |

) |

|

|

1,911 |

|

|

|

991,553 |

|

| WH|BM outlets |

|

|

121,565 |

|

|

|

4,413 |

|

|

|

— |

|

|

|

— |

|

|

|

125,978 |

|

| WH|BM Canada |

|

|

7,987 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

7,987 |

|

| Soma frontline boutiques |

|

|

441,387 |

|

|

|

21,147 |

|

|

|

(1,684 |

) |

|

|

29 |

|

|

|

460,879 |

|

| Soma outlets |

|

|

32,682 |

|

|

|

— |

|

|

|

(2,346 |

) |

|

|

(109 |

) |

|

|

30,227 |

|

| Boston Proper frontline boutiques |

|

|

6,003 |

|

|

|

3,421 |

|

|

|

— |

|

|

|

— |

|

|

|

9,424 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Chico’s FAS, Inc. |

|

|

3,546,780 |

|

|

|

69,814 |

|

|

|

(20,726 |

) |

|

|

1,092 |

|

|

|

3,596,960 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 8 of 8

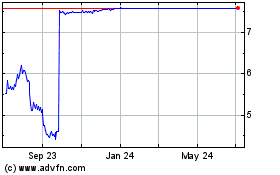

Chicos FAS (NYSE:CHS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Chicos FAS (NYSE:CHS)

Historical Stock Chart

From Apr 2023 to Apr 2024