Casino Stocks Tumble on Credit Growth Concerns - Analyst Blog

April 16 2014 - 1:00PM

Zacks

Casino stocks have been in the limelight of late due to one

issue or the other. Share prices of leading U.S.-based casino

operators such as Wynn Resorts Ltd. (WYNN),

Las Vegas Sands Corp. (LVS), MGM Resorts

International (MGM) and Melco Crown Entertainment

Limited (MPEL) tumbled on credit growth concerns in China,

which are expected to result in lower VIP bets. These casino

operators earn the majority of their revenues from Macau, the only

city in China where gambling is legal.

Credit growth is one of the driving forces behind the gaming

industry. A decline in credit growth rate limits prospects for

economic expansion. Tight money supply would impact spending on

casino gaming as visitors will have less money in hand to gamble.

As per media reports, though China banks have issued more new loans

in the month of March than February, outstanding bank loans have

grown at the slowest pace on a yearly basis since 2005.

As a matter of fact, M2, a measure of broad money supply, missed

economist expectations. Total social financing, the broadest

measure of lending in China, has also expanded at a slow pace

compared to the year-ago period. This tightening of credit can be

seen as a measure to discourage excessive borrowing to curb the

rise in property prices.

As per a few analysts, credit slowdown is still on track and credit

data is not as bad as M2 growth indicates. However, according to

Wells Fargo & Company (WFC), credit growth concerns are not yet

over and it expects VIP growth to decelerate over the next six

months. We believe that this would hurt the profitability of these

casino companies.

Meanwhile, China's economy grew at the slowest pace in the first

quarter of 2014 in the past one and a half years, which has

compelled the government to take a few actions to stabilize the

world's second-largest economy. This increases the concerns of the

gaming companies.

Macau, one of the world's fastest growing-economies for the last

three years, has been a treasure trove for gaming operators who

earn the majority of their revenues from here. Despite credit

concerns and China’s sluggish economy, these casino operators are

busy expanding their share of hotel rooms in Macau to accommodate

the increasing number of visitors. Though there are no casino

openings scheduled for this year, Wynn Resorts, MGM Resorts and Las

Vegas Sands are all set to make multibillion dollar openings by

2016. The development of facilities for entertainment, retail and

convention centers would give visitors an added reason to visit

Macau. Meanwhile, improving infrastructure will shorten the

journey to Macau from the Chinese mainland and drive

visitation.

While Wynn Resorts sports a Zacks Rank #1 (Strong Buy), Las Vegas

Sands, MGM Resorts and Melco Crown Entertainment carry a Zacks Rank

#2 (Buy).

LAS VEGAS SANDS (LVS): Free Stock Analysis Report

MGM RESORTS INT (MGM): Free Stock Analysis Report

MELCO CROWN ENT (MPEL): Free Stock Analysis Report

WYNN RESRTS LTD (WYNN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

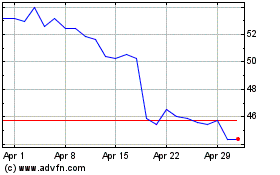

Las Vegas Sands (NYSE:LVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

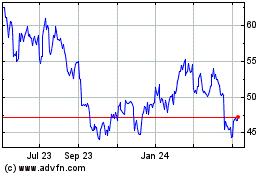

Las Vegas Sands (NYSE:LVS)

Historical Stock Chart

From Apr 2023 to Apr 2024