Definitive Materials Filed by Investment Companies. (497)

April 04 2014 - 4:35PM

Edgar (US Regulatory)

NOMURA PARTNERS FUNDS, INC.

THE JAPAN FUND

SUPPLEMENT

DATED APRIL 4, 2014

TO THE PROSPECTUS DATED JANUARY 28, 2014

This Supplement provides new and additional information beyond that which is contained in the Prospectus, and any supplements thereto. Please keep this

Supplement and read it together with the Prospectus dated January 28, 2014, and other supplements.

The Board of Directors of Nomura Partners Funds, Inc.

(the “

Board

”) has approved the reorganization of The Japan Fund, a series of Nomura Partners Funds, Inc., into the Matthews Japan Fund, a series of Matthews International Funds (the “

Reorganization

”).

As a result of Nomura Asset Management U.S.A. Inc.’s (“

NAM USA

”) decision to exit the U.S. open-end mutual fund business the Board

retained an independent consultant and considered a number of alternatives, including liquidation, and other possible reorganization candidates. In making its decision to entrust Mathews International Capital Management, LLC (“

Matthews

Asia

”) with The Japan Fund’s shareholders’ assets the Board considered many factors including the reputation, financial strength, resources and capabilities of Matthews Asia.

Subject to and following the approval of a charter amendment by the Nomura Partners Funds, Inc. shareholders, Nomura Partners Funds, Inc. will transfer all of

the assets and specified liabilities of The Japan Fund (NPJAX, NPJCX, NPJIX, SJPNX) to the Matthews Japan Fund (MJFOX, MIJFX) in exchange for shares of the Matthews Japan Fund. The Japan Fund will distribute these shares of the Matthews Japan Fund

on the closing date. It is a condition of the closing of the Reorganization that each fund receive an opinion from Mathews Japan Fund’s counsel that the Reorganization will not subject shareholders of The Japan Fund to U.S. federal income tax

on the exchange of shares of The Japan Fund for shares of the Matthews Japan Fund in the Reorganization. Additional information about the Reorganization will be circulated with the proxy in a couple of months.

In the interim, The Japan Fund remains closed to all purchases and exchanges. At any time prior to the Reorganization, shareholders may redeem their shares

and receive the net asset value thereof pursuant to the procedures set forth under “How to Purchase, Exchange and Redeem Shares – How to Redeem Shares” in the Prospectus. However, your redemption of shares of The Japan Fund prior to

the Reorganization will be treated as a sale of The Japan Fund’s shares for U.S. federal income tax purposes. Shareholders should consult their tax advisors to determine the federal, state, and other income tax consequences of the

Reorganization or of the redemption of shares of The Japan Fund with respect to their particular tax circumstances.

INVESTMENT COMPANY ACT FILE NO:

811-01090

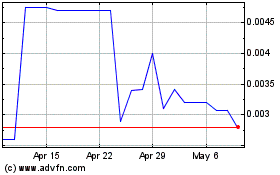

Graystone (PK) (USOTC:GYST)

Historical Stock Chart

From Aug 2024 to Sep 2024

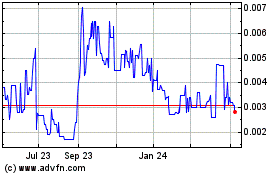

Graystone (PK) (USOTC:GYST)

Historical Stock Chart

From Sep 2023 to Sep 2024