Current Report Filing (8-k)

March 12 2014 - 3:07PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 11, 2014

THE GRAYSTONE COMPANY, INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

|

000-54254

|

|

27-3051592

|

| (Commission File No.) |

|

(IRS Employer Identification No.) |

2620 Regatta Drive, Ste 102

Las Vegas, NV 89128

(Address of principal executive offices, including ZIP code)

(888) 552-3750

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2 (b))

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4 (c))

|

|

(1)

|

The Company has received questions from shareholders regarding the Company’s decision not to seek additional financing from Asher. The Company recently received an offer of $82,500 from Asher which the Company promptly rejected. As previously stated, the Company does not intend to borrow any additional funds from Asher Enterprises. As a result of this decision, the Company’s cash position will be affected; however, the Company expects the increase in production and other cost saving initiatives to allow the Company to no longer rely on funding from Asher to expand its operations.

|

|

(2)

|

At a Board Meeting on March 11, 2014 the two following items were discussed:

|

|

(a)

|

The filing of the Form 5s as required by Rule 16a3(f) which are the annual reports of the current holdings of the officers and directors; and

|

|

(b)

|

The Company’s CEO and CFO agreed to a lock up agreement whereby any shares owned by them individually or by entities beneficially owned (i.e. Renard Properties) shall be restricted from re-sale until December 31, 2017. This lockup agreement shall include any additional issuances made between March 11, 2014 and December 31, 2017.

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

The Graystone Company, Inc. |

|

| |

|

|

|

|

|

By:

|

/s/ Paul Howarth

|

|

|

|

Name:

|

Paul Howarth

|

|

|

|

Title:

|

CEO

|

|

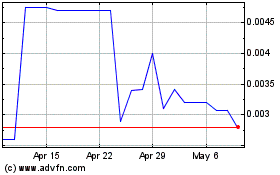

Graystone (PK) (USOTC:GYST)

Historical Stock Chart

From Mar 2024 to Apr 2024

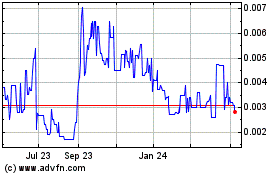

Graystone (PK) (USOTC:GYST)

Historical Stock Chart

From Apr 2023 to Apr 2024