Coffee Holding Co., Inc. ("Coffee Holding" or the "Company")

(NASDAQ: JVA) today announced its operating results for the three

months ended January 31, 2013.

"We are pleased with our results for the quarter. In the first

fiscal quarter of 2012, we recorded record revenue of $56.6

million, which was more than 121% of the first fiscal quarter of

2011 revenue and well in excess of any previous fiscal first

quarter and not consistent with our historical growth. We believe

this year's level of sales of $31.3 million in the first fiscal

quarter of 2013, while below the first fiscal quarter of 2012, is

more normalized from a historical perspective. Excluding 2012, our

revenue for the first quarter of 2013 well exceeded previous first

fiscal quarter results. In the first fiscal quarters of 2011, 2010,

2009, and 2008, we had revenues of $25.6 million, $21.4 million,

$18.9 million, $15.0 million, respectively. In addition, during

this quarter our gross margins increased on a percentage basis from

7.9% to 11.8% reflecting our efforts to increase our profit margins

which we believe will result in greater future profitability for

the company. We also believe this is a successful result given the

negative impact on our profitability attributable to our withdrawal

of our investment in Global Mark during the quarter," noted Andrew

Gordon, our President and CEO.

"We experienced growth in key areas compared to the first

quarter of fiscal 2012, most importantly on the branded and private

label sides of the business. We believe it is the growth in these

two areas that will ultimately enable us to achieve the targeted

annualized gross profit level of nine percent for our 2013 fiscal

year. A more favorable revenue mix is the first step for overall

increased margins. We also believe coffee prices will rebound in

the second half of 2013, helping to improve both our revenues and

profits on the sales of wholesale green coffee. We anticipate a

more normalized growth pattern on a going forward basis, while we

remain focused on margin expansion and new business opportunities,"

stated Mr. Gordon.

Results of Operations

The Company had net income of $937,537, or $0.15 per share basic

and $0.14 diluted, for the three months ended January 31, 2013

compared to net income of $1,578,345 or $0.25 per share basic and

$0.24 diluted, for the three months ended January 31, 2012. The

decrease in net income primarily reflects lower sales for the

period year over year and the write off involving the Company's

investment in Global Mark partially offset by higher gross margins

of 11.8% during the three month period.

Net sales totaled $31,318,804 for the three months ended January

31, 2013, a decrease of $25,282,880, or 44.7%, from $56,601,684 for

the three months ended January 31, 2012. The decrease in net sales

primarily reflects lower coffee prices as well as reduced volumes

of wholesale green coffee sales during the three month period.

Cost of sales for the three months ended January 31, 2013 was

$27,636,207 or 88.2% of net sales, as compared to $52,151,940 or

92.1% of net sales for the three months ended January 31, 2012. The

decrease in cost of sales reflects a shift in our overall business

to a higher percentage of roasted coffee sales which tend to be

more profitable on a percentage basis than our green coffee.

Total operating expenses increased by $65,686, or 3.6%, to

$1,895,178 for the three months ended January 31, 2013 as compared

to operating expenses of $1,829,492 for the three months ended

January 31, 2012. The increase in operating expenses was due to

increases in selling and administrative expense of $82,907

partially offset by a decrease in officers' salaries of

$17,221.

About Coffee Holding

Coffee Holding is a leading integrated wholesale coffee roaster

and dealer in the United States and one of the few coffee companies

that offers a broad array of coffee products across the entire

spectrum of consumer tastes, preferences and price points. Coffee

Holding has been a family-operated business for three generations

and has remained profitable through varying cycles in the coffee

industry and the economy. The Company's private label and branded

coffee products are sold throughout the United States, Canada and

abroad to supermarkets, wholesalers, and individually owned and

multi-unit retail customers.

Any statements that are not historical facts contained in this

release are "forward-looking statements" within the meaning of the

Private Securities Litigation Reform Act of 1995. We have based

these forward-looking statements upon information available to

management as of the date of this release and management's

expectations and projections about certain future events. It is

possible that the assumptions made by management for purposes of

such statements may not materialize. Actual results may differ

materially from those projected or implied in any forward-looking

statements. Such statements may involve risks and uncertainties,

including but not limited to those relating to product demand,

coffee prices, pricing of our products, market acceptance, the

effect of economic conditions, intellectual property rights, the

outcome of competitive products, risks in product development, the

results of financing efforts, the ability to complete transactions,

and other factors discussed from time to time in the Company's

Securities and Exchange Commission filings. The Company undertakes

no obligation to update or revise any forward-looking statement for

events or circumstances after the date on which such statement is

made.

COFFEE HOLDING CO., INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

JANUARY 31, 2013 AND OCTOBER 31, 2012

January 31, October 31,

2013 2012

------------ ------------

(unaudited)

- ASSETS -

CURRENT ASSETS:

Cash $ 8,271,965 $ 7,568,583

Accounts receivable, net of allowances of

$213,674 for 2013 and 2012 10,223,591 12,633,128

Inventories 10,241,463 11,303,581

Prepaid green coffee 205,000 150,000

Prepaid expenses and other current assets 650,455 704,013

Prepaid and refundable income taxes 52,106 62,763

Deferred income tax asset 477,443 702,655

------------ ------------

TOTAL CURRENT ASSETS 30,122,023 33,124,723

Machinery and equipment, at cost, net of

accumulated depreciation of $2,747,212 and

$2,631,468 for 2013 and 2012, respectively 1,744,407 1,791,754

Customer list and relationships, net of

accumulated amortization of $20,625 and $18,750

for 2013 and 2012, respectively 129,375 131,250

Trademarks 180,000 180,000

Goodwill 440,000 440,000

Equity method investments 99,522 1,931,931

Deposits and other assets 648,385 648,094

------------ ------------

TOTAL ASSETS $ 33,363,712 $ 38,247,752

- LIABILITIES AND STOCKHOLDERS' EQUITY -

CURRENT LIABILITIES:

Accounts payable and accrued expenses $ 6,260,622 $ 11,769,107

Line of credit 953,571 562,500

Due to broker 913,507 1,367,389

Income taxes payable 96,115 21,122

------------ ------------

TOTAL CURRENT LIABILITIES 8,223,815 13,720,118

Deferred income tax liabilities 9,443 32,655

Deferred rent payable 170,680 166,668

Deferred compensation payable 530,851 528,687

------------ ------------

TOTAL LIABILITIES 8,934,789 14,448,128

------------ ------------

STOCKHOLDERS' EQUITY:

Coffee Holding Co., Inc. stockholders' equity:

Preferred stock, par value $.001 per share;

10,000,000 shares authorized; 0 issued - -

Common stock, par value $.001 per share;

30,000,000 shares authorized, 6,456,316 shares

issued; 6,372,309 shares outstanding for 2013

and 2012 6,456 6,456

Additional paid-in capital 15,904,109 15,904,109

Retained earnings 8,529,405 7,979,247

Less: Treasury stock, 84,007 common shares, at

cost for 2013 and 2012 (272,133) (272,133)

------------ ------------

Total Coffee Holding Co., Inc. Stockholders'

Equity 24,167,837 23,617,679

Noncontrolling interest 261,086 181,945

------------ ------------

TOTAL EQUITY 24,428,923 23,799,624

------------ ------------

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $ 33,363,712 $ 38,247,752

COFFEE HOLDING CO., INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

THREE MONTHS ENDED JANUARY 31, 2013 AND 2012

(Unaudited)

2013 2012

------------ ------------

NET SALES $ 31,318,804 $ 56,601,684

COST OF SALES (which includes purchases of

approximately $9.7 million and $10.5 million

for the three months ended January 31, 2013 and

2012, respectively from a related party) 27,636,207 52,151,940

------------ ------------

GROSS PROFIT 3,682,597 4,449,744

------------ ------------

OPERATING EXPENSES:

Selling and administrative 1,765,241 1,682,334

Officers' salaries 129,937 147,158

------------ ------------

TOTAL 1,895,178 1,829,492

------------ ------------

INCOME FROM OPERATIONS 1,787,419 2,620,252

------------ ------------

OTHER INCOME (EXPENSE):

Interest income 7,579 13,884

Loss from equity method investments (104,437) (20,137)

Interest expense (38,399) (65,730)

------------ ------------

TOTAL (135,257) (71,983)

------------ ------------

INCOME BEFORE PROVISION FOR INCOME TAXES AND

NONCONTROLLING INTEREST IN SUBSIDIARY 1,652,162 2,548,269

Provision for income taxes 635,484 962,900

------------ ------------

NET INCOME BEFORE NONCONTROLLING INTEREST IN

SUBSIDIARY 1,016,678 1,585,369

Less: Net income attributable to the

noncontrolling interest (79,141) (7,024)

------------ ------------

NET INCOME ATTRIBUTABLE TO COFFEE HOLDING CO.,

INC. $ 937,537 $ 1,578,345

Basic earnings per share $ .15 $ .25

Diluted earnings per share $ .14 $ .24

Dividends declared per share $ .06 $ .03

Weighted average common shares outstanding:

Basic 6,372,309 6,372,309

Diluted 6,639,309 6,644,309

COFFEE HOLDING CO., INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

THREE MONTHS ENDED JANUARY 31, 2013 AND 2012

(Unaudited)

2013 2012

------------ ------------

OPERATING ACTIVITIES:

Net income $ 1,016,678 $ 1,585,369

Adjustments to reconcile net income to net cash

provided by operating activities:

Depreciation and amortization 117,616 112,693

Unrealized gain on commodities (453,882) (1,577,294)

Loss on equity method investment 380 20,137

Loss on disposition of equity method investment 104,057 -

Deferred rent 4,012 4,937

Deferred income taxes 202,000 599,000

Changes in operating assets and liabilities:

Accounts receivable 2,409,537 (1,937,860)

Inventories 1,565,618 1,497,745

Prepaid expenses and other current assets 53,558 43,768

Prepaid green coffee (55,000) 152,036

Prepaid and refundable income taxes 10,657 267,757

Accounts payable and accrued expenses (4,516,084) 2,781,754

Deposits and other assets 1,873 4,873

Income taxes payable 74,993 35,918

------------ ------------

Net cash provided by operating activities 536,013 3,590,833

------------ ------------

INVESTING ACTIVITIES:

Purchase of equity method investment - (200,000)

Proceeds from disposition of equity method

investment 232,069 -

Purchases of machinery and equipment (68,394) (54,590)

------------ ------------

Net cash provided by (used in) investing

activities 163,675 (254,590)

------------ ------------

FINANCING ACTIVITIES:

Advances under bank line of credit 3,441,192 48,525,026

Principal payments under bank line of credit (3,050,121) (48,549,137)

Payment of dividend (387,377) (193,689)

------------ ------------

Net cash provided by (used in) financing

activities 3,694 (217,800)

------------ ------------

NET INCREASE IN CASH 703,382 3,118,443

CASH, BEGINNING OF PERIOD 7,568,583 4,244,335

------------ ------------

CASH, END OF PERIOD $ 8,271,965 $ 7,362,778

SUPPLEMENTAL DISCLOSURE OF CASH FLOW DATA:

Interest paid $ 41,191 $ 71,340

Income taxes paid $ 347,834 $ 60,225

COFFEE HOLDING CO., INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

THREE MONTHS ENDED JANUARY 31, 2013 AND 2012

(Unaudited)

Schedule of noncash investing and financing activities:

Proceeds from disposition of equity method investment:

2013 2012

----------- -----------

Inventory received $ 503,500 $ -

Settlement of accounts payable 992,402 -

----------- -----------

Total noncash proceeds $ 1,495,902 $ -

----------- -----------

CONTACT: Coffee Holding Co., Inc. Andrew Gordon President &

CEO (718) 832-0800

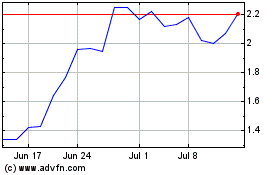

Coffee (NASDAQ:JVA)

Historical Stock Chart

From Apr 2024 to May 2024

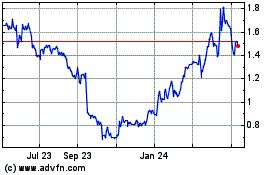

Coffee (NASDAQ:JVA)

Historical Stock Chart

From May 2023 to May 2024