WMS Industries Inc. (NYSE:WMS) today reported revenue of $195.9

million and net income of $22.1 million, or $0.40 per diluted

share, for the quarter ended June 30, 2012, compared to revenue of

$203.2 million and net income of $10.3 million, or $0.18 per

diluted share, in the June 2011 quarter. The June 2012 quarter

results reflect the third consecutive quarter of sequential revenue

growth as revenues rose $19.9 million, or 11% from the March 2012

quarter. Earnings per share in the June 2012 quarter were impacted

by $0.02 per diluted share for charges related to legal settlements

and include a $0.01 per diluted share benefit for a reduction in

bad debt expense related to customer receivables in Mexico. In

addition, the June 2012 quarter earnings also reflect

acquisition-related expenses. The June 2011 quarter results

included $0.26 per diluted share of net charges for impairment and

restructuring costs, asset write-downs and other charges.

Recent Highlights:

- The commercialization of new game

themes contributed to 6,146 global new units shipped in the June

2012 quarter, including a 16% increase from the prior year in the

U.S. and Canada to 4,672 new gaming machines driven by a

near-quarterly record 3,900 replacement units.

- Game conversion revenues rose year over

year reflecting the sale of approximately 5,500 kits in the June

2012 quarter compared to 2,100 kits in the prior-year period,

bringing total shipments in fiscal 2012 to 19,900 kits compared to

8,200 kits in fiscal 2011. Annual unit sales of conversion kits

rose to nearly 95% of annual new gaming machine unit sales in

fiscal 2012 compared with 34% in fiscal 2011, and represented

approximately 27% of the nearly 75,000 cumulative Bluebird®2 and

Bluebird xD™ gaming machines sold life-to-date globally.

- Launched the first two slot games

powered by WMS’ next-generation CPU-NXT®3 platform – the Aladdin

& the Magic Quest® game featuring unique synchronized motion of

the chair with the game play and the Super Team® game featuring

player-customizable superheroes made possible by WMS’ award-winning

Player’s Life® Web Services. These new games, along with several

other new participation themes, drove a 172 unit quarterly

sequential increase in the quarter-end participation installed base

at June 30, 2012 and a 135 unit quarterly sequential increase in

the average installed footprint.

- Entered into agreement to launch My

Poker® video poker games by 2012 calendar year-end at Station

Casinos’ properties in Las Vegas.

- At June 30, 2012 WMS’ networked gaming

products were installed at 98 casino properties in 16 countries

around the world, on more than 1,900 gaming machines.

- Sharpened focus on WMS’ online, social,

casual and mobile gaming products and services, to leverage the

Company’s gaming content and resources to actively participate in

the significant growth potential from the convergence of land-based

casino gaming with interactive gaming distribution channels. In

addition:

- Completed the acquisitions of Jadestone

Group and Phantom EFX to accelerate interactive initiatives;

and,

- Entered into a strategic alliance with

888 Holdings to pursue online poker initiatives in the U.S.,

including play-for-fun and real money applications when legally

permitted, as well as other online casino applications and future

opportunities.

“Quarterly sequential improvements in new unit shipments, and in

particular new replacement units in the U.S. and Canada, along with

higher game conversion revenues and growth in our installed

participation base, demonstrate the ongoing progress WMS is

achieving in the commercialization of new innovative game content

and products,” said Brian R. Gamache, Chairman and Chief Executive

Officer. “We have returned to a normalized rate of new product

introductions; and our newest for-sale and participation products

are providing customers with the strong performance historically

associated with WMS products. As we continue to introduce creative

and differentiated new products, we expect to grow our product

sales ship share, as well as our installed participation base.

“At the same time, we have enhanced our focus and accelerated

spending in a measured manner to build a comprehensive suite of

interactive products and services that provide our customers with

solutions that enable them to benefit from interactive gaming

opportunities. While this spending impacts near-term financial

results, we believe it favorably positions WMS to participate in

the tremendous high-margin growth potential of these opportunities

that will create longer-term shareholder value.”

Fiscal 2012 Fourth Quarter Financial Review

The following table summarizes key components related to revenue

generation for the three and twelve months ended June 30, 2012, and

2011 (dollars in millions, except unit, per unit and per day

data):

Three Months Ended Twelve Months

Ended June 30, June 30, Product Sales

Revenues: 2012 2011

2012 2011

New unit sales revenues $ 98.2 $ 110.3 $ 333.6 $ 403.2 Other

product sales revenues 34.9 20.3

94.7 86.0 Total product sales revenues $ 133.1

$ 130.6 $ 428.3 $ 489.2 New

units on which revenue was recognized 6,146 6,510 20,903 24,216

Average sales price per new unit $ 15,982 $ 16,951 $ 15,959 $

16,651 Gross profit on product sales revenues (1) $ 72.7 $

58.7 $ 223.1 $ 235.3 Gross margin on product sales revenues (1)

54.6 % 44.9 % 52.1 % 48.1 %

Gaming Operations

Revenues:

Participation revenues $ 56.1 $ 66.7 $ 234.2 $ 277.7 Other gaming

operations revenues 6.7 5.9 27.2

16.4 Total gaming operations revenues $ 62.8

$ 72.6 $ 261.4 $ 294.1

Installed participation units at period

end, with lease payments based on:

Percentage of coin-in 3,681 3,780 3,681 3,780 Percentage of net win

2,859 3,072 2,859 3,072 Daily lease rate (2) 3,021

3,018 3,021 3,018 Total

installed participation units at period end 9,561

9,870 9,561 9,870

Average installed participation units 9,250 9,635 9,335 10,046

Average revenue per day per participation unit $ 66.50 $ 76.13 $

68.52 $ 75.76 Gross profit on gaming operations revenues (1)

$ 48.6 $ 57.9 $ 205.9 $ 235.4 Gross margin on gaming operations

revenues (1) 77.4 % 79.8 % 78.8 % 80.0 %

Total

revenues $ 195.9 $ 203.2

$ 689.7 $ 783.3

Total gross profit (1) $ 121.3 $

116.6 $ 429.0 $

470.7 Total gross margin (1)

61.9 % 57.4 % 62.2

% 60.1 % (1) As used herein,

gross profit and gross margin do not include depreciation,

amortization and distribution expenses. (2) Includes only

participation game theme units. Does not include units with product

sales game themes placed under fixed-term, daily fee operating

leases.

Total product sales revenues for the June 2012 quarter were

$133.1 million, which increased 2% from the year-ago period and 20%

on a quarterly sequential basis. WMS recorded revenue on 4,672 new

gaming machines shipped to customers in the U.S. and Canada, an

increase of 629 units, or 16%, over the prior-year period.

Replacement units comprised approximately 3,900 of the total units

shipped to U.S. and Canadian customers in the June quarter,

representing the second-highest number of quarterly replacement

unit shipments in the Company’s history and an increase of 1,100

and 200 units on a quarterly sequential and year-over-year basis,

respectively. New gaming machine sales for new casino openings and

expansions in the U.S. and Canada totaled approximately 775 units

compared with approximately 1,800 units in the March 2012 quarter

and 300 units in the prior-year period. WMS shipped 1,474 new units

to international customers, or 24% of total global new unit

shipments, in the June 2012 quarter, which was consistent with the

number of new unit shipments in the March 2012 quarter, and

compares to 2,467 units, or 38%, of total global new unit shipments

in the year-ago period as demand in Australia, Mexico and Europe

continues to lag prior-year levels.

The average sales price for new units declined on a

year-over-year basis to $15,982 reflecting the effect of

larger-volume orders that carry higher volume discounts, a lower

mix of premium games in the quarter compared with the same period a

year ago and the competitive marketplace. Notwithstanding the

year-over-year decline, the average selling price increased $749

per unit on a quarterly sequential basis and was in line with the

average selling price for the full year. WMS’ Bluebird xD units

represented 36% of total global new unit shipments compared with

26% of total shipments in the prior year period. Additionally, the

new Bluebird2e cabinet that was launched in the March 2012 quarter

and features emotive lighting represented a majority of the

Bluebird2 new unit sales in the June 2012 quarter.

Other product sales revenue increased 72% year over year, or

$14.6 million, to $34.9 million, reflecting higher revenue from

used gaming machines and game conversion kit sales, partially

offset by lower parts revenue. Approximately 2,500 used gaming

machines were sold in the June 2012 quarter, including a

significant number of refurbished units at higher average selling

prices and higher gross margin compared with approximately 1,700

used units in the prior-year quarter. Revenue was recognized on

approximately 5,500 conversion kits in the June 2012 quarter

compared to approximately 2,100 conversion kits a year ago.

Gaming operations revenues were $62.8 million in the June 2012

quarter compared with $72.6 million in the year-ago period. The

quarter-end installed participation base increased by 172 units on

a quarterly sequential basis to 9,561 gaming machines at June 30,

2012, and compares to an installed participation base of 9,870

units at June 30, 2011. The average installed participation base

for the June 2012 quarter was 9,250 units compared to 9,635 units

in the year-ago period. Average revenue per day in the quarter was

down 2.3% to $66.50 compared to $68.06 in March 2012 quarter and

reflects the absence of normal seasonal improvement due to soft

consumer spending in the June 2012 quarter as reported across most

regional gaming markets.

Other gaming operations revenue increased $0.8 million year over

year, primarily reflecting continued growth in our interactive

gaming products and services and incremental revenue from networked

gaming solutions, but declined $2.3 million on a quarterly

sequential basis reflecting lower royalties from licensing

proprietary intellectual property and technologies.

Total gross profit, excluding depreciation, amortization and

distribution expense as used herein, increased to $121.3 million

from $116.6 million in the year-ago period and $110.1 million in

the March 2012 quarter. Total gross margin improved to 61.9%

compared to 57.4% a year ago. Product sales gross margin rose 970

basis points to 54.6% in the June 2012 quarter compared to 44.9% in

the prior-year quarter and increased 280 basis points on a

quarterly sequential basis. The year-over-year increase reflects

the $4.9 million of incremental inventory write-down costs recorded

in the June 2011 quarter, ongoing cost reduction efforts from our

strategic sourcing actions, and strong high-margin conversion kit

sales and improved used gaming machine margins, partially offset by

the impact of a lower average selling price. Gaming operations

gross margin was 77.4% in the June 2012 quarter compared with 79.8%

in the prior year, primarily reflecting an increase in wide-area

progressive units and the related higher jackpot expense, as well

as higher costs to support our interactive gaming products and

services, partially offset by the $1.7 million of other asset

write-downs recorded in fiscal 2011.

The following table summarizes key components of operating

expenses and operating income for the three and twelve months ended

June 30, 2012, and 2011 ($ in millions):

Three Months Ended Twelve Months

Ended June 30, June 30, Operating

Expenses: 2012 2011

2012 2011

Research and development $ 24.3 $ 30.5 $ 94.5 $ 117.0 As a

percentage of revenues 12.4 % 15.0 % 13.7 % 14.9 % Selling and

administrative 40.0 37.5 145.2 150.0 As a percentage of revenues

20.4 % 18.5 % 21.0 % 19.2 % Impairment and restructuring charges —

18.4 9.7 22.2 As a percentage of revenues — 9.1 % 1.4 % 2.8 %

Depreciation and amortization 25.3 20.6 92.2 71.1 As a percentage

of revenues 12.9 % 10.1 % 13.4 % 9.1 %

Total operating expenses $ 89.6

$ 107.0 $ 341.6 $

360.3 Operating expenses as a percentage of

revenues 45.7 % 52.7 % 49.5

% 46.0 % Operating income $

31.7 $ 9.6 $ 87.4

$ 110.4 Operating margin

16.2 % 4.7 % 12.7 %

14.1 %

Research and development expenses in the June 2012 quarter

declined $6.2 million on a year-over-year basis, but increased $2.2

million on a quarterly sequential basis to $24.3 million. The

year-over-year decline reflects the savings generated from the

organizational changes announced in August 2011 and $3.0 million of

write-down charges for intellectual property impairment recorded in

the June 2011 quarter, while the quarterly sequential increase

reflects higher spending and investment on innovative new gaming

products, coupled with higher incentive compensation expense and

the increased spending to support the Company’s participation in

long-term, high-margin growth opportunities in interactive

gaming.

Selling and administrative expenses in the June 2012 quarter of

$40.0 million were $2.5 million higher than the year-ago period and

$6.3 million higher than the March 2012 quarter, reflecting $2.1

million for legal settlements in the quarter, increased costs

associated with our interactive gaming products and services,

including acquisition-related expenses, and higher incentive

compensation expense, partially offset by savings from the

organizational changes announced in August 2011 and a $0.7 million

reduction in bad debt reserves related to Mexican customer

receivables.

Depreciation and amortization expense was $25.3 million in the

June 2012 quarter compared with $20.6 million in the year-ago

quarter and $23.1 million in the March 2012 quarter, primarily

reflecting the Company’s continued investment in gaming operations

equipment during the last 12 months to upgrade and transition its

installed base of participation units to Bluebird2 and Bluebird xD

cabinets, and amortization related to the Company’s investment in

the development of its WAGE-NET® networked gaming system following

initial commercialization in the June 2011 quarter.

Interest income and other income and expense, net was $3.8

million in the June 2012 quarter compared with $7.8 million in the

year-ago quarter. The prior year quarter included $4.0 million from

a cash settlement of litigation.

The effective tax rate for the June 2012 quarter was 37%, which

reflects the absence of the expired Federal R&D tax credit,

while the effective rate of 40% in the prior year reflected the

greater relative impact of certain international subsidiary

start-up operating losses not benefiting the effective global tax

rate.

Cash flow provided by operating activities for the fiscal year

ended June 30, 2012 was $156.8 million and was comparable to the

prior-year. Cash flow provided by operating activities reflects

higher depreciation and amortization, as well as a lower negative

impact from tax-related items, offset by lower net income, a

decrease in non-cash restructuring and impairment charges and lower

share-based compensation expense. Total receivables, net were

$405.1 million at June 30, 2012 compared with $366.2 million at

June 30, 2011, which reflects the use of the Company’s strong

financial liquidity to support customers’ demands to refresh their

slot base during a period of constrained capital for many, along

with higher sales during the past twelve months into markets that

historically depend upon extended financing terms. Inventory was

$53.3 million, which was $13.8 million lower than at June 30, 2011,

primarily reflecting operational improvements and lower finished

goods inventory. Total current liabilities at June 30, 2012

increased $18.4 million from the prior year due to higher accounts

payables arising from higher capital spending in the June 2012

quarter and working capital management, and higher accrued

liabilities.

Net cash used in investing activities was $194.2 million in

fiscal 2012 compared to $157.0 million in fiscal 2011, reflecting a

$17.1 million increase in capital deployed for gaming operations

equipment as we continued to upgrade our installed base with newer

gaming cabinets and operating systems, $15.2 million for higher

property, plant and equipment expenditures, primarily related to

two significant projects that will be placed into service early in

fiscal 2013, and $16.4 million for acquisition of businesses, net

of cash acquired, partially offset by an $11.5 million decrease in

capital deployed to acquire or license intangible and other

non-current assets. Net cash provided by financing activities was

$10.8 million compared to $77.0 million used in the prior year,

primarily due to $60.0 million in proceeds from borrowings under

the Company’s line of credit and $51.1 million in lower stock

repurchase activity in fiscal 2012 compared to fiscal 2011,

partially offset by lower cash received and tax benefits from stock

option activity. The Company expects an aggregate 20% decline in

capital spending on gaming operations equipment and property, plant

and equipment in fiscal 2013.

Adjusted EBITDA, a non-GAAP financial metric (see reconciliation

to net income schedule near the end of this release), was $69.8

million in the June 2012 quarter compared with $70.4 million in the

prior-year period. The adjusted EBITDA margin for the June 2012

quarter increased to 35.6% compared to 34.6% in the year-ago

period.

Total cash, cash equivalents and restricted cash was $76.1

million at June 30, 2012, a quarterly sequential decrease of $11.5

million, partially reflecting the higher level of capital

expenditures totaling $58 million in the June 2012 quarter.

Share Repurchase Program Update

During the three months ended June 30, 2012, the Company

purchased 349,515 shares of its common stock for $7.1 million.

During fiscal 2012, WMS repurchased 2.4 million shares, or 4% of

the outstanding shares at June 30, 2011, for an aggregate $50.4

million. Approximately $148 million remains available pursuant to

WMS’ share repurchase authorization. At June 30, 2012, WMS had 54.8

million shares outstanding and 4.9 million shares in the Company’s

treasury.

Fiscal Year 2013 Outlook

The Company expects the general economic environment to remain

unchanged in the next twelve months, as customers’ capital spending

plans are likely to remain relatively flat throughout the remainder

of calendar 2012 and into calendar 2013. Revenue growth in fiscal

2013 is expected to reflect: 1) modest growth in product sales ship

share in the U.S. and Canada and in the installed participation

base, 2) the introduction of innovative new gaming content,

platforms and cabinets, 3) an increased contribution from the

ongoing commercialization of the Company’s networked gaming system

and portal game applications, 4) an increase in revenues from the

Company’s interactive products and services and 5) higher VLT

replacement demand from Canadian VLT operators that will partially

offset lower domestic new casino and expansion unit demand, but at

lower average selling prices as VLT’s typically are lower priced

than gaming machines sold to new casino openings and expansions.

WMS also expects that it will begin to ship units to the Illinois

VLT market, with a portion of these units being operating leases.

WMS expects fiscal first quarter revenues to approach fiscal 2012

first quarter revenues with growth occurring in the second half of

the fiscal year.

WMS expects to accelerate spending on R&D initiatives to

equal about 15%-to-16% of fiscal 2013 revenues to fund innovative

new products and the creation of intellectual property, along with

higher spending to grow its interactive products and services. In

addition, with increased spending to expand interactive gaming

products and services and higher spending to support overall

revenue growth, WMS expects selling and administrative expenses, as

a percentage of total revenues, also will rise in fiscal 2013 over

fiscal 2012. WMS expects depreciation and amortization expense to

increase primarily reflecting the Company’s investment in expanding

its gaming operations installed base with newer cabinets and

upgraded equipment throughout fiscal 2012 and incremental

depreciation associated with property, plant and equipment

resulting from two significant projects being placed in service

early in fiscal 2013. We expect the increased gross profit

contribution from higher revenues mostly will be offset by higher

operating expenses in fiscal 2013, as we increase spending to

accelerate innovation efforts, expand our interactive initiatives

and support revenue growth.

The attached supplemental schedule documents revenue, operating

margin and diluted earnings per share progression by quarter for

each of the last three fiscal years. Consistent with fiscal 2012,

quarterly revenues and operating margin are anticipated to be

lowest in the September 2012 quarter and increase in each

subsequent quarter with the highest revenue levels and operating

margin in the June 2013 quarter.

The Company routinely reviews its guidance and may update it

from time to time based on changes in the market and its

operations.

WMS Industries is hosting a conference call and webcast at 4:30

PM ET today, Monday, August 6, 2012. The conference call numbers

are 212/231-2905 or 415/226-5355. To access the live call on the

Internet, log on to www.wms.com (select “Investor Relations”).

Following its completion, a replay of the call can be accessed for

thirty days on the Internet via www.wms.com.

About WMS

WMS serves the gaming industry worldwide by designing,

manufacturing and marketing games, video and mechanical

reel-spinning gaming machines, video lottery terminals and in

gaming operations, which consists of the placement of leased

participation gaming machines in legal gaming venues. The Company

also develops and markets digital gaming content, products,

services and end-to-end solutions that address global online

wagering and play-for-fun social, casual and mobile gaming

opportunities. WMS is proactively addressing the next stage of

casino gaming floor evolution with its WAGE-NET networked gaming

solution, a suite of systems technologies and applications designed

to increase customers’ revenue generating capabilities and

operational efficiency. More information on WMS can be found at

www.wms.com or visit the Company on Facebook®, Twitter® or

YouTube®.

This press release contains forward-looking statements

concerning our future business performance, strategy, outlook,

plans, products and liquidity, including, but not limited to, the

statements set forth under the caption “Fiscal Year 2013 Outlook.”

Forward-looking statements may be typically identified by such

words as “may,” “will,” “should,” “expect,” “anticipate,” “plan,”

“likely,” “believe,” “estimate,” “project,” and “intend,” among

others. These forward-looking statements are subject to risks and

uncertainties that could cause our actual results to differ

materially from the expectations expressed in the forward-looking

statements. Although we believe that the expectations reflected in

our forward-looking statements are reasonable, any or all of our

forward-looking statements may prove to be incorrect. Consequently,

no forward-looking statements may be guaranteed. We undertake no

obligation to update such forward looking statements, all of which

are made only as of this date, August 6, 2012. Factors that could

cause our actual results to differ from expectations include (1)

delay or refusal by regulators to approve our new gaming platforms,

cabinet designs, game themes and related hardware and software; (2)

changes in regulations or regulatory interpretations that may

adversely affect existing product placements or future placements;

(3) an inability to introduce in a timely manner new games and

gaming machines that achieve and maintain market acceptance; (4) a

decrease in the desire of casino customers to upgrade gaming

machines or allot floor space to leased or participation games,

resulting in reduced demand for our products; (5) a reduction in

capital spending or interruption in payments by casino customers

associated with business weakness or economic uncertainty that

adversely affects our customers' ability to make purchases or pay;

(6) a greater-than-expected demand for operating leases by

customers over outright product sales or sales financing leases

that shift revenue recognition from a single period to the term of

such operating leases; (7) future costs to restructure our business

and other charges that may be higher than currently estimated,

including additional charges related to actions at a later time not

presently contemplated; (8) ability to realize in full, or part,

the anticipated savings and expense reductions from restructuring

and lower staffing; (9) adverse affects on product development,

innovation and the ability to retain and attract key personnel

following the restructuring and reorganization actions taken in

fiscal 2011 and 2012; (10) a reduction in play levels of our

participation games by casino patrons, whether due to economic

conditions or increased placements of competitive product; (11)

inability of suppliers of key components to timely meet our

requirements to fulfill customer orders; (12) increased pricing or

promotional competitive activity that adversely affects our average

selling price or product revenues; (13) a failure to obtain and

maintain our gaming licenses and regulatory approvals; (14) failure

of customers or players to adapt to the new technologies that we

introduce in new product concepts; (15) a software anomaly or

fraudulent manipulation of our gaming machines and software; (16) a

failure to obtain the right to use or an inability to adapt to

rapid development of new technologies; (17) an infringement claim

seeking to restrict our use of material technologies; (18) risks of

doing business in international markets, including political and

economic instability, terrorist activity, changes in importation

and repatriation regulations such as currently experienced in

Argentina, and foreign currency fluctuations; and (19) the

unfavorable outcome of any legal proceedings in which we may be

involved from time to time. These factors and other factors that

could cause actual results to differ from expectations are more

fully described under “Item 1. Business”, “Item 1A. Risk Factors”

and “Legal Proceedings” in our Annual Report on Form 10-K for the

year ended June 30, 2011, and our more recent reports filed with

the U.S. Securities and Exchange Commission.

- financial tables follow -

WMS INDUSTRIES INC. CONDENSED

CONSOLIDATED STATEMENTS OF INCOME For the Three and Twelve

Months Ended June 30, 2012 and 2011 (in millions of U.S.

dollars and millions of shares, except per share amounts)

Three Months Ended Twelve Months Ended June

30, June 30, 2012

2011 2012

2011 REVENUES: (unaudited) (unaudited)

(unaudited) Product sales $ 133.1 $ 130.6 $ 428.3 $ 489.2 Gaming

operations 62.8 72.6 261.4

294.1

Total revenues 195.9

203.2 689.7 783.3

COSTS AND EXPENSES:

Cost of product sales (1) 60.4 71.9 205.2 253.9 Cost of gaming

operations (1) 14.2 14.7 55.5 58.7 Research and development 24.3

30.5 94.5 117.0 Selling and administrative 40.0 37.5 145.2 150.0

Depreciation and amortization (1) 25.3 20.6 92.2 71.1 Impairment

and restructuring charges — 18.4

9.7 22.2

Total costs and expenses

164.2 193.6

602.3 672.9 OPERATING

INCOME 31.7 9.6 87.4 110.4 Interest

expense (0.4 ) (0.3 ) (1.6 ) (1.2 ) Interest income and other

income and expense, net 3.8 7.8

13.3 14.4 Income before income taxes 35.1 17.1

99.1 123.6 Provision for income taxes 13.0 6.8

35.0 42.6

NET INCOME

$

22.1

$

10.3

$

64.1

$

81.0

Earnings per share:

Basic $ 0.40 $ 0.18 $ 1.15 $ 1.40

Diluted $ 0.40 $ 0.18 $ 1.15 $ 1.37

Weighted-average common shares:

Basic common stock outstanding 54.9 57.0

55.5 57.7 Diluted common stock

and common stock equivalents 55.2 58.0

55.8 59.0

(1) Cost of product sales and cost of

gaming operations exclude the following amounts of depreciation

and

amortization, which are included in the depreciation and

amortization line item:

Cost of product sales $ 2.1 $ 1.2 $ 6.4 $ 4.8 Cost of gaming

operations $ 15.8 $ 10.7 $ 57.6 $ 40.1

WMS

INDUSTRIES INC. CONDENSED CONSOLIDATED BALANCE SHEETS

June 30, 2012 and 2011 (in millions of U.S. dollars and

millions of shares) June 30,

June 30, ASSETS 2012 2011 CURRENT

ASSETS: (unaudited) Cash and cash equivalents $ 62.3 $ 90.7

Restricted cash and cash equivalents 13.8 14.3

Total cash, cash equivalents and restricted cash

76.1 105.0 Accounts and notes receivable, net of

allowances of $6.9 and $5.5, respectively 282.8 284.6 Inventories

53.3 67.1 Other current assets 40.1 40.8

Total current assets 452.3 497.5

NON-CURRENT ASSETS: Long-term notes receivable, net 122.3

81.6

Gaming operations equipment, net of

accumulated depreciation and amortization of $227.1 and $270.5,

respectively

115.7 86.8

Property, plant and equipment, net of

accumulated depreciation and amortization of $142.0 and $115.7,

respectively

226.7 171.5 Intangible assets, net 178.9 153.9 Deferred income tax

assets 39.3 43.1 Other assets, net 18.9 11.9

Total non-current assets 701.8

548.8 TOTAL ASSETS $

1,154.1 $ 1,046.3

LIABILITIES AND STOCKHOLDERS’

EQUITY

CURRENT LIABILITIES: Accounts payable $ 84.8 $ 66.2

Accrued compensation and related benefits 9.5 12.3 Other accrued

liabilities 76.5 73.9

Total current

liabilities 170.8 152.4 NON-CURRENT

LIABILITIES: Long-term debt 60.0 —

Deferred income tax liabilities

22.7 23.9 Other non-current liabilities 23.3

14.1

Total non-current liabilities 106.0

38.0 Commitments, contingencies and indemnifications — —

STOCKHOLDERS’ EQUITY: Preferred stock (5.0 shares

authorized, none issued) — — Common stock (200.0 shares authorized

and 59.7 shares issued) 29.8 29.8 Additional paid-in capital 443.5

437.9 Treasury stock, at cost (4.9 and 2.9 shares, respectively)

(144.1 ) (104.9 ) Retained earnings 554.9 490.0 Accumulated other

comprehensive income (loss) (6.8 ) 3.1

Total stockholders’ equity 877.3

855.9 TOTAL LIABILITIES AND STOCKHOLDERS’

EQUITY $ 1,154.1 $ 1,046.3

WMS INDUSTRIES INC. CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS For the Twelve Months

Ended June 30, 2012 and 2011 (in millions of U.S.

dollars) Twelve Months Ended June 30,

2012 2011

CASH FLOWS FROM OPERATING ACTIVITIES (unaudited) Net income

$ 64.1 $ 81.0

Adjustments to reconcile net income to net

cash provided by (used in) operating activities:

Depreciation 77.8 71.1 Amortization of intangible and other

non-current assets 29.0 21.6 Share-based compensation 15.8 18.7

Non-cash restructuring and impairment charges 0.6 18.4 Other

non-cash items 11.7 11.4 Deferred income tax benefit (1.0 ) (13.1 )

Tax benefit from exercise of stock options (0.2 ) (10.1 ) Change in

operating assets and liabilities (41.0 ) (41.9 )

Net cash provided by operating activities 156.8 157.1

CASH FLOWS FROM INVESTING ACTIVITIES Additions to gaming

operations equipment (83.0 ) (65.9 ) Additions to property, plant

and equipment (81.4 ) (66.2 ) Acquisition of businesses, net of

cash acquired (16.4 ) — Payments to acquire or license intangible

and other non-current assets (13.4 ) (24.9 )

Net

cash used in investing activities (194.2 ) (157.0 )

CASH FLOWS FROM FINANCING ACTIVITIES Proceeds from

borrowings under revolving credit facility make this first line

60.0 — Purchases of treasury stock (50.4 ) (101.5 ) Debt issuance

costs (2.4 ) — Cash received from exercise of stock options and

employee stock purchase plan 3.4 14.4 Tax benefit from exercise of

stock options 0.2 10.1

Net cash

provided by (used in) financing activities 10.8 (77.0 )

Effect of exchange rates on cash and cash equivalents

(1.8 ) 0.9

DECREASE IN CASH AND CASH

EQUIVALENTS (28.4 ) (76.0 )

CASH AND CASH EQUIVALENTS,

beginning of year 90.7 166.7

CASH

AND CASH EQUIVALENTS, end of year $ 62.3 $ 90.7

WMS INDUSTRIES INC. Supplemental Data –

Earnings per Share (in millions of U.S. dollars and millions

of shares, except per share amounts) Three

Months Ended Twelve Months Ended June 30, June

30, 2012 2011 2012

2011

(unaudited) (unaudited) (unaudited) Net income $ 22.1 $ 10.3 $ 64.1

$ 81.0 Basic weighted average common shares outstanding 54.9

57.0 55.5 57.7 Dilutive effect of stock options 0.2 0.7 0.2 0.9

Dilutive effect of restricted common stock and warrants 0.1

0.3 0.1 0.4 Diluted weighted average common

stock and common stock

equivalents

55.2 58.0 55.8 59.0 Basic

earnings per share of common stock $ 0.40 $ 0.18 $ 1.15 $ 1.40

Diluted earnings per share of common stock and common stock

equivalents $ 0.40 $ 0.18 $ 1.15 $ 1.37

Supplemental Data – Reconciliation of Net Income to Adjusted

EBITDA (in millions of U.S. dollars) (unaudited)

Three Months Ended Twelve Months

Ended June 30, June 30, 2012

2011 2012

2011 Net income $ 22.1 $

10.3 $ 64.1 $ 81.0 Net income $ 22.1 $

10.3 $ 64.1 $ 81.0 Depreciation 21.0 20.6 77.8 71.1 Amortization of

intangible and other non-current assets 8.6 7.7 29.0 21.6 Provision

for income taxes 13.0 6.8 35.0 42.6 Interest expense 0.4 0.3 1.6

1.2 Share-based compensation 4.3 3.5 15.8 18.7 Other non-cash items

0.4 21.2 12.3 29.8

Adjusted EBITDA $ 69.8 $ 70.4 $ 235.6

$ 266.0

Adjusted EBITDA margin 35.6 %

34.6 % 34.2 % 34.0 %

Adjusted EBITDA (earnings before interest, taxes, depreciation,

amortization, share-based compensation and other non-cash items,

including non-cash impairment and restructuring charges) and

adjusted EBITDA margin are supplemental non-GAAP financial metrics

used by our management and commonly used by industry analysts to

evaluate our financial performance. Adjusted EBITDA and adjusted

EBITDA margin provide additional useful information to investors

regarding our ability to service debt and are commonly used

financial analysis metrics for measuring and comparing gaming

companies in areas of liquidity, operating performance, valuation

and leverage. Adjusted EBITDA and adjusted EBITDA margin should not

be construed as an alternative to operating income (as an indicator

of our operating performance) or net cash provided by operating

activities (as a measure of liquidity) as determined in accordance

with U.S. generally accepted accounting principles. All companies

do not calculate adjusted EBITDA and adjusted EBITDA margin in

necessarily the same manner, and WMS’ presentation may not be

comparable to those presented by other companies.

WMS INDUSTRIES INC. Supplemental Data –

Items Impacting Comparability: Net Charges For the Three and

Twelve Months Ended June 30, 2012 and 2011 (in millions of

U.S. dollars, except per share amounts) (unaudited)

Three Months Ended June 30, Twelve Months Ended

June 30, 2012 2012

2011 2011

2012 2012

2011 2011

DESCRIPTION OF

NET CHARGES

Per Per Per Per

(BENEFITS)

Pre-tax diluted Pre-tax diluted

Pre-tax diluted Pre-tax diluted

amount share amount share amount

share amount share IMPAIRMENT AND

RESTRUCTURING CHARGES: NON-CASH CHARGES

Impairment of licensed technologies and

brand name

$ — $ — $ 14.4 $ 0.15 $ — $ — $ 14.4 $ 0.15

Impairment of receivables and property,

plant and equipment

— — 1.6 0.02

0.6 0.01 4.0

0.05

TOTAL NON-CASH IMPAIRMENT AND

RESTRUCTURING CHARGES

$ —

$ —

$ 16.0 $ 0.17

$ 0.6 $ 0.01 $ 18.4

$ 0.20 CASH CHARGES

Restructuring charges, primarily

separation charges

— — 2.4 0.03

9.1 0.11 3.8

0.04

TOTAL IMPAIRMENT AND RESTRUCTURING

CHARGES

$ —

$ —

$ 18.4 $ 0.20 $

9.7 $ 0.12 $ 22.2 $

0.24 ASSET WRITE-DOWNS AND OTHER CHARGES

(BENEFITS):

Inventory and other asset write-downs

(recorded in cost of product sales)

$ — $ — $ 4.9 $ 0.05 $ — $ — $ 4.9 $ 0.05

Asset write-downs and other charges

(recorded in cost of gaming operations)

— — 1.7 0.02 — — 1.7 0.02

Intellectual property asset write-downs

(recorded in research and development)

— — 3.0 0.03 — — 3.0 0.03

Cost of legal settlements (recorded in

selling and administrative expenses)

2.1 0.02 — — 2.1 0.02 — —

Non-cash charges (benefit) to write-down

Mexican customer receivables (recorded in selling and

administrative expenses)

(0.7 ) (0.01 ) —

—

3.6 0.04 —

—

TOTAL ASSET WRITE-DOWNS AND OTHER

CHARGES

$ 1.4 $ 0.01 $

9.6 $ 0.10 $ 5.7

$ 0.06 $ 9.6

$ 0.10 TOTAL IMPAIRMENT,

RESTRUCTURING, ASSET WRITE-DOWNS AND OTHER CHARGES $

1.4 $ 0.01 $ 28.0 $

0.30 $ 15.4 $ 0.18 $

31.8 $ 0.34 CASH BENEFITS:

Proceeds from litigation settlement

(recorded in interest income and other income and expense, net)

$ — $ — $ (4.0 ) $ (0.04 ) $ (2.1 ) $ (0.02 )

$ (4.0 ) $ (0.04 )

Prior period impact from retroactive

reinstatement of the Federal research and development tax credit

(recorded in provision for income taxes)

— — — —

— — — (0.02 )

TOTAL CASH BENEFITS $ —

$ —

$

(4.0 ) $ (0.04 ) $

(2.1 ) $ (0.02 ) $

(4.0 ) $ (0.06 ) TOTAL

NET CHARGES $ 1.4 $ 0.01

$ 24.0 $ 0.26

$ 13.3 $ 0.16 $

27.8 $ 0.28

The three-month period ended June 30, 2012 includes net pre-tax

charges of $1.4 million, or $0.01 per diluted share, including $2.1

million pre-tax, or $0.02 per diluted share, of costs for legal

settlements, partially offset by $0.7 million pre-tax, or $0.01 per

diluted share of benefit from the reduction in the bad debt reserve

related to the write-down of receivables following government

enforcement actions at certain casinos in Mexico. The twelve-month

period ended June 30, 2012 includes net charges of $13.3 million

pre-tax, or $0.16 per diluted share, including $15.4 million of

pre-tax charges, or $0.18 per diluted share, principally recorded

in the September 2011 quarter, which includes $9.7 million pre-tax,

or $0.12 per diluted share, of pre-tax impairment and restructuring

charges, including $5.9 million pre-tax of separation-related

charges and $3.8 million pre-tax of costs related to the decision

to close two facilities; $3.6 million pre-tax, or $0.04 per diluted

share, of non-cash charges to write-down receivables following

government enforcement actions at certain casinos in Mexico; and

$2.1 million pre-tax, or $0.02 per diluted share, of costs for

legal settlements; partially offset by a pre-tax cash benefit of

$2.1 million, or $0.02 per diluted share, from litigation

settlement recorded in the December 2011 period.

The three month period ended June 30, 2011 includes $24.0

million of net pre-tax charges, or $0.26 per diluted share, which

includes $18.4 million, or $0.20 per diluted share, of pre-tax

impairment and restructuring charges comprised of $16.0 million, or

$0.17 per diluted share, for non-cash asset impairments (including

$11.0 million for impairment of technology licenses, $3.4 million

for impairment of the Orion™ brand name, $1.4 million for

impairment of receivables related to government action to close

casinos in Venezuela and $0.2 million of other impairment charges);

and $2.4 million or $0.03 per diluted share for restructuring

charges (primarily separation costs); along with $9.6 million of

pre-tax charges, or $0.10 per diluted share, for asset write-downs

and other charges (including charges for inventory write-downs

related to winding down the Orion and original Bluebird product

lines); partially offset by $4.0 million or $0.04 per diluted share

from cash proceeds of litigation settlement. For the twelve months

ended June 30, 2011, impairment and restructuring charges also

include the $3.8 million of pre-tax charges, or $0.04 per diluted

share, incurred in the September 2010 quarter related to closing

WMS’ main Netherlands facility, of which $2.4 million was a

non-cash, pre-tax charge for the write-down to fair market value of

property, plant and equipment and $1.4 million was pre-tax

separation charges. The twelve-month period ended June 30, 2011

also includes a $0.02 per diluted share benefit recorded in income

taxes in the December 2010 quarter related to the period January 1,

2010 through June 30, 2010 from the retroactive reinstatement of

the Federal research and development tax credit.

WMS INDUSTRIES INC. Supplemental Data – Historical

Quarterly Revenues, Operating Margin and Diluted Earnings per

Share (in millions of U.S. dollars, except per share amounts

and as a % of annual revenues and % of annual diluted

earnings per share) (unaudited) Fiscal

Quarters Ended: Sept. 30 Dec. 31

Mar. 31 June 30 Fiscal 2012 Revenues $

155.6 $ 162.2 $ 176.0 $ 195.9 As a percentage of annual revenues 23

% 23 % 26 % 28 % Fiscal 2011 Revenues $ 187.5 $ 199.9 $ 192.7 $

203.2 As a percentage of annual revenues 24 % 25 % 25 % 26 % Fiscal

2010 Revenues $ 165.3 $ 188.9 $ 197.5 $ 213.4 As a percentage of

annual revenues 21 % 25 % 26 % 28 %

Fiscal Quarters

Ended: Sept. 30 Dec. 31 Mar. 31 June

30 Fiscal 2012 Operating Margin (1) (3) 2.2 % 12.9 %

17.7 % 16.2 % Fiscal 2011 Operating Margin (4) (6) 15.6 % 18.4 %

18.1 % 4.7 % Fiscal 2010 Operating Margin 19.1 % 20.9 % 22.5 % 24.6

%

Fiscal Quarters Ended: Sept. 30 Dec.

31 Mar. 31 June 30 Fiscal 2012 Diluted EPS

(1) (2) (3) (3) $ 0.07 $ 0.29 $ 0.40 $ 0.40 As a percentage of

annual Diluted EPS 7 % 25 % 34 % 34 % Fiscal 2011 Diluted EPS (4)

(5) (6) $ 0.33 $ 0.46 $ 0.41 $ 0.18 As a percentage of annual

Diluted EPS 24 % 33 % 30 % 13 % Fiscal 2010 Diluted EPS (7) (8) $

0.34 $ 0.44 $ 0.55 $ 0.56 As a percentage of annual Diluted EPS 18

% 23 % 29 % 30 % (1) The June 2012 quarter includes pre-tax

charges of $2.1 million, or $0.02 per diluted share, for legal

settlements, partially offset by a $0.7 million, or 0.01 per

diluted share, pre-tax reduction in the reserve for bad debts

related to government enforcement actions at certain casinos in

Mexico. (2) The December 2011 quarter includes a pre-tax cash

benefit of $2.1 million, or $0.02 per diluted share, from

litigation settlement. (3) The September 2011 quarter includes

$14.0 million of net pre-tax charges, or $0.17 per diluted share,

including $0.12 per diluted share of impairment and restructuring

charges and $0.05 per diluted share, of non-cash charges to

write-down receivables following government enforcement actions at

certain casinos in Mexico. (4) The June 2011 quarter includes $24.0

million of net pre-tax charges, or $0.26 per diluted share,

including $0.17 per diluted share of non-cash charges for asset

impairments, $0.03 per diluted share of restructuring charges and

$0.10 per diluted share of charges for asset write-downs and other

charges, partially offset by $0.04 per diluted share benefit from

cash settlement of litigation. (5) The December 2010 quarter

includes the impact from the retroactive reinstatement of the U.S.

Federal Research and Development tax credit to January 1, 2010, of

which approximately $1.1 million, or $0.02 per diluted share,

related to the period January 1, 2010 through June 30, 2010. (6)

The September 2010 quarter includes $3.8 million pre-tax, or $0.04

per diluted share, of charges to close WMS’ main facility in the

Netherlands, including a $2.4 million pre-tax, non-cash write-down

of the facility and $1.4 million of cash-based, pre-tax separation

charges. (7) The March 2010 quarter had several discrete income tax

items, which netted out to a lower effective income tax rate that

increased diluted earnings per share by $0.06; primarily the

completion of Federal income tax return audits by the Internal

Revenue Service for fiscal 2004 through fiscal 2007 that resulted

in a reduction of our liability for uncertain tax positions by $4.6

million, or a $0.07 per diluted share benefit, partially offset by

the expiration of the R&D tax credit legislation effective as

of December 31, 2009, which had the impact of reducing diluted

earnings per share by $0.01. (8) The September 2009 quarter

includes a $0.02 per diluted share impact for interest expense and

an inducement payment related to early conversion by holders of

$79.4 million principal amount WMS’ 2.75% Convertible Notes to

common stock.

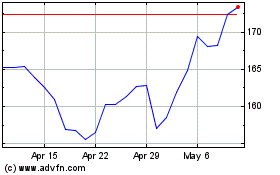

Advanced Drainage Systems (NYSE:WMS)

Historical Stock Chart

From Apr 2024 to May 2024

Advanced Drainage Systems (NYSE:WMS)

Historical Stock Chart

From May 2023 to May 2024