Enablence Technologies Inc. ("Enablence" or the "Company") (TSX VENTURE:ENA), a

leading supplier of optical components and subsystems for access, metro and

long-haul markets, announced today financial results for its fiscal year end,

the fourteen months ending June 30, 2011.

Highlights

The highlights during the quarter and fiscal year include:

-- Increased year-over-year revenues by 41% (after normalizing for the

longer fiscal year and the impacts of foreign exchange)

-- Improved year-over-year gross margins from 21% to 27%;

-- Invested US$3.5 million to establish a 49% share in a joint venture in

China ("China JV") which has an enterprise value of US$18 million;

-- Initiated the planned divestiture of the Systems segment;

-- Raised $10.0 million in gross proceeds to fund continuing operations

through the issuance of common shares;

-- Raised US$3.5 million through a secured note payable to fund the China

JV; and

-- Completed the integration of the polymer-based production operations

from Wilmington Massachusetts to the Company's operation in Fremont,

California, which is expected to generate $1.0 million in cost savings

per year;

In September 2011, the Company sold the majority of its United States ("US")

based Systems segment through two asset sale transactions. Enablence sold part

of the Systems segment, primarily the Trident7(TM) universal access platform, to

Aurora Networks, Inc. for a total purchase price of US$5.1 million comprised of

US$2.75 million of cash and the transfer of certain liabilities and contingent

liabilities. The cash portion of the purchase prices includes a US$0.75 million

holdback, while US$2.0 million of the cash portion of the purchase price was

received on September 15, 2011. Enablence also sold the MAGNM(TM) FX product

line by divesting certain assets, including $0.2 million of cash and

transferring certain liabilities totaling $0.4 million to FX Support, LLC.

Financial and Operating Results

On July 25, 2010 the Company changed its year end from April 30 to June 30,

2011. Accordingly, the current fiscal period covers the fourteen months from May

1, 2010 to June 30, 2011, while the prior year comparison is for the twelve

months ended April 30, 2010.

On April 28, 2011 the Company announced its plans to exit the Systems segment.

As a result, the operating results from the Systems segment have been

reclassified as discontinued operations. The current and historical financial

results have been restated to remove the results of the Systems segment and

report them as discontinued operations.

The following chart highlights the key financial results for the periods

indicated ($000's, except per share data):

Three Three Fourteen Twelve

months months % months months %

June 30, April 30, June 30, April 30,

2011 2010 Change 2011 2010 Change

----------------------------------------------------------------------------

Revenues $ 5,465 $ 6,925 -21% $ 35,300 $ 23,448 51%

Gross Margin 1,096 1,751 -37% 9,632 4,955

Gross Margin

% 20% 25% 45% 27% 21% 39%

Net loss from

Continuing

Operations $ (3,377)$ (5,386) -37% $ (10,148)$ (14,476) -30%

Loss from

Discontinued

Operations (37,687) (3,245) 1061% (91,968) (18,098) 408%

---------------------- ----------------------

Net loss $ (41,064)$ (8,631) 376% $ (102,116)$ (32,574) 213%

---------------------- ----------------------

Basic &

diluted loss

per share

Continuing

Operations $ (0.01)$ (0.02) -55% $ (0.03)$ (0.05) -40%

Discontinued

Operations (0.08) (0.01) 736% (0.23) (0.07) 229%

---------------------- ----------------------

Net loss per

share (basic

& diluted) (0.09) (0.03) 243% (0.26) (0.12) 117%

---------------------- ----------------------

Adjusted

EBITDA(i) $ (1,811)$ (1,570) 15% $ (3,603)$ (6,263) -42%

---------------------- ----------------------

(i) Adjusted EBITDA is a non-GAAP financial measure. Adjusted EBITDA comprises:

Net loss excluding the following - loss from discontinued operations, interest

income and expense, income tax recovery and expense, depreciation and

amortization, asset impairment charges, stock-based compensation expense and

restructuring charges. A reconciliation of Adjusted EBITDA with Net loss is

reported in the Company's Management Discussion & Analysis, filed today on

sedar.com. Management uses Adjusted EBITDA as one measure to evaluate the

performance of the continuing operations of the business.

Revenues for the fourteen months ending June 30, 2011 ("Current Fiscal Year")

increased by $11.9 million, or 51% compared to the twelve months ending April

30, 2011 ("Prior Fiscal Year"). After removing the effects of the additional two

months in the Current Fiscal Year and the effects of foreign exchange, revenue

increased by 41% year over year. This increase was driven by a growth in sales

from arrayed waveguide grating ("AWG") products, multiplexer and demultiplexer

("VMUX") products and photodiodes. Revenues for the quarter ending June 30, 2011

("Current Quarter") decreased by $1.5 million or 21% compared to the quarter

ending April 30, 2011 ("Prior Year Quarter"). This decrease was driven by a

slow-down in demand for AWG and VMUX optical components as there was a general

market slowdown, in part to consume inventory in the quarter. The decrease in

optical components was offset slightly by growth in photodiode revenue, which

increased by 27% over the prior year quarter. Changes in foreign exchange rates

accounted for 2% of the decline.

Gross margin increased 6 points from 21% of revenues in the Prior Fiscal Year to

27% of revenues in the Current Fiscal Year. Gross margin was positively impacted

by 5 points due to the growth in volume, as fixed overheads are spread over more

revenue. The Company was able to offset the impact of price erosion with

improved production costs and shifts in product mix, including growth in the

Company's revenue from engineering services. Gross margin for the Current

Quarter was 20%, compared to 25% in the Prior Year Quarter. The decrease from

the Prior Year Quarter is due to the decrease in volume, combined with

approximately $0.4 million of inventory related charges taken in the Current

Quarter.

The net loss from continuing operations improved by 30% from the Prior Fiscal

Year due to the growth in revenue and margin. Operating expenses increased by

$1.8 million, offset by a decrease in other expenses of $1.5 million. The Prior

Fiscal Year included a $1.6 million impairment charge on intangible assets. The

net loss from continuing operations in the Current Quarter was $3.4 million, a

$2.0 million improvement over the Prior Year Quarter. The Prior Year Quarter

includes $1.8 million of restructuring costs, compared to the Current Quarter

restructuring costs of $0.4 million.

The net loss from discontinued operations was $92.0 million in the Current

Fiscal Year, compared to $18.1 million in the Prior Fiscal Year. The Current

Fiscal Year includes $60.0 million of impairment charges related to goodwill and

intangibles, compared to $2.8 million in the Prior Fiscal Year. The Current

Fiscal Year also includes $7.4 million of restructuring and $1.1 million of

inventory write-offs relating to the sale of the parts of the US Systems segment

and the announcement of the planned divestiture. The net loss from discontinued

operations was $37.7 million in the Current Quarter, compared to $3.2 million in

the Prior Year Quarter. The Current Quarter includes $22.7 million of impairment

charges related to goodwill and intangibles, compared to $nil in the Prior Year

Quarter. The Current Quarter also includes $7.4 million of restructuring and

$1.1 million of inventory write-offs relating to the sale of the parts of the US

Systems segment and the announcement of the planned divestiture.

Adjusted EBITDA (a non-GAAP measure) was a $3.6 million loss for the Current

Fiscal Year, compared to a $6.3 million loss in the Prior Fiscal Year. The $2.8

million improvement in Adjusted EBITDA was due to increased revenue and improved

gross margin. Adjusted EBITDA (a non-GAAP measure) was a $1.8 million loss for

the Current Quarter, compared to a $1.6 million loss in the Prior Year Quarter,

due to the decline in revenue.

Cash Position

Enablence's cash and cash equivalents were $10.0 million at June 30, 2011 ($11.5

million including $1.5 million held in discontinued operations) as compared to

$23.4 million at April 30, 2010. This net decrease of $11.9 million was the

result of using $10.1 million in continuing operations, $21.8 million in

discontinued operations, $4.8 million in investing activities (including the

US$3.5 million investment in the joint venture in China), $10.8 million in

investing activities in discontinued operations (including $9.5 million from

acquiring Teledata Networks Ltd), offset by $6.0 million from additional debt

and $30.4 million for the sale of common shares.

China Joint Venture

Enablence plans to grow its revenue in part through its investment in a joint

venture with Sunsea Telecommunications Co. Ltd. (the "JV Partner") that will

operate in China, named Foshan Sunsea-Enablence Optoelectronics Technology Co.,

Ltd (the "China JV"). The JV Partner owns 51% of the China JV, and Enablence

owns a 49% interest. The China JV will develop, manufacture and sell optical

components based primarily on Enablence's PLC technology. This will allow

Enablence to leverage its technology into the Chinese market, and provide

Enablence with access to a low cost manufacturing base.

The initial investments by the China JV partners total US$18.0 million as follows:

-- US$9.2 million by the JV Partner, all in cash

-- US$8.8 million by Enablence, comprising:

-- US$3.5 million in cash, paid on May 12, 2011;

-- US$1.0 million of capital equipment; and,

-- US$4.3 million in intellectual property and know-how

The Company is in process of transferring the capital equipment and the

intellectual property and know-how. The Company expects to complete the transfer

during its quarter ending December 31, 2011.

In conjunction with the initial funding of the China JV, on May 10, 2011,

Enablence finalized a note payable with a U.S. bank, with a principal amount of

US$3.5 million. As partial consideration for the loan, the Company issued to the

bank warrants to purchase up to 400,000 common shares of Enablence, at an

exercise price of $0.22 per share, expiring April 9, 2013.

Divestiture of Systems Segment - Update

On April 28, 2011, the Company announced that it had begun an initiative to

explore strategic alternatives to achieve the most value-enhancing and efficient

divestiture of the Systems segment. The decision to divest the Systems segment

will allow management to focus on the optical components business. The Company

has retained an investment banker to assist in the evaluation of alternatives

such as a sale, partial sale or closure. Management originally anticipated the

transaction or transactions to be completed prior to September 30, 2011. While

the majority of the US based Systems segment was sold on September 15th, the

Company continues to pursue its alternatives with respect to Teledata and its

remaining US Systems business. Management believes these transactions can be

completed by December 31, 2011, however there can be no assurance as to the

likelihood, terms or timing of any transaction.

Outlook

The Company expects revenue to improve in future quarters compared with the June

30, 2011 quarter, as the Company's customers resume their buying pattern. The

Company will be introducing its multi-channel 100G optical components, including

transmitter/receiver optical sub-assembly ("TOSA/ROSA") among other products

during fiscal 2012, and the joint venture is expected to start operations in the

quarter ending December 31, 2011 and generate revenue in the quarter ending

March 31, 2012.

"While the market slowdown is disappointing, we believe we are well positioned

to participate when spending returns, as well as grow faster than our markets

through the introduction of our 100G TOSA/ROSA chip, launching the China JV and

expanding our addressable market into datacom and packaged photodiodes. Our

challenge continues to be the divestiture of the remaining Systems business

while preserving as much cash as possible to fund our growth initiatives," said

Chief Executive Officer, Tim Thorsteinson. "When we have completed the

divestiture, our ability to focus on our optical components business will, we

believe, provide the most shareholder value", he added.

The Company will host a conference call on Friday, October 21, 2011 between 9:00

a.m. and 10:00 am EDT. All interested parties should call 416-340-8061 /

1-866-225-0198. Management will respond to questions from analysts on this call.

About Enablence Technologies Inc.

Enablence Technologies Inc. is a publicly traded company (TSX VENTURE:ENA) that

designs, manufactures and sells optical components and subsystems to a global

customer base. It utilizes its patented technologies including planar lightwave

circuit ("PLC") intellectual property in the production of an array of photonics

components and broadband subsystems that deliver a key portion of the

infrastructure for next-generation telecommunication systems. The Company's

product lines address all three segments of optical networks: Access, connecting

homes and businesses to the network; Metro, communication rings within large

cities; and Long-haul, linking cities and continents. For more information,

visit www.enablence.com.

Forward-looking Statements

This press release may contain forward-looking statements, in particular with

respect to the current and future revenue, the strategic alternatives and

divestiture of the Systems segment, the funding of the joint venture in China

and the revenue, margins, profitability and future growth of the continuing

operations (including the joint venture) that are made that are made as of the

date hereof and are based on current expectations, forecasts and assumptions

which involve risks and uncertainties associated with our business and the

economic environment in which the business operates. All such statements are

made pursuant to the 'safe harbour' provisions of, and are intended to be

forward-looking statements under, applicable Canadian securities legislation.

Any statements contained herein that are statements of historical facts may be

deemed to be forward-looking statements. By their nature, forward-looking

statements require us to make assumptions and are subject to inherent risks and

uncertainties. We caution our readers of this press release not to place undue

reliance on our forward looking statements as a number of factors could cause

actual results or conditions to differ materially from current expectations.

Please refer to the risks set forth in the Company's continuous disclosure

documents that can be found on SEDAR www.sedar.com. Enablence does not intend,

and disclaims any obligation, except as required by law, to update or revise any

forward looking statements whether as a result of new information, future events

or otherwise.

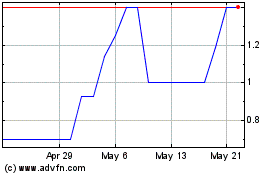

Enablence Technologies (TSXV:ENA)

Historical Stock Chart

From Mar 2024 to Apr 2024

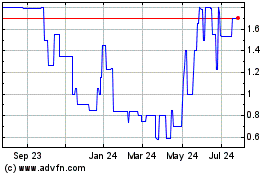

Enablence Technologies (TSXV:ENA)

Historical Stock Chart

From Apr 2023 to Apr 2024