UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C

INFORMATION STATEMENT PURSUANT TO SECTION 14(c)

OF THE SECURITIES EXCHANGE ACT OF 1934

Check the appropriate box:

x

Preliminary Information Statement

o

Confidential, for use of the Commission only as permitted by Rule 14c-6(e)(2)

o

Definitive Information Statement

Asia Global Holdings Corp.

(Name of Registrant as Specified in Its Charter)

Payment of filing fee (Check the appropriate box):

x

No fee required.

o

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

1) Title of each class of securities to which transaction applies:

2) Aggregate number of securities to which transaction applies:

|

|

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

4) Proposed maximum aggregate value of transaction:

|

o

Fee paid with preliminary materials.

o

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, of the Form or Schedule and the date of its filing.

1) Amount Previously Paid:

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Date Filed:

ASIA GLOBAL HOLDINGS CORP.

NOTICE OF STOCKHOLDER ACTION BY WRITTEN CONSENT

To our Stockholders:

We are furnishing the attached Information Statement to the holders of common stock of Asia Global Holding Corp., a Nevada corporation (referred to below as the “

Company

” or “

AAGH

”). The purpose of the Information Statement is to notify stockholders that the Board of Directors of the Company (the “

Board

”) and the holder of more than a majority of our common stock (approximately 63%) (the “

Voting Stockholder

”), has taken and approved actions to amend the Company’s Certificate of Incorporation by a reverse split of the outstanding Common Stock, on a 1 share for each 1,000 shares, and to approve and adopt an Amendment to the Company’s Articles of Incorporation to reflect the reverse split. These matters are described in this Information Statement.

The amendment to the Company’s Articles of Incorporation will not be effective until the Company files its Amendment with the Nevada Secretary of State, to officially accomplish the reverse stock split and the Amendment reflecting the stock split. The reverse stock split will not take effect, nor will the Amendment be filed, until on or immediately after August 4, 2011.

The accompanying Information Statement is being furnished to our stockholders for informational purposes only, pursuant to Section 14(c) of the Securities Exchange Act of 1934, as amended (the “

Exchange Act

”), and the rules and regulations prescribed thereunder. As described in this Information Statement, the foregoing actions have been approved by the stockholder representing more than a majority of the voting power of our outstanding shares of common stock. The Board is not soliciting your proxy or consent in connection with the matters discussed above. You are urged to read the Information Statement in its entirety for a description of the action taken by certain stockholders representing more than a majority of the voting power of our outstanding shares of common stock.

The Information Statement is being made available on or about July 16, 2011 to stockholders of record as of June 30, 2011, the record date for determining our stockholders eligible to consent in writing to the matters discussed above and entitled to notice of those matters.

THIS IS FOR YOUR INFORMATION ONLY. YOU DO NOT NEED TO DO ANYTHING IN RESPONSE TO THIS INFORMATION STATEMENT. THIS IS NOT A NOTICE OF SPECIAL MEETING OF STOCKHOLDERS AND NO STOCKHOLDER MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN.

|

|

|

|

|

|

|

Sincerely,

|

|

|

|

|

|

|

|

|

|

/s/ Mr. Gang Dong

|

|

|

|

|

Chief Executive Officer

Chief Financial Officer, and

Sole Director

|

|

ASIA GLOBAL HOLDINGS CORP.

|

Room 901, Haleson Building

|

|

1 Jubilee Street

|

|

Central, Hong Kong

Tel.

(+852) 2850 7680

|

INFORMATION STATEMENT

We Are Not Asking You for a Proxy and

You are Requested Not To Send Us a Proxy

INTRODUCTION

Stockholder Actions

We are disseminating this Information Statement to notify you that the controlling stockholder (the “

Voting Stockholder

”), being the owner of more than a majority of the voting power of the Company’s outstanding shares of common stock, delivered written consent to the Company on June 30, 2011 to approve an Amendment to our Articles of Incorporation and to approve the form and terms of the Company’s Amendment, for the sole purposes of (a) implementing a reverse split of the outstanding shares of common stock on a 1 share for each 1,000 shares held on the Record Date (the “

Reverse Split Action

”) and implementing the establishment of a new Series B Preferred Stock (the “

Series B Preferred Action

”). These matters are referred to below collectively as the “

Actions

”).

Forward Looking Statements

This Information Statement may contain certain “forward-looking” statements, as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, in connection with the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties, as well as assumptions that, if they never materialize or prove incorrect, could cause our results to differ materially and adversely from those expressed or implied by such forward-looking statements

Such forward-looking statements include statements about our expectations, beliefs or intentions regarding actions contemplated by this Information Statement, our potential business, financial condition, results of operations, strategies or prospects. You can identify forward-looking statements by the fact that these statements do not relate strictly to historical or current matters. Rather, forward-looking statements relate to anticipated or expected events, activities, trends or results as of the date they are made and are often identified by the use of words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” or “will,” and similar expressions or variations. Because forward-looking statements relate to matters that have not yet occurred, these statements are inherently subject to risks and uncertainties that could cause our actual results to differ materially from any future results expressed or implied by the forward-looking statements. Many factors could cause our actual activities or results to differ materially from the activities and results anticipated in forward-looking statements. Furthermore, such forward-looking statements speak only as of the date of this Information Statement. We undertake no obligation to update any forward-looking statements to reflect events or circumstances occurring after the date of such statements.

Vote Required

We are not seeking consent, authorizations, or proxies from you. The vote which was required to approve the Actions, which as discussed below, require amendments to our articles of incorporation, was the affirmative vote of the holders of a majority of the Company’s voting stock.

The Nevada Revised Statutes, (Sections 78.010 through 78.795, hereafter referred to as the “

Nevada Corporate Statute

” or the “

NCS

”), and specifically Sections 78.315 and 320, permit the holders of a corporation’s outstanding stock representing a majority of that corporation’s voting power to approve and authorize corporate actions by written consent as if such actions were undertaken at a duly called and held meeting of stockholders. In order to significantly reduce the costs and management time involved in soliciting and obtaining proxies to approve the Actions, and in order to effectuate the Actions as early as possible, the Board elected to utilize, and did in fact obtain, the written consent of the holder of a majority of the voting power (Mr. Gang Dong, the Voting Stockholder) of the Company. The Company obtained the written consents of Mr. Dong who as of the Record Date owned approximately 63% of the Company’s voting stock. The written consents satisfy the stockholder approval requirement for the Actions. Accordingly, under the NRS, no other Board or stockholder approval is required in order to effect the Actions. The Company’s articles and bylaws have no provision that requires a higher percentage of voting approval than the majority requirement of the NRS, and the articles and bylaws do not limit or otherwise change the general legal requirements allowing corporate approval by consent without an actual meeting.

Recent Share Capital History and Current Status; Approval of the Series B Preferred Action

On June 30, 2011 (the “

Record Date

”), there were 292,138,400 shares of the Company’s common stock issued and outstanding. Each share of common stock is entitled to one vote. The Company has an authorized class of 500,000 shares of Preferred Stock, all of which had been designated as the Series A Convertible Preferred Stock (the “

Series A Shares

”).

Of these Series A shares, 500,000 shares were issued to Michael Mak, a former officer and director in 2007 while 250,000 shares were cancelled in 2008, and the remaining 250,000 Series A Shares (as well as 33,500,000 common shares which he owned) were sold to Sina Dragon Holdings in September 2009.

As of June 30, 2011, Mr. Gang Dong purchased the stock of Sina Dragon Holdings Limited ; Sina Dragon’s only assets were the 250,000 Series A Shares and the 33,500,000 common shares mentioned above, and advances owed by AAGH to Sina ($51,282). Also as of June 30, 2011, Mr. Gang Dong purchased 100,000,000 shares of common stock which AAGH had issued to Mr. Lim – Kwong Liang in third quarter 2010, to purchase Ultra Professional Limited. AAGH owed Mr. Lim – Kwong Liang $74,392 as of March 31, 2011.

Also as of June 30, 2011, Mr. Gang Dong was appointed sole director, Chief Executive Officer, President, Chief Financial Officer, Secretary and Treasurer of AAGH, and converted the 250,000 Series A Shares to 50,000,000 common shares. As a result of these transactions, Mr. Gang Dong controlled the voting power over 183,500,000 common shares (62.8% of the total voting power of all stockholders in the Company). The foregoing transactions, and Mr. Gang Dong’s business biography, can be read in the Form 8-K filed by AAGH with the Securities and Exchange Commission (the “

SEC

”) on June 30, 2011. AAGH is shell company, as disclosed in that Form 8-K.

Authorization and Issuance of New Series B Preferred Stock

The Company’s Board authorized the following actions, which will implemented by filings with the Nevada Secretary of State. As stated below, these filings (amendments to the articles of incorporation) cannot be made until 20 calendar days after distribution of this Information Statement to all stockholders, in conformity with SEC rules.

Series B Preferred Stock

A new series of preferred stock, the Series B Preferred Stock, has been approved to be established by the Board, consisting of 250,000 shares, and a Designation stating the rights and preferences of the Series B Preferred will be filed to implement the Designation with the Nevada Secretary of State on or immediately following August 4, 2011. Since all the Series A Preferred shares have been exercised, the 250,000 shares which had been reserved for the Series A designation have been re-classified as part of the undesignated class of preferred stock.

The Series B shares will have the same rights and preferences as the Series A Preferred Stock:

Conversion at any time to common stock (one Series B share will be convertible to 200 common shares (total of 50 million common shares if all the Series B shares are converted);

Equal participation with the holders of common shares in Company assets in the event of dissolution of the Company; and

Even if not yet converted to common shares, the holder of the Series B Preferred Stock will have the right to vote the common shares issuable on conversion as if converted. A copy of the Designation as filed with the Nevada Secretary of State is included with this Information Statement.

Issuance of the Series B Preferred Stock

AAGH has approved the issuance of 250,000 shares of Series B Preferred Stock to Mr. Gang Dong, when the Series B Preferred Action is effected on or immediately following August 4, 2011. Mr. Gong has already paid for these shares by the following:

|

·

|

Sina Dragon Holdings Limited assigned, to Mr. Gong, its right to be repaid $51,282 by AAGH, and Mr. Lim – Kwong Liang assigned his right to be repaid $30,416 (being the balance as of June 30, 2011) by AAGH. Mr. Gang Dong has cancelled his right to be paid the balance of the advances ($81,698) which AAGH owed to him as a result of the assignments by Sina Dragon and Mr. Lim-Kwong Liang.

|

|

·

|

Mr. Gang Dong has paid, from his personal funds, $50,000 to a consultant for one month of services to AAGH (until July 20, 2011) for corporate restructuring advice to position AAGH for in the market for reverse merger candidates for AAGH. There are no candidates identified, and there are no discussions with any such candidates, as of the date of this Information Statement.

|

|

·

|

Mr. Gang Dong has paid $21,000, from his personal funds, for legal fees related to this Information Statement, the Form 8-K filed on June 30, 2011, and related Nevada corporate work.

|

These payments are subject to the implementation of the Series B Preferred Acton by the filing with the Nevada Secretary of State, as discussed above. If for any reason this Action is not so implemented, that portion of the payments consisting of Mr. Gang Dong’s cancellation of the net debt owed to him by AAGH will be rescinded. The remaining portions of the payment will not be affected, and will be booked as advances to AAGH.

The total of the preceding is $152,698, which represents an effective conversion price of $0.003 per common share when and if Mr. Gang Dong converts all of his Series B Preferred Stock to common stock. AAGH stock was traded on low volume for the 52 weeks ended July 5, 2011, generally at prices in the general range of $0.001 to $0.002, until a recent increase (late June and early July).

AAGH believes the effective conversion price of $0.003 per common share is appropriate, because the common stock issuable on conversion will be, when issued, subject to the limited resale provisions of Rule 144 applicable to affiliates (such as Mr. Gang Dong), but if the conversion occurs while AAGH is a shell company, resales by him are not possible. Further, even if AAGH becomes an operating company through a reverse merger with an operating company, Rule 144 will be inaccessible by Mr. Gang Dong until the first anniversary of the filing with the SEC of a Form 8-K reporting the merger and including complete information about the operating company.

If Mr. Gang Dong were to convert all of his Series B shares to common shares, then, on a pro forma basis using the 292,138 shares issued and outstanding after the Reverse Split, he would own 50,183,500 common shares (99.8% of the issued and outstanding 50,292,138 common shares). As noted above, he has paid for the Series B shares, and the Designation of the Series B Preferred Shares does not require additional payment to AAGH at such time as he converts to common shares.

Under Nevada law and the Company’s articles of incorporation, the establishment of the Series B Preferred Stock and the issuance of 250,000 Series B shares to Mr. Gang Dong, required approval of the stockholders, because Nevada law requires amendments to the articles of incorporation. However, under SEC regulations (see “Effective Date” below), even though Mr. Gang Dong already has approved these matters, their taking effect will not occur until on or immediately after August 4, 2011.

Effective Date

The Reverse Split Action and the Series B Preferred Action both were unanimously approved by the Board by written consent, and on the same day (July 5, 2011), the Voting Stockholder (Mr. Gang Dong) approved these Actions, subject to SEC rules (see below).

This Information Statement is being made available on or about July 16, 2011 to the Company’s stockholders of record as of the Record Date. The Actions will be effective when the Company’s Amendments to its Articles of Incorporation (one for the Reverse Split and one for establishing the Series B Preferred Stock), are filed with the Nevada Secretary of State, which we expect with be made on or immediately after August 4, 2011 (which is more than 20 calendar days after this Information Statement is first sent to our stockholders). This 20 day waiting period before implementation of the Actions by filings with the Nevada Secretary of State, is required by the SEC’s rules concerning Information Statements, which govern when the taking of corporate actions by consent instead of an actual meeting of all shareholders can take effect.

The expenses of distributing this Information Statement will be borne by the Company, including expenses in connection with the preparation and mailing of this Information Statement and all documents that now accompany or may in the future supplement it. The Company contemplates that brokerage houses, custodians, nominees, and fiduciaries will forward this Information Statement to the beneficial owners of the Company’s common stock held of record by these persons and the Company will reimburse them for their reasonable expenses incurred in this process.

Dissenters’ Rights of Appraisal

The Reverse Split Action will not provide for issuance of “scrip” or a “cash payment” in the event of a stockholder being entitled to less than a full share following the Reverse Split. Rather, all such stockholders will receive one full share of the Common Stock after the Reverse Split takes effect. Accordingly, under the NRS, Company stockholders are not entitled to dissenters’ rights with respect to the Reverse Split Action.

Proposals by Security Holders

No stockholder has requested that we include any additional proposals in this Information Statement.

Record Date and Security Ownership of Certain Beneficial Owners and Management

As of the Record Date, the Company had 292,138,400 shares of its common stock issued and outstanding. The following table sets forth the beneficial ownership of the Company’s common stock as of the Record Date by each person who served as a director and/or an executive officer of the Company on that date, the number of shares beneficially owned by all of the Company’s directors and executive officers as a group, and any persons who beneficially own 5% or greater of the Company’s outstanding common stock as of the Record Date. Only one person, Mr. Gang Dong, was a director and executive officer and owner of more than 5% of the common stock outstanding on the Record. His business address for this disclosure is the Company’s address, Room 901, Haleson Building, 1 Jubilee Street, Central, Hong Kong.

|

Name and Address of Beneficial Owner

|

|

Amount of Beneficial Ownership

(1)

|

|

Percent of Class

(2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mr. Gang Dong, Sole Executive Officer, Sole Director, and Sole Owner of more than 5% of the Outstanding Stock

|

|

183,500,00

|

|

62.8%

|

|

|

|

|

|

|

|

Name of Beneficial Owner

|

|

Amount of Beneficial Ownership

(1)

|

|

|

Percent of Class

(2)

|

|

|

Options and Warrants Exercisable Within 60 Days

|

|

|

Total

|

|

|

Percent of Class – Total

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Executive Officers and Directors

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mr. Gang Dong, Sole Officer and Director

|

|

|

183,500,00

|

|

|

|

62.8

|

%

|

|

|

--

|

|

|

|

183,500,000

|

|

|

|

62.8

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All directors and executive officers as a group (one persons)

|

|

|

183,500,000

|

|

|

|

62.8% 98.1

|

%

|

|

|

--

|

|

|

|

183,500,000

|

|

|

|

62.8

|

%

|

______________________

Interested Party Disclosure

The Company believes that Mr. Dong, sole officer and director, has no direct or indirect interest in the Reverse Split Action. He has a direct personal interest in The Series B Preferred Action, but he (being the only director) believes that payment for the Series B Preferred Shares is fair and reasonable to the Company and its shareholders.

ADDITIONAL INFORMATION

Information Available

The Company is subject to the information and reporting requirements of the Exchange Act and in accordance with the Exchange Act, the Company files periodic reports, documents and other information with the SEC relating to its business, financial statements and other matters, including the Company’s annual report on Form 10-K for the year ended March 31, 2010, its quarterly report on Form 10-Q for the quarter ended March 31, 2011, and any reports prior to or subsequent to that date.

These reports and other information filed with the SEC by the Company may be inspected and are available for copying at the public reference facilities maintained at the Securities and Exchange Commission at 100 F Street NW, Washington, D.C. 20549.

The Company’s filings with the Securities and Exchange Commission are also available to the public from the SEC’s website, http://www.sec.gov. The Company’s Annual Report on Form 10-K for the year ended March 31, 2010, and other reports filed under the Securities Exchange Act of 1934, are also available to any stockholder at no cost upon request to: President, Asia Global Holdings Corp.,of Room 901, Haleson Building, 1 Jubilee Street, Central, Hong Kong.

Delivery Of Documents To Security Holders Sharing An Address

If hard copies of the materials are requested, we will send only one Information Statement and other corporate mailings to stockholders who share a single address unless we receive contrary instructions from any stockholder at that address. This practice, known as “householding,” is designed to reduce our printing and postage costs. However, the Company will deliver promptly upon written or oral request a separate copy of the Information Statement to a stockholder at a shared address to which a single copy of the Information Statement was delivered. You may make such a written or oral request by

(a)

sending a written notification stating (i) your name and telephone number, (ii) your shared address and (iii) the address to which the Company should direct the additional copy of the Information Statement, to Rhonda Singleton, at Corporate Stock Transfer, 3200 Cherry Creek Drive North Dr., Suite 430, Denver, Colorado 80209; or

(b)

by e-mail to

rsingleton@corporatestock.com

. Corporate Stock’s telephone number is 303.282.4800.

If multiple stockholders sharing an address have received one copy of this Information Statement or any other corporate mailing and would prefer the Company to mail each stockholder a separate copy of future mailings, you may send notification to or call Corporate Stock Transfer, as above provided. Additionally, if current stockholders with a shared address received multiple copies of this Information Statement or other corporate mailings and would prefer to receive only one copy of future mailings to stockholders at the shared address, notification of such request may also be made by to Corporate Stock Transfer.

The materials also can be viewed at the SEC’s website,

www.sec.gov

. Go to “Company or Firm name . . .”, then type in Asia Global Holdings Corp.

By Order of the Board of Directors

/s/ Mr. Gang Dong,

President, Chief Executive Officer and Director

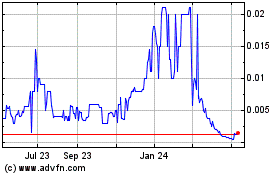

America Great Health (PK) (USOTC:AAGH)

Historical Stock Chart

From Apr 2024 to May 2024

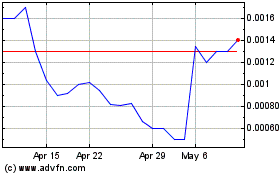

America Great Health (PK) (USOTC:AAGH)

Historical Stock Chart

From May 2023 to May 2024