Commission File No.

000-52861

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 10-K

x

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT

OF 1934

For the Fiscal Year Ended: April 30, 2010

o

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For the Transition Period From __ to __

|

BELLTOWER ENTERTAINMENT CORP.

|

|

(Exact Name of Small Business Issuer as Specified in its Charter)

|

|

NEVADA

|

|

47-0926554

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

|

11684 Ventura Boulevard, Suite 685

Studio City, CA

|

|

91604

|

|

(Address of principal executive offices)

|

|

(Zip code)

|

Issuer's telephone number:

(877) 355-1388

Securities to be registered pursuant to Section 12(b) of the Act:

None

Securities to be registered pursuant to Section 12(g) of the Act:

$.001 Common Stock

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer,

as defined in Rule 405 of the Securities Act. Yes

o

No

x

Indicate by check mark if the registrant is not required to file reports

pursuant to Section 13 or 15(d) of the Act. Yes

o

No

x

Indicate by check mark whether the Registrant (1) has filed all reports

required to be filed by Section 13 or 15(d) of the Securities Exchange Act of

1934 during the preceding 12 months (or for such shorter period that the

Registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days. Yes

x

No

o

Indicate by check mark whether the registrant has submitted electronically

and posted on its corporate Web site, if any, every Interactive Data File

required to be submitted and posted pursuant to Rule 405 of Regulation S-T (ss.

232.405 of this chapter) during the preceding 12 months (or for such shorter

period that the registrant was required to submit and post such files). Yes

o

No

x

Indicate by check mark if disclosure of delinquent filers pursuant to Item

405 of Regulation S-K is not contained herein, and will not be contained, to the

best of the Registrant's knowledge, in definitive proxy or information

statements incorporated by reference in Part III of this Form 10-K or any

amendment to this Form 10-K.

o

Indicate by check mark whether the registrant is a large accelerated filer,

an accelerated filer, a non-accelerated filer or a smaller reporting company.

See definitions of "large accelerated filer," "accelerated filer" and "smaller

reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

|

Non-accelerated filer

|

o

(Do not check if a smaller reporting company)

|

Smaller reporting company

|

x

|

Indicate by check mark whether the registrant is a shell company (as

defined in Rule 12b-2 of the Securities Exchange Act of 1934). Yes

o

No

x

The aggregate market value of the Registrant's Common Stock held by

non-affiliates of the Registrant (without admitting that any person whose shares

are not included in such calculation is an affiliate) computed by reference to

the price at which the common stock was last sold as of the last business day of

the Registrant's most recently completed second fiscal quarter was $3,501,000.

As of April 30, 2010, the Registrant had 47,646,924 shares of Common Stock,

$0.0001 par value, issued and outstanding. As of the date hereof, the Registrant

had 48,116,923 shares of Common Stock, $0.001 par value, issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None

TABLE OF CONTENTS

|

|

|

|

Page

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 1.

|

Business

|

|

1

|

|

|

|

|

|

|

|

|

|

Item 1A.

|

Risk Factors

|

|

|

2

|

|

|

|

|

|

|

|

|

|

Item 1B.

|

Unresolved Staff Comments

|

|

|

6

|

|

|

|

|

|

|

|

|

|

Item 2.

|

Properties

|

|

|

6

|

|

|

|

|

|

|

|

|

|

Item 3.

|

Legal Proceedings

|

|

|

6

|

|

|

|

|

|

|

|

|

|

Item 4.

|

Submission of Matters to a Vote of Security Holders

|

|

|

6

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 5.

|

Market for Registrant's Common Equity, Related Stockholder

Matters and Issuer Purchases of Equity Securities

|

|

|

7

|

|

|

|

|

|

|

|

|

|

Item 6.

|

Selected Financial Data

|

|

|

9

|

|

|

|

|

|

|

|

|

|

Item 7.

|

Management's Discussion and Analysis of Financial Condition

and Results of Operations

|

|

|

9

|

|

|

|

|

|

|

|

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

|

|

10

|

|

|

|

|

|

|

|

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

|

|

10

|

|

|

|

|

|

|

|

|

|

Item 9.

|

Changes in and Disagreements With Accountants on Accounting

and Financial Disclosure

|

|

|

11

|

|

|

|

|

|

|

|

|

|

Item 9A.

|

Controls and Procedures

|

|

|

11

|

|

|

|

|

|

|

|

|

|

Item 9B

|

Other Information

|

|

|

11

|

|

|

|

|

|

|

|

|

|

|

PART III

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

|

|

12

|

|

|

|

|

|

|

|

|

|

Item 11.

|

Executive Compensation

|

|

|

14

|

|

|

|

|

|

|

|

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and

Management and Related Stockholder Matters

|

|

|

14

|

|

|

|

|

|

|

|

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director

Independence

|

|

|

16

|

|

|

|

|

|

|

|

|

|

Item 14.

|

Principal Accountant Fees and Services

|

|

|

16

|

|

|

|

|

|

|

|

|

|

|

PART IV

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

|

|

17

|

|

|

|

|

|

|

|

|

|

Signatures

|

|

|

|

18

|

|

PART I

ITEM 1. BUSINESS.

Belltower Entertainment Corp, formerly Britton International Inc.

(sometimes the "Company") is a Nevada corporation incorporated on August 1,

2003. On September 5, 2008, we acquired all of the outstanding shares of capital

stock of CaliCo Entertainment Group, Inc. ("CaliCo) from the shareholders of

CaliCo and the Company (directly or through Calico) is currently engaged in the

production, as an independent filmmaker, and in distribution of feature length

and shorter length movies.

The Company believes that the entertainment industry is experiencing major

market expansion along with major structural and technological change. Although

the industry is dominated by the major studios, the Company believes that there

is still opportunity for independent filmmakers in the domestic and foreign

markets.

We currently own a 20% revenue interest in an original literary composition

and completed film project called "Stuck" that we acquired from Prodigy Pictures

Inc. in 2007; said revenue interest is subject to the repayment of prior

financing on the film from the net proceeds from distribution. Our interest and

participation in the investment is passive and we will be relying upon Prodigy

Pictures Inc. to monitor the investment. Prodigy Pictures Inc. currently owns a

40% revenue interest in the film and owns approximately 2% of our issued and

outstanding common stock.

In addition, we are in the process of developing a production slate of

future projects. We are developing a film project currently known as "Dance the

Green," a story of a legendary golfer named Moe Norman. Further, we are

developing a film project currently known as "A Kid for Christmas," a family

comedy. Further, we are currently negotiating for other potential feature film

projects. We anticipate that any selection of a film project and our

participation in the venture may be complex and extremely risky. Further, there

can be no assurance that any of our production slate will be completed or if

completed, successful. Due to current general economic condition and the

shortages of available capital, there is no assurance that we will be able to

identify and evaluate other suitable film projects.

We intend to use outside financing wherever it is possible for our film

projects. This ability will allow the Company to attract higher quality

independent projects. Typically a single purpose entity specific to the film

project is established to produce and finance the film. We have formed Y2K

Productions, Inc., 3A Productions Corp, and 19

th

Holl Productions, LLC to serve as these entities. This

entity, with the Company or CaliCo, then contracts with the financing parties

and the owners of the film project. We will be competing, however, with other

established and well-financed entities. Our competitive advantage is that we

will be able to provide the targeted independent project with less production

restrictions and a larger ownership in the completed project. We further have

had preliminary negotiations, at a favorable cost, with established production

facilities in Canada and China. There is no assurance that these negotiations

will result in enhancing or increasing our competitive advantage, if any, or

result in us utilizing the production facility or completing a film project.

ITEM 1A. RISK FACTORS.

1. The film industry is highly competitive and we will be competing with

companies with much greater resources than we have.

The business in which we engage is significantly competitive. Each of our

primary business operations is subject to competition from companies which, in

some instances, have greater production, distribution and capital resources than

us. We compete for relationships with a limited supply of facilities and

talented creative personnel to produce our films. We will compete with major

motion picture studios, such as Warner Brothers and The Walt Disney Company, for

the services of writers, actors and other creative personnel and specialized

production facilities. We also anticipate that we will compete with a large

number of United States-based and international distributors of independent

films, including divisions of The Walt Disney Company/Pixar, Warner Brothers,

Universal, Paramount/Dreamworks, Fox and Sony/MGM in the production of films

expected to appeal to international audiences. More generally, we anticipate we

will compete with various other leisure-time activities, such as home videos,

movie theaters, personal computers and other alternative sources of

entertainment.

The production and distribution of theatrical productions, television

animation, videocassettes and video disks are significantly competitive

businesses, as they compete with each other, in addition to other forms of

entertainment and leisure activities, including video games and on-line

services, such as the Internet. There is also active competition among all

production companies in these industries for services of producers, directors,

actors and others and for the acquisition of literary properties. The increased

number of theatrical films released in the United States has resulted in

increased competition for theater space and audience attention. Revenues for

film entertainment products depend in part on general economic conditions, but

the competitive situation of a producer of films is still greatly affected by

the quality of, and public response to, the entertainment product that the

producer makes available to the marketplace.

There is strong competition throughout the home video industry, both from

home video subsidiaries of several major motion picture studios and from

independent companies, as well as from new film viewing opportunities such as

pay-per-view.

We also anticipate competing with several major film studios such as

Paramount Communications/Dreamworks SGA, MCA/Universal, Sony Pictures

Entertainment/ MGM/UA Inc, Twentieth Century Fox; Time Warner; and Disney/Pixar,

which are dominant in the motion picture industry, in addition to numerous

independent motion picture and television production companies, television

networks and pay television systems, for the acquisition of literary properties,

the services of performing artists, directors, producers, other creative and

technical personnel, and production financing.

2. Audience acceptance of our films will determine our success, and the

prediction of such acceptance is inherently risky.

We believe that a production's theatrical success is dependent upon general

public acceptance, marketing, advertising and the quality of the production.

The Company's production will compete with numerous independent and foreign

productions, in addition to productions produced and distributed by a number of

major domestic companies, many of which are divisions of conglomerate

corporations with assets and resources substantially greater than that of ours.

Our management believes that in recent years there has been an increase in

competition in virtually all facets of our business. The growth of pay-per-view

television and the use of home video products may have an effect upon theater

attendance and non-theatrical motion picture distribution. As we may distribute

productions to all of these markets, it is not possible to determine how our

business will be affected by the developments, and accordingly, the resultant

impact on our financial statements. Moreover, audience acceptance can be

affected by any number of things over which we cannot exercise control, such as

a shift in leisure time activities or audience acceptance of a particular genre,

topic or actor

3. The competition for booking screens may have an adverse effect to any

theatrical revenues.

In the distribution of motion pictures, there is very active competition to

obtain bookings of pictures in theaters and television networks and stations

throughout the world. A number of major motion picture companies have acquired

motion picture theaters. Such acquisitions may have an adverse effect on our

distribution endeavors and our ability to book certain theaters which, due to

their prestige, size and quality of facilities, are deemed to be especially

desirable for motion picture bookings.

4. Governmental restrictions may adversely affect our revenues.

In addition, our ability to compete in certain foreign territories with

either film or television product is affected by local restrictions and quotas.

In certain countries, local governments require that a minimum percentage of

locally produced productions be broadcast, thereby further reducing available

time for exhibition of our productions. Additional or more restrictive

theatrical or television quotas may be enacted and countries with existing

quotas may more strictly enforce such quotas.

Additional or more restrictive quotas or stringent enforcement of existing

quotas could materially and adversely affect our business by limiting our

ability to fully exploit our productions internationally.

5. We have limited financial resources and there are risks we may be unable to

acquire financing when needed.

To achieve and maintain competitiveness, we may be required to raise

substantial funds. Our forecast for the period for which our financial resources

will be adequate to support our operations involves risks and uncertainties and

actual results could fail as a result of a number of factors. We anticipate that

we may need to raise additional capital to develop, promote and distribute our

films. Such additional capital may be raised through public or private financing

as well as borrowings and other sources. Public or private offerings may dilute

the ownership interests of our stockholders. Additional funding may not be

available under favorable terms, if at all. If adequate funds are not available,

we may be required to curtail Operations significantly or to obtain funds

through entering into arrangements with collaborative partners or others that

may require us to relinquish rights to certain products and services that we

would not otherwise relinquish and thereby reduce revenues to the company.

6. We are at risk of internet competition which may develop and the effects of

which we cannot predict.

The Internet market is new, rapidly evolving and intensely competitive. We

believe that the principal competitive factors in maintaining an Internet

business are selection, convenience of download and other features, price, speed

and accessibility, customer service, quality of image and site content, and

reliability and speed of fulfillment. Many potential competitors have longer

operating histories, more customers, greater brand recognition, and

significantly greater financial, marketing and other resources. In addition,

larger, well-established and well- financed entities may acquire, invest in, or

form joint ventures as the Internet, and e-commerce in general, become more

widely accepted. Although we believe that the diverse segments of the Internet

market will provide opportunities for more than one supplier of productions

similar to CaliCo's, it is possible that a single supplier may dominate one or

more market segments. We also have significant competition from online websites

in international markets, including competition from US-based competitors in

addition to online companies that are already well established in those foreign

markets. Many of our existing competitors, in addition to a number of potential

new competitors, have significantly greater financial, technical and marketing

resources than we do.

7. We are at risk of technological changes to which we may be unable to adapt

as swiftly as our competition.

We believe that our future success will be partially affected by continued

growth in the use of the Internet. E-commerce and the distribution of goods and

services over the Internet for film product are relatively new, and predicting

the extent of further growth, if any, are difficult. The market for Internet

products and services is characterized by rapid technological developments,

evolving industry standards and customer demands and frequent new product

introductions and enhancements. For example, to the extent that higher bandwidth

Internet access becomes more widely available using cable modems or other

technologies, we may be required to make significant changes to the design and

content of our films and distribution process in order to compete effectively.

Our failure to adapt to these or any other technological developments

effectively could adversely affect our business, operating results, and

financial condition.

8. We face risks of compliance with government regulation of the film

industry.

The following does not purport to be a summary of all present and proposed

federal, state and local regulations and legislation relating to the production

and distribution of film entertainment and related products; rather, the

following attempts to identify those aspects that could affect our business.

Also, other existing legislation and regulations, copyright licensing, and, in

many jurisdictions, state and local franchise requirements, are currently the

subject of a variety of judicial proceedings, legislative hearings and

administrative and legislative proposals which could affect, in various manners,

the methods in which the industries involved in film entertainment operate.

Audiovisual works such as motion pictures and television programs are not

included in the terms of the General Agreement on Tariffs and Trade. As a

result, many countries, including members of the European Union, are able to

enforce quotas that restrict the number of United States produced feature films

which may be distributed in such countries. Although the quotas generally apply

only to television programming and not to theatrical exhibitions of motion

pictures, there can be no assurance that additional or more restrictive

theatrical or television quotas will not be enacted or that existing quotas will

not be more strictly enforced. Additional or more restrictive quotas or more

stringent enforcement of existing quotas could materially or adversely limit our

ability to exploit our productions completely. The Office of the United States

Trade Representative (USTR) under the Executive Office of the President cites

such restrictive trade practices in Korea, China, and the European Union as a

whole with even more restrictive practices in France, Italy and Spain.

Voluntary industry embargos or United States government trade sanctions to

combat piracy, if enacted, could impact the amount of revenue that we realize

from the international exploitation of our film productions.

The Code and Ratings Administration of the Motion Picture Association of

America assigns ratings indicating age group suitably for the theatrical

distribution for motion pictures. United States television stations and

networks, in addition to foreign governments, could impose additional

restrictions on the content of motion pictures which may restrict, in whole or

in part, theatrical or television exhibitions in particular territories.

Congress and the Federal Trade Commission are considering, and in the future may

adopt, new laws, regulations and policies regarding a wide variety of matters

that may affect, directly or indirectly, the operation, ownership and profitably

of our business.

9. The motion picture industry is at high risk for piracy which may effect our

earnings.

The motion picture industry, including us, may continue to lose an

indeterminate amount of revenue as a result of motion picture piracy both in the

country to unauthorized copying from our films at post production houses, copies

of prints in circulation to theaters, unauthorized video taping at theaters and

other illegal means of acquiring our copywritten material. The USTR has placed

Argentina, Brazil, Egypt, Indonesia, Israel, Kuwait, Lebanon, Pakistan, the

Philippines, Russia, The Ukraine and Venezuela on the 301 Special Watch List for

excessive rates of piracy of motion pictures and optical disks. The USTR has

placed Azerbaijan, Bahamas, Belarus, Belize, Bolivia, Bulgaria, Colombia, the

Dominican Republic, Ecuador, Hungary, Italy, Korea, Latvia, Lithuania, Mexico,

Peru, Romania, Taiwan, Tajikistan, Thailand, and Uzbekistan on the watch list

for excessive piracy.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

The Securities and Exchange Commission has made a limited review of our

financial statements as contained in our Form 10-KSB for the fiscal year ended

April 30, 2008, filed on August 13, 2008 and our Form 10-Q for the fiscal

quarter ended July 31, 2008 filed on September 22, 2008. The financial

statements, and other information contained in this and prior Form 10-Ks have been prepared

by the Company and its auditors after giving consideration to the comments

of the

Until such time as the amendments may have been filed and the

Securities and Exchange Commission has completed the review of the amendments,

the comments remain unresolved.

ITEM 2. PROPERTIES.

We utilize an executive office and mailing service at 11684 Ventura Boulevard,

Suite 685, Studio City, California 91604. This space is located near the major

production studios in Los Angeles County. The Company intends to maintain an

office at the production studios during primary filming (usually furnished

without cost) and it is anticipated that this arrangement will remain until such

time as the Company completes the production of a film property. Until we

complete production of a film property, we believe that this arrangement will

meet our initial needs. Thereafter, we will need to obtain alternate space and

that space is readily available in Studio City, California.

ITEM 3. LEGAL PROCEEDINGS.

There is no litigation pending or threatened by or against the Company.

ITEM 4. SUBMISSION OF MATTERS TO VOTE OF SECURITY HOLDERS.

There have been no matters submitted to the Company's security holders.

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND

ISSUER PURCHASES OF EQUITY SECURITIES.

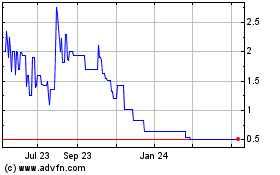

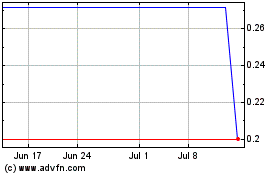

(a) Market Price.

The Company's common stock is publicly traded in the over-the-counter

market in the OTC Bulletin Board System under the ticker symbol BTOW. The

following table sets forth the reported high and low prices of our common stock

for each quarter during fiscal 2010. The prices reflect inter-dealer prices without

mark-ups mark-downs, or commissions, and may not necessarily reflect actual transactions.

|

Fiscal Year Ended April 30, 2010

|

|

|

Quarter

|

|

High

|

|

|

Low

|

|

|

First

|

|

$

|

0.27

|

|

|

$

|

0.25

|

|

|

Second

|

|

$

|

0.21

|

|

|

$

|

0.18

|

|

|

Third

|

|

$

|

0.26

|

|

|

$

|

0.24

|

|

|

Fourth

|

|

$

|

0.20

|

|

|

$

|

0.18

|

|

The Securities and Exchange Commission adopted Rule 15g-9, which

established the definition of a "penny stock," for purposes relevant to the

Company, as any equity security that has a market price of less than $5.00 per

share or with an exercise price of less than $5.00 per share, subject to certain

exceptions. For any transaction involving a penny stock, unless exempt, the

rules require: (i) that a broker or dealer approve a person's account for

transactions in penny stocks; and (ii) the broker or dealer receive from the

investor a written agreement to the transaction, setting forth the identity and

quantity of the penny stock to be purchased. In order to approve a person's

account for transactions in penny stocks, the broker or dealer must (i) obtain

financial information and investment experience and objectives of the person;

and (ii) make a reasonable determination that the transactions in penny stocks

are suitable for that person and that person has sufficient knowledge and

experience in financial matters to be capable of evaluating the risks of

transactions in penny stocks. The broker or dealer must also deliver, prior to

any transaction in a penny stock, a disclosure schedule prepared by the

Commission relating to the penny stock market, which, in highlight form, (i)

sets forth the basis on which the broker or dealer made the suitability

determination; and (ii) that the broker or dealer received a signed, written

agreement from the investor prior to the transaction. Disclosure also has to be

made about the risks of investing in penny stock in both public offering and in

secondary trading, and about commissions payable to both the broker-dealer and

the registered representative, current quotations for the securities and the

rights and remedies available to an investor in cases of fraud in penny stock

transactions. Finally, monthly statements have to be sent disclosing recent

price information for the penny stock held in the account and information on the

limited market in penny stocks.

(b) Holders.

There are sixty two (62) holders of the Company's Common Stock of record.

Currently, all of our issued and outstanding shares of Common Stock held by

non-affiliates are eligible for sale under Rule 144 promulgated under the

Securities Act of 1933, as amended, subject to certain limitations included in

said Rule. In general, under Rule 144, a person (or persons whose shares are

aggregated), who has satisfied a six month holding period, under certain

circumstances, has unlimited public resales under said Rule if the seller

complies with said Rule.

In summary, Rule 144 applies to affiliates (that is, control persons) and

nonaffiliates when they resell restricted securities (those purchased from the

issuer or an affiliate of the issuer in nonpublic transactions) issued by a

shell company. Nonaffiliates reselling restricted securities, as well as

affiliates selling restricted or nonrestricted securities, are not considered to

be engaged in a distribution and, therefore, are not deemed to be underwriters

as defined in Section 2(11) if the seller complies with said Rule.

(c) Dividends.

We have declared no stock or cash dividends and we do not intend to declare

or pay any dividends in the future.

(d) Application of California law.

Section 2115 of the California General Corporation law provides that a

corporation incorporated under the laws of a jurisdiction other than California,

but which has more than one-half of its "outstanding voting securities" and

which has a majority of its property, payroll and sales in California, based on

the factors used in determining its income allocable to California on its

franchise tax returns, may be required to provide cumulative voting until such

time as the Company has its shares listed on certain national securities

exchanges, or designated as a national market security on NASDAQ (subject to

certain limitations). Accordingly, holders of our Common Stock may be entitled

to one vote for each share of Common Stock held and may have cumulative voting

rights in the election of directors. This means that holders are entitled to one

vote for each share of Common Stock held, multiplied by the number of directors

to be elected, and the holder may cast all such votes for a single director, or

may distribute them among any number of all of the directors to be elected.

(e) Purchases of Equity Securities.

We (and affiliated purchasers) have made no purchases or repurchases of any

securities of the Company or any other issuer.

(f) Securities Authorized for Issuance under an Equity Compensation Plan.

We have not authorized the issuance of any of our securities in connection

with any form of equity compensation plan.

(g) Recent Sale of Unregistered Securities

As of April 30, 2010,

we sold and issued an aggregate of 10,065,300 shares of

common stock at $0.10 per share for cash, cancellation of indebtness services.

The sale and issuance of the shares was exempt from registration

under the Securities Act of 1933, as amended, by virtue of section 4(2) as a

transaction not involving a public offering. Each of the two shareholders had

acquired the shares for investment and not with a view to distribution to the

public. All of these shares had been issued for investment purposes in a

"private transaction" and were "restricted" shares as defined in Rule 144 under

the Securities Act of 1933, as amended.

ITEM 6. SELECTED FINANCIAL DATA.

Not applicable to smaller reporting companies.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION and

RESULTS OF OPERATIONS.

RESULTS OF OPERATIONS FOR THE YEAR ENDED APRIL 30, 2010 AND 2009.

The following table presents the statements of operations for the year

ended April 30, 2010 as compared to the comparable period of April 30, 2009. The

discussion following the table is based on these results.

|

|

|

2010

|

|

|

2009

|

|

|

Revenue, net

|

|

$

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

|

|

$

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative expenses

|

|

|

-

|

|

|

|

31,020

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations

|

|

|

-

|

|

|

|

(31,020

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Other (Income) Expense

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

|

-

|

|

|

|

(10

|

)

|

|

Other (income) expense

|

|

|

|

|

|

|

-

|

|

|

Interest expense

|

|

|

-

|

|

|

|

1,603

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Other (Income) Expense

|

|

|

-

|

|

|

|

1,593

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) before income taxes

|

|

$

|

-

|

|

|

$

|

(32,613

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income tax

|

|

|

-

|

|

|

|

-

|

|

|

Net loss from discontinued operations

|

|

|

-

|

|

|

|

(20,492

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

$

|

-

|

|

|

$

|

(53,105

|

)

|

NET REVENUE

Net revenue for the years ended April 30, 2010 and 2009 totaled $0.

COST OF SALES

Cost of sales for the years ended April 30, 2010 and 2009 totaled $0.

OPERATING EXPENSE

General and administrative expenses for the year ended April 30, 2010

totaled $307,860, compared to $31,020 for the year ended April 30, 2009, an

increase of $276,840, or approximately 892%. The increase in general and

administrative expenses is primarily due to salary and professional fees (legal,

accounting and auditing) incurred of $186,670 in the current year end compared

to $29,134 for the prior year end.

In addition to the increases in salary and professional fees, during the

year 2009 Belltower incurred another $40,940 in expenses related to rental of

office space and $50,465 in travel and consulting expenses related to project

development.

Income (Loss) from Operations.

Income (loss) from operations for the year ended April 30, 2010 totaled

$(307,860), compared to $(31,020), for the year ended April 30, 2009, an

increase of $276,840, or approximately 892%. The increase in loss from

operations was primarily due to the reasons stated above.

NON-OPERATING EXPENSE

Non-operating expenses for the year ended April 30, 2010 totaled $3,166,

compared to $1,593 for the year ended April 30, 2009, an increase of $1,573, or

approximately 99%. The increase in non-operating expenses is due to an increase

in interest expense of $1,544 during the current year end.

NET LOSS

Net loss from operations for the year ended April 30, 2010 totaled

$(311,027), compared to $(53,105), for the year ended April 30, 2009, an

increase of $257,922, or approximately 486%. The decrease in net loss was

primarily due to the reasons stated above.

LIQUIDITY

As of April 30, 2009, Belltower had total assets of $258,811 and total

liabilities of $475,244 and we had a negative net worth of ($216,433). As of

April 30, 2010, Belltower had total assets of $1,506 and total liabilities of

$93,171 and a negative net worth of ($91,665).

As of April 30, 2010 The Company had a cash balance of $9,724, as of April

30, 2009 The Company had a cash balance of $910.

Belltower has had no revenues from May 1, 2009 through April 30, 2010. We

have an accumulated deficit from inception through April 30, 2010 of $494,130.

We had a related party advance of $62,195 as of April 30, 2009. As of April 30,

2009, the related party advance of $63,195 loaned at 5%

annual interest rate.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

Not applicable to smaller reporting companies.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

|

BELLTOWER ENTERTAINMENT CORP.

|

|

|

|

|

|

CONSOLIDATED BALANCE SHEETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

April 30,

|

|

|

|

|

2010

|

|

|

2009

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Assets

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

45,674

|

|

|

$

|

9,724

|

|

|

Receivables - Other

|

|

|

1,465

|

|

|

|

-

|

|

|

Deposits

|

|

|

750,000

|

|

|

|

-

|

|

|

Prepaid expenses

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Current Assets

|

|

|

797,139

|

|

|

|

9,724

|

|

|

|

|

|

|

|

|

|

|

|

|

Fixed assets, net

|

|

|

6,725

|

|

|

|

7,586

|

|

|

Film costs

|

|

|

354,089

|

|

|

|

46,618

|

|

|

Goodwill

|

|

|

164,884

|

|

|

|

164,884

|

|

|

Intangible assets

|

|

|

10,000

|

|

|

|

30,000

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Assets

|

|

$

|

1,332,837

|

|

|

$

|

258,811

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' (DEFICIT)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Liabilities

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$

|

143,037

|

|

|

$

|

32,767

|

|

|

Loans payable

|

|

|

1,140,025

|

|

|

|

-

|

|

|

Due to related parties

|

|

|

-

|

|

|

|

325,042

|

|

|

Accrued liabilities

|

|

|

93,531

|

|

|

|

110,577

|

|

|

Accrued interest

|

|

|

16,236

|

|

|

|

6,857

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Current Liabilities

|

|

|

1,392,829

|

|

|

|

475,244

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS' EQUITY (DEFICIT)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common shares, 50,000,000 shares with par value $0.0001

|

|

|

|

|

|

|

|

|

|

authorized, and 47,296,924 issued and outstanding as of

|

|

|

|

|

|

|

|

|

|

April 30, 2010 and 37,231,424 as of April 30, 2009

|

|

|

1,607

|

|

|

|

602

|

|

|

Additional paid in capital

|

|

|

1,292,638

|

|

|

|

277,094

|

|

|

Retained deficit

|

|

|

(1,354,237

|

)

|

|

|

(494,130

|

)

|

|

Retained deficit from development stage

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Stockholders' Equity (Deficit)

|

|

|

(59,992

|

)

|

|

|

(216,433

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities and Stockholders' Equity (Deficit)

|

|

$

|

1,332,837

|

|

|

$

|

258,811

|

|

The accompanying notes are an integral part of these audited consolidated financial statements.

|

BELLTOWER ENTERTAINMENT CORP.

|

|

|

|

|

|

CONSOLIDATED STATEMENTS OF OPERATIONS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Years Ended April 30,

|

|

|

|

|

2010

|

|

|

2009

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

$

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

General, selling and

|

|

|

|

|

|

|

|

|

|

administrative expenses

|

|

|

796,093

|

|

|

|

307,860

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss from operations

|

|

|

(796,093

|

)

|

|

|

(307,860

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Nonoperating income ( expense )

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

|

8

|

|

|

|

3

|

|

|

Interest expense

|

|

|

(44,022

|

)

|

|

|

(3,147

|

)

|

|

Other income (expense) net

|

|

|

(20,000

|

)

|

|

|

(22

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Total nonoperating income ( expenses )

|

|

|

(64,014

|

)

|

|

|

(3,166

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss before provision for income tax

|

|

|

(860,107

|

)

|

|

|

(311,027

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes

|

|

|

-

|

|

|

|

-

|

|

|

Net loss from discontinued operations

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

|

(860,107

|

)

|

|

|

(311,027

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share:

|

|

|

|

|

|

|

|

|

|

Basic and Diluted

|

|

$

|

(0.0211

|

)

|

|

$

|

(0.0085

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of shares outstanding:

|

|

|

|

|

|

|

|

|

|

Basic and Diluted

|

|

|

40,727,659

|

|

|

|

36,625,841

|

|

The accompanying notes are an integral part of these audited consolidated financial statements.

|

BELLTOWER ENTERTAINMENT CORP.

|

|

|

|

|

|

CONSOLIDATED STATEMENTS OF CASH FLOW

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Years Ended April 30,

|

|

|

|

|

2010

|

|

|

2009

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(860,107

|

)

|

|

$

|

(311,027

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments to reconcile net loss to net cash

|

|

|

|

|

|

|

|

|

|

used in operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

3,829

|

|

|

|

9,316

|

|

|

Shares issued for professional fees

|

|

|

357,000

|

|

|

|

75,000

|

|

|

Impairment of intangible asset

|

|

|

20,000

|

|

|

|

-

|

|

|

(Increase) / decrease in current assets:

|

|

|

|

|

|

|

|

|

|

Film costs

|

|

|

(307,471

|

)

|

|

|

(46,618

|

)

|

|

Prepaid expenses

|

|

|

-

|

|

|

|

596

|

|

|

Accounts receivable

|

|

|

(1,465

|

)

|

|

|

-

|

|

|

Deposit

|

|

|

(750,000

|

)

|

|

|

-

|

|

|

Increase / (decrease) in current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

|

110,270

|

|

|

|

15,501

|

|

|

Accrued interest

|

|

|

9,379

|

|

|

|

3,147

|

|

|

Accrued expenses

|

|

|

(17,046

|

)

|

|

|

25,577

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Adjustments

|

|

|

(575,505

|

)

|

|

|

82,520

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash used in operating activities

|

|

|

(1,435,612

|

)

|

|

|

(228,506

|

)

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Cash acquired during acquisition

|

|

|

-

|

|

|

|

(432

|

)

|

|

Purchase of fixed assets

|

|

|

(2,968

|

)

|

|

|

(16,902

|

)

|

|

Purchase of intangible assets

|

|

|

-

|

|

|

|

(10,000

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net cash used in investing activities

|

|

|

(2,968

|

)

|

|

|

(27,334

|

)

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds from issuance of common stock

|

|

|

301,000

|

|

|

|

20,658

|

|

|

Proceeds from loans

|

|

|

1,140,025

|

|

|

|

-

|

|

|

Proceeds from related party loans

|

|

|

33,505

|

|

|

|

243,995

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by investing activities

|

|

|

1,474,530

|

|

|

|

264,653

|

|

|

|

|

|

|

|

|

|

|

|

|

Net increase/(decrease) in cash and cash equivalents

|

|

|

35,951

|

|

|

|

8,814

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents, beginning of year

|

|

|

9,724

|

|

|

|

910

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents, end of year

|

|

$

|

45,674

|

|

|

$

|

9,724

|

|

The accompanying notes are an integral part of these audited consolidated financial statements.

|

BELLTOWER ENTERTAINMENT, INC.

|

|

|

CONSOLIDATED STATEMENT OF STOCKHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deficit Accumulated

|

|

|

Total

|

|

|

|

|

|

|

|

Capital Stock

|

|

|

Additional

|

|

|

Comprehensive

|

|

|

(Accumulated deficit) Retained

|

|

|

During the Development

|

|

|

Stockholders'

|

|

|

|

|

Shares

|

|

|

Amount

|

|

|

Paid in Capital

|

|

|

Income

|

|

|

Earnings

|

|

|

Stage

|

|

|

Equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance April 30, 2007

|

|

|

110,703,135

|

|

|

$

|

738

|

|

|

$

|

70,699

|

|

|

$

|

(338

|

)

|

|

$

|

(129,997

|

)

|

|

$

|

-

|

|

|

$

|

(58,898

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common shares issued for cash at $0.25 on July 20, 2007

|

|

|

1,200,000

|

|

|

|

8

|

|

|

|

19,992

|

|

|

|

|

|

|

|

|

|

|

|

-

|

|

|

|

20,000

|

|

|

(Note 6)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock cancellation October 1, 2007 (Note 6)

|

|

|

(76,500,000

|

)

|

|

|

(510

|

)

|

|

|

510

|

|

|

|

|

|

|

|

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss during Period from May 1, 2007 to October 2, 2007

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

338

|

|

|

|

(20,492

|

)

|

|

|

-

|

|

|

|

(20,154

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss for during Period from October 3, 2007 to April 30, 2008

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(32,613

|

)

|

|

|

(32,613

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance April 30, 2008

|

|

|

35,403,135

|

|

|

$

|

236

|

|

|

$

|

91,201

|

|

|

$

|

-

|

|

|

$

|

(150,489

|

)

|

|

$

|

(32,613

|

)

|

|

$

|

(91,665

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of stock in exchange of 100% of issued and outstanding

|

|

|

1,725,000

|

|

|

|

345

|

|

|

|

165,255

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

165,600

|

|

|

shares of Calico Entertainment Group Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of shares for cash on May 28, 2008 at $0.10

|

|

|

103,289

|

|

|

|

21

|

|

|

|

20,637

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20,658

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transfer from development stage entity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(32,614

|

)

|

|

|

32,613

|

|

|

|

(1

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss for the year ended April 30, 2009

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(311,027

|

)

|

|

|

|

|

|

|

(311,027

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance April 30, 2009

|

|

|

37,231,424

|

|

|

$

|

602

|

|

|

$

|

277,094

|

|

|

$

|

-

|

|

|

$

|

(494,130

|

)

|

|

$

|

-

|

|

|

$

|

(216,434

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of 9,465,500 shares

|

|

|

10,065,500

|

|

|

|

1,006

|

|

|

|

1,015,544

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

1,016,550

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss for the year ended April 30, 2010

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(860,107

|

)

|

|

|

|

|

|

|

(860,107

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance April 30, 2010

|

|

|

47,296,924

|

|

|

$

|

1,607

|

|

|

$

|

1,292,638

|

|

|

$

|

-

|

|

|

$

|

(1,354,237

|

)

|

|

$

|

-

|

|

|

$

|

(59,992

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these audited consolidated financial statements.

BELLTOWER ENTERTAINMENT CORP.

Notes to Consolidated Financial Statements

April 30, 2010

Note 1 – Nature of Operations

Belltower Entertainment Corp. (“Belltower”, “We”, or the “Company”) was incorporated in the State of Nevada on August 1, 2003.

On September 5, 2008, the Company acquired all of the issued and outstanding stock of Calico Entertainment Group, Inc. in exchange for 1,725,000 (reverse split adjusted) newly issued shares of Belltower. Upon completion of the transaction the shareholders of Calico owned approximately 5% of the issued and outstanding shares of Belltower.

On April 28, 2008 a corporation was formed under the laws of the State of Nevada called Belltower Entertainment Corp. and on September 15, 2008, Britton International Inc. acquired one hundred shares of its common stock for cash. As such, Belltower Entertainment Corp. became a wholly-owned subsidiary of Britton.

On September 24, 2008, Belltower was merged with and into Britton. As a result of the merger, the corporate name of Britton was changed to “Belltower Entertainment Corp.”

Our fiscal year end is April 30th.

On September 15, 2008 a corporation was formed under the laws of the Sate of Nevada named 3A Productions Corp. and on September 15, 2008, Belltower Entertainment Corp. acquired one hundred shares of its common stock (100% of the issued and outstanding shares on that date). As such, 3A Productions Corp. became a wholly-owned subsidiary of Belltower Entertainment Corp.

On September 19, 2008 a corporation was formed under the laws of the Sate of California named Y2K Productions, Inc. and on September 19, 2008, Belltower Entertainment Corp. acquired one hundred shares of its common stock (100% of the issued and outstanding shares on that date). As such, Y2K Productions Inc. became a wholly-owned subsidiary of Belltower Entertainment Corp.

On August 19, 2009 a Limited Liability Company (LLC) was formed under the laws of the State of Nevada and named 19th Hole Productions, LLC. Belltower Entertainment Corp. is the sole member of the LLC and as such is a wholly owned subsidiary.

Belltower Entertainment Corp., through its wholly owned subsidiaries, Calico Entertainment Group, Y2K Productions, Inc. 19th Hole Productions, LLC and 3A Productions Corp. is a producer and distributor of feature length motion pictures.

Note 2 – Summary of Significant Accounting Policies

This summary of significant accounting policies is presented to assist in understanding Belltower Entertainment Corp.’s financial statements. The financial statements and notes are representations of the Company’s management, who are responsible for their integrity and objectivity. These accounting policies conform to generally accepted accounting principles in the United States of America and have been consistently applied in the preparation of the financial statements.

The financial statements reflect the following significant accounting policies:

Revenue Recognition

Revenues are recognized in accordance with AICPA Statement of Position (SOP) 00-2, "Accounting by Producers or Distributors of Films". Under SOP 00-2, revenue from the sale or licensing of a film should be recognized only when all five of the following conditions are met:

1. Persuasive evidence of a sale or licensing arrangement with a customer exists.

2. The film is complete and has been delivered or is available for immediate and unconditional delivery (in accordance with the terms of the arrangement).

3. The license period has begun and the customer can begin its exploitation, exhibition, or sale.

4. The fee is fixed or determinable.

5. Collection of the fee is reasonably assured.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the period. Actual results could differ from those estimates.

Loss per Share

Loss per share is computed in accordance with SFAS No. 128, “Earnings per Share”. Basic loss per share is calculated by dividing the net loss available to common stockholders by the weighted average number of common shares outstanding for the period. Diluted loss per share is computed by dividing net loss by the weighted average shares outstanding assuming all dilutive potential common shares were issued. There were no dilutive potential common shares at balance sheet date. The Company has incurred a net loss and has no potentially dilutive common shares, therefore; basic and diluted loss per share is the same. Additionally, for the purposes of calculating diluted loss per share, there were no adjustments to net loss.

Estimated Fair Value of Financial Instruments

The carrying value of accounts payable, and other financial instruments reflected in the financial statements approximates fair value due to the short-term maturity of the instruments. It is management’s opinion that the Company is not exposed to significant interest, currency or credit risks arising from these financial instruments.

Comprehensive Income

The Company has adopted Statement of Financial Accounting Standards (SFAS) No. 130, "Reporting Comprehensive Income". SFAS 130 requires that the components and total amounts of comprehensive income be displayed in the financial statements beginning in 1998. Comprehensive income includes net income and all changes in equity during a period that arises from non-owner sources, such as foreign currency items and unrealized gains and losses on certain investments in equity securities. Comprehensive loss for the periods shown equals the net loss for the period plus the effect of foreign currency translation.

Income Taxes

The Company follows the provisions of Statement of Financial Accounting Standards (“SFAS”) No. 109, “Accounting for Income Taxes”, which requires the Company to recognize deferred tax liabilities and assets for the expected future tax consequences of events that have been recognized in the Company’s financial statements or tax returns using the liability method. Under this method, deferred tax liabilities and assets are determined based on the temporary differences between the financial statement carrying amounts and tax bases of assets and liabilities using enacted rates in effect in the years during which the differences are expected to reverse and upon the possible realization of net operating loss carry-forwards.

Valuation of Long-Lived Assets

The Company periodically analyzes its long-lived assets for potential impairment, assessing the appropriateness of lives and recoverability of un-depreciated balances through measurement of undiscounted operation cash flows on a basis consistent with accounting principles generally accepted in the United States of America.

Start-up Costs

The Company has adopted Statement of Position No. 98-5 ("SOP 98-5"), "Reporting the Costs of Start-Up Activities." SOP 98-5 requires that all non-governmental entities expense the cost of start-up activities, including organizational costs as those costs are incurred.

Currency

The majority of the Company's cash flows are in United States dollars. Accordingly, the US dollar is the Company’s functional currency.

Cash and Cash Equivalents

The Company considers cash and cash equivalents to consist of cash on hand and demand deposits in banks with an initial maturity of 90 days or less.

Property, plant and equipment

Property and equipment are stated at cost. Expenditures for maintenance and repairs are charged to earnings as incurred; additions, renewals and betterments are capitalized. When property and equipment are retired or otherwise disposed of, the related cost and accumulated depreciation are removed from the respective accounts, and any gain or loss is included in operations. Depreciation of property and equipment is provided using the straight-line method for substantially all assets with estimated lives of:

Equipment 3 -5 years

Furniture & Fixtures 5 -10 years

Motor Vehicles 5 years

As of April 30, 2010 and 2009 property, plant and equipment consisted of the following:

|

|

|

|

|

|

|

|

|

|

|

April 30, 2010

|

|

|

April 30, 2009

|

|

|

Furniture and fixtures

|

|

$

|

1,405

|

|

|

$

|

1,405

|

|

|

Office equipment

|