Rurelec PLC Comment on Share Price (6140W)

August 19 2020 - 8:18AM

UK Regulatory

TIDMRUR

RNS Number : 6140W

Rurelec PLC

19 August 2020

Rurelec PLC

("Rurelec" or the "Company")

Comment on Share Price

The Directors of the Company note the recent movement in the

Company's share price and confirm that they know of no reason for

the share price movement.

General Update

By way of a general update, the Directors of the Company refer

to the audited results of the Company for the year ended 31

December 2019, which were released to the market on 1 June 2020

("Financial Results Announcement").

As set out in the Financial Results Announcement, the highlights

for the twelve months ended 1 June 2020 were:

" Operating loss GBP3.1 million (2018: loss GBP2.9 million).

Loss before tax GBP4.4 million (2018: loss GBP0.6 million).

2019 had seen a marked improvement in the Group's liquidity

position, current liabilities have fallen to GBP0.5 million (2018:

GBP2.0 million).

The Group was able to settle the outstanding GBP1.2m repayment

of BPAC secured debt principal during 2019 whilst limiting the

decrease in net cash to GBP214k (2018: increase GBP188k).

The main drivers for the loss before tax of GBP4.4 million were

a provision of GBP2.0 million (2018: GBPnil) against the 701

turbines, and foreign exchange losses of GBP1.3 million (2018:

gains GBP1.7 million).

Write downs of assets by GBP2.0 million (2018: GBPNil) to values

the directors believe can be supported in current market

conditions.

Administration expenses of GBP1.2 million (2018: GBP1.5 million)

reduced due to further employment cost savings and a reduction in

professional fees.

Total loss per share 0.79p (2018: 0.11p).

Net Asset Value per share 3.7p (2018: 4.4p)."

As also set out in the Financial Results Announcement:

"The Group has started to benefit from being on a more secure

financial footing. December 2019 marked the first time since 2008

that the Group has received loan repayments due from the holding

company of our joint venture operation of GBP0.5 million. This

follows the completion of the major maintenance programme carried

out at the Argentinian plant in late 2018 and early 2019. The total

cash remittances by EdS to the Group and PEL described above amount

to GBP2.2 million which compares to total debt repayments by EdS of

GBP2.0 million in 2018. In addition, EdS ended the year with cash

reserves of GBP1.7 million (2018: GBP0.5 million).

To date, the COVID-19 pandemic has had little impact on the

Group. The Group's Head Office in London has operated on a remote

basis and the EdS plant in Argentina is situated in a region which

has to date had very little incidence of the virus. EdS's power

generation is considered part of an essential industry, and it has

implemented procedures and protocols to allow as near to normal

safe working practices in place. Output and profitability to the

end of April 2020 are in line with expectations, whilst cash

remittances are above forecast for 2020 year to date and higher

than for the same period in 2019.Notwithstanding the above, it is

not considered possible to estimate the long-term financial impact

of COVID-19 on the already-weak Argentinian economy at the present

time, nor to anticipate the economic and fiscal measures that the

Argentinian Government will impose.

As previously announced on 19 November 2019, the new Agreement

reached with the Group's 50:50 joint venture partner in the

Argentinian operation has established a framework regulating future

cash repayments. However, the Resolution 220/2007 Power Purchase

Agreement ("PPA") expires in September 2020, and will be superseded

by a new tariff or, at worst case, be sold on the energy spot

market. At the date of this report, the outcome remains

uncertain.

The year 2019 has seen a marked improvement in the Group's

liquidity position. The improvements in the performance of the

Argentinian asset, and the relationship with our joint venture

partner, have been encouraging. However, the effect of the current

poor state of the Argentinian economy, and the uncertainty around

the renegotiation of the Resolution 220 PPA later this year do cast

a shadow over future performance".

Capital Reorganisation and Capital Reduction

As also set out in the Financial Results Announcement, the

Company proposed to progress a Capital Reorganisation and Capital

Reduction, subject to relevant approvals. This proposal was

approved by shareholders at the AGM on 30 June 2020 and the

reduction of capital was approved by the High Court of Justice on

14 August 2020 (as set out in the announcement of that date). A

further update will be made when the Court Order has been

successfully filed at Companies House and the Reduction of Capital

becomes effective .

For further information please contact:

Rurelec PLC W H Ireland (Nomad & Broker)

Simon Morris, Director Katy Mitchell

Andy Coveney, Director Lydia Zychowska

Tel: 020 7549 2839/40 Tel: 020 7220 1666

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCSFMFEUESSEFA

(END) Dow Jones Newswires

August 19, 2020 08:18 ET (12:18 GMT)

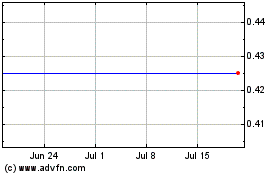

Rurelec (LSE:RUR)

Historical Stock Chart

From May 2024 to Jun 2024

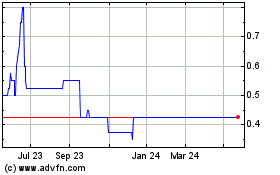

Rurelec (LSE:RUR)

Historical Stock Chart

From Jun 2023 to Jun 2024