TIDMDSG

RNS Number : 5381A

Dillistone Group PLC

26 September 2022

Dillistone Group Plc

("Dillistone", the "Company" or the "Group")

Interim Results & Investor Presentation

Dillistone Group Plc, the AIM quoted supplier of software and

services to recruiters, is pleased to announce interim results for

the six months ended 30 June 2022.

Financial Highlights

-- Revenue increased by 1% to GBP2.823m. First H1 growth since 2017.

-- Recurring revenues represented 88% (2021: 90%) of Group

revenue, which covers administration expenses (excluding

depreciation and amortisation).

-- Annualised recurring revenue relating to Talentis ended H1 at

GBP62k, an increase of over 300% on the equivalent figure at the

end of H2 2021.

-- Growth in orders driven by improving performance in market.

Order book increased by 13% year on year.

-- The Group benefited from flexible furlough support worth

GBP0.170m in 2021. Excluding this, the Adjusted(*) loss on

operating activity decreased from GBP0.260m in 2021 to GBP0.129m in

2022 - an improvement of 51%.

-- Net cash from operating activities broadly the same at GBP0.560m (2021: GBP0.562m).

-- Cash at period end of GBP0.608m. The Board does not expect

the Group to require additional funding to reach profitability.

Operational Highlights

-- Improved performance in both UK contingency and global executive search sectors.

-- Contingency business successfully implemented previously

announced large contract win. A further large contract was received

post period end, providing confidence in H2 and visibility into the

future.

-- Driven by Talentis, our executive search products had their

best H1 in terms of new contract wins since 2017.

Commenting on the results and prospects, Giles Fearnley,

Non-Executive Chairman, said:

"In my statement in the annual report, I was optimistic for the

future and our H1 results validate this belief. Revenue is growing,

our order book is stronger and operational performance is

improving. We enter the second half with a strong pipeline of

business and are optimistic about delivering further progress in

the coming months.

"While the Board is conscious of the broader economic situation,

it expects the Group to deliver full year results in line with

market expectations."

* Note: "Adjusted" refers to activities before acquisition,

reorganisation, furlough support, and one-off costs

Investor Presentation: 3pm today, Monday 26 September 2022

Jason Starr, Chief Executive, and Ian Mackin, Interim Finance

Director, will hold an investor presentation to cover the results

and prospects at 3pm today, Monday 26 September 2022.

The presentation will be hosted through the digital platform

Investor Meet Company. Investors can sign up to Investor Meet

Company and add to meet Dillistone Group Plc via the following link

https://www.investormeetcompany.com/dillistone-group-plc/register-investor

. For those investors who have already registered and added to meet

the Company, they will automatically be invited.

Questions can be submitted pre-event to

dillistone@walbrookpr.com or in real time during the presentation

via the "Ask a Question" function.

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

Contacts:

Dillistone Group Plc Via Walbrook PR

Jason Starr Chief Executive

Ian Mackin Interim Finance Director

WH Ireland Limited (Nominated adviser)

Chris Fielding Head of Corporate Finance 020 7220 1650

Walbrook PR

Tom Cooper / Nick Rome 020 7933 8780

dillistone@walbrookpr.com

Notes to Editors:

Dillistone Group Plc is a global leader in the supply of

technology solutions and test & train services to the

recruitment sector worldwide, in both contingency recruitment and

executive search markets.

The Group trades through the Ikiru People brand (

www.IkiruPeople.com ), selling into recruitment, staffing and

executive search businesses, as well as corporate talent

acquisition teams around the world.

Ikiru People provides the platforms its clients need to test and

train candidates, support further development, enhance the

recruitment process, and source the best talent. With clients in

more than 50 countries over six continents and working with

thousands of users, the Group boasts more than 30 years in the

market and 100's of years of collective experience.

The Group develops, markets and supports the Talentis,

FileFinder, Infinity, Mid-Office, ISV and GatedTalent products.

Dillistone was admitted to AIM, a market operated by the London

Stock Exchange plc, in June 2006.

Learn about our products:

Talentis Software: https://www.talentis.global/recruitment-software

Voyager Software: https://www.voyagersoftware.com

GatedTalent Services: https://www.talentis.global/optimization-services

Chairman's Statement

In my statement in the annual report, I said that I was

optimistic for the future. This has been validated by our first

half results which show a strong and improving performance in both

our executive search and contingency staffing markets.

In the first half, the Group has delivered increased revenue,

improved cash generation and a healthy order book. The Group

benefited from flexible furlough support worth GBP0.170m in 2021.

Excluding this, the Adjusted loss on operating activity decreased

from GBP0.260m in 2021 to GBP0.129m in 2022 - an improvement of

51%.

We have previously announced that our non-executive Director,

Julie Pomeroy, was due to step down from the Board on 30(th)

September 2022. We are pleased to say that Julie has now agreed to

stay with the Group. We are also delighted to confirm that Ian

Mackin, previously Interim FD has now accepted the position on a

permanent basis. We would like to thank Joanne Curd, who left the

Group at the end of July 2022, for her valuable contribution.

Operational Review

The Group has seen order book growth of 13%, helping us to

deliver H1 year on year revenue growth. While much of the growth

has been in non-recurring revenue, we are pleased to note that

recurring revenue saw year on year quarterly growth during Q2 2022,

and we fully expect this growth to continue into H2. Net debt

stands at (GBP0.992m), against a 2021 figure of (GBP0.925m). Cash

generation in H1 was ahead of budget and the Group does not expect

to need to raise additional capital to restore profitability.

We are pleased to report an improving performance from both our

contingency and executive search products.

Our contingency products (Infinity, ISV, Mid-Office and VDQ) saw

revenue grow by a combined 9%, driven by a particularly strong

performance from our Infinity recruiting CRM. Many of our Infinity

projects have been on behalf of firms in the Temporary staffing

space and, as such, some of these firms also implement our

Mid-Office application.

The period saw the successful completion of our previously

announced large Infinity order and we are pleased to report that,

post period end, we have won a further large contract for this

product.

Our ISV product continues to make a contribution to profits,

with clients including many of the UK's largest recruitment

businesses. A number of these firms are on multi-year

contracts.

The increasingly strong performance by Infinity has allowed the

Group to prepare for the withdrawal of support for our VDQ product,

and this is expected to occur over the coming months.

Our market share in the executive search software space (where

historically we have offered FileFinder and GatedTalent) has fallen

over recent years. However, we are delighted to report that this

trend has begun to reverse. Driven by strong performance by our

Talentis product, launched in 2021, this part of our business has

added more than 50 new clients in the first half. In terms of new

client wins, this was our best executive search CRM performance

since 2017.

Launched in early 2021 and provided as part of a package to many

FileFinder clients, Talentis now also has "stand alone" paying

clients on six continents. Most of these clients have a small

number of users, but we expect average client size (and associated

revenue) to grow over time as we continue to develop and extend the

product. Annualised recurring revenue associated with Talentis

ended H1 at GBP62k, an increase of over 300% on the equivalent

figure at the end of H2 2021. Across the Group, it has become our

fastest growing CRM product by number of contract wins in the

period.

Our FileFinder product has seen improved client retention,

partly as a result of our decision to provide Talentis as part of a

package to many of these firms. We have now completed our

re-engineering of the FileFinder SaaS platform and are pleased to

report a reduction in our FileFinder hosting costs of 21% in the

period, largely as a result of this work.

GatedTalent continues to make a contribution to the Group, and

the period has seen us undertake work to improve the margin

associated with the professional services delivered under this

banner. As part of this, we were delighted when one of our

employees became - we believe - the first resume writer in Europe

to be recognised by the National Résumé Writers' Association.

Across all of our product range, we continue to deliver

best-in-class customer service. During the period, we were

delighted to become, we believe, the first firm in our market to

earn a "5* Excellent" rating on Trustpilot.

Financial Performance

Revenue in the six months ended 30 June 2022 amounted to

GBP2.823m, up GBP0.022m (1%) (2021: GBP2.801m). Recurring revenues

decreased by 2% to GBP2.477m over the comparable period last year

(2021: 17% decline on 2020 H1 to GBP2.522m). However, in Q2 2022 we

experienced our first year on year growth in quarterly recurring

revenue since Q2 2018. Recurring revenues represented 88% of total

revenues (2021: 90%). Non-recurring revenues were up 30% at

GBP0.261m (2021: GBP0.200m).

Cost of sales increased 4% to GBP0.351m (2021: GBP0.336m),

benefitting from a decrease of 21% in hosting costs for our

FileFinder SaaS product as we moved to a new platform. This helped

offset a growth driven rise in cloud and data processing costs

elsewhere.

Adjusted administration expenses decreased by GBP0.139m to

GBP2.037m (2021: GBP2.176m). These expenses are covered 122% by

recurring revenue (2021: 116%)

Amortisation of acquisition intangibles amounted to GBP0.082m

(2021: GBP0.107m). In 2021 other items of credit GBP(0.092m) were

received, which included the write-off of a US payroll protection

loan which was forgiven in the period and, in Australia, a Covid-19

related grant.

The loss for the period before tax increased to GBP0.274m (2021:

loss GBP0.141m). The loss after tax was GBP(0.183m) (2021:

GBP(0.101m)).

There is a tax credit for the period of GBP0.091m (2021: credit

GBP0.040m). The 2021 and 2022 tax credits have benefited from

claims in the UK for research and development reflecting the

continuing development of our products.

Cash generated from operating activities stayed broadly level at

GBP0.560m (2021: GBP0.562m). Total cash flows in the 6 months ended

30 June 2022 showed a net outflow of GBP0.186m (2021: outflow

GBP0.110m). The main elements of non-operating expenditure related

to investment in new product development of GBP0.477m (2021:

GBP0.504m) and loan repayments of GBP0.150m (2021: GBP0.213m).

At 30 June 2022, we had net cash reserves of GBP0.608m (2021:

GBP1.039m) and GBP1.600m in borrowings (2021: GBP1.964m).

The CBIL loan balance stands at GBP1.200m and, on the current

payment profile, has another 4 years until it is fully repaid. The

Group also has a convertible loan of GBP0.400m, which will not be

repaid until the CBIL loan has been repaid.

Strategy

Our long-term strategy is unchanged, concentrating on returning

to sustainable growth and increasing profits. We are excited by the

opportunity provided by our new Talentis product and the continued

investment across our product range, backed up by consistently

delivering "best in class" service to our clients.

Outlook

In my statement in the annual report, I was optimistic for the

future. This remains my view, and I am delighted to that our

performance during and since H1 has compounded this opinion.

In our view, Infinity has become a leading product in the UK

temporary staffing sector, and we believe that this market is

likely to perform well during any economic downturn. Talentis

continues to grow rapidly and, based on the number of contracts

signed in H1, we believe that the product has taken a significant

share of new orders in the market and will increasingly be

considered a market leader in the sectors it serves. Our aim now is

to increase the size and value of the contracts associated with

this product - and we are already seeing progress to this end. We

remain very excited by the opportunity that Talentis presents for

our Group.

The Group expects to deliver full year results in line with

market expectations. Our cash position as at 31 August 2022 was

GBP0.617m and we do not expect to raise additional funds to reach

profitability.

Giles Fearnley

Non-Executive Chairman

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Note 6 Months ended 30 Year ended

June 31 Dec

2022 2021 2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Revenue 4 2,823 2,801 5,599

Cost of sales (351) (336) (685)

----------------- ----------------- -----------

Gross profit 2,472 2,465 4,914

Administrative expenses (2,683) (2,570) (5,113)

----------------- ----------------- -----------

Result from operating activities 4 (211) (105) (199)

Analysed as:

Result from operating

activities before furlough

support, acquisition related,

reorganisation and other

items (129) (260) (375)

Furlough support - 170 235

Acquisition related, reorganisation

and other items 5 (82) (15) (59)

----------------- ----------------- -----------

Result after acquisition related

items (211) (105) (199)

-------------------------------------------- ----------------- ----------------- -----------

Financial cost (63) (36) (99)

----------------- ----------------- -----------

(Loss) before tax (274) (141) (298)

Tax income 6 91 40 302

----------------- ----------------- -----------

(Loss)/profit for the

period (183) (101) 4

Other comprehensive income

net of tax:

Currency translation differences 6 2 4

----------------- ----------------- -----------

Total comprehensive (loss)/income

for period net of tax (177) (99) 8

----------------- ----------------- -----------

Earnings per share (pence)

Basic 8 (0.93) (0.51) 0.02

Diluted (0.93) (0.51) 0.02

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 30 June As at 30 June 2021 As at 31 Dec

2022 2021

Unaudited Unaudited Audited

ASSETS GBP'000 GBP'000 GBP'000

Non-current assets

Goodwill 3,415 3,415 3,415

Intangible assets 3,030 3,274 3,142

Right of use assets 541 646 592

Property plant & equipment 22 18 25

-------------- ------------------- -------------

7,008 7,353 7,174

Current assets

Trade and other receivables 739 843 615

Current tax receivable 119 67 29

Cash and cash equivalents 608 1,175 764

-------------- ------------------- -------------

1,466 2,085 1,408

-------------- ------------------- -------------

Total assets 8,474 9,438 8,582

-------------- ------------------- -------------

EQUITY AND LIABILITIES

Equity

Share capital 983 983 983

Share premium 1,631 1,631 1,631

Merger reserve 365 365 365

Convertible loan reserve 14 14 14

Retained earnings 79 107 262

Share option reserve 72 124 64

Translation reserve 69 61 63

-------------- ------------------- -------------

Total equity 3,213 3,285 3,382

Liabilities

Non current liabilities

Trade and other payables 252 237 238

Lease liabilities 516 604 560

Borrowings 1300 1,600 1,450

Deferred tax 210 299 210

-------------- ------------------- -------------

Total non-current liabilities 2,278 2,740 2,458

-------------- ------------------- -------------

Current liabilities

Trade and other payables 2,595 2,808 2,347

Lease liabilities 88 105 95

Borrowings 300 364 300

Utilisation of banking - 136 -

facility

Current tax payable - - -

-------------- ------------------- -------------

Total non-current liabilities 2,983 3,413 2,742

-------------- ------------------- -------------

Total liabilities 5,261 6,153 5,200

-------------- ------------------- -------------

Total liabilities and

equity 8,474 9,438 8,582

-------------- ------------------- -------------

The interim report was approved by the Board of directors and

authorised for issue on 23 September 2022. They

were signed on its behalf by: JS Starr IJ Mackin

CONSOLIDATED STATEMENT OF CASH FLOWS

As at 30 June As at

31 December

2022 2021 2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Operating Activities

(Loss) before tax (274) (141) (298)

Adjustment for

Financial cost 63 36 99

Depreciation and amortisation 648 656 1,335

Share option expense 8 15 3

Other including foreign exchange adjustments

arising from operations (24) (4) 10

Operating cash flows before movements

in working capital 421 562 1,149

Increase / (Decrease) in receivables (124) 20 268

Increase / (Decrease) in payables 263 (184) (639)

Net taxation repaid - 164 373

Net cash generated from operating

activities 560 562 1,151

---------- ----------- -------------

Investing Activities

Purchases of property plant and equipment (5) (4) (21)

Investment in development costs (477) (504) (987)

Net cash used in investing activities (482) (508) (1,008)

---------- ----------- -------------

Financing Activities

Finance cost (63) (36) (99)

Lease payments made (51) (51) (104)

Bank loan repayments (150) (213) (461)

Utilisation of banking facility - 136 -

---------- ----------- -------------

Net cash generated from financing

activities (264) (164) (664)

---------- ----------- -------------

Net change in cash and cash equivalents (186) (110) (521)

Cash and cash equivalents at beginning

of the period 764 1,291 1291

Effect of foreign exchange rate changes 30 (6) (6)

Cash and cash equivalents at end of

period 608 1,175 764

---------- ----------- -------------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share Share Merger Retained Convertible Share Foreign Total

capital premium Reserve earnings loan option exchange

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 31

December 2021 983 1,631 365 262 14 64 63 3,382

Comprehensive

income

Loss for the 6

months ended 30

June 2022 - - - (183) - - - (183)

Other comprehensive -

income

Exchange differences

on translation

of overseas operations - - - - - - 6 6

Total comprehensive

(loss) - - - (183) - - 6 (177)

--------- --------- --------- --------- ------------ --------- --------- --------

Transactions with

owners

Share option charge - - - - - 8 - 8

Balance at 30

June 2022 983 1,631 365 79 14 72 69 3,213

--------- --------- --------- --------- ------------ --------- --------- --------

Balance at 31

December 2020 983 1,631 365 208 14 110 59 3,370

Comprehensive

income

Loss for the 6

months ended 30

June 2021 - - - (101) - - - (101)

Other comprehensive -

income

Exchange differences

on translation

of overseas operations - - - - - - 2 2

Total comprehensive

(loss) - - - (101) - - 2 (99)

--------- --------- --------- --------- ------------ --------- --------- --------

Transactions with

owners

Share option charge - - - - - 14 - 14

Balance at 30

June 2021 983 1,631 365 107 14 124 61 3,285

--------- --------- --------- --------- ------------ --------- --------- --------

NOTES TO THE INTERIM

NOTES TO THE UNAUDITED INTERIM REPORT

CONSOLIDATED STATEMENT OF

1. Basis of Preparation

The financial information for the six months ended 30 June 2022

included in this condensed interim report comprises the

consolidated statement of comprehensive income, the consolidated

statement of financial position, the consolidated statement of cash

flows, the consolidated statement of changes in equity and the

related notes.

The financial information in these interim results is that of

the holding company and all of its subsidiaries (the Group). It has

been prepared in accordance with UK adopted international

accounting standards but does not include all of the disclosures

that would be required under International Financial Reporting

Standards (IFRSs). The accounting policies applied by the Group in

this financial information are the same as those applied by the

Group in its financial statements for the year ended 31 December

2021 and are those which will form the basis of the 2022 financial

statements.

The comparative financial information presented herein for the

year ended 31 December 2021 does not constitute full statutory

accounts for that period. The Group's annual report and accounts

for the year ended 31 December 2021 have been delivered to the

Registrar of Companies. The Group's independent auditor's report on

those statutory accounts was unqualified, did not draw attention to

any matters by way of emphasis, and did not contain a statement

under 498(2) or 498(3) of the Companies Act 2006.

Going concern

The directors have continued to perform detailed forecasting on

a regular basis taking into account current trading and

expectations and cash balances and, having reflected upon these

forecasts, the directors of the Company continue to adopt the going

concern basis of accounting in preparing the financial

statements.

Dillistone Group Plc is the Group's ultimate parent company. It

is a public listed company and is domiciled in the United Kingdom.

The address of its registered office and principal place of

business is 12 Cedarwood, Crockford Lane, Chineham Business Park,

Basingstoke, RG24 8WD. Dillistone Group Plc's shares are listed on

the Alternative Investment Market (AIM).

2. Share Based Payments

The Company operates two share option schemes. The fair value of

the options granted under these schemes is recognised as an

employee expense with a corresponding increase in equity. The fair

value is measured at grant date and spread over the period at the

end of which the option holder may exercise the option. The fair

value of the options granted is measured using the Black-Scholes

model.

3. Reconciliation of adjusted operating profits to consolidated

statement of comprehensive income

30 June 2022 and 30 June 2021

Adjusted Acquisition Adjusted Acquisition

operating related operating and reorganisation

profits items profits related

items

30-Jun

30-Jun-2022 2022* 30-Jun-2022 30-Jun-2021 2021* 2021

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue 2,823 - 2,823 2,801 - 2,801

Cost of sales (351) - (351) (336) - (336)

Gross profit 2,472 - 2,472 2,465 - 2,465

Administrative expenses (2,601) (82) (2,683) (2,555) (15) (2, 570)

Results from operating

activities (inc

furlough) (129) (82) (211) (90) (15) (105)

Financial cost (63) - (63) (36) - (36)

(Loss) before tax (192) (82) (274) (126) (15) (141)

Tax expense/(income) 76 15 91 36 4 40

(Loss)/profit for

the year (116) (67) (183) (90) (11) (101)

Other comprehensive

income net of tax:

Currency translation

differences 6 - 6 2 - 2

Total comprehensive

(loss) for the year

net of tax (110) (67) (177) (88) (11) (99)

------------ ------------ ------------ ------------ -------------------- ---------

* see accounts note 5

Earnings per share - from continuing activities

Basic (0.59)p (0.93)p (0.46)p (0.51)p

Diluted (0.59)p (0.93)p (0.46)p (0.51)p

31 December 2021

Adjusted Acquisition

operating and reorganisation

profits related

items

31 December 2021* 31 December

2021 2021

GBP'000 GBP'000 GBP'000

Revenue 5,599 - 5,599

Cost of sales (685) - (685)

------------ -------------------- ------------

Gross profit 4,914 - 4,914

Administrative expenses (5,054) (59) (5,113)

Results from operating activities

(inc furlough) (140) (59) (199)

Financial cost (99) - (99)

Loss before tax (239) (59) (298)

Tax income 287 15 302

Profit/(loss) for the year 48 (44) 4

Other comprehensive income

net of tax:

Currency translation differences 4 - 4

Total comprehensive profit/(loss)

for the year net of tax 52 (44) 8

============ ==================== ==============

* see accounts note 5

Earnings per share - from continuing activities

Basic 0.24p 0.02p

Diluted 0.24p 0.02p

4. Segment reporting

Results

Year ended

6 months ended 30 June 31 Dec

2022 2021 2021

GBP'000 GBP'000 GBP'000

Results from operating activities

Ikiru People (128) (61) (169)

Central (1) (29) 29

Reorganisation and

other costs - 92 154

Amortisation of acquisition

intangibles and reorganisation

costs (82) (107) (213)

Result from operating

activities (211) (105) (199)

========== ============ ================

Geographical segments

The following table provides an analysis of the Group's revenues

by geographical market.

Year ended

6 months ended 30

June 31 Dec

2022 2021 2021

GBP'000 GBP'000 GBP'000

UK 1,942 1,928 3,933

Europe 350 441 762

Americas 309 242 526

Australia 117 76 140

ROW 105 114 238

2,823 2,801 5,599

=============== ============ =================

Business Segment

The following table provides an analysis of the Group's revenues

by products and services.

Year ended

6 months ended 30

June 31 Dec

2022 2021 2021

GBP'000 GBP'000 GBP'000

Recurring 2,477 2,522 5,009

Non recurring 261 200 427

Third party revenues 85 79 163

2,823 2,801 5,599

============= ============= ===========

'Recurring income' represents all income recognised over time,

whereas 'Non-recurring income' represents all income recognised

at a point in time. Recurring income includes all support services,

software as a service income (SaaS) and hosting income. Non-recurring

income includes sales of new licenses, and income derived from

installing those licenses including training, installation, and

data translation. Third party revenues arise from the sale of

third party software.

5. Acquisition related items and other one off costs

Year ended

6 months ended 30

June 31 Dec

2022 2021 2021

GBP'000 GBP'000 GBP'000

Reorganisation costs - - 6

US Government loan (Payment

Protection Program) - (86) (154)

Grants received from overseas

jurisdictions - (6) (6)

Amortisation of acquisition

intangibles 82 107 213

Total 82 15 59

========= ========= ===========

6. Tax

Year ended

6 months ended 30

June 31 Dec

2022 2021 2021

GBP'000 GBP'000 GBP'000

Current tax (56) (43) (96)

Prior year adjustment - current

tax - - (121)

Deferred tax release (20) (11) (35)

Prior year adjustment - deferred

tax - - (60)

2021 Deferred tax rate change

to 25% (19% in 2020) - 34 50

Deferred tax re acquisition

intangibles (15) (20) (40)

Tax credit for the period (91) (40) (302)

========= ========= ===========

The tax charge is calculated for each jurisdiction based on the

estimated position for the year. Deferred tax has been provided at

a rate of 25% (2021: 25%).

7. Dividends

The Board has decided not to pay an interim dividend (2021: nil

per share).

8. Earnings per Share

Year ended

6 months ended 30

June 31 Dec

2022 2021 2021

Basic earnings per share

(Loss) attributable to ordinary

shareholders GBP(183,000) GBP(101,000) GBP4,000

Weighted average number of

shares 19,668,021 19,668,021 19,668,021

Basic (loss) per share (pence) (0.93) (0.51) 0.02

============= ============= ===========

As the Group is in a loss position shares options are

anti-dilutive.

9. Related party transactions

The Company has related party relationships with its

subsidiaries, its directors, and other employees of the Company

with management responsibility. There were no transactions with

these parties during the period outside the usual course of

business.

The Directors participated in the issue of convertible loan

notes in 2017 which carry interest at 8.15% per annum payable

quarterly in arrears.

There were no transactions with any other related parties.

10. Cautionary statement

This Interim Report has been prepared solely to provide

additional information to shareholders to assess the Company's

strategies and the potential for these strategies to succeed. The

Interim Report should not be relied on by any other party or for

any other purpose. The Interim Report contains certain

forward-looking statements with respect to the financial condition,

results of operations and businesses of the Company. These

statements are made in good faith based on the information

available to them up to the time of their approval of this report.

However, such statements should be treated with caution as they

involve risk and uncertainty because they relate to events and

depend upon circumstances that will occur in the future. There are

a number of factors that could cause actual results or developments

to differ materially from those expressed or implied by these

forward-looking statements. The continuing uncertainty in global

economic outlook inevitably increases the economic and business

risks to which the Company is exposed. Nothing in this announcement

should be construed as a profit forecast.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EAPNSAFPAEFA

(END) Dow Jones Newswires

September 26, 2022 02:01 ET (06:01 GMT)

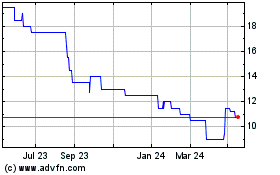

Dillistone (LSE:DSG)

Historical Stock Chart

From Nov 2024 to Dec 2024

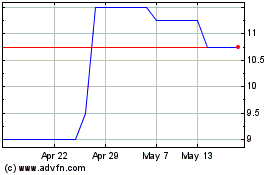

Dillistone (LSE:DSG)

Historical Stock Chart

From Dec 2023 to Dec 2024