United

States

Securities

and Exchange Commission

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15[d] of the Securities Exchange Act of 1934

February

5, 2015

Date

of Report

[Date of Earliest

Event Reported]

PCS EDVENTURES!.COM, INC.

(Exact name of registrant as specified in its

charter)

| IDAHO |

000-49990 |

82-0475383 |

| (State or Other Jurisdiction of |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

| Incorporation) |

|

|

345 Bobwhite Court, Suite 200

Boise, Idaho 83706

(Address of Principal Executive

Offices)

(208) 343-3110

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see general instruction A.2. below):

[ ] Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant

to Rule 14-a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.03 Creation of a Direct Financial Obligation or an Obligation

under an Off-Balance Sheet Arrangement of a Registrant.

On January 22, 2015, we entered into a loan transaction in

the amount of $400,000 with an “accredited investor” as that term is defined in Rule 501 of Regulation D of

the Securities and Exchange Commission (the “SEC”). The transaction involved the issuance of a Promissory Note,

which is payable with interest of 10% per annum. The interest is payable monthly in cash, with the first payment due on or

before March 10, 2015. The note principle balance and any outstanding interest, are due on or before June 30, 2015. PCS has

agreed to issue 2,000,000 warrants with a 36 month term at $0.04 per share exercise price. The Promissory Note is secured by

the T4EDU Toolkits Contract 0006/0017 Work Order No. 5, 6, 7, 8, less zakat and holdback, with PCS Edventures for the sum of

$491,928 as collateral. The loan proceeds will be utilized to purchase inventory, bring certain vendors and payable accounts

current, and finance the operations and logistics required to fulfill and support Operations. Final loan documents between

Mr. Hackett and PCS Edventures were not executed and delivered until February 05, 2015.

The Contract requires delivery of materials and curriculum T4EDU

by March, 2015. We are scheduling, recruiting, and producing, the contract to meet the full delivery Contract timeline.

There are risks associated with the delivery requirements, even

though we believe that the general risk of rejection of the deliveries if delayed is small. These risks include, among general

risks associated with all forms of transportation, the following:

- There is risk in the supply chain for curriculum writers as the Contract requirements are

significant and complex.

- Despite all efforts, the funds available to the customer for our products could be withdrawn

if deliveries are late, and there can be no assurance that we would be paid if the funds were withdrawn; if this happened, we may

be required to inventory the materials prepared for delivery without a customer readily available for purchase, while still having

the liability under the Promissory Note referenced herein.

No assurance can be given that any one of these or other potential

risks will not result in our inability to satisfy the requirements of the Contract though we will remain liable on the Promissory

Note.

Item 9.01 Financial Statements and Exhibit

| (d) |

Exhibit No. |

Exhibit Description |

| |

|

|

| |

10.1 |

Promissory Note |

| |

10.2 |

Form of Warrant |

SIGNATURES

Pursuant to the requirements of the Securities

and Exchange Act of 1934, the Registrant has duly caused this Current Report to be signed on its behalf by the undersigned hereunto

duly authorized.

PCS EDVENTURES!.COM, INC.

| Dated: |

February 5, 2015 |

|

By: |

/s/ Robert Grover |

| |

|

|

|

Robert Grover |

| |

|

|

|

CEO |

2

Exhibit 10.1

PROMISSORY NOTE

$40,000 January

16, 2015

$360,000 January 22, 2015

FOR VALUE RECEIVED,

the undersigned, PCS Edventures!.Com, Inc.,

an Idaho corporation (hereinafter referred to as “Borrower”), hereby promises to pay to the order of TODD R. HACKETT,

or (his/her/its) successors and assigns, if any (hereinafter referred to as “Lender”), the principal sum of Four Hundred

Thousand Dollars ($400,000), together with interest on the unpaid principal amount of this Promissory Note (“Note”)

at the rate of ten percent (10%) per annum in the manner and upon the terms and conditions set forth below.

As part of this Promissory

Note, the Borrower has issued warrants (“Original Warrants”) to acquire up to 2,000,000 shares of Company’s common

stock for $0.04 per share exercisable at any time within 36 months after the date of issuance of the Original Warrants.

The principal and interest

on the unpaid principal amount of this Note, or any portion thereof, shall be paid in full in cash on or before June 30, 2015.

All cash payments on this Note shall be made in lawful currency of the United States at the address of the Lender, or at such other

place as the holder of this Note may designate in writing.

In connection with the

loan from Lender and the issuance of this Note by the Borrower, the Lender represents and warrants to the matters listed on Attachment

A.

This Note is secured by the T4EDU Toolkits Contract

0006/0017 Work Order No. 5, 6, 7, 8, less zakat and holdback, with PCS

Edventures!.Com for the sum of $491,928 as collateral.

Beginning

on March 10, 2015, the Company shall make a payment for all accrued interest from January 16, 2015 to

February 28, 2015 on this Note, in the amount of $3,957.81, which payment in full of accrued interest is acknowledged. In

addition, the company agrees to make monthly interest payments within 10 days of each calendar month end. The last payment due

and payable by the last day of June 30, 2015, shall be made in such amount to pay all remaining principal of the Note and accrued

interest in full.

Upon default in the payment

of any amount due pursuant to this Note for more than thirty (30) days after the due date, the Lender may, without notice, declare

the entire debt and principal amount then remaining unpaid under this Note immediately due and payable and may, without notice,

in addition to any other remedies, proceed against the

Borrower to collect the unpaid principal and

any interest due. Presentment for payment, notice of dishonor, protest and notice of protest are waived by the Borrower and any

and all others who may at any time become liable or obligated for the payment of all or any part of this Note, the principal or

interest due.

This Note may be amended

only by a written instrument executed by Lender and Borrower.

This Note shall be governed

by, and shall be construed and enforced in accordance with, the laws of the State of Idaho. Any legal action to enforce any obligation

of the parties to this Note shall be brought only in the District Court of the Fourth Judicial District of the State of Idaho,

in and for the County of Ada.

In the event of any civil

action filed or initiated between the parties to this Note or any other documents accompanying this Note, or arising from the breach

or any provision hereof, the prevailing party shall be entitled to seek from the other party all costs, damages, and expenses,

including reasonable attorney’s and paralegal’s fees, incurred by the prevailing party.

Dated the day and year

first above written.

PCS

Edventures!.Com, Inc.

/s/ Robert O. Grover

Robert O. Grover, CEO

PCS Edventures, Inc.

345 Bobwhite Ct. Ste. 200

Boise, ID 83706

(Borrower)

/s/ Todd Hackett

Todd Hackett

1923 Wildwood Lane

Muscatine, Iowa, 52761

(Lender)

Attachment

A

Todd

R. Hackett (“Hackett”) hereby represents and warrants

to PCS Edventures!.com, Inc. (the “Company”), in connection with

the warrants issued in conjunction with the Note (“Note”) to which this is attached, as follows:

(a)

HACKETT HAS, EITHER ALONE OR WITH

THE ASSISTANCE OF A

REPRESENTATIVE(S), SUCH KNOWLEDGE AND

EXPERIENCE IN FINANCIAL AND BUSINESS MATTERS TO BE CAPABLE

OF EVALUATING THE MERITS AND RISKS OF A

LOAN AND/OR AN INVESTMENT IN THE COMPANY

AND TO MAKE AN INFORMED DECISION WITH RESPECT TO THE LOAN AND/OR INVESTMENT THAT IS THE SUBJECT MATTER OF THE NOTE.

In

addition, Hackett is an “accredited investor” as defined in Regulation D under the Securities Act of 1933,

as amended, under one or more of the following qualifications for status as an accredited investor:

(i) Hackett is a

natural person who had an income

in excess of $200,000 in each of

the two most recent years (or joint income with

his or her spouse in excess

of $300,000 in each of those years) and has a reasonable

expectation of reaching the same income level

in the current year.

(ii)

Hackett is a natural person who has a net worth (or joint

net worth with his or her spouse) in excess

of $1,000,000 excluding the value of his primary residence.

(iii)

Hackett is a director, executive officer, or manager of the Company.

(b) Hackett recognizes that a

loan and/or investment in the Company involves significant risks.

(c)

Hackett has been furnished all

materials relating to the Company, its business

and financial condition, and any other matters

relating to the Company and the industries in which it operates, which Hackett has requested. Hackett has been afforded the opportunity

to ask questions and receive answers concerning the

Company and to obtain any

additional information which the Company or its

management possesses or can acquire

without unreasonable effort or expense, which

is necessary to verify the accuracy of the information

provided by the Company. Hackett represents that, in making his decision to lend

and/or invest in the Company, Hackett has relied solely

on the information

provided in writing by the Company (and not information provided in any other form), and Hackett has not relied

on

representations, warranties, opinions, projections, financial or

other information or

analysis, if any, supplied to it

by any person, in any form

and at any time, including, without limitation, any summaries, presentations, or

other materials, other than information set forth

in the public filings of the Company with the Securities & Exchange Commission or other information provided directly

to Hackett by the Company’s Chief Executive Officer over the course of the sixty days preceding the note and/or

investment in the Company and identified in writing as relating to Hackett’s evaluation of the note and/or

investment (such publicly filed information and written materials from the Company’s Chief Executive Officer

being defined in this Agreement as information”).

(d)

The Company has answered all inquiries

that Hackett has made of it concerning the

Company, its business and financial

condition, or any other matter relating

to the operation of

the Company and the note and/or investment described herein.

No oral or

written statement or inducement which is

contrary to the information set forth in the Hackett Information has been made by or on

behalf of the Company to Hackett.

(e)

Hackett is not relying on the Company or its employees, officers, directors, members,

managers, agents, or representatives with respect to the legal, tax, economic, and related considerations of the note and/or investment

in the Company; and Hackett has relied on the advice of, or has consulted with, only Hackett's own advisors.

(f)

Hackett (i) has adequate means of providing for Hackett's current needs and possible

personal contingencies, (ii) has no need for liquidity in Hackett's investment in the note and/or investment in the Company,

(iii) is able to bear the economic risks of Hackett's loan and/or investment in the Company, and (iv) at the present time,

can afford a complete loss of Hackett's note and/or investment in the Company.

(g)

Hackett is making the note and/or investment in the Company for its own account,

and not for distribution, assignment, or resale to others in whole or in part; and no other person has any direct or indirect beneficial

interest in such note and/or investment. Hackett has no agreement or arrangement, formal or informal, with any person to sell

or transfer all or any part of the note and/or investment in the Company; and Hackett has no plans to enter into any such

agreement or arrangement.

(h)

Hackett understands that (i) there is and will be no market for the note and/or

investment in the Company, (ii) the note and/or investment in the Company have not been and will not be registered under

the Securities Act of 1933, as amended (the "Securities Act"), and Hackett must hold the note and/or

investment in the Company indefinitely unless the note and/or investment in the Company are subsequently registered

under the Securities Act or an exemption from such registration is available, (iii) the Company is under no obligation to register the

note and/or investment in the Company on Hackett's behalf or to assist Hackett in complying with

any

exemption from registration, and (iv) the note and/or investment in the Company may not be sold pursuant to Rule 144

promulgated by the Securities and Exchange Commission pursuant to the Securities Act, unless all of the conditions of that Rule

are met.

| (i) | Hackett understands that no Federal or State

agency has passed upon the note and/or investment in the Company, or made any finding or determination as to the fairness

of the investment or any recommendation or endorsement of the note and/or investment in the Company. |

Exhibit 10.2

FORM OF WARRANT

THESE WARRANTS MAY BE EXERCISED PRIOR TO ANY REGISTRATION

STATEMENT COVERING THE SHARES OF COMMON STOCK UNDERLYING THE WARRANTS BEING DECLARED EFFECTIVE BY THE SECURITIES AND EXCHANGE COMMISSION,

OR PURSUANT TO AN AVAILABLE EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT OF 1933. UNLESS OTHERWISE PROVIDED

HEREIN, THE FILING OF ANY SUCH REGISTRATION STATEMENT SHALL BE AT THE SOLE DISCRETION OF THE COMPANY. THE WARRANTS MAY ONLY BE

EXERCISED IN THOSE STATES IN WHICH IT IS LEGALLY PERMISSIBLE TO DO SO.

| WARRANT NUMBER |

PCS EDVENTURES!.COM, INC. |

NUMBER OF WARRANTS |

| 510102 |

Incorporated Under the Laws of the State of Idaho |

2,000,000 |

CERTIFICATE FOR WARRANTS TO PURCHASE COMMON STOCK

This Warrant Certificate

Certifies that Todd Hackett registered (the "Warrant Holder"), is the registered owner of the above indicated number

of Warrants expiring at 11:59 p.m. Mountain Time, 36 months from the date hereof (the "Expiration Date"). One (1) Warrant

entitles the Warrant Holder to purchase one share of “restricted” Rule 144 Common Stock, no par value (the "Share"),

from the Company at a purchase price of $0.04 per share of Common Stock (the "Exercise Price"). These Warrants are fully

vested and exercisable.

This Warrant may be exercised

in full by the Warrant Holder hereof by delivery of an original or facsimile copy of the Warrant Exercise Form, duly executed by

such Warrant Holder and surrender of the original Warrant within five (5) days of exercise, to the Company at its principal office,

accompanied by payment, in cash, wire transfer or by certified or official bank check payable to the order of the Company, in the

amount obtained by multiplying the number of shares of Common Stock for which this Warrant is then exercisable by the Exercise

Price.

The Warrant Holder of the Warrants evidenced

by this Warrant Certificate may exercise all or part of the Warrants during the Exercise Period and in the manner stated hereon.

The Exercise Price shall be payable in lawful money of the United States of America and in cash or by certified or bank cashier's

check or bank draft payable to the order of the Company. If upon exercise of any Warrants evidenced by this Warrant Certificate

the number of Warrants exercised shall be less than the total number of Warrants so evidenced, there shall be issued to the Warrant

Holder a new Warrant Certificate evidencing the number of Warrants not so exercised. No fractional shares may be purchased.

No Warrant may be exercised after 5:00

p.m. Mountain Time on the Expiration Date and any Warrant not exercised by such time shall expire and become void unless extended

by the Company.

IN WITNESS WHEREOF, the Company has caused this Warrant to

be signed by its CEO and by its Secretary, each by a facsimile of his signature and has caused a facsimile of its corporate seal

to be imprinted hereon.

| Dated: January 22, 2015 |

Expiration Date: January 22, 2018 |

| |

|

|

|

|

| PCS EDVENTURES!.COM, INC. |

| |

|

|

|

|

| By |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

By |

/s/ Robert O. Grover |

|

By |

/s/ Britt Ide |

| |

|

Robert O. Grover |

|

Britt Ide |

| |

|

CEO |

|

Secretary |

(Seal)

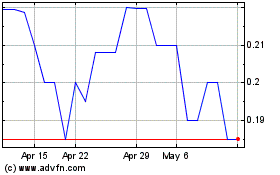

PCS Edventures Com (PK) (USOTC:PCSV)

Historical Stock Chart

From May 2024 to Jun 2024

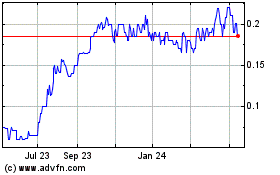

PCS Edventures Com (PK) (USOTC:PCSV)

Historical Stock Chart

From Jun 2023 to Jun 2024