UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

X

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended March 31, 2012.

¨ TRANSITION REPORT UNDER SECTION 13 OF 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number: 000-49990

PCS Edventures!.com, Inc.

(Exact name of Registrant as specified in its charter)

|

|

| |

|

Idaho

|

|

82-0475383

|

|

(State or other jurisdiction of

Incorporation or organization

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

345 Bobwhite Court, Suite 200 Boise, ID

|

|

83706

|

|

(Address of principal executive offices)

|

|

(Zip code)

|

|

|

|

|

Registrant’s telephone number, including area code: (208) 343-3110

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act: No par value common stock

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes No X

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No X.

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes X No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of

“

large accelerated filer,

”

“

accelerated filer,

”

and

“

smaller reporting company

”

in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

| |

|

Large accelerated filer ¨

|

|

Accelerated filer

|

|

|

Non-accelerated filer ¨

|

|

Smaller reporting company X

|

|

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes No X

PAGE 1

State the aggregate market value of the voting and non-voting common equity held by non-affiliates as of the last business day of FY2012 Q2: $6,663,654 as of September 30, 2011.

Indicate the number of shares outstanding of each of the Registrant’s classes of common stock, as of the latest practicable date. As of

July 5, 2012, the Registrant had outstanding 44,972,963 shares of common stock.

DOCUMENTS INCORPORATED BY REFERENCE:

None.

PAGE 2

|

|

| |

|

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

Page

|

|

PART I

|

|

|

|

Item 1.

|

Business

|

4

|

|

Item 1A.

|

Risk Factors

|

18

|

|

Item 1B.

|

Unresolved Staff Comments

|

19

|

|

Item 2.

|

Properties

|

19

|

|

Item 3.

|

Legal Proceedings

|

20

|

|

Item 4.

|

Mine Safety Disclosures

|

20

|

|

PART II

|

|

|

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

20

|

|

Item 6.

|

Selected Financial Data

|

24

|

|

Item 7.

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

24

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

30

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

30

|

|

Item 9.

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

62

|

|

Item 9A.

|

Controls and Procedures

|

62

|

|

Item 9B.

|

Other Information

|

63

|

|

PART III

|

|

|

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

63

|

|

Item 11.

|

Executive Compensation

|

68

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

73

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

74

|

|

Item 14.

|

Principal Accounting Fees and Services

|

76

|

|

PART IV

|

|

|

|

Item 15.

|

Exhibits, Financial Statement Schedules

|

77

|

|

|

|

|

|

Signatures

|

|

78

|

PAGE 3

PART I

Item 1. Business.

PCS Edventures!.com, Inc. (the “Company”, “PCS”, “we”, ”our”, “us” or similar words) was incorporated in 1994 in the State of Idaho. In November 2005, we acquired PCS LabMentors, Ltd. (“PCS LabMentors”) based in Fredericton, New Brunswick, Canada, which is a wholly owned subsidiary of PCS Edventures!.com, Inc.

PCS is engaged in the business of developing, marketing, and distributing educational products and services for the PreK-16 market that are implemented in PCS private learning centers and sold to public and private schools and institutions. These products include professional development, proprietary hardware and software, curriculum, and comprehensive learning labs bundled with related technologies and programs. Our products and technologies target public and private school classrooms for pre-kindergarten through college, as well as the afterschool market that includes YMCAs, Boys and Girls Clubs, and 21

st

Century Learning Centers. Our products and technologies enable students ages 3 and up to explore the foundations of science, technology, engineering, and mathematics (“STEM”) through experiential-learning programs that embed 21

st

century skills.

PCS has developed a number of innovative technology-based educational products and programs directed to the pre-kindergarten through college educational market, as well as Professional Development STEM Institutes for educators. Our PCS BrickLab, ThinkBug, PCS Academy of Engineering

™

, PCS Academy of Electronics

™

, PCS Academy of Science

™

, PCS Academy of Robotics

™

, and Digital Media Labs (

“

Audio/Video/Photography

”

) products are sold to classrooms and afterschool learning programs. The PCS Brain is a proprietary robotic microcontroller designed to facilitate educational robotic activities and the Cortex is a proprietary, progressive programming environment developed to manage the Brain and teach robotic programming concepts. Our online Learning Management System (“LMS”) supports our customers with online learning activities, support, assessment, file sharing, and social networking services for our customers. Our Professional Development STEM Institute offers a 30-hour professional development certification program in the areas of science, technology, engineering, and mathematics for elementary teachers. Separately, and in combination, these products present a platform for delivering educational services and support to classrooms, and learning centers. They help create a virtual community of learners on the web. PCS also partners with several companies to represent their product lines including fischertechnik®, Valiant Technologies, LEGO® Education, and K’NEX® Education. These companies offer products known for their hands-on, educational nature and PCS includes many of these products in our curriculum offerings. In addition, we have partnered with MINDS-i, Inc., of Liberty Lake, Washington, to combine their innovative construction system with the PCS robotic and controller programming solutions, which we believe offers a unique advantage over other competitors.

PCS LabMentors is the exclusive provider of a proprietary virtual lab technology which is designed to provide hands-on experience to high school, community college and university students studying a variety of technical topics. These technical topics include programming, network management, security, operating systems, and other IT subjects. LabMentors’ technology provides students with the ability to manage and configure any hardware/software platform remotely, through a proprietary client accessed remote server farm. Also embedded within the LabMentors system is a Learning Management System (“LMS”) that enables the delivery and tracking of curriculum and tasks to students. Using LabMentors' complete solution, any school or institution can offer advanced IT training topics in any number of areas such as Windows Server® 2008, Windows® 7, Exchange 2010, SharePoint® 2010, Linux® system administration, and various other applications without the associated overhead of owning and managing heterogeneous hardware and software platforms.

The Results of Operations discussed herein are on a consolidated basis.

Recent Developments.

The following are business developments during the fiscal year that ended March 31, 2012 (FY2012):

In addition to product enhancements and the beginning stages of phasing in learning center operations, several management changes have been implemented. Effective January 5, 2012 Robert O. Grover was appointed to serve as

PAGE 4

Chief Executive Officer. He succeeds Valerie L. Grindle who resigned on January 4, 2012. Mr. Grover has spent the last two decades with PCS designing, developing, and creating PCS learning programs and services intended to facilitate student-centered, experiential-learning. Mr. Grover has worked closely with partners and customers in the education industry over the past two decades and knows the complexities of the domestic and international educational marketspace well. Mr. Grover has traveled extensively throughout the world promoting PCS programs and developing International relationships for the Company. He was appointed to the Idaho District Export Council by the US Secretary of Commerce in January of 2012. A Merit Scholar, Mr. Grover attended Michigan State University for course work in Astrophysics, Philosophy, Computer Science, and Religious Studies; he attended the University of Idaho for additional coursework in History, Religious Studies, and Philosophy; and graduated with a B.A. in English, Creative Writing and an A.A.S in Management from Boise State University in 1988.

To strengthen financial planning and control capabilities, and better address the reporting needs of a publicly held company, PCS initiated an extensive search for a skilled financial officer in Q2 of FY2012. As a result, Ms. Leann Gilberg joined PCS in September 2011 as Chief Financial Officer. Ms. Gilberg has held multiple high-level financial management roles including work with Albertson’s Inc, Resources Global Professionals and two of the leading firms in the public accounting industry – KPMG LLP and Arthur Andersen LLP. She gained extensive business and accounting experience by serving publicly- traded and privately-owned companies and was a Senior Manager with KPMG LLP when she left public accounting in 2003. Her experiences have included audit and consulting engagements, work with internal controls, periodic filings with the Securities and Exchange Commission (the “SEC”), assisting on an initial public offering (“IPO”), management reporting and financial analysis. Ms. Gilberg, a Certified Public Accountant, earned a Bachelor of Science Degree in Business Administration (Accounting Emphasis) from the University of Montana with a minor in Political Science in 1992. She is a past member and chairperson of the University of Montana Accounting Advisory Board.

To strengthen PCS operational capabilities PCS initiated a search in Q2 of FY2012 for a candidate to fill the role of Chief Operating Officer. As a result, Mr. Brett Newbold joined PCS in January of 2012 as an operational advisor and active member of the executive management team. In March 2012 he was appointed Chief Operating Officer for PCS. Mr. Newbold has extensive executive management experience having served the role of CEO, COO, and CTO for a variety of companies both domestic and international over the past three decades. Mr. Newbold served as a direct report to Larry Ellison for eight years as a Vice President of R&D with Oracle, managing many significant technology initiatives. In addition, he has served as the Managing Director (CEO role) on several International startups, building them to successful levels and selling them after reaching profitability. As President of OpenText Corporation, a publicly held company with over 1,000 employees, from February 1997 - October 1998, he tripled revenues and market cap. We believe Mr. Newbold, whose extensive experience in detailed operating efficiencies, from development to product management to sales/marketing, will strengthen our bottom-line progressively.

During FY2012 the Company settled both the SEC case and the class action lawsuit that had been pending against the Company and certain of its former officers with no significant penalties or financial liabilities resulting. On January 3, 2012, the U.S. District Court for the District of Idaho signed Final Judgment in the SEC case pursuant to the Consent that the Company and Mr. Anthony Maher, its former CEO, had previously executed. Without admitting or denying the allegations of the Complaint, the Company and Mr. Maher consented to the entry of the Final Judgment. In September, the Company announced that it had entered into an agreement to settle the class action lawsuit, subject to further proceedings and approval by the Court. While the Company denies the allegations made in the class action lawsuit, the settlement was entered to eliminate the burden and expense of further litigation. On February 22, 2012, the Court gave final approval to the settlement and entered the Final Judgment and Order of Dismissal With Prejudice. The class action was settled for $665,000, with the Company’s insurance carrier providing most of the settlement funds. Both of these matters were costly, financially and as a burden on management. Settlement has allowed focus to return more completely to operations.

In November of 2011, we entered into an agreement with Colebrook Capital to assist with financial restructuring and raise capital. No additional capital was raised under this arrangement.

In January of 2012, we restructured a defaulted note payable to eight note holders that established a payment plan and new terms for the notes eliminating the default.

In January of 2012, we renewed our D&O insurance on favorable terms for a one year period.

PAGE 5

In February of 2012, we filed documents and released a private placement offer to raise capital using convertible notes. Thus far no funding has been raised under this offering.

From January of 2012 going forward, we have researched and pursued potential capital investments through the EB5 foreign investment program.

In March of 2012, we successfully initiated the process required to expand our pool of authorized shares for the purposes of raising capital and compensating employees through our incentive stock option program. These changes were approved by a vote of shareholders via proxy at a Special Meeting held on April 4, 2012. Shareholders voted to increase our authorized no par value common stock from 60,000,000 shares to 90,000,000 and to increase the shares of common stock available for grants, incentive or other purposes under our 2009 Equity Incentive Plan from 4,000,000 shares to 8,000,000 shares.

We continued to explore potential partnerships during FY2012, seeking opportunities and values that would strengthen PCS Edventures and advance shareholder value through improved sales and marketing, development, or operational efficiency.

We continued to grow our long term relationship with Edison schools in 2011, providing additional customized learning labs for their summer adventures programs, as well as supplying them with materials authored and developed in previous years. Edison Schools has been the resource of well over $1M in revenue since the inception of the relationship. Edison program, developed by PCS, range from primary stage camps in life science and biology to high school age activities in engineering, electronics, and robotics. Development, packaging, fulfillment, and support were further streamlined this year to improve efficiency and the overall customer experience.

We formed a relationship with STEM Academy (“STEM 101”) in which PCS provides the robotics curriculum and Labs for their 6

th

and 8

th

grade programs, and are working on developing additional programs for their elementary and high school STEM solutions.

We executed a contract with Tatweer Holding Company, a Saudi entity charged with managing education reform activities defined by the Saudi Ministry of Education, to compete for STEM consulting services related to the design and implementation of a nationwide network of science centers in Saudi Arabia, as part of the King Abdullah Education Initiative.

We further expanded our statewide penetration of STEM programs into Idaho schools. PCS is one of four state selected vendors for supplying a high school technical professional solution.

We further expanded our penetration into the Boys and Girls Clubs of America, a significant niche market for PCS afterschool products with over 5,000 sites across the United States.

Our LabMentors division partnered with Cengage Learning to develop and release two new titles in late fiscal year 2012.

PCS continues to strengthen and develop the core line of STEM products and services. Our Academy of Robotics

™

was updated and improved through a major technical upgrade of the PCS Brain, our microcontroller, to version 4.0. Improved supply chain and engineering resources are increasing our product margin and improving overall efficiencies in production and fulfillment.

Our relationship with Creya Learning of India was significantly strengthened through extended support, a two week visit from Creya business owners and educators to Boise for training and development. Expanded market testing has enabled Creya to refine and improve their business plan for delivering experiential education to the Indian marketplace. Creya opened its first learning center in the spring.

PCS launched and managed a series of pilot programs related to the afterschool center model in partnership with Sage International Charter School located in Boise. These programs went well and the offerings were extended to regularly scheduled afterschool offerings and summer programs.

PAGE 6

Net Loss in Q4 FY2012 decreased nearly 68% from the same quarter FY2011 before inclusion of the impairment charge on the LabMentors assets. We anticipate that our new focus on operating efficiencies and increased revenue generation should continue to narrow that gap.

During fiscal year 2011, PCS applied for and was awarded Trade Adjustment Assistance funds in the amount of $75,000 to apply to the development and promotion of PCS programs to improve our competitiveness against foreign imports. These matching funds are being used to improve and expand the PCS Robotics line of controllers, proprietary software, and curriculum solutions to take advantage of the rapidly growing robotics education market. Trade Adjustment Assistance funds suffered budgetary cutbacks in FY2012. PCS is continuing to apply for additional project assistance.

Strategy.

Our strategy is to continue to design and develop brain-based learning educational products and services for the PreK-16 market that emphasize STEM topics and develop contemporary skills for the 21

st

century learner. These skills include critical thinking, problem solving, innovation, creativity and communications. These products, PCS will deploy in experiential-learning centers which will serve as direct revenue generating entities as well as product and service showrooms that will improve our sales, service, and support to school districts around the country.

Our strategy consists of:

·

Using licensing and partnerships to drive the development of a global network of experiential-learning centers that will generate revenues and act as a sales and support network for PCS products and services;

·

Relentless commitment to making our products friendly and helpful for educators. If our products make their job easier, our products will be more and more popular;

·

The continued emphasis on forward looking development of products and services, recognizing the challenges that educators will be facing in several years, and preparing our products to help them meet those challenges early. We strive to be seen as thought leaders in the space;

·

Building PCS brand recognition and market appeal through a network of learning centers and strong commitment to customer loyalty;

·

Continuing to incorporate the latest in brain-based research to improve the effectiveness of our curriculum and content product;

·

Using the Internet and other digital technologies to bring our products and services to other areas, persons, and markets, to increase market penetration;

·

Leveraging our expertise in K-12 and educational robotics to expand our robotics offerings and capture market share in the K-12 educational and afterschool robotics space; and

·

Expanding our STEM professional development programs for K-6 classrooms to take advantage of market conditions that represent demand for these solutions.

Foreign Currency Exchange Rate Risk.

The Company promotes many of our products in the international market, as well as having established operations in Canada as a result of the acquisition of LabMentors. As a result, our statement of cash flows and operating results could be affected by changes in foreign currency exchange rates or weak economies of foreign countries. Working capital necessary to continue operating our foreign subsidiary are held in local, Canadian currency, with additional funds used through the parent company being held in U.S. dollars. In accordance with SFAS 52, “Foreign Currency Translation”, all assets and liabilities are translated at the exchange rate on the balance sheet date and all revenues and expenditures are translated at the average rate for the period. Translation adjustments are reflected as a separate component of stockholders' equity, accumulated other comprehensive income (loss), and the net change for the year reflected separately in the statements of operations and other comprehensive income (loss). While our Canadian

PAGE 7

subsidiary provided approximately 14% of our revenue in fiscal year 2012, the sales and receivables are transacted in USD$ and thus there is not a significant exchange risk associated with those transactions.

Backlog.

Our unearned revenue was $117,314 at March 31, 2012. At the end of fiscal year 2012, the entire amount of unearned revenue is expected to be earned during fiscal years 2013 and 2014. Of the total listed in unearned revenue at March 31, 2012, $4,058 is for orders prepaid by customers, $25,000 and $68,750 are advanced royalties and license fees resulting from our agreement with Creya Learning of India, and the remaining amount is for license fees paid but that have yet to be fully used by our domestic customers. PCS, as part of the agreement with Creya Learning, will receive ongoing royalties on the tuition charged to students attending PCS based programs and royalties will be amortized as earned. Each month, the license fees are amortized according to the length of the subscription/license.

Seasonality.

Our quarterly operating results fluctuate as a result of a number of factors, including, but not limited to, the funding of customers, timing of product development and release, availability and timeliness of items required for assembly of the products, budget cycles, buying patterns of our customers, period ending dates, and the general health of the economy. Our learning center strategy is designed to offset these factors and smooth cash flow and revenue predictability over time.

Principal Products or Services and Their Markets.

The primary goal of the products we develop for the education industry is to make teaching STEM easier for the classroom teacher. To this end, we have developed and are currently marketing a number of innovative technology-based educational programs for the pre-kindergarten through university (“PreK-16”) classroom market, the K-12 afterschool market, the private learning center market, and the home school market. In addition, the virtual lab programs from our LabMentors division are currently marketed to the collegiate level. Separately, and in combination, these lab products present a platform for delivering educational services and support, and create a virtual community of learners and parents on the web. It is our intent that as this community grows, it becomes an education portal through which additional PCS programs and services can be deployed.

We believe that education programs of our type are not currently available from any other source and present a unique opportunity for sales and marketing to specific segments of the education industry. We believe that PCS' education programs deliver a unique, proven learning experience that:

·

Provide students with exciting and relevant activities that brings curriculum to life;

·

Develop essential critical thinking and problem-solving skills;

·

Prepare students for real-world career demands; and

·

Build a strong foundation in technical literacy.

Customers currently use our products to:

·

Uniquely motivate students by engaging them in their own learning;

·

Provide opportunities for students to pursue their own interests and questions and make decisions about how they will find answers and solve problems;

·

Make learning relevant and useful to students by establishing connections to life outside the classroom, addressing real world concerns, and developing real world skills which are desired by today’s employers, including the ability to work well with others, make thoughtful decisions, take initiative, and solve complex problems;

PAGE 8

·

Provide opportunities for teachers to build relationships with each other and with those in the larger community through sharing with other teachers, parents, mentors, and the business community who all have a stake in the student's education;

·

Provide exciting, hands-on, inquiry based instruction, which is aligned by standards produced by The National Science Teachers Association, the American Association for the Advancement of Science, Project 2061, the National Curriculum of the UK, the Core, Knowledge, Sequence, the National Association for the Education of Young Children (“NAEYC”), and many more depending on grade level or subject focus;

·

Help increase test scores and understanding in STEM standards;

·

Infuse engaging, technology-based methods and practices into the traditional classroom;

·

Teach concepts from mechanical, electrical, structural, and software engineering as well as mechatronics and robotics;

·

Challenge students through promoting critical thinking, creativity, and problem solving techniques;

·

Enable teachers to teach science lab activities without a science lab;

·

Enable IT training professionals at the high school and college level to offer sophisticated hands-on training labs through virtualization, effectively eliminating their need to own and manage expensive server networks.

The products we are currently marketing are applicable and useful to a variety of educational market segments. These product lines have been designed to stand-alone as well as integrate with one another to create contiguous, systemic solutions:

ThinkBug

The ThinkBug product line includes an Alphabet Builder Curriculum, a Number Builder Curriculum, PCS Big Bricks, and an optional mobile furniture unit. Designed around the most current brain and block play research, ThinkBug brings a comprehensive manipulative based literacy and numeracy STEM solution to early childhood and kindergarten educators

PCS BrickLab®

The PCS BrickLab® is a remarkably effective system of building blocks combined with PCS curriculum resources that addresses technology, math, construction engineering, communication, and science principles at the early primary grades. Simple to use, manage, and teach, it is an engaging and effective tool for hands-on STEM education. PCS currently has over six volumes of curriculum that support the BrickLab manipulative package addressing needs for students in the elementary and afterschool setting.

PCS Professional Development STEM Institutes

The PCS STEM institutes offer a 30 hour professional development program for elementary teachers that develops student-centered learning environments, improves student academic performance, promotes 21st century skills in students, and improves teacher comfort and competence in teaching science, technology, engineering, and mathematics (STEM) across the curriculum. Our institutes use products such as Bricklab to make STEM education approachable, less intimidating, and easier for the teacher.

PCS Digital Media Labs

Designed for today's “digital native” youth, PCS Digital Media Labs transform educational settings into technology-driven environments that use digital photography, video, and podcasting to make daily lesson plans more engaging. The curriculum is aligned with technology standards from the International Society for Technology Education (“ISTE”) and the International Technology Education Association (“ITEA”). Each Digital Media Lab contains hands-on lesson plans, a hard cover mobile case, digital cameras, camcorders or voice recorders, accessories, and a teacher guide. It is currently available in Elementary and Secondary versions for classrooms and afterschool programs.

PAGE 9

PCS Academy of Engineering

™

The PCS Academy of Engineering

™

Lab is a STEM program designed for use within tech-ed programs and is scalable for various environments using 10 student modules that include hardware, software, lab furniture, and curriculum. Using the PCS Academy of Engineering

™

students develop, design, and produce exciting hands-on projects ranging from catapults to robots in response to engaging challenges in a variety of topics. The current PCS Academy of Engineering

™

product includes three primary volumes of mechanical engineering activities. The Tech Ed configuration of the Academy of Engineering uses fischertechnik constructs for hands-on activities. The Academy of Engineering includes online assessment and support tools as well as access to an online competition framework that enables all lab students to share information and compete. The AOE is currently marketed to middle and junior high schools.

Academy of Robotics

™

The Academy of Robotics

™

Lab is a STEM program that is scalable for various environments using 10 student modules that include hardware, software, lab furniture, and curriculum. Using the Academy of Robotics

™

students develop, design, and produce exciting hands-on projects ranging from simple robotic automatons to advanced manufacturing simulations. The current Academy of Robotics

™

product for the classroom setting includes three primary volumes of robotics curriculum covering the basics of mobility, structural integrity, motorization, end effectors, working envelopes, programming, sensor integration, and more. In addition, three volumes of applied mathematics activities, Pre-Algebra, Algebra Book 1, and Algebra Book 2, have been developed to provide real world applications and illustrations of mathematics. The Tech Ed configuration of the Academy of Robotics uses fischertechnik constructs for hands-on activities. Fischertechnik solutions are typically used in more rigorous applications at the high school or university level. We also have the Academy of Robotics

™

Lab Afterschool Edition available. With the use of LEGO® building elements, we have created an in-depth robotics program that was designed specifically for use in afterschool programs. Using the Academy of Robotics

™

Afterschool Edition, students develop, design, and produce exciting hands-on projects ranging from simple robotic automatons to advanced manufacturing simulations. It

’

s a great way to introduce students outside the classroom to the importance of robotics and STEM, so they will look forward to these subjects within their regular school day. Academy of Robotics

™

Labs include online assessment and support tools as well as access to an online competition framework that enables all lab students to share information and compete in exciting virtual challenges. Also available is a smaller package called the Robotic Educator Pack (REP), which bundles the Academy of Robotics Challenge with a starter inventory of manipulatives from fischertechnik at a lower price point. We recommend our AOR labs for students in grades 5-12.

Academy of Electronics

™

The PCS Academy of Electronics

™

Lab is designed for use within Tech Ed programs and is scalable using 10 student modules that include hardware, software, lab furniture and curriculum. Using the Academy of Electronics

™

students develop, design, and produce exciting hands-on projects ranging from simple analog circuits demonstrating resistance to advanced digital logic projects using a variety of industry standard integrated circuits. The current Academy of Electronics

™

product includes two primary volumes of electronics curriculum covering the basics of analog and digital electronics. Academy of Electronics

™

modules use standard electronic components and breadboards as constructs for hands-on activities.

PCS Academy of Science®

The PCS Academy of Science® is an integrated chemistry-physical science solution designed for use within Tech Ed and science programs and is scalable using 10 student modules that include hardware, software, and curriculum. The unique, hands-on science packages within the PCS Academy of Science® combine curriculum and simple, effective apparatus that enable teachers to quickly and easily demonstrate complex science concepts. Various configurations of the products enable it to be effective as an afterschool or classroom solution and the curriculum is aligned with National and State science standards. The products can be purchased in a lab format or individually based on the specific needs of the customer. The AOS is currently marketed to classrooms and afterschool programs for a variety of age groups.

PAGE 10

PCS Discover STEM Lab

The PCS Discover STEM Lab is a modular, easy to present program that provides activities for afterschool facilitators in the areas of STEM. Modules include hands-on activities that utilize PCS robotics, engineering, digital media, applied math activities and more. This cost-effective lab is the perfect fit into any afterschool program, and has been a great addition to our afterschool product line.

LabMentors

LabMentors offers technologies and products through their virtual labs on a proprietary platform as described below:

Windows® Based Applications: Currently LabMentors has virtual labs on its proprietary platform for Windows XP®, Windows Vista®, Windows® 7, Windows Server® 2003, Windows Server® 2008, and Windows SharePoint® 2010.

Linux® Based Virtual Labs: LabMentors offers virtual labs on its proprietary platform for Linux+®.

Certification tracks: LabMentors offers labs for Comptia and other certification tracks including Network+®, Security+®, GCFI Guide to Computer Forensics and Investigations Virtual Labs. LabMentors offers virtual labs on its proprietary platform for these Comptia and other certification tracks.

Custom Labs; In addition, LabMentors also provides custom lab development. This pricing is based on the complexity and resources involved in developing such curriculum/virtual labs.

On-call mentoring: This is a 24 hour 7 days per week call in and/or email service for students to contact the company for technical assistance regarding the virtual labs related to their studies.

PCS Designated Markets

The educational market represents significant business opportunities in the US. There are several segments within the educational market that can benefit from the products and services that PCS provides. PCS has developed sales and marketing strategies to position the Company and its products to meet the needs of specific segments in the education market.

There is increasing focus and importance being placed on the role of technology in both public and private education. Educators and parents are not only striving to integrate technology into the educational experiences of students, but also needing to increase student’s performance in technology-based subjects such as Engineering, Mathematics and Science, creating STEM. Public schools are trying to increase their ability to deliver technology education effectively to students. The increased value being placed on technology in the classroom has also led to an increase in growth for private, charter, and magnet school alternatives, because of their very nature, that can offer better programs for STEM education. Growth of extended learning programs continues as well. Federally funded STEM programs that include before, after and summer school programs have also remained an important educational focus and are also expected to meet demands for technology.

PCS’ core curriculum strength is based on STEM principles. In order to increase market penetration and continued growth PCS has identified the following as key target markets:

1)

K6 Programs for the elementary classroom

2)

Tech Ed Programs for grades 6-12

3)

Afterschool Programs

4)

Products and Services adapted to provide K-16 educational solutions for the international market

5)

Virtual labs for grades 10-16

PAGE 11

PCS’ understanding of the complexities of STEM subjects and our progressive methodologies give us a unique ability to deliver solutions for educators to meet the growing demands of teaching STEM and integrating technology into classrooms and afterschool settings. Here is a briefing of our current Strategic Business Units (SBU) and their markets:

K6 Strategic Business Unit

With over 50,000 public elementary schools alone, the elementary classroom in the United States represents one of the largest markets in the education industry. We are currently developing new marketing strategies to reach elementary teachers and district leaders in the U.S. While this is a newer SBU, we feel that we are gaining great traction and believe we will continue to thrive throughout the years. PCS K-6 programs for the elementary classroom consist of professional development and classroom resources that promote student centered learning, inquiry, and STEM topics. K-6 products include ThinkBug, PCS BrickLab®, Academy of Robotics

™

and Digital Media Labs.

Technical Education Strategic Business Unit

Targeting the domestic technical education marketplace, which has an estimated 22,081 programs in the U.S, the Tech Ed SBU offers STEM products that meet the needs of technology teachers servicing grades 7-12 providing pre-engineering, computer science, and robotics solutions. With most educators and districts realizing the need for STEM education improvement, the Tech Ed SBU has a great product line to meet the market’s needs. A primary focus for the Tech Ed SBU is the exploding marketplace for robotics. Markets for educational robotic kits at $27.5 million in 2007 are anticipated to reach $1.69 billion by 2014. Tech Ed products include the PCS Academy of Engineering, Academy of Robotics

™

, Academy of Science®, PCS Digital Media Labs and the current development of MINDS-i kits.

Afterschool Strategic Business Unit

Targeting the domestic afterschool marketplace, the PCS Afterschool SBU offers products that were specifically designed for the unique needs of the afterschool enrichment environment. The market for afterschool programs in the United States is significant with specific market segments such as the Boys and Girls Clubs (4,000 sites) and the $1B 21

st

Century Community Learning Centers program. It continues to be one of our more successful markets and we believe that this trend will continue. Afterschool products include the PCS BrickLab®, Discover STEM Lab, the Academy of Robotics

™

afterschool version, MINDS-i packages with PCS robotics and the PCS Digital Media Labs.

International Strategic Business Unit

Internationally, PCS programs have a great deal of appeal from the perspective of STEM education needs, and also as a catalyst for developing student-centered learning environments that emphasize 21

st

century skills such as problem solving, critical thinking, communications, and collaboration skills. PCS continues to explore opportunities in foreign markets. PCS takes great pride in being able to adapt its products to meet the diverse and unique needs of the international market place.

LabMentors

PCS LabMentors is the exclusive provider of a proprietary virtual lab technology which is designed to provide hands-on experience to high school, community college and university students studying a variety of technical topics. These technical topics include programming, network management, security, operating systems and other IT subjects. LabMentors' technology provides students with the ability to manage and configure any hardware/software platform remotely, through a proprietary client accessed remote server farm. Also embedded within the LabMentors system is a Learning Management System (LMS) that enables the delivery and tracking of curriculum and tasks to students. Using LabMentors' complete solution, any school or institution can offer advanced IT training topics in any number of areas such as Windows Server® 2008, Windows® 7,Exchange 2010, SharePoint® 2010, Linux system administration and various other applications without the associated overhead of owning and managing heterogeneous hardware and software platforms.

PAGE 12

Marketing and Other Agreements.

(i) In March of 2010 PCS successfully completed a pilot robotics competition program in Cairo, Egypt, partnering with the Integrated Care Society and Bibliotech Alexandria. In December 2010 and January 2011, PCS completed shipments for lab implementations into five experimental schools in Egypt. Political turmoil slowed implementation and training programs in January and February, but the programs are now in place and operational in five Egyptian Governorates.

(ii) In order to facilitate future revenue growth, PCS engaged in an in-depth review of our “go to market” strategy during FY2012, which resulted in a shift to re-focus the delivery of our unique capabilities to meet the needs of the market. We have ceased direct sales based on geographical regions and have moved into four Strategic Business Units (“SBUs”), in addition to our wholly owned subsidiary LabMentors. We currently have three in-house sales employees, consisting of sales managers covering specific products in specific territories. In addition, there are two marketing support roles providing advertising, trade show support, online SEO, social networking, and other lead generation programs.

(iii) In June 2011, we entered into a licensing agreement with Kindle Education, now Creya Learning, for the country of India and have provided support, curriculum, and training for their experiential learning programs.

(v) In April 2012, we entered into a distribution agreement with STEMfinity, an online source for a variety of STEM products.

(vi) In May 2012, we entered into an agreement with Cultural Innovations, a British museum consulting company, to provide STEM education consulting services related to the King Abdullah Education Initiative in Saudi Arabia. The King Abdullah initiative, launched in 2007, is a sweeping reform program designed to transform the Saudi education system and includes a strong emphasis on student centered learning and STEM education.

Distribution Methods of the Products or Services.

All products except the virtual labs produced by LabMentors are drop shipped from the manufacturer or shipped through a preferred provider from our warehouse to the specified customer. The virtual labs produced by LabMentors are delivered on the Internet through server farms located off-site.

Status of any Publicly Announced New Product or Service.

PCS continues to strengthen and develop the core line of STEM products and services. The Discover STEM lab afterschool product line was created and the first section completed. Robotics was updated and enriched through the development and partnering with a new heavy-duty manipulative system and many advanced peripherals. Additional volumes of curriculum in Pre-Algebra and Algebra I were completed. This series was developed by experts in the field of mathematics and in cooperation with the Boise School District. The development of robotics competition resources including manuals, judging rubrics, and overall competition framework was completed and successfully launched with an International competition conducted in July 2010. In addition, curriculum development around PCS early childhood materials and the BrickLab professional development programs were completed and enhanced, and additional research from the Meridian District/Boise State University research project was added to our research base for products.

In August of 2010, PCS successfully completed an entirely new set of BrickLab curriculum for first through sixth grade and added heavily to the already extensive BrickLab Institute professional development materials. The new curriculum was designed to be more lesson-plan friendly for the classroom. The previous incarnation of the BrickLab became the lead for the afterschool BrickLab market. A body of research produced by Boise State University in the Idaho SySTEMic Institute has helped to drive the research-based improvements to the overall process and experience for educators.

PAGE 13

In October of 2010, PCS continued the integration of the MINDS-i building system into its current product lines. New sensors and sensor fittings were designed and created, the complete MINDS-i CAD library was developed, and two MINDS-i summer camp products were planned for summer of 2011.

In November of 2010, additional BrickLab extension building cards were created to offer thematic building activities. This was a requested curriculum by teachers already using the BrickLab in the classroom.

November 2010 also brought the creation of three new 12-day summer camps for Newton Learning.

Continual development of the next version of our microcontroller, The Brain and sensors, has begun with the goal of creating a smaller more efficient electronic footprint, adding more capability and furthering integration of servos and other third-party sensors.

Winter of 2010 focused on creating a new STEM afterschool lab offering. Using the already existing Discover Lab name, a new modular STEM product was created for grades 4-6. Offering 12 activities in each subject area Science, Technology, Engineering and Math, the lab could support sixteen students working in pairs.

In January 2011, PCS began designing a comprehensive experiential education solution for afterschool centers in the Kingdom of Saudi Arabia, potential domestic application, and for other locations worldwide. The solution uses the PCS Merit System to facilitate student use of PCS curriculum programs such as PCS BrickLab®, the Academy of Robotics

™

, PCS Academy of Engineering

™

, Digital Media Labs, and integrated hands-on, project based learning approaches. From January through May of 2011, PCS presented this solution to a number of potential partners from India (Kindle Learning), Saudi Arabia, Turkey, the United Arab Emirates, and Oman.

In the Summer of 2011, PCS completed its efforts to migrate manufacturing and production for portions of its PCS robotics line to a new supplier, Qingdao Smart Robot Technologies Co. Limited, in China.

From November of 2011, through March of 2012, PCS launched and managed a series of pilot programs related to the afterschool center model in partnership with Sage International Charter School located in Boise.

In January of 2012, PCS recruited a new operations advisor, now COO, Brett A. Newbold who assumed direction of product development. In Q4 of FY 2012 the primary development focus was the improvement and refining of key PCS Robotics products including the Robotics Educator Pack (“REP”) and the PCS Brain and Cortex programming environment.

Competitive Business Conditions and the Small Business Issuer's Competitive Position in the Industry

and Methods of Competition.

The education industry is highly competitive, fragmented, and is rapidly evolving around the STEM disciplines. We expect the industry to continue to undergo significant and rapid technology change. The Nationwide economic difficulties are causing budget deficits, teacher layoffs, and program reductions, which may impede industry growth.

Competitors in the STEM marketplace include a variety of publishers, technical education companies and non-profit solution providers including VEX, Pitsco, LabVolt, Pasco, LEGO® Education, McGraw Hill and Project Lead the Way. These companies along with new entrants into the market may develop products and services and technologies superior to our products that may result in our products and services becoming less competitive. Many of the companies that are established or are entering the market have substantially greater financial, manufacturing, marketing, technical resources and established historical channels than we have and represent significant long-term competition. To the extent that these companies offer comparable products and services at lower prices or higher quality and more cost effective, our business could be adversely affected.

PAGE 14

Potential Competitive Advantages.

We believe that we have and continue to develop certain additional competitive advantages that we will attempt to maximize in developing and implementing our business strategy.

Experiential learning centers

- We believe the establishment of a network of experiential learning centers, based on our curriculum, products and expertise in afterschool programs, will yield us a significant competitive advantage through improved presence in key markets for both sales and support. The establishment of these centers, in addition to providing revenues from operations, creates a dynamic showroom that can be used for sales demonstrations, product training and support activities, and promotional events within the targeted community.

Professional development

- Our BrickLab professional development institute conducted from 2008-2010 resulted in the successful deployment of this product into hundreds of Idaho elementary classrooms and the production of University authored research now available for educators and administrators through the American Association of Engineering Education (ASEE). This research documents the effectiveness of the Bricklab Institute in improving teacher attitudes and their comfort level in conducting STEM activities in the elementary classroom. The network of active teachers also provides PCS with a strong community of program advocates from which PCS can leverage and expand the program. Since elementary teachers are typically more comfortable with language arts than STEM topics, the BrickLab Institute provides a proven solution to a prevalent problem for elementary principals across the country.

Robotics programs

- Our PCS Robotics programs are specifically designed to accommodate needs in the education marketplace that were identified through years of experience with K12 robotics. The result is less expensive, more flexible robotics solution that has the ability to integrate into every robotic educator’s classroom. Specific examples of this flexibility include a multi-level programming environment that naturally evolves in complexity to match the needs of the student, an open physical architecture that provides hooks for all major manipulative manufacturers including fischertechnik®, LEGO®, K’NEX®, MINDS-i, VEX, erector, and even industry standard R/C components. The open physical architecture of our microcontroller and its basis on the highly popular Atmel AVR platform provides educators and robotic enthusiasts direct hardware access and the ability to use a variety of programming environments.

Our framework

- Our unique experiential learning framework is designed for managing and facilitating non-formal education provides us with in-house capabilities unavailable through other channels. Initially designed over a decade ago, the PCS Merit System is a non-formal learning framework that provides flexibility, adaptability, and a variety of unique characteristics that create a highly effective pedagogical model unavailable elsewhere.

Forward looking processes

- Our forward looking educational development processes include mapping our curriculum and products against future trends such as the upcoming Next Generation Science Standards, the Common Core, and the NAEP’s mandated technology and engineering literacy assessment to be implemented nationwide in the US in 2014.

Our use of the Internet as a delivery and support mechanism for the programs

- By leveraging our expertise in Internet technology, PCS believes it can achieve the following significant advantages: (1) a high level of program control and protection; (2) the building of a significant data model regarding program usage; and (3) a direct channel to our users who are migrating towards digital e-reading devices. Each of these advantages provides tangible long-term benefits to the Company.

Organic expansion of program offerings

- After implementing and proving a successful program model, PCS believes it can leverage its high level of customer satisfaction to expand current and additional programs designed to integrate seamlessly into the already deployed sites. This creates a long-term growth strategy that includes new and residual sales to an ever-growing list of customers.

The flexibility of products and staff to align STEM solutions to multiple types of users

- Our in-house intellectual capital has experience in a variety of educational environments and has demonstrated an ability to create highly effective solutions for specific niche markets. This extensive experience of almost 25 years in STEM education provides PCS with an advantage over competitors with less experience in STEM education.

PAGE 15

PCS believes the contiguous nature of its products creates a system that provides a competitive advantage over other companies who may have single product offerings or products with no systemic approach or plan. This system begins at the PreK level and extends through college. School districts seeking a systemic approach to STEM education will find the PCS approach comprehensive.

Sources and Availability of Raw Materials and the Names of Principal Suppliers.

We currently do not manufacture the products that accompany our curriculum and are dependent on vendors for our supply of these products. We believe that efficient purchasing is a key factor in maintaining our competitiveness. The following is a list of vendors for our key products: I.B.A., MINDS-i, fischertechnik, K’NEX, QSmart Robotics Technologies, Educator’s Resource and Ingram Micro.

Dependence on One or a Few Major Customers.

In general, PCS does not rely on one or a few major customers. However, PCS LabMentors has one major customer, Cengage Learning, previously known as Thomson Course Technology, whose revenue is greater than 10% of the total LabMentors revenue stream.

Patents, Trademarks, Licenses, Franchises, Concessions, Royalty Agreements or Labor Contracts, including Duration.

We seek to protect our technology, documentation, and other written materials under trade secret and copyright laws, which afford only limited protection. Generally, we enter into confidentiality and non-disclosure agreements with our key vendors and suppliers. At the present time, we have not applied for any patents, nor do we have any patents pending. We anticipate that our products will not be the type for which patent protection will be sought. However, we may file for patent protection on certain aspects of our proprietary technology in the future.

Currently we use the following registered and common-law trademarks: PCS & Design®, Academy of Learning

™

, Edventures!

™

, PCS BrickLab®, PCS Academy of Science®, Academy of Robotics

™

, Academy of Electronics

™

, PCS Edventures!.com.®, PCS STEPS & Design®, PCS Young Learning

™

, Little Edventures

™

, PCS STEPS®, New Learning for a New World®, Imagination in Education®, and PCS Academy of Engineering

™

. We intend to evaluate continually the appropriateness of seeking registration of additional product names and trademarks as they evolve.

Our PCS & Design® mark (Registration No. 2,213,678) has been in use since at least as early as 1992 and has been a U.S. Registered Trademark since December 29, 1998. PCS Edventures!.Com® (Registration No. 2,511,642) has been in use since at least as early as June 1, 1996 and has been a U.S. Registered Trademark since November 27, 2001.

We applied for a U.S. trademark registration (application serial number #78/329,127) for PCS BrickLab® on November 17, 2003. PCS BrickLab® was registered on January 16, 2007 with Registration Number 3,198,009. PCS BrickLab® has been in use since at least as early as January 1, 2002.

We applied for a U.S. trademark registration (application serial number #78/841,293) for PCS STEPS® on March 20, 2006. PCS STEPS® was registered on May 22, 2007 with Registration Number 3,244,304. PCS STEPS® has been in use since at least as early as January 1, 2006.

We applied for a U.S. trademark registration (application serial number #77/184,052) for Imagination in Education® on May 17, 2007. Imagination in Education® was registered on August 5, 2008 with Registration Number 3,478,928. Imagination in Education® has been in use since at least as early as July 1, 2006.

PAGE 16

We applied for a U.S. trademark registration (application serial number #77/184,043) for New Learning for a New World® on May 17, 2007. New Learning for a New World was registered on November 11, 2008 with Registration Number 3,529,785. New Learning for a New World® has been in use since at least as early as July 1, 2006.

We applied for a U.S. trademark registration (application serial number #78/472600) for PCS Academy of Science® on August 24, 2004. PCS Academy of Science® was registered on September 1, 2009 with Registration Number 3,676,485. PCS Academy of Science® has been in use since at least as early as January 1, 2004.

We applied for U.S. Copyright Registration of Infusing Technology Digital Photography Lab: Elementary on August 4, 2008. Registration #TX6-863-245 was granted effective August 4, 2008. Infusing Technology Digital Photography Lab: Elementary date of first publication was March 26, 2008.

We applied for U.S. Copyright Registration of Infusing Technology Digital Photography Lab: Grades 1-6 on August 4, 2008. Registration #TX6-865-569 was granted effective August 4, 2008. Infusing Technology Digital Photography Lab: Grades 1-6 date of first publication was June 10, 2008.

We applied for U.S. Copyright Registration of Infusing Technology Digital Photography Lab: High School on August 4, 2008. Registration #TX6-964-151 was granted effective August 4, 2008. Infusing Technology Digital Photography Lab: High School date of first publication was May 7, 2008.

We applied for U.S. Copyright Registration of Digital Audio Lab Grades 1 through 6 Curriculum on October 14, 2008. Registration #TX6-881-690 was granted effective October 14, 2008. Digital Audio Lab Grades 1 through 6 Curriculum date of first publication was October 1, 2008.

Although we believe that our products have been independently developed and that we do not infringe on any third party rights, third parties may, in the future, assert infringement claims against us. We may be required to modify our products, trademarks, and/or technology or to obtain licenses to permit our continued use of those rights. We may not be able to do so in a timely manner or upon reasonable terms and conditions and as such failure to do so could irreparably harm the Company and/or our operating results.

We currently have curriculum royalty agreements with GibsonTech. The agreement with Gibson Tech, which was renewed this past year, is for cash royalty payments based on sales of our PCS Academy of Electronics

™

product. An agreement with Jackie DeLuna,that was for cash royalty payments based on sales of our Digital Photography lab product(s) expired March 31, 2012.

Need for any Government Approval of Principal Products or Services.

None, not applicable.

Effect of Existing or Probable Governmental Regulations on the Business.

Exchange Act

.

We are subject to the following regulations of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and applicable securities laws, rules and regulations promulgated under the Exchange Act by the Securities and Exchange Commission (the “SEC”). Compliance with these requirements of the Exchange Act also substantially increase our legal and accounting costs.

Smaller Reporting Company.

We are subject to the reporting requirements of Section 13 of the Exchange Act, and subject to the disclosure requirements of Regulation S-K of the SEC, as a “smaller reporting company.” That designation will relieve us of some of the informational requirements of Regulation S-K.

PAGE 17

Sarbanes-Oxley Act.

We are also subject to the Sarbanes-Oxley Act of 2002. The Sarbanes-Oxley Act created a strong and independent accounting oversight board to oversee the conduct of auditors of public companies and strengthens auditor independence. It also requires steps to enhance the direct responsibility of senior members of management for financial reporting and for the quality of financial disclosures made by public companies; establishes clear statutory rules to limit, and to expose to public view, possible conflicts of interest affecting securities analysts; creates guidelines for audit committee members’ appointment, compensation and oversight of the work of public companies’ auditors; management assessment of our internal controls; prohibits certain insider trading during pension fund blackout periods; requires companies and auditors to evaluate internal controls and procedures; and establishes a federal crime of securities fraud, among other provisions. Compliance with the requirements of the Sarbanes-Oxley Act substantially increases our legal and accounting costs.

Reporting Obligations.

Section 14(a) of the Exchange Act requires all companies with securities registered pursuant to Section 12(g) of the Exchange Act to comply with the rules and regulations of the SEC regarding proxy solicitations, as outlined in Regulation 14A. Matters submitted to stockholders of our Company at a special or annual meeting thereof or pursuant to a written consent will require our Company to provide our stockholders with the information outlined in Schedules 14A or 14C of Regulation 14; preliminary copies of this information must be submitted to the SEC at least 10 days prior to the date that definitive copies of this information are forwarded to our stockholders.

We will also be required to file annual reports on Form 10-K and quarterly reports on Form 10-Q with the SEC on a regular basis, and will be required to timely disclose certain material events (e.g., changes in corporate control; acquisitions or dispositions of a significant amount of assets other than in the ordinary course of business; and bankruptcy) in a Current Report on Form 8-K.

Cost and Effects of Compliance with Environmental Laws.

None, not applicable.

Number of Total Employees and Number of Full Time Employees.

We employ approximately 15 full-time employees, while our LabMentors subsidiary has four full-time employees. We will hire part-time and additional full-time employees on an “as-needed” basis. We have not experienced a shortage of qualified employees. None of our employees are a party to a collective bargaining unit and we believe that our relationship with our employees is good.

Item 1A - Risk Factors.

Smaller reporting companies are not required to provide this information; however, you should be aware that an investment in the Company is highly speculative and subject to numerous risks. You should consider the following most notable risk factors together with all the other information contained in this Annual Report on Form 10-K before making an investment decision with respect to our common stock. This list is not to be considered all inclusive.

Risks Related to our Business.

Ability to Raise Capital

We have a history of significant operating losses and may not be able to achieve sustained profitability if we are unable to increase revenue from our new products and marketing efforts. To achieve sustained profitability, we will need

PAGE 18

to implement changes to existing business processes and improve our cost cutting efforts in addition to driving revenue growth. This history of operating losses could impede our future ability to raise capital.

Potential Loss of Intellectual Property

The company has pledged its Intellectual Property as collateral for notes payable as discussed in Note 7. Risk of loss of the underlying IP exists should the Company default on these notes.

Education Funding

The education market is heavily dependent on support from federal, state and local governments. These government agencies have realized budget cuts and the government appropriations process is often slow and unpredictable. Funding difficulties can negatively impact our ability to increase revenue.

International Expertise

Our attempt to enter international markets introduces political and cultural risk. As a small company, we do not have extensive experience in international business arrangements and will need to rely on certain outside expertise which can be costly.

Item 1B-Unresolved Staff Comments.

None, not applicable.

Item 2. Property.

Location.

The Company leases its Principal executive offices in Boise, Idaho. These offices consist of approximately 7,300 square feet of office space. Rent obligations are currently $10,266/month under a non-cancelable operating lease that expired May 31, 2012. The lease was extended effective June 1, 2012, at a rate of $8,680/month for 13 months.

The Company leases additional warehouse space in Boise, Idaho. This warehouse space consists of approximately 2,880 square feet. Rent obligations are approximately $1,400/month under a non-cancelable operating lease that expired June 30, 2012. The lease was extended effective July 1, 2012, at a rate of $1,325/month for 24 months.

Effective October, 2010, the Company entered into a five year office lease for the LabMentors subsidiary located in Fredericton, New Brunswick, Canada. This space consists of approximately 1,700 square feet. Rent obligations in Canadian dollars (CAD) were $1,713/month through September 30, 2011, and $1,894/month through September 30, 2012. This lease was cancelled effective July 1, 2012. Employees will be working from their respective homes until a new lease is negotiated.

Investment Policies.

None, not applicable.

Description of Real Estate and Operating Data.

None, not applicable.

PAGE 19

Item 3. Legal Proceedings.

(i) On January 3, 2012, the U.S. District Court for the District of Idaho signed the Final Judgment in the Securities and Exchange Commission (the “SEC”) case pursuant to the Consent that the Company and Mr. Anthony Maher, its former CEO, had previously executed. Without admitting or denying the allegations of the Complaint, the Company and Mr. Maher consented to the entry of the Final Judgment which, among other things: permanently restrained and enjoined the Company from violations of, and permanently restrained and enjoined Mr. Maher from aiding and abetting violations of, Section 13(a) of the Securities Exchange Act of 1934 (the “Exchange Act”) and Rules 12b-20, 13a-1, and 13a-11 thereunder; permanently restrained and enjoined Mr. Maher from violations of Section 10(b) of the Exchange Act and Rule 10b-5 thereunder; permanently restrained and enjoined Mr. Maher from violations of Section 13(a) of the Exchange Act and Rule 13a-14 thereunder; barred Mr. Maher from serving as an officer or director of any issuer that has a class of securities registered pursuant to Section 12 of the Exchange Act, as amended, or that is required to file reports pursuant to Section 15(d) of the Exchange Act, for a period of five years from the date of the entry of the Final Judgment; and ordered Mr. Maher to pay a civil penalty in the amount of $100,000 to be paid in equal quarterly amounts of $25,000. There were no monetary sanctions imposed against the Company.

(ii)

Class Action Lawsuit

: The Company, along with its former CEO and former CFO, was named in a class action lawsuit (

Niederklein v. PCS Edventures!.com, Inc., et al.

, U.S. District Court for the District of Idaho, Case 1:10-cv-00479-CWD). The class action was brought on behalf of shareholders who purchased shares of the Company’s common stock during the period between March 28, 2007 and August 15, 2007. In September, the Company announced that it had entered into an agreement to settle the class action lawsuit, subject to further proceedings and approval by the Court. While the Company denies the allegations made in the class action lawsuit, the settlement was entered to eliminate the burden and expense of further litigation. On October 5, 2011, the Court granted preliminary approval to the settlement, and approved the notices that were sent to potential class members. At the Settlement Fairness Hearing on February 22, 2012, the Court gave final approval to the settlement and entered the Final Judgment and Order of Dismissal With Prejudice. The class action was settled for $665,000 with the Company’s insurance carrier providing most of the settlement funds. In accordance with the Court ordered settlement, all settlement funds were paid on or before February 29, 2012.

Item 4. Mine Safety Disclosures

None; not applicable.

PART II

Item 5. Market for Common Equity, Related Stockholder Matters and Small Business Issuer Purchases of Equity Securities.

Market Information.

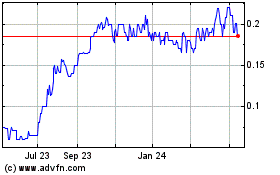

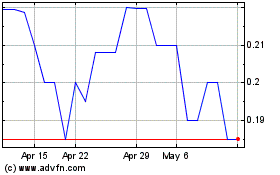

Our common stock is presently quoted on the OTC Bulletin Board of the NASD under the symbol “PCSV” as discussed below. No assurance can be given that the market for our common stock will continue in the future or will be maintained. The possible sale of “restricted securities” (common stock) pursuant to Rule 144 of the SEC held by members of management or others could have a substantial adverse impact on this market. The range of high and low bid quotations for our common stock during each quarter of our past two fiscal years is shown below. Prices are inter-dealer quotations as reported by the NQB, LLC, and do not necessarily reflect transactions, retail markups, markdowns, or commissions.

Stock Quotations.

|

|

| |

|

Quarter Ended

|

High

|

Low

|

|

June 30, 2010

|

$ 0.85

|

$ 0.54

|

|

September 30, 2010

|

0.75

|

0.30

|

|

December 31, 2010

|

0.42

|

0.11

|

|

March 31, 2011

|

0.26

|

0.11

|

|

June 30, 2011

|

0.51

|

0.16

|

|

September 30, 2011

|

0.30

|

0.13

|

|

December 31, 2011

|

0.20

|

0.01

|

|

March 31, 2012

|

0.10

|

0.03

|

Holders.

As of March 31, 2012, we had approximately 245 stockholders of record through our transfer agent. This figure does not include an indeterminate number of stockholders who may hold their shares in a street name.

Dividends.

We have not paid any cash dividends since our inception and do not anticipate or contemplate paying dividends in the foreseeable future. It is the present intent of management to utilize all available funds for the development of our business.

Securities Authorized for Issuance Under Equity Compensation Plans.

On August 27, 2009, the Board of Directors adopted and the shareholder’s approved the PCS Edventures!.com, Inc. 2009 Equity Incentive Plan (“2009 Plan”). The 2009 Plan was designed to replace the existing 2004 Nonqualified Stock Option Plan (“2004 Plan”). The 2009 Plan provides for the grant of various types of equity instruments, including grants of restricted and unrestricted PCS common stock as well as options and other types of awards. The 2009 Plan was implemented to align the interests of the Company’s employees with those of the shareholders and to motivate, attract, and retain its employees and provide an incentive for outstanding performance.

|

|

|

| |

|

|

Number of Securities to be issued upon exercise of outstanding options, warrants and rights

|

Weighted-average exercise price of outstanding options, warrants and rights

|

Number of securities remaining available for future issuance under equity compensation plans excluding securities reflected in column (a)

|

|

|

(a)

|

(b)

|

(c)

|

|

Equity compensation plans approved by security holders

|

908,534

|

$ 0.56

|

592,523

|

|

Equity compensation plans not approved by security holders

|

-

|

$ -

|

-

|

|

Total

|

908,534

|

$ 0.56

|

592,523

|

On April 4, 2012, the Board adopted and the shareholders approved an Amendment to an increase in the number of shares of common stock available for grants, incentive or other purposes under the Company’s 2009 Equity Incentive Plan from 4,000,000 shares to 8,000,000 shares.

Recent Sales of Unregistered Securities

During the last three years, we sold the securities listed below in unregistered transactions. Each of the sales was sold in reliance on the exemption provided for in Section 4(2) of the Securities Act of 1933, as amended (the “Securities Act”). No underwriting fee or other compensation was paid in connection with the issuance of shares.

PAGE 21

|

|

|

|

| |

|

|

|

Number of

|

|

|

|

Name of Person or Group

|

|

Shares

|

Consideration

|

Note

|

|

* Consultants

|

|

695,431

|

$ 181,824

|

1

|

|

Legal Consultants

|

|

439,217

|

120,501

|

2

|

|

Private Investors

|

|

1,785,414

|

608,000

|

3

|

|

Private Investors: Warrants

|

|

370,000

|

105,000

|

4

|

|

*Employees: Benefits

|

|

1,178,704

|

240,734

|

5

|

|

*Employees: Bonus

|

|

147,701

|

65,908

|

6

|

|

*Employee Options: cash

|

|

105,699

|

38,149

|

7

|

|

*Employees Options: cashless

|

|

520,130

|

-

|

8

|

|

*Board of Directors: RSU’s

|

|

282,354

|

180,000

|

9

|

|

|

|

5,524,650

|

$ 1,540,116

|

|

* Issued as Restricted Securities under the 2009 Equity Incentive Plan.

1.

Shares issued to consultants for services:

|

|

|

|

|

|

|

| |

|

|

Shares

|

|

Value

|

|

|

Fiscal Year

|

|

Fiscal Year

|

|

|

2010

|

2011

|

2012

|

|

2010

|

2011

|

2012

|

|

Q1

|

13,893

|

12,624

|

56,339

|

|

$ 11,593

|