UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☒ |

Soliciting Material Pursuant to §240.14a-12 |

| Crown Castle Inc. |

| (Name of Registrant as Specified In Its Charter) |

| |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check all boxes that apply):

| ☒ |

No fee required |

| ☐ |

Fee paid previously with preliminary materials |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Crown Castle Reiterates Actions

Underway to Enhance and Unlock Shareholder Value

Rejects Slate of Directors Nominated by Ted Miller for Election to Crown Castle’s Board

Company Remains Focused on CEO Search and Fiber

Review

No Shareholder Action Required at This Time

HOUSTON, TX – February 20, 2024 – Crown Castle Inc.

(NYSE: CCI) (“Crown Castle” or the “Company”) today confirmed that Boots Capital Management, LLC

(“Boots Capital”), which is led by Ted Miller, has nominated four candidates to stand for election to Crown

Castle’s Board of Directors (“Board”) at the Company’s 2024 Annual Meeting of Stockholders. Mr. Miller is a

co-founder of Crown Castle and resigned as CEO and a Director of the Company in 2001 and 2002, respectively.

After careful consideration of Mr. Miller and his nominees, which included

interviews by members of the Crown Castle Board, the Board unanimously determined not to recommend anyone from the Boots Capital slate

for election at the Company’s upcoming Annual Meeting.

The Crown Castle Board and management team are confident in the actions

the Company is taking to remain well positioned for long term success and shareholder value creation. In particular, during the last

two months the Company has made significant strides forward toward creating a stronger and more valuable Crown Castle, including:

| · | Initiated

a comprehensive strategic and operating review of the fiber business, the formation of

a fiber review committee and the appointment of Paul, Weiss, Morgan Stanley, BofA Securities

and leading industry consultants to advise on the fiber review process. |

| · | Appointed

three new independent directors, resulting in a total of seven of the twelve directors

having been appointed to the Board since 2020. Crown Castle’s three recent board member

additions include Sunit Patel, the former CFO of Level-3 and former EVP of T-Mobile, Jason

Genrich, a shareholder representative from one of the Company’s largest investors,

Elliott Investment Management L.P., and Bradley Singer, the former CFO of American Tower

and former COO and an Investment Partner at ValueAct Capital. |

| · | Appointed

Tony Melone as interim CEO following the retirement of former CEO Jay Brown, and the

formation of a CEO search committee, which has hired a leading executive search firm to help

identify the next CEO of Crown Castle. |

The Crown Castle Board and management team value constructive dialogue

with shareholders and regularly engage with an open mind to better understand their perspectives on the Company’s strategy, performance

and business objectives. Accordingly, members of the Board and management team have engaged in multiple discussions with Mr. Miller since

late last year, including providing Mr. Miller as well as his director candidates and his advisors the opportunity to make a presentation

to the Board. While we recognize Mr. Miller’s contributions to the formation of Crown Castle more than twenty years ago, Boots Capital’s

nominees do not possess the relevant expertise and experience to successfully oversee Crown Castle’s strategy.

The Board will present its formal recommendation regarding election of

directors to the Company’s Board in the Company’s definitive proxy statement, to be filed with the Securities and Exchange

Commission and mailed to all shareholders eligible to vote at the 2024 Annual Meeting of Stockholders, which, as previously announced,

has been scheduled for May 22, 2024. Shareholders are not required to take any action at this time.

Boots Capital issued a press release attaching a letter that its counsel

sent to the Company’s counsel. A copy of the response that the Company delivered to Boots Capital’s counsel can be found here: https://pr.globenewswire.com/FileDownloader/DownloadFile?source=ml&fileGuid=2c556d21-62b3-4e20-a4ed-bdaf688b1057.

ABOUT CROWN CASTLE

Crown Castle owns, operates and leases more than 40,000 cell towers and

approximately 90,000 route miles of fiber supporting small cells and fiber solutions across every major U.S. market. This nationwide

portfolio of communications infrastructure connects cities and communities to essential data, technology and wireless service –

bringing information, ideas and innovations to the people and businesses that need them. For more information on Crown Castle, please

visit www.crowncastle.com.

CAUTIONARY LANGUAGE REGARDING FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements for purposes of

the safe harbor provisions of The Private Securities Litigation Reform Act of 1995. Statements that are not historical facts are hereby

identified as forward-looking statements. In addition, words such as “estimate,” “anticipate,” “project,”

“plan,” “intend,” “believe,” “expect,” “likely,” “predicted,”

“positioned,” “continue,” “target,” “seek,” “focus” and any variations of

these words and similar expressions are intended to identify forward-looking statements. Examples of forward-looking statements include

(1) statements and expectations regarding the process and outcomes of Company’s Fiber Review Committee, including that it will

help enhance and unlock shareholder value, (2) statements and expectations regarding the process and outcomes of CEO Search Committee,

including that it will conduct the search to identify Crown Castle’s next CEO, (3) that the actions set forth in this press

release best position the Company for long term success, including our Board’s regular evaluation of all paths to enhance shareholder

value, (4) that the Company will benefit from the experience and insights of the newly appointed directors, (5) that the Company

will identify the best path forward to capitalize on significant opportunities for growth in our industry. Such forward-looking statements

should, therefore, be considered in light of various risks, uncertainties and assumptions, including prevailing market conditions, risk

factors described in “Item 1A. Risk Factors” of the Annual Report on Form 10-K for the fiscal year ended

December 31, 2022 (“2022 Form 10-K”) and other factors. Should one or more of these risks or uncertainties

materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those expected.

Our filings with the SEC are available through the SEC website at www.sec.gov or

through our investor relations website at investor.crowncastle.com. We use our investor relations website to disclose information

about us that may be deemed to be material. We encourage investors, the media and others interested in us to visit our investor relations

website from time to time to

review up-to-date information or to sign up for e-mail alerts to be notified when new

or updated information is posted on the site.

Important Stockholder Information

The Company intends to file a proxy statement and

a WHITE proxy card with the U.S. Securities and Exchange Commission (the “SEC”) in connection with its solicitation

of proxies for its 2024 Annual Meeting. THE COMPANY’S STOCKHOLDERS ARE STRONGLY ENCOURAGED TO READ THE DEFINITIVE PROXY STATEMENT,

THE ACCOMPANYING WHITE PROXY CARD, AND ANY AMENDMENTS AND SUPPLEMENTS TO THESE DOCUMENTS WHEN THEY BECOME AVAILABLE AS

THEY WILL CONTAIN IMPORTANT INFORMATION. Stockholders may obtain the proxy statement, any amendments or supplements to the proxy statement,

and other documents as and when filed by the Company with the SEC without charge from the SEC’s website at www.sec.gov.

Participant Information

For participant information, see the Company’s

Schedule 14A filed with the SEC on February 14, 2024 and available here.

CONTACTS:

Dan Schlanger, CFO

Kris Hinson, VP & Treasurer

Crown Castle Inc.

713-570-3050

MEDIA:

Andy Brimmer / Adam Pollack

Joele Frank, Wilkinson Brimmer Katcher

212-355-4449

|

|

|

| February 20, 2024 |

|

|

|

VIA EMAIL AND FEDEX

Stephen Fraidin

Cadwalader, Wickersham & Taft LLP

200 Liberty Street

New York, NY 10281

|

|

| |

|

Dear Steve:

I write in response to your letter of February 14 regarding the cooperation

agreement between Crown Castle Inc. (“CCI” or the “Company”) and Elliott Investment Management L.P.

and certain of its affiliated entities (collectively, “Elliott”) dated December 19, 2023 (the “Cooperation

Agreement”).

Your letter is replete with factual inaccuracies and completely distorts

the nature of the relationship between CCI and Elliott, including, among others:

| · | Your letter alleges that Elliott had “substantial power” at the Company before the Board approved the Cooperation Agreement

and that at least “six of the twelve |

directors … have either been selected by Elliott or with

its direct input and consent.” These statements are wholly inaccurate. Before the execution of the Cooperation Agreement, Elliott

had no representation whatsoever on CCI’s Board. Elliott had no relationship with—and zero input in selecting—the three

directors (Tammy K. Jones, Kevin A. Stephens and Matthew Thornton, III) who joined CCI’s Board in 2020 after Elliott’s earlier

engagement with CCI. In fact, Elliott had no knowledge that the Board was even interviewing any of these three directors. As a matter

of reality, every director on CCI’s Board was fully independent from Elliott at the time the Cooperation Agreement was approved.

| · | Your letter suggests that the Board has “appeased” Elliott by giving it “more” Board seats. Untrue. In reality,

the Board negotiated intensely with Elliott before entering into the Cooperation Agreement. Elliott initially asked the Board to add five

new directors and identified seven candidates to fill those positions. Following extensive negotiations with Elliott, the Board agreed

to appoint only two individuals Elliott had proposed—Jason Genrich, an Elliott employee, and Sunit Patel, an independent director. |

| · | Your letter suggests that Bradley Singer was selected by Elliott for the Board or appointed as a result of Elliott’s input.

Not the case. Mr. Singer was not recommended to the Board by Elliott nor was Elliott aware of the Board’s discussions with Mr. Singer

prior to the commencement of its engagement with CCI in November 2023. |

| · | Your letter asserts that Tony Melone was “endorsed by Elliott” and “may be beholden to Elliott.” The reality

is that Mr. Melone, who had been a director of the Company since 2015, had no connection with Elliott and was appointed by the Board as

the interim CEO with zero input from Elliott on December 6, 2023, after Jay Brown notified the Board that he would be stepping down as

CEO. This occurred nearly two weeks before the Cooperation Agreement was signed and before any Elliott-affiliated individuals joined the

Board. Elliott had no knowledge it was in progress and learned about it from the public announcement. |

Contrary to your letter, the Cooperation Agreement was the product of vigorous

negotiations and internal CCI discussions—including at eight Board meetings—and was designed to limit the rights afforded

to Elliott. Indeed, the Board negotiated Elliott’s initial demand of five Board seats down to two. There was no need to form a special

committee because no members of the Board had a relationship with Elliott—material or otherwise—or other form of potential

conflict. Your assertion that Elliott was a related party at the time the Cooperation Agreement was approved because of its Board representation

when it had none, its ownership of shares despite no shareholder being permitted to own more than 9.8% of CCI’s shares by virtue

of CCI’s status as a REIT, and its “publicly assertive behavior” is absurd as a matter of both fact and law.

The Company rejects your request to submit the Cooperation Agreement to

a stockholder vote. There is no such requirement under Delaware law and it would highly unusual, if not unprecedented, to expend resources

to seek stockholder approval of this type of common contractual arrangement. Indeed, we are aware of over 70 cooperation agreements between

U.S. public companies and activist investors that were entered into in 2023 alone and, as far as we could determine, none of them were

submitted for stockholder approval.

As you note, “[s]tandstill and cooperation agreements are common”

and “are often sensible approaches to resolving conflicts with activist investors.” Here, in a routine exercise of business

judgment, the Board determined that entering into the Cooperation Agreement with Elliott was in the best interests of CCI’s stockholders.

Very truly yours,

/s/ Scott A. Barshay

Scott A. Barshay

cc:

P. Robert Bartolo

Board Chair, Crown Castle Inc.

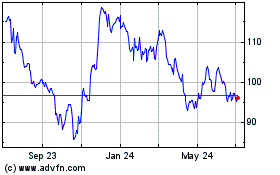

Crown Castle (NYSE:CCI)

Historical Stock Chart

From Oct 2024 to Nov 2024

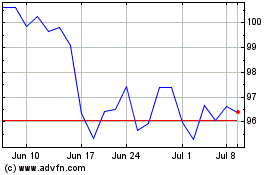

Crown Castle (NYSE:CCI)

Historical Stock Chart

From Nov 2023 to Nov 2024