UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of January, 2025

Commission File Number: 001-38049

Azul S.A.

(Name of Registrant)

Edifício Jatobá, 8th floor, Castelo Branco Office Park

Avenida Marcos Penteado de Ulhôa Rodrigues, 939

Tamboré, Barueri, São Paulo, SP 06460-040, Brazil.

+55 (11) 4831 2880

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ¨ No x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ¨ No x

| Material Fact January | 2025 |

| | |

Azul Announces the Extension

of its Previously Announced Exchange Offers

São Paulo, January 16, 2025 – Azul

S.A. (“Azul” or “Company”) (B3: AZUL4, NYSE: AZUL) and its subsidiary Azul Secured Finance LLP (“Issuer”)

today announce the extension of the expiration deadline for the previously announced offers to exchange (“Exchange Offers) the Existing

Notes (as defined below).

The Issuer has extended the Original Expiration Deadline

(as defined below) to 5:00 p.m., New York City time, on January 21, 2025 (“Extended Expiration Deadline”).

In view of the material fact published by the Company on January 15, 2025, the extension allows eligible holders who have not yet tendered

their Existing Notes the opportunity to participate in the Exchange Offers.

As of 11:59 p.m., New York City time, on January

15, 2025 (“Original Expiration Deadline”) for the Exchange Offers:

| · | 99.69% of outstanding principal

amount of the 11.930% Senior Secured First Out Notes due 2028 have been tendered; |

| · | 98.02% of the outstanding principal

amount of the 11.500% Senior Secured Second Out Notes due 2029 (“2029 Notes”) have been tendered; and |

| · | 94.42% of the outstanding principal

amount of the 10.875% Senior Secured Second Out Notes due 2030 (“2030 Notes”) have been tendered, |

together, the “Existing Notes”.

Existing Notes tendered in the Exchange Offers can no longer be withdrawn.

As previously disclosed by Azul on January 8,

2025, the conditions to the Exchange Offers that relate to the required aggregate principal amount of Existing Notes required to be tendered

in the Exchange Offers have been satisfied.

There can be no assurance that all of the conditions

to the Exchange Offers or the issuance of the Superpriority notes referred to in Azul’s previous announcements (“Superpriority

Notes”) will be satisfied or waived, or that the Exchange Offers and the issuance of the Superpriority Notes will be consummated.

Azul will keep investors and the general market

updated on the progress of the Exchange Offers.

Important

Notes

This communication

is for information purposes only and is not intended to be published or distributed, directly or indirectly, in the United States or in

any other jurisdiction. This communication is not and shall not constitute (i) an offer to buy, or a solicitation of an offer to sell,

the Existing Notes or any other securities, (ii) the solicitation of consents from any holders of the Existing Notes or any other securities,

or (iii) an offer to sell, or the solicitation of an offer to buy, the New Notes or any other securities (together, “Securities”).

There shall be no offering or sale of Securities, and no solicitation of consents from any

holders of the Existing Notes or any other Securities, in any jurisdiction in which such offer, sale or solicitation would be unlawful.

Any offer or solicitation will only be made pursuant to a separate disclosure or solicitation document and only to such persons and in

such jurisdictions as permitted under applicable law. The offering of any Securities has not been, and will not be, registered under the

Securities Act of 1933, as amended (“Securities Act”). No Securities may be offered or sold absent registration under the

Securities Act or pursuant to an offer or sale under one or more exemptions from, or in a transaction not subject to, the registration

requirements of the Securities Act.

The Securities

have not been and will not be issued or placed, distributed, offered or traded in the Brazilian

capital markets. The issuance of the Securities has not been nor will the relevant Securities be registered with the Brazilian Securities

Commission (Comissão de Valores Mobiliários) (“CVM”). Any public offering or distribution, as defined

under Brazilian laws and regulations, of any Securities in Brazil is not legal without prior registration under Law No. 6,385, dated December

15, 1976, as amended, and CVM Resolution No. 160, dated July 13, 2022, as amended. Documents relating to the offering of the relevant

Securities, as well as information contained therein, may not be supplied to the public in Brazil (as the offering of the relevant Securities

will not be a public offering of securities in Brazil), nor be used in connection with any offer for subscription or sale of the relevant

Securities to the public in Brazil. The relevant Securities will not be offered or sold in Brazil, except in circumstances, which do not

constitute a public offering, placement, distribution or negotiation of securities in the Brazilian capital markets regulated by Brazilian

legislation.

| Material Fact January | 2025 |

| | |

Forward-Looking

Statements

This communication

includes forward-looking statements within the meaning of the U.S. federal securities laws. These forward-looking statements are based

mainly on our current expectations and estimates of future events and trends that affect or may affect our business, financial condition,

results of operations, cash flow, liquidity, prospects and the trading price of our securities,

including the potential impacts of the material transactions referred to in this communication. Although we believe that any forward-looking

statements are based upon reasonable assumptions in light of information currently available to us, any such forward-looking statements

are subject to many significant risks, uncertainties and assumptions, including those factors discussed under the heading “Risk

Factors” in the Company’s annual report on Form 20-F for the year ended December 31, 2023 and any other cautionary statements

which may be made or referred to in connection with any such forward-looking statements.

In this

communication, the words “believe,” “understand,” “may,” “will,” “aim,” “estimate,”

“continue,” “anticipate,” “seek,” “intend,” “expect,” “should,”

“could,” “forecast” and similar words are intended to identify forward-looking statements. You should not place

undue reliance on such statements, which speak only as of the date they were made. Except as required by applicable law, we do not undertake

any obligation to update publicly or to revise any forward-looking statements after the date of this communication because of new information,

future events or other factors. Our independent public auditors have neither examined nor compiled the forward-looking statements and,

accordingly, do not provide any assurance with respect to such statements. In light of the risks and uncertainties described above, the

future events and circumstances discussed in this communication might not occur and are not guarantees of future performance. Because

of these uncertainties, you should not make any investment decision based upon these forward-looking statements.

About

Azul

Azul S.A. (B3: AZUL4, NYSE: AZUL), the largest

airline in Brazil by number of flight departures and cities served, offers 1,000 daily flights to over 160 destinations. With an operating

fleet of over 180 aircraft and more than 15,000 Crewmembers, the Company has a network of 300 non-stop routes. Azul was named by Cirium

(leading aviation data analysis company) as the most on-time airline in the world in 2022, being the first Brazilian airline to obtain

this honor. In 2020, Azul was awarded best airline in the world by TripAdvisor, the first time a Brazilian Flag Carrier earned the number

one ranking in the Traveler’s Choice Awards.

For more information visit https://ri.voeazul.com.br/en.

Contact:

Investor Relations

Tel: +55 11 4831 2880

invest@voeazul.com.br

Media Relations

Tel: +55 11 4831 1245

imprensa@voeazul.com.br

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: January 16, 2025

Azul S.A.

By: /s/ Alexandre Wagner Malfitani

Name: Alexandre Wagner Malfitani

Title: Chief Financial Officer

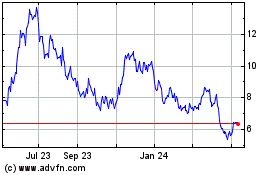

Azul (NYSE:AZUL)

Historical Stock Chart

From Jan 2025 to Feb 2025

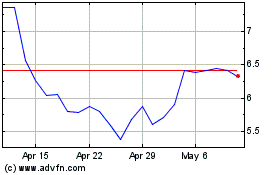

Azul (NYSE:AZUL)

Historical Stock Chart

From Feb 2024 to Feb 2025