false

0000787253

0000787253

2023-07-21

2023-07-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

DATE OF REPORT (Date of earliest event reported): July 21, 2023

000-15701

(Commission file number)

NATURAL ALTERNATIVES INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

84-1007839

|

|

(State of incorporation)

|

|

(IRS Employer Identification No.)

|

| |

|

|

1535 Faraday Avenue

Carlsbad, California 92008

|

|

(760) 736-7700

|

|

(Address of principal executive offices)

|

|

(Registrant’s telephone number)

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common

|

NAII

|

NASDAQ

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT.

On July 21, 2023, Natural Alternatives International, Inc. (“NAI”) entered into a Fourth Amendment to Lease amending and extending the term of the lease of its Vista California manufacturing facilities. The Fourth Amendment extends the term of the Lease by an additional ten years and five months commencing April 1, 2024. The amended Lease covering two buildings and approximately 162,000 square feet will result in an increase in base rent to $1.50 per square foot, after five free months of base rent beginning at the commencement of the extended term. NAI intends to construct substantial improvements to the facilities including but not limited to installation of an approximately $2.3 million solar electrical generating system on both buildings, and other substantial improvements. Pursuant to the Fourth Amendment the Landlord will reimburse NAI for up to $1.1 million of these tenant improvements to the buildings.

The foregoing description does not purport to be complete and is qualified in its entirety by the copy of the Fourth Amendment to Lease included as Exhibit 10.17 hereto and Exhibits 10.1 and 10.7 to NAI’s most recent Annual Report, those being the original 2003 Lease and the Third Amendment dated July 31, 2013. Each of these Exhibits are incorporated herein by reference.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits.

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

Natural Alternatives International, Inc.

|

| |

|

|

| |

|

|

| |

|

|

|

Date: July 21, 2023

|

|

By:

|

|

/s/ Michael E. Fortin

|

| |

|

|

|

Michael E. Fortin

|

| |

|

|

|

Chief Financial Officer

|

Exhibit 10.17

FOURTH AMENDMENT TO LEASE

THIS FOURTH AMENDMENT TO LEASE (this “Amendment”) is made this 18th day of July, 2023, by and between PARK CENTER INDUSTRIAL ILP, LLC, a Delaware limited liability company (“Landlord”), and NATURAL ALTERNATIVES INTERNATIONAL, INC., a Delaware corporation (“Tenant”).

WITNESSETH:

WHEREAS, Landlord (successor in interest to WCA Vista Distribution 77, L.L.C.) and Tenant are parties to that certain Lease, dated as of June 12, 2003 (the “Original Lease”), as amended by that certain First Amendment to Lease, dated as of December 21, 2004 (the “First Amendment”), that certain Second Amendment to Lease, dated as of January 13, 2006 (the “Second Amendment”), and that certain Third Amendment to Lease, dated as of July 31, 2013 (the “Third Amendment” and collectively with the Original Lease, the First Amendment, the Second Amendment and the Third Amendment, the “Lease”), pursuant to which Landlord leases to Tenant certain premises consisting of approximately 162,000 rentable square feet, as more particularly described in the Lease (the “Premises”) located at 1211 and 1215 Park Center Drive, Vista, California (the “1211 Building” and the “1215 Building,” respectively) in the project commonly known as Vista Distribution Center (the “Project”).

WHEREAS, the Term is scheduled to expire on March 31, 2024, and Landlord and Tenant desire to extend the Term for an additional one hundred twenty-five (125) full calendar months from such expiration date and to amend the terms and conditions of the Lease as hereinafter provided.

AGREEMENT:

NOW, THEREFORE, in consideration of the mutual covenants set forth herein, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged by the parties, the parties hereto agree as follows:

1. Extension of Term. The Term is hereby extended for a period of one hundred twenty-five (125) full calendar months, commencing as of April 1, 2024 (the “Extended Term Commencement Date”) and expiring on August 31, 2034 (the “Extended Term Termination Date”) (which period is referred to herein as the “Extended Term”), unless sooner terminated in accordance with the terms of the Lease, as amended hereby. As used herein, the term “Lease” shall be deemed to mean the Lease, as amended hereby, unless the context clearly indicates otherwise. From and after the date hereof, the “Term” shall he deemed to include the Extended Term. Tenant’s lease of the Premises during the Extended Term shall be subject to all the terms and conditions of the Lease, except as expressly modified herein, and except that Tenant shall not be entitled to receive any allowances, abatements, or other financial concession granted in connection with entering into the Lease unless such concessions are expressly provided for herein with respect to the Extended Term.

2. Rent.

(a) Monthly Installment of Rent Schedule. Effective as of the Extended Term Commencement Date, the Monthly Installment of Rent for the Premises payable by Tenant to Landlord during the Extended Term is as follows:

|

From:

|

To:

|

Rentable Square Footage

|

Monthly Installment of Rent

|

|

4/01/2024

|

3/31/2025

|

162,000

|

$243,000.00*

|

|

4/01/2025

|

3/31/2026

|

162,000

|

$252,720.00

|

|

4/01/2026

|

3/31/2027

|

162,000

|

$262,828.80

|

|

4/01/2027

|

3/31//2028

|

162,000

|

$273,341.95

|

|

4/01/2028

|

3/31/2029

|

162,000

|

$284,275.63

|

|

4/01/2029

|

3/31/2030

|

162,000

|

$295,646.66

|

|

4/01/2030

|

3/31/2031

|

162,000

|

$307,472.52

|

|

4/01/2031

|

3/31/2032

|

162,000

|

$319,771.42

|

|

4/01/2032

|

3/31/2033

|

162,000

|

$332,562.28

|

|

4/01/2033

|

3/31/2034

|

162,000

|

$345,864.77

|

|

4/01/2034

|

8/31/2034

|

162,000

|

$359,699.36

|

*Provided that Tenant has faithfully performed all of the terms and conditions of the Lease, Landlord agrees to abate the obligation of Tenant to pay the Monthly Installment of Rent for the first five (5) months of the Extended Term (the “Conditional Rent”). Notwithstanding the foregoing, however, during such months, Tenant shall still be responsible for the payment of all other amounts payable under the Lease, including, without limitation, Tenant’s Proportionate Share of Expenses and Taxes and additional rent due under the Lease. In the event of a Tenant default under the Lease at any time during the Extended Term, in addition to any other remedies to which Landlord may be entitled, Landlord shall be entitled to recover the Conditional Rent (i.e., the amount of the Conditional Rent shall not be deemed to have been abated, but shall become immediately due and payable as unpaid Annual Rent earned, but due at the time of such default). The right to the abatement set forth above shall be personal to the current Tenant, Natural Alternatives International, Inc. (“Named Tenant”) and shall not be transferable to any assignee, sub-tenant or other transferee of Named Tenant’s interest in the Lease unless the transferee acquires all or substantially all of the assets of Named Tenant or more than fifty percent (50%) of the equity interests of Named Tenant.

Except as otherwise set forth in this Amendment, all other terms and conditions with respect to the payment of Monthly Installment of Rent shall remain as set forth in the Lease.

(b) Expenses and Taxes. For the period commencing on the Extended Term Commencement Date and ending on the Extended Term Termination Date, Tenant shall pay for Tenant’s Proportionate Share of Expenses and Taxes in accordance with the terms of Article 4 of the Original Lease, as amended by this Amendment.

3. Specific Modifications to the Lease. Effective as of the Extended Term Commencement Date, the Original Lease shall be modified as follows:

(a) The first sentence of Section 7.1 of the Original Lease shall be amended and restated to read in full as follows:

“Landlord shall have no obligation to alter, remodel, improve, repair, decorate or paint the Premises, except as specified in Exhibit B attached to this Lease and except that Landlord, at its sole cost and expense and not subject to reimbursement as Expenses, shall repair and maintain the structural portions of the roof, foundation and walls of the Building, the concrete subflooring of the Building and the underground utilities serving the Building.”

(b) The definition of “Landlord Entities” appearing in Article 30 of the Original Lease shall be amended and restated to mean and refer to Landlord, Landlord’s investment manager, the California Public Employees Retirement System, and the trustees, boards of directors, officers, general partners, beneficiaries, stockholders, employees and agents of each of them.

4. Tenant’s Amendment Work; Allowance.

(a) Landlord shall reimburse Tenant for the actual, documented costs of performing certain Alterations in the Premises pursuant to plans and specifications approved by Landlord (“Tenant’s Amendment Work”) up to a maximum of $1,134,000.00 (i.e., $7.00 per rentable square foot of the Premises) (the “Amendment Allowance”) on the terms and conditions of this Section 4 provided that (i) all conditions to the final disbursement of the Amendment Allowance (collectively, the “Final Disbursement Conditions”) have been satisfied on or before the date that is three hundred eighty (380) days following the later of the dates set forth Landlord and Tenant’s signature hereto (the “Sunset Date”), (ii) there is no uncured Event of Default and (iii) the Lease is in full force and effect. Tenant’s Amendment Work shall consist of the work described on Exhibit A to this Amendment that Tenant elects to perform, subject to Landlord’s approval of the plans and specifications therefor, and such additional Alterations as may be approved by Landlord in accordance with Section 6.1 of the Original Lease. Tenant’s Amendment Work shall be performed in accordance with, and shall be subject to, the terms and conditions of this Section 4 and Article 6 of the Original Lease. Tenant shall schedule all Tenant’s Amendment Work such that it may reasonably be completed within the timeframe required to satisfy all Final Disbursement Conditions on or before the Sunset Date. In the event that Tenant has complied with the immediately preceding sentence and is delayed from satisfying all Final Disbursement Conditions due to any delays caused by (x) Landlord or any of Landlord’s contractors, subcontractors, employees, agents or invitees, (y) strikes, lockouts, casualties, Acts of God, war, material or labor shortages, supply-chain issues, pandemics, public health emergencies, governmental orders, regulations or controls, or (z) any other causes beyond the reasonable control of Tenant, including, without limitation, delays in Tenant’s contractor’s performance of Tenant’s Amendment Work due to causes beyond Tenant’s reasonable control, the Sunset Date shall be extended for such period of time as Tenant is so delayed in satisfying all Final Disbursement Conditions. In the event Tenant anticipates that it will not be able to satisfy all Final Disbursement Conditions by the Sunset Date specified above due to any delay described in the immediately preceding sentence, Tenant shall advise Landlord in writing of the cause of the delay and the anticipated length of delay within five (5) business days after Tenant first becomes aware of such delay. Tenant thereafter shall keep Landlord reasonably apprised of the status of such delay and promptly respond to all inquiries of Landlord regarding such delay. Landlord and Tenant shall mutually cooperate using good faith, commercially reasonable efforts, to coordinate performance of Tenant’s Amendment Work and Landlord’s Work (as defined below). Landlord shall have the right to approve Tenant’s project management team (“Tenant’s Management Team”), architect (“Architect”), contractor and subcontractors for Tenant’s Amendment Work. Tenant agrees on behalf of itself and its contractors and subcontractors to comply and cooperate with all directives and supervision of Landlord’s roofing contractor with respect to any Tenant’s Amendment Work affecting the roof of the 1211 Building and/or the 1215 Building, including, without limitation, the installation of the solar panels thereon (the “Solar Installation Work”), and shall undertake all actions necessary to preserve Landlord’s roof warranty(ies). Landlord shall have the right to require that Landlord’s roofing contractor, its employees or representatives and/or Landlord’s property manager be present at all times during the performance of the Solar Installation Work. Tenant shall cooperate with Landlord regarding the scheduling of the Solar Installation Work such that the party(ies) Landlord reasonably designates may be present. Without limiting the foregoing, Landlord reserves the right to require any Tenant’s Amendment Work (not including the Solar Installation Work) affecting the roof of the 1211 Building and/or the 1215 Building to be performed by Landlord’s roofing contractor. Tenant shall not undertake any activities in connection with Tenant’s Amendment Work that would void Landlord’s roof or other warranties.

(b) The Amendment Allowance shall be paid by Landlord directly to Tenant in three (3) equal progress payments equal to 30% of the applicable Amendment Allowance. The first progress payment shall be paid after it has been mutually agreed by Landlord and Tenant and Architect has certified in writing to Landlord that one-third of Tenant’s Amendment Work has been satisfactorily completed in accordance with plans and specifications therefor approved by Landlord; the second progress payment shall be paid after it has been mutually agreed and Architect has certified in writing to Landlord that two-thirds of Tenant’s Amendment Work has been satisfactorily completed in accordance with plans and specifications therefor approved by Landlord; and the third progress payment shall be paid after it has been mutually agreed and Architect has certified in writing to Landlord that 100% of Tenant’s Amendment Work has been satisfactorily completed in accordance with plans and specifications therefor approved by Landlord. Landlord shall pay each progress payment within thirty (30) days after receipt from Tenant of a written request for payment, together with copies of invoices or receipts for Tenant’s Amendment Work expenses equaling the amount of the requested progress payment, and all applicable unconditional waivers and releases upon progress payment for material and labor from Tenant’s contractor, subcontractors and suppliers.

(c) The remaining 10% of the Amendment Allowance shall be paid within sixty (60) days following proper recordation of a Notice of Completion for Tenant’s Amendment Work, and upon the satisfaction of the following conditions:

(i) Tenant has completed Tenant’s Amendment Work in accordance with the Landlord approved final plans and specifications therefor;

(ii) Tenant has submitted a complete set of “as built” plans and specifications for Tenant’s Amendment Work to Landlord;

(iii) Tenant has provided Landlord with properly executed mechanics lien releases in compliance with California Civil Code Section 3262(d)(4) from Tenant's Contractor, subcontractors and suppliers performing work Tenant’s Amendment Work;

(iv) Tenant has provided Landlord all construction warranties and guarantees obtained by Tenant in connection with the construction of Tenant’s Amendment Work, which warranties and guarantees shall provide that they may be enforceable by Landlord; and

(v) Landlord has inspected and approved Tenant’s Amendment Work and is reasonably satisfied that Tenant’s Amendment Work has been performed in a good and workmanlike manner in accordance with the approved plans and specifications therefor and in accordance with all applicable laws, using Building standard materials where applicable; provided, however, no such inspection shall impose any liability upon Landlord, nor absolve Tenant, Architect or Tenant’s contractor from liability for any defect or failure to comply with the requirements hereof.

(d) Notwithstanding anything herein to the contrary, Landlord shall not be obligated to disburse any portion of the Amendment Allowance during the continuance of an Event of Default under the Lease, and Landlord’s obligation to disburse shall only resume when and if such Event of Default is cured. The Amendment Allowance may only be used for hard and soft costs in connection with Tenant’s Amendment Work, and in no event shall any portion of the Amendment Allowance be used for the purchase of equipment, cabling, furniture or other items of personal property of Tenant other than the solar panels to be installed in connection with the Solar Installation Work.

(e) If Tenant does not submit a request for payment of the final disbursement of the Amendment Allowance to Landlord in accordance with the provisions contained in this Section 4 by the Sunset Date, any undisbursed amount of the Amendment Allowance shall accrue to the sole benefit of Landlord; it being understood that Tenant shall not be entitled to any credit, abatement or other concession in connection therewith. Tenant shall be responsible for all applicable state sales or use taxes, if any, payable in connection with Tenant’s Amendment Work and/or Amendment Allowance. Notwithstanding anything to the contrary contained in Article 6 of the Original Lease, provided Tenant provides all necessary construction management services and complies with all of its obligations hereunder (including, without limitation, the completion of Tenant’s Amendment Work in a good and workmanlike manner in accordance with the approved plans and specifications therefor and in accordance with all applicable laws) such that Landlord is not required to provide any construction management services in connection with Tenant’s Amendment Work, Landlord shall not charge a construction management fee, but shall fund a management fee equal to 2% of Tenant’s Amendment Work costs (exclusive of such management fee) to Tenant’s Management Team from the Amendment Allowance. Landlord shall be entitled to deduct from the Amendment Allowance its actual third-party costs and fees incurred in supervising and inspecting Tenant’s Amendment Work and reviewing the plans and specifications therefor.

(f) Notwithstanding anything to the contrary contained in Section 26.2 of the Original Lease, but subject to Section 8 of Exhibit B of the Original Lease, Tenant shall not be obligated to remove any improvements constructed or installed in connection with Tenant’s Amendment Work; provided that the same are approved by Landlord and constructed or installed in a good and workerlike manner in accordance with the plans and specifications therefor approved by Landlord and all applicable laws. Notwithstanding the foregoing, Landlord may approve certain Alterations as part of Tenant’s Amendment Work that it would not otherwise approve provided that Tenant agrees to remove such Alterations and repair any resulting damage at the expiration or termination of the Lease. In any such event, Landlord shall notify Tenant that its approval of any such Alteration is contingent upon Tenant’s removal thereof and repair of any resulting damage and, if applicable in Landlord’s sole discretion, Tenant’s compliance with the last sentence of Section 6.3 of the Original Lease. Upon any such notification by Landlord, the provisions of this Section 4(f) shall not apply to the Alterations specified by Landlord and Tenant’s obligations regarding removal thereof and any related repairs to the Premises shall be subject to Section 6.3 and Section 26.2 of the Original Lease, except as otherwise expressly provided in this Section 4(f).

5. Slab and Drywall Repair. Without limiting the generality of Section 18 below, the provisions of Section 3 of the Third Amendment concerning Landlord’s furnishing to Tenant of an Annual Allowance for Eligible Repair Costs (as such terms are defined in such Section 3) shall continue in full force and effect throughout the Extended Term.

6. Landlord’s Amendment Work. Landlord, at its sole cost and expense, shall perform the work described on Exhibit B hereto (“Landlord’s Work”). Subject to any delays caused by Tenant or any of Tenant’s contractors, subcontractors, employees, agents or invitees and any delays caused by strikes, lockouts, casualties, Acts of God, war, material or labor shortages, supply-chain issues, pandemics, public health emergencies, governmental orders, regulations or controls, or any other causes beyond the reasonable control of Landlord, Landlord shall use commercially reasonable efforts to complete Landlord’s Work no later than the Extended Term Commencement Date.

7. Condition of the Premises. Tenant hereby acknowledges and agrees that it has accepted the Premises as of the date hereof, and will accept the Premises as of the Extended Term Commencement Date in AS-IS, WHERE-IS condition without any representation or warranty of any kind made by Landlord in favor of Tenant. The foregoing, however, does not affect the provisions of Section 4, Section 5 or Section 6 of this Amendment or the repair and maintenance obligations of Landlord as expressly set forth in the Lease.

8. Sustainable Building Operations. Effective as of the date of this Amendment, the following provisions shall be incorporated into the Lease and shall be binding on Tenant:

(a) Tenant acknowledges that the Building is or may be in the future be certified or rated pursuant to the U.S. EPA’s Energy Star ® Portfolio Manager, the Green Building Initiative’s Green Globes™ building rating system, the U.S. Green Building Council’s Leadership in Energy and Environmental Design (LEED®) building rating system, the ASHRAE Building Energy Quotient (BEQ), the Environmental, Social and Governance (ESG) performance standards that are assessed and measured by GRESB, or operated to meet another standard for high performance buildings adopted by Landlord (collectively, the “Green Building Standard(s)”), and provided it does not increase Tenant’s obligations pursuant to Section 4.1.2 of the Original Lease, Tenant agrees to cooperate with Landlord in achieving or maintaining the certifications, ratings, or other standards applicable to the Building or Project pursuant to such Green Building Standards. In addition, as contemplated by the Nonresidential Building Energy Use Disclosure Program (AB 1103) and other Green Building Standards, Landlord may collect and maintain records regarding energy and utilities usage at the Building. Notwithstanding anything to the contrary contained in the Lease, as and when requested by Landlord during the Term, to the extent reasonably available to Tenant, Tenant shall provide to Landlord without warranty, but subject to Tenant’s reasonable efforts to confirm the accuracy thereof (in the format requested by Landlord and reasonably necessary or desirable to comply with the requirements of the applicable Green Building Standard or any commissioning or retro-commissioning of the Building’s systems or the Nonresidential Building Energy Use Disclosure Program), data concerning Tenant’s and its employees’ transportation means, energy consumption, water consumption, and the operation of the Building’s systems. Such data may include, without limitation, Tenant’s operating hours, the number of on-site personnel, the types of equipment used at the Building (including computer equipment, if applicable), office supply purchases, light bulb purchases, cleaning product materials (both chemicals and paper products), as applicable, and energy use and cost. Landlord may post such information to its account with the EPA’s ENERGY STAR® program Portfolio Manager and disclose such information to any applicable governmental authority or state energy commission or to its lenders, its constituents, consultants and advisors and prospective purchasers, investors and lenders. Landlord shall have no liability to Tenant if, once obtained, any such Green Building Standard rating or certification lapses and is not reinstated by Landlord.

(b) Landlord’s sustainability practices address, without limitation, whole-building operations and maintenance issues including chemical use; indoor air quality; energy efficiency; water efficiency; recycling programs; exterior maintenance programs; and systems upgrades to meet green building energy, water, Indoor Air Quality, and lighting performance standards. All of Tenant’s construction and maintenance methods and procedures, material purchases, and disposal of waste, including, without limitation, in connection with the Amendment Work, must be in compliance with minimum standards and specifications as outlined by the Green Building Standard(s), in addition to all applicable laws. Tenant shall use proven energy and carbon reduction measures, including energy efficient bulbs in task lighting; use of lighting controls; daylighting measures to avoid overlighting interior spaces; closing shades as necessary to avoid over heating the space; turning off lights and equipment at the end of the work day; and purchasing ENERGY STAR® qualified equipment, including but not limited to lighting, office equipment, commercial and residential quality kitchen equipment, vending and ice machines; and purchasing products certified by the U.S. EPA’s Water Sense® program.

(c) Tenant covenants and agrees, at its sole cost and expense: (i) to comply with all present and future applicable laws regarding the collection, sorting, separation, and recycling of garbage, trash, rubbish and other refuse (collectively, “trash”); (ii) provided it does not increase Tenant’s obligations pursuant to Section 4.1.2 of the Original Lease, to comply with Landlord’s recycling policy for the Building (as such policy may be amended or supplemented from time to time), as part of Landlord’s sustainability practices where it may be more stringent than applicable laws, including without limitation, recycling such categories of items designated by Landlord and transporting such items to any recycling areas designated by Landlord; (iii) to sort and separate its trash and recycling into such categories as are provided by applicable laws or provided it does not increase Tenant’s obligations pursuant to Section 4.1.2 of the Original Lease, Landlord’s then-current sustainability practices; (iv) provided it does not increase Tenant’s obligations pursuant to Section 4.1.2 of the Original Lease, that each separately sorted category of trash and recycling shall be placed in separate receptacles as directed by Landlord; (v) that Landlord reserves the right to refuse to collect or accept from Tenant any waste that is not separated and sorted as required by applicable laws, and to require Tenant to arrange for such collection at Tenant’s sole cost and expense, utilizing a contractor satisfactory to Landlord; and (vi) that Tenant shall pay all costs, expenses, fines, penalties or damages that may be imposed on Landlord or Tenant by reason of Tenant’s failure to comply with the provisions of this Section 8(c).

9. Renewal Option. Notwithstanding anything to the contrary set forth in the Lease, the named Tenant hereunder shall have one (1) option to extend the Term for a period of sixty (60) months following the expiration of the Extended Term on the terms and conditions set forth in Section 6 of the Third Amendment; provided however, that all references in such Section 6 to the “Term,” “Extended Term” and the “Amendment” shall have the respective meanings given to such terms in this Amendment.

10. Security Deposit. Landlord and Tenant acknowledge and agree that, as of the date of this Amendment, the Security Deposit held by Landlord under the Lease is in the amount of One Hundred Six Thousand Sixty-Nine and 00/100 Dollars ($106,069.00) (the “Existing Security Deposit”). Landlord and Tenant further acknowledge and agree that (a) pursuant to Section 12.b of the Original Lease, the Security Deposit held by Landlord during the Term shall equal 105% of the then current Monthly Installment of Annual Rent, (b) the amount of the Monthly Installment of Annual Rent due under the Lease as of the date of this Amendment is One Hundred Twenty-Seven Thousand Four Hundred Fifty-Eight and 95/100 Dollars ($127,458.95), (c) the Security Deposit held by Landlord as of the date of this Amendment is required to be in the amount of One Hundred Thirty-Three Thousand Eight Hundred Thirty-One and 90/100 Dollars ($133,831.90), and (d) as of the date of this Amendment, there is a Security Deposit shortfall in the amount of Twenty-Seven Thousand Seven Hundred Sixty-Two and 90/100 Dollars ($27,762.90) (the “Security Deposit Shortfall”). Concurrently with Tenant’s execution of this Amendment, and as a condition to Landlord’s obligations hereunder, Tenant shall deposit the amount of the Security Deposit Shortfall with Landlord in immediately available U.S. funds, which Security Deposit Shortfall, together with the Existing Security Deposit, shall be held and disbursed by Landlord in accordance with the terms of the Lease. Tenant acknowledges, agrees and covenants that (x) pursuant to Section 12.b of the Addendum to Lease attached to the Original Lease, the Security Deposit automatically increases on each date that the Monthly Installment of Annual Rent increases during the Term, as it may be extended (each, a “Rent Adjustment Date”), and (y) on or before each Rent Adjustment Date, Tenant shall deposit immediately available U.S. funds with Landlord, without claim, notice or demand, in such amount as shall be required such that the Security Deposit held by Landlord equals 105% of the then applicable Monthly Installment of Annual Rent at all times during the Term, as it may extended. The foregoing shall in no manner limit Tenant’s obligations to restore the Security Deposit if any portion thereof is applied by Landlord as provided in Section 5 of the Original Lease.

11. Parking. Landlord and Tenant each acknowledge and agree that, under Section 5 of the Addendum to the Original Lease, Tenant has the right to one hundred thirty-two (132) parking spaces of the Building on a non-exclusive basis with other tenants of the Project. Subject to the rights of such other tenants under their existing leases, Landlord agrees to reasonably cooperate with Tenant to enforce Tenant’s parking rights under the Lease.

12. OFAC. Tenant hereby represents and warrants that, to the best of its knowledge, without investigation, neither Tenant, nor any persons or entities holding any legal or beneficial interest whatsoever in Tenant, are (i) the target of any sanctions program that is established by Executive Order of the President or published by the Office of Foreign Assets Control, U.S. Department of the Treasury (“OFAC”); (ii) designated by the President or OFAC pursuant to the Trading with the Enemy Act, 50 U.S.C. App. 5, the international Emergency Economic Powers Act, 50 U.S.C. §§ 1701-06, the Patriot Act, Public Lau 107-56, Executive Order 13224 (September 23, 2001) or any Executive Order of the President issued pursuant to such statutes; or (iii) named on the following list that is published by OFAC: “List of Specially Designated Nationals and Blocked Persons.” If the foregoing representation is untrue at any time during the Term, an uncurable Event of Default will be deemed to have occurred without the necessity of notice or a grace period being afforded to Tenant.

13. Tenant’s Broker. Tenant represents and warrants that it has dealt with no broker, agent or other person in connection with this transaction, other than Hughes Marino (“Tenant’s Broker”). Tenant agrees to indemnify and hold Landlord and the Landlord Entities harmless from and against any claims by any other broker, agent or other person claiming a commission or other form of compensation by virtue of having dealt with Tenant with regard to this Amendment. Landlord shall pay Tenant’s Broker a commission pursuant to a separate agreement.

14. No Offer. Submission of this Amendment by Landlord is not an offer to enter into this Amendment, but rather is a solicitation for such an offer by Tenant. Landlord shall not be bound by this Amendment until Landlord and Tenant have fully executed and delivered this Amendment.

15. Authority. Tenant represents and warrants to Landlord that (a) Tenant has been and is qualified to do business in the state in which the Premises is located, (b) Tenant has the full right and authority to enter into this Amendment, and (c) the person(s) signing this Amendment on behalf of Tenant are authorized to do so by appropriate actions.

16. Severability. If any clause or provision of this Amendment is illegal, invalid or unenforceable under present or future laws, then and in that event, it is the intention of the parties hereto that the remainder of this Amendment shall not be affected thereby. It is also the intention of the panics to this Amendment that in lieu of each clause or provision of this Amendment that is illegal, invalid or unenforceable, there be added, as a part of this Amendment, a clause or provision as similar in terms to such illegal, invalid or unenforceable clause or provision as may be possible and be legal, valid and enforceable.

17. Counterparts and Delivery. This Amendment may be executed in any number of counterparts each of this shall be deemed in be an original, and all of such counterparts shall constitute one instrument. This Amendment may be executed electronically, including by DocuSign, and all electronic signatures or signature pages delivered electronically shall be deemed originals for all purposes.

18. Conflict; Ratification; Integration. In the event of any inconsistency or conflict between the terms and provisions of this Amendment and the exhibits hereto and the terms and provisions of the Lease (including all addenda and exhibits thereto), the terms and provisions of this Amendment shall govern and control. Landlord and Tenant hereby agree that (a) this Amendment is incorporated into and made a part of the Lease, (b) any and all references to the Lease hereinafter shall include this Amendment, and (c) the Lease, and all terms, conditions and provisions of the Lease, are in full force and effect as of the date hereof, and shall continue in full force and effect in accordance with its terms, except as expressly modified and amended hereinabove. The recitals set forth herein are incorporated by reference. Capitalized terms used in this Amendment shall have the same definition, as set forth in the Lease to the extent that such capitalized terms are defined therein and not redefined in this Amendment. This Amendment and any attached exhibits set forth the entire agreement between the parties with respect to the matters set forth herein.

[Signature Page Follows]

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly authorized, executed and delivered as of the day and year first set forth above.

|

LANDLORD:

PARK CENTER INDUSTRIAL ILP, LLC, a

Delaware limited liability company

By: Institutional Logistics Partners, LLC, a California

limited liability company, its Member

By: BentallGreenOak (U.S.) Limited

Partnership, a Delaware limited

partnership, its Manager

By: BentallGreenOak (U.S.) GP

LLC, a Delaware limited

liability company, its General

Partner

By: /s/ Mark Reinikka

Name: Mark Reinikka

Title: Managing Director, Asset Mangement

By: /s/ Michael Chukwueke

Name: Michael Chukwueke

Title: Principal, Asset Management

|

TENANT:

NATURAL ALTERNATIVES

INTERNATIONAL, INC., a Delaware

corporation

By: /s/ Kenneth Wolf

Name: Kenneth Wolf

Title: President and Chief Operating Officer

Dated: July 18, 2023

|

|

Dated: July 18, 2023

|

|

[Landlord and Tenant Signature Page to Fourth Amendment to Lease -

Natural Alternatives International, Inc.]

EXHIBIT A

TENANT’S AMENDMENT WORK

1. Repair epoxy coatings on the interior of the walls throughout the Premises.

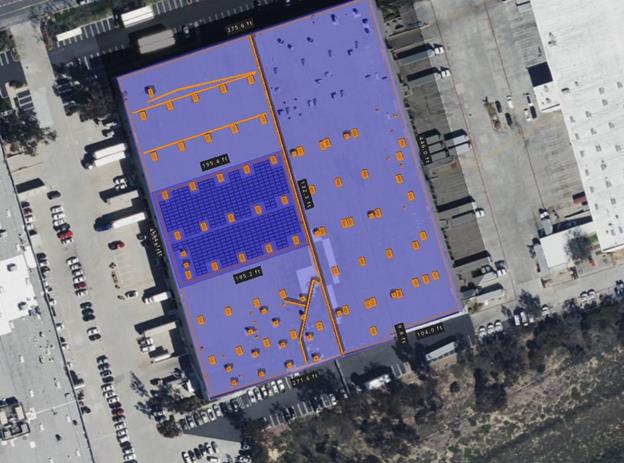

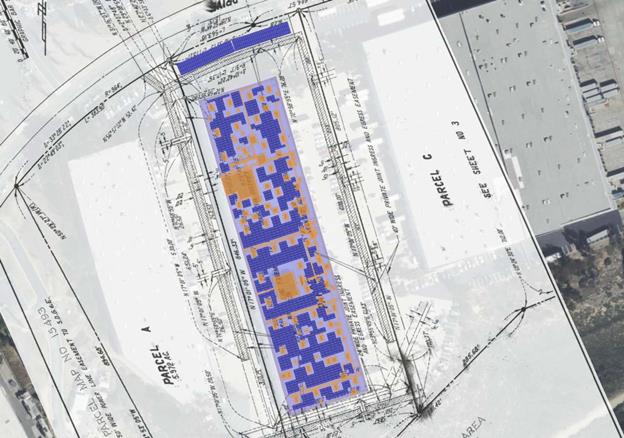

2. Installation of solar panels, including solar panels on the roof of both the 1211 Building directly above the Premises and the 1215 Building, as well as solar panel carports in the porting spots located on the north end of the 1215 Building in the locations depicted on Schedule A hereto.

3. LED Lighting Upgrade throughout the exterior of the Premises.

4. Replace HVAC Units located on the rooftops of the 1211 Building and/or 1215 Building that are beyond their useful life.

5. Install a separate meter for landscaping potable water.

6. Install drought tolerant landscaping in the exterior areas of the 1211 Building and the 1215 Building.

7. Remodel restrooms in the 1211 Building and the 1215 Building.

SCHEDULE A

LOCATION OF SOLAR PANELS

(See attached two pages)

1211 Park Center Solar Panel Layout

1215 Park Center Solar Panel Layout

EXHIBIT B

LANDLORD’S WORK

1. Repair or replace roofs of the 1211 Building and the 1215 Building.

2. Take corrective action regarding the cause of the falling dry pack at panel joint connections at the 1215 Building roof line as determined by Landlord based upon recommendations from Landlord’s engineers and consultants.

3. Take corrective action regarding the cause of the exterior panel shifting at the southwest exterior wall of the 1215 Building as determined by Landlord based upon recommendations from Landlord’s engineers and consultants.

v3.23.2

Document And Entity Information

|

Jul. 21, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

NATURAL ALTERNATIVES INTERNATIONAL, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Jul. 21, 2023

|

| Entity, File Number |

000-15701

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, Tax Identification Number |

84-1007839

|

| Entity, Address, Address Line One |

1535 Faraday Avenue

|

| Entity, Address, City or Town |

Carlsbad

|

| Entity, Address, State or Province |

CA

|

| Entity, Address, Postal Zip Code |

92008

|

| City Area Code |

760

|

| Local Phone Number |

736-7700

|

| Title of 12(b) Security |

Common

|

| Trading Symbol |

NAII

|

| Security Exchange Name |

NASDAQ

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000787253

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

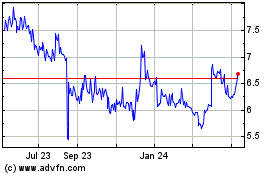

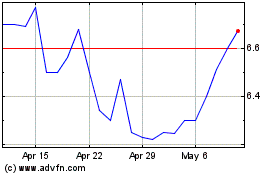

Natural Alternatives (NASDAQ:NAII)

Historical Stock Chart

From Oct 2024 to Nov 2024

Natural Alternatives (NASDAQ:NAII)

Historical Stock Chart

From Nov 2023 to Nov 2024