Genetron Holdings Limited (“Genetron Health” or the “Company”,

NASDAQ:GTH), a leading precision oncology platform company in China

that specializes in offering molecular profiling tests, early

cancer screening products and companion diagnostics development,

today announced its unaudited financial results for the third

quarter ended September 30, 2020 and provided an update on

recent developments.

Third Quarter 2020 Unaudited Financial

and Recent Operating Highlights

- Recorded total revenue of RMB112.0

million for the third quarter 2020, representing a 37.6% increase

over the same period of 2019.

- Diagnosis and monitoring

revenue increased to RMB101.5 million in the third quarter

2020, representing a 45.0% increase over the same period of

2019.

- Gross margin improved to 62.2% for

the third quarter 2020, compared to 44.2% in the same period of

2019.

- Received U.S. FDA breakthrough

device designation for its blood-based NGS test, HCCscreenTM, for

early detection of hepatocellular carcinoma in September 2020.

- Joined a major R&D project led

by the Ministry of Science and Technology in China for early

screening of lung and digestive system cancers.

- Entered into exclusive global

licensing agreement with ImmuQuad Biotechnologies to develop and

commercialize minimal residual disease (MRD) assays in hematologic

cancer in October 2020.

- Launched clinical trial in China

for companion diagnostic test in development for avapritinib with

its strategic partner CStone Pharmaceuticals.

- Established partnership with dMed

Biopharmaceuticals to pioneer a "one-stop" new drug research and

development service offering and registration services in both

China and the U.S. for biopharmaceutical companies.

- Presented data from 18 studies in

conjunction with its collaborations at ESMO 2020.

“Despite COVID-19 pandemic’s impact in some of

our major markets in the third quarter, we continued to see robust

top-line growth with 37.6% year-over-year increase, representing an

acceleration from the 28.3% year-over-year growth seen in the first

half of 2020. The upward sales momentum was accompanied by

strong margin improvements and SG&A operational efficiencies,

compared to the same period last year,” remarked Mr. Sizhen Wang,

co-founder and CEO of Genetron Health. “Overall, we had an

eventful quarter and made significant progress across all business

lines, and we are very pleased with our operational accomplishments

and financial results.”

“Looking ahead, although the pandemic has

largely remained stable in China in the recent weeks, we remain

vigilant regarding the situation. With that said, we are

particularly encouraged by our IVD (in-vitro diagnostic) and early

screening sales momentum and expect those to be the growth drivers

heading into next year. Our strategic focus going forward will be

to accelerate the development of liquid biopsy-based solutions

across the full-cycle cancer management, particularly in early

screening and MRD. In early screening for liver cancer, we plan to

further ramp up our commercialization initiatives in China, while

advancing the preparations to commence clinical trials in both

China and the US. We are progressing on a case control early

screening study for colorectal cancer as well and expect to report

preliminary data in 2021. Genetron is also working on other MRD

projects in solid tumors with an initial focus on liver and

colorectal cancer. For biopharma services, our pipeline is looking

strong thanks partly to our newly added MRD capability in

hematologic cancer. We are confident that we would become a

prominent player in the liquid biopsy space and are committed to

bringing these innovative products to patients faster,” concluded

Mr. Wang.

Third Quarter 2020 Unaudited Financial

ResultsTotal revenue for the third quarter 2020 increased

by 37.6% to RMB112.0 million (US$16.5 million) from RMB81.3 million

in the same period of 2019.

Diagnosis and monitoring revenue increased

by 45.0% to RMB101.5 million (US$15.0 million) in the third quarter

2020 from RMB70.0 million in the same period of 2019. The

increase was driven by the growth in the revenues generated from

both the provision of LDT services and the sale of IVD

products.

- Revenue generated from the

provision of LDT services increased by 17.9% to RMB71.4 million

(US$10.5 million) during the third quarter 2020 from RMB60.5

million in the same period of 2019. LDT diagnostic tests sold in

the third quarter 2020 totaled approximately 5,900 units,

representing an increase of 5% compared to the number of LDT

diagnostic tests sold in the same period of 2019. The average

selling price also increased compared to the same period in 2019,

attributable to a shift to higher value products such as Genetron

Health’s Onco PanScan™. In the third quarter, sales of LDT services

included sales of our early screening test, HCCscreenTM, in the

form of LDT services, which contributed to a small portion of total

LDT revenue.

- Revenue generated from sale of IVD

products increased by 217.3% to RMB30.1 million (US$4.4 million) in

the third quarter 2020 from RMB9.5 million in the third quarter

2019. The increase was mainly driven by the increase in the number

of assays and sequencing platforms sold in the third quarter 2020,

notably the Genetron S5 instrument and Lung 8 Assay.

Contracted in-hospital

partners

| |

|

|

|

|

| |

2019 |

1Q20 |

2Q20 |

3Q20 |

| IVD In-hospital

partners |

13 |

13 |

18 |

20 |

| |

|

|

|

|

| |

2019 |

1Q20 |

2Q20 |

3Q20 |

| Total in-hospital

partners(1) |

25 |

26 |

35 |

38 |

| Note:(1) The

number of total in-hospital partners include both sales of LDT

services and IVD products. |

Revenue generated from development services

decreased by 7.6% to RMB10.4 million (US$1.5 million) in the third

quarter 2020, from RMB11.3 million in the same period of 2019. The

change mainly resulted from the decrease in sequencing services,

reflecting the adjustment of the Company’s business strategy

towards biopharmaceutical services and in the increased revenue

from biopharmaceutical services recorded in the third quarter

2020.

Despite higher revenue, cost of revenue

decreased by 6.8% to RMB42.3 million (US$6.2 million) for the three

months ended September 30, 2020, compared to RMB45.4 million in the

same period of 2019. These decreases were primarily due to

economies of scale.

Gross profit increased by 93.7% to RMB69.6

million (US$10.3 million) in the third quarter 2020 from RMB35.9

million in the same period of 2019. Gross margin increased to 62.2%

for the third quarter of 2020, compared to 44.2% in the same period

of 2019. Year-over-year gross margin improvements were seen across

all major business lines, mainly attributable to improved scale,

operational optimization, and better product mix.

Operating expenses increased by 7.4% to RMB128.8

million (US$19.0 million) for the three months ended September 30,

2020, from RMB120.0 million in the same period of 2019.

Selling expenses continued to decline,

decreasing by 7.9% to RMB60.6 million (US$8.9 million) in the third

quarter 2020 from RMB65.7 million in the same period of 2019.

Selling expenses as a percentage of revenues decreased to 54.1% in

the third quarter 2020 from 80.8% in the same period of 2019. These

decreases were primarily due to increased sales productivity.

Administrative expenses decreased by 2.9% to

RMB32.4 million (US$4.8 million) in the third quarter 2020 from

RMB33.4 million in the same period of 2019. Administrative expenses

as a percentage of revenues decreased to 29.0% in the third quarter

2020 from 41.1% in the third quarter 2019, reflecting the benefit

of improved operational scale.

Research and development expenses increased by

85.8% to RMB38.6 million (US$5.7 million) in the third quarter 2020

from RMB20.8 million in the same period of 2019. The increase was

driven by continued innovation efforts inclusive of development of

new products and technologies, as well as clinical trial

activities. Research and development expenses as a percentage of

revenues increased to 34.4% in the third quarter of 2020 from 25.5%

in the same period of 2019.

As a result of the above, operating loss

decreased by 29.5% to RMB59.2 million (US$8.7 million) for the

three months ended September 30, 2020, from RMB84.0 million for the

three months ended September 30, 2019.

Finance income increased to RMB12.8 million

(US$1.9 million) in the third quarter 2020 from RMB26,000 in the

same period of 2019. The increase was driven by the foreign

currency exchange gain.

Loss for the period was RMB48.0 million (US$7.1

million) for the three months ended September 30, 2020, compared to

RMB274.1 million for the three months ended September 30, 2019.

Non-IFRS loss for the period, defined as loss

for the period excluding share-based compensation expenses, fair

value change and other loss of financial instruments with preferred

rights, was RMB43.7 million (US$6.4 million) for the three months

ended September 30, 2020, compared to RMB75.4 million for the three

months ended September 30, 2019.

Basic loss per ordinary share was RMB0.11

(US$0.02) for the third quarter of 2020, compared with a basic loss

per ordinary share of RMB2.15 for the same period of 2019.

Excluding share-based compensation expenses, fair value change of

financial instruments with preferred rights and other loss of

financial instruments with preferred rights, non-IFRS basic loss

per ordinary share was RMB0.10 (US$0.01) for the third quarter of

2020, compared with non-IFRS basic loss per ordinary share of

RMB0.59 for the same period of 2019. Diluted loss per ordinary

share is equivalent to basic loss per ordinary share. Each ADS

represents of five ordinary shares, par value US$0.00002 per

share.

Cash, cash equivalents and financial assets at

fair value were RMB1,868.5 million (US$275.2 million) as of

September 30, 2020.

Conference CallA conference

call and webcast to discuss the results will be held at 8:30 a.m.

U.S. Eastern Time on November 9, 2020 (or at 9:30 pm Beijing Time

on November 9, 2020). Interested parties may listen to the

conference call by dialing numbers below:

| United

States: |

+1

845-675-0437 |

| China Domestic: |

400-620-8038 |

| Hong Kong: |

+852-3018-6771 |

| International: |

+65-6713-5090 |

| Conference ID: |

5248398 |

Participants are encouraged to dial into the

call at least 15 minutes in advance due to high call volumes.

The replay will be accessible through December

9, 2020, by dialing the following numbers:

| United

States: |

+1-855-452-5696 |

| International: |

+61-2-8199-0299 |

| Conference ID: |

5248398 |

A simultaneous webcast of the conference call

will be available on the "News and Events" page of the Investors

section of the Company's website. A replay of the webcast will be

available for 30 days following the event. For more information,

please visit ir.genetronhealth.com.

About Genetron Holdings

LimitedGenetron Holdings Limited (“Genetron Health” or the

“Company”) (Nasdaq:GTH) is a leading precision oncology platform

company in China that specializes in cancer molecular profiling and

harnesses advanced technologies in molecular biology and data

science to transform cancer treatment. The Company has developed a

comprehensive oncology portfolio that covers the entire spectrum of

cancer management, addressing needs and challenges from early

screening, diagnosis and treatment recommendations, as well as

continuous disease monitoring and care. Genetron Health also

partners with global biopharmaceutical companies and offers

customized services and products. For more information, please

visit ir.genetronhealth.com.

Safe Harbor Statement This

press release contains forward-looking statements. These statements

are made under the “safe harbor” provisions of the U.S. Private

Securities Litigation Reform Act of 1995. Statements that are not

historical facts, including statements about the Company’s beliefs

and expectations, are forward-looking statements. Forward-looking

statements involve inherent risks and uncertainties, and a number

of factors could cause actual results to differ materially from

those contained in any forward-looking statement. In some cases,

forward-looking statements can be identified by words or phrases

such as “may”, “will,” “expect,” “anticipate,” “target,” “aim,”

“estimate,” “intend,” “plan,” “believe,” “potential,” “continue,”

“is/are likely to” or other similar expressions. Further

information regarding these and other risks, uncertainties or

factors is included in the Company’s filings with the SEC. All

information provided in this press release is as of the date of

this press release, and the Company does not undertake any duty to

update such information, except as required under applicable

law.

Exchange Rate Information All

translations made in the financial statements or elsewhere in this

press release made from RMB into United States dollars (“US$”) are

solely for convenience and calculated at the rate of

US$1.00=RMB6.7896, representing the exchange rate as of September

30, 2020, set forth in the H.10 statistical release of the U.S.

Federal Reserve Board. No representation is made that the RMB

amounts could have been, or could be, converted, realized or

settled into US$ at that rate, or at any other rate, on September

30, 2020.

Non-IFRS Financial Measures The

Company uses non-IFRS loss and non-IFRS loss per ordinary share for

the year/period, which are non-IFRS financial measures, in

evaluating its operating results and for financial and operational

decision-making purposes. The Company believes that non-IFRS loss

and non-IFRS loss per ordinary share help identify underlying

trends in the Company's business that could otherwise be distorted

by the effect of certain expenses that the Company includes in its

loss for the year/period. The Company believes that non-IFRS loss

and non-IFRS loss per ordinary share for the year/period provide

useful information about its results of operations, enhances the

overall understanding of its past performance and future prospects

and allows for greater visibility with respect to key metrics used

by its management in its financial and operational

decision-making.

Non-IFRS loss and non-IFRS loss per ordinary

share for the year/period should not be considered in isolation or

construed as an alternative to operating profit, loss for the

year/period or any other measure of performance or as an indicator

of its operating performance. Investors are encouraged to review

non-IFRS loss and non-IFRS loss per ordinary share for the

year/period and the reconciliation to its most directly comparable

IFRS measures. Non-IFRS loss and non-IFRS loss per ordinary share

for the year/period presented here may not be comparable to

similarly titled measures presented by other companies. Other

companies may calculate similarly titled measures differently,

limiting their usefulness as comparative measures to the Company's

data. The Company encourages investors and others to review its

financial information in its entirety and not rely on a single

financial measure.

Non-IFRS loss and non-IFRS loss per ordinary

share for the year/period represent loss for the year/period

excluding share-based compensation expenses, fair value change of

financial instruments with preferred rights and other loss of

financial instruments with preferred rights (if applicable).

Please see the “Unaudited Non-IFRS Financial

Measure” included in this press release for a full reconciliation

of non-IFRS loss for the year/period to loss for the year/period

and non-IFRS loss per ordinary share for the year/period to loss

per ordinary share for the year/period.

Investor Relations

ContactUS:Hoki LukHead of Investor RelationsEmail:

hoki.luk@genetronhealth.comPhone: +1 (408) 891-9255

Stephanie CarringtonWestwicke, an ICR CompanyEmail:

Stephanie.Carrington@westwicke.comOffice: +1 (646) 277-1282

Asia:Bill ZimaICR, Inc.Email:

bill.zima@icrinc.comir@genetronhealth.com

Media Relations ContactEdmond

LococoICREdmond.Lococo@icrinc.comMobile: +86

138-1079-1408pr@genetronhealth.com

GENETRON HOLDINGS LIMITEDUNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF LOSS

| |

For the

three months ended |

|

For the nine months ended |

| |

|

| |

September30,

2019 |

September 30, 2020 |

|

September30,

2019 |

September

30, 2020 |

| |

RMB’000 |

RMB’000 |

US$’000 |

|

RMB’000 |

RMB’000 |

US$’000 |

|

Revenue |

81,344 |

|

|

111,963 |

|

|

16,490 |

|

|

220,485 |

|

|

290,541 |

|

|

42,792 |

|

| Cost of revenue |

(45,398 |

) |

|

(42,331 |

) |

|

(6,235 |

) |

|

(121,315 |

) |

|

(114,448 |

) |

|

(16,856 |

) |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Gross profit |

35,946 |

|

|

69,632 |

|

|

10,255 |

|

|

99,170 |

|

|

176,093 |

|

|

25,936 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Selling expenses |

(65,716 |

) |

|

(60,558 |

) |

|

(8,919 |

) |

|

(184,549 |

) |

|

(175,000 |

) |

|

(25,775 |

) |

| Administrative expenses |

(33,416 |

) |

|

(32,440 |

) |

|

(4,778 |

) |

|

(88,471 |

) |

|

(81,969 |

) |

|

(12,073 |

) |

| Research and development expenses |

(20,752 |

) |

|

(38,556 |

) |

|

(5,679 |

) |

|

(59,336 |

) |

|

(96,030 |

) |

|

(14,144 |

) |

| Net impairment losses on financial and contract assets |

(331 |

) |

|

(1,107 |

) |

|

(163 |

) |

|

(736 |

) |

|

(2,097 |

) |

|

(309 |

) |

| Other income/(loss) - net |

259 |

|

|

3,819 |

|

|

562 |

|

|

11,813 |

|

|

(513 |

) |

|

(75 |

) |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Operating expenses |

(119,956 |

) |

|

(128,842 |

) |

|

(18,977 |

) |

|

(321,279 |

) |

|

(355,609 |

) |

|

(52,376 |

) |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Operating loss |

(84,010 |

) |

|

(59,210 |

) |

|

(8,722 |

) |

|

(222,109 |

) |

|

(179,516 |

) |

|

(26,440 |

) |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Finance income |

26 |

|

|

12,772 |

|

|

1,881 |

|

|

438 |

|

|

11,062 |

|

|

1,629 |

|

| Finance costs |

(2,134 |

) |

|

(1,560 |

) |

|

(230 |

) |

|

(3,603 |

) |

|

(3,997 |

) |

|

(589 |

) |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Finance (costs)/income - net |

(2,108 |

) |

|

11,212 |

|

|

1,651 |

|

|

(3,165 |

) |

|

7,065 |

|

|

1,040 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Fair value loss of financial instruments with preferred

rights |

(187,955 |

) |

|

- |

|

|

- |

|

|

(315,962 |

) |

|

(2,823,370 |

) |

|

(415,837 |

) |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Loss before income tax |

(274,073 |

) |

|

(47,998 |

) |

|

(7,071 |

) |

|

(541,236 |

) |

|

(2,995,821 |

) |

|

(441,237 |

) |

| Income tax expense |

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Loss for the period |

(274,073 |

) |

|

(47,998 |

) |

|

(7,071 |

) |

|

(541,236 |

) |

|

(2,995,821 |

) |

|

(441,237 |

) |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Loss attributable to: |

|

|

|

|

|

|

|

| Owners of the Company |

(274,073 |

) |

|

(47,998 |

) |

|

(7,071 |

) |

|

(541,236 |

) |

|

(2,995,821 |

) |

|

(441,237 |

) |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Loss per share |

RMB |

|

|

RMB |

|

|

USD |

|

|

RMB |

|

|

RMB |

|

|

USD |

|

| -Basic and diluted |

(2.15 |

) |

|

(0.11 |

) |

|

(0.02 |

) |

|

(4.35 |

) |

|

(12.02 |

) |

|

(1.77 |

) |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Loss per ADS |

|

|

|

|

|

|

|

| -Basic and diluted |

|

(0.53 |

) |

|

(0.08 |

) |

|

|

(60.10 |

) |

|

(8.85 |

) |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Shares used in loss

per ordinary share computation: |

|

|

|

|

|

|

|

| -Basic and diluted |

127,274,280 |

|

|

454,231,486 |

|

|

454,231,486 |

|

|

124,286,433 |

|

|

249,230,922 |

|

|

249,230,922 |

|

| ADS used in loss per

ADS computation: |

|

|

|

|

|

|

|

| -Basic and diluted |

|

90,846,297 |

|

|

90,846,297 |

|

|

|

49,846,184 |

|

|

49,846,184 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

GENETRON HOLDINGS LIMITEDUNAUDITED

NON-IFRS FINANCIAL MEASURE

| |

|

|

|

|

|

| |

For the

three months ended |

For the nine months ended |

| |

| |

|

|

|

|

| |

September 30,

2019 |

September 30, 2020 |

September 30,

2019 |

September 30, 2020 |

| |

RMB’000 |

RMB’000 |

US$’000 |

RMB’000 |

RMB’000 |

US$’000 |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Loss for the

period |

(274,073 |

) |

|

(47,998 |

) |

|

(7,071 |

) |

|

(541,236 |

) |

|

(2,995,821 |

) |

|

(441,237 |

) |

| Adjustments: |

|

|

|

|

|

|

| Share-based compensation |

10,755 |

|

|

4,268 |

|

|

629 |

|

|

31,494 |

|

|

19,222 |

|

|

2,831 |

|

| Fair value loss of financial instruments with preferred

rights |

187,955 |

|

|

- |

|

|

- |

|

|

315,962 |

|

|

2,823,370 |

|

|

415,837 |

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Non-IFRS

Loss |

(75,363 |

) |

|

(43,730 |

) |

|

(6,442 |

) |

|

(193,780 |

) |

|

(153,229 |

) |

|

(22,569 |

) |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Attributable to: |

|

|

|

|

|

|

| Owners of the Company |

(75,363 |

) |

|

(43,730 |

) |

|

(6,442 |

) |

|

(193,780 |

) |

|

(153,229 |

) |

|

(22,569 |

) |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Non-IFRS loss per share |

RMB |

|

|

RMB |

|

|

USD |

|

|

RMB |

|

|

|

RMB |

|

|

USD |

|

| -Basic and diluted |

(0.59 |

) |

|

(0.10 |

) |

|

(0.01 |

) |

|

(1.56 |

) |

|

(0.61 |

) |

|

(0.09 |

) |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Non-IFRS loss per

ADS(5 ordinary shares equal to 1 ADS) |

|

|

|

|

|

|

| -Basic and diluted |

|

(0.48 |

) |

|

(0.07 |

) |

|

|

(3.07 |

) |

|

(0.45 |

) |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Shares used in

non-IFRS loss per ordinary share computation: |

|

|

|

|

|

|

| -Basic and diluted |

127,274,280 |

|

|

454,231,486 |

|

|

454,231,486 |

|

|

124,286,433 |

|

|

249,230,922 |

|

|

249,230,922 |

|

| |

|

|

|

|

|

|

| ADS used in non-IFRS

loss per ADS computation: |

|

|

|

|

|

|

| -Basic and diluted |

|

90,846,297 |

|

|

90,846,297 |

|

|

|

49,846,184 |

|

|

49,846,184 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

GENETRON HOLDINGS LIMITEDUNAUDITED

REVENUE AND SEGMENT INFORMATION

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

Diagnosis andmonitoring |

|

Diagnosis andmonitoring |

|

Developmentservices |

|

Total |

| - provision ofLDT services |

- sale of IVDproducts |

| |

RMB’000 |

|

RMB’000 |

|

RMB’000 |

|

RMB’000 |

| |

|

|

|

|

|

|

|

| Three months ended September 30,

2019 |

|

|

|

|

|

|

|

Revenue |

60,542 |

|

9,490 |

|

11,312 |

|

|

81,344 |

| Segment profit/(loss) |

34,605 |

|

2,707 |

|

(1,366 |

) |

|

35,946 |

| |

|

|

|

|

|

|

|

| Three months ended September 30,

2020 |

|

|

|

|

|

|

| Revenue |

71,406 |

|

30,110 |

|

10,447 |

|

|

111,963 |

| Segment profit |

49,212 |

|

18,439 |

|

1,981 |

|

|

69,632 |

| |

|

|

|

|

|

|

|

| Nine months ended September 30,

2019 |

|

|

|

|

|

|

| Revenue |

169,285 |

|

14,434 |

|

36,766 |

|

|

220,485 |

| Segment profit/(loss) |

101,533 |

|

4,576 |

|

(6,939 |

) |

|

99,170 |

| |

|

|

|

|

|

|

|

| Nine months ended September 30,

2020 |

|

|

|

|

|

|

| Revenue |

194,754 |

|

67,468 |

|

28,319 |

|

|

290,541 |

| Segment profit |

130,961 |

|

43,827 |

|

1,305 |

|

|

176,093 |

| |

|

|

|

|

|

|

|

|

GENETRON HOLDINGS LIMITEDUNAUDITED

CONDENSED CONSOLIDATED BALANCE SHEETS

|

|

As at

December

31,2019 |

As at September

30,2020 |

|

|

RMB’000 |

|

|

RMB’000 |

|

|

US$’000 |

|

| ASSETS |

|

|

|

|

|

|

|

|

| Non-current assets |

|

|

|

|

|

|

|

|

| Property, plant and equipment |

83,013 |

|

|

73,500 |

|

|

10,825 |

|

| Right-of-use assets |

43,182 |

|

|

57,204 |

|

|

8,425 |

|

| Intangible assets |

5,482 |

|

|

9,453 |

|

|

1,392 |

|

| Prepayments |

12,679 |

|

|

11,975 |

|

|

1,765 |

|

| |

|

|

|

|

|

|

|

|

| Total non-current assets |

144,356 |

|

|

152,132 |

|

|

22,407 |

|

| |

|

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

|

| Inventories |

17,896 |

|

|

22,972 |

|

|

3,383 |

|

| Contract assets |

1,020 |

|

|

1,698 |

|

|

250 |

|

| Other current assets |

43,711 |

|

|

40,494 |

|

|

5,965 |

|

| Trade receivables |

83,757 |

|

|

128,013 |

|

|

18,854 |

|

| Other receivables and prepayments |

19,526 |

|

|

33,011 |

|

|

4,862 |

|

| Amounts due from related parties |

1,064 |

|

|

72 |

|

|

11 |

|

| Financial assets at fair value through profit or loss |

122,224 |

|

|

233,534 |

|

|

34,396 |

|

| Cash and cash equivalents |

139,954 |

|

|

1,635,000 |

|

|

240,809 |

|

| |

|

|

|

|

|

|

|

|

| Total current assets |

429,152 |

|

|

2,094,794 |

|

|

308,530 |

|

| |

|

|

|

|

|

|

|

|

| Total assets |

573,508 |

|

|

2,246,926 |

|

|

330,937 |

|

| |

|

|

|

|

|

|

|

|

GENETRON HOLDINGS LIMITEDUNAUDITED

CONDENSED CONSOLIDATED BALANCE SHEETS

(CONTINUED)

| |

As

at

December

31,2019 |

As

at September

30,202 |

| |

RMB’000 |

RMB’000 |

US$’000 |

| |

|

|

|

| LIABILITIES |

|

|

|

| Non-current liabilities |

|

|

|

| Financial

instruments with preferred rights |

2,106,334 |

|

|

- |

|

|

- |

|

| Borrowings |

3,643 |

|

|

5,921 |

|

|

872 |

|

| Lease liabilities |

29,124 |

|

|

40,090 |

|

|

5,905 |

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| Total non-current liabilities |

2,139,101 |

|

|

46,011 |

|

|

6,777 |

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| Current liabilities |

|

|

|

| Trade payables |

49,955 |

|

|

26,595 |

|

|

3,917 |

|

| Contract liabilities |

18,189 |

|

|

6,132 |

|

|

903 |

|

| Other payables and accruals |

109,683 |

|

|

263,576 |

|

|

38,821 |

|

| Amounts due to related parties |

34 |

|

|

- |

|

|

- |

|

| Borrowings |

19,514 |

|

|

53,097 |

|

|

7,820 |

|

| Lease liabilities |

15,363 |

|

|

15,459 |

|

|

2,277 |

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| Total current liabilities |

212,738 |

|

|

364,859 |

|

|

53,738 |

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| Total liabilities |

2,351,839 |

|

|

410,870 |

|

|

60,515 |

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| Net (liabilities)/assets |

(1,778,331 |

) |

|

1,836,056 |

|

|

270,422 |

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| SHAREHOLDERS’ (DEFICIT)/EQUITY |

|

|

|

| (Deficit)/equity attributable to owners of the

Company |

|

|

|

|

|

| Share capital |

17 |

|

|

59 |

|

|

9 |

|

| Share premium |

- |

|

|

6,657,562 |

|

|

980,553 |

|

| Treasury shares |

(3,578 |

) |

|

- |

|

|

- |

|

| Other reserves |

69,207 |

|

|

18,233 |

|

|

2,685 |

|

| Accumulated losses |

(1,843,977 |

) |

|

(4,839,798 |

) |

|

(712,825 |

) |

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

|

Total shareholders’ (deficit)/equity |

(1,778,331 |

) |

|

1,836,056 |

|

|

270,422 |

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

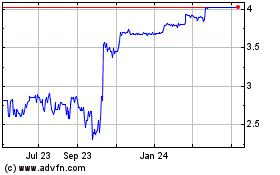

Genetron (NASDAQ:GTH)

Historical Stock Chart

From May 2024 to Jun 2024

Genetron (NASDAQ:GTH)

Historical Stock Chart

From Jun 2023 to Jun 2024