Bitcoin Buying Pressure Rises, But Here’s Why A Pullback Could Be Coming

November 12 2024 - 1:00AM

NEWSBTC

A recent analysis from BaroVirtual, a CryptoQuant analyst, offers a

nuanced perspective on the current state of the Bitcoin market.

According to the analyst, fluctuations in the Coinbase premium—a

key metric that tracks the price difference between Bitcoin on

Coinbase and other exchanges—can offer significant insights.

Related Reading: Bitcoin ETFs See Historic Surge – Institutions Go

Bullish On BTC With $1.38 Billion Record Inflows Retail Leverage

And Premiums: A Double-Edged Sword Rising or elevated Coinbase

premiums typically suggest intense buying pressure, indicating

strong medium-term sentiment for Bitcoin. However, BaroVirtual

warns that in the short term, these high premiums may present a

double-edged sword, as they often precede a localized downward

movement in Bitcoin’s price. This phenomenon stems from market

dynamics, as high premiums reflect surges in demand that can lead

to overheating. When this occurs in combination with a high volume

of leveraged retail positions and an excessive number of long

contracts, the risk of a market pullback increases. Notably,

BaroVirtual pointed out that this scenario has been evident in some

Asian exchanges, where traders’ aggressive positions and leveraged

setups further amplified market vulnerabilities. The analyst’s

observations extend beyond the Coinbase premium to the broader

market context. When premiums soar, they signal strong demand and

positive sentiment among investors. This can provide a floor for

Bitcoin’s price, strengthening support levels and creating a

bullish sentiment over the medium term. However, in the short run,

the influx of highly leveraged retail positions can destabilize

market balance, leading to sharp corrections. High leverage implies

that even minor price swings can force liquidations, exacerbating

downward price movements. The CryptoQuant analyst emphasized

leverage dynamics’ major role in determining bullish trends’

sustainability. Retail traders’ aggressive positioning on some

Asian exchanges reflects a growing risk appetite, which may lead to

sudden market shifts if sentiment turns or if premiums dip. Bitcoin

Nears $100,000 After previously trading just above $83,000 earlier

today, Bitcoin’s price has now pushed further. So far, BTC has

achieved a latest all-time high of (ATH) of $84,929 less than an

hour ago. However, the asset has seen a slight correction with a

current trading price of $84,929, at the time of writing.

Regardless of this slight pullback, with the current bullish

momentum in Bitcoin, it is evident that the asset could continue

this rally and rise above $85,000 soon, bringing it closer to a six

digit ATH of $100,000 and beyond. Related Reading: Bitcoin Stock To

Flow Model Reveals $500,000 Price Target Renowned crypto analyst

known as Javon Marks on X has highlighted that Bitcoin still has

“more upside coming” especially since it recently broke above a

descending broadening wedge pattern. Prices of $BTC (Bitcoin),

after breaking out of this descending broadening wedge pattern,

have been climbing MAJORLY, moving roughly +24% since but there can

still be much more upside coming! The measured breakout target is

another near 20% away just around the $100,000 mark and…

https://t.co/F01HbCd1kv pic.twitter.com/k0bv9xqUwK — JAVON⚡️MARKS

(@JavonTM1) November 11, 2024 Featured image created with DALL-E,

Chart from TradingView

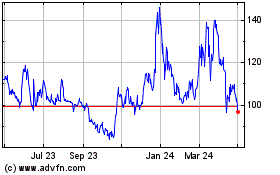

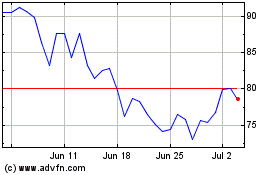

Quant (COIN:QNTUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Quant (COIN:QNTUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024