Short-Term Bitcoin Holders Move Millions To Binance—Is A Market Correction Imminent?

November 13 2024 - 3:00AM

NEWSBTC

Bitcoin has been on a major upward trajectory, recently hitting an

all-time high (ATH) of above $89,000. As this milestone was

crossed, a notable trend emerged with short-term holders

transferring their holdings to major exchanges, particularly

Binance. According to CryptoQuant analyst Joao Wedson, this

behavior suggests that investors with shorter time horizons may be

positioning themselves to take profits, leading to potential

selling pressure in the market. What To Watch Out For Wedson

highlighted that the concentration of Bitcoin deposits to a single

exchange like Binance is worth close monitoring, as it could impact

liquidity and price stability on the platform, potentially

reverberating through the broader market. Related Reading: Is

Bitcoin Now Overheating? Key Metrics Reveal Crucial Insights For

Investors The CryptoQuant analyst emphasized three areas for market

participants to watch closely. First, tracking the flow of BTC to

exchanges, especially Binance, can provide insights into the

potential scale of selling intent among short-term holders. As more

coins flow to a major exchange, the potential for market impact

rises, making it crucial to gauge the extent of any impending

sell-off. Second, the impact on price volatility is expected to be

significant as concentrated selling or profit-taking on Binance

could create sharp movements, providing both challenges and

opportunities for traders. The final area of focus, according to

Wedson, is anticipating potential price movements based on these

inflows and understanding how they may influence the broader

market’s behavior. Bitcoin Market Correction Imminent? Meanwhile,

further insights were provided by another CryptoQuant analyst known

as “caueconomy.” This analyst pointed out that Bitcoin’s breakout

of its previous all-time high has initiated a price discovery

process. With this milestone, the market has seen heightened open

interest levels, with more than $16 billion added to futures

positions over the past week. This surge indicates a rise in

leveraged positions, which can lead to heightened risk of

corrections in the short term. Related Reading: Bitcoin Buying

Pressure Rises, But Here’s Why A Pullback Could Be Coming However,

the analyst emphasized that the market’s underlying fundamentals

appear much more strong this time around, suggesting that any

potential short-term corrections could be viewed as natural

adjustments. Rather than signalling a broader downturn, these

corrections may offer buying opportunities for investors looking to

enter or accumulate during periods of market pullback. Bitcoin

trades for $86,441, which has increased by 2.3% in the past day.

Notably, this current trading price marks a 3.6% decline from BTC’s

latest achieved all-time high of $89,864 earlier today. According

to renowned crypto analyst known as Ali on X, key support levels

for Bitcoin to watch are between $83,250 – $85,800 and $72,880 –

$75,520. Featured image created with DALL-E, Chart from TradingView

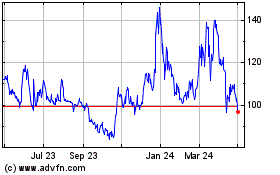

Quant (COIN:QNTUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

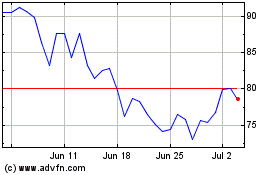

Quant (COIN:QNTUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024