Bitcoin 2 Months Through “Euphoria Wave,” How Long Was The Last One?

April 10 2024 - 9:00PM

NEWSBTC

On-chain data shows Bitcoin has been going through a “euphoria

wave” for two months. Here’s how long it was in this phase during

the last bull run. Bitcoin Has Been In Euphoria Wave Phase

According To Supply In Profit According to the latest weekly report

from the on-chain analytics firm Glassnode, the current BTC cycle

is similar to the last one regarding the “Supply Profitability

State.” This indicator is based on the “Percent Supply in Profit,”

which keeps track of the percentage of the total circulating

Bitcoin supply that’s currently carrying a profit. Related Reading:

Dogecoin Slows Down: What Needs To Happen For New DOGE Highs? This

metric works by going through the on-chain history of each coin in

circulation to see the price at which it was last transferred.

Assuming that this last transaction was the last point at which it

changed hands, the price at its time would reflect the coin’s

current cost basis. Naturally, if this cost basis is lower in value

than the current spot price of the cryptocurrency, then the coin in

question carries some net unrealized gain. The Percent Supply in

Profit adds up all such coins and calculates what percentage of the

supply they make up for. The supply Profitability State signals

BTC’s current phase based on the market’s profitability status. The

chart below shows the trend in this indicator over the past few

years. Looks like the metric has been giving a green signal in

recent weeks | Source: Glassnode's The Week Onchain - Week 15, 2024

In the chart, the analytics firm has highlighted three important

lines for the Bitcoin Percent Supply in Profit. The middle line

(colored in blue) represents the cumulative mean of the metric,

while the other two signify +1 (green) and -1 (red) standard

deviation (SD) from this mean. When the Bitcoin Percent Supply in

Profit is above the +1SD (approximately 95% of the supply being in

the green), the market may be considered to be in the euphoria or

pre-euphoria phase. Similarly, the Supply Profitability State would

indicate a bottom discovery phase for values less than -1SD. The

zone between these two corresponds to the “bear/bull transition”

phase. From the chart, it’s visible that during the last bull run,

Bitcoin first saw a 1.5-month-long pre-euphoria wave, during which

the metric tested the +1SD line. The asset followed up with a

period of decline and consolidation, which put the Supply In Profit

back under the +1 SD mark. Related Reading: Bitcoin Nears Two

Important On-Chain Levels: What Happened Last Time Finally, the

coin observed a sharp rally, broke past the +1SD barrier, and went

on to achieve new all-time highs, which naturally set the Supply In

Profit to 100%. Bitcoin seems to have witnessed a similar pattern

this time around. A two-month-long pre-euphoria phase was followed

by a drawdown, which has now been succeeded by a two-month-long

euphoria wave during which the cryptocurrency has achieved new

records. If the euphoria wave lasts for a period similar to the

last bull run, then four or more months might still be left for

this Bitcoin bull rally. BTC Price Bitcoin had recovered above

$72,000 earlier, but it appears that the asset has retraced back

towards the $69,400 level. The price of the asset appears to have

gone through a drawdown over the last couple of days | Source:

BTCUSD on TradingView Featured image from iStock.com,

Glassnode.com, chart from TradingView.com

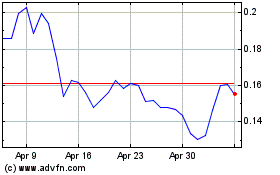

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024