Is the craze for social media evaporating across the globe? At

least, the poor performance by

Global X Social Media Index

ETF (SOCL) this year is

giving such cues. In the year-to-date period, SOCL was off about

9.50% with the last one month being hardest hit when SOCL slumped

more than 15%.

The reasons for this slide boils down to the social media sell-off

in China as well as acute selling pressure witnessed in some of

SOCL’s top holdings, like

Facebook (FB) and

Twitter (

TWTR).

Investors should note that SOCL has about half of its focus on the

U.S., 25% of exposure in China and the remaining portfolio in the

rest of the world. This clearly points to why any movement in the

U.S. and China can make or break this social media ETF. Let’s delve

into the matter in greater detail below:

What Happened in China?

Internet censorship has always been severe in China, resulting in a

ban on some renowned social networking websites like FB, TWTR,

YouTube, and FourSquare. These sites were identified as risks to

state-controlled media. However, this is an old story.

The latest hazard was a possible bursting of the tech bubble

in the U.S. in March which spilled over into the Asian tech

sell-off as well. The Chinese Internet ETF has seen a spectacular

run with

CSI China Internet ETF

(

KWEB) gaining as much as 21% in the first two

months of the year.

Though overall China ETFs started the year with sluggish trading,

two other tech ETFs like

Guggenheim China Technology

ETF (

CQQQ) and

Global X China

Technology ETF (

QQQC) returned about

10.0%.

This splendid run-up had to end at some point as the Chinese

Internet market was due for a correction. As a result, the largest

holding of SOCL – Tencent – which accounts for about 13.08% of the

basket, was down more than 17% since the beginning of February.

Its market capitalization plunged to $126 billion from $152

billion. Another Chinese company

SINA Corp (SINA)

– occupying 7.41% share of SOCL – tumbled 11.4% in the last one

month (China Internet ETF: The Best Choice in the Space?).

Internet Stocks Losing Charm?

Russian Internet Company Yandex – accounting for 4% of SOCL’s share

– lost about 11.2%, and the situation back home was even more

vexing.

FB – having more than 12% share of SOCL – gave up 13.5% in price,

LinkedIn (LNKD) having more than 8% share shed

12.8%,

Zynga (ZNGA) making up 5.5% of SOCL

plummeted 26.6%, Yelp (YELP) contributor of 5.29% of the fund’s

total assets plunged 28%, and TWTR having more than 4.5% focus

slipped 19% over the past month.

In short, most components forming SOCL’s top-10 holdings

experienced a bloodbath lately (read: Buy These 2 Tech ETFs on

NASDAQ Sell-Off).

If this was not enough, recently, the Turkish government imposed a

ban on Twitter. Should this trend continue, we may see more trouble

for social media stocks in the near term, though its long-term

potential looks promising.

This suggests that investors may want to pay close attention to the

sole ETF tracking this space, especially when investors can easily

use this deep plunge as a buying opportunity. Investors should keep

in mind that SOCL delivered an impressive return of 42% over the

past one-year period.

SOCL in Focus

This ETF offers the only pure play in the social media space and

amassed $145 million in its asset base. The ETF charges 0.65% in

fees and expenses. The product tracks the Solactive Social Media

Index, holding 27 securities in the basket. In terms of country

exposure, U.S. firms take more than half the portfolio, closely

followed by China (26%) and Japan (11%).

After incurring a steep loss, the product was down only 0.52% last

week. SOCL currently has a Zacks ETF Rank of 2 or ‘Buy’ rating with

a ‘High’ risk outlook (read: Facebook to Buy WhatsApp, 3 ETFs to

Watch).

Conclusion

We do not think that the social media space is running out of

favor. In fact, it sees solid potential ahead. But the recent slump

will likely put the planned listing of Alibaba (Chinese Internet

company) on the U.S. exchange in a tough spot (read: 4 ETFs to Tap

on Upcoming Alibaba IPO).

Also, Weibo –the Chinese version of

Twitter

– seeks to raise $500 million in an initial public

offering in the U.S., according to a recent regulatory filing. With

investors in no mood to binge on social media, these IPOs might

fail to succeed especially when Weibo’s parent company SINA is

struggling under pressure.

If we rule out these near-term hurdles, SOCL might turn around,

with investors’ interest on stock markets returning. Markets are

hitting new highs lately. The relative strength index of SOCL is

also hovering round 30, indicating that the fund has slipped to the

oversold territory. The ETF’s Parabolic SAR is also higher than its

current price, pointing to an entry point in the ETF for investors

who aren’t afraid of taking on a little risk at this time.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

GUGG-CHINA TEC (CQQQ): ETF Research Reports

FACEBOOK INC-A (FB): Free Stock Analysis Report

KRANS-C CHN INT (KWEB): ETF Research Reports

LINKEDIN CORP-A (LNKD): Free Stock Analysis Report

GLBL-X NDQ CHIN (QQQC): ETF Research Reports

GLBL-X SOCL MDA (SOCL): ETF Research Reports

ZYNGA INC (ZNGA): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

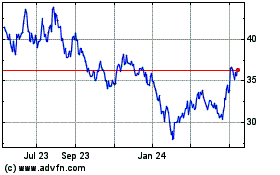

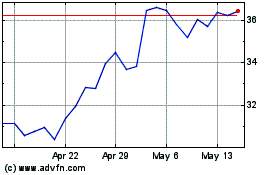

Invesco China Technology... (AMEX:CQQQ)

Historical Stock Chart

From Oct 2024 to Nov 2024

Invesco China Technology... (AMEX:CQQQ)

Historical Stock Chart

From Nov 2023 to Nov 2024