UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 6-K

Report of Foreign Private Issuer Pursuant to Rule 13a-16

or

15d-16 of the Securities Exchange Act of 1934

For the month of October 2021

Commission File Number: 1-15256

_____________________

OI S.A. – In Judicial Reorganization

(Exact Name as Specified in its Charter)

N/A

(Translation of registrant’s name into

English)

Rua Humberto de Campos, No. 425, 8th floor –

Leblon

22430-190 Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal executive offices)

(Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F: ý

Form 40-F: o

(Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)):

Yes: o

No: ý

(Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7)):

Yes: o No: ý

(Indicate by check

mark whether the registrant by furnishing the information contained in this Form, the Registrant is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes: o No:

ý

If “Yes” is marked, indicate

below the file number assigned to the

registrant in connection with Rule 12g3-2(b):

|

Oi S.A. – In Judicial Reorganization

Federal Taxpayers’ (CNPJ/ME) No. 76.535.764/0001-43

Board of Trade (NIRE) No. 33.3.0029520-8

Publicly-Held Company

|

MATERIAL FACT

Intention to Delist its American Depositary Receipts

from the New York Stock Exchange

Oi S.A. – In Judicial Reorganization

(“Oi” or the “Company”), in compliance with Article 157, Section 4, of Law No. 6,404/76 and

the provisions of CVM Instruction No. 44/2021, hereby informs its shareholders and the market in general that, its Board of Directors,

in a meeting held on September 30, 2021, has approved the Company’s intention to: (i) delist its American Depositary Receipts (“ADRs”),

each representing five common shares of the Company (“Common ADRs”), from the New York Stock Exchange (the “NYSE”)

while maintaining a Level 1 ADR program for its Common ADRs to trade over-the-counter in the United States together with its Preferred

ADRs, which currently trade over-the-counter; and (ii) once the Company meets the relevant criteria, terminate its registration with the

U.S. Securities and Exchange Commission (the “SEC”).

Reasons for the Delisting from NYSE

The Company listed its Common ADRs on the NYSE

mainly to promote trading in its shares and to raise the Company’s visibility in the United States. The Company now finds that the

economic rationale for maintaining a listing on the NYSE has declined in recent years due in part to: (i) increases in trading volume

of Brazilian stocks in Brazil by overseas investors due to the internationalization of the Brazilian financial and capital markets, as

well as the narrowing of the gap between U.S. and Brazilian disclosure standards with respect to financial reporting; and (ii) a decreasing

trend in recent years in the trading volume of the Company’s Common ADRs on the NYSE. The Company’s preferred ADRs, each representing

one preferred shares of the Company (“Preferred ADRs”), have traded over-the-counter since 2016.

In addition, the delisting of the Common ADRs

from the NYSE is in line with the Company’s transformation plan, as previously disclosed to the market, one of the principal pillars

of which is to simplify the Company’s operational structure and readjustment of its cost base, in order to create an increasingly

agile, light and efficient company.

In due course, the Company expects to file a

Form 25 with the SEC to permanently delist the Common ADRs. The delisting is expected to be effective 10 days after the filing of Form

25. The Company expects that immediately following the delisting, its Common ADRs will begin to trade over-the-counter.

The Company will continue

to be registered under the U.S. Securities Exchange Act of 1934 (the “Exchange Act”) for the time being, and the Company

will continue to comply with its reporting obligations under the Exchange Act following delisting from the NYSE. Once the Company meets

the criteria for terminating its reporting obligations under the Exchange Act, Oi intends to file a Form 15F with the SEC to deregister

and terminate its reporting obligations under the Exchange Act. Immediately upon filing Form 15F, The Company’s legal obligation

to file reports under the Exchange Act will be suspended, and deregistration is expected to become effective 90 days later.

The Board of Directors

authorized the Company’s management to take all necessary steps to delist the Common ADRs from the NYSE and deregister the Company

from the SEC.

The Company reserves

the right, for any reason, to delay these filings or to withdraw them prior to their effectiveness, and to otherwise change its plans

in this regard.

Maintenance

of the Listing on the B3 and Disclosure

The Company clarifies

that it will (i) maintain the listing of its common shares on Level 1 of the B3 in Brazil, and continue to be subject to applicable

disclosure requirements under Brazilian laws and regulations; and (ii) continue to disclose its periodic reports, annual and interim results

and communications as required by applicable laws and regulations on its website (https://ri.oi.com.br), including in English.

Additional Information

This Material Fact is

not an offer of securities for sale in the United States, Brazil or elsewhere. It is merely intended for information purposes, under the

terms of the applicable laws and regulations, and shall not, in any circumstances, be deemed or considered as an investment recommendation,

an offer for sale, or a solicitation or offer for acquisition of securities of the Company.

The Company reaffirms

its commitment to keep its shareholders and the market informed about the development of the subject matter of this Material Fact.

Rio de Janeiro, October 01, 2021.

Oi S.A. – In Judicial Reorganization

Cristiane Barretto Sales

Chief Financial Officer and Investor Relations Officer

Special Note Regarding

Forward-Looking Statements:

This Material Fact contains certain forward-looking

statements. Statements that are not historical facts, including statements about our beliefs and expectations, are forward-looking statements.

The words “expects”, “maintain”, “plans”, “intends” and “tendency” and similar

expressions, as they relate to the Company, are intended to identify forward-looking statements. Such statements reflect the current views

of management and are subject to a number of risks and uncertainties. The statements are based on many assumptions and factors, including

general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause

actual results to differ materially from current expectations. Undue reliance should not be placed on such statements. Forward-looking

statements speak only for the date they are made.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: October 1, 2021

OI S.A. – In Judicial Reorganization

By: /s/ Rodrigo Modesto de Abreu

Name: Rodrigo Modesto de Abreu

Title: Chief Executive Officer

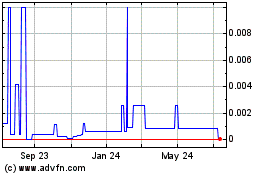

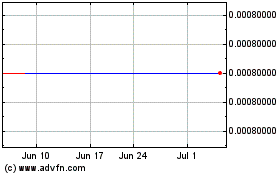

OI (CE) (USOTC:OIBRQ)

Historical Stock Chart

From Apr 2024 to May 2024

OI (CE) (USOTC:OIBRQ)

Historical Stock Chart

From May 2023 to May 2024