UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event

Reported): October 16, 2014

FXCM Inc.

(Exact Name of Registrant as Specified in

its Charter)

| Delaware |

|

001-34986 |

|

27-3268672 |

| (State or Other Jurisdiction of |

|

(Commission File Number) |

|

(IRS Employer |

| Incorporation) |

|

|

|

Identification No.) |

55 Water Street, FL 50, New York, NY,

10041

(Address of Principal Executive Offices)

(Zip Code)

(646) 432-2986

(Registrant’s

Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 7.01 Regulation FD Disclosure

On October 16, 2014, FXCM Inc. issued a press release regarding

its monthly business metrics for September 2014. The text of the press release is furnished as Exhibit 99.1 to this Form 8-K.

In accordance with General Instruction B.2 of Form 8-K, the

information in this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed to be “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), or otherwise subject to the liability of

that section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or

the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

| (a) | Financial statements of businesses acquired: None |

| (b) | Pro forma financial information: None |

| (c) | Shell company transactions: None |

| (d) | Exhibits: Press release, dated October 16, 2014, issued

by FXCM Inc. |

| Exhibit No. |

|

Exhibit Description |

| |

|

|

| 99.1** |

|

Press Release dated October 16, 2014 |

** Furnished herewith.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

FXCM INC. |

| |

|

| |

By: |

/s/Robert Lande |

| |

|

Name: |

Robert Lande |

| |

|

Title: |

Chief Financial Officer |

Date: October 16, 2014

Exhibit Index

| Exhibit No. |

|

Description |

| |

|

|

| 99.1 |

|

Press Release dated as of October 16, 2014 |

Exhibit 99.1

FXCM Reports Monthly Metrics

Record Retail Trading Volume of $414

billion

Record Institutional Trading Volume of $362 billion

NEW YORK—October 16, 2014— FXCM Inc. (NYSE:FXCM)

today announced certain key operating metrics for September 2014 for its retail and institutional foreign exchange business. Monthly

activities included:

September 2014 Retail Trading Metrics

| · | Retail customer trading volume(1) of $414 billion in September

2014, 38% higher than August 2014 and 45% higher than September 2013. Volume from indirect sources was 47% of total retail volume(1)

in the third quarter 2014. |

| · | Retail customer trading volume(1) for the third quarter

2014 was $977 billion, 27% higher than the second quarter 2014, and relatively flat when compared to third quarter 2013. |

| · | Average retail customer trading volume(1) per day of $18.8

billion in September 2014, 31% higher than August 2014 and 38% higher than September 2013. |

| · | An average of 482,784 retail customer trades per day in September

2014, 23% higher than August 2014 and 26% higher than September 2013. |

| · | Tradable accounts(2) of 212,019 as of September 30, 2014,

an increase of 12,642, or 6% from August 2014, and an increase of 23,031, or 12%, from September 2013. Tradable accounts as of

September 30, 2014 include 12,575 accounts acquired from IBFX. |

September 2014 Institutional Trading Metrics

| · | Institutional customer trading volume(1) of $362 billion

in September 2014, 41% higher than August 2014 and 100% higher than September 2013. |

| · | Institutional customer trading volume(1) for the third

quarter 2014 was $881 billion, 48% higher than the second quarter 2014 and 53% higher than the third quarter 2013. |

| · | Average institutional trading volume(1) per day of $16.5

billion in September 2014, 35% higher than August 2014 and 92% higher than September 2013. |

| · | An average of 39,379 institutional client trades per day in September

2014, 11% higher than August 2014 and 3% higher than September 2013. |

More information, including historical results for each of the

above metrics, can be found on the investor relations page of the Company's corporate web site, www.fxcm.com.

This operating data is preliminary and subject to revision and

should not be taken as an indication of the financial performance of FXCM Inc. FXCM undertakes no obligation to publicly update

or review previously reported operating data. Any updates to previously reported operating data will be reflected in the historical

operating data that can be found on the Investor Relations page of the Company's corporate web site, www.fxcm.com.

(1) Volume that FXCM customers traded in period

translated into US dollars.

(2) An account that has sufficient funds to place

a trade in accordance with FXCM trading policies.

Disclosure Regarding Forward-Looking Statements

In addition to historical information, this release contains

forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange

Act of 1934, which reflect FXCM Inc.'s current views with respect to, among other things, its operations and financial performance

for the future. You can identify these forward-looking statements by the use of words such as "outlook," "believes,"

"expects," "potential," "continues," "may," "will," "should," "seeks,"

"approximately," "predicts," "intends," "plans," "estimates," "anticipates"

or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks

and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially

from those indicated in these statements. FXCM Inc. believes these factors include but are not limited to evolving legal and regulatory

requirements of the FX industry, the limited operating history of the FX industry, risks related to the protection of its proprietary

technology, risks related to its dependence on FX market makers, market conditions and those other risks described under "Risk

Factors" in FXCM Inc.'s Annual Report on Form 10-K and other SEC filings, which are accessible on the SEC website at sec.gov.

These factors should not be construed as exhaustive and should

be read in conjunction with the other cautionary statements that are included in this presentation and in our SEC filings. FXCM

Inc. undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information,

future developments or otherwise, except as required by law.

About FXCM Inc.

FXCM Inc. (NYSE: FXCM) is a global online provider of

foreign exchange (forex) trading and related services to retail and institutional customers world-wide.

At the heart of FXCM's client offering is No Dealing Desk forex

trading. Clients benefit from FXCM's large network of forex liquidity providers enabling FXCM to offer competitive spreads on major

currency pairs. Clients have the advantage of mobile trading, one-click order execution and trading from real-time charts. FXCM's

U.K. subsidiary, Forex Capital Markets Limited, also offers CFD products with no re-quote trading and allows clients to trade oil,

gold, silver and stock indices along with forex on one platform. In addition, FXCM offers educational courses on forex trading

and provides free news and market research through DailyFX.com.

Trading foreign exchange and CFDs on margin carries a high level

of risk, and may not be suitable for all. Read full disclaimer.

Visit www.fxcm.com and follow us on

Twitter @FXCM, Facebook FXCM, Google+ FXCM or YouTube FXCM.

FXCM Inc.

Jaclyn Klein, 646-432-2463

Vice-President, Corporate Communications

jklein@fxcm.com

investorrelations@fxcm.com

Global Brokerage (CE) (USOTC:GLBR)

Historical Stock Chart

From Jun 2024 to Jul 2024

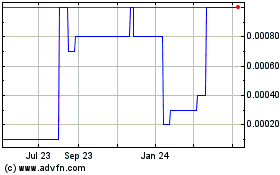

Global Brokerage (CE) (USOTC:GLBR)

Historical Stock Chart

From Jul 2023 to Jul 2024