UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20509

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

November

20, 2015

Date

of Report

(Date

of earliest event reported)

FONU2

INC.

(Exact

name of registrant as specified in its charter)

| NEVADA |

|

000-49652 |

|

65-0773383 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File No.) |

|

(IRS

Employee

I.D. No.) |

135

Goshen Road Ext., Suite 205

Rincon,

GA 31326

(Address

of Principal Executive Offices)

(912)

655-5321

Registrant's

Telephone Number

N/A

Former

name or former address, if changed since last report

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item

5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On

November 20, 2015, the Company filed with the Nevada Secretary of State an Amended Certificate of Designations, Rights and Preferences

of Series B Convertible Preferred Stock (the “Amended Certificate”). As previously disclosed with respect to a 1 for

400 reverse stock split of the Company’s Common Stock and Series B Convertible Preferred Stock, the Amended Certificate

decreased the number of issued and outstanding shares of such Preferred Stock from 2,500,000 to 6,250 and increased the Stated

Value of such shares of Preferred Stock from $1.00 per share to $400 per share. Such changes were previously disclosed in the

Company’s definitive Information Statement filed on January 5, 2015, and in all of the Company’s periodic filings

with the Securities and Exchange Commission due after the effective date of such reverse stock split.

Item

9.01 – Financial Statements and Exhibits.

Exhibit

No. |

|

Description of Exhibit |

| 3.1 |

|

Certificate of Designations, Rights and Preferences of Series B Convertible Preferred Stock (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K filed on December 12, 2014). |

| |

|

|

| 3.2 |

|

Amended Certificate of Designations, Rights and Preferences of Series B Convertible Preferred Stock. |

SIGNATURES

Pursuant

to the requirements of the Securities and Exchange Act of 1934, the Registrant has duly caused this Current Report to be signed

on its behalf by the undersigned hereunto duly authorized.

| |

FONU2

INC., a Nevada corporation |

| |

|

|

| Date: November

25, 2015 |

By: |

/s/

Roger Miguel |

| |

|

Roger Miguel,

Chief Executive Officer |

3

Exhibit 3.2

AMENDED

CERTIFICATE

OF DESIGNATIONS,

RIGHTS

AND PREFERENCES

OF

SERIES

B CONVERTIBLE PREFERRED STOCK

OF

FONU2,

INC.

FONU2,

INC., a corporation organized and existing under the laws of the State of Nevada, hereby certifies that the following resolution

was duly adopted by the Board of Directors of the Company effective as of February 8, 2015:

WHEREAS,

effective December 5, 2014, the Board of Directors created a series of preferred stock, therein designated and authorized as the

Series B Convertible Preferred Stock, par value $0.01 per share, which consisted of Two Million Five Hundred Thousand (2,500,000)

of the twenty million (20,000,000) shares of preferred stock and the Board of Directors thereby fixed the powers, designations

and preferences and the relative, participating, optional and other special rights of the shares of each such class and series,

and the qualifications, limitations and restrictions thereof (the “Terms”); and

WHEREAS,

on December 22, 2014, the Company’s shareholders approved a reverse stock split for its Common Stock and Series B Convertible

Preferred Stock in the ratio of one share of Common Stock and one share of Preferred stock for each 400 shares of such Common

Stock and Preferred Stock, respectively, which stock split was effective February 8, 2015; and

RESOLVED,

that effective February 8, 2015, the Terms are hereby amended as follows:

1. The first sentence of Section 1 of the Terms is hereby deleted in its entirety and replaced by the following:

“1.

Number: The number of shares constituting the Series B Convertible Preferred Stock shall be six thousand two hundred fifty

(6,250).”

2. The definition of “Stated Value” in Section 2 of the Terms is hereby deleted in its entirety and replaced by the following:

““Stated Value” is an amount equal to Four Hundred Dollars ($400) per share of Series B Preferred Stock plus

(x) any accrued and unpaid dividends (as of the date of determination, which for purposes of Section 6(A) shall be any

applicable Conversion Closing Date, whether or not declared and whether or not earnings are available in respect of such dividends

and assuming solely for the purposes of this definition that such dividends are paid in cash in accordance with Section 6(A)(iii),

and (y) any dividends declared on the Common Stock in an amount equal to the product of (A) the per-share dividend on Common Stock

multiplied by (B) the number of shares of Common Stock issuable upon conversion of a share of Series B Preferred Stock on the

date such dividend is declared on the Common Stock. In the event the Company shall declare a distribution on the Common Stock

payable in securities or property other than cash, the value of such securities or property will be the fair market value. Any

such securities shall be valued as follows: (i) if traded on a National Securities Exchange, the value shall be deemed to be the

average of the closing prices of the securities on such National Securities Exchange over the thirty (30) Business Day period

ending three (3) calendar days prior to such declaration; (ii) if actively traded on another market, the value shall be deemed

to be the average of the closing bid or sale prices (whichever is applicable) over the thirty (30) Business Day period

ending three (3) calendar days prior to such declaration; and (iii) if there is no active market, the value shall be the fair

market value thereof, as determined in good faith by the Board over the thirty (30) Trading Days period ending three (3) calendar

days prior to such declaration.”

IN

WITNESS WHEREOF, this Amendment to Certificate has been signed on behalf of the Company by its Chief Executive Officer and attested

to by its Secretary, all as of February 8, 2015.

|

FONU2,

INC. |

| |

|

| |

Name:

Roger Miguel |

| |

Title:

CEO |

| |

|

| |

|

| |

Name:

Roger Miguel |

| |

Title:

Secretary |

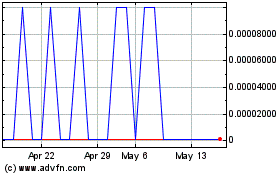

FONU2 (PK) (USOTC:FONU)

Historical Stock Chart

From Jun 2024 to Jul 2024

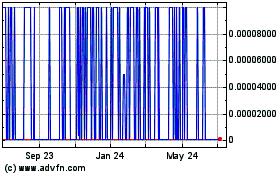

FONU2 (PK) (USOTC:FONU)

Historical Stock Chart

From Jul 2023 to Jul 2024