Dinewise, Inc. - Current report filing (8-K)

August 25 2008 - 3:18PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________

FORM 8-K

______________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 22, 2008

______________

Dinewise, Inc.

(Exact name of registrant as specified in its charter)

______________

|

|

|

|

|

Nevada

|

333-100110

|

01-0741042

|

|

(State or Other Jurisdiction

|

(Commission

|

(I.R.S. Employer

|

|

of Incorporation)

|

File Number)

|

Identification No.)

|

500 Bi-Country Boulevard, Suite 400

Farmingdale, NY 11735

(Address of Principal Executive Office) (Zip Code)

(631) 694-1111

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01

Entry into a Material Definitive Agreement.

On August 22, 2008, Dinewise, Inc. (the “Company”), entered into a definitive Asset Purchase Agreement (“APA”) with Leon Kastner Wholesale Meat Corp. (“KAS”), a New York corporation engaged in supplying and distributing meats and other specialty products. Houlihan Smith &Company Inc. has been engaged to advise on the transaction.

Under the terms of the APA, the Company will acquire substantially all the assets and assume certain liabilities of KAS. Stephen A. Fraum, Chairman and COO of KAS, will be appointed President of a new division (the “Division”) of the Company which will operate the KAS business and will be provided a two-year employment agreement.

The APA is expected to close on or about October 12, 2008, or such later date as is mutually agreed to. Subject to certain closing conditions, including 1) the completion of the Company’s satisfactory due diligence and 2) the Company achieving adequate financing, the Company will pay $1,715,000 in cash, issue $250,000 of the Company’s stock and issue a three year Convertible Subordinated Note (the “Note”) to KAS in the amount of $1,000,000. The Note will be secured by the acquired assets and payable in twelve equal quarterly payments of $83,333 plus accrued interest. In addition, within 30 days of the completion of the audited financials of the Company for each of the years ending December 31, 2009, 2010 and 2011 (EBITDA Periods), an additional amount (“Earn Out”) is payable to KAS up to a maximum $1,118,000 in each EBITDA Period, with a minimum Earn Out in each EBITDA Period of $508,000. The maximum total Earn Out payable for the EBITDA Periods is $3,355,000 based upon the Company’s EBITDA in 2009, 2010 and 2011. 25% of the Earn Out amount will be paid in cash and the balance by a three-year Note, bearing interest at 8% per annum.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

Dinewise, Inc.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Thomas McNeill

|

|

|

|

Thomas McNeill

Vice President and Chief Financial Officer

|

|

|

|

Date: August 25, 2008

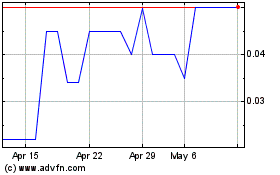

Dinewise (PK) (USOTC:DWIS)

Historical Stock Chart

From Apr 2024 to May 2024

Dinewise (PK) (USOTC:DWIS)

Historical Stock Chart

From May 2023 to May 2024