CDTi Advanced Materials, Inc. Reports First Quarter 2018 Financial Results

May 14 2018 - 4:05PM

CDTi Advanced Materials, Inc. (Nasdaq:CDTI) (“CDTi” or “the

Company”), a leader in advanced catalyst materials technology,

reported its financial results for the first quarter ended March

31, 2018.

Matthew Beale, CDTi’s CEO, stated, “In the first quarter of

2018, we achieved 35% gross margin, more than double that obtained

in the first quarter of 2017. In addition, we reduced our operating

expenses by 45% and created the path to profitability as our

advanced materials business gains traction. These achievements were

enabled by the successful execution of our 2017 business

realignment strategy.

“We expect to make tangible progress in both vehicle

applications and fundamental catalyst design projects with OEMs and

other partners during the balance of 2018. In addition, this year

we expect to complete partnerships that will provide for local

production of our materials in China and India. We believe that

continued progress with catalyst coaters in India and China will

lead to direct relationships with OEMs as they become confident of

the adoption of our novel technology in the market.

“We also realigned our Board of Directors with the nomination of

two seasoned executives who will bring significant business acumen

in international markets, including China and India, to support the

execution of our long-term growth strategy.”

Financial Highlights: First Quarter 2018 compared to

First Quarter 2017

- Total revenue was $4.9 million, compared to $8.2 million.

- Coated catalyst revenue was $2.7 million, compared to $4.7

million. The first quarter 2018 is the last quarter in which CDTi

will generate revenue from shipments to Honda.

- Emissions control systems revenue was $1.8 million, compared to

$3.3 million.

- Technology and advanced materials revenue was $0.4 million,

compared to $0.2 million.

- Gross margin was 35%, compared to 17%, primarily due to product

mix which reflected the sale of the company’s 2017 DuraFit product

line and final shipments to Honda.

- Total operating expenses in the first quarter of 2018 were $2.2

million, compared to $3.8 million in the first quarter of 2017 due

to decreases in sales and support staff resulting from the sale of

the company’s DuraFit product line and the completion of its Honda

production.

- Net loss was $0.3 million, or $0.02 per share, compared to a

net loss of $3.1 million, or $0.20 per share in the first quarter

of 2017.

- Cash at March 31, 2018, was $2.1 million, compared to $2.8

million at December 31, 2017.

Company Outlook The company currently expects

2018 revenue of approximately $12 million. With the implementation

of local production capabilities in China and India the company

believes that a growing pipeline of customers will begin to

generate material revenue beginning in 2018 and accelerating into

2019.

In addition to materials applications generating revenue in

2018, the company expects that its materials technology will be

selected by at least one global OEM for inclusion in next

generation exhaust systems and that CDTi will have established at

least one partnership for deployment of its Spinel™ technology in

fuel cell and advanced battery applications during the

year.

Conference Call and Webcast InformationCDTi

will host a conference call and live webcast beginning at 2:00 p.m.

Pacific Time today, May 14th, to discuss its financial results and

its business outlook. This conference call will contain

forward-looking information. To participate in the conference call,

please dial +1 (877) 303-9240 and international participants should

dial +1 (760) 666-3571. The conference code is 7419489. The

conference call will be webcast live on the CDTi website at

www.cdti.com under the "Investor Relations" section. To listen to

the live webcast, participants should visit the site at least 15

minutes prior to the conference to download any required streaming

media software. An archived recording of the conference call will

be available on the CDTi website for 30 days. You may also access a

telephone replay for two business days following the conclusion of

the call by dialing +1 (855) 859-2056 or +1 (404) 537-3406 if

dialing in internationally. The passcode is 7419489.

About CDTi Advanced Materials CDTi Advanced

Materials, Inc. (NASDAQ:CDTI) develops advanced materials

technology for the emissions control and other catalysis markets.

CDTi’s proprietary technologies provide high-value sustainable

solutions to reduce hazardous emissions from on- and off-road

combustion engine systems at significantly lower cost. With a

continuing focus on innovation-driven commercialization and global

expansion, CDTi’s breakthrough Powder-to-Coat (P2C™) approach

delivers those technologies to customers in a ready to use powder

form. Key technology platforms include Base Metal Activated Rhodium

Support (BMARS™), Synergized PGM (SPGM™), Zero PGM (ZPGM™) and

Spinel™. For more information, please visit www.cdti.com.

Forward-Looking StatementsCertain information

contained in this press release constitutes forward-looking

statements, including any statements that are not statements of

historical fact. You can identify these forward-looking statements

by the use of the words “believes”, “expects”, “anticipates”,

“plans”, “may”, “will”, “would”, “intends”, “estimates”, and other

similar expressions, whether in the negative or affirmative.

Forward-looking statements are based on a series of expectations,

assumptions, estimates and projections, which involve substantial

uncertainty and risk. In this document, the Company includes

forward-looking statements regarding the acceleration of the

Company’s business transformation into an advanced materials

company, global trends in the automotive and heavy duty diesel

markets, the Company’s future financial performance, and the

performance of the Company’s technology, are all subject to risks

and uncertainties that could cause our actual results and financial

position to differ materially. In general, actual results may

differ materially from those indicated by such forward-looking

statements as a result of risks and uncertainties, including, but

not limited, to (i) that the Company may not be able to (a)

successfully implement, or implement at all, its strategic

priorities; (b) streamline its operations or align its organization

and infrastructure with the anticipated business; (c) meet

expectations or projections; (d) decrease costs; (e) increase

sales; (f) obtain adequate funding; (g) retain or secure customers;

(h) increase its customer base; (i) protect its intellectual

property; (j) successfully evolve into an advanced materials

supplier or, even if successful, increase profitability; (k)

successfully market new products; (l) obtain product

verifications or approvals; (m) attract or retain key personnel;

(n) validate, optimize and scale our powder-to-coat capability; or

(o) realize benefits from investments; (ii) funding for and

enforcement and tightening of emissions controls, standards and

regulations; (iii) prices of PGM and rare earth metals; (iv)

royalty and other restrictions on sales in certain Asian countries;

(v) supply disruptions or failures; (vi) regulatory, marketing and

competitive factors; (vii) environmental harm or damages; and

(viii) other risks and uncertainties discussed or referenced in the

Company’s filings with the Securities and Exchange Commission,

including its most recent Annual Report on Form 10-K and any

subsequent periodic reports on Form 10-Q and Form 8-K. In addition,

any forward-looking statements represent the Company’s estimates

only as of the date of such statements and should not be relied

upon as representing the Company’s estimates as of any subsequent

date. The Company specifically disclaims any obligation to update

forward-looking statements. All forward-looking statements in this

press release are qualified in their entirety by this cautionary

statement.

Contact Information: Moriah

Shilton or Kirsten ChapmanLHA Investor Relations +1 415 433

3777cdti@lhai.com

[Tables to follow]

| CDTi ADVANCED MATERIALS, INC. |

| Condensed Consolidated Statement of Operations |

| (in thousands, except percentage and per share

amounts) |

| (unaudited) |

| |

Three Months Ended March 31, |

|

|

|

2018 |

% of Revenues |

|

2017 |

% of Revenues |

|

| |

|

|

|

|

|

|

| Coated catalysts |

$ |

2,716 |

|

55 |

% |

|

$ |

4,669 |

|

57 |

% |

|

| Emission control

systems |

|

1,786 |

|

37 |

% |

|

|

3,342 |

|

41 |

% |

|

| Technology and advanced

materials |

|

410 |

|

8 |

% |

|

|

203 |

|

2 |

% |

|

| Revenues |

$ |

4,912 |

|

100 |

% |

|

$ |

8,214 |

|

100 |

% |

|

| Gross profit |

|

1,718 |

|

|

|

|

1,434 |

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

| Research

and development |

|

757 |

|

|

|

|

1,069 |

|

|

|

| Selling,

general and administrative |

|

1,453 |

|

|

|

|

2,726 |

|

|

|

| Total

operating expenses |

|

2,210 |

|

|

|

|

3,795 |

|

|

|

| Loss from

operations |

|

(492 |

) |

|

|

|

(2,361 |

) |

|

|

| Other income

(expense): |

|

|

|

|

|

|

| Interest

expense, net |

|

— |

|

|

|

|

(103 |

) |

|

|

| Loss on

extinguishment of debt |

|

— |

|

|

|

|

(194 |

) |

|

|

| Gain

(loss) on change in fair value of liability-classified

warrants |

|

364 |

|

|

|

|

(338 |

) |

|

|

| Other

expense, net |

|

(130 |

) |

|

|

|

(101 |

) |

|

|

| Total

other income (expense) |

|

234 |

|

|

|

|

(736 |

) |

|

|

| Loss

before income taxes |

|

(258 |

) |

|

|

|

(3,097 |

) |

|

|

| Income

tax expense (benefit) |

|

37 |

|

|

|

|

(1 |

) |

|

|

| Net

loss |

$ |

(295 |

) |

|

|

$ |

(3,096 |

) |

|

|

| Basic and diluted net

loss per common share: |

|

|

|

|

|

|

| Net loss |

$ |

(0.02 |

) |

|

|

$ |

(0.20 |

) |

|

|

| Weighted average shares

outstanding – basic and diluted |

|

15,804 |

|

|

|

|

15,703 |

|

|

|

| |

|

|

|

|

|

|

| CDTi ADVANCED MATERIALS, INC. |

| Condensed Consolidated Balance Sheet |

| (in thousands, except share and per share amounts) |

| (unaudited) |

| |

|

|

|

| |

March 31, 2018 |

|

December 31, 2017 |

|

ASSETS |

|

|

|

| Current assets: |

|

|

|

| Cash |

$ |

2,128 |

|

|

$ |

2,807 |

|

| Accounts

receivable, net |

|

2,992 |

|

|

|

2,097 |

|

|

Inventories |

|

1,840 |

|

|

|

2,647 |

|

| Prepaid

expenses and other current assets |

|

1,108 |

|

|

|

667 |

|

| Total

current assets |

|

8,068 |

|

|

|

8,218 |

|

| Property and equipment,

net |

|

676 |

|

|

|

714 |

|

| Intangible assets,

net |

|

1,010 |

|

|

|

1,051 |

|

| Deferred tax

assets |

|

644 |

|

|

|

644 |

|

| Other assets |

|

188 |

|

|

|

187 |

|

| Total

assets |

$ |

10,586 |

|

|

$ |

10,814 |

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

| Current

liabilities: |

|

|

|

| Accounts

payable |

$ |

2,465 |

|

|

$ |

2,059 |

|

| Accrued

expenses and other current liabilities |

|

2,958 |

|

|

|

3,585 |

|

| Income

taxes payable |

|

796 |

|

|

|

789 |

|

| Total

current liabilities |

|

6,219 |

|

|

|

6,433 |

|

| Commitments and

contingencies |

|

|

|

| Stockholders’

equity: |

|

|

|

| Preferred stock, par

value $0.01 per share: authorized 100,000; no shares issued and

outstanding |

|

— |

|

|

|

— |

|

| Common stock, par value

$0.01 per share: authorized 50,000,000; issued and outstanding

15,803,736 shares at March 31, 2018 and December 31,

2017, respectively |

|

158 |

|

|

|

158 |

|

| Additional paid-in

capital |

|

238,556 |

|

|

|

238,455 |

|

| Accumulated other

comprehensive loss |

|

(5,706 |

) |

|

|

(5,886 |

) |

| Accumulated

deficit |

|

(228,641 |

) |

|

|

(228,346 |

) |

| Total stockholders’

equity |

|

4,367 |

|

|

|

4,381 |

|

| Total liabilities and

stockholders’ equity |

$ |

10,586 |

|

|

$ |

10,814 |

|

| |

|

|

|

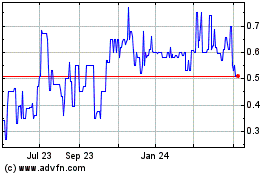

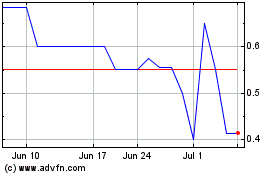

CDTI Advanced Materials (PK) (USOTC:CDTI)

Historical Stock Chart

From Jun 2024 to Jul 2024

CDTI Advanced Materials (PK) (USOTC:CDTI)

Historical Stock Chart

From Jul 2023 to Jul 2024