Form N-CSR - Certified Shareholder Report

August 10 2023 - 4:24PM

Edgar (US Regulatory)

|

|

|

|

|

|

|

|

|

UNITED STATES |

|

SECURITIES AND EXCHANGE COMMISSION |

|

Washington, D.C. 20549 |

|

|

|

|

|

FORM N-CSR |

|

|

|

|

|

CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

|

MANAGEMENT INVESTMENT COMPANIES |

|

|

|

Investment Company Act File Number 811-23782 |

|

|

|

|

|

California First Leasing Corporation |

|

(Exact name of registrant as specified in charter) |

|

|

|

5000 Birch Street, Suite 500, Newport Beach, CA 92660 |

|

(Address of principal executive offices) |

|

|

|

Glen T. Tsuma |

|

California First Leasing Corporation |

|

5000 Birch Street, Suite 500 |

|

|

Newport Beach, CA 92660 |

|

|

(Name and address of agent for service) |

|

|

|

Registrant’s telephone number, including area code: 949-255-0500 |

|

|

|

Date of fiscal year end: June 30 |

|

|

|

Date of reporting period: June 30, 2023 |

|

|

|

|

|

|

|

|

Item 1(a). Reports to Stockholders

|

|

California First Leasing Corporation

‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗‗ |

|

Annual Report |

|

For the Year Ended June 30, 2023 |

|

California First Leasing Corporation, (OTCQX: CFNB, “CalFirstLease” or the “Company”), headquartered in Newport Beach, California, is an internally managed non-diversified closed-end investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The Company continues its lease business while using equity and other investments to maximize current income and generate capital appreciation. |

|

|

|

An investment in the Company’s common stock involves certain risks, including the risk of loss. The shares of common stock are not deposits or obligations of, or guaranteed by any Federal or other government agency. A registration statement dated July 20, 2022 (the “Registration Statement”) containing additional information about the Company is on file with the Securities and Exchange Commission (the “SEC”). Investors should carefully consider the Company’s objectives and risks detailed in the Registration Statement and in this Annual Report that may adversely affect the Company’s shareholders’ equity and stock price and may make an investment in the Company not appropriate for all investors. |

|

|

|

Statements made in this report that are not strictly historical in nature constitute “forward-looking statements.” Forward-looking statements involve management judgment and assumptions, risks and uncertainties and include, but are not limited to, beliefs regarding investments in equity securities, swings in stock prices and the potential for this to cause significant volatility in reported net earnings and net asset values, the impact of external events on business activities and the lease portfolio, estimates of expected tax rates applicable to future periods, impact of changes in interest rates and equity and fixed income markets. Such forward-looking statements involve known and unknown risks and uncertainties and factors that could cause actual results to differ materially include political, economic, competitive, market, regulatory and other risks. Consequently, if management assumptions prove to be incorrect or such risks or uncertainties materialize, the Company’s actual results could differ materially from the results forecast in the forward-looking statements. All forward-looking statements are qualified in their entirety by this cautionary statement, and the Company undertakes no obligation to revise or update this information to reflect events or circumstances arising after the date hereof (August 2, 2023). |

CONTENTS

|

|

Page |

|

Selected Financial Data………………………………………………………………………………… |

1 |

|

Discussion of Performance and Results of Operations…………………………………………….... |

2 |

|

Investment Operations………………………………………………………………………………. |

2 |

|

Lease Operations ……………………………………………………………………………………. |

4 |

|

Financial Statements |

|

|

Report of Independent Registered Public Accounting Firm……………………………………… |

6 |

|

Statement of Investments …………………………………………………………………………… |

8 |

|

Statements of Assets, Liabilities and Stockholders’ Equity……………………………………… |

10 |

|

Statements of Operations …………………………………………………………………………… |

11 |

|

Statements of Stockholders' Equity ………………………………………………………………… |

12 |

|

Statements of Cash Flows…………………………………………………………………………… |

13 |

|

Financial Highlights ………………………………………………………………………………… |

14 |

|

Notes to Financial Statements………………………………………………………………………. |

15 |

|

Business Objectives and Risk Factors………………………………………………………………. |

23 |

|

Information on Officers and Directors………………………………………………………………… |

25 |

|

Other Information ….…………………………………………………………………………………… |

25 |

|

|

|

| As permitted by regulations adopted by the SEC, paper copies of the Company’s annual and semiannual shareholder reports will not be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Company’s website (www.calfirstlease.com), and you will be notified each time a report is posted and provided with a website link to access the report. To elect to receive all future reports on paper free of charge, please send an email request to invest@calfirstlease.comor you may call 800-460-4640. |

|

|

California First Leasing Corporation |

Annual Report for June 30, 2023 |

Selected Financial Data

|

The following table sets forth selected financial data and operating information of the Company. The selected data should be read in conjunction with the Financial Statements and notes thereto and management's Discussion of Performance and Results of Operations contained herein. Through February 26, 2021, the Company operated as a bank holding company. Following registration as an investment company in February 2022, the Company’s financial statements and discussion of results were revised to conform to 1940 Act requirements, and presentation of prior period operating results have been revised accordingly. |

| |

|

YEAR ENDED JUNE 30, |

|

| |

|

|

2023 |

|

|

2022 |

|

|

2021 |

|

| |

|

(in thousands, except per share data) |

|

|

Statement of Operations |

|

|

|

|

|

|

|

|

|

|

|

Dividends and interest |

|

$ |

5,687 |

|

$ |

4,008 |

|

$ |

2,845 |

|

|

Net realized gain (loss) on securities |

|

|

(2,848) |

|

|

(1,165) |

|

|

2,089 |

|

|

Net unrealized securities gain (loss) |

|

|

16,809 |

|

|

(22,349) |

|

|

36,681 |

|

|

Investment Income (Loss) |

|

|

19,648 |

|

|

(19,506) |

|

|

41,615 |

|

|

Finance and loan income, net |

|

|

1,331 |

|

|

2,287 |

|

|

3,858 |

|

|

Release of reserves |

|

|

160 |

|

|

215 |

|

|

- |

|

|

Other lease income |

|

|

3,577 |

|

|

1,251 |

|

|

3,579 |

|

|

Gain on sale of Bank |

|

|

- |

|

|

- |

|

|

2,343 |

|

|

Lease Income |

|

|

5,068 |

|

|

3,753 |

|

|

9,780 |

|

|

Investment and Lease Income (Loss) |

|

|

24,716 |

|

|

(15,753) |

|

|

51,395 |

|

|

Operating expenses |

|

|

2,786 |

|

|

3,034 |

|

|

4,273 |

|

|

Income tax (benefit) expense |

|

|

5,068 |

|

|

(6,126) |

|

|

10,891 |

|

|

Net Earnings (Loss) |

|

$ |

16,862 |

|

$ |

(12,661) |

|

$ |

36,231 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Number of shares outstanding |

|

|

9,703 |

|

|

10,284 |

|

|

10,284 |

|

|

Weighted average shares outstanding |

|

|

9,969 |

|

|

10,284 |

|

|

10,284 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Beginning Net Asset Value (NAV) per share |

|

$ |

20.60 |

|

$ |

22.39 |

|

$ |

19.41 |

|

|

Net earnings (loss) |

|

|

1.69 |

|

|

(1.23) |

|

|

3.52 |

|

|

Dividends paid |

|

|

- |

|

|

0.56 |

|

|

0.54 |

|

|

Net gain on share repurchase |

|

|

0.32 |

|

|

- |

|

|

- |

|

|

Net Asset Value, end of period |

|

$ |

22.61 |

|

$ |

20.60 |

|

$ |

22.39 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Total return |

|

|

|

|

|

|

|

|

|

|

|

CFNB, based on NAV |

|

|

9.8% |

|

|

(5.5)% |

|

|

18.1% |

|

|

S&P 500 (TR) Index |

|

|

19.6% |

|

|

(10.6)% |

|

|

40.8% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

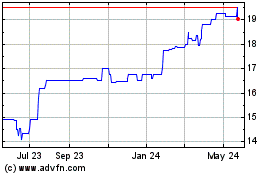

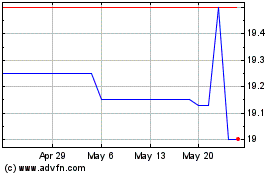

The chart above illustrates the value of $10,000 invested in the Company’s stock in comparison to the performance of the S&P 500(TR)® (“S&P 500”), an unmanaged index that covers 500 leading companies that approximate 80% of the available market capitalization. Results for the Company are an after-tax amount. The S&P index is an unmanaged benchmark, that assumes reinvestment of all distributions and includes capital gains and distributions in the calculation, but does not include a deduction for expenses or taxes. It is not possible to invest directly in an index. Performance data shown represents past performance and is no guarantee of future results. |

|

|

California First Leasing Corporation |

Annual Report for June 30, 2023 |

Discussion of Performance and Results of Operations

|

The Company’s operating results are comprised of two primary components: |

|

|

|

· |

Investment income includes current income from dividends on equity securities, realized and unrealized gains or losses in the value of the securities, and interest earned on short-term treasury securities and money market balances. |

|

|

|

· |

Lease income includes direct finance and interest income earned from leases and loans, as well as other income from sales of leased property, sales of leases and operating lease income. |

|

|

The results discussed below represent past performance, and current or future performance may be lower or higher than the data included here. The Company’s periodic earnings can fluctuate widely due to including gains and losses on equity securities, including unrealized amounts, that are determined based on stock prices on the last day of a fiscal quarter. |

|

|

|

For the year ended June 30, 2023, net earnings were $16.9 million, or $1.69 per share. This included a gain on equity securities of $14.0 million that swung from a loss of $23.5 million on the securities portfolio the prior year. Total lease income increased 35% to $5.1 million compared to $3.8 million in fiscal 2022, reflecting strong income from lease extensions and property sales. The 9.8% return to shareholders based on the change in net asset value reflects the 12.6% return on the equity portfolio dampened by having 18% of earning assets invested in short-term treasury and money-market securities producing lower current returns than equities, notwithstanding a significant increase in interest rates over the past year. |

|

|

|

Investment Operations |

|

|

|

Based on the S&P 500 index, U.S. equity markets returned 19.6% for the 12 months ending June 30, 2023, but results varied substantially as mega-cap growth and technology stocks rebounded while certain segments such as value and small-capitalization U.S. stocks lagged. This is seen in lower returns reported in more balanced indexes such as 14.2% for the Dow Jones Industrial Average, 12.31% for the Russell 2000 index and 13.8% for the S&P 500® Equal weighted index (“EWI”) that includes the same constituents as the capitalization weighted S&P 500. A multitude of factors, including high inflation, energy price increases related to the Russia-Ukraine conflict, supply-chain issues, and aggressive tightening by the Federal Reserve have led to elevated volatility in market conditions. The S&P 500 return of 2.37% for the six months ended December 31, 2022 reversed a negative 24.8% for the three months through September 30, 2022. The returns continued a positive trend for the six months through June 30, 2023 amid signs of moderating inflation, low unemployment and the possibility that the Fed is nearing the end of increasing interest rates, and the return on the S&P 500 increased to 15.9% for the period. |

|

|

|

The Company focuses on investing in fair or under-valued public companies that we expect to generate excess cash flow that can be reinvested at attractive rates of return to continue substantial growth or be returned to shareholders via share repurchases or dividends. A high percentage of the equity portfolio generally is invested in U.S. large capitalization equities. From time to time, the Company may retain a significant amount of funds in short-term liquid investments in order to be positioned to take advantage of investment or lease opportunities as they arise. The Company does not specialize in any specific industry, but may hold large positions in certain sectors that it believes offer the opportunity for long-term returns but may underperform in certain market environments. |

|

Allocation of Securities * |

|

6/30/2023 |

|

|

|

6/30/2022 |

|

|

($ in 000's) |

|

|

|

|

|

|

|

|

US Large Cap Equities |

$ |

124,253 |

60.5% |

|

$ |

116,051 |

62.9% |

|

US Mid Cap Equities |

|

26,164 |

12.7% |

|

|

8,715 |

4.7% |

|

US Small Cap Equities |

|

6,002 |

2.9% |

|

|

17 |

0.0% |

|

Developed Markets, Non-US |

|

5,542 |

2.7% |

|

|

5,870 |

3.2% |

|

Income fund |

|

1,004 |

0.5% |

|

|

- |

0.0% |

|

Emerging Market Equities |

|

688 |

0.3% |

|

|

984 |

0.5% |

|

Equity securities |

$ |

163,653 |

79.7% |

|

$ |

131,637 |

71.4% |

|

Money market funds |

|

11,928 |

5.8% |

|

|

52,723 |

28.6% |

|

US Treasury Bills |

|

29,746 |

14.5% |

|

|

- |

0.0% |

|

Fixed Income securities |

|

41,674 |

20.3% |

|

|

52,723 |

28.6% |

|

Investment securities |

$ |

205,327 |

100.0% |

|

$ |

184,360 |

100.0% |

|

|

|

|

* Equity securities classification based on information from Wells Fargo Advisors |

|

| |

|

|

|

|

|

|

|

|

|

|

California First Leasing Corporation |

Annual Report for June 30, 2023 |

|

The Company produced a return of 12.6% on the equity portfolio for fiscal 2023 compared to the 19.6% return on the S&P 500 and return of 13.8% for the EWI for the same period. The results contrasted with a return of only 3.0% for the first half of the fiscal year, and included a 7.2% annualized return for the fourth quarter ended June 30, 2023 that compared to an 8.7% return in the S&P 500 and 4.0% for the EWI for the same 3 month-period. |

|

The Company’s investment performance in fiscal 2023 benefitted from a concentration in select big technology stocks and oil companies. Applied Materials produced the largest gains for both for the year and last six months ended June 30, 2023, and four semiconductor companies accounted for 64% of the net securities gains in fiscal 2023. Exxon was the second largest contributor to full year investment results, but gave back some gains in the last six months as oil prices declined. Other strong contributors to full year performance were Ford Motor, Meta Platforms and Alphabet. The largest detractors to the investment performance for the year generally were in the consumer sector and included Verizon Communications, Bristol Myers Squibb and British American Tobacco. |

|

|

|

The equity securities portfolio at June 30, 2023 consisted of common stock holdings in 36 public companies and 1 investment fund, compared to 34 public companies at June 30, 2022 and 32 companies at June 30, 2021. During the six months ended June 30, 2023, the Company invested $8.1 million in 8 companies, including 6 new positions. For the fiscal year, the Company invested $28.9 million in 18 positions, 13 of which were new. During the last half of fiscal 2023, the Company sold parts of 3 positions for $1.5 million, realizing a net loss of $827,000 to offset taxable gains recognized in prior years. For the full 2023 fiscal year, the Company realized losses of $2.9 million. |

|

|

|

The distribution of the Company’s equity securities across four industry groups at June 30, 2023 and the comparative gains or losses by group is summarized below: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in thousands) |

|

|

|

|

Unrealized |

|

|

|

|

|

|

|

Cost Basis |

|

|

Gains |

|

|

(Losses) |

|

|

Fair Value |

|

as of June 30, 2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial / Industrial |

|

$ |

80,292 |

|

$ |

25,935 |

|

$ |

(5,532) |

|

$ |

100,695 |

|

Consumer |

|

|

28,781 |

|

|

2,621 |

|

|

(4,403) |

|

|

26,999 |

|

Financial |

|

|

16,476 |

|

|

2,234 |

|

|

(1,057) |

|

|

17,653 |

|

Healthcare |

|

|

14,983 |

|

|

3,323 |

|

|

- |

|

|

18,306 |

| |

|

$ |

140,532 |

|

$ |

34,113 |

|

$ |

(10,992) |

|

$ |

163,653 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ten Largest Equity Holdings at June 30, 2023 as a percent of net assets: |

|

Exxon Mobil |

7.86% |

|

|

|

|

|

|

Applied Materials |

6.72% |

|

|

|

|

|

|

Alphabet Inc. |

5.73% |

|

|

|

|

|

|

Ford Motor Company |

4.12% |

|

|

|

|

|

|

Cigna Corp New |

3.93% |

|

|

|

|

|

|

Bristol Myers Squibb |

3.87% |

|

|

|

|

|

|

Marvell Technology Inc |

3.53% |

|

|

|

|

|

|

Qualcomm Inc |

3.18% |

|

|

|

|

|

|

Verizon Communications |

2.95% |

|

|

|

|

|

|

Schlumberger LTD |

2.89% |

|

|

|

|

|

|

Interest and Dividend Income |

|

A key component of the Company’s strategy is to generate current income on its investments through dividends, in addition to the opportunity to realize investment returns from appreciation in stock values. Of the 37 stock positions held at June 30, 2023, 26 pay a dividend, accounting for 81% of the fair value of equity securities at June 30, 2023. The following table presents the Company’s average balances and yields earned on investments for the periods shown: |

|

|

California First Leasing Corporation |

Annual Report for June 30, 2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Period Ended |

|

|

Period Ended |

|

|

($ in thousands) |

|

|

June 30, 2023 |

|

|

June 30, 2022 |

|

| |

|

|

Average |

|

|

|

|

|

|

|

Average |

|

|

|

|

|

|

| |

|

|

Balance |

|

|

Income |

|

Yield |

|

|

Balance |

|

|

Income |

|

Yield |

|

|

Three Months |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank deposits |

|

$ |

807 |

|

$ |

2 |

|

0.99% |

|

$ |

3,858 |

|

$ |

4 |

|

0.41% |

|

|

Money market funds |

|

|

13,491 |

|

|

164 |

|

4.86% |

|

|

38,278 |

|

|

77 |

|

0.80% |

|

|

US treasury bills |

|

|

29,446 |

|

|

351 |

|

4.77% |

|

|

- |

|

|

- |

|

0.00% |

|

|

Equity securities |

|

|

154,222 |

|

|

928 |

|

2.41% |

|

|

157,253 |

|

|

899 |

|

2.29% |

|

| |

|

$ |

197,966 |

|

$ |

1,445 |

|

2.92% |

|

$ |

199,389 |

|

$ |

980 |

|

1.97% |

|

|

Twelve Months |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank deposits |

|

$ |

1,276 |

|

$ |

5 |

|

0.39% |

|

$ |

4,974 |

|

$ |

15 |

|

0.30% |

|

|

Money market funds |

|

|

30,615 |

|

|

1,025 |

|

3.35% |

|

|

27,434 |

|

|

83 |

|

0.30% |

|

|

US treasury bills |

|

|

14,795 |

|

|

685 |

|

4.63% |

|

|

- |

|

|

- |

|

0.00% |

|

|

Equity securities |

|

|

148,865 |

|

|

3,972 |

|

2.67% |

|

|

170,845 |

|

|

3,910 |

|

2.29% |

|

|

|

|

$ |

195,551 |

|

$ |

5,687 |

|

2.91% |

|

$ |

203,253 |

|

$ |

4,008 |

|

1.97% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total dividend and interest income for the fourth quarter ending June 30, 2023 of $1.45 million increased 47.5% as interest income jumped significantly on a 396-basis point increase in average yield to 4.73% on average balances that were unchanged. Dividend income for the fourth quarter of fiscal 2023 increased 3.2% due to a 12-basis point increase in yield that offset a 2% decline in average balances. For the full 2023 fiscal year, total dividend and interest income from investments increased 41.9% to $5.7 million, including a $1.6 million increase in interest income from less than $100,000 in fiscal 2022. The yield on cash and equivalents increased by 337 basis points to 3.67% while the average balance increased by $14.3 million, or 45%. Dividend income was up by 1.6% as a 17% decline in average balances was offset by a 38-basis point increase in yield to 2.67%. |

|

|

|

Lease Operations

|

|

At June 30, 2023, the Company’s investment in lease assets of $20.2 million represented 8.9% of total assets. Fiscal 2023 lease bookings of $13.6 million were up from $6.8 million in fiscal 2022 while lease originations were minimal, leaving a backlog of approved lease commitments of $4.2 million at June 30, 2023, down from $8.0 million at June 30, 2022. Transactions in process of $729,500 at June 30, 2023 are down from $2.7 million at June 30, 2022. |

|

|

|

Finance and loan income of $1.3 million for fiscal 2023 was down 41.8% due to a 36.9% decrease in average balances to $19.7 million and a 57-basis point decrease in the average yield to 6.77%. The following table presents the Company’s average lease and loan balances, finance and loan income and related yields earned, presented on an annualized basis. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lease Operations |

|

|

Period Ended |

|

|

Period Ended: |

|

|

($ in thousands) |

|

|

June 30, 2023 |

|

|

June 30, 2022 |

|

| |

|

|

Average |

|

|

|

|

|

|

|

Average |

|

|

|

|

|

|

| |

|

|

Balance |

|

|

Income |

|

Yield |

|

|

Balance |

|

|

Income |

|

Yield |

|

|

Three Months |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net investment in leases |

|

$ |

16,002 |

|

$ |

270 |

|

6.75% |

|

$ |

23,399 |

|

$ |

453 |

|

7.74% |

|

|

Commercial loans |

|

|

2,523 |

|

|

29 |

|

4.60% |

|

|

3,262 |

|

|

31 |

|

3.80% |

|

|

Lease and loan assets |

|

$ |

18,525 |

|

$ |

299 |

|

6.46% |

|

$ |

26,661 |

|

$ |

484 |

|

7.26% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Twelve Months |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net investment in leases, net |

|

$ |

16,736 |

|

$ |

1,196 |

|

7.15% |

|

$ |

27,770 |

|

$ |

2,129 |

|

7.67% |

|

|

Commercial loans |

|

|

2,936 |

|

|

135 |

|

4.60% |

|

|

3,387 |

|

|

158 |

|

4.66% |

|

|

Lease and loan assets |

|

$ |

19,672 |

|

$ |

1,331 |

|

6.77% |

|

$ |

31,157 |

|

$ |

2,287 |

|

7.34% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Lease Income – For the year ended June 30, 2023, other lease income of $3.7 million was up from $1.5 million for the prior year. The $2.3 million increase in fiscal 2023 was primarily due to a $1.6 million increase in income from end of term transactions and income recovered on lease-related claims from prior years. |

|

|

|

Included with other lease income is income related to the allowance for credit losses. During fiscal 2023, the Company released reserves of $160,000 from the allowance for credit losses, compared to a release of $215,000 in fiscal year 2022. The fiscal 2023 release reflected the 24% decline in the lease and loan portfolio since June 30, 2022 while credit quality remained stable. At June 30, 2023, the allowance for credit losses of $200,600, 1.05% of the investment in leases and loans, while down from 1.4% at June 30, 2022, is considered appropriate for the consolidated portfolio. |

|

|

|

|

California First Leasing Corporation |

Annual Report for June 30, 2023 |

|

The top five customer industries and geographic locations at June 30, 2023 and 2022 are shown below: |

| |

|

|

|

|

|

|

|

|

|

($ in thousands) |

June 30, 2023 |

|

June 30, 2022 |

|

|

Industry |

|

Balance |

Percent |

|

|

Balance |

Percent |

|

|

Educational services |

$ |

10,283 |

53.9% |

|

$ |

9,355 |

37.1% |

|

|

Public administration |

|

3,145 |

16.5% |

|

|

3,171 |

12.6% |

|

|

Agriculture and food products |

|

1,863 |

9.8% |

|

|

3,041 |

12.1% |

|

|

Manufacturing – industrial |

|

1,247 |

6.5% |

|

|

502 |

2.0% |

|

|

Retail Trade |

|

843 |

4.4% |

|

|

1,389 |

5.5% |

|

|

Top five |

|

17,381 |

91.1% |

|

|

17,458 |

69.3% |

|

|

All other industries |

|

1,690 |

8.9% |

|

|

7,729 |

30.7% |

|

| |

$ |

19,071 |

100% |

|

$ |

25,187 |

100% |

|

|

States |

|

|

|

|

|

|

|

|

|

DC |

$ |

3,189 |

16.7% |

|

$ |

1,150 |

4.6% |

|

|

Rhode Island |

|

2,956 |

15.5% |

|

|

2,609 |

10.4% |

|

|

Louisiana |

|

2,531 |

13.3% |

|

|

2,022 |

8.0% |

|

|

California |

|

2,052 |

10.8% |

|

|

2,411 |

9.6% |

|

|

New York |

|

1,607 |

8.4% |

|

|

2,536 |

10.1% |

|

|

Top five |

|

12,335 |

64.7% |

|

|

10,728 |

42.6% |

|

|

All other states |

|

6,736 |

35.3% |

|

|

14,459 |

57.4% |

|

| |

$ |

19,071 |

100.0% |

|

$ |

25,187 |

100.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At June 30, 2023, approximately 51.2% of the portfolio was with public and private colleges and universities, up from 36.6% at June 30, 2022. Approximately 16.5% of the portfolio consists of tax-exempt leases with municipalities, up from 12.6% at June 30, 2022. Leases with three largest lease customers aggregate to $8.7 million, 47% of the investment in leases and loans. The high percentage with large customers and in the education field reflects the reduced size of the portfolio and the continued importance of this market to the Company. The universities and colleges are located throughout the United States, and at June 30, 2023 the portfolio includes over 40 leases with 21 different institutions and no university represents more than 17% of the portfolio. |

|

|

|

Operating Expenses – The Company’s operating expenses for the year ended June 30, 2023 decreased by 8.2% to $2.79 million compared to $3.0 million the year before. The decrease in fiscal 2023 included a $103,300, or 5.0% decline in compensation costs and a $152,400, or 20.5% decline in other costs related to registering as an investment company in the prior year. |

|

|

|

Income Taxes – For the year ended June 30, 2023, the income tax expense of $5.0 million represented an overall effective tax rate of 23.1%. This included a provision accrued at the tax rate of 18.2% on pretax earnings of $7.97 million excluding the equity security gain, and a provision accrued at the rate of 25.9% on the net equity security gain of $14.0 million .The effective tax rate reflects the benefit the Company receives from the dividends received exclusion. The 2023 security gain includes net unrealized gains of $16.8 million and realized taxable losses of $2.8 million. |

|

|

|

The components of earnings and taxes are summarized as follows: |

| |

|

Year ended June 30, |

|

|

|

|

(dollars in thousands) |

|

|

2023 |

|

|

2022 |

|

|

|

|

Pretax earnings excluding securities gain (loss) |

|

$ |

7,969 |

|

$ |

4,727 |

|

|

|

|

Gain (loss) on securities |

|

|

13,961 |

|

|

(23,514) |

|

|

|

|

Pretax earnings (loss) |

|

|

21,930 |

|

|

(18,787) |

|

|

|

|

Income tax expense excluding securities gain (loss) |

|

|

1,451 |

|

|

646 |

|

|

|

|

Income tax expense (benefit) on securities gain (loss) |

|

|

3,617 |

|

|

(6,772) |

|

|

|

|

Net tax expense |

|

|

5,068 |

|

|

(6,126) |

|

|

|

|

Net earnings excluding equity gain (loss) |

|

|

6,518 |

|

|

4,081 |

|

|

|

|

Net equity portfolio gain (loss) |

|

|

10,344 |

|

|

(16,742) |

|

|

|

|

Net earnings (loss) |

|

$ |

16,862 |

|

$ |

(12,661) |

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

California First Leasing Corporation |

Annual Report for June 30, 2023 |

|

Report of Independent Registered Public Accounting Firm |

|

|

|

To the Stockholders and Board of Directors

California First Leasing Corporation

Newport Beach, California

|

|

Report on the Audit of the Financial Statements |

|

|

|

Opinion

|

|

We have audited the accompanying statements of assets, liabilities and stockholders’ equity of California First Leasing Corporation, as of June 30, 2023 and 2022, including the statement of investments as of June 30, 2023, and the related statements of operations, stockholders’ equity, and cash flows for each of the years in the three-year period ended June 30, 2023, and the related notes (collectively referred to as the “financial statements”) and the financial highlights for each of the years in the three-year period ended June 30, 2023. |

|

|

|

In our opinion, the accompanying financial statements present fairly, in all material respects, the financial position of California First Leasing Corporation as of June 30, 2023 and 2022, and the results of its operations and its cash flows for each of the years in the three-year period ended June 30, 2023 and the financial highlights for each of the years in the three-year period ended June 30, 2023, in accordance with accounting principles generally accepted in the United States of America. |

|

|

|

Basis for Opinion |

|

|

|

We conducted our audits in accordance with auditing standards generally accepted in the United States of America (GAAS). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent of California First Leasing Corporation, and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements relating to our audits. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. |

|

Responsibilities of Management for the Financial Statements

|

|

Management is responsible for the preparation and fair presentation of these financial statements in accordance with accounting principles generally accepted in the United States of America; and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements and financial highlights that are free from material misstatement, whether due to fraud or error.

|

|

|

|

In preparing the financial statements and financial highlights, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about California First Leasing Corporation’s ability to continue as a going concern for one year after the date that the financial statements are available to be issued. |

|

|

|

Auditor’s Responsibilities for the Audit of the Financial Statements |

|

|

|

Our objectives are to obtain reasonable assurance about whether the financial statements and financial highlights are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the financial statements and financial highlights. |

|

|

California First Leasing Corporation |

Annual Report for June 30, 2023 |

In performing an audit in accordance with GAAS, we:

|

|

|

| · |

Exercise professional judgment and maintain professional skepticism throughout the audit. |

| · |

Identify and assess the risks of material misstatement of the financial statements and financial highlights, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and included confirmation of securities owned as of June 30, 2023, by direct correspondence with custodians. |

| · |

Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of California First Leasing Corporation’s internal control. Accordingly, no such opinion is expressed. |

| · |

Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the financial statements and financial highlights. |

| · |

Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about California First Leasing Corporation’s ability to continue as a going concern for a reasonable period of time. |

|

We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control–related matters that we identified during the audit. |

Laguna Hills, California

August 2, 2023

What inspires you, inspires us. | eidebailly.com

25231 Paseo De Alicia, Ste. 100 | Laguna Hills, CA 92653-4615 | T 949.768.0833 | F 949.768.8408 | EOE

|

|

California First Leasing Corporation |

Annual Report for June 30, 2023 |

Statement of Investments – June 30, 2023

| |

|

|

|

|

|

|

Industry - Percent of Net Assets |

Company |

Shares |

|

Market Value |

|

| |

|

|

|

|

|

|

Common Stocks -- 74.60% |

|

|

|

|

|

|

Auto & Truck Dealerships -- 0.85% |

Lithia Mtrs Inc |

6,145 |

$ |

1,868,756 |

|

|

Auto Manufacturers -- 4.12% |

Ford Motor Company |

597,300 |

|

9,037,149 |

|

|

Auto Parts -- 1.09% |

Allison Transmission |

42,290 |

|

2,387,693 |

|

| |

|

|

|

|

|

|

Banks - Diversified -- 3.78% |

Wells Fargo & Co |

100,400 |

|

4,285,072 |

|

| |

Bank of America Corporation |

117,500 |

|

3,371,075 |

|

| |

JP Morgan Chase & Co |

4,380 |

|

637,027 |

|

| |

|

|

|

8,293,174 |

|

| |

|

|

|

|

|

|

Capital Markets -- 2.73% |

Goldman Sachs |

18,600 |

|

5,999,244 |

|

| |

|

|

|

|

|

|

Credit Services -- 0.70% |

PayPal Holdings Inc (1) |

13,600 |

|

907,528 |

|

| |

Credit Acceptance Corporation (1) |

1,220 |

|

619,675 |

|

| |

|

|

|

1,527,203 |

|

| |

|

|

|

|

|

|

Drug Manufacturers -- 3.87% |

Bristol Myers Squibb |

132,800 |

|

8,492,560 |

|

|

Entertainment -- 0.53% |

Netflix.com Inc. (1) |

2,650 |

|

1,167,299 |

|

|

Financial -- 0.31% |

Pimco Muni Income Fund III |

85,459 |

|

687,945 |

|

| |

|

|

|

|

|

|

Healthcare Plans -- 4.47% |

Cigna Corp New |

30,710 |

|

8,617,226 |

|

| |

United Health Group |

2,489 |

|

1,196,313 |

|

| |

|

|

|

9,813,539 |

|

| |

|

|

|

|

|

|

Insurance - Diversified -- 0.52% |

Berkshire Hathaway Inc (1) |

3,364 |

|

1,147,124 |

|

| |

|

|

|

|

|

|

Internet Content & Information -- 8.07% |

Alphabet Inc. (1) |

105,100 |

|

12,580,470 |

|

| |

Meta Platforms Inc (1) |

13,907 |

|

3,991,031 |

|

| |

Match Group Inc (1) |

27,100 |

|

1,134,135 |

|

| |

|

|

|

17,705,636 |

|

| |

|

|

|

|

|

|

Internet Retail -- 0.19% |

Alibaba Grp Hldg (1) |

4,900 |

|

408,415 |

|

|

Oil & Gas E & P -- 2.78% |

Ovintiv Inc. |

159,925 |

|

6,088,345 |

|

|

Oil & Gas Equipment & Services -- 2.89% |

Schlumberger LTD |

129,000 |

|

6,336,480 |

|

|

Oil & Gas Integrated -- 7.86% |

Exxon Mobil |

160,800 |

|

17,245,800 |

|

|

Scientific & Technical Instruments -- 0.46% |

Sensata Technologies |

22,300 |

|

1,003,277 |

|

| |

|

|

|

|

|

|

Semiconductor Equip & Materials -- 7.27% |

Applied Materials |

102,000 |

|

14,743,080 |

|

| |

Teradyne Incorporated |

10,900 |

|

1,213,497 |

|

| |

|

|

|

15,956,577 |

|

| |

|

|

|

|

|

|

Semiconductors -- 10.94% |

Marvell Technology Inc |

129,500 |

|

7,741,510 |

|

| |

Qualcomm Inc |

58,650 |

|

6,981,696 |

|

| |

Micron Technology Inc |

81,300 |

|

5,130,843 |

|

| |

Advanced Micro Devices Inc. (1) |

31,100 |

|

3,542,601 |

|

| |

Taiwan Semiconductor Co |

5,900 |

|

595,428 |

|

| |

|

|

|

23,992,078 |

|

| |

|

|

|

|

|

|

Specialty Business Services -- 1.04% |

Global Payments Inc. |

23,050 |

|

2,270,886 |

|

|

Specialty Chemicals -- 1.69% |

Dupont De Nemours |

51,940 |

|

3,710,594 |

|

|

Steel -- 1.83% |

Cleveland-Cliffs Inc. (1) |

239,000 |

|

4,005,640 |

|

| |

|

|

|

|

|

|

|

California First Leasing Corporation |

Annual Report for June 30, 2023 |

| |

|

|

|

|

|

|

Industry - Percent of Net Assets |

Company |

Shares |

|

Market Value |

|

|

|

|

|

|

|

|

|

Telecom Services -- 4.03% |

Verizon Communications |

173,750 |

|

6,461,763 |

|

| |

Charter Communications Inc (1) |

6,484 |

|

2,382,027 |

|

| |

|

|

|

8,843,790 |

|

| |

|

|

|

|

|

|

Thermal Coal -- 0.51% |

Consol Energy Inc |

16,600 |

|

1,125,646 |

|

|

Tobacco -- 2.07% |

British American Tobacco |

136,700 |

|

4,538,440 |

|

| |

|

|

|

|

|

| |

Total-Equity Securities |

|

$ |

163,653,288 |

|

| |

|

|

|

|

|

|

Short-term Investments -- 19.63% |

|

|

|

|

|

|

Bank Deposit -- 0.63% |

Liberty Bank, N.A. |

|

1,390,761 |

|

|

U.S.Treasuries -- 13.56% |

U.S. Treasury Bills (5.16%) * |

|

29,746,380 |

|

|

Money Market Mutual Funds -- 5.44% |

JP Morgan Prime MMkt 3605 (5.18%) ** |

|

9,146,761 |

|

| |

Goldman FSQ Money Market (5.12%) ** |

|

2,781,545 |

|

| |

|

|

|

|

|

| |

Total Short-term Investments |

|

$ |

43,065,448 |

|

| |

|

|

|

|

|

|

Total Equity Securities and Short-term Investments -- 94.23% |

|

$ |

206,718,736 |

|

| |

|

|

|

|

|

|

Net Assets at June 30, 2023 |

|

$ |

219,380,479 |

|

|

(1) Non-income producing security |

|

|

|

|

|

* Weighted average yield to maturity for bills maturing from 7/27/23 to 9/21/23. |

|

|

|

|

|

** Rate is the annualized seven-day yield of the fund at period end. |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these financial statements |

|

|

|

|

|

|

|

|

.

|

|

California First Leasing Corporation |

Annual Report for June 30, 2023 |

|

|

|

|

|

|

|

|

|

STATEMENTS OF ASSETS, LIABILITIES AND STOCKHOLDERS’ EQUITY

(in thousands, except share amounts)

|

|

|

|

|

|

|

|

|

|

| |

June 30, |

|

June 30, |

|

| |

|

2023 |

|

|

2022 |

|

| |

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Cash and due from banks |

$ |

1,391 |

|

$ |

1,085 |

|

|

Money-market mutual funds |

|

11,928 |

|

|

52,723 |

|

|

U.S. Treasury bills |

|

29,746 |

|

|

- |

|

|

Cash and cash equivalents |

|

43,065 |

|

|

53,808 |

|

| |

|

|

|

|

|

|

|

Equity investments |

|

163,653 |

|

|

131,637 |

|

|

Property acquired for transactions-in-process |

|

729 |

|

|

2,672 |

|

|

Leases and loans: |

|

|

|

|

|

|

|

Net investment in leases |

|

16,994 |

|

|

21,961 |

|

|

Commercial loans |

|

2,077 |

|

|

3,246 |

|

|

Allowance for credit losses |

|

(201) |

|

|

(361) |

|

|

Net investment in leases and loans |

|

18,870 |

|

|

24,846 |

|

|

Property on operating leases, less accumulated depreciation |

|

|

|

|

|

|

|

of $0 (2023) and (2022) |

|

553 |

|

|

514 |

|

|

Income tax receivable |

|

265 |

|

|

2,069 |

|

|

Other assets |

|

303 |

|

|

455 |

|

|

Discounted lease rentals assigned to lenders |

|

- |

|

|

515 |

|

|

Total Assets |

$ |

227,438 |

|

$ |

216,516 |

|

| |

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Liabilities: |

|

|

|

|

|

|

|

Accounts payable |

$ |

1,679 |

|

$ |

954 |

|

|

Accrued liabilities |

|

592 |

|

|

829 |

|

|

Lease deposits |

|

51 |

|

|

145 |

|

|

Non-recourse debt |

|

- |

|

|

515 |

|

|

Deferred income taxes, net |

|

5,736 |

|

|

2,193 |

|

|

Total Liabilities |

|

8,058 |

|

|

4,636 |

|

| |

|

|

|

|

|

|

|

Commitments and contingencies |

|

- |

|

|

- |

|

| |

|

|

|

|

|

|

|

Stockholders' equity: |

|

|

|

|

|

|

|

Preferred stock; 2,500,000 shares authorized; none issued |

|

- |

|

|

- |

|

|

Common stock; $.01 par value; 20,000,000 shares authorized; 9,703,456 |

|

|

|

|

|

|

|

June 30, 2023 and 10,284,139 June 30, 2022 issued and outstanding |

|

97 |

|

|

103 |

|

|

Additional paid in capital |

|

1,694 |

|

|

2,314 |

|

|

Retained earnings |

|

217,589 |

|

|

209,463 |

|

| |

|

219,380 |

|

|

211,880 |

|

|

Total Liabilities & Stockholders' Equity |

$ |

227,438 |

|

$ |

216,516 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these financial statements.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

California First Leasing Corporation |

Annual Report for June 30, 2023 |

STATEMENTS OF OPERATIONS *

(in thousands, except share and per share amounts)

| |

|

|

|

|

|

|

|

|

|

|

| |

|

Years ended June 30, |

|

| |

|

|

2023 |

|

|

2022 |

|

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment income |

|

|

|

|

|

|

|

|

|

|

|

Dividend income |

|

$ |

3,972 |

|

$ |

3,910 |

|

$ |

2,751 |

|

|

Interest income |

|

|

1,715 |

|

|

98 |

|

|

94 |

|

|

Gain (loss) on equity securities |

|

|

13,961 |

|

|

(23,514) |

|

|

38,770 |

|

|

Total investment income (loss) |

|

|

19,648 |

|

|

(19,506) |

|

|

41,615 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Lease income |

|

|

|

|

|

|

|

|

|

|

|

Finance and loan income |

|

|

1,331 |

|

|

2,287 |

|

|

3,858 |

|

|

Release of (provision for) reserves for credit losses |

|

|

160 |

|

|

215 |

|

|

298 |

|

|

Operating and sales-type leases |

|

|

1,081 |

|

|

355 |

|

|

533 |

|

|

Gain on sale of leases, loans and leased property |

|

|

1,503 |

|

|

300 |

|

|

2,481 |

|

|

Other fee income |

|

|

993 |

|

|

596 |

|

|

267 |

|

|

Gain on sale of bank subsidiary |

|

|

- |

|

|

- |

|

|

2,343 |

|

|

Total lease income |

|

|

5,068 |

|

|

3,753 |

|

|

9,780 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

Compensation and benefits |

|

|

1,941 |

|

|

2,044 |

|

|

3,137 |

|

|

Director fees |

|

|

144 |

|

|

144 |

|

|

118 |

|

|

Occupancy |

|

|

111 |

|

|

103 |

|

|

177 |

|

|

Other general and administrative |

|

|

590 |

|

|

743 |

|

|

841 |

|

|

Total operating expenses |

|

|

2,786 |

|

|

3,034 |

|

|

4,273 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Earnings (loss) before income taxes |

|

|

21,930 |

|

|

(18,787) |

|

|

47,122 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Income taxes |

|

|

5,068 |

|

|

(6,126) |

|

|

10,891 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Net earnings (loss) |

|

$ |

16,862 |

|

$ |

(12,661) |

|

$ |

36,231 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Basic earnings (loss) per common share |

|

$ |

1.69 |

|

$ |

(1.23) |

|

$ |

3.52 |

|

|

Dividends declared per common share |

|

$ |

- |

|

$ |

0.56 |

|

$ |

0.54 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding |

|

|

9,969,138 |

|

|

10,284,139 |

|

|

10,284,139 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

* For periods prior to February 26, 2021, financial statements represent the consolidation of California First National Bancorp and subsidiaries, California First National Bank and California First Leasing.

The accompanying notes are an integral part of these financial statements.

|

|

|

California First Leasing Corporation |

Annual Report for June 30, 2023 |

STATEMENTS OF STOCKHOLDERS' EQUITY *

(in thousands, except for share amounts)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Additional |

|

|

|

|

|

|

| |

Common Stock |

|

Paid in |

|

Retained |

|

|

|

| |

Shares |

|

Amount |

|

Capital |

|

Earnings |

|

Total |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance, June 30, 2020 |

10,284,139 |

|

$ |

103 |

|

$ |

2,314 |

|

$ |

197,206 |

|

$ |

199,623 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings |

- |

|

|

- |

|

|

- |

|

|

36,231 |

|

|

36,231 |

|

Dividends paid |

- |

|

|

- |

|

|

- |

|

|

(5,554) |

|

|

(5,554) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance, June 30, 2021 |

10,284,139 |

|

|

103 |

|

|

2,314 |

|

|

227,883 |

|

|

230,300 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

- |

|

|

- |

|

|

- |

|

|

(12,661) |

|

|

(12,661) |

|

Dividends paid |

- |

|

|

- |

|

|

- |

|

|

(5,759) |

|

|

(5,759) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance, June 20, 2022 |

10,284,139 |

|

|

103 |

|

|

2,314 |

|

|

209,463 |

|

|

211,880 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings |

- |

|

|

- |

|

|

- |

|

|

16,862 |

|

|

16,862 |

|

Shares repurchased |

(580,683) |

|

|

(6) |

|

|

(620) |

|

|

(8,736) |

|

|

(9,362) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance, June 20, 2023 |

9,703,456 |

|

$ |

97 |

|

$ |

1,694 |

|

$ |

217,589 |

|

$ |

219,380 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* For periods prior to February 26, 2021, financial statements represent the consolidation of California First National Bancorp and subsidiaries, California First National Bank and California First Leasing.

The accompanying notes are an integral part of these financial statements.

|

|

|

California First Leasing Corporation |

Annual Report for June 30, 2023 |

STATEMENTS OF CASH FLOWS *

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Years Ended June 30, |

| |

|

|

2023 |

|

|

2022 |

|

|

2021 |

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

|

Net earnings (loss) |

|

$ |

16,862 |

|

$ |

(12,661) |

|

$ |

36,231 |

|

Adjustments to reconcile net earnings to cash flows |

|

|

|

|

|

|

|

|

|

|

provided by (used for) operating activities: |

|

|

|

|

|

|

|

|

|

|

Release of reserves for credit losses |

|

|

(160) |

|

|

(215) |

|

|

(298) |

|

Depreciation and net amortization (accretion) |

|

|

48 |

|

|

74 |

|

|

111 |

|

Gain on sale of leased property and sales-type lease income |

|

|

(663) |

|

|

(213) |

|

|

(2,215) |

|

(Gain) loss on equity securities, net |

|

|

(13,960) |

|

|

23,514 |

|

|

(38,770) |

|

Gain on sale of bank subsidiary |

|

|

- |

|

|

- |

|

|

(2,343) |

|

Deferred income taxes, including income taxes payable |

|

|

3,543 |

|

|

(7,117) |

|

|

6,104 |

|

Decrease (increase) in income taxes receivable |

|

|

1,804 |

|

|

788 |

|

|

(2,481) |

|

Net decrease in accounts payable and accrued liabilities |

|

|

(237) |

|

|

(435) |

|

|

(852) |

|

Other, net |

|

|

(128) |

|

|

(467) |

|

|

69 |

|

Net cash provided by (used for) operating activities |

|

|

7,109 |

|

|

3,268 |

|

|

(4,444) |

| |

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

|

Investment in leases, loans and transactions in process |

|

|

(11,098) |

|

|

(7,114) |

|

|

(30,891) |

|

Payments received on lease receivables and loans |

|

|

14,803 |

|

|

20,191 |

|

|

38,688 |

|

Proceeds from sales of leased property and sales-type leases |

|

|

2,136 |

|

|

1,147 |

|

|

2,769 |

|

Proceeds from sales and assignments of leases |

|

|

3,712 |

|

|

- |

|

|

4,725 |

|

Net decrease in Fed funds sold |

|

|

- |

|

|

- |

|

|

660 |

|

Purchase of equity securities |

|

|

(28,845) |

|

|

(67,582) |

|

|

(115,413) |

|

Pay down on investments |

|

|

- |

|

|

- |

|

|

452 |

|

Proceeds from sale of equity securities |

|

|

10,789 |

|

|

72,556 |

|

|

45,396 |

|

Proceeds from sale of bank subsidiary |

|

|

- |

|

|

- |

|

|

4,523 |

|

Net decrease (increase) in other assets |

|

|

13 |

|

|

56 |

|

|

(142) |

|

Net cash (used for) provided by investing activities |

|

|

(8,490) |

|

|

19,254 |

|

|

(49,233) |

| |

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

|

Net decrease in time certificates of deposit |

|

|

- |

|

|

- |

|

|

(22,259) |

|

Net decrease in demand and savings deposits |

|

|

- |

|

|

- |

|

|

(34,548) |

|

Payments to repurchase common stock |

|

|

(9,362) |

|

|

- |

|

|

- |

|

Dividends to stockholders |

|

|

- |

|

|

(5,759) |

|

|

(5,554) |

|

Net cash used for financing activities |

|

|

(9,362) |

|

|

(5,759) |

|

|

(62,361) |

| |

|

|

|

|

|

|

|

|

|

|

NET CHANGE IN CASH AND CASH EQUIVALENTS |

|

|

(10,743) |

|

|

16,763 |

|

|

(116,038) |

|

CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD |

|

|

53,808 |

|

|

37,045 |

|

|

153,083 |

|

CASH AND CASH EQUIVALENTS AT END OF PERIOD |

|

$ |

43,065 |

|

$ |

53,808 |

|

$ |

37,045 |

| |

|

|

|

|

|

|

|

|

|

|

SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION |

|

|

|

|

|

|

|

|

|

|

Decrease in lease rentals assigned to lenders and |

|

|

|

|

|

|

|

|

|

|

related non-recourse debt |

|

$ |

(515) |

|

$ |

(713) |

|

$ |

(713) |

|

Estimated residual values recorded on leases |

|

$ |

(17) |

|

$ |

(19) |

|

$ |

(716) |

|

Interest paid on deposits and borrowed funds |

|

$ |

- |

|

$ |

- |

|

$ |

43 |

|

Income tax (refunds received) paid, net |

|

$ |

(279) |

|

$ |

202 |

|

$ |

7,267 |

|

Addition to ROU assets from new operating lease liabilities |

|

$ |

- |

|

$ |

- |

|

$ |

336 |

|

Remaining bank equity capital at sale closing |

|

$ |

- |

|

$ |

- |

|

$ |

12,524 |

|

|

|

|

|

|

|

|

|

|

|

|

* For periods prior to February 26, 2021, financial statements represent the consolidation of California First National Bancorp and subsidiaries, California First National Bank and California First Leasing.

The accompanying notes are an integral part of these financial statements. |

|

|

California First Leasing Corporation |

Annual Report for June 30, 2023 |

|

|

|

|

|

|

|

|

|

|

Financial Highlights* |

|

|

|

|

|

Years Ended June 30, |

| |

|

2023 |

|

|

2022 |

|

|

2021 |

|

Per Share Operating Performance |

|

|

|

|

|

|

|

|

|

Net book value, beginning of period |

$ |

20.60 |

|

$ |

22.39 |

|

$ |

19.41 |

|

Net earnings (loss) |

|

1.69 |

|

|

(1.23) |

|

|

3.52 |

|

Less: Dividends paid |

|

- |

|

|

0.56 |

|

|

0.54 |

|

Net gain on share repurchase |

|

0.32 |

|

|

- |

|

|

- |

|

Net Book Value, end of period |

$ |

22.61 |

|

$ |

20.60 |

|

$ |

22.39 |

|

Market price, end of period |

$ |

14.35 |

|

$ |

17.40 |

|

$ |

18.40 |

|

Return to Shareholders (1) |

|

|

|

|

|

|

|

|

|

Based on net book value |

|

9.7% |

|

|

(5.5)% |

|

|

18.1% |

|

Based on market price |

|

(17.5)% |

|

|

(2.4)% |

|

|

23.4% |

|

|

|

|

|

|

|

|

|

|

|

Ratios, Supplemental Data |

|

|

|

|

|

|

|

|

|

Expenses per share (2) |

$ |

0.28 |

|

$ |

0.29 |

|

$ |

0.42 |

|

Expenses plus taxes per share (2) |

$ |

0.79 |

|

$ |

(0.30) |

|

$ |

1.47 |

|

Average Book Value per share |

$ |

21.99 |

|

$ |

22.10 |

|

$ |

20.68 |

|

Expenses to Average Book Value |

|

1.3% |

|

|

1.3% |

|

|

2.0% |

|

Net earnings (loss) to Average Book Value |

|

7.9% |

|

|

(5.6)% |

|

|

17.0% |

|

Portfolio turnover rate |

|

7.2% |

|

|

39.6% |

|

|

44.4% |

|

|

|

|

|

|

|

|

|

|

|

* For periods prior to February 26, 2021, amounts reflect the consolidation of California First National Bancorp and subsidiaries, California First National Bank and California First Leasing. |

|

(1) Total return on market price assumes a purchase on the first day and sale on the last day of each period reported. Dividends and distributions are assumed to be reinvested. Total return on book value uses the same methodology, using book value for the beginning and ending values, and dividend reinvestment at the closing price on the day of distribution. Past performance is not an indication of future results. |

|

(2) Interest expense paid on bank deposits of $39,127 in fiscal 2021 for periods prior to the bank sale in February 2021, has been included with expenses. |

|

|

The accompanying notes are an integral part of these financial statements.

|

|

California First Leasing Corporation |

Annual Report for June 30, 2023 |

|

NOTES TO FINANCIAL STATEMENTS |

|

|

|

Note 1 – Summary of Significant Accounting Policies: |

|

|

|

Nature of Operations |

|