Retailers Are Showing Softness In December Same-Store Sales

January 06 2011 - 8:39AM

Dow Jones News

Retailers are delivering a bit of coal to investors stockings as

early reports of December sales are proving lackluster.

Of the roughly dozen that have reported, about half have missed

analysts' expectations for the holiday month's same-store sales,

including Costco Wholesale Corp. (COST), which had been faring

well, and teen retailers Zumiez Inc. (ZUMZ) and Wet Seal Inc.

(WTSLA). Fellow teen retailer Hot Topic (HOTT) Inc. had a slight

beat, although sales fell.

Department stores have yet to report and it may be a case where

at least some of the business that usually goes to the teen

merchants shifted over to department stores that made a big play

for the demographic this year.

All told, the 28 retailers followed by Thomson Reuters are

expected to report that their December same-store sales rose 3.4%

after a 5.6% gain in November. If retailers hit the 3.4% gain, the

showing would be the best December since 2006, when same-store

sales rose 4.7%. Sandwiched between was the recession and lingering

economic weakness in which December comparable-store sales dropped

2.5% in 2009, declined 0.7% the prior year and rose 3.2% in

2007.

So far, though, some softness prevails. Many retailers were

coming off a strong November, which may have raised expectations

that the momentum would continue into December. Retailers also

contended with massive strong storms in the West before Christmas

and in the East just after the holiday. In general, according to

comments retailers are making, there appeared to be a pronounced

lull in buying during mid-December. A number of retailers said they

lowered prices toward the latter part of the buying season in an

apparent bid to try and make up business.

There are some success stories, although their comparable-store

sales in a number of cases weren't as strong as they have been in

prior months. Limited Inc. (LTD) reported a 5% rise in same-store

sales, beating expectations for a 4.6% gain. Buckle Inc. (BKE) said

sales at stores open more than a year rose 6.1% in December, when a

4.5% increase was expected.

A number of retailers have reduced their quarterly expectations

as a result of their showing. Wet Seal, women's apparel retailer

Cato Corp. (CATO) and Bebe Stores Inc. (BEBE) have all tempered

their views.

Consumers appear to have come into the holiday season primed. In

December 2009, only 10% planned to spend more on holiday gifts than

the previous year, according to a U.S. spending survey by Discover

Financial Services (DFS). In 2010, the number rose to 14%. Also,

only 57% planned to spend less on holiday gifts during the recent

holiday season, 7 percentage points less than in 2009, Discover

said.

This was the year retailers also had an additional leg up,

having their online operations come into their own. U.S. online

sales for the November through December holiday shopping period

were a record $32.6 billion, up 12% from a year ago, according to

ComScore Inc. (SCOR), with Cyber Monday, the Monday after

Thanksgiving, seeing over $1 billion spent, the largest one-day

online sales day ever.

-By Karen Talley, Dow Jones Newswires; 212-416-2196;

karen.talley@dowjones.com

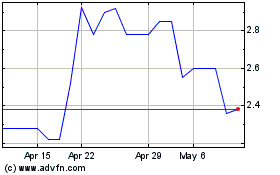

Bebe Stores (PK) (USOTC:BEBE)

Historical Stock Chart

From Aug 2024 to Sep 2024

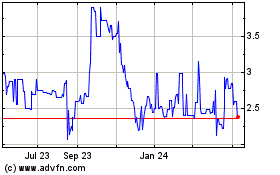

Bebe Stores (PK) (USOTC:BEBE)

Historical Stock Chart

From Sep 2023 to Sep 2024