Anglo American 1st Half Earnings Dropped on Weaker Prices, Higher Costs

July 27 2023 - 3:18AM

Dow Jones News

By Christian Moess Laursen

Anglo American said Thursday that earnings slipped in the first

half of the year as macro headwinds weighed on the results, but it

remains on track to meet full-year production views.

The multinational mining company achieved underlying earnings

before interest, taxes, depreciation and amortization of $5.11

billion in the half year, down from $8.70 billion in the first half

of 2022, largely due to weaker product prices and a 1% unit cost

increase.

This missed market views of $5.28 billion, based on an analyst

poll taken from FactSet.

Revenue fell to $15.67 billion from $18.11 billion, beating the

$15.45 billion consensus.

Net profit fell 66% to $1.26 billion, compared with consensus'

$1.455 billion, while earnings per share fell to $1.04 from $3.30,

compared with consensus of $1.30.

The FTSE 100-listed company declared an interim dividend of

$0.55, in line with its payout policy.

The company's new Peruvian copper mine Quellaveco is ramping up

strongly and is on track to produce 310,000-350,000 metric tons of

copper in 2023, the mining group said.

"We are on track to deliver on our full year production

guidance, which includes a significant anticipated step-up in

volumes in the second half," Chief Executive Duncan Wanblad

said.

Write to Christian Moess Laursen at christian.moess@wsj.com

(END) Dow Jones Newswires

July 27, 2023 03:03 ET (07:03 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

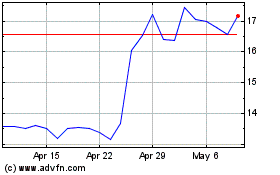

Anglo American (QX) (USOTC:NGLOY)

Historical Stock Chart

From Apr 2024 to May 2024

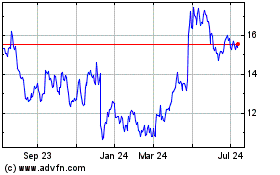

Anglo American (QX) (USOTC:NGLOY)

Historical Stock Chart

From May 2023 to May 2024