|

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION |

| |

Washington,

D.C. 20549

|

|

SCHEDULE

14D-9

SOLICITATION/RECOMMENDATION

STATEMENT UNDER SECTION 14(d)(4) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Amendment

No. 13) |

| |

|

|

| |

|

WYNDHAM

HOTELS & RESORTS, INC.

(Name of Subject Company) |

| |

|

|

| |

WYNDHAM

HOTELS & RESORTS, INC.

(Name of Persons Filing Statement) |

| |

|

|

| |

Common

Stock, $0.01 par value per share

(Title of Class of Securities) |

| |

|

|

| |

98311A105

(CUSIP Number of Class of Securities) |

Paul

Cash, Esq.

General Counsel and Corporate Secretary

Wyndham Hotels & Resorts, Inc. |

22

Sylvan Way

Parsippany, New Jersey 07054

Telephone: (973) 753-6000

(Name, address and telephone number of persons authorized to receive notices and

communications on behalf of the person filing statement)

Copies

to:

Daniel

E. Wolf, Esq.

David B. Feirstein, Esq.

Carlo

F. Zenkner, Esq.

Kirkland & Ellis LLP

601

Lexington Avenue

New

York, NY 10022

(212) 446-4800 |

| |

| ☐ Check

the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Introduction

This

Amendment No. 13 to Schedule 14D-9 (this “Amendment”) amends and supplements the Solicitation/Recommendation

Statement on Schedule 14D-9 (as amended from time to time, the “Statement”) originally filed by Wyndham

Hotels & Resorts, Inc., a Delaware corporation (the “Company”), with the U.S. Securities and Exchange Commission

on December 18, 2023. The Statement relates to the unsolicited offer by Choice Hotels International, Inc., a Delaware corporation

(“Choice”), through its wholly owned subsidiary, WH Acquisition Corporation, a Delaware corporation, to exchange any

and all of the issued and outstanding shares of Wyndham common stock, par value $0.01 per share, for, at the election of the holder,

(i) $49.50 in cash and 0.324 shares of Choice common stock, par value $0.01 per share (“Choice Common Stock”) (together

with the $49.50 in cash, the “Standard Offer Consideration”), (ii) an amount in cash equal to the equivalent market

value of the Standard Offer Consideration based on the volume-weighted average of the closing prices of Choice Common Stock as quoted

on the New York Stock Exchange (the “NYSE”) over the five NYSE trading days ending on the 10th business day preceding

March 8, 2024 (the “Expiration Date”) or (iii) a number of shares of Choice Common Stock having a value equal to the

equivalent market value of the Standard Offer Consideration (based on the volume-weighted average of the closing prices of Choice Common

Stock as quoted on the NYSE over the five NYSE trading days ending on the 10th business day preceding the Expiration Date), subject to

proration, as disclosed in the Prospectus/Offer to Exchange dated December 12, 2023 and the related Letter of Transmittal. Except

as otherwise set forth in this Amendment, the information set forth in the Statement remains unchanged.

Item

9. Exhibits

Item

9 of the Statement is hereby amended and supplemented by adding the following exhibit:

SIGNATURE

After

due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

Dated:

February 23, 2024

| |

WYNDHAM HOTELS & RESORTS, INC. |

| |

|

| |

By: |

/s/

Paul F. Cash |

| |

Name: |

Paul F. Cash |

| |

Title: |

General Counsel |

2

Exhibit (a)(1)(U)

Wyndham Hotels & Resorts

A Message from Geoff Ballotti

Dear Team,

If you own Wyndham stock, you may have received materials in the mail

from our 401k administrator, Merrill Lynch, or your personal broker noting a “voluntary corporate action.” This letter was

prompted when Choice launched its unsolicited exchange offer in December. The purpose of this letter is to ask for your support of Choice’s

unsolicited exchange offer by tendering your Wyndham shares.

As we have stated, Wyndham’s Board has unanimously determined

that the offer is NOT in the best interests of our Company or our shareholders and continues to recommend that our shareholders NOT tender

their shares into the offer.

We encourage you to disregard these materials.

If you have questions with respect to the exchange offer, you can call

Wyndham’s information agent, Innisfree, at the numbers below:

Innisfree M&A Incorporated

501 Madison Avenue, 20th Floor

New York, NY 10022

Stockholders: (877) 750-8307 (Toll-free from the

U.S. and Canada)

or +1 (412) 232-3651 (from other countries)

We’ll continue sharing important updates with you when appropriate

and in the meantime, you can visit https://StayWyndham.com/ to get the facts and more information on the Board’s recommendation.

Thank you for your ongoing support.

Geoff

Important Additional Information

This communication is not an offer to purchase

or a solicitation of an offer to sell any securities or the solicitation of any vote or approval. Wyndham Hotels & Resorts, Inc. (“Wyndham”

or the “Company”) has filed with the U.S. Securities and Exchange Commission (the “SEC”) a solicitation/recommendation

statement on Schedule 14D-9. Any solicitation/recommendation statement filed by the Company that is required to be mailed to stockholders

will be mailed to Company stockholders. COMPANY STOCKHOLDERS ARE ADVISED TO READ THE COMPANY’S SOLICITATION/RECOMMENDATION STATEMENT

ON SCHEDULE 14D-9 AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE BEFORE MAKING ANY DECISION WITH RESPECT

TO ANY EXCHANGE OFFER BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Company stockholders may obtain a copy of the Solicitation/Recommendation

Statement on Schedule 14D-9, as well as any other documents filed by the Company in connection with any exchange offer by Choice Hotels

International, Inc. or one of its affiliates, free of charge at the SEC’s website at www.sec.gov. In addition, investors and security

holders will be able to obtain free copies of these documents from the Company by directing a request to Matt Capuzzi, Senior Vice President,

Investor Relations at matthew.capuzzi@wyndham.com or by calling 973.753.6453.

The Company intends to file a proxy statement

and accompanying WHITE proxy card with the SEC with respect to the Company’s 2024 Annual Meeting of Stockholders (the “2024

Annual Meeting”). The Company’s stockholders are strongly encouraged to read such proxy statement, the accompanying WHITE

proxy card and other documents filed with the SEC carefully in their entirety when they become available because they will contain important

information. The Company’s stockholders will be able to obtain any proxy statement, any amendments or supplements to the proxy statement

and other documents filed by the Company with the SEC free of charge at the SEC’s website at www.sec.gov. Copies will also be available

free of charge at the Company’s website at https://investor.wyndhamhotels.com.

Certain Information Concerning Participants

Wyndham and certain of its directors and executive

officers may be deemed to be participants in the solicitation of proxies under the rules of the SEC. Information regarding the Company’s

directors and officers and their respective interests in the Company by security holdings or otherwise is available in its most recent

Annual Report on Form 10-K filed with the SEC on February 16, 2023 and its most recent definitive Proxy Statement on Schedule 14A filed

with the SEC on March 28, 2023. To the extent holdings of the Company’s securities have changed since the filing of the Company’s

most recent Annual Report on Form 10-K or the Company’s most recent definitive Proxy Statement on Schedule 14A, such changes have

been reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Updated information relating to the foregoing will also

be set forth in the Company’s proxy statement and other materials to be filed with the SEC for its 2024 Annual Meeting. These documents

can be obtained free of charge from the sources indicated above.

Cautionary Statement on Forward-Looking Statements

Certain statements either contained in or incorporated

by reference into this communication, other than purely historical information, and assumptions upon which those statements are based,

are “forward-looking statements.” Forward-looking statements include those that convey management’s expectations as

to the future based on plans, estimates and projections at the time Wyndham makes the statements and may be identified by words such as

“will,” “expect,” “believe,” “plan,” “anticipate,” “intend,” “goal,”

“future,” “outlook,” “guidance,” “target,” “objective,” “estimate,”

“projection” and similar words or expressions, including the negative version of such words and expressions. Such forward-looking

statements involve known and unknown risks, uncertainties and other factors, which may cause the actual results, performance or achievements

of Wyndham to be materially different from any future results, performance or achievements expressed or implied by such forward-looking

statements. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of hereof.

Factors that could cause actual results to differ

materially from those in the forward-looking statements include, without limitation, factors relating to the unsolicited exchange offer

by Choice Hotels International, Inc. (“Choice”) to acquire all outstanding shares of our common stock (the “Exchange

Offer”), including actions taken by Choice in connection with such offer, actions taken by Wyndham or its stockholders in respect

of the Exchange Offer or other actions or developments involving Choice, such as a potential proxy contest, the completion or failure

to complete the Exchange Offer, the effects of such offer on our business, such as the cost, loss of time and disruption; general economic

conditions, including inflation, higher interest rates and potential recessionary pressures; global or regional health crises or pandemics

(such as the COVID-19 pandemic) including the resulting impact on the Company’s business operations, financial results, cash flows

and liquidity, as well as the impact on its franchisees, guests and team members, the hospitality industry and overall demand for and

restrictions on travel; the performance of the financial and credit markets; the economic environment for the hospitality industry; operating

risks associated with the hotel franchising business; the Company’s relationships with franchisees; the impact of war, terrorist

activity, political instability or political strife, including the ongoing conflicts between Russia and Ukraine and between Israel and

Hamas; the Company’s ability to satisfy obligations and agreements under its outstanding indebtedness, including the payment of

principal and interest and compliance with the covenants thereunder; risks related to the Company’s ability to obtain financing

and the terms of such financing, including access to liquidity and capital; and the Company’s ability to make or pay, plans for

and the timing and amount of any future share repurchases and/or dividends, as well as the risks described in the Company’s most

recent Annual Report on Form 10-K filed with the Securities and Exchange Commission and any subsequent reports filed with the Securities

and Exchange Commission. The Company undertakes no obligation to update or revise any forward-looking statements, whether as a result

of new information, subsequent events or otherwise, except as required by law.

Please note you are receiving this message as you are a global

corporate team member.

3

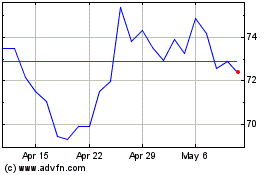

Wyndham Hotels & Resorts (NYSE:WH)

Historical Stock Chart

From Mar 2024 to Apr 2024

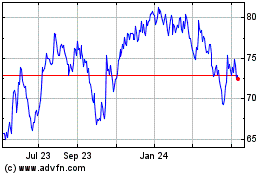

Wyndham Hotels & Resorts (NYSE:WH)

Historical Stock Chart

From Apr 2023 to Apr 2024