Current Report Filing (8-k)

July 01 2021 - 5:18PM

Edgar (US Regulatory)

0001701051

false

0001701051

2021-06-30

2021-06-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

June 30, 2021

WideOpenWest,

Inc.

(Exact Name of Registrant As Specified In

Its Charter)

|

Delaware

|

|

001-38101

|

|

46-0552948

|

|

(State or Other Jurisdiction

|

|

(Commission

|

|

(IRS Employer

|

|

of Incorporation)

|

|

File Number)

|

|

Identification No.)

|

7887

East Belleview Avenue, Suite

1000

Englewood, CO 80111

(Address of Principal Executive Offices, including Zip Code)

(720) 479-3500

(Registrant’s telephone number, including area code)

Not applicable

(Former Name or Former

Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

¨

|

Written communications pursuant to Rule 425

under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12

under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to

Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to

Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

Title

of each

class

|

Trading

Symbol(s)

|

Name of each exchange on which

registered

|

|

Common Stock

|

WOW

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry

into a Material Definitive Agreement.

On June 30, 2021, WideOpenWest, Inc. (the

“Company”) entered into an Asset Purchase Agreement by and between the Company, WideOpenWest Ohio LLC, a Delaware limited

liability company, WideOpenWest Cleveland LLC, a Delaware limited liability company, Atlantic Broadband (OH), LLC (“Atlantic”),

a U.S. cable operator and subsidiary of Cogeco Communications Inc., and Atlantic Broadband Finance, LLC, a Delaware limited liability

company (the “Atlantic Purchase Agreement”), whereby Atlantic agreed to acquire the Company’s Cleveland and Columbus,

Ohio markets for approximately $1.125 billion, subject to adjustments, including customary working capital adjustments, as specified in

the Atlantic Purchase Agreement. Either party may terminate the Atlantic Purchase Agreement if regulatory clearances are not obtained

on or before six months from the date of the Atlantic Purchase Agreement, subject to a six-month extension if certain conditions are satisfied

(provided that such outside date will not be a date that is later than three hundred sixty four days (364) after the date of the Atlantic

Purchase Agreement). The Company is subject to a three-year non-solicitation and a five-year non-compete period following the closing

and has agreed to provide Atlantic with certain transition services following the closing.

Also on June 30, 2021, the Company entered

into an Asset Purchase Agreement with Radiate HoldCo, LLC, a telecommunications holding company affiliated with RCN

Telecom Services LLC, Grande Communications Networks, LLC and WaveDivision Holdings, LLC (collectively, “Astound Broadband”)

(the “Astound Purchase Agreement”), whereby Radiate HoldCo, LLC agreed to acquire the Company’s Illinois, Indiana and

Anne Arundel, Maryland markets for approximately $661 million, subject to adjustments, including customary working capital adjustments,

as specified in the Astound Purchase Agreement. Either party may terminate the Astound Purchase Agreement if regulatory clearances are

not obtained on or before nine months from the date of the Astound Purchase Agreement, subject to a three-month extension if certain conditions

are satisfied. The Company is subject to a two-year non-solicitation and a three-year non-competition period following the closing and

has agreed to provide Astound with certain transition services following the closing.

Both transactions are expected to close in

the second half of 2021. The closing of each transaction is subject to certain regulatory reviews and approvals and the satisfaction of

other customary closing conditions.

The foregoing descriptions of

the Atlantic Purchase Agreement and Astound Purchase Agreement (collectively, the “Purchase Agreements”) do

not purport to be complete and each are qualified in its entirety by reference to the full text of the applicable purchase agreement,

which are attached hereto as Exhibit 10.1 and 10.2, respectively to this Current Report on Form 8-K and incorporated herein by reference.

Each of the Atlantic Purchase Agreement and Astound Purchase Agreement have been included

to provide the Company’s stockholders with information regarding its terms. It is not intended to provide any other information

about the Company or the respective purchasers or their respective subsidiaries and affiliates. The Purchase Agreements contain customary

representations and warranties by each of the Company and respective purchasers. These representations and warranties were made solely

for the benefit of the parties to the Purchase Agreements and (i) may have been used for purposes of allocating risk between the respective

parties rather than establishing matters as facts, (ii) may have been qualified in the Purchase Agreements by confidential disclosure

schedules that were delivered by and between the parties in connection with the signing of the Purchase Agreements, which disclosure schedules

may contain information that modifies, qualifies and creates exceptions to the representations, warranties and covenants set forth in

the Purchase Agreements, (iii) may be subject to a contractual standard of materiality applicable to the parties that differs from what

a stockholder may view as material and (iv) may have been made only as of the date of the applicable Purchase Agreement or as of another

date or dates as may be specified in the Purchase Agreements, and information concerning the subject matter of the representations and

warranties may change after the date of the Purchase Agreements, which subsequent information may or may not be fully reflected in the

Company’s public disclosures, if at all. Accordingly, stockholders should not rely upon representations and warranties or any descriptions

thereof as characterizations of the actual state of facts or condition of the Company or respective purchaser or their respective subsidiaries

and affiliates.

Item 8.01 Other

Events.

On June 30, 2021, the Company issued a press release announcing its

entry into the Atlantic Purchase Agreement and Astound Purchase Agreement, a copy of which is attached as Exhibit 99.1 to this Current

Report on Form 8-K and incorporated by reference herein.

Certain statements in this Current Report on Form

8-K that are not historical facts contain “forward-looking statements” within the meaning of Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements represent

our goals, beliefs, plans and expectations about our prospects for the future and other future events. Forward-looking statements include

all statements that are not historical fact and can be identified by terms such as “may,” “intend,” “might,”

“will,” “should,” “could,” “would,” “anticipate,” “expect,” “believe,”

“estimate,” “plan,” “project,” “predict,” “potential,” or the negative of

these terms. Although these forward-looking statements reflect our good-faith belief and reasonable judgment based on current information,

these statements are qualified by important factors, many of which are beyond our control that could cause our actual results to differ

materially from those in the forward-looking statements. These factors and other risks that could cause our actual results to differ materially

are set forth in the section entitled “Risk Factors” in our Annual Report filed on Form 10-K with the Securities and Exchange

Commission (“SEC”) on February 24, 2021, and also include the following factors: uncertainties relating to the timing of the

consummation of the sale of systems to each of Atlantic and Astound Broadband (the “Transactions”); the possibility that any

or all of the conditions to the consummation of the transactions may not be satisfied or waived, including failure to receive any required

regulatory approvals; the effect of the announcement or pendency of the Transactions on the Company’s ability to retain key personnel

and to maintain relationships with customers, suppliers and other business partners; and risks relating to potential diversion of management

attention from the Company’s ongoing business operations. Given these uncertainties, you should not place undue reliance on any

such forward-looking statements. The forward-looking statements included in this report are made as of the date hereof or the date specified

herein, based on information available to us as of such date. Except as required by law, we assume no obligation to update these forward-looking

statements, even if new information becomes available in the future.

Item 9.01

Financial Statements and Exhibits.

*Schedules and certain Exhibits

omitted pursuant to Item 601(a)(5) of Regulation S-K. The Company agrees to furnish supplementally

a copy of any omitted schedule to the SEC upon request,

provided, however, that the Company may request confidential treatment pursuant

to Rule 24b-2 of the Exchange Act, as amended, for any schedule or exhibit so furnished.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

WIDEOPENWEST, INC

|

|

|

|

|

|

|

|

Date: July 1, 2021

|

By:

|

/s/ John Rego

|

|

|

|

John Rego

|

|

|

|

Chief Financial Officer

|

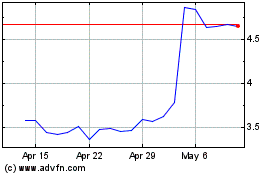

WideOpenWest (NYSE:WOW)

Historical Stock Chart

From Apr 2024 to May 2024

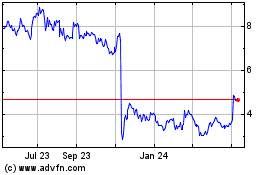

WideOpenWest (NYSE:WOW)

Historical Stock Chart

From May 2023 to May 2024