Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

September 15 2021 - 4:47PM

Edgar (US Regulatory)

Issuer Free Writing Prospectus

Filed Pursuant to Rule 433

Registration No. 333-256120

September 15, 2021

WESTERN ALLIANCE BANCORPORATION

12,000,000 Depositary Shares

Each

Representing a 1/400th Interest in a Share of 4.250% Fixed-Rate Reset Non-Cumulative Perpetual Preferred Stock, Series A

(liquidation preference $25 per Depositary Share (equivalent to $10,000 per share of Preferred Stock))

Pricing Term Sheet

This term sheet

supplements the information set forth under “Description of Preferred Stock” and “Description of Depositary Shares” in the preliminary prospectus supplement, dated September 15, 2021, to the prospectus dated May 14,

2021.

|

|

|

|

|

Issuer:

|

|

Western Alliance Bancorporation (the “Issuer”)

|

|

|

|

|

Securities Offered:

|

|

Depositary shares (the “Depositary Shares”), each representing a 1/400th interest in a share of 4.250% Fixed-Rate Reset Non-Cumulative Perpetual Preferred Stock, Series A (the

“Preferred Stock”)

|

|

|

|

|

Expected Ratings (Moody’s/Kroll)*:

|

|

Ba1 / BBB

|

|

|

|

|

Number of Depositary Shares:

|

|

12,000,000 Depositary Shares

|

|

|

|

|

Aggregate Liquidation Preference:

|

|

$300,000,000

|

|

|

|

|

No Option to Purchase Additional Depositary Shares:

|

|

The underwriters will not have an option to purchase additional Depositary Shares.

|

|

|

|

|

First Reset Date:

|

|

September 30, 2026

|

|

|

|

|

Reset Date:

|

|

The First Reset Date and each date falling on the fifth anniversary of the preceding Reset Date.

|

|

|

|

|

Reset Period:

|

|

The period from, and including, the First Reset Date to, but excluding, the following Reset Date and thereafter each period from, and including, each Reset Date to, but excluding, the next following Reset Date.

|

|

|

|

|

Dividend Payment Dates:

|

|

If declared, dividends will be payable quarterly, in arrears, on March 30, June 30, September 30 and December 30 of each year, beginning on December 30, 2021.

|

|

|

|

|

Dividend Rate (Non-Cumulative):

|

|

From and including the original issue date to, but excluding, September 30, 2026 or the date of earlier redemption, 4.250% and from and including September 30, 2026, during each Reset Period, the five-year treasury rate as

of the most recent reset dividend determination date (as defined in the preliminary prospectus supplement dated September 15, 2021 (the “Preliminary Prospectus Supplement”)) plus 3.452%.

|

|

|

|

|

|

Day Count:

|

|

30/360 to, but excluding, September 30, 2026, and, thereafter, a 360-day year and the number of days actually elapsed.

|

|

|

|

|

Term:

|

|

Perpetual

|

|

|

|

|

Trade Date:

|

|

September 15, 2021

|

|

|

|

|

Settlement Date**:

|

|

September 22, 2021 (T+5)

|

|

|

|

|

Optional Redemption:

|

|

The Issuer may, at its option and subject to any required regulatory approval, redeem the shares of the Preferred Stock (i) in whole or in part, from time to time, on any dividend payment date on or after the First Reset Date,

or (ii) in whole but not in part at any time within 90 days following a “regulatory capital treatment event,” as described in the Preliminary Prospectus Supplement, in each case at a cash redemption price equal to $10,000 per share of

Preferred Stock (equivalent to $25 per Depositary Share), plus any declared and unpaid dividends, without accumulation of any undeclared dividends to but excluding the redemption date. Holders of Depositary Shares will not have the right to require

the redemption or repurchase of the Depositary Shares.

|

|

|

|

|

Listing:

|

|

The Issuer intends to apply to list the Depositary Shares on the New York Stock Exchange (“NYSE”) under the symbol “WAL PrA”. If the application is approved, trading of the Depositary Shares on NYSE is expected

to commence within the 30-day period following the original issue date of the Depositary Shares.

|

|

|

|

|

Public Offer Price:

|

|

$25 per Depositary Share

|

|

|

|

|

Underwriting Discounts and Commissions:

|

|

$0.7875 per Depositary Share for Depositary Shares sold to retail investors and $0.3750 per Depositary Share for Depositary Shares sold to institutional investors.

|

|

|

|

|

Net Proceeds to Issuer (before offering expenses):

|

|

$295,277,250

|

|

|

|

|

Insider Participation:

|

|

Certain of our directors have agreed to purchase 240,000 Depositary Shares (representing an aggregate liquidation preference of $6,000,000) in this offering at the public offering price for investment purposes.

|

|

|

|

|

CUSIP/ISIN for the Depositary Shares:

|

|

957638 406/ US9576384062

|

|

|

|

|

Joint Book-Running Managers:

|

|

Morgan Stanley & Co. LLC

BofA Securities, Inc.

J.P. Morgan Securities LLC

Piper Sandler & Co.

|

|

|

|

|

Co-Managers:

|

|

D.A. Davidson & Co.

Janney Montgomery

Scott LLC

Jefferies LLC

|

|

|

|

|

|

Depositary:

|

|

Jointly, Computershare Trust Company, N.A. and Computershare Inc.

|

|

*

|

Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to

revision, suspension or withdrawal at any time.

|

|

**

|

The Issuer expects that delivery of the Depositary Shares will be made against payment therefor on or about

September 22, 2021, which is the fifth business day following the date hereof (such settlement cycle being referred to as “T+5”). Under Rule 15c6-1 under the Exchange Act, trades in the

secondary market generally are required to settle in two business days, unless the parties to the trade expressly agree otherwise. Accordingly, purchasers who wish to trade the Depositary Shares before their delivery hereunder will be required, by

virtue of the fact that the Depositary Shares initially will settle in T+5, to specify an alternate settlement cycle at the time of any such trade to prevent a failed settlement. Purchasers of the Depositary Shares who wish to trade the Depositary

Shares prior to their date of delivery hereunder should consult their own advisors.

|

The Preferred Stock and Depositary Shares are

not savings accounts, deposits or other obligations of, nor are they guaranteed by, a bank and are not insured or guaranteed by the Federal Deposit Insurance Corporation or by any other government agency or instrumentality.

The Issuer has filed a registration statement (including a prospectus and preliminary prospectus supplement) with the SEC for the offering to which this

communication relates. Before you invest, you should read each of these documents and the other documents the Issuer has filed with the SEC and incorporated by reference in such documents for more complete information about the issuer and this

offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the Issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by

contacting Morgan Stanley & Co. LLC toll free at 1-866-718-1649, BofA Securities, Inc. toll free at 1-800-294-1322, J.P. Morgan Securities LLC, collect at

212-834-4533, or Piper Sandler & Co. toll free at

1-800-805-4128.

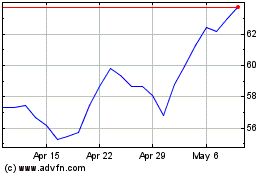

Western Alliance Bancorp... (NYSE:WAL)

Historical Stock Chart

From Apr 2024 to May 2024

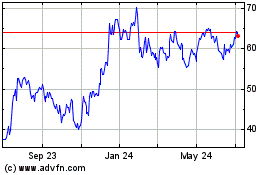

Western Alliance Bancorp... (NYSE:WAL)

Historical Stock Chart

From May 2023 to May 2024