Current Report Filing (8-k)

May 05 2020 - 10:02AM

Edgar (US Regulatory)

VALERO ENERGY CORP/TX false 0001035002 0001035002 2020-04-30 2020-04-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 30, 2020

VALERO ENERGY CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

1-13175

|

|

74-1828067

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

One Valero Way

San Antonio, Texas

|

|

78249

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (210) 345-2000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common stock

|

|

VLO

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 5.07

|

Submission of Matters to a Vote of Security Holders.

|

The 2020 annual meeting of the stockholders of Valero Energy Corporation was held April 30, 2020. Matters voted on at the annual meeting and the results thereof were as follows:

|

|

(1)

|

Proposal 1: Election of directors. The election of each director was approved as follows.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

H. Paulett Eberhart

|

|

shares voted

|

|

|

required vote *

|

|

|

vote received

|

|

|

for

|

|

|

300,691,260

|

|

|

|

>50.0%

|

|

|

|

99.40

|

%

|

|

against

|

|

|

1,805,577

|

|

|

|

|

|

|

|

|

|

|

abstain

|

|

|

622,523

|

|

|

|

|

|

|

|

|

|

|

broker non-votes

|

|

|

48,173,769

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Joseph W. Gorder

|

|

shares voted

|

|

|

required vote *

|

|

|

vote received

|

|

|

for

|

|

|

278,859,194

|

|

|

|

>50.0%

|

|

|

|

92.68

|

%

|

|

against

|

|

|

22,020,403

|

|

|

|

|

|

|

|

|

|

|

abstain

|

|

|

2,239,763

|

|

|

|

|

|

|

|

|

|

|

broker non-votes

|

|

|

48,173,769

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kimberly S. Greene

|

|

shares voted

|

|

|

required vote *

|

|

|

vote received

|

|

|

for

|

|

|

300,751,393

|

|

|

|

>50.0%

|

|

|

|

99.42

|

%

|

|

against

|

|

|

1,753,695

|

|

|

|

|

|

|

|

|

|

|

abstain

|

|

|

614,272

|

|

|

|

|

|

|

|

|

|

|

broker non-votes

|

|

|

48,173,769

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deborah P. Majoras

|

|

shares voted

|

|

|

required vote *

|

|

|

vote received

|

|

|

for

|

|

|

296,582,639

|

|

|

|

>50.0%

|

|

|

|

98.05

|

%

|

|

against

|

|

|

5,909,132

|

|

|

|

|

|

|

|

|

|

|

abstain

|

|

|

627,589

|

|

|

|

|

|

|

|

|

|

|

broker non-votes

|

|

|

48,173,769

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Eric D. Mullins

|

|

shares voted

|

|

|

required vote *

|

|

|

vote received

|

|

|

for

|

|

|

300,299,935

|

|

|

|

>50.0%

|

|

|

|

99.29

|

%

|

|

against

|

|

|

2,161,443

|

|

|

|

|

|

|

|

|

|

|

abstain

|

|

|

657,982

|

|

|

|

|

|

|

|

|

|

|

broker non-votes

|

|

|

48,173,769

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Donald L. Nickles

|

|

shares voted

|

|

|

required vote *

|

|

|

vote received

|

|

|

for

|

|

|

293,301,634

|

|

|

|

>50.0%

|

|

|

|

96.97

|

%

|

|

against

|

|

|

9,164,496

|

|

|

|

|

|

|

|

|

|

|

abstain

|

|

|

653,230

|

|

|

|

|

|

|

|

|

|

|

broker non-votes

|

|

|

48,173,769

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Philip J. Pfeiffer

|

|

shares voted

|

|

|

required vote *

|

|

|

vote received

|

|

|

for

|

|

|

300,844,458

|

|

|

|

>50.0%

|

|

|

|

99.46

|

%

|

|

against

|

|

|

1,639,388

|

|

|

|

|

|

|

|

|

|

|

abstain

|

|

|

635,514

|

|

|

|

|

|

|

|

|

|

|

broker non-votes

|

|

|

48,173,769

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Robert A. Profusek

|

|

shares voted

|

|

|

required vote *

|

|

|

vote received

|

|

|

for

|

|

|

288,193,010

|

|

|

|

>50.0%

|

|

|

|

95.74

|

%

|

|

against

|

|

|

12,815,959

|

|

|

|

|

|

|

|

|

|

|

abstain

|

|

|

2,110,391

|

|

|

|

|

|

|

|

|

|

|

broker non-votes

|

|

|

48,173,769

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stephen M. Waters

|

|

shares voted

|

|

|

required vote *

|

|

|

vote received

|

|

|

for

|

|

|

295,706,261

|

|

|

|

>50.0%

|

|

|

|

97.77

|

%

|

|

against

|

|

|

6,742,809

|

|

|

|

|

|

|

|

|

|

|

abstain

|

|

|

670,290

|

|

|

|

|

|

|

|

|

|

|

broker non-votes

|

|

|

48,173,769

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Randall J. Weisenburger

|

|

shares voted

|

|

|

required vote *

|

|

|

vote received

|

|

|

for

|

|

|

298,918,218

|

|

|

|

>50.0%

|

|

|

|

98.83

|

%

|

|

against

|

|

|

3,539,866

|

|

|

|

|

|

|

|

|

|

|

abstain

|

|

|

661,276

|

|

|

|

|

|

|

|

|

|

|

broker non-votes

|

|

|

48,173,769

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rayford Wilkins, Jr.

|

|

shares voted

|

|

|

required vote *

|

|

|

vote received

|

|

|

for

|

|

|

300,067,739

|

|

|

|

>50.0%

|

|

|

|

99.21

|

%

|

|

against

|

|

|

2,401,170

|

|

|

|

|

|

|

|

|

|

|

abstain

|

|

|

650,451

|

|

|

|

|

|

|

|

|

|

|

broker non-votes

|

|

|

48,173,769

|

|

|

|

|

|

|

|

|

|

|

|

(2)

|

Proposal 2: Ratify the appointment of KPMG LLP to serve as Valero’s independent registered public accounting firm for the fiscal year ending December 31, 2020. The proposal was approved as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proposal 2

|

|

shares voted

|

|

|

required vote *

|

|

|

vote received

|

|

|

for

|

|

|

339,387,093

|

|

|

|

>50.0%

|

|

|

|

96.61

|

%

|

|

against

|

|

|

10,896,334

|

|

|

|

|

|

|

|

|

|

|

abstain

|

|

|

1,009,702

|

|

|

|

|

|

|

|

|

|

|

broker non-votes

|

|

|

n/a

|

|

|

|

|

|

|

|

|

|

|

|

(3)

|

Proposal 3: Advisory vote to ratify the 2019 compensation of the named executive officers listed in the proxy statement. The proposal was approved as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proposal 3

|

|

shares voted

|

|

|

required vote *

|

|

|

vote received

|

|

|

for

|

|

|

276,103,462

|

|

|

|

>50.0%

|

|

|

|

91.09

|

%

|

|

against

|

|

|

25,006,631

|

|

|

|

|

|

|

|

|

|

|

abstain

|

|

|

2,009,267

|

|

|

|

|

|

|

|

|

|

|

broker non-votes

|

|

|

48,173,769

|

|

|

|

|

|

|

|

|

|

|

|

(4)

|

Proposal 4: Approval of 2020 Omnibus Stock Incentive Plan. The proposal was approved as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proposal 3

|

|

shares voted

|

|

|

required vote *

|

|

|

vote received

|

|

|

for

|

|

|

284,865,748

|

|

|

|

>50.0%

|

|

|

|

93.98

|

%

|

|

against

|

|

|

16,966,534

|

|

|

|

|

|

|

|

|

|

|

abstain

|

|

|

1,287,078

|

|

|

|

|

|

|

|

|

|

|

broker non-votes

|

|

|

48,173,769

|

|

|

|

|

|

|

|

|

|

* Notes:

Required votes. For Proposal 1, as required by Valero’s bylaws, each director is to be elected by a majority of votes cast with respect to that director’s election. Proposals 2, 3 and 4 required approval by the affirmative vote of a majority of the voting power of the shares present in person or by proxy at the annual meeting and entitled to vote.

Effect of abstentions. Shares voted to abstain are treated as “present” for purposes of determining a quorum. In the election of directors (Proposal 1), pursuant to Valero’s bylaws, shares voted to abstain are not deemed to be “votes cast,” and are accordingly disregarded. When, however, approval for a proposal requires the affirmative vote of a majority of the voting power of the shares present in person or by proxy and entitled to vote (Proposals 2, 3 and 4), then shares voted to abstain have the effect of a negative vote.

Effect of broker non-votes. Brokers holding shares for the beneficial owners of such shares must vote according to specific instructions received from the beneficial owners. If instructions are not received, in some instances (e.g., for Proposal 2), a broker may nevertheless vote the shares in the broker’s discretion. Under New York Stock Exchange rules, brokers are precluded from exercising voting discretion on certain proposals without specific instructions from the beneficial owner (Proposals 1, 3 and 4). This results in a “broker non-vote” on the proposal. A broker non-vote is treated as “present” for purposes of determining a quorum, has the effect of a negative vote when approval for a particular proposal requires the affirmative vote of the voting power of the issued and outstanding shares of the Company, and has no effect when approval for a proposal requires the affirmative vote of a majority of the voting power of the shares present in person or by proxy and entitled to vote.

On April 30, 2020, Valero entered into a Stock Unit Award Agreement with each of its non-employee directors who was re-elected at the annual meeting of the stockholders. The grant of stock units, valued at $200,000, represents the equity portion of Valero’s non-employee director compensation program. Each stock unit represents the right to receive one share of Valero common stock, and is scheduled to vest (become nonforfeitable) in full on the date of Valero’s 2021 annual meeting of stockholders. The foregoing description of the stock units is not complete and is qualified in its entirety by reference to the full text of the agreement governing the awards, which is attached as Exhibit 10.01 to this Current Report and is incorporated herein by reference.

|

Item 9.01

|

Financial Statements and Exhibit.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

VALERO ENERGY CORPORATION

|

|

|

|

|

|

|

|

|

|

Date: May 5, 2020

|

|

|

|

by:

|

|

/s/ J. Stephen Gilbert

|

|

|

|

|

|

|

|

J. Stephen Gilbert, Secretary

|

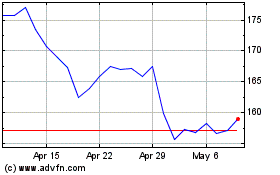

Valero Energy (NYSE:VLO)

Historical Stock Chart

From Jun 2024 to Jul 2024

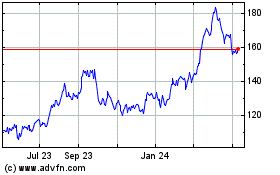

Valero Energy (NYSE:VLO)

Historical Stock Chart

From Jul 2023 to Jul 2024