00008997150001004036false00008997152023-12-132023-12-130000899715skt:TangerPropertiesLimitedPartnershipMember2023-12-132023-12-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________

FORM 8-K

Current Report Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (date of earliest event reported): December 13, 2023

TANGER INC.

TANGER PROPERTIES LIMITED PARTNERSHIP

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | |

| North Carolina | | 1-11986 | | 56-1815473 | |

| (Tanger Inc.) | | (Tanger Inc.) | | (Tanger Inc.) | |

| North Carolina | | 333-03526-01 | | 56-1822494 | |

| (Tanger Properties Limited Partnership) | | (Tanger Properties Limited Partnership) | | (Tanger Properties Limited Partnership) | |

| (State or other jurisdiction of Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification Number) | |

3200 Northline Avenue, Suite 360, Greensboro, NC 27408

(Address of principal executive offices)

(336) 292-3010

(Registrant’s telephone number, including area code)

N/A

(former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Tanger Inc.: |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common Shares,

$0.01 par value | | SKT | | New York Stock Exchange |

| Tanger Properties Limited Partnership: |

| None |

| Securities registered pursuant to Section 12(g) of the Act: |

| Tanger Inc.: None |

| Tanger Properties Limited Partnership: None |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Tanger Inc.: Emerging growth company ☐

Tanger Properties Limited Partnership: Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Tanger Inc.: o

Tanger Properties Limited Partnership: o

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On December 13, 2023, Tanger Inc. (the “Company”) and Tanger Properties Limited Partnership, the Company’s operating partnership (the “Operating Partnership”) entered into an amendment (the “Amendment”) to that certain Employment Agreement dated as of April 6, 2020, as amended by the first amendment to the Employment Agreement dated as of April 9, 2020 (the “Employment Agreement”), with Stephen Yalof who serves as the Company’s and the Operating Partnership’s President and Chief Executive Officer. The Amendment has an effective date of December 31, 2023. Mr. Yalof's current employment agreement will remain in effect until the effective date of the Amendment.

Pursuant to the Amendment, Mr. Yalof will continue to serve as an officer of the Company and the Operating Partnership for a period of thirty-six (36) months through December 31, 2026 (the “Contract Term”) unless otherwise extended or terminated according to the terms of the Employment Agreement as amended. Unless written notice of nonrenewal is given by either Mr. Yalof or the Company and the Operating Partnership at least 180 days prior to the expiration of the Contract Term, the Employment Agreement as amended and Mr. Yalof’s employment with the Company and the Partnership shall continue for one additional 12-month period through December 31, 2027 unless earlier terminated.

If the Company and the Operating Partnership do not offer Mr. Yalof a new employment agreement on terms and conditions substantially similar to the terms and conditions of the Employment Agreement as amended no later than 120 days prior to the expiration of the Contract Term (including the additional 12-month period through December 31, 2027), assuming Mr. Yalof was ready and willing to provide services, or if the Contract Term is not extended due to delivery by the Company and the Operating Partnership of notice of nonrenewal, Mr. Yalof’s employment shall automatically terminate on the last day of the Contract Term and Mr. Yalof shall receive (i) an amount equal to 100% of his annual base salary in effect as of the date of termination, and (ii) a pro rata portion of the annual bonus for the year in which termination occurs based on the number of days in that year prior to the termination date.

During the Contract Term, Mr. Yalof will be entitled to receive a base salary of no less than $900,000 (the “Annual Base Salary”) unless otherwise agreed to by the Company, the Operating Partnership and Mr. Yalof. During each contract year starting with 2024, Mr. Yalof’s bonus opportunity under the Company’s and/or the Operating Partnership’s annual cash bonus plan or program for senior executives (the “Annual Bonus Plan”) will be equal to 75%, 150% and 250% of Mr. Yalof’s base salary upon achievement of “threshold,” “target,” and “stretch” performance levels, respectively, subject to the terms of the Employment Agreement as amended and the Annual Bonus Plan. The performance goals and levels under the Annual Bonus Plan will be determined by the Compensation Committee. Mr. Yalof also is entitled to participate in or receive benefits under all employee benefit plans or other arrangements made available by the Company, Operating Partnership or Tanger Management, LLC. (“Tanger Management”), including paid time off, on a basis which is no less favorable than is provided to other senior executives of the Company, Operating Partnership or Tanger Management.

During the Contract Term, Mr. Yalof also will be entitled to participate in the Company’s annual long term incentive program (the “Incentive Award Plan”) on a basis no less favorable than that afforded to other senior officers of the Company and/or the Operating Partnership. The aggregate target grant date fair value of Mr. Yalof’s Incentive Award Plan award for 2024 will be no less than $3.75 million, 40% of the value of which shall be awarded in the form of time-vested restricted shares of common shares of the Company (“Common Shares”) vesting in three equal installments on the first three anniversaries of the date of grant (the “2024 Time-Vesting Restricted Shares”) and the remaining 60% of the value of which shall be awarded in the form of equity awards subject to performance-based vesting (the “2024 Performance-Vesting Notional Units”).

If Mr. Yalof’s employment is terminated by the Company or the Operating Partnership other than for Cause (as such term is defined in the Employment Agreement), death or Disability (as such term is defined in the Employment Agreement), or if Mr. Yalof resigns for Good Reason (as such term is defined in the Employment Agreement), then, in exchange for signing a general release of the Company, the Operating Partnership and certain Related Entities (as defined in the Amendment) and complying with certain terms of the Employment Agreement as amended, Mr. Yalof will be entitled to receive an amount equal to: (A) the sum of (1) Mr. Yalof’s Annual Base Salary in effect as of the date of termination; plus (2) the average of the annual bonuses, if any, received (or to be received) by Mr. Yalof for the three most recent calendar years prior to the date of termination for which the amount of such annual bonus has been determined; multiplied by (B) two. The amount shall be paid in equal pro rata consecutive monthly or bi-weekly installments in accordance with the Company’s regular pay schedule and subject to Section 22 of the Employment Agreement over a twelve (12) month period beginning with the first regular Company payday following the Effective Date of the release.

In addition, upon Mr. Yalof’s termination of employment by reason of his death or Disability, Mr. Yalof will be entitled to receive 100% of his annual base salary for the contract year in which the termination occurs, (A) payable in lump sum within thirty (30) days after the termination in case of death or, (B) in the case of Disability in equal pro rata consecutive installments in accordance with the Company’s regular pay schedule. In the case of Disability, such payments are conditioned on Mr. Yalof signing a general release of the Company, the Operating Partnership and certain Related Entities.

During and following Mr. Yalof’s employment, the Company shall maintain, at its expense, officers and directors fiduciary liability insurance that would cover Mr. Yalof in an amount, and on terms and conditions, no less favorable to Mr. Yalof than the amount and the terms and conditions applicable to any other member of the board of directors of the Company, any trustee of Tanger GP Trust, or any other executive officer of the Company, the Operating Partnership or Tanger Management, LLC.

The foregoing description of the terms and conditions of the Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the Amendment, a copy of which is filed as Exhibits 10.1 hereto and incorporated herein by reference.

There are no transactions involving the Company or the Operating Partnership and Mr. Yalof that the Company or the Operating Partnership would be required to report pursuant to Item 404(a) of Regulation S-K.

INDEX TO EXHIBITS

| | | | | |

Exhibit

No. | Description |

| 10.1 | |

| 104 | Cover Page Interactive Data File – the cover page XBRL tags are embedded with the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: December 18, 2023

| | | | | | | | | | | | | | |

| | |

| | | | |

| | TANGER INC. |

| | | | |

| | By: | /s/ | Michael J. Bilerman |

| | | | Michael J. Bilerman |

| | | | Executive Vice President, Chief Financial Officer |

| | | | and Chief Investment Officer |

| | | | |

| | TANGER PROPERTIES LIMITED PARTNERSHIP |

| | | | |

| | By: TANGER INC., its sole general partner |

| | | | |

| | By: | /s/ | Michael J. Bilerman |

| | | | Michael J. Bilerman |

| | | | Executive Vice President, Chief Financial Officer |

| | | | and Chief Investment Officer |

[execution copy] SECOND AMENDMENT TO EMPLOYMENT AGREEMENT THIS SECOND AMENDMENT TO EMPLOYMENT AGREEMENT (this “Amendment”) is entered into as of December 13, 2023 by and among TANGER PROPERTIES LIMITED PARTNERSHIP, a North Carolina limited partnership (the “Partnership”), TANGER INC., a North Carolina corporation (the “Company”), and collectively with the Partnership and the Company, the “Tanger Parties”) and Stephen Yalof (the “Executive”) (the Tanger Parties and the Executive each a “Party” and collectively the “Parties”). RECITALS: WHEREAS, Tanger Factory Outlet Centers, Inc. changed its name to Tanger Inc.; and WHEREAS, the Partnership, the Company and Tanger GP Trust on the one hand and the Executive on the other hand entered into that certain Employment Agreement dated April 6, 2020, as amended by that certain First Amendment to Employment Agreement dated April 9, 2020 (as amended, the “Agreement”); WHEREAS, the Company replaced Tanger GP Trust as the general partner of the Partnership in November 2021 and Tanger GP Trust ceased active operations as of November 12, 2021; WHEREAS, Executive will continue to serve as a trustee of Tanger GP Trust until the earlier of the dissolution of Tanger GP Trust or Executive’s removal as trustee; WHEREAS, as of January 1, 2023, Executive became President, CEO and an employee of Tanger Management and Executive’s compensation is paid through Tanger Management; WHEREAS, the Tanger Parties desire to amend the Agreement to (i) extend the Contract Term, and (ii) adjust certain compensation and benefits, as more fully set forth below; WHEREAS, on September 19, 2023, the Company offered the Executive, subject to approval of the Board, the terms set forth herein; WHEREAS, the Executive and the Tanger Parties mutually agreed upon these terms as of the date that they entered into this Agreement first listed above; and WHEREAS, to the extent necessary to give legal effect to this amendment, Tanger GP Trust consents to this amendment as indicated by its signature below. NOW, THEREFORE, in consideration of the foregoing and of the mutual covenants and agreements set forth below, pursuant to Section 19 of the Agreement, the parties hereto agree to amend the Agreement as follows, effective on and after December 31, 2023 (unless another date is expressly indicated below): 1. DEFINITIONS. a. Section 1(c)(ii) of the Agreement is amended by replacement of the phrase “or the General Partner ceases to be the sole general partner of the Partnership” with the phrase “or the Company ceases to be the sole general partner of the Partnership.” b. Section 1(g)(i)(w) of the Agreement is amended by the deletion of the phrase “Executive Chairman of the Company and/or.” Exhibit 10.1

[execution copy] c. Section 1(g)(i)(y) of the Agreement is amended by replacing it in its entirety with the following: (y) on or within twelve months following a Change in Control occurring, the failure of Executive to be the President and Chief Executive Officer of the successor entity (or entities) to the Company and the Partnership, and of any ultimate parent to the Company or its successor, or d. Section 1(g)(iii) is amended in its entirety as follows: (iii) a material breach of this Agreement by the Partnership, Tanger Management or the Company, including without limitation the failure to pay compensation or benefits when due hereunder or a material breach of Section 12 of this Agreement by the Company, Tanger Management and/or the Partnership. 2. EMPLOYMENT. Section 2(a) of the Agreement is amended in its entirety as follows: The Partnership and the Company hereby agree to employ the Executive under this Agreement and the Executive agrees to such employment during the Contract Term (as defined in Section 2(b) below) in the positions set forth in Section 3 and upon the other terms and conditions set forth in this Agreement, unless earlier terminated as set forth in Section 7. Unless otherwise expressly stated in the notice of termination, a termination by the Company or the Partnership shall be effective as a termination by the Company, the Partnership and any then Related Entity. For the avoidance of doubt, the termination by a Related Entity of Executive’s employment with that Related Entity by itself will not constitute a termination without Cause or grounds for resignation for Good Reason under this Agreement provided that Executive remains employed in the positions described in Section 3(b) (and Section 1(g)(i)(y), if applicable). 3. TERM. Section 2(b) of the Agreement is amended by inserting the following after the first sentence of Section 2(b): Thereafter, this Agreement and Executive’s employment with the Company and the Partnership will continue for a period of thirty-six (36) months through December 31, 2026 (the “Additional Term”), unless earlier terminated as provided in Section 7 below. Thereafter, unless written notice of nonrenewal is given by either the Executive on the one hand or the Company and the Partnership on the other hand to the other party at least 180 days prior to the expiration of the Additional Term, this Agreement and Employee’s employment with the Company and the Partnership shall continue for one additional 12-month period through December 31, 2027 unless earlier terminated as provided in Section 7 below. 4. POSITION AND DUTIES. Section 3(b) of the Agreement is amended by the replacement of the phrase “to the Executive Chairman of the Company and the Board” with the phrase Exhibit 10.1

[execution copy] “solely and directly to the Board.” 5. PLACE OF EMPLOYMENT. Section 4(a) the Agreement is amended in its entirety to read as follows: (a) During the Contract Term, the Executive shall maintain his primary residence in North Carolina and is required by the Company and the Partnership to primarily work out of the Company’s primary office in North Carolina. In addition, Executive may spend an appropriate amount of time working at the Company’s other primary offices (such primary offices as designated by the Board from time to time), but not to exceed 183 full or partial days a year (whether consecutive or nonconsecutive) at any single other primary office. The Executive understands and agrees that in his position he also will be required to travel outside of the area in which the Company’s primary offices are located to perform his duties. 6. ANNUAL BASE SALARY. Section 5(a) of the Agreement is amended in its entirety to read as follows: (a) Annual Base Salary. During the Contract Term, the Executive’s annual base salary (“Annual Base Salary”) shall be not less than $900,000 unless otherwise agreed to by the parties, payable by the Company in regular pro-rata installments in accordance with the Company’s general payroll practices in effect from time to time, but in no event less frequently than monthly. The amount of Annual Base Salary payable to the Executive shall not be decreased other than for Cause, as agreed to by Executive, or as required by law. 7. BENEFITS. Section 5(b)(iii) of the Agreement is amended in its entirety to read as follows:(iii) participate in or receive benefits under all employee benefit plans or other arrangements made available by the Partnership, Tanger Management or the Company (or any successor entities), including paid time off, on a basis which is no less favorable than is provided to other senior executives of the Partnership, Tanger Management and the Company (or any successor entities)(collectively “Benefits”). 8. ANNUAL BONUS. Section 5(c) of the Agreement is amended in its entirety to read as follows: (c) Annual Bonus. As additional compensation for services rendered, for each Contract Year in the Contract Term, the Executive shall be entitled to participate in the Company’s and/or the Partnership’s annual cash bonus plan or program for senior executives (the “Annual Bonus Plan”), which, with respect to each Contract Year starting with 2024, subject to the terms and conditions set forth in this Agreement and in the Annual Bonus Plan, will provide for (i) a Exhibit 10.1

[execution copy] “target” annual cash bonus amount equal to no less than 150% of the Annual Base Salary received by the Executive during such Contract Year, to be payable if the applicable performance goals set by the Compensation Committee are achieved at target level for the applicable Contract Year but do not reach the stretch level set by the Compensation Committee, (ii) a “threshold” annual cash bonus of 75% of the Annual Base Salary received by the Executive during such Contract Year, to be payable if the applicable performance goals set by the Compensation Committee are achieved at the threshold level for the applicable Contract Year but do not reach the “target” level set by the Compensation Committee; or (iii) a “stretch” bonus of 250% of the Annual Base Salary received by the Executive during such Contract Year, to be payable if the applicable performance goals set by the Compensation Committee are achieved at stretch level for the applicable Contract Year (the annual cash bonus earned for a Contract Year, the “Annual Bonus”). The Annual Bonus for any Contract Year shall be payable to the Executive in cash in the Contract Year following the Contract Year in respect of which such Annual Bonus relates, at the same time in such following year as any annual bonus for the preceding Contract Year is paid to any other Company, Tanger Management and/or Partnership executive but in all events no later than the fifteenth (15th) day of the third (3rd) calendar month following the end of the Contract Year with respect to which such Annual Bonus relates. The Executive shall be entitled to payment under an applicable Annual Bonus Plan if he is employed on the last day of the Contract Year in respect of which such Annual Bonus relates. 9. LONG TERM EQUITY. Section 5(e) of the Agreement is amended in its entirety as follows: (e) Annual Equity and/or Long-Term Incentive Awards. As additional compensation for services rendered, for each Contract Year during the Contract Term starting with 2024, the Executive shall be entitled to receive annual awards under the Incentive Award Plan on a basis no less favorable to the Executive than the basis on which any other senior officer of the Company, Tanger Management and/or the Partnership receives annual awards under such plans, including the date of grant and the form of the awards; for the avoidance of doubt, for purposes of the foregoing, sign-on, retention or other equity award made to any other senior officer of the Company, Tanger Management and/or the Partnership other than ordinary course annual equity awards shall not be taken into account. In addition to the compensation payable under Section 5(d) and notwithstanding anything herein to the contrary, during the 2024 Contract Year, the Company shall grant the Executive annual awards under the Incentive Award Plan with an aggregate target grant date fair value of no less than $3.75 million (the “2024 Equity Award”), 40% of the value of which shall be awarded in the form of time-vested restricted Common Shares, with dividends payable thereon for both vested and unvested shares from the date of grant, vesting one-third on each of the first, second and third anniversaries of the date of grant, and 60% of the value of which shall be awarded in the form of equity awards subject to performance-based vesting. Any time-vested equity awards granted to Executive shall vest pro rata upon a termination of the Executive’s employment by the Company or the Partnership other than for Cause, due to death or Disability or by the Executive’s resignation for Good Reason. In the event of a termination of the Executive’s employment by the Exhibit 10.1

[execution copy] Company or the Partnership other than for Cause, due to death or Disability or by the Executive’s resignation for Good Reason, a pro-rata portion of Executive’s performance-based equity awards then subject to open performance periods shall remain outstanding (based on the portion of the performance period actually worked by the Executive) and, to the extent the applicable performance measures are actually achieved at the end of the applicable performance period, that pro-rata portion will then vest (with no requirement of additional service beyond the end of the performance period); provided that if such termination, death, Disability or resignation occurs within 12 months following a Change in Control, such performance-based awards will instead vest immediately, without pro-ration, assuming target performance or, if greater, actual performance through the date of termination (with performance goals equitably adjusted to reflect the shortened performance period). However, to the extent at the time of the Executive’s separation the Company’s Executive Severance and Change of Control Plan provides vesting upon termination without cause that is more beneficial than the treatment described in the preceding two sentences, or to the extent the Executive’s own equity awards provide for more beneficial treatment than the treatment described in the preceding two sentences, such better treatment will be afforded to the Executive in lieu of the treatment described in the two preceding sentences. 10. EXECUTIVE PHYSICAL. Section 5(g) of the Agreement (Relocation Assistance) is deleted in its entirety and replaced with the following: (g) Executive Physical. During the Contract Term, the Executive will obtain an annual executive physical at the Mayo Clinic, Weill Cornell Medical Center or similar facility of Executive’s choosing and the Company will pay the costs of such examination and related travel expenses, up to an annual maximum of $10,000 (inclusive of any portion covered by the Company’s group health benefits or other applicable insurance coverage), less taxes and withholdings required by law. 11. LEGAL FEES. Section 5(h) of the Agreement is amended in its entirety as follows: (h) Legal Fees. The Company and the Partnership shall pay, within thirty (30) days after receipt of proper invoices from Executive, up to $15,000 of reasonable legal fees and expenses incurred by the Executive in negotiating any material amendment offered by the Company and the Partnership to this Agreement. 12. TERMINATION WITHOUT CAUSE OR FOR GOOD REASON. a. The first sentence of Section 8(a)(i) of the Agreement is amended in its entirety as follows: (i) The Company or the Partnership shall pay or cause to be paid to the Executive an amount equal to: (A) the sum of (1) the Executive’s Annual Base Salary in effect as of the date of termination, plus (2) the average of the Annual Bonuses, if any, received (or to be received) by the Exhibit 10.1

[execution copy] Executive for the three most recent calendar years prior to the date of termination for which the amount of such Annual Bonus has been determined; multiplied by (B) two. b. Effective on the date hereof, the second sentence of Section 8(a)(i) of the Agreement is amended in its entirety as follows: Except as otherwise required by Section 22(b), this amount shall be paid in equal pro rata consecutive monthly or bi-weekly installments in accordance with the Company's regular pay schedule and subject to Section 22 over a twelve (12) month period beginning with the first regular Company payday following the Release Effective Date (as defined in the Release); provided that if the first regular Company payday occurring at least 30 days after the date of termination is in a different calendar year than the date of termination, then such installments will begin on the first regular Company payday following the later of (1) the Release Effective Date, and (2) the end of the calendar year in which the date of termination occurs. c. The text of Section 8(a)(ii) is deleted in its entirety and replaced with the following: (ii) [intentionally left blank] 13. TERMINATION BY DEATH OR DISABILITY. Effective on the date hereof, Section 8(b(i) of the Agreement is amended in its entirety as follows: (i) one hundred percent (100%) of the Executive's Annual Base Salary for the Contract Year in which the termination occurs (A) in a lump-sum payment within thirty (30) day after the termination in the case of death, or (B) in the case of Disability, in equal pro rata consecutive monthly or bi-weekly installments in accordance with the Company's regular pay schedule and subject to Section 22 over a twelve (12) month period beginning with the first regular Company payday following the Release Effective Date; provided that if the first regular Company payday occurring at least 30 days after the date of termination is in a different calendar year than the date of termination, then such installments will begin on the first regular Company payday following the later of (1) the Release Effective Date, and (2) the end of the calendar year in which the date of termination occurs, and 14. OFFICERS AND DIRECTORS FIDUCIARY LIABILITY INSURANCE. Section 10 of the Agreement is amended in its entirety as follows: 10. Insurance. Officers and Directors Fiduciary Liability Insurance. During and following the Executive’s employment under this Agreement, the Company shall maintain, at its expense, officers and directors fiduciary liability insurance that would cover the Executive in an amount, and on terms and conditions, no less favorable to the Executive than the amount and the terms and conditions applicable to any other member of the Board, any other trustee of Tanger GP Trust or any other executive officer of the Company, Tanger Management and/or the Partnership. Exhibit 10.1

[execution copy] 15. ENTIRE AGREEMENT. Section 18 of the Agreement is amended by replacing “the Partnership and the Company” with “the Partnership, Tanger Management, the Company and/or any Related Entity”. 16. NO SUCCESSOR AGREEMENT. Section 25 of the Agreement is amended in its entirety as follows: 25. No Successor Agreement. Subject to such changes or adjustments required by applicable law, if the Company and the Partnership do not offer the Executive a new employment agreement on terms and conditions substantially similar to the terms and conditions of this Agreement (and is willing to execute same) no later than 120 days’ prior to the expiration of the Contract Term covering the one additional 12 month period through December 31, 2027, assuming the Executive was ready and willing to continue to provide services, or if the Additional Term is not extended due to delivery by the Company and the Partnership of notice of nonrenewal, the Executive’s employment shall automatically terminate on the last day of the Contract Term and such termination shall be treated as a termination without Cause under this Agreement and a termination without Cause for the purposes of any other agreement, plan or policy of the Company and/or the Partnership; provided, however, that in lieu of the amount payable upon a termination without Cause or for Good Reason pursuant to Section 8(a)(i), the Company or the Partnership shall pay or cause to be paid to Executive (i) an amount equal to 100% of the Executive’s Annual Base Salary in effect as of the date of termination, which amount will be paid in accordance with the second sentence of Section 8(a)(i), and (ii) on or before the day on which the Executive’s Annual Bonus for the Contract Year in which termination occurs would have been payable if the termination had not occurred, an amount equal to the Annual Bonus the Executive would have received for the Contract Year in which the date of termination occurs if the termination had not occurred multiplied by a fraction the numerator of which is the number of days in the Contract Year before the date of termination and the denominator of which is 365. For the avoidance of doubt, the Executive shall also be entitled to any earned Annual Bonus for the last full Contract Year of the Contract Term in accordance with the applicable Annual Bonus plan. 17. ADDITION OF TANGER MANAGEMENT, LLC. The following new Section 27 is added to the Agreement. 27. Tanger Management, LLC. In any section of the Agreement in which the Company or the Partnership agrees to pay Executive monetary compensation for services rendered (including without limitation Annual Base Salary and Annual Bonus in Sections 5(a) and 5(c) of this Agreement) or expense reimbursements (including without limitation Executive’s physical under 5(g) and legal fees under Section 5(h) of the Agreement (as amended by this Amendment), but excluding any equity awards), such payments will be made through the payroll of Tanger Management (or such other Related Entity subsequently designated by the Company) and Exhibit 10.1

[execution copy] references herein to the payroll schedule, payroll dates or benefit plans of the Company will be deemed to include the payroll schedule, payrolls dates or benefit plans of Tanger Management (or other designated Related Entity). However, for avoidance of doubt, this paragraph merely describes a payroll arrangement and does not supersede Section 5(i) of this Agreement or otherwise reduce the obligations of the Company and the Partnership to Executive; if Tanger Management does not timely or fully pay any amount due to Executive, the Company and the Partnership will remain jointly and severally obligated to pay (and will promptly pay) the unpaid amount. 18. DEFINITION OF RELATED ENTITY. Each reference to “Related Entity” in the Agreement, as amended, shall mean a subsidiary of or other entity under common control with the Company and/or the Partnership at any time during the Contract Term (including without limitation as of the date of termination); provided, however, that the prohibitions on competition, solicitation, disparagement and making untrue comments in subsections 6(a), the last sentence of 6(b)(ii), 6(c), (6(d) and 23 of the Agreement (the “Prohibited Conduct”) shall not apply to any entity that is no longer a Related Entity as of the date of termination of Contract Term or, if earlier, the date of the Prohibited Conduct, unless, in either case, such Related Entity is the beneficiary of an express contractual provision of another agreement prohibiting the Prohibited Conduct. 18. REMOVAL OF TANGER GP TRUST. The term “General Partner” is deleted from Section 3(b) of the Agreement. 19. Except as expressly or by necessary implication amended by this Amendment, the Agreement shall continue in full force and effect. [signature page follows] Exhibit 10.1

[execution copy] IN WITNESS WHEREOF, the parties have executed this Amendment as of the date first above written. Stephen Yalof TANGER INC. a North Carolina corporation By: Steven B. Tanger Executive Chairman of the Board TANGER PROPERTIES LIMITED PARTNERSHIP a North Carolina limited partnership By: Tanger Inc., a North Carolina corporation Its sole General Partner By: Name:Steven B. Tanger_____________ Title: Executive Chair of the Board_____ CONSENTED TO: TANGER GP TRUST a Maryland business trust By: Steven B. Tanger, Executive Chairman of the Board /s/ Stephen Yalof /s/ Steven B. Tanger /s/ Steven B. Tanger /s/ Steven B. Tanger Exhibit 10.1

v3.23.4

Document and Entity Information

|

Dec. 13, 2023 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Dec. 13, 2023

|

| Entity Registrant Name |

TANGER INC

|

| Entity Incorporation, State or Country Code |

NC

|

| Entity File Number |

1-11986

|

| Entity Central Index Key |

0000899715

|

| Amendment Flag |

false

|

| Entity Tax Identification Number |

56-1815473

|

| Entity Address, Address Line One |

3200 Northline Avenue

|

| Entity Address, Address Line Two |

Suite 360

|

| Entity Address, City or Town |

Greensboro

|

| Entity Address, State or Province |

NC

|

| Entity Address, Postal Zip Code |

27408

|

| City Area Code |

336

|

| Local Phone Number |

292-3010

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Shares, $0.01 par value

|

| Trading Symbol |

SKT

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Tanger Properties Limited Partnership [Member] |

|

| Entity Information [Line Items] |

|

| Entity Registrant Name |

TANGER PROPERTIES LIMITED PARTNERSHIP

|

| Entity Incorporation, State or Country Code |

NC

|

| Entity File Number |

333-03526-01

|

| Entity Central Index Key |

0001004036

|

| Entity Tax Identification Number |

56-1822494

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

dei_LegalEntityAxis=skt_TangerPropertiesLimitedPartnershipMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

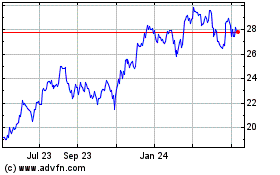

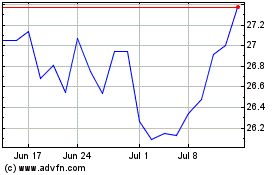

Tanger (NYSE:SKT)

Historical Stock Chart

From Apr 2024 to May 2024

Tanger (NYSE:SKT)

Historical Stock Chart

From May 2023 to May 2024