false000000733200000073322021-11-032021-11-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________________________________

FORM 8-K

________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 3, 2021

________________________________________________________________

SOUTHWESTERN ENERGY COMPANY

(Exact name of registrant as specified in its charter)

________________________________________________________________

| | | | | | | | | | | | | | |

| | | | |

| Delaware | | 001-08246 | | 71-0205415 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

10000 Energy Drive

Spring, TX 77389

(Address of principal executive offices)(Zip Code)

(832) 796-1000

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

________________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, Par Value $0.01 | | SWN | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory Note

The information in this report provided under Item 2.02, including Exhibit 99.1 attached hereto, shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that Section, and shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

SECTION 2 - Financial Information

Item 2.02 Results of Operations and Financial Condition.

On November 3, 2021, Southwestern Energy Company (the "Company") issued a press release announcing the Company's financial results for the quarter ended September 30, 2021 (Exhibit 99.1). The press release is being furnished as Exhibit 99.1.

SECTION 9 - Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. | | | | | | | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | |

| | | SOUTHWESTERN ENERGY COMPANY |

| | |

Dated: November 3, 2021 | | By: | | /s/ CARL F. GIESLER, JR. |

| | | Name: | | Carl F. Giesler, Jr. |

| | | Title: | | Executive Vice President and Chief Financial Officer |

| | | | | |

NEWS RELEASE

SOUTHWESTERN ENERGY ANNOUNCES THIRD QUARTER 2021 RESULTS

Creating sustainable value in responsible natural gas development from disciplined execution, growing scale and financial strength

SPRING, Texas – November 3, 2021 – Southwestern Energy Company (NYSE: SWN) today announced financial and operating results for the third quarter ended September 30, 2021.

•Established scale positions in the two premier US natural gas basins by expanding operations into the Haynesville with the closing and integration of Indigo Natural Resources;

•Generated $213 million net cash provided by operating activities, $396 million net cash flow (non-GAAP), and $105 million of free cash flow (non-GAAP);

–On track to exceed $475 million in free cash flow in 2021

•Improved leverage ratio by 0.4x to 2.2x and expect to reduce leverage to approximately 2x by year-end;

•Issued $1.2 billion of 5.375% senior notes due 2030, extending maturity runway and lowering cost of debt; received credit rating upgrade to BB by S&P;

•Reported total production of 310 Bcfe, or 3.4 Bcfe per day, including one month of Haynesville production; total 2.7 Bcf per day of gas and 106 MBbls per day of liquids;

•Achieved record SEC proved reserves (unaudited) of approximately 18.5 Tcfe; and

•Received weighted average realized price (excluding impact of transportation and hedges) of $4.08 per Mcfe.

“Disciplined execution and financial strength defined the quarter for Southwestern Energy. Our team delivered financial and operating results which exceeded expectations, including the successful establishment of operations in Haynesville. Our team’s proven capabilities in large scale consolidation and development are capturing the tangible benefits of scale from core positions in the two premier US gas basins. Our strategy continues to differentiate SWN and strengthen our position as a preferred investment opportunity for institutional investors seeking exposure to responsible natural gas development,” said Bill Way, Southwestern Energy President and Chief Executive Officer.

Finance Update

The Company prioritizes protecting its financial strength and will continue the allocation of free cash flow to debt reduction and disciplined risk management. Given the current commodity price outlook and successful recent strategic actions, the Company has reduced its sustainable leverage target from 2x to a target range of 1.0x to 1.5x.

Within its disciplined risk management policy, the Company will target a level of hedges that protects the funding for capital investments and other financial priorities, including

debt repayment. This approach to hedging safeguards the Company’s financial strength while also retaining meaningful exposure to potential commodity price upside.

Financial Results

| | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended | | For the nine months ended |

| September 30, | | September 30, |

| (in millions) | 2021 | | 2020 | | 2021 | | 2020 |

| Net loss | $ | (1,857) | | | $ | (593) | | | $ | (2,386) | | | $ | (3,020) | |

| Adjusted net income (non-GAAP) | $ | 188 | | | $ | 47 | | | $ | 513 | | | $ | 102 | |

| Diluted loss per share | $ | (2.36) | | | $ | (1.04) | | | $ | (3.34) | | | $ | (5.48) | |

| Adjusted diluted earnings per share (non-GAAP) | $ | 0.24 | | | $ | 0.08 | | | $ | 0.72 | | | $ | 0.18 | |

| Adjusted EBITDA (non-GAAP) | $ | 426 | | | $ | 154 | | | $ | 1,108 | | | $ | 466 | |

| Net cash provided by operating activities | $ | 213 | | | $ | 153 | | | $ | 830 | | | $ | 407 | |

| Net cash flow (non-GAAP) | $ | 396 | | | $ | 135 | | | $ | 1,022 | | | $ | 413 | |

Total capital investments (1) | $ | 291 | | | $ | 223 | | | $ | 816 | | | $ | 705 | |

(1)Capital investments include an increase of $34 million and a decrease of $7 million for the three months ended September 30, 2021 and 2020, respectively, and increases of $63 million and $1 million for the nine months ended September 30, 2021 and 2020, respectively, relating to the change in accrued expenditures between periods.

For the quarter ended September 30, 2021, Southwestern Energy recorded a net loss of $1.86 billion, or ($2.36) per diluted share, compared to a net loss in 2020 of $593 million, or ($1.04) per diluted share. The quarter ended September 30, 2021 included a $2,011 million loss on unsettled derivatives, and the same period for 2020 included a $361 million non-cash impairment and a $289 million loss on unsettled derivatives.

Adjusted net income was $188 million, or $0.24 per diluted share, in the third quarter of 2021, compared to $47 million, or $0.08 per diluted share, for the prior year period. The increase was primarily related to a 40% increase in the weighted average realized price, including derivatives, and a 40% increase in production volumes, largely due to the Indigo and Montage acquisitions. Adjusted EBITDA (non-GAAP) was $426 million, net cash provided by operating activities was $213 million, net cash flow (non-GAAP) was $396 million and free cash flow (non-GAAP) was $105 million.

As indicated in the table below, third quarter 2021 weighted average realized price, including $0.34 per Mcfe of transportation expenses, was $3.74 per Mcfe, excluding the impact of derivatives. Including derivatives, weighted average realized price (including transportation) for the quarter was up 40% from $1.78 per Mcfe in 2020 to $2.49 per Mcfe in 2021, primarily due to higher commodity prices, including a 103% increase in NYMEX Henry Hub and a 72% increase in WTI, partially offset by the impact of settled derivatives. Third quarter 2021 weighted average realized price before transportation expense and excluding the impact of derivatives was $4.08 per Mcfe.

As of September 30, 2021, Southwestern Energy had total debt of $4.2 billion and a leverage ratio of 2.2x, an improvement of 0.4x compared to the previous quarter. At quarter end, the Company had $665 million of borrowings under its revolving credit facility with $159 million in letters of credit. The letters of credit decreased $74 million due to the Company’s September 1st S&P upgrade to BB credit rating.

During the quarter, the Company issued $1.2 billion of 5.375% senior notes due 2030 and utilized the proceeds to refinance higher coupon senior notes due 2025 and 2026 and to repay a portion of its revolver. The issuance extended the weighted average time to maturity of its senior notes to greater than 6 years and improved the weighted average cost of debt to approximately 6%.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Realized Prices | | For the three months ended | | For the nine months ended |

| (includes transportation costs) | | September 30, | | September 30, |

| | 2021 | | 2020 | | 2021 | | 2020 |

| Natural Gas Price: | | | | | | | | |

NYMEX Henry Hub price ($/MMBtu) (1) | | $ | 4.01 | | | $ | 1.98 | | | $ | 3.18 | | | $ | 1.88 | |

Discount to NYMEX (2) | | (0.83) | | | (0.89) | | | (0.74) | | | (0.68) | |

| Realized gas price per Mcf, excluding derivatives | | $ | 3.18 | | | $ | 1.09 | | | $ | 2.44 | | | $ | 1.20 | |

Gain on settled financial basis derivatives ($/Mcf) | | 0.11 | | | 0.12 | | | 0.11 | | | 0.06 | |

Gain (loss) on settled commodity derivatives ($/Mcf) | | (1.14) | | | 0.31 | | | (0.43) | | | 0.39 | |

Realized gas price, including derivatives ($/Mcf) | | $ | 2.15 | | | $ | 1.52 | | | $ | 2.12 | | | $ | 1.65 | |

| Oil Price: | | | | | | | | |

WTI oil price ($/Bbl) (3) | | $ | 70.56 | | | $ | 40.93 | | | $ | 64.82 | | | $ | 38.32 | |

| Discount to WTI | | (8.24) | | | (11.47) | | | (8.71) | | | (10.12) | |

Realized oil price, excluding derivatives ($/Bbl) | | $ | 62.32 | | | $ | 29.46 | | | $ | 56.11 | | | $ | 28.20 | |

Realized oil price, including derivatives ($/Bbl) | | $ | 44.83 | | | $ | 46.69 | | | $ | 40.06 | | | $ | 44.97 | |

| NGL Price: | | | | | | | | |

Realized NGL price, excluding derivatives ($/Bbl) | | $ | 31.76 | | | $ | 10.34 | | | $ | 26.05 | | | $ | 8.37 | |

Realized NGL price, including derivatives ($/Bbl) | | $ | 19.31 | | | $ | 10.50 | | | $ | 17.13 | | | $ | 9.85 | |

| Percentage of WTI, excluding derivatives | | 45 | % | | 25 | % | | 40 | % | | 22 | % |

| Total Weighted Average Realized Price: | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Excluding derivatives ($/Mcfe) | | $ | 3.74 | | | $ | 1.34 | | | $ | 3.01 | | | $ | 1.36 | |

Including derivatives ($/Mcfe) | | $ | 2.49 | | | $ | 1.78 | | | $ | 2.41 | | | $ | 1.86 | |

(1)Based on last day monthly futures settlement prices.

(2)This discount includes a basis differential, a heating content adjustment, physical basis sales, third-party transportation charges and fuel charges, and excludes financial basis derivatives.

(3)Based on the average daily settlement price of the nearby month futures contract over the period.

Operational Results

Total production for the quarter ended September 30, 2021 was 310 Bcfe, of which 81% was natural gas, 16% NGLs and 3% oil. Capital investments totaled $291 million for the third quarter, with 17 wells drilled, 23 wells completed and 24 wells placed to sales.

| | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended | | For the nine months ended |

| September 30, | | September 30, |

| 2021 | | 2020 | | 2021 | | 2020 |

| Production | | | | | | | |

Gas production (Bcf) | 251 | | | 173 | | | 684 | | | 487 | |

Oil production (MBbls) | 1,729 | | | 1,294 | | | 5,222 | | | 3,776 | |

NGL production (MBbls) | 8,011 | | | 6,687 | | | 23,255 | | | 18,926 | |

Total production (Bcfe) | 310 | | | 221 | | | 855 | | | 623 | |

Total production (Bcfe/day) | 3.4 | | | 2.4 | | | 3.1 | | | 2.3 | |

| | | | | | | |

| Average unit costs per Mcfe | | | | | | | |

Lease operating expenses (1) | $ | 0.95 | | | $ | 0.91 | | | $ | 0.94 | | | $ | 0.93 | |

General & administrative expenses (2,3) | $ | 0.09 | | | $ | 0.12 | | | $ | 0.11 | | | $ | 0.13 | |

| Taxes, other than income taxes | $ | 0.11 | | | $ | 0.07 | |

| $ | 0.10 | | | $ | 0.06 | |

| Full cost pool amortization | $ | 0.43 | | | $ | 0.29 | | | $ | 0.37 | | | $ | 0.40 | |

(1)Includes post-production costs such as gathering, processing, fractionation and compression.

(2)Excludes $35 million and $39 million in merger-related expenses for the three and nine months ended September 30, 2021, respectively, and $7 million in restructuring charges for the nine months ended September 30, 2021.

(3)Excludes $3 million in merger-related expenses for the three and nine months ended September 30, 2020, respectively, and $12 million in restructuring charges for the nine months ended September 30, 2020.

Appalachia – In the third quarter, total production was 280 Bcfe, with NGL production of 87 MBbls per day and oil production of 19 MBbls per day. The Company drilled 15 wells, completed 19 wells and placed 19 wells to sales with an average lateral length of 14,147 feet. During the third quarter, Appalachia well costs averaged under $630 per lateral foot for wells placed to sales, including approximately $550 per lateral foot in dry gas Marcellus. In the fourth quarter, the Company expects to average 2 rigs and 2 completion crews on its Appalachia properties, with activity in both dry gas and liquids rich areas.

Haynesville – The Company closed on the acquisition of its Haynesville assets on September 1, 2021, and as such, third quarter results include 30 days of production and activity. Production was 30 Bcf, or 1.0 Bcf per day. The Company drilled two wells, completed four wells and placed five wells to sales. All five wells placed to sales were in the highly economic Middle Bossier with an average initial production rate of 24 MMcf per day and an average lateral length of 6,326 feet. The Company expects to maintain the current rig and completion crew activity through the fourth quarter, placing 10 to 13 wells to sales.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| E&P Division Results | For the three months ended September 30, 2021 | | For the nine months ended September 30, 2021 | |

| Appalachia | | Haynesville | | Appalachia | | Haynesville | |

Gas production (Bcf) | 221 | | | 30 | | | 654 | | | 30 | | |

| Liquids production | | | | | | | | |

Oil (MBbls) | 1,722 | | | 2 | | | 5,206 | | | 2 | | |

NGL (MBbls) | 8,011 | | | — | | | 23,253 | | | — | | |

Production (Bcfe) | 280 | | | 30 | | | 825 | | | 30 | | |

| | | | | | | | |

Gross operated production September 2021 (MMcfe/d) | 4,147 | | | 1,325 | | | | | | |

Net operated production September 2021 (MMcfe/d) | 3,038 | | | 1,016 | | | | | | |

| | | | | | | | |

Capital investments ($ in millions) | | | | | | | | |

| Drilling and completions, including workovers | $ | 176 | | | $ | 52 | | | $ | 591 | | | $ | 52 | | |

| Land acquisition and other | 14 | | | 1 | | | 41 | | | 1 | | |

| Capitalized interest and expense | 34 | | | 6 | | | 109 | | | 6 | | |

| Total capital investments | $ | 224 | | | $ | 59 | | | $ | 741 | | | $ | 59 | | |

| | | | | | | | |

Gross operated well activity summary (1) | | | | | | | | |

| Drilled | 15 | | | 2 | | | 61 | | | 2 | | |

| Completed | 19 | | | 4 | | | 67 | | | 4 | | |

| Wells to sales | 19 | | | 5 | | | 67 | | | 5 | | |

| | | | | | | | |

| Total weighted average realized price per Mcfe, excluding derivatives | $ | 3.68 | | | $ | 4.33 | | (2) | $ | 2.96 | | | $ | 4.33 | | (2) |

(1)For Haynesville, represents wells drilled, completed and placed to sales by Southwestern Energy after the close of the acquisition on September 1, 2021.

(2)Haynesville weighted average realized price of $4.33 per Mcfe only includes sales beginning on September 1, 2021. The NYMEX Henry Hub price for September 2021 was $4.37 per MMBtu.

| | | | | | | | | | | | | | |

| Wells to sales summary | | For the three months ended September 30, 2021 |

| | Gross wells to sales | | Average lateral length |

| Appalachia | | | | |

| Super Rich Marcellus | | 5 | | | 14,473 | |

| Rich Marcellus | | 3 | | | 11,324 | |

| Dry Gas Utica | | 4 | | | 15,574 | |

| Dry Gas Marcellus | | 7 | | | 15,829 | |

Haynesville (1) | | 5 | | | 6,326 | |

| Total | | 24 | | | |

(1)Wells to sales following the close of the acquisition on September 1, 2021. Includes wells drilled and completed by previous operator.

Fourth Quarter 2021 Price Guidance

Based on current market conditions, Southwestern expects fourth quarter price differentials to be within the following ranges.

| | | | | |

Natural gas discount to NYMEX including transportation (1) | $0.52 – $0.62 per Mcf |

| Natural gas liquids realization as a % of WTI including transportation | 42% – 50% |

(1)Includes an estimated $0.03 to $0.06 per Mcfe gain on basis hedges.

Conference Call

Southwestern Energy will host a conference call on Thursday, November 4, 2021 at 10:00 a.m. Central to discuss third quarter 2021 results. To participate, dial US toll-free 877-883-0383, or international 412-902-6506 and enter access code 7695937. A live webcast will be available at ir.swn.com.

About Southwestern Energy

Southwestern Energy Company (NYSE: SWN) is a leading U.S. producer of natural gas and natural gas liquids focused on responsibly developing large-scale energy assets in the nation’s most prolific shale gas basins. SWN’s returns-driven strategy strives to create sustainable value for its stakeholders by leveraging its scale, financial strength and operational execution. For additional information, please visit www.swn.com and www.swn.com/responsibility.

Investor Contact

Brittany Raiford

Director, Investor Relations

(832) 796-7906

brittany_raiford@swn.com

Forward Looking Statement

Certain statements and information in this news release may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act, as amended. The words “believe,” “expect,” “anticipate,” “plan,” "predict," “intend,” "seek," “foresee,” “should,” “would,” “could,” “attempt,” “appears,” “forecast,” “outlook,” “estimate,” “project,” “potential,” “may,” “will,” “likely,” “guidance,” “goal,” “model,” “target,” “budget” and other similar expressions are intended to identify forward-looking statements, which are generally not historical in nature. Statements may be forward looking even in the absence of these particular words. Examples of forward-looking statements include, but are not limited to our financial position, business strategy, production, reserve growth and other plans and objectives for our future operations, and generation of free cash flow. These forward-looking statements are based on our current expectations and beliefs concerning future developments and their potential effect on us. The forward-looking statements contained in this document are largely based on our expectations for the future, which reflect certain estimates and assumptions made by our management. These estimates and assumptions reflect our best judgment based on currently known market conditions, operating trends, and other factors. Although we believe such estimates and assumptions to be reasonable, they are inherently uncertain and involve a number of risks and uncertainties that are beyond our control. As such, management’s assumptions about future events may prove to be inaccurate. For a more detailed description of the risks and uncertainties involved, see “Risk Factors” in our most recently filed Annual Report on Form 10-K, subsequent Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other SEC filings. We do not intend to publicly update or revise any forward-looking statements as a result of new information, future events, changes in circumstances, or otherwise. These cautionary statements qualify all forward-looking statements attributable to us, or persons acting on our behalf. Management cautions you that the forward-looking statements contained herein are not

guarantees of future performance, and we cannot assure you that such statements will be realized or that the events and circumstances they describe will occur. Factors that could cause actual results to differ materially from those anticipated or implied in the forward-looking statements herein include, but are not limited to: the timing and extent of changes in market conditions and prices for natural gas, oil and natural gas liquids (“NGLs”), including regional basis differentials and the impact of reduced demand for our production and products in which our production is a component due to governmental and societal actions taken in response to COVID-19 or other public health crises and any related company or governmental policies and actions to protect the health and safety of individuals or governmental policies or actions to maintain the functioning of national or global economies and markets; our ability to fund our planned capital investments; a change in our credit rating, an increase in interest rates and any adverse impacts from the discontinuation of the London Interbank Offered Rate; the extent to which lower commodity prices impact our ability to service or refinance our existing debt; the impact of volatility in the financial markets or other global economic factors; difficulties in appropriately allocating capital and resources among our strategic opportunities; the timing and extent of our success in discovering, developing, producing and estimating reserves; our ability to maintain leases that may expire if production is not established or profitably maintained; our ability to transport our production to the most favorable markets or at all; the impact of government regulation, including changes in law, the ability to obtain and maintain permits, any increase in severance or similar taxes, and legislation or regulation relating to hydraulic fracturing, climate and over-the-counter derivatives; the impact of the adverse outcome of any material litigation against us or judicial decisions that affect us or our industry generally; the effects of weather; increased competition; the financial impact of accounting regulations and critical accounting policies; the comparative cost of alternative fuels; credit risk relating to the risk of loss as a result of non-performance by our counterparties; and any other factors listed in the reports we have filed and may file with the SEC that are incorporated by reference herein. All written and oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary statement.

Use of Non-GAAP Information

This news release contains non-GAAP financial measures, such as net cash flow, free cash flow, net debt and adjusted EBITDA, including certain key statistics and estimates. We report our financial results in accordance with accounting principles generally accepted in the United States of America (“GAAP”). However, management believes certain non-GAAP performance measures may provide users of this financial information additional meaningful comparisons between current results and the results of our peers and of prior periods. Please see below for definitions of the non-GAAP financial measures that are based on reconcilable historical information.

Use of Projections

The financial, operational, industry and market projections, estimates and targets in this news release are forward-looking statements that are based on assumptions that are inherently subject to significant uncertainties and contingencies, many of which are beyond SWN's control. The assumptions and estimates underlying the projected, expected or target results are inherently uncertain and are subject to a wide variety of

significant business, economic, regulatory and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the financial, operational, industry and market projections, estimates and targets, including assumptions, risks and uncertainties described in "Forward-looking Statements" above.

###

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| SOUTHWESTERN ENERGY COMPANY AND SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF OPERATIONS |

| (Unaudited) |

| | | | | | | | |

| | For the three months ended | | For the nine months ended |

| | September 30, | | September 30, |

| (in millions, except share/per share amounts) | | 2021 | | 2020 | | 2021 | | 2020 |

| Operating Revenues: | | | | | | | | |

| Gas sales | | $ | 811 | | | $ | 199 | | | $ | 1,708 | | | $ | 611 | |

| Oil sales | | 110 | | | 40 | | | 297 | | | 111 | |

| NGL sales | | 255 | | | 68 | | | 607 | | | 158 | |

| Marketing | | 418 | | | 219 | | | 1,102 | | | 645 | |

| Other | | 4 | | | 1 | | | 6 | | | 4 | |

| | 1,598 | | | 527 | | | 3,720 | | | 1,529 | |

| Operating Costs and Expenses: | | | | | | | | |

| Marketing purchases | | 420 | | | 226 | | | 1,109 | | | 675 | |

| Operating expenses | | 296 | | | 202 | | | 805 | | | 577 | |

| General and administrative expenses | | 32 | | | 31 | | | 104 | | | 89 | |

| Merger-related expenses | | 35 | | | 3 | | | 39 | | | 3 | |

| Restructuring charges | | — | | | — | | | 7 | | | 12 | |

| | | | | | | | |

| Depreciation, depletion and amortization | | 138 | | | 70 | | | 334 | | | 267 | |

| Impairments | | 6 | | | 361 | | | 6 | | | 2,495 | |

| Taxes, other than income taxes | | 35 | | | 15 | | | 86 | | | 38 | |

| | 962 | | | 908 | | | 2,490 | | | 4,156 | |

| Operating Income (Loss) | | 636 | | | (381) | | | 1,230 | | | (2,627) | |

| Interest Expense: | | | | | | | | |

| Interest on debt | | 56 | | | 43 | | | 154 | | | 123 | |

| Other interest charges | | 3 | | | 2 | | | 9 | | | 7 | |

| Interest capitalized | | (25) | | | (23) | | | (68) | | | (67) | |

| | 34 | | | 22 | | | 95 | | | 63 | |

| | | | | | | | |

| Gain (Loss) on Derivatives | | (2,399) | | | (192) | | | (3,461) | | | 38 | |

| Gain (Loss) on Early Extinguishment of Debt | | (59) | | | — | | | (59) | | | 35 | |

| Other Income (Loss), Net | | (1) | | | 2 | | | (1) | | | 3 | |

| | | | | | | | |

| Loss Before Income Taxes | | (1,857) | | | (593) | | | (2,386) | | | (2,614) | |

| Provision (Benefit) for Income Taxes | | | | | | | | |

| Current | | — | | | — | | | — | | | (2) | |

| Deferred | | — | | | — | | | — | | | 408 | |

| | — | | | — | | | — | | | 406 | |

| Net Loss | | $ | (1,857) | | | $ | (593) | | | $ | (2,386) | | | $ | (3,020) | |

| | | | | | | | |

| | | | | | | | |

| Loss Per Common Share | | | | | | | | |

| Basic | | $ | (2.36) | | | $ | (1.04) | | | $ | (3.34) | | | $ | (5.48) | |

| Diluted | | $ | (2.36) | | | $ | (1.04) | | | $ | (3.34) | | | $ | (5.48) | |

| | | | | | | | |

| Weighted Average Common Shares Outstanding: | | | | | | | | |

| Basic | | 787,032,414 | | | 571,872,413 | | | 713,455,662 | | | 551,162,559 | |

| Diluted | | 787,032,414 | | | 571,872,413 | | | 713,455,662 | | | 551,162,559 | |

| | | | | | | | | | | | | | |

| SOUTHWESTERN ENERGY COMPANY AND SUBSIDIARIES |

| CONSOLIDATED BALANCE SHEETS |

| (Unaudited) |

| | September 30, 2021 | | December 31, 2020 |

| ASSETS | | (in millions) |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 12 | | | $ | 13 | |

| Accounts receivable, net | | 708 | | | 368 | |

| Derivative assets | | 130 | | | 241 | |

| Other current assets | | 52 | | | 49 | |

| Total current assets | | 902 | | | 671 | |

| Natural gas and oil properties, using the full cost method | | 31,486 | | | 27,261 | |

| | | | |

| Other | | 503 | | | 523 | |

| Less: Accumulated depreciation, depletion and amortization | | (23,987) | | | (23,673) | |

| Total property and equipment, net | | 8,002 | | | 4,111 | |

| Operating lease assets | | 144 | | | 163 | |

| Deferred tax assets | | — | | | — | |

| Other long-term assets | | 193 | | | 215 | |

| Total long-term assets | | 337 | | | 378 | |

| TOTAL ASSETS | | $ | 9,241 | | | $ | 5,160 | |

| LIABILITIES AND EQUITY | | | | |

| Current liabilities: | | | | |

| | | | |

| Current portion of long-term debt | | $ | 201 | | | $ | — | |

| Accounts payable | | 955 | | | 573 | |

| Taxes payable | | 78 | | | 74 | |

| Interest payable | | 42 | | | 58 | |

| | | | |

| Derivative liabilities | | 2,769 | | | 245 | |

| Current operating lease liabilities | | 41 | | | 42 | |

| Other current liabilities | | 76 | | | 20 | |

| Total current liabilities | | 4,162 | | | 1,012 | |

| Long-term debt | | 4,036 | | | 3,150 | |

| Long-term operating lease liabilities | | 101 | | | 117 | |

| Long-term derivative liabilities | | 960 | | | 183 | |

| Pension and other postretirement liabilities | | 31 | | | 45 | |

| Other long-term liabilities | | 237 | | | 156 | |

| Total long-term liabilities | | 5,365 | | | 3,651 | |

| Commitments and contingencies | | | | |

| Equity: | | | | |

| Common stock, $0.01 par value; 2,500,000,000 shares authorized; issued 1,059,331,421 shares as of September 30, 2021 and 718,795,700 shares as of December 31, 2020 | | 11 | | | 7 | |

| | | | |

| Additional paid-in capital | | 6,688 | | | 5,093 | |

| Accumulated deficit | | (6,749) | | | (4,363) | |

| Accumulated other comprehensive loss | | (34) | | | (38) | |

| Common stock in treasury, 44,353,224 shares as of September 30, 2021 and December 31, 2020 | | (202) | | | (202) | |

| Total equity/(deficit) | | (286) | | | 497 | |

| TOTAL LIABILITIES AND EQUITY | | $ | 9,241 | | | $ | 5,160 | |

| | | | | | | | | | | | | | |

| SOUTHWESTERN ENERGY COMPANY AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

| (Unaudited) |

| | For the nine months ended |

| | September 30, |

| (in millions) | | 2021 | | 2020 |

| Cash Flows From Operating Activities: | | | | |

| Net loss | | $ | (2,386) | | | $ | (3,020) | |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | | |

| Depreciation, depletion and amortization | | 334 | | | 267 | |

| Amortization of debt issuance costs | | 6 | | | 6 | |

| Impairments | | 6 | | | 2,495 | |

| Deferred income taxes | | — | | | 408 | |

| Loss on derivatives, unsettled | | 2,952 | | | 272 | |

| Stock-based compensation | | 2 | | | 2 | |

| (Gain) loss on early extinguishment of debt | | 59 | | | (35) | |

| | | | |

| Other | | 3 | | | 3 | |

| Change in assets and liabilities: | | | | |

| Accounts receivable | | (147) | | | 106 | |

| Accounts payable | | 58 | | | (129) | |

| Taxes payable | | (10) | | | (12) | |

| Interest payable | | (13) | | | 3 | |

| Inventories | | (2) | | | 3 | |

| Other assets and liabilities | | (32) | | | 38 | |

| Net cash provided by operating activities | | 830 | | | 407 | |

| | | | |

| Cash Flows From Investing Activities: | | | | |

| Capital investments | | (747) | | | (700) | |

| Proceeds from sale of property and equipment | | 4 | | | 2 | |

| Cash acquired in Indigo Acquisition | | 55 | | | — | |

| Cash paid in Indigo Acquisition | | (373) | | | — | |

| Other | | (1) | | | — | |

| | | | |

| Net cash used in investing activities | | (1,062) | | | (698) | |

| | | | |

| Cash Flows From Financing Activities: | | | | |

| | | | |

| Payments on long-term debt | | (844) | | | (72) | |

| Payments on revolving credit facility | | (3,401) | | | (1,449) | |

| Borrowings under revolving credit facility | | 3,366 | | | 1,415 | |

| Change in bank drafts outstanding | | 33 | | | (9) | |

| | | | |

| Repayment of Indigo revolving credit facility | | (95) | | | — | |

| Proceeds from issuance of long-term debt | | 1,200 | | | 350 | |

| Debt issuance/amendment costs | | (25) | | | (5) | |

| Proceeds from issuance of common stock, net | | — | | | 152 | |

| Cash paid for tax withholding | | (3) | | | (1) | |

| | | | |

| Net cash provided by financing activities | | 231 | | | 381 | |

| | | | |

| Increase (decrease) in cash and cash equivalents | | (1) | | | 90 | |

| Cash and cash equivalents at beginning of year | | 13 | | | 5 | |

| Cash and cash equivalents at end of period | | $ | 12 | | | $ | 95 | |

Hedging Summary

A detailed breakdown of derivative financial instruments and financial basis positions as of September 30, 2021 is shown below. Please refer to the Company’s quarterly report on Form 10-Q to be filed with the Securities and Exchange Commission for complete information on the Company’s commodity, basis and interest rate protection.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Weighted Average Price per MMBtu |

| Volume | | | | Sold | | Purchased | | Sold |

| (Bcf) | | Swaps | | Puts | | Puts | | Calls |

| Natural gas | | | | | | | | | |

| 2021 | | | | | | | | | |

| Fixed price swaps | 102 | | | $ | 2.83 | | | $ | — | | | $ | — | | | $ | — | |

| Two-way costless collars | 88 | | | — | | | — | | | 2.70 | | | 3.04 | |

| Three-way costless collars | 84 | | | — | | | 2.19 | | | 2.54 | | | 2.91 | |

| Total | 274 | | | | | | | | | |

| 2022 | | | | | | | | | |

| Fixed price swaps | 539 | | | $ | 2.77 | | | $ | — | | | $ | — | | | $ | — | |

| Two-way costless collars | 141 | | | — | | | — | | | 2.66 | | | 3.06 | |

| Three-way costless collars | 333 | | | — | | | 2.06 | | | 2.51 | | | 2.94 | |

| Total | 1,013 | | | | | | | | | |

| 2023 | | | | | | | | | |

| Fixed price swaps | 274 | | | $ | 2.76 | | | $ | — | | | $ | — | | | $ | — | |

| Two-way costless collars | 83 | | | — | | | — | | | 2.69 | | | 2.92 | |

| Three-way costless collars | 215 | | | — | | | 2.09 | | | 2.54 | | | 3.00 | |

| Total | 572 | | | | | | | | | |

| 2024 | | | | | | | | | |

| Fixed price swaps | 57 | | | $ | 2.43 | | | $ | — | | | $ | — | | | $ | — | |

| Three-way costless collars | 11 | | | — | | | 2.25 | | | 2.80 | | | 3.54 | |

| Total | 68 | | | | | | | | | |

| | | | | | | | | | | | | | |

| | Volume | | Weighted Average Strike Price |

| | (Bcf) | | ($/MMBtu) |

| Call Options – Natural Gas (Net) | | | | |

| 2021 | | 19 | | | $ | 3.19 | |

| 2022 | | 77 | | | $ | 3.00 | |

| 2023 | | 46 | | | $ | 2.94 | |

| 2024 | | 9 | | | $ | 3.00 | |

| Total | | 151 | | | |

| Swaptions – Natural Gas | | | | |

2021 (1) | | 18 | | | $ | 3.00 | |

(1)The Company has sold swaptions with an underlying tenor of January 2022 to December 2022, with an exercise date of December 23, 2021.

| | | | | | | | | | | | | | |

| Natural gas financial basis positions | | Volume | | Basis Differential |

| | (Bcf) | | ($/MMBtu) |

| Q4 2021 | | | | |

| Dominion South | | 28 | | | $ | (0.63) | |

| TCO | | 18 | | | $ | (0.49) | |

| TETCO M3 | | 25 | | | $ | 0.06 | |

| Total | | 71 | | | $ | (0.36) | |

| Q1 2022 | | | | |

| Dominion South | | 25 | | | $ | (0.59) | |

| TCO | | 18 | | | $ | (0.49) | |

| TETCO M3 | | 23 | | | $ | 1.27 | |

| Total | | 66 | | | $ | 0.07 | |

| Q2 2022 | | | | |

| Dominion South | | 33 | | | $ | (0.58) | |

| TCO | | 20 | | | $ | (0.50) | |

| TETCO M3 | | 24 | | | $ | (0.48) | |

| Total | | 77 | | | $ | (0.53) | |

| Q3 2022 | | | | |

| Dominion South | | 33 | | | $ | (0.58) | |

| TCO | | 21 | | | $ | (0.51) | |

| TETCO M3 | | 24 | | | $ | (0.49) | |

| Total | | 78 | | | $ | (0.54) | |

| Q4 2022 | | | | |

| Dominion South | | 27 | | | $ | (0.61) | |

| TCO | | 21 | | | $ | (0.51) | |

| TETCO M3 | | 15 | | | $ | (0.26) | |

| Total | | 63 | | | $ | (0.49) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Weighted Average Price per Bbl |

| Volume | | | | Sold | | Purchased | | Sold |

| (MBbls) | | Swaps | | Puts | | Puts | | Calls |

| Oil | | | | | | | | | |

| 2021 | | | | | | | | | |

| Fixed price swaps | 780 | | | $ | 48.94 | | | $ | — | | | $ | — | | | $ | — | |

| Two-way costless collars | 46 | | | — | | | — | | | 37.50 | | | 45.50 | |

| Three-way costless collars | 550 | | | — | | | 39.18 | | | 48.95 | | | 54.35 | |

| Total | 1,376 | | | | | | | | | |

| 2022 | | | | | | | | | |

| Fixed price swaps | 3,203 | | | $ | 53.54 | | | $ | — | | | $ | — | | | $ | — | |

| Three-way costless collars | 1,380 | | | — | | | 39.89 | | | 50.23 | | | 57.05 | |

| Total | 4,583 | | | | | | | | | |

| 2023 | | | | | | | | | |

| Fixed price swaps | 846 | | | $ | 55.98 | | | $ | — | | | $ | — | | | $ | — | |

| Three-way costless collars | 1,268 | | | — | | | 33.97 | | | 45.51 | | | 56.12 | |

| Total | 2,114 | | | | | | | | | |

| 2024 | | | | | | | | | |

| Fixed price swaps | 54 | | | $ | 53.15 | | | $ | — | | | $ | — | | | $ | — | |

| Ethane | | | | | | | | | |

| 2021 | | | | | | | | | |

| Fixed price swaps | 2,483 | | | $ | 9.74 | | | $ | — | | | $ | — | | | $ | — | |

| Two-way costless collars | 147 | | | — | | | — | | | 7.14 | | | 10.40 | |

| Total | 2,630 | | | | | | | | | |

| 2022 | | | | | | | | | |

| Fixed price swaps | 3,361 | | | $ | 10.01 | | | $ | — | | | $ | — | | | $ | — | |

| Two-way costless collars | 135 | | | — | | | — | | | 7.56 | | | 9.66 | |

| Total | 3,496 | | | | | | | | | |

| Propane | | | | | | | | | |

| 2021 | | | | | | | | | |

| Fixed price swaps | 2,107 | | | $ | 23.98 | | | $ | — | | | $ | — | | | $ | — | |

| 2022 | | | | | | | | | |

| Fixed price swaps | 4,471 | | | $ | 26.96 | | | $ | — | | | $ | — | | | $ | — | |

| Three-way costless collars | 305 | | | — | | | 16.80 | | | 21.00 | | | 31.92 | |

| Total | 4,776 | | | | | | | | | |

| Normal Butane | | | | | | | | | |

| 2021 | | | | | | | | | |

| Fixed price swaps | 617 | | | $ | 29.08 | | | $ | — | | | $ | — | | | $ | — | |

| 2022 | | | | | | | | | |

| Fixed price swaps | 1,295 | | | $ | 29.16 | | | $ | — | | | $ | — | | | $ | — | |

| Natural Gasoline | | | | | | | | | |

| 2021 | | | | | | | | | |

| Fixed price swaps | 635 | | | $ | 43.62 | | | $ | — | | | $ | — | | | $ | — | |

| 2022 | | | | | | | | | |

| Fixed price swaps | 1,256 | | | $ | 46.41 | | | $ | — | | | $ | — | | | $ | — | |

Explanation and Reconciliation of Non-GAAP Financial Measures

The Company reports its financial results in accordance with accounting principles generally accepted in the United States of America (“GAAP”). However, management believes certain non-GAAP performance measures may provide financial statement users with additional meaningful comparisons between current results, the results of its peers and of prior periods.

One such non-GAAP financial measure is net cash flow. Management presents this measure because (i) it is accepted as an indicator of an oil and gas exploration and production company’s ability to internally fund exploration and development activities and to service or incur additional debt, (ii) changes in operating assets and liabilities relate to the timing of cash receipts and disbursements which the Company may not control and (iii) changes in operating assets and liabilities may not relate to the period in which the operating activities occurred.

Another such non-GAAP financial measure is free cash flow, which is defined as cash provided by operating activities, adjusting for changes in operating assets and liabilities, merger-related expenses and restructuring charges, less total capital investment. Management presents this measure because it is accepted as an indicator of excess cash flow available to a company for the repayment of debt or for other general corporate purposes, including the possible return of capital to shareholders.

Additional non-GAAP financial measures the Company may present from time to time are net debt, adjusted net income, adjusted diluted earnings per share and adjusted EBITDA, all which exclude certain charges or amounts. Management presents these measures because (i) they are consistent with the manner in which the Company’s position and performance are measured relative to the position and performance of its peers, (ii) these measures are more comparable to earnings estimates provided by securities analysts, and (iii) charges or amounts excluded cannot be reasonably estimated and guidance provided by the Company excludes information regarding these types of items. These adjusted amounts are not a measure of financial performance under GAAP.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2021 | | 2020 | | 2021 | | 2020 |

| (in millions) |

| Adjusted net income: | |

| Net income (loss) | $ | (1,857) | | | $ | (593) | | | $ | (2,386) | | | $ | (3,020) | |

| Add back (deduct): | | | | | | | |

| Merger-related expenses | 35 | | | 3 | | | 39 | | | 3 | |

| Restructuring charges | — | | | — | | | 7 | | | 12 | |

| Impairments | 6 | | | 361 | | | 6 | | | 2,495 | |

| | | | | | | |

| Loss on unsettled derivatives | 2,011 | | | 289 | | | 2,952 | | | 272 | |

| (Gain) loss on early extinguishment of debt | 59 | | | — | | | 59 | | | (35) | |

| Legal settlement charges | — | | | 1 | | | — | | | 1 | |

| | | | | | | |

| Other loss | — | | | 1 | | | — | | | — | |

Adjustments due to discrete tax items (1) | 447 | | | 139 | | | 570 | | | 1,020 | |

| Tax impact on adjustments | (513) | | | (154) | | | (734) | | | (646) | |

| Adjusted net income | $ | 188 | | | $ | 47 | | | $ | 513 | | | $ | 102 | |

(1)2020 primarily relates to the recognition of a valuation allowance. The Company expects its 2021 income tax rate to be 24.3% before the impacts of any valuation allowance.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2021 | | 2020 | | 2021 | | 2020 |

| Adjusted diluted earnings per share: | | | | | | | |

| Diluted earnings (loss) per share | $ | (2.36) | | | $ | (1.04) | | | $ | (3.34) | | | $ | (5.48) | |

| Add back (deduct): | | | | | | | |

| Merger-related expenses | 0.05 | | | 0.01 | | | 0.05 | | | 0.01 | |

| Restructuring charges | — | | | — | | | 0.01 | | | 0.02 | |

| Impairments | 0.01 | | | 0.63 | | | 0.01 | | | 4.50 | |

| | | | | | | |

| Loss on unsettled derivatives | 2.54 | | | 0.50 | | | 4.12 | | | 0.50 | |

| (Gain) loss on early extinguishment of debt | 0.08 | | | — | | | 0.08 | | | (0.06) | |

| Legal settlement charges | — | | | 0.00 | | | — | | | 0.00 | |

| | | | | | | |

| Other loss | — | | | 0.00 | | | — | | | — | |

Adjustments due to discrete tax items (1) | 0.57 | | | 0.24 | | | 0.80 | | | 1.84 | |

| Tax impact on adjustments | (0.65) | | | (0.26) | | | (1.01) | | | (1.15) | |

| Adjusted diluted earnings per share | $ | 0.24 | | | $ | 0.08 | | | $ | 0.72 | | | $ | 0.18 | |

(1)2020 primarily relates to the recognition of a valuation allowance. The Company expects its 2021 income tax rate to be 24.3% before the impacts of any valuation allowance.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2021 | | 2020 | | 2021 | | 2020 |

| Net cash flow: | (in millions) |

| Net cash provided by operating activities | $ | 213 | | | $ | 153 | | | $ | 830 | | | $ | 407 | |

| Add back (deduct): | | | | | | | |

| Changes in operating assets and liabilities | 148 | | | (21) | | | 146 | | | (9) | |

| Merger-related expenses | 35 | | | 3 | | | 39 | | | 3 | |

| Restructuring charges | — | | | — | | | 7 | | | 12 | |

| Net cash flow | $ | 396 | | | $ | 135 | | | $ | 1,022 | | | $ | 413 | |

| | | | | | | | | | | |

| Three Months Ended

September 30, 2021 | | | | |

| Free cash flow: | (in millions) | | | | | | |

| Net cash flow (as shown above) | $ | 396 | | | | | | | |

| Subtract: | | | | | | | |

| Total capital investments | (291) | | | | | | | |

| Free cash flow | $ | 105 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2021 | | 2020 | | 2021 | | 2020 |

| Adjusted EBITDA: | (in millions) |

| Net loss | $ | (1,857) | | | $ | (593) | | | $ | (2,386) | | | $ | (3,020) | |

| Add back (deduct): | | | | | | | |

| Interest expense | 34 | | | 22 | | | 95 | | | 63 | |

| Provision (benefit) for income taxes | — | | | — | | | — | | | 406 | |

| Depreciation, depletion and amortization | 138 | | | 70 | | | 334 | | | 267 | |

| Merger-related expenses | 35 | | | 3 | | | 39 | | | 3 | |

| Restructuring charges | — | | | — | | | 7 | | | 12 | |

| Impairments | 6 | | | 361 | | | 6 | | | 2,495 | |

| Loss on unsettled derivatives | 2,011 | | | 289 | | | 2,952 | | | 272 | |

| (Gain) loss on early extinguishment of debt | 59 | | | — | | | 59 | | | (35) | |

| Legal settlement charges | — | | | 1 | | | — | | | 1 | |

| Stock based compensation expense | — | | | — | | | 2 | | | 2 | |

| Other loss | — | | | 1 | | | — | | | — | |

| Adjusted EBITDA | $ | 426 | | | $ | 154 | | | $ | 1,108 | | | $ | 466 | |

| | | | | | | | |

| | September 30, 2021 |

| Net debt: | | (in millions) |

Total debt (1) | | $ | 4,245 | |

| Subtract: | | |

| Cash and cash equivalents | | (12) | |

| Net debt | | $ | 4,233 | |

(1)Does not include $8 million of unamortized debt premium and issuance expense.

| | | | | | | | |

| | September 30, 2021 |

| Net debt to Adjusted EBITDA: | | (in millions) |

| Net debt | | $ | 4,233 | |

Adjusted EBITDA (1) | | $ | 1,897 | |

| Net debt to Adjusted EBITDA | | 2.2x |

(1)Adjusted EBITDA of $1,897 million for the twelve months ended September 30, 2021 includes $8 million of adjusted EBITDA generated by Indigo Natural Resources prior to the September 2021 acquisition and $505 million of adjusted EBITDA generated by Montage Resources prior to the November 2020 acquisition.

v3.21.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe end date of the period reflected on the cover page if a periodic report. For all other reports and registration statements containing historical data, it is the date up through which that historical data is presented. If there is no historical data in the report, use the filing date. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation 12B

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation 12B

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation 12B

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation 12B

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

This regulatory filing also includes additional resources:

swn20211103x8k.pdf

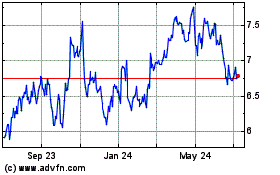

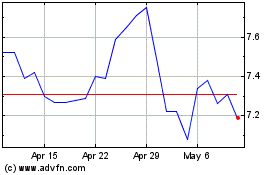

Southwestern Energy (NYSE:SWN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Southwestern Energy (NYSE:SWN)

Historical Stock Chart

From Apr 2023 to Apr 2024