As filed with the Securities and Exchange Commission on December 6, 2023

Registration No. 333-

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________________________

Form S-3

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

___________________________

SERVICE CORPORATION INTERNATIONAL

(Exact name of registrant as specified in its charter)

___________________________

| | | | | | | | |

| | |

| Texas | | 74-1488375 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

1929 Allen Parkway

Houston, Texas 77019

(713) 522-5141

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

___________________________

Lori Spilde

Senior Vice President, General Counsel and Secretary

1929 Allen Parkway

Houston, Texas 77019

(713) 522-5141

(Name, address, including zip code, and telephone number, including area code, of agent for service)

___________________________

Copies to:

Jamie L. Yarbrough

Baker Botts L.L.P.

910 Louisiana Street

Houston, Texas 77002

(713) 229-1234

___________________________

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of the Registration Statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☒

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | (Do not check if a smaller reporting company) | Smaller reporting company | ☐ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

Service Corporation International

Debt Securities

We may offer and sell from time to time our debt securities in one or more offerings pursuant to this prospectus. The debt securities may consist of debentures, notes or other types of debt.

We will provide the specific terms and manner of any offering in a supplement to this prospectus. Any prospectus supplement may add, update, or change information contained in this prospectus. You should carefully read this prospectus and the applicable prospectus supplement as well as the documents incorporated or deemed to be incorporated in this prospectus or the applicable prospectus supplement before you purchase any of the debt securities offered hereby.

The names of any underwriters, dealers, or agents involved in the sale of our debt securities and their compensation will be described in the applicable prospectus supplement. Our net proceeds from the sale of our debt securities also will be described in the applicable prospectus supplement.

Our common stock is listed on the New York Stock Exchange under the symbol “SCI.” Unless we state otherwise in a prospectus supplement, we will not list any securities sold by us under this prospectus and any prospectus supplement on any securities exchange.

Investing in these securities involves certain risks. You should consider the risks that we have described in this prospectus and in the accompanying prospectus supplement before you invest. See “Risk Factors” on page 2 of this prospectus. NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS OR ANY ACCOMPANYING PROSPECTUS SUPPLEMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is December 6, 2023.

About This Prospectus

This prospectus is part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission (the “SEC”), utilizing a “shelf” registration process. Under this shelf process, we may offer and sell our debt securities from time to time in one or more offerings.

This prospectus provides you with a general description of the debt securities we may offer. Each time that we sell our debt securities under this prospectus, we will provide a prospectus supplement that will contain specific information about the terms of that offering. The prospectus supplement may add, update, or change information contained in this prospectus. You should read both this prospectus and the prospectus supplement related to any offering as well as additional information described under the headings “Where You Can Find More Information” and “Incorporation of Certain Information by Reference.”

We have not authorized anyone to provide you with information different from that contained or incorporated by reference in this prospectus or any accompanying prospectus supplement or any “free writing prospectus.” If anyone provides you with different or inconsistent information, you should not rely on it as having been authorized by us. The information contained in this prospectus and in any accompanying prospectus supplement is accurate only as of the date thereof as set forth on their covers, regardless of the time of delivery of this prospectus or any prospectus supplement or of any sale of our debt securities. Our business, financial condition, results of operations, and prospects may have changed since those dates. To the extent there is a conflict between the information contained in this prospectus and the prospectus supplement, you should rely on the information in the prospectus supplement, provided that if any statement in one of these documents is inconsistent with a statement in another document having a later date – for example, a document incorporated by reference into this prospectus or any prospectus supplement – the statement in the document having the later date modifies or supersedes the earlier statement. We are offering to sell, and seeking offers to buy, our debt securities only in jurisdictions where offers and sales are permitted.

In this prospectus, the terms “SCI,” the “Company,” “we,” “our,” and “us” refer to Service Corporation International and its subsidiaries, unless otherwise specified.

Our Company

Service Corporation International is North America’s largest provider of deathcare products and services, with a network of funeral service locations and cemeteries unequaled in geographic scale. At September 30, 2023, we operated 1,486 funeral service locations and 489 cemeteries (including 304 funeral service/cemetery combination locations), which are geographically diversified across 44 states, eight Canadian provinces, the District of Columbia, and Puerto Rico.

We are well known for our Dignity Memorial® brand, North America's first transcontinental brand of deathcare products and services. Our other brands include Dignity Planning™, National Cremation Society®, Advantage® Funeral and Cremation Services, Funeraria del Angel™, Making Everlasting Memories®, Neptune Society™ and Trident Society™. Our funeral service and cemetery operations consist of funeral service locations, cemeteries, funeral service/cemetery combination locations, crematoria, and other related businesses, which enable us to serve a wide array of customer needs. We sell cemetery property and funeral and cemetery merchandise and services at the time of need and on a preneed basis.

We were incorporated in Texas in July of 1962. Our principal executive offices are located at 1929 Allen Parkway, Houston, Texas 77019. Our telephone number at that address is (713) 522-5141. Our website is located at www.sci-corp.com. Other than as described in “Where You Can Find More Information” and “Incorporation of Certain Information by Reference” below, the information on, or that can be accessed through, our website is not incorporated by reference in this prospectus or any prospectus supplement, and you should not consider it to be a part of this prospectus or any prospectus supplement. Our website address is included as an inactive textual reference only.

Risk Factors

Investing in our debt securities involves a high degree of risk. Please see the risk factors described under the caption “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 on file with the SEC, as updated by our subsequent quarterly reports on Form 10-Q and certain other filings we make with the SEC, which are incorporated by reference in this prospectus and in any accompanying prospectus supplement. Before making an investment decision, you should carefully consider these risks as well as information we include or incorporate by reference in this prospectus and in any accompanying prospectus supplement. The risks and uncertainties we have described are not the only ones facing our company. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business operations.

Cautionary Statement on Forward-Looking Statements

The statements in this prospectus and the documents incorporated by reference into this prospectus that are not historical facts are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, made in reliance on the “safe harbor” protections provided under the Private Securities Litigation Reform Act of 1995. These statements may be accompanied by words such as “believe”, “estimate”, “project”, “expect”, “anticipate”, or “predict” that convey the uncertainty of future events or outcomes. These statements are based on assumptions that we believe are reasonable; however, many important factors could cause our actual results in the future to differ materially from the forward-looking statements made herein and in any other documents or oral presentations made by, or on behalf of, the Company. These factors include, among others, the following:

•Our affiliated trust funds own investments in securities, which are affected by market conditions that are beyond our control.

• We may be required to replenish our affiliated funeral and cemetery trust funds to meet minimum funding requirements, which would have a negative effect on our earnings and cash flow.

• Our ability to execute our strategic plan depends on many factors, some of which are beyond our control.

• We may be adversely affected by the effects of inflation.

• Our results may be adversely affected by significant weather events, natural disasters, catastrophic events or public health crises.

• Our credit agreements contain covenants that may prevent us from engaging in certain transactions.

• If we lost the ability to use surety bonding to support our preneed activities, we may be required to make material cash payments to fund certain trust funds.

• Increasing death benefits related to preneed contracts funded through life insurance or annuity contracts may not cover future increases in the cost of providing a price-guaranteed service.

• The financial condition of third-party life insurance companies that fund our preneed contracts may impact our future revenue.

• Unfavorable publicity could affect our reputation and business.

• Our failure to attract and retain qualified sales personnel could have an adverse effect on our business and financial condition.

• We use a combination of insurance, self-insurance, and large deductibles in managing our exposure to certain inherent risks; therefore, we could be exposed to unexpected costs that could negatively affect our financial performance.

• Declines in overall economic conditions beyond our control could reduce future potential earnings and cash flows and could result in future impairments to goodwill and/or other intangible assets.

• Any failure to maintain the security of the information relating to our customers, their loved ones, our associates, and our vendors could damage our reputation, could cause us to incur substantial additional costs and to become subject to litigation, and could adversely affect our operating results, financial condition, or cash flow.

• Our Canadian business exposes us to operational, economic, and currency risks.

• Our level of indebtedness could adversely affect our ability to raise additional capital to fund our operations, limit our ability to react to changes in the economy or our industry, and may prevent us from fulfilling our obligations under our indebtedness.

• A failure of a key information technology system or process could disrupt and adversely affect our business.

• Failure to maintain effective internal control over financial reporting could adversely affect our results of operations, investor confidence, and our stock price.

• The funeral and cemetery industry is competitive.

• If the number of deaths in our markets declines, our cash flows and revenue may decrease. Changes in the number of deaths are not predictable from market to market or over the short term.

• If we are not able to respond effectively to changing consumer preferences, our market share, revenue, and/or profitability could decrease.

• The continuing upward trend in the number of cremations performed in North America could result in lower revenue, operating profit, and cash flows.

• Our funeral and cemetery businesses are high fixed-cost businesses.

• Risks associated with our supply chain could materially adversely affect our financial performance.

• Regulation and compliance could have a material adverse impact on our financial results.

• Unfavorable results of litigation could have a material adverse impact on our financial statements.

• Cemetery burial practice claims could have a material adverse impact on our financial results.

• The application of unclaimed property laws by certain states to our preneed funeral and cemetery backlog could have a material adverse impact on our liquidity, cash flows, and financial results.

• Changes in taxation as well as the inherent difficulty in quantifying potential tax effects of business decisions could have a material adverse effect on the results of our operations, financial condition, or cash flows.

These and other factors are discussed under the heading “Risk Factors” and elsewhere in our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q filed with the SEC. We also may include or incorporate by reference in each prospectus supplement additional important factors that we believe could cause actual results or events to differ materially from the forward-looking statements that we make.

Should one or more known or unknown risks or uncertainties materialize, or should underlying assumptions prove inaccurate, actual results could differ materially from past results and those anticipated, estimated, projected, or implied by these forward-looking statements. You should consider these factors and the other cautionary statements made in this prospectus, any prospectus supplement or the documents we incorporate by reference in this prospectus as being applicable to all related forward-looking statements wherever they appear in this prospectus, any prospectus supplement or the documents incorporated by reference. While we may elect to update forward-looking statements wherever they appear in this prospectus, any prospectus supplement or the documents incorporated by reference, we do not assume, and specifically disclaim, any obligation to do so, whether as a result of new information, future events, or otherwise.

Use of Proceeds

Except as may be otherwise set forth in any prospectus supplement accompanying this prospectus, we intend to use the net proceeds we receive from sales of our securities offered hereby for general corporate purposes, which may include the repayment of indebtedness outstanding from time to time and for working capital, capital expenditures, acquisitions and repurchases of our securities. Pending these uses, the net proceeds may also be temporarily invested in short-term securities. Any specific allocations of the proceeds to a particular purpose that has been made at the date of any prospectus supplement will be described therein.

Description of Debt Securities

The debt securities covered by this prospectus will be issued under our Senior Indenture dated February 1, 1993, as amended and supplemented from time to time, between us and The Bank of New York Mellon Trust Company, N.A., as successor trustee to The Bank of New York, as trustee (the “Indenture”), a copy of which has been incorporated into the registration statement of which this prospectus is a part. The particular terms of the debt securities offered will be outlined in a prospectus supplement. The discussion of such terms in the prospectus supplement is subject to, and qualified in its entirety by, reference to all provisions of the Indenture and any applicable supplemental indenture.

Plan of Distribution

We may offer and sell these debt securities through one or more underwriters, dealers or agents, or directly to one or more purchasers, or through a combination of any of these methods of sale. We will provide the specific plan of distribution for any debt securities to be offered in a prospectus supplement.

Legal Matters

The validity of the debt securities offered hereby and certain other legal matters in connection with the sale of the debt securities will be passed upon for us by Baker Botts L.L.P., Houston, Texas, and Lori Spilde, general counsel to the Company. Certain legal matters in connection with the sale of the debt securities will be passed upon for any underwriters or agents by counsel named in the applicable prospectus supplement. Lori Spilde is paid a salary by our company and participates in various employee benefit plans offered by us, including equity-based plans.

Experts

The financial statements and management’s assessment of the effectiveness of internal control over financial reporting (which is included in Management’s Report on Internal Control over Financial Reporting) incorporated in this Prospectus by reference to the Annual Report on Form 10-K for the year ended December 31, 2022 have been so incorporated in reliance on the report of PricewaterhouseCoopers LLP, an independent registered public accounting firm, given on the authority of said firm as experts in auditing and accounting.

Where You Can Find More Information

We file annual, quarterly, and current reports, proxy statements, and other information with the SEC under the Securities Exchange Act of 1934, as amended, or the Exchange Act. Through our website at www.sci-corp.com, you may access, free of charge, our filings, shortly after we electronically file them with or furnish them to the SEC. Other information contained in our website is not incorporated by reference in, and should not be considered a part of, this prospectus or any accompanying prospectus supplement. Our SEC filings are also available to the public from the SEC’s website at www.sec.gov.

This prospectus is part of a registration statement on Form S-3 that we filed with the SEC to register the securities offered hereby under the Securities Act of 1933, as amended, or the Securities Act. This prospectus does not contain all of the information included in the registration statement, including certain exhibits and schedules. You may obtain the registration statement and exhibits to the registration statement in any manner noted above.

Incorporation of Certain Information by Reference

The SEC allows us to incorporate by reference the information we file with the SEC, which means that we can disclose important information to you by referring you to those documents. The information that we incorporate by reference is considered to be part of this prospectus. Information that we file with the SEC in the future and incorporate by reference in this prospectus automatically updates and supersedes previously filed information as applicable.

We incorporate by reference into this prospectus the following documents filed by us with the SEC, other than any portions of any such documents that are not deemed “filed” under the Exchange Act in accordance with the Exchange Act and applicable SEC rules:

•Annual Report on Form 10-K for the year ended December 31, 2022 (including those sections incorporated by reference from our Proxy Statement filed with the SEC on March 23, 2023). •All documents filed by us in the future under Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act until all of the securities registered under this prospectus or any accompanying prospectus supplement are sold, other than any portions of any such documents that are not deemed “filed” under the Exchange Act in accordance with the Exchange Act and applicable SEC rules.

You may obtain a copy of these filings at no cost, by writing or telephoning us as follows:

Service Corporation International

Attention: General Counsel

1929 Allen Parkway

Houston, Texas 77019

(713) 522-5141

Any statement contained in a document that is incorporated by reference will be modified or superseded for all purposes to the extent that a statement contained in this prospectus or any accompanying prospectus supplement, or in any other document that is subsequently filed with the SEC and incorporated by reference, modifies, or is contrary to that previous statement. Any statement so modified or superseded will not be deemed a part of this prospectus or any accompanying prospectus supplement, except as so modified or superseded. Since information that we later file with the SEC will update and supersede previously incorporated information, you should look at all of the SEC filings that we incorporate by reference to determine if any of the statements in this prospectus or any accompanying prospectus supplement or in any documents previously incorporated by reference have been modified or superseded.

| | |

PART II Information not required in prospectus |

Item 14. Other Expenses of Issuance and Distribution

The following table sets forth the estimated expenses (other than the underwriting discount) payable by the registrant in connection with the offering described in the registration statement. All of the amounts shown are estimates, except for the SEC registration fee:

| | | | | |

| Amount to

be Paid |

| SEC registration fee | $ (1) |

| Accountants’ fees and expenses | (2) |

| Legal fees and expenses | (2) |

| Printing and engraving expenses | (2) |

| Rating agency fees | (2) |

| Transfer agent fees | (2) |

| Trustee fees and expenses | (2) |

| Miscellaneous fees | (2) |

| Total | $ (2) |

(1) Deferred in accordance with Rules 456(b) and 457(r) under the Securities Act and will be paid at the time of any particular offering of securities under this registration statement.

(2) Estimated expenses are not presently known. The foregoing sets forth the general categories of expenses (other than the underwriting discount) that we anticipate we will incur in connection with the offering of securities under this registration statement. An estimate of the aggregate expenses in connection with the issuance and distribution of securities offered hereby will be included in the prospectus supplement applicable to such offering.

Item 15. Indemnification of Directors and Officers

Service Corporation International is a Texas corporation. Chapter 8 of the Texas Business Organization Code (the “TBOC”) provides that a corporation may indemnify any director or officer who was, is, or is threatened to be made a respondent in a proceeding because the person was or is a director or officer if it is determined that such person (1) conducted himself in good faith, (2) reasonably believed (a) in the case of conduct in his official capacity as a director or officer of the corporation, that his conduct was in the corporation’s best interest, or (b) in other cases, that his conduct was at least not opposed to the corporation’s best interests, and (3) in the case of any criminal proceeding, had no reasonable cause to believe that his conduct was unlawful. In addition, the TBOC requires a corporation to indemnify a director or officer for any action that such director or officer is wholly successful in defending on the merits.

Under the Company’s Restated Articles of Incorporation, as amended (the “Articles of Incorporation”), no director of the registrant will be liable to the registrant or any of its shareholders for monetary damages for an act or omission in the director’s capacity as a director, except for liability (i) for any breach of the director’s duty of loyalty to the registrant or its shareholders, (ii) for acts or omissions not in good faith or that involve intentional misconduct or a knowing violation of law, (iii) for any transaction for which the director received an improper benefit, whether or not the benefit resulted from an action taken within the scope of the director’s office, (iv) for acts or omissions for which the liability of a director is expressly provided by statute, or (v) for acts related to an unlawful stock repurchase or dividend payment. The Articles of Incorporation further provide that, if the statutes of Texas are amended to further limit the liability of a director, then the liability of the Company’s directors will be limited to the fullest extent permitted by any such provision.

The Company’s Bylaws provide for indemnification of officers and directors of the registrant and persons serving at the request of the registrant in such capacities for other business organizations against certain losses, costs, liabilities, and expenses incurred by reason of their positions with the registrant or such other business organizations. The Company also has policies insuring its officers and directors and certain officers and directors of its wholly owned subsidiaries against certain liabilities for actions taken in such capacities, including liabilities under the Securities Act of 1933, as amended (the “Act”). In addition, the Company has an Indemnification Agreement with each of its directors and officers providing for the indemnification of each such person to the fullest extent permitted by Texas law.

Item 16. Exhibits

| | | | | | | | | |

| Exhibit Number | | | Description |

| 1.1* | | — | Form of Underwriting Agreement |

| | — | |

| 4.2* | | — | Form of Debt Securities |

| | — | |

| | — | |

| | — | |

| | — | |

| | — | |

| | — | |

* To be filed by amendment or to be incorporated by reference to a report filed hereafter in connection with or prior to an offering of debt securities.

Item 17. Undertakings

(a) The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by section 10(a)(3) of the Securities Act of 1933;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement;

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

Provided, however, that paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) of this section do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to section 13 or section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser:

(A) Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(B) Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5) or (b)(7) as part of this registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii) or (x) for the purpose of providing the information required by section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

(5) That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution of securities, the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i) Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

(iii) The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

(iv) Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

(b) The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to section 13(a) or section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

Signatures

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the city of Houston, State of Texas, on the 6th day of December, 2023.

| | | | | | |

| SERVICE CORPORATION INTERNATIONAL |

| By: | /s/ LORI SPILDE |

| Name: | Lori Spilde |

| Title: | Senior Vice President, General Counsel and Secretary |

Power of Attorney

Each person whose signature appears below appoints Thomas L. Ryan and Lori Spilde, and each of them, any of whom may act without the joinder of the other, as his or her true and lawful attorneys-in-fact and agents, with full power of substitution and re-substitution, for him or her and in his or her name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments) to this registration statement and any registration statement (including any amendment thereto) and to file the same, with all exhibits thereto, and all other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents full power and authority to do and perform each and every act and thing requisite and necessary to be done, as fully to all intents and purposes as he might or would do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents, or any of them of their or his or her substitute and substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the date indicated.

| | | | | | | | | | | | | | | | | | | | |

| Signature | | Title | | Date |

| /s/ THOMAS L. RYAN | | President, Chief Executive Officer, and Chairman of the Board (Principal Executive Officer) | | December 6, 2023 |

| (Thomas L. Ryan) | | | |

| /s/ ERIC D. TANZBERGER | | Senior Vice President, Chief Financial Officer (Principal Financial Officer) | | December 6, 2023 |

| (Eric D. Tanzberger) | | | |

| /s/ TAMMY R. MOORE | | Vice President and Corporate Controller (Principal Accounting Officer) | | December 6, 2023 |

| (Tammy R. Moore) | | | |

| | | | |

| | | | |

| | | |

| /s/ MARCUS A. WATTS | | Lead Independent Director | | December 6, 2023 |

| Marcus A. Watts | | | | |

| /s/ ALAN R. BUCKWALTER, III | | Director | | December 6, 2023 |

| Alan R. Buckwalter, III | | | | |

| /s/ ANTHONY L. COELHO | | Director | | December 6, 2023 |

| Anthony L. Coelho | | | | |

| /s/ JAKKI L. HAUSSLER | | Director | | December 6, 2023 |

| Jakki L. Haussler | | | | |

| /s/ VICTOR L. LUND | | Director | | December 6, 2023 |

| Victor L. Lund | | | | |

| | | | |

| | | | |

| /s/ ELLEN OCHOA | | Director | | December 6, 2023 |

| Ellen Ochoa | | | | |

| /s/ C. PARK SHAPER | | Director | | December 6, 2023 |

| C. Park Shaper | | | | |

| /s/ SARA MARTINEZ TUCKER | | Director | | December 6, 2023 |

| Sara Martinez Tucker | | | | |

| /s/ W. BLAIR WALTRIP | | Director | | December 6, 2023 |

| W. Blair Waltrip | | | | |

Exhibit 107

Calculation of Filing Fee Tables

Form S-3

(Form Type)

Service Corporation International

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered and Carry Forward Securities

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Security

Type | | Security

Class Title | | Fee

Calculation

or Carry

Forward

Rule | | Amount

Registered | | | Proposed

Maximum

Offering

Price Per

Unit | | Maximum

Aggregate

Offering Price | | Fee Rate | | Amount of

Registration

Fee | | | Carry

Forward

Form

Type | | Carry

Forward

File

Number | | Carry

Forward

Initial

effective

date | | Filing Fee

Previously

Paid In

Connection

with Unsold

Securities to

be Carried

Forward |

| Newly Registered Securities |

Fees to Be Paid | | Debt | | Debt Securities | | Rule 457(r) | | | (1) | | | (1) | | (1) | | (2) | | | (2) | | | | | | | | | |

Fees Previously Paid | | N/A | | N/A | | N/A | | | N/A | | | N/A | | N/A | | | | | N/A | | | | | | | | | |

| Carry Forward Securities |

Carry Forward Securities | | N/A | | N/A | | N/A | | | N/A | | | | | N/A | | | | | | | | N/A | | N/A | | N/A | | N/A |

| | Total Offering Amounts | | | | | N/A | | | | | N/A | | | | | | | | | |

| | Total Fees Previously Paid | | | | | | | | | | N/A | | | | | | | | | |

| | Total Fee Offsets | | | | | | | | | | N/A | | | | | | | | | |

| | Net Fee Due | | | | | | | | | | N/A | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

| (1) | An indeterminate amount of securities to be offered at indeterminate prices from time to time is being registered pursuant to this Registration Statement. |

| (2) | The Registrant is relying on Rule 456(b) and Rule 457(r) under the Securities Act of 1933, as amended, to defer payment of all registration fees. In connection with the securities offered hereby, the Registrant will pay “pay-as-you-go registration fees” in accordance with Rule 456(b). The Registrant will calculate the registration fee applicable to an offer of securities pursuant to this Registration Statement based on the fee payment rate in effect on the date of such fee payment. |

EXHIBIT 5.1

| | | | | | | | |

| December 6, 2023 | | |

| | |

| Service Corporation International | | |

| 1929 Allen Parkway | |

| Houston, Texas 77019 | |

Ladies and Gentlemen:

As set forth in the Registration Statement on Form S-3 (the “Registration Statement”) to be filed on the date hereof by Service Corporation International, a Texas corporation (the “Company”), with the Securities and Exchange Commission (the “Commission”) under the Securities Act of 1933, as amended (the “Act”), relating to the offering of an indeterminate amount of debt securities (the “Securities”) that may be issued and sold by the Company from time to time pursuant to Rule 415 under the Act, certain legal matters in connection with such Securities are being passed upon for you by us. At your request, this opinion is being furnished to you for filing as Exhibit 5.1 to the Registration Statement.

Each series of the Securities is to be issued pursuant to the Indenture, dated as of February 1, 1993 (the “Indenture”), between the Company and The Bank of New York Mellon Trust Company, N.A. (successor to The Bank of New York), as trustee. The Indenture will be supplemented in connection with the issuance of each series of Securities by a supplemental indenture, officers’ certificate or other writing thereunder (each, a “Supplemental Indenture”) establishing the form and terms of such series.

In our capacity as your counsel in the connection referred to above, we have examined originals, or copies certified or otherwise identified, of the Company’s restated articles of incorporation and bylaws, each as amended to date (the “Charter Documents”), the Indenture, corporate records of the Company (including certain resolutions of the board of directors of the Company as furnished to us by you), certificates of public officials and of representatives of the Company, statutes and other instruments and documents as a basis for the opinion hereinafter expressed. In giving such opinion, we have relied, to the extent we deem appropriate without independent investigation or verification, upon certificates of officers of the Company and of public officials with respect to the accuracy of the material factual matters contained in such certificates. In giving the opinion below, we have assumed, without independent investigation that the signatures on all documents examined by us are genuine, that all documents submitted to us as originals are accurate and complete, that all documents submitted to us as copies are true, correct and complete copies of the originals thereof and that all information submitted to us is accurate and complete. Further, we have assumed that:

(a) the Registration Statement and any amendments thereto (including post-effective amendments) will have become effective under the Act;

(b) a prospectus supplement will have been prepared and filed with the Commission describing the Securities offered thereby;

(c) all Securities will be offered, issued and sold in compliance with applicable federal and state securities laws and in the manner stated in the Registration Statement (including any post-effective amendments thereto) and the applicable prospectus supplement;

(d) the board of directors of the Company or, to the extent permitted by the Texas Business Organizations Code, as amended, and the Charter Documents, a duly constituted and acting committee thereof (such board of directors or committee thereof being hereinafter referred to as the “Board”) will have taken all necessary corporate action to authorize the issuance of the Securities and any other securities issuable on the conversion, exchange, redemption or exercise thereof, and to authorize the terms of the offering and sale of the Securities and related matters;

(e) a definitive purchase, underwriting or similar agreement with respect to any Securities offered will have been duly authorized and validly executed and delivered by the Company and the other parties thereto (each, a “Purchase Agreement”);

(f) any securities issuable upon conversion, exchange, redemption or exercise of any Securities being offered will have been duly authorized, created and, if appropriate, reserved for issuance upon such conversion, exchange, redemption or exercise;

(g) all Securities will be delivered (i) in accordance with the provisions of the applicable Purchase Agreement approved by the Board upon receipt of the consideration therein provided or (ii) upon conversion, exchange, redemption or exercise of any other security, in accordance with the terms of such security or the instrument governing such security providing for such conversion, exchange, redemption or exercise as approved by the Board for the consideration approved by the Board;

(h) the Board will have taken all necessary corporate action to designate and establish the terms of the Securities in accordance with the terms of the Indenture, including, if applicable, the execution and delivery of a Supplemental Indenture by the Company and the trustee thereunder, and the Securities will not include any provision that is unenforceable;

(i) a Supplemental Indenture will have been duly executed and delivered by the Company and, as applicable, the trustee thereunder;

(j) the Indenture will have become qualified under the Trust Indenture Act of 1939, as amended; and

(k) forms of the Securities complying with the terms of the Indenture and evidencing the Securities will have been duly executed, authenticated, issued and delivered in accordance with the provisions of the Indenture;

On the basis of the foregoing, and subject to the assumptions, limitations, qualifications and exceptions set forth herein, we are of the opinion that the Securities will, when issued, constitute legal, valid and binding obligations of the Company, enforceable against the Company in accordance with their terms, except as that enforcement is subject to (a) any applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent transfer or conveyance or other similar laws relating to or affecting creditors’ rights and remedies

generally, (b) general principles of equity (regardless of whether such enforceability is considered in a proceeding in equity or at law) and comity, (c) public policy and applicable law relating to fiduciary duties and indemnification and (d) any implied covenants of good faith and fair dealing.

The opinion set forth above in this letter is limited in all respects to matters of the laws of the State of Texas, applicable federal law and the contract law of the State of New York. We hereby consent to the filing of this opinion letter of counsel with the Commission as Exhibit 5.1 to the Registration Statement. We also consent to the reference to our Firm under the heading “Legal Matters” in the prospectus forming a part of the Registration Statement. In giving this consent, we do not hereby admit that we are in the category of persons whose consent is required under Section 7 of the Act or the rules and regulations of the Commission thereunder.

Very truly yours,

/s/ Baker Botts L.L.P.

EXHIBIT 23.2

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We hereby consent to the incorporation by reference in this Registration Statement on Form S-3 of Service Corporation International of our report dated February 15, 2023 relating to the financial statements, financial statement schedule and the effectiveness of internal control over financial reporting, which appears in Service Corporation International's Annual Report on Form 10-K for the year ended December 31, 2022. We also consent to the reference to us under the heading “Experts” in such Registration Statement.

/s/PricewaterhouseCoopers LLP

Houston, Texas

December 6, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

FORM T-1

___________________________

STATEMENT OF ELIGIBILITY

UNDER THE TRUST INDENTURE ACT OF 1939

OF A CORPORATION DESIGNATED TO ACT AS TRUSTEE

☐ CHECK IF AN APPLICATION TO DETERMINE ELIGIBILITY OF A TRUSTEE PURSUANT TO SECTION 305(b)(2)

___________________________

THE BANK OF NEW YORK MELLON TRUST COMPANY, N.A.

(Exact name of trustee as specified in its charter)

___________________________

| | | | | | | | |

| | 95-3571558 |

(Jurisdiction of incorporation if not a U.S. national bank) | | (I.R.S. employer

identification no.) |

| | |

400 South Hope Street Suite 500 Los Angeles, California | | 90071 |

| (Address of principal executive offices) | | (Zip code) |

___________________________

SERVICE CORPORATION INTERNATIONAL

(Exact name of obligor as specified in its charter)

___________________________

| | | | | | | | |

| Texas | | 74-1488375 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. employer identification no.) |

| | |

1929 Allen Parkway Houston, Texas | | 77019 |

(Address of principal executive offices) | | (Zip code) |

___________________________

Debt Securities

(Title of the indenture securities)

1. General information. Furnish the following information as to the trustee:

(a) Name and address of each examining or supervising authority to which it is subject.

| | | | | |

| Name | Address |

Comptroller of the Currency United States Department of the Treasury

| Washington, DC 20219 |

| Federal Reserve Bank | San Francisco, CA 94105

|

| Federal Deposit Insurance Corporation | Washington, DC 20429 |

(b) Whether it is authorized to exercise corporate trust powers.

Yes.

2. Affiliations with Obligor.

If the obligor is an affiliate of the trustee, describe each such affiliation.

None.

16. List of Exhibits.

Exhibits identified in parentheses below, on file with the Commission, are incorporated herein by reference as an exhibit hereto, pursuant to Rule 7a-29 under the Trust Indenture Act of 1939 (the "Act").

1. A copy of the articles of association of The Bank of New York Mellon Trust Company, N.A., formerly known as The Bank of New York Trust Company, N.A. (Exhibit 1 to Form T-1 filed with Registration Statement No. 333-121948 and Exhibit 1 to Form T-1 filed with Registration Statement No. 333-152875).

2. A copy of certificate of authority of the trustee to commence business. (Exhibit 2 to Form T-1 filed with Registration Statement No. 333-121948).

3. A copy of the authorization of the trustee to exercise corporate trust powers (Exhibit 3 to Form T-1 filed with Registration Statement No. 333-152875).

4. A copy of the existing by-laws of the trustee (Exhibit 4 to Form T-1 filed with Registration Statement No. 333-229762).

6. The consent of the trustee required by Section 321(b) of the Act (Exhibit 6 to Form T-1 filed with Registration Statement No. 333-152875).

7. A copy of the latest report of condition of the Trustee published pursuant to law or to the requirements of its supervising or examining authority.

SIGNATURE

Pursuant to the requirements of the Act, the trustee, The Bank of New York Mellon Trust Company, N.A., a banking association organized and existing under the laws of the United States of America, has duly caused this statement of eligibility to be signed on its behalf by the undersigned, thereunto duly authorized, all in the City of Los Angeles, and State of California, on the 21st day of November, 2023.

THE BANK OF NEW YORK MELLON TRUST COMPANY, N.A.

By: /s/ Gloria Ramirez

Name: Gloria Ramirez

Title: Vice President

EXHIBIT 7

Consolidated Report of Condition of

THE BANK OF NEW YORK MELLON TRUST COMPANY, N.A.

of 333 South Hope Street, Suite 2525, Los Angeles, CA 90071

At the close of business September 30, 2023, published in accordance with Federal regulatory authority instructions.

| | | | | |

| |

| | Dollar amounts in thousands |

| |

| |

| ASSETS | |

Cash and balances due from depository institutions | |

Noninterest-bearing balances and currency and coin | $ | 6,412 | |

Interest-bearing balances | 328,965 | |

Securities: | |

Held-to-maturity securities | — | |

Available-for-sale securities | 520 | |

Equity securities with readily determinable fair values not held for trading | — | |

Federal funds sold and securities purchased under agreements to resell: | |

Federal funds sold in domestic offices | — | |

Securities purchased under agreements to resell | — | |

Loans and lease financing receivables: | |

Loans and leases held for sale | — | |

Loans and leases, held for investment | — | |

LESS: Allowance for loan and lease losses | — | |

Loans and leases held for investment, net of allowance | — | |

Trading assets | — | |

Premises and fixed assets (including capitalized leases) | 16,471 | |

Other real estate owned | — | |

Investments in unconsolidated subsidiaries and associated companies | — | |

Direct and indirect investments in real estate ventures | — | |

Intangible assets | 856,313 | |

Other assets | 110,191 | |

| Total assets | $ | 1,318,872 | |

| |

LIABILITIES | |

Deposits: | |

In domestic offices | 1,063 | |

Noninterest-bearing | 1,063 | |

Interest-bearing | — | |

Not applicable | |

Federal funds purchased and securities sold under agreements to repurchase | — | |

| Federal funds purchased in domestic offices | — | |

| Securities sold under agreements to repurchase | — | |

| Trading liabilities | — | |

| Other borrowed money: | |

| (includes mortgage indebtedness and obligations under capitalized leases) | — | |

| Not applicable | |

| Not applicable | |

| Subordinated notes and debentures | — | |

| Other liabilities | 265,839 |

| Total liabilities | 266,902 |

| Not applicable | |

| EQUITY CAPITAL: | |

| Perpetual preferred stock and related surplus | — | |

| Common stock | 1,000 | |

| Surplus (exclude all surplus related to preferred stock) | 106,172 | |

| Not available | |

| Retained earnings | 944,799 | |

| Accumulated other comprehensive income | (1) | |

| Other equity capital components | — | |

| Not available | |

| Total bank equity capital | 1,051,970 | |

| Noncontrolling (minority) interests in consolidated subsidiaries | — | |

| Total equity capital | 1,051,970 | |

| Total liabilities and equity capital | $ | 1,318,872 | |

I, Matthew J. McNulty, CFO of the above-named bank do hereby declare that the Reports of Condition and Income (including the supporting schedules) for this report date have been prepared in conformance with the instructions issued by the appropriate Federal regulatory authority and are true to the best of my knowledge and belief.

Matthew J. McNulty ) CFO

We, the undersigned directors (trustees), attest to the correctness of the Report of Condition (including the supporting schedules) for this report date and declare that it has been examined by us and to the best of our knowledge and belief has been prepared in conformance with the instructions issued by the appropriate Federal regulatory authority and is true and correct.

Antonio I. Portuondo, President )

Loretta A. Lundberg, Managing Director ) Directors (Trustees)

Jon M. Pocchia, Managing Director )

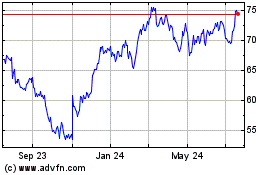

Service (NYSE:SCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

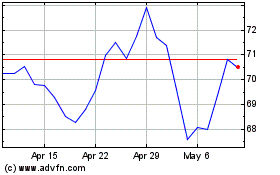

Service (NYSE:SCI)

Historical Stock Chart

From Apr 2023 to Apr 2024