San Juan Basin Royalty Trust Declares Cash Distribution for July 2023

July 21 2023 - 9:00AM

Business Wire

PNC Bank, National Association, as the trustee (the “Trustee”)

of the San Juan Basin Royalty Trust (the “Trust”) (NYSE: SJT),

today declared a monthly cash distribution to the holders (the

“Unit Holders”) of its units of beneficial interest (the “Units”)

of $475,477.18 or $0.010201 per Unit, based primarily upon the

reported production of the Trust’s subject interests (the “Subject

Interests”) during the month of May 2023. The distribution is

payable August 14, 2023, to the Unit Holders of record as of July

31, 2023.

For the production month of May 2023, the owner of the Subject

Interests, Hilcorp San Juan L.P. and the operator of the Subject

Interests, Hilcorp Energy Company (collectively, “Hilcorp”),

reported to the Trust net profits of $731,812 ($548,859 net royalty

amount to the Trust).

Hilcorp reported $3,815,199 of total revenue from the Subject

Interests for the production month of May 2023, consisting of

$3,419,956 of gas revenues and $395,243 of oil revenues. For the

Subject Interests, Hilcorp reported $3,083,386 of production costs

for the production month of May 2023, consisting of $2,413,194 of

lease operating expense, $556,852 of severance taxes and $113,340

of capital costs.

Based upon the information that Hilcorp provided to the Trust,

gas volumes for the Subject Interests for May 2023 totaled

1,997,433 Mcf (2,219,370 MMBtu), as compared to 1,885,511 Mcf

(2,095,012 MMBtu) for April 2023.

Dividing gas revenues by production volume yielded an average

gas price for May 2023 of $1.71 per Mcf ($1.54 per MMBtu), as

compared to an average gas price for April 2023 of $2.17 per Mcf

($1.96 per MMBtu).

Production from the Subject Interests continues to be gathered,

processed, and sold under market sensitive and customary

agreements, as recommended for approval by the Trust’s Consultant.

The Trustee continues to engage with Hilcorp regarding its ongoing

accounting and reporting to the Trust, and the Trust’s third-party

compliance auditors continue to audit payments made by Hilcorp to

the Trust, inclusive of sales revenues, production costs, capital

expenditures, adjustments, actualizations, and recoupments. The

Trust’s auditing process has also included detailed analysis of

Hilcorp’s pricing and rates charged. As previously disclosed in the

Trust’s filings, these revenues and costs (along with all costs)

are the subject of the Trust’s ongoing comprehensive audit process

by our professional consultants and outside counsel to ensure full

compliance with all the underlying operative Trust agreements and

evaluating all available potential remedies in the event there is

evidence of non-compliance.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230721680382/en/

San Juan Basin Royalty Trust PNC Bank, National Association PNC

Asset Management Group 2200 Post Oak Blvd., Floor 18 Houston, TX

77056 website: www.sjbrt.com e-mail: sjt@pnc.com

Ross Durr, RPL, Senior Vice President & Mineral Interest

Director Kaye Wilke, Investor Relations, toll-free: (866)

809-4553

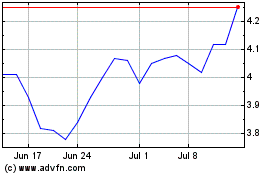

San Juan Basin Royalty (NYSE:SJT)

Historical Stock Chart

From Mar 2024 to Apr 2024

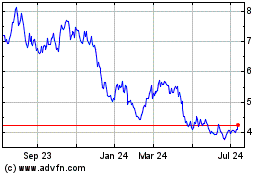

San Juan Basin Royalty (NYSE:SJT)

Historical Stock Chart

From Apr 2023 to Apr 2024